Professional Documents

Culture Documents

Prediction On House Asking Price in Jinjang

Uploaded by

sadyehclenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prediction On House Asking Price in Jinjang

Uploaded by

sadyehclenCopyright:

Available Formats

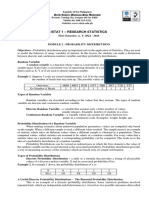

UECM2263 Applied Statistical Models, January 2016

Assignment Report 1

UTAR, Malaysia

Lecturer: Dr. Chang Yun Fah

PREDICTION ON HOUSE ASKING PRICE IN JINJANG

Sutha Kathiravan1, Keoy Eng Chiew2, Chin Yan3, Sathya Seelan1, Liaw Zhen Liang1

1

AS, Y2S2, Department of Mathematics and Actuarial Sciences, UTAR

FM, Y2S1, Department of Mathematics and Actuarial Sciences, UTAR

AM, Y2S2, Department of Mathematics and Actuarial Sciences, UTAR

sutha_sky@yahoo.com

Abstract Statistical research was carried out

on houses pending for sale in Jinjang, Kuala

Lumpur in order to determine the housing

affordability and other information that are

relevant for potential buyers to know. This will

ensure that house hunters are able to make good

decisions when choosing a house through our

statistical findings. Key word: statistics

I.

INTRODUCTION

This project is a research on the factors affecting

the houses up for sale in Jinjang. Researches in

Malaysia currently say that even though the

economy is slowing and the value of ringgit

Malaysia is depreciating but economists say that

the price of the houses continue to rise. Making it

difficult for Malaysians to own a house in the

future.[2]

Through our project, we have identified 13

predictor variables: We want to investigate what are

the Area, Housing Type, Land area, Built-up area,

Tenure type, Number of bedroom, Number of

bathroom, Furnished, Distance to nearest

LRT/KTM/Monorail station, Distance to nearest

primary school, Distance to nearest secondary

school, Distance to nearest shopping mall, and

Distance to nearest mosque. Plus, and a response

variable (Asking price of the property). We

collected data from a website (iProperty) and then

conducted statistical analysis on it using Rprogram. In this project, we do not use area and

land area as predictor variable because they are not

related. Distance to nearest mosque also not used

because there are too many missing value.

The variables we will be using are defined as

follow:

+6011-26169767

* X2 is the Built-up Area.

* X3 is the Tenure Type.

* X4 is the Number of Bedroom.

* X5 is the Number of Bathroom.

* X6 is the Distance to the nearest

LRT/KTM/Monorial station.

* X7 is the Distance to the nearest primary school.

* X8 is the Distance to the nearest secondary school

* X9 is the Distance to nearest shopping mall/

convenience store

* X10 is the Furnished.

The significance level that we will use throughout

this project is =0.05.

II.

Methodology

We carried out our project on houses that were up

for sale in Jinjang, Kuala Lumpur through

iProperty. Our population is Jinjang and our sample

consists of 65 observations.

Firstly, we suggest a multi-linear regression model

to explain the relationship between the response

variable Y, and the predictor variables. Under this

hypothesis,

Y= 0 + 1X1 + 2X2 + B3X3 + 4X4 + 5X5 +

6X6 + 7X7 + 8X8 + 9X9 + 10X10 +

III.

Analysis and Discussion

Residuals:

Min

1Q Median

* Y is the Asking Price.

-532028 -101390

* X1 is the Housing Type

Coefficients:

3Q

Max

2596 135809 427012

UECM2263 Applied Statistical Models, January 2016

Assignment Report 1

UTAR, Malaysia

Lecturer: Dr. Chang Yun Fah

Estimate Std. Error t value Pr(>|t|)

3.

4.

5.

6.

(Intercept) 79525.93 156095.35 0.509 0.61250

X1

99512.34 59918.18 1.661 0.10255

X2

220.92

53.87 4.101 0.00014 ***

The error term has constant variance.

The errors are normally distributed.

The error are uncorrelated.

No outliers.

The validity of these assumptions should always be

doubtful and conduct analysis to examine the

adequacy of model. The residual vs x is examine

the linearity for a model while the residual vs

predicted value is measure the constancy of the

variance. Normal probability plot is measure

whether the error is normally distributed or not. In

this assignment we are going to check X2 (Built-up

Area) and X4 (Number of Bedroom) as the others

variables are not related.

X3

***

-262283.09 63980.86 -4.099 0.00014

X4

***

83774.21 16884.73 4.962 7.34e-06

X5

109262.42 45492.11 2.402 0.01979 *

X6

-67520.15 39347.29 -1.716 0.09189 .

