Professional Documents

Culture Documents

AdvAcc Entries

Uploaded by

ralphalonzo0 ratings0% found this document useful (0 votes)

67 views2 pagesAdvAcc Entries

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAdvAcc Entries

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views2 pagesAdvAcc Entries

Uploaded by

ralphalonzoAdvAcc Entries

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

EQUITY METHOD

4. Intercompany dividends, with NCI

5. Intercompany downstream and upstream sales/gains*

First year after acquisition

6. Realize deferred downstream and upstream sales*

Subsidiary investment-related entries [ADSAUR]

1. Acquisition of subsidiary

7. Defer downstream and upstream sales*

2. Dividends from subsidiary

8. Intercompany downstream and upstream depreciation expense*

3. Share in net income of subsidiary

9. NCI in subsidiarys net income

COST METHOD

4. Amortization of allocated excess of assets, liabilities, and goodwill impairment loss

5. Unrealized profit/gaindownstream and upstream sales*

6. Realized gaindownstream and upstream sales*

First year after acquisition

Eliminating entries [EAGI IDIN]

1. Acquisition of subsidiary

2. Dividends from subsidiary

1. Equity accounts of subsidiary, with NCI

2. Allocated excess, with NCI

Subsidiary investment-related entries [AD]

Eliminating entries [EAGI IDIN]

3. Goodwill impairment loss, depreciation, and amortization

1. Equity accounts of subsidiary, with NCI

4. Intercompany dividends, with NCI

2. Allocated excess, with NCI

5. Intercompany downstream and upstream sales/gains*

3. Goodwill impairment loss, depreciation, and amortization

6. Defer downstream and upstream sales*

4. Intercompany dividends, with NCI

7. Intercompany downstream and upstream depreciation expense*

5. Intercompany downstream and upstream sales/gains*

8. NCI in subsidiarys net income

6. Defer downstream and upstream sales*

7. Intercompany downstream and upstream depreciation expense*

8. NCI in subsidiarys net income

Second year after acquisition

Subsidiary investment-related entries [DSARUR]

1. Dividends from subsidiary

2. Share in net income of subsidiary

Second year after acquisition

3. Amortization of allocated excess of assets and liabilities

4. Realized profitdownstream and upstream sales*

Subsidiary investment-related entries [D]

1. Dividends from subsidiary

Eliminating entries [REAGI IRDIN]

5. Unrealized profitdownstream and upstream sales*

1. Retroactive adjustment

6. Realized gaindownstream and upstream sales*

2. Equity accounts of subsidiary, with NCI

Eliminating entries [EAGI IRDIN]

3. Allocated excess, with NCI

1. Equity accounts of subsidiary, with NCI

4. Goodwill impairment loss, depreciation, and amortization

2. Allocated excess, with NCI

5. Intercompany dividends, with NCI

3. Goodwill impairment loss, depreciation, and amortization

6. Intercompany downstream and upstream sales/gains*

7. Realize deferred downstream and upstream sales*

8. Defer downstream and upstream sales*

9. Intercompany downstream and upstream depreciation expense*

10. NCI in subsidiarys net income

profit = inventory

gain = equipment and land

You might also like

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Fund Flow StatementDocument11 pagesFund Flow Statementtripathi_indramani5185No ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- M3 Exe SolDocument6 pagesM3 Exe SolJay Ann DomeNo ratings yet

- Consolidation ProceduresDocument7 pagesConsolidation ProceduresharoonacmaNo ratings yet

- Regular Itemized DeductionsDocument32 pagesRegular Itemized Deductionsdianne caballeroNo ratings yet

- Seminar Practice 5 Answers UpdatedDocument41 pagesSeminar Practice 5 Answers UpdatedFeeling_so_flyNo ratings yet

- 5capital and Revenue ConceptDocument4 pages5capital and Revenue ConceptRojesh BasnetNo ratings yet

- Ch4 SolutionsDocument23 pagesCh4 SolutionsFahad Batavia100% (1)

- Fund Flow StatementDocument13 pagesFund Flow StatementAncy BcNo ratings yet

- 9706 Y16 SP 3Document10 pages9706 Y16 SP 3Wi Mae RiNo ratings yet

- Unit 8 WB SolutionDocument11 pagesUnit 8 WB SolutionEthanChiongson0% (2)

