Professional Documents

Culture Documents

Pre Semi

Uploaded by

Anonymous t1lbUug0A0 ratings0% found this document useful (0 votes)

49 views2 pagessemi

Original Title

pre semi

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsemi

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views2 pagesPre Semi

Uploaded by

Anonymous t1lbUug0Asemi

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

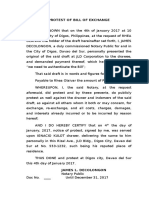

Function and importance of

negotiable instruments.

*Use as a substitute for money.

*Constitute at present, the media of

exchange for most commercial

transactions.

*Serve as a medium of credit

transaction

Characteristic of features of

negotiable instruments

*Negotiability

a.) Authorizes the sale of collateral

securities in case the instrument be

not paid at maturity

b.) Authorizes a confession of

judgment if the instrument be not paid

at maturity

c.) Waives the benefit of any law

intended for the advantage or

protection of the obligor

d.) Gives the holder an election to

require something to be done in lieu of

payment of money

Two type of instrument

Section 6. Omissions; Seal;

particular money. Not affected by

the fact

a.) Promissory Note

a.) It is not dated

b.) Bills of exchange

b.) Does not specify the value given,

or that any value has been given

therfor

*Accumulation of Secondary Contracts

Sec 2. Certainty as to sum: what

constitutes. The sum payable is a

sum certain.

a.) With interest

c.) Does not specify the place it is

drawn or the place where it is payable

b.) By stated installments

d.) Bears a seal.

c.) By stated installments with a

provision that, upon default in

payment of any installment or of

interest, the whole shall become due

e.) Designates a particular kind of

current money in which payment is to

be made.

d.) With exchange, whether at a fixed

rate or at the current rate

e.) With cost of collection or an

attorneys fee in case payment shall

not be made at maturity.

Section 3. When promise is

unconditional

a.) An indication of a particular fund

out of which reimbursement is to be

made or a particular account to be

debited with the amount

b.) A statement of the transaction

which gives rise to the instrument.

Section 4. Determinable future

time; what constitutes.

a.) at a fixed period after date or sight

b.) On or before a fixed or

determinable future time specified

therin

c.) On or at a fixed period after the

occurrence of specified event which is

certain to happen, though the time of

happening be uncertain.

Section 5. Not affecting

negotiability

Section 7. When payable on

demand.

a.) Where it is expressed to be payable

on demand, or at sight, or on

presentation

b.) In which no time for payment is

epressed

Section 8. When payable to order.

The instrument is payable to

order where it is drawn payable to

order of a specified person.

a.) A payee who is not maker, drawer,

or drawee

b.) The drawer or maker

c.) The drawee

d) Two or more payees

f.) The holder of an office for the time

being

Section 9. When Payable to

bearer.

a.) When it is expressed to be so

payable

b.) When it is payable to a person

name therin or bearer

c.) When it is payable to the order of a

fictitous or non- exsting person, and

such fact was known to the person

making it so payable

No person is liable on the instrument

whose signature does not appear

thereon, except as herin otherwise

expressly provides.

d.) When the name of the payee does

not purport to be the name of any

person

Section 21. Signature by

procuration; effect

e.) When the only or last indorsement

is an indorsement in blank

Section 11. Presumption as to

date.

If the instrument bears a date, such

date is deemed prima facie to be true

date of the making, drawing,

acceptance or indorsement, as the

case may be.

Section 12. Anti-dated and postdated.

The instrument is not invalid for the

reason only that it is for an illegal or

fraudulent purpose.

Anti dated contains a date earlier

than the true date of its issuance.

Post Dated contains a date later than

true date of its issuance,

Section 13. When date may be

inserted.

a.) Where an instrument is payable at

a fixed period after date but is issued

undated

b.) Where an instrument is payable at

a fixed period after sight but the

acceptance is undated.

Section 18. Liability of person

signing in trade or assumed

name.

It gives a warning that the agent has

but a limited authority, so that it is the

duty of the person dealing with him to

inquire into the extent of his authority.

The principal is bound only in case the

agent in so signing acted within the

actual limits of his authority

Sec 22. Effect of indorsement by

infant or corporation.

The indorsement or assignment of the

instrument by a corporation or by an

infant passes the property therein,

notwithstanding that from want of

capacity, the corporation or infant

may incur no liability thereon.

Sec 23. Forged Signature effect.

It is wholly inoperative and so no right

can be acquired through the forged

signature.

Sec 52. What constitutes a holder

in due course.

a.) That it is complete and regular

upon its face

b.) That he became the holder of it

before it was overdue, and without

notice that it had been previously

dishonoured, if such was the fact

c.) The he took it in good faith and for

value

d.) That a the time it was negotiated

to him he had no notice of any

infirmity in the instrument or defect in

the title of the person negotiating it.