X7

-130055.64 84225.01 -1.544 0.12839

X8

31032.78 75666.86 0.410 0.68334

Residual VS Built-Up Area

X9

50432.54 49294.02 1.023 0.31082

Input

X10

106441.45 130001.33 0.819 0.41652

Non-linearity of Regression Model

model.reg<-lm(Y~X2,data=model.dat)

Signif. codes: 0 *** 0.001 ** 0.01 * 0.05 .

0.1 1

plot(x=model.dat$X2, y=model.reg$residuals, xlab

= "Built-Up Area", ylab = "Residuals",

main="Residuals vs. Built-Up Area", col = "red",

pch =

19,cex=1.5,panel.first=grid(col="gray",lty="dotted

"))

Residual standard error: 230400 on 54 degrees of

freedom

abline(h=0,col="blue")

Multiple R-squared: 0.7909, Adjusted R-squared:

0.7522

Output

---

F-statistic: 20.43 on 10 and 54 DF, p-value:

5.681e-15

After analyzing the data to find the summary of

each variables, we have found that the fitted

regression equation is

= 79525.93 + 99512.34X1 + 220.92X2

262283.09X3 + 83774.21X4+ 109262.42X5

67520.15X6 - 130055.64X7 + 31032.78X8 +

50432.54X9 + 106441.45X10

Model Adequancy Checking

Assumptions:

1.

2.

The relationship between the response Y

and the predictor variables are linear.

The error term, has zero mean.

Figure 1: The residuals fall within a horizontal

band centred around 0, displaying no systematic

tendencies to be positive and negative. Therefore,

linear regression model is appropriate.

Residual VS Bedrooms

model.reg<-lm(Y~X4,data=model.dat)

plot(x=model.dat$X4, y=model.reg$residuals, xlab

= "Bedrooms", ylab = "Residuals",

main="Residuals vs. Bedrooms", col = "red", pch =

UECM2263 Applied Statistical Models, January 2016

Assignment Report 1

Lecturer: Dr. Chang Yun Fah

19,cex=1.5,panel.first=grid(col="gray",lty="dotted

"))

abline(h=0,col="blue")

UTAR, Malaysia

Residual VS Bedrooms

Input

model.reg<-lm(Y~X4,data=model.dat)

plot(x=model.reg$fitted.values,

y=model.reg$residuals, xlab = "Bedrooms", ylab =

"Residuals", main="Residuals vs. Predicted

Values", col = "red", pch =

19,cex=1.5,panel.first=grid(col="gray",lty="dotted

"))

abline(h=0,col="blue")

Output

Figure 2: The residuals fall within a horizontal

band centred around 0, displaying no systematic

tendencies to be positive and negative. Therefore,

linear regression model is appropriate.

Non-constancy of Error Variance

Residual VS Built-Up Area

Input

model.reg<-lm(Y~X2,data=model.dat)

plot(x=model.reg$fitted.values,

y=model.reg$residuals, xlab = "Built-Up Area",

ylab = "Residuals", main="Residuals vs. Predicted

Values", col = "red", pch =

19,cex=1.5,panel.first=grid(col="gray",lty="dotted

"))

abline(h=0,col="blue")

Output

Figure 4: The graph shown that all points are

randomly scatted within a horizontal band centred

and no funnel shape is observed. Hence, constant

variance assumption seems to be fulfilled.

Normal Probability Plot

Price vs Built-Up Area

Input

model.reg<-lm(Y~X2,data=model.dat)

qqplot<qqnorm(model.reg$residuals,main="Normal

Probability Plot",xlab="Built-up

Area",ylab="Price",plot.it=TRUE ,col="blue",

pch=19,

cex=1.5,panelfirst=grid(col="gray",lty="dotted"))

abline(lm(qqplot$y~qqplot$x))

Figure 3: The graph shown that all points are

randomly scatted within a horizontal band centered

and no funnel shape is observed. Hence, constant

variance assumption seems to be fulfilled.

UECM2263 Applied Statistical Models, January 2016

Assignment Report 1

UTAR, Malaysia

Lecturer: Dr. Chang Yun Fah

Output

the error of all regressors conform to the normality

assumption initially made. No violation of

normality is detected.

According to [3], it says here that the interior

designs do affect the pricing of the house due the

number of bathrooms, bedrooms and the housing

type apart from its geographical location.