- FARAP-4517Document4 pagesFARAP-4517Accounting StuffNo ratings yet

- Fischer11e PPT Ch04Document22 pagesFischer11e PPT Ch04John Smith100% (1)

- Chapter 8Document6 pagesChapter 8Nor AzuraNo ratings yet

- Accounting Policies and Significant Accounting PoliciesDocument7 pagesAccounting Policies and Significant Accounting PoliciesShalini GuptaNo ratings yet

- Presentation of Financial Statements (IAS 1)Document30 pagesPresentation of Financial Statements (IAS 1)Ashura ShaibNo ratings yet

- Company Accounts: Balance Sheet and Profit and Loss of A Limited Liability CompanyDocument41 pagesCompany Accounts: Balance Sheet and Profit and Loss of A Limited Liability CompanyDiksha BohraNo ratings yet

- Chapter 5 - Group DisposalsDocument4 pagesChapter 5 - Group DisposalsSheikh Mass JahNo ratings yet

- Ifsa Chapter9Document42 pagesIfsa Chapter9Iwan PutraNo ratings yet

- True or FalseDocument7 pagesTrue or FalseColline ZoletaNo ratings yet

- Accountancy Notes PDFDocument11 pagesAccountancy Notes PDFSantosh ChavanNo ratings yet

- Income Statement To The NetDocument26 pagesIncome Statement To The NetOman SherNo ratings yet

- Finance For NonfinanceDocument35 pagesFinance For Nonfinancelasyboy20No ratings yet

- Analyzing Investing Activities Chapter 5Document29 pagesAnalyzing Investing Activities Chapter 5Agathos Kurapaq0% (1)

- CH09 - Intermediate AccountingDocument34 pagesCH09 - Intermediate Accountingklebek100% (1)

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Cash Flow Statement ExplainedDocument17 pagesCash Flow Statement ExplainedvyahutsupriyaNo ratings yet

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- CH09SDocument34 pagesCH09SIntelaCrosoftNo ratings yet

- Investment Interest Expense Deduction: Go To WWW - Irs.gov/form4952 For The Latest Information. Attach To Your Tax ReturnDocument4 pagesInvestment Interest Expense Deduction: Go To WWW - Irs.gov/form4952 For The Latest Information. Attach To Your Tax ReturnAfzal ImamNo ratings yet

- Du-Pont Analysis: Financial Statement Information of Stylecraft LimitedDocument2 pagesDu-Pont Analysis: Financial Statement Information of Stylecraft Limitedনাফিস ইকবাল আকিলNo ratings yet

- OPERATING SEGMENT With ANSWERSDocument8 pagesOPERATING SEGMENT With ANSWERSRaven Sia100% (1)

- GoodwillDocument2 pagesGoodwillbdharshini06No ratings yet

- Amity Business School: Cost & Management Accounting For Decision Making-ACCT611Document76 pagesAmity Business School: Cost & Management Accounting For Decision Making-ACCT611Manjula ShastriNo ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- CRS Chapter 9 RIT Inclusions To Gross IncomeDocument60 pagesCRS Chapter 9 RIT Inclusions To Gross Incomesheryl ann dizonNo ratings yet

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- 2 Corporate Accounting NotesDocument26 pages2 Corporate Accounting NotesYogesh Kumpawat100% (2)

- Tugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Guide To Consolidation Journal EntriesDocument9 pagesGuide To Consolidation Journal EntriesClarize R. MabiogNo ratings yet

- Lec6 - Plant Assets DepreciationDocument58 pagesLec6 - Plant Assets DepreciationDylan Rabin Pereira100% (1)

- How to Analyze Cash Flows and Financial PlanningDocument68 pagesHow to Analyze Cash Flows and Financial Planninghunkie71% (7)

- MAS 10 - Capital BudgetingDocument10 pagesMAS 10 - Capital BudgetingClint AbenojaNo ratings yet

- Profit Prior IncorporationDocument11 pagesProfit Prior IncorporationAparna ViswakumarNo ratings yet

- Beta Company-Three ExamplesDocument15 pagesBeta Company-Three ExamplesDilip Monson83% (12)

