Professional Documents

Culture Documents

Principles of Accounting SSC II Paper II

Uploaded by

SoniyaKanwalGCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of Accounting SSC II Paper II

Uploaded by

SoniyaKanwalGCopyright:

Available Formats

Page 1 of 12

AGA KHAN UNIVERSITY EXAMINATION BOARD

SECONDARY SCHOOL CERTIFICATE

CLASS X EXAMINATION

MAY 2015

Principles of Accounting Paper II

Time: 2 hours 25 minutes

Marks: 50

INSTRUCTIONS

Please read the following instructions carefully.

1.

Check your name and school information. Sign if it is accurate.

I agree that this is my name and school.

Candidate's signature

2.

RUBRIC. There are SEVEN questions. Answer ALL questions.

3.

When answering the questions:

Read each question carefully.

Use a black pencil for diagrams. DO NOT use coloured pencils.

DO NOT use staples, paper clips, glue, correcting fluid or ink erasers.

Complete your answer in the allocated space only. DO NOT write outside the answer box.

4.

The marks for the questions are shown in brackets ( ).

5.

You may use a simple calculator if you wish.

S1502-3621120

Page 2 of 12

Q.1.

a.

(Total 12 Marks)

Below is the list of different expenditure transactions of Al-Mehran Seafood distributors.

Classify the following transaction as either capital or revenue expenditure. The first has been

done for your reference.

(6 Marks)

S. No.

Expenditure Transactions

change of tyres of a delivery van

overhauling of the engine of the delivery

van

monthly tuning charges of the delivery van

printing charges of the companys logo on

the new delivery van

Purchase of another delivery truck

purchase of laptop for record keeping

sundry repairs of the delivery van

S1502-3621120

Classification of the Expenditure

Transactions

Revenue Expenditure

Page 3 of 12

b.

Kashif & Co. purchased an electronic equipment worth Rs 750,000 on 1st January, 2012. The

estimated life of the device is 10 years with salvage value of Rs 100,000.

On 1st January, 2015, the company exchanged the electronic equipment with the new one with a

market value of Rs 650,000, device life of 15 years and salvage value of Rs 100,000.

The company received a trade in allowance of Rs 450,000 for the old electronic equipment and

rest of the amount was paid in cash. The companys financial year ends on 31st December.

Required

i.

Compute the depreciation for year 2012, 2013 and 2014 by reducing (diminishing) balance

method for the electronic equipment.

(4 Marks)

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

ii.

Compute the loss or gain faced by the company during the exchange of electronic

equipment.

(2 Marks)

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

PLEASE TURN OVER THE PAGE

S1502-3621120

Page 4 of 12

Q.2.

(Total 10 Marks)

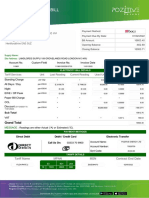

Following is the trial balance of Hakimi Enterprises for the year ended 31st December, 2014.

Particulars

Debit

Cash

15,000

Merchandise Inventory (Opening Stock)

10,500

Account Receivable

64,500

Prepaid Insurance

36,000

Office Equipment

12,000

Allowance for Depreciation (Equipment)

1,500

Account Payable

45,000

Capital (01-01-2014)

88,000

Drawing

12,000

Sales

Sales Return

Purchases

160,000

8,000

90,000

Purchases Return

Transportation-In

5,000

6,600

Administrative Expense

10,600

Salaries Expense

24,000

Rent Expense

7,000

Depreciation Expense (Office Equipment)

2,500

Interest Payable

4,000

Pre-Paid Advertisement

4,500

Bad Debts Expense

3,500

Allowance for Bad Debts

Total

Data for Adjustment

Credit

Merchandise inventory at the year end was Rs 12,500.

Prepaid advertisement expired by Rs 1,500.

Salaries payable are at Rs 12,000.

S1502-3621120

2,400

306,700

306,700

Page 5 of 12

Required

Prepare a classified income statement

Particulars

Sales

Sales Returns

Net Sales

Cost of Goods Sold

Merchandise Inventory

Purchase

Purchase Return

Net Purchases

Transportation-In

Total Purchases

Total Goods Available for Sold

Ending Inventory

Cost of Goods Sold

Gross Profit

Operating Expenditure

Administrative Expense

Salaries Expense

Rent Expense

Depreciation Expense (office

equipment)

Bad Debts Expense

Advertisement Expense

Total Operating Expense

Net Income

PLEASE TURN OVER THE PAGE

S1502-3621120

Page 6 of 12

Q.3.

(Total 4 Marks)

The following information is extracted from the books of Adam Brothers.

Creditors

Additional Information

Cash purchased during the year

Paid to creditors

Purchases return and allowance

Start of the Year

115,000

End of the Year

140,000

Rs 142,000

Rs 675,000

Rs 12,000

Required

Compute total credit purchases and total gross purchases.

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

S1502-3621120

Page 7 of 12

Q.4.

a.

(Total 4 Marks)

Compute the amount of the net income with the help of the information given below.

Capital at Start

Drawing

Additional Investment

Capital at End

(2 Marks)

70,000

8,000

18,000

80,000

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

b.

Aslam bought merchandise for Rs 80,000 and sold it for Rs 85,000. Compute the amounts of his

rate of markup and margin.

(2 Marks)

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

Q.5.

(Total 5 Marks)

Identify the error in the following transactions. The first has been done for your reference.

Transactions

Type of Error

An entry of sales was found missing in the

sales record.

Error of omission

1. Goods sold to Ms Mubeen were wrongly

charged to Ms Mubeenas account.

2. Equipment purchased for sales counter was

wrongly charged to the store supplies account.

3. Goods purchased from Danish on credit is

credited to Danial account.

4. Goods sold to Mr Faheem were wrongly

recorded as Rs 15,000 instead of Rs 1,500.

5. Goods sold to customer on cash was recorded

as debit sales and credit cash.

PLEASE TURN OVER THE PAGE

S1502-3621120

Page 8 of 12

Q.6.

(Total 5 Marks)

Prepare the correcting entries for the identified errors in Q.5.

Date

S1502-3621120

Particulars

P/R

Debit

Credit

Page 9 of 12

Q.7.

a.

(Total 10 Marks)

State THREE purposes of establishing a non-profit organization.

(3 Marks)

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

b.

List any THREE types of non-profit organizations.

(3 Marks)

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

c.

State the NPOs alternative for the following terms used by profit-based business.

Terms in other business

Profit or gain

Surplus

Loss

Income statement

Balance sheet

Sales revenue / commission income

END OF PAPER

S1502-3621120

NPOs Terms

(4 Marks)

Page 10 of 12

S1502-3621120

Page 11 of 12

S1502-3621120

Page 12 of 12

S1502-3621120

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Anoka - Hennepin - Probability - and - Statistics-4 2013 NEW - 4 PDFDocument357 pagesAnoka - Hennepin - Probability - and - Statistics-4 2013 NEW - 4 PDFSoniyaKanwalG100% (2)

- Total Selection Leftover Seats Morning PDFDocument12 pagesTotal Selection Leftover Seats Morning PDFSoniyaKanwalGNo ratings yet

- Notes Part 2Document70 pagesNotes Part 2AXA2000No ratings yet

- Chapter 9Document28 pagesChapter 9Aniket BatraNo ratings yet

- SL RegressionDocument57 pagesSL RegressionSoniyaKanwalGNo ratings yet

- Total Selection Leftover Seats Morning PDFDocument12 pagesTotal Selection Leftover Seats Morning PDFSoniyaKanwalGNo ratings yet

- First List SF f16Document7 pagesFirst List SF f16SoniyaKanwalGNo ratings yet

- Simple RegressionDocument11 pagesSimple RegressionSoniyaKanwalGNo ratings yet

- RegressionDocument6 pagesRegressionluispedro1985No ratings yet

- Regression PDFDocument13 pagesRegression PDFSyaza IbrahimNo ratings yet

- Research Methods For Business Students 5th EditionDocument57 pagesResearch Methods For Business Students 5th EditionfarazNo ratings yet

- SimpleLinearRegressionCollection PDFDocument58 pagesSimpleLinearRegressionCollection PDFSoniyaKanwalGNo ratings yet

- Simple Linear Regression CollectionDocument14 pagesSimple Linear Regression CollectionSoniyaKanwalGNo ratings yet

- Economics BookDocument5 pagesEconomics BookKhokanuzzaman KhokanNo ratings yet

- CH 04Document5 pagesCH 04SoniyaKanwalGNo ratings yet

- E6 34Document11 pagesE6 34SoniyaKanwalGNo ratings yet

- History of Chemical EngineeringDocument104 pagesHistory of Chemical EngineeringThiago Dalgalo de QuadrosNo ratings yet

- Chapter 9Document7 pagesChapter 9SoniyaKanwalGNo ratings yet

- Lecture 25Document8 pagesLecture 25SoniyaKanwalGNo ratings yet

- 1 Inorganic Chemistry7Document7 pages1 Inorganic Chemistry7SoniyaKanwalGNo ratings yet

- Chapter 9Document28 pagesChapter 9Aniket BatraNo ratings yet

- An Introduction To Probability Theory by William FellerDocument5 pagesAn Introduction To Probability Theory by William FellerSoniyaKanwalGNo ratings yet

- Bdmpi 14 PCDocument14 pagesBdmpi 14 PCSoniyaKanwalGNo ratings yet

- Ch2 MO TheoryDocument62 pagesCh2 MO TheoryAbhishek KukretiNo ratings yet

- 5 B FRSDocument6 pages5 B FRSSoniyaKanwalGNo ratings yet

- Engineering Environment in Pakistan Changing Role of Chemical / Mechanical EngineersDocument29 pagesEngineering Environment in Pakistan Changing Role of Chemical / Mechanical EngineersSoniyaKanwalGNo ratings yet