Coefficient of Determination

model

R.sq

adj.R.sq

Figure 5.From the graph above, error terms do not

depart substantially from normality suggesting that

the error of all regressors conform to the normality

assumption initially made. No violation of

normality is detected.

x1

0.1331626

0.1194033

x1, x2

0.5943963

0.5813123

x1, x2, x3

x1, x2, x3, x4

Referring to [1], research has shown that built-up

affects according to its location. If it is rural, the

housing price should be lower but if the it is located

in a city with a large built-up area, dwellers would

show in favour of those kind of houses.

x1, x2, x3, x4,x5

0.7551079

0.7343543

x1,x2,x3,x4,x5,x6

0.7769258

0.7538492

x1,x2,x3,x4,x5,x6,x7

0.7831864

0.7565602

x1,x2,x3,x4,x5,x6,x7,x8

0.7832118

0.7522420

x1,x2,x3,x4,x5,x6,x7,x8,x9

0.7883409

0.7537057

0.7909363

0.7522208

Price vs Bedrooms

0.6297972 0.6115905

0.7343859

10 x1,x2,x3,x4,x5,x6,x7,x8,x9,x10

0.7166783

Input

model.reg<-lm(Y~X4,data=model.dat)

Call:

qqplot<qqnorm(model.reg$residuals,main="Normal

Probability

Plot",xlab="Bedrooms",ylab="Price",plot.it=TRUE

,col="blue", pch=19,

cex=1.5,panelfirst=grid(col="gray",lty="dotted"))

lm(formula = Y ~ X1 + X2 + X3 + X4 + X5 + X6 +

X7, data = model.dat)

abline(lm(qqplot$y~qqplot$x))

Residuals:

Min

1Q Median

3Q

Max

-534969 -81367 13282 156080 410508

Output

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 139279.00 138479.11 1.006 0.318774

X1

X2

Figure 6 From the graph above, error terms do not

depart substantially from normality suggesting that

102055.71 57921.39 1.762 0.083437 .

218.51

52.48 4.164 0.000107 ***

X3

***

-247709.72 60273.66 -4.110 0.000128

X4

81540.08 16412.54 4.968 6.5e-06 ***

UECM2263 Applied Statistical Models, January 2016

Assignment Report 1

UTAR, Malaysia

Lecturer: Dr. Chang Yun Fah

X5

**

119661.49 44113.46 2.713 0.008811

X6

-77243.87 37898.25 -2.038 0.046180 *

X7

-92439.26 72053.61 -1.283 0.204711

--Signif. codes: 0 *** 0.001 ** 0.01 * 0.05 .

0.1 1

Residual standard error: 228400 on 57 degrees of

freedom

Multiple R-squared: 0.7832, Adjusted R-squared:

0.7566

F-statistic: 29.41 on 7 and 57 DF, p-value: < 2.2e16

IV.

Conclusion

As you can see the best model is model7 because

model7 has the highest adjusted R squared.

Therefore, the best model used to estimate the price

of a house is

= 139279 + 102055.71X1 + 218.51X2

247709.72X3 + 81540.08X4 + 119661.49X5

77243.87X6 92439.26X7

The challenge that we faced throughout this project

was having certain predictors corresponding with

the response variable because throughout the

process of collecting the data and compiling them,

we have found that the variable that contains the

distance to the nearest mosque has a lot of missing

variables and it became a challenge for us to do the

scatterplot. Hence, this predictor had to be ignored.

In the future, a project should be carried out where

all the predictors have values.

V.

Reference

[1] Gallent N., Shucksmith M., Tewdwr-Jones M.

(2003). Housing in the European Countryside:

Rural Pressure and Policy in Western Europe.

Architecture. 35-36

[2] Malaysias property market slowing sharply.

(2016, January 4). Global Property Guide.

Retrieved

March

23,

2016,

from

http://www.globalpropertyguide.com/Asia/malaysia

/Price-History

[3] Positive and negative impacts on house prices.

Rightmove.

Retrieved

from

http://www.rightmove.co.uk/what-affects-houseprices.html

VI. Overall

Overall, from the project that we have carried out,

we made assumptions of a multiple linear

regression models. Obtained a scatterplot to test its

validity by testing the non-linearity of regression

model and the non-constancy of error variance

between Residual vs. Built-Up Area and Residual

vs. Bedrooms; testing the Normal Probability Plot

between Price vs. Built-Up Area and Price vs.

Bedroom. The coefficient of determination was

obtained in order R square and the adjusted R

square so that the best model could be obtained.

We were able to get the best model and

was able to determine the validity of the all 7

models before choosing the best one. Hence, with

the model that we have just obtained, we could now

determine the asking price of the houses in Jinjang.