You might also like

- The Magnitect FieldDocument1 pageThe Magnitect FieldAnonymous t1lbUug0ANo ratings yet

- Economics 14Document2 pagesEconomics 14KaiserNo ratings yet

- Make or Made or Offer or SellDocument3 pagesMake or Made or Offer or SellAnonymous t1lbUug0ANo ratings yet

- Obligation and Contracts (Review)Document1 pageObligation and Contracts (Review)KaiserNo ratings yet

- Partnership Formation RequirementsDocument1 pagePartnership Formation RequirementsAnonymous t1lbUug0A50% (4)

- MapehDocument10 pagesMapehAnonymous t1lbUug0ANo ratings yet

- Law FinalsDocument4 pagesLaw FinalsAnonymous NnPT01YM9GNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Payments System in Trinidad & Tobago PDFDocument48 pagesThe Payments System in Trinidad & Tobago PDFIsaiah SandyNo ratings yet

- Sample Memorandum PDFDocument16 pagesSample Memorandum PDFsuresh6265No ratings yet

- Negotiable Instruments Law Notes Atty Zarah Villanueva CastroDocument16 pagesNegotiable Instruments Law Notes Atty Zarah Villanueva CastroMarcelino CasilNo ratings yet

- NIDocument6 pagesNIDeopito BarrettNo ratings yet

- Mercantile Reviewer UP 2016 NEGO PDFDocument48 pagesMercantile Reviewer UP 2016 NEGO PDFAnonymousNo ratings yet

- Modernisation in Banking Sector in India Axis Bank VDocument90 pagesModernisation in Banking Sector in India Axis Bank V54 - Akanksha KashyapNo ratings yet

- Nego OutlineDocument7 pagesNego OutlineFncsixteen UstNo ratings yet

- Protest of Bill of Exchange and Notice of ProtestDocument3 pagesProtest of Bill of Exchange and Notice of ProtestJames Decolongon33% (3)

- Report On Cheque DishonourDocument63 pagesReport On Cheque DishonourAyush Tiwari100% (1)

- Romeo C Garcia Vs Dionisio V LlamasDocument10 pagesRomeo C Garcia Vs Dionisio V LlamasGennard Michael Angelo AngelesNo ratings yet

- MFC-I Syllabus for 2011-2012 and 2012-2013 SessionsDocument11 pagesMFC-I Syllabus for 2011-2012 and 2012-2013 SessionsangelagarwalNo ratings yet

- Example Open Items Via Direct InputDocument8 pagesExample Open Items Via Direct InputSri RamNo ratings yet

- Banking Law Honors PaperDocument4 pagesBanking Law Honors PaperDudheshwar SinghNo ratings yet

- Negotiable Instruments: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments: Legal Aspects of BusinessArun Sharma100% (2)

- Law and Practice of BankingDocument106 pagesLaw and Practice of BankingArvind RaviNo ratings yet

- Philippine National Bank Vs Benito Seeto091 Phil 756Document4 pagesPhilippine National Bank Vs Benito Seeto091 Phil 756andrea ibanezNo ratings yet

- 1991-1996 BAR Mercantile QuestionsDocument63 pages1991-1996 BAR Mercantile QuestionsasdgafsdgadfgNo ratings yet

- Negotiable Instruments Midterms Atty - CenizaDocument13 pagesNegotiable Instruments Midterms Atty - CenizaKate MontenegroNo ratings yet

- Rights of Unpaid Seller ExplainedDocument21 pagesRights of Unpaid Seller ExplainedAnanya ShuklaNo ratings yet

- PLDT v Jeturian - Employees entitled to pension planDocument9 pagesPLDT v Jeturian - Employees entitled to pension planJotmu Solis50% (2)

- BFSM Unit IDocument30 pagesBFSM Unit IAbhinayaa SNo ratings yet

- Law and Citizenship Education Revision QuestionsDocument123 pagesLaw and Citizenship Education Revision QuestionsNsemi NsemiNo ratings yet

- Banking Law Notes LLB IIIDocument183 pagesBanking Law Notes LLB IIINathan NakibingeNo ratings yet

- Memo in Opp To Note Coming Into EvidenceDocument27 pagesMemo in Opp To Note Coming Into EvidenceForeclosure FraudNo ratings yet

- Income Tax Legality QuestionedDocument19 pagesIncome Tax Legality QuestionedHenoAlambre67% (3)

- Accounts TestDocument3 pagesAccounts TestAMIN BUHARI ABDUL KHADERNo ratings yet

- Ca - DC - Nuwara Eliya - 751 - 2000Document10 pagesCa - DC - Nuwara Eliya - 751 - 2000Thidas Herath MaduwalthanneNo ratings yet

- Ijaz KhanDocument78 pagesIjaz Khanwaqar ahmadNo ratings yet

- Legal Aspects of BusinessDocument5 pagesLegal Aspects of BusinessMaxson MirandaNo ratings yet

- New 10Document43 pagesNew 10abel becheniNo ratings yet