- ARF 330.0 Financial Performance ReportDocument2 pagesARF 330.0 Financial Performance ReportcastluciNo ratings yet

- Consolidated Statement of Cash FlowDocument14 pagesConsolidated Statement of Cash FlowVasunNo ratings yet

- Capital Receipts vs Revenue Receipts, Capital Expenditure vs Revenue Expenditure, and Capital Losses vs Revenue LossesDocument13 pagesCapital Receipts vs Revenue Receipts, Capital Expenditure vs Revenue Expenditure, and Capital Losses vs Revenue LossesYaksha AllolaNo ratings yet

- Project Valuation Review: Beyond The BasicsDocument14 pagesProject Valuation Review: Beyond The BasicsBabar AdeebNo ratings yet

- ACC 226 Investment in Associate COPYDocument3 pagesACC 226 Investment in Associate COPYJAYBIE ENDAYANo ratings yet

- Asics CorporationDocument6 pagesAsics Corporationasadguy2000No ratings yet

- CAD ROI and Residual IncomeDocument7 pagesCAD ROI and Residual IncomeRen100% (1)

- Measuring and Forecasting Company EarningsDocument38 pagesMeasuring and Forecasting Company EarningsSoumendra RoyNo ratings yet

- TAX 2 Allowable DeductionsDocument36 pagesTAX 2 Allowable DeductionsfayeNo ratings yet

- Deductions from Gross Income ExplainedDocument2 pagesDeductions from Gross Income ExplainedmarjotalaNo ratings yet

- Capital and Revenue TransactionsDocument23 pagesCapital and Revenue TransactionsRajib Deb100% (1)

- FAR - Revaluation Increase and DecreaseDocument1 pageFAR - Revaluation Increase and DecreaseralphalonzoNo ratings yet

- Estate Taxation Self-TestDocument4 pagesEstate Taxation Self-TestralphalonzoNo ratings yet

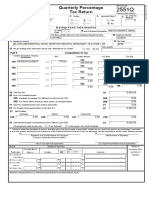

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument1 pageSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoNo ratings yet

- RFBT - Directors and Stockholders' MeetingDocument1 pageRFBT - Directors and Stockholders' MeetingralphalonzoNo ratings yet

- Deductions From Gross IncomeDocument1 pageDeductions From Gross IncomeralphalonzoNo ratings yet

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- FAR - Conceptual FrameworkDocument8 pagesFAR - Conceptual FrameworkralphalonzoNo ratings yet

- Real Estate Mortgage Requisites and RemediesDocument11 pagesReal Estate Mortgage Requisites and RemediesralphalonzoNo ratings yet

- TAX - Gross Estate RemindersDocument2 pagesTAX - Gross Estate RemindersralphalonzoNo ratings yet

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoNo ratings yet

- RFBT - Forms of Partnership ContractsDocument1 pageRFBT - Forms of Partnership ContractsralphalonzoNo ratings yet

- T02 - Capital BudgetingDocument121 pagesT02 - Capital Budgetingralphalonzo75% (4)

- Chapter 4 and Chapter 5Document9 pagesChapter 4 and Chapter 5ralphalonzoNo ratings yet

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoNo ratings yet

- Business Law and TaxationDocument15 pagesBusiness Law and TaxationKhim Dagangon100% (1)

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Document3 pagesDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoNo ratings yet

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- PRTC TOA First PreboardDocument9 pagesPRTC TOA First PreboardralphalonzoNo ratings yet

- PRTC at 1st PreboardDocument11 pagesPRTC at 1st PreboardralphalonzoNo ratings yet

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoNo ratings yet

- PRTC P2 1st PreboardDocument10 pagesPRTC P2 1st PreboardRommel Royce0% (1)

- PRTC AP First PBDocument9 pagesPRTC AP First PBralphalonzoNo ratings yet

- Chapter 1 With Reference To ICAP 2015 Study TextDocument10 pagesChapter 1 With Reference To ICAP 2015 Study TextralphalonzoNo ratings yet

- 7 Remedial PDFDocument66 pages7 Remedial PDFMinahNo ratings yet

- HyperinflationDocument2 pagesHyperinflationralphalonzoNo ratings yet

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Document10 pagesCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoNo ratings yet