You might also like

- Integer Optimization and its Computation in Emergency ManagementFrom EverandInteger Optimization and its Computation in Emergency ManagementNo ratings yet

- Development of Robust Design Under Contaminated and Non-Normal DataDocument21 pagesDevelopment of Robust Design Under Contaminated and Non-Normal DataVirojana TantibadaroNo ratings yet

- Clay 2017Document13 pagesClay 2017everst gouveiaNo ratings yet

- Econometric Model With Cross-Sectional, Time Series, and Panel DataDocument4 pagesEconometric Model With Cross-Sectional, Time Series, and Panel DataDian KusumaNo ratings yet

- Chapter 8 Non-Parametric StatisticsDocument26 pagesChapter 8 Non-Parametric Statisticstemesgen yohannesNo ratings yet

- Error and Uncertainty: General Statistical PrinciplesDocument8 pagesError and Uncertainty: General Statistical Principlesdéborah_rosalesNo ratings yet

- QM Resit AssignmntDocument9 pagesQM Resit AssignmntrunaNo ratings yet

- 6034 - Classical Linear Regression ModelDocument30 pages6034 - Classical Linear Regression Modelbobktg82No ratings yet

- ECO 401 Model Selection and Structural BreaksDocument31 pagesECO 401 Model Selection and Structural BreaksJerry maNo ratings yet

- Stat 101 Exam 1 FormulasDocument18 pagesStat 101 Exam 1 FormulasXanh Nước BiểnNo ratings yet

- Unit 9Document16 pagesUnit 9swingbikeNo ratings yet

- MicroEconometrics Lecture10Document27 pagesMicroEconometrics Lecture10Carolina Correa CaroNo ratings yet

- A Cusp Catastrophe Model For Developing Marketing Strategies For Online Art AuctionDocument10 pagesA Cusp Catastrophe Model For Developing Marketing Strategies For Online Art AuctionNha ReshNo ratings yet

- Devore Ch. 1 Navidi Ch. 1Document16 pagesDevore Ch. 1 Navidi Ch. 1chinchouNo ratings yet

- Econometrics Project 2020323Document7 pagesEconometrics Project 2020323usaeed alviNo ratings yet

- RegressionDocument6 pagesRegressionRAJU SHATHABOINANo ratings yet

- Chapter 36 Large Sample Estimation and Hypothesis TestingDocument135 pagesChapter 36 Large Sample Estimation and Hypothesis Testingdoanhnghiep171No ratings yet

- Introductory Econometrics Exam MemoDocument9 pagesIntroductory Econometrics Exam Memomdxful002100% (4)

- Statistics Lecture Course 2022-2023Document66 pagesStatistics Lecture Course 2022-2023Cece SesNo ratings yet

- Business SolutionsDocument227 pagesBusiness Solutionsoykubayraktar100% (6)

- Econ 306 HW 3Document7 pagesEcon 306 HW 3PPPNo ratings yet

- Robust Statistics For Outlier Detection (Peter J. Rousseeuw and Mia Hubert)Document8 pagesRobust Statistics For Outlier Detection (Peter J. Rousseeuw and Mia Hubert)Robert PetersonNo ratings yet

- Multiple RegressionDocument7 pagesMultiple RegressionarmailgmNo ratings yet

- Sta. Elena College Data InterpretationDocument40 pagesSta. Elena College Data InterpretationJohn Ericson PeñaNo ratings yet

- Geographically Weighted Regression: Martin Charlton A Stewart FotheringhamDocument17 pagesGeographically Weighted Regression: Martin Charlton A Stewart FotheringhamAgus Salim ArsyadNo ratings yet

- Specification Testing of Production in A Stochastic Frontier ModelDocument10 pagesSpecification Testing of Production in A Stochastic Frontier ModelMireya Ríos CaliNo ratings yet

- CHAPTER 11 Chi Square and Other Non Parametric TestsDocument77 pagesCHAPTER 11 Chi Square and Other Non Parametric TestsAyushi JangpangiNo ratings yet

- SLR Assignment1 CSDocument3 pagesSLR Assignment1 CSTariqNo ratings yet

- Module 2 in IStat 1 Probability DistributionDocument6 pagesModule 2 in IStat 1 Probability DistributionJefferson Cadavos CheeNo ratings yet

- Regression and Multiple Regression AnalysisDocument21 pagesRegression and Multiple Regression AnalysisRaghu NayakNo ratings yet

- Regression Analysis Engineering StatisticsDocument72 pagesRegression Analysis Engineering StatisticsLeonardo Miguel LantoNo ratings yet

- AQM Regression Day 3 Class WorkDocument4 pagesAQM Regression Day 3 Class Workaneeqa.shahzadNo ratings yet

- Real estate value prediction using regression modelsDocument8 pagesReal