- Hec List 2015Document23 pagesHec List 2015SoniyaKanwalGNo ratings yet

- Asaan Lughat e Quran PDFDocument408 pagesAsaan Lughat e Quran PDFSoniyaKanwalGNo ratings yet

- List 4 Merit f16Document7 pagesList 4 Merit f16SoniyaKanwalGNo ratings yet

- Chem310 MO TheoryDocument18 pagesChem310 MO TheoryNitinKumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Appendix 1: Sample Limited Partnership AgreementDocument70 pagesAppendix 1: Sample Limited Partnership AgreementectrimbleNo ratings yet

- CashTOa JPDocument11 pagesCashTOa JPDarwin LopezNo ratings yet

- TempBillDocument1 pageTempBillNilesh UmaretiyaNo ratings yet

- Modi Bats For Unlocking Economy, Cms Divided: He Conomic ImesDocument12 pagesModi Bats For Unlocking Economy, Cms Divided: He Conomic ImesyodofNo ratings yet

- Employee Benefits: Accounting Standard (AS) 15Document67 pagesEmployee Benefits: Accounting Standard (AS) 15hanumanthaiahgowdaNo ratings yet

- Basic Accounting Concepts and Case StudiesDocument114 pagesBasic Accounting Concepts and Case Studiesgajiniece429No ratings yet

- Sales Report: Philippine Seven CorporationDocument2 pagesSales Report: Philippine Seven CorporationGreyNo ratings yet

- Registration of Corporations Stock Corporation Basic RequirementsDocument27 pagesRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNo ratings yet

- Accountant. CVDocument4 pagesAccountant. CVNamwangala Rashid NatinduNo ratings yet

- Cost Behaviour & Decision Making - HodDocument65 pagesCost Behaviour & Decision Making - Hodsrimant100% (2)

- Course by Course Evaluation Report: U.S. Equivalence: Grade AverageDocument2 pagesCourse by Course Evaluation Report: U.S. Equivalence: Grade AverageBhageshwar ChaudharyNo ratings yet

- 2023 - Q1 Press Release BAM - FDocument9 pages2023 - Q1 Press Release BAM - FJ Pierre RicherNo ratings yet

- HLB CC Sutera Plat TNCDocument3 pagesHLB CC Sutera Plat TNCAnonymous gMgeQl1SndNo ratings yet

- 6th NLIU Trilegal Summit 2021 BrochureDocument11 pages6th NLIU Trilegal Summit 2021 Brochuremihir khannaNo ratings yet

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet

- Ibn Sina - Financial AnalysisDocument19 pagesIbn Sina - Financial Analysisabdel hameed ibrahimNo ratings yet

- DrVijayMalik Company Analyses Vol 5Document349 pagesDrVijayMalik Company Analyses Vol 5THE SCALPERNo ratings yet

- Bar Review Material No. 3 PDFDocument2 pagesBar Review Material No. 3 PDFScri Bid100% (1)

- Joint Venture Agreement TemplateDocument3 pagesJoint Venture Agreement Templategwynette12No ratings yet

- Chapter 1: A Simple Market ModelDocument8 pagesChapter 1: A Simple Market ModelblillahNo ratings yet

- ETAMAG - The Lost OrderDocument6 pagesETAMAG - The Lost OrderSalekin Mahamood Chowdhury100% (1)

- Introduction TABDocument2 pagesIntroduction TABShreshtha ShahNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 2Document5 pagesINCOME TAX AND GST. JURAZ-Module 2TERZO IncNo ratings yet

- Worksheet 4.1 Introducing Bank ReconciliationDocument4 pagesWorksheet 4.1 Introducing Bank ReconciliationHan Nwe Oo100% (1)

- Basics of Accounting in Small Business NewDocument50 pagesBasics of Accounting in Small Business NewMohammed Awwal NdayakoNo ratings yet

- Chapter 4 The Internal AssessmentDocument26 pagesChapter 4 The Internal AssessmentKrisKettyNo ratings yet

- Pacifico Renewables Yield AG 2021H1 enDocument50 pagesPacifico Renewables Yield AG 2021H1 enLegonNo ratings yet

- What Do You Mean by OverheadsDocument6 pagesWhat Do You Mean by OverheadsNimish KumarNo ratings yet

- 2013 Syllabus 12 AccountancyDocument4 pages2013 Syllabus 12 Accountancybhargavareddy007No ratings yet

- SOLVED - IAS 7 Statement of Cash FlowsDocument16 pagesSOLVED - IAS 7 Statement of Cash FlowsMadu maduNo ratings yet