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoNo ratings yet

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- 2022 Schindler q1 PresentationDocument22 pages2022 Schindler q1 Presentationmohammad ghassanNo ratings yet

- Lgu Naguilian HousingDocument13 pagesLgu Naguilian HousingLhyenmar HipolNo ratings yet

- Solar Power Forecast: Weather. Impact On Your BusinessDocument2 pagesSolar Power Forecast: Weather. Impact On Your BusinessCamilo DiazNo ratings yet

- Case Study KarimRamziDocument10 pagesCase Study KarimRamziToufik Akhdari0% (1)

- Promo Pricing Strategies Reduce Prices Attract CustomersDocument20 pagesPromo Pricing Strategies Reduce Prices Attract CustomersMarkDePazDiazNo ratings yet

- A Project Report: Kurukshetra University, KurukshetraDocument74 pagesA Project Report: Kurukshetra University, KurukshetrasudhirNo ratings yet

- BSC Hospital 1Document24 pagesBSC Hospital 1sesiliaNo ratings yet

- Hill V VelosoDocument3 pagesHill V VelosoChaii CalaNo ratings yet

- Incoterms QuestionsDocument6 pagesIncoterms Questionsndungutse innocent100% (1)

- Monografia Edificios VerdesDocument56 pagesMonografia Edificios VerdesKa VaNo ratings yet

- Abhay KumarDocument5 pagesAbhay KumarSunil SahNo ratings yet

- Assignment 2Document2 pagesAssignment 2Syed Osama AliNo ratings yet

- Achieving Strategic Fit Across the Entire Supply ChainDocument28 pagesAchieving Strategic Fit Across the Entire Supply ChainJoann TeyNo ratings yet

- Fiscal Policy Vs Monetary PolicyDocument6 pagesFiscal Policy Vs Monetary PolicyShahrukh HussainNo ratings yet

- Product Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.Document22 pagesProduct Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.R16094101李宜樺No ratings yet

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- Ensuring E/CTRM Implementation SuccessDocument10 pagesEnsuring E/CTRM Implementation SuccessCTRM CenterNo ratings yet

- Batik Fabric Manila Philippines Starting US 199 PDFDocument3 pagesBatik Fabric Manila Philippines Starting US 199 PDFAjeng Sito LarasatiNo ratings yet

- F.W.TAYLOR Father of scientific managementDocument7 pagesF.W.TAYLOR Father of scientific managementTasni TasneemNo ratings yet

- MSC - Engineering Management (D)Document12 pagesMSC - Engineering Management (D)Charles OndiekiNo ratings yet

- 0 - 265454387 The Bank of Punjab Internship ReportDocument51 pages0 - 265454387 The Bank of Punjab Internship Reportفیضان علیNo ratings yet

- Software Process ModelsDocument9 pagesSoftware Process Modelsmounit121No ratings yet

- Ripple CryptocurrencyDocument5 pagesRipple CryptocurrencyRipple Coin NewsNo ratings yet

- ACI LimitedDocument2 pagesACI LimitedAshique IqbalNo ratings yet

- MC DonaldDocument3 pagesMC DonaldRahulanandsharmaNo ratings yet

- Transfer Pricing of Tivo and Airbag Division: RequiredDocument7 pagesTransfer Pricing of Tivo and Airbag Division: RequiredajithsubramanianNo ratings yet

- Platinum Gazette 29 July 2011Document12 pagesPlatinum Gazette 29 July 2011Anonymous w8NEyXNo ratings yet

- Disputed Invoice CreationDocument13 pagesDisputed Invoice CreationSrinivas Girnala100% (1)

- UNDP Interview Questions - GlassdoorDocument6 pagesUNDP Interview Questions - GlassdoorKumar SaurabhNo ratings yet

- Franchise Rule Compliance Guide - FTC - GovDocument154 pagesFranchise Rule Compliance Guide - FTC - GovFranchise InformationNo ratings yet

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsFrom EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNo ratings yet

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionFrom EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionRating: 5 out of 5 stars5/5 (3)

- Financial Management: The Basic Knowledge of Financial Management for StudentFrom EverandFinancial Management: The Basic Knowledge of Financial Management for StudentNo ratings yet

- Will Work for Pie: Building Your Startup Using Equity Instead of CashFrom EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNo ratings yet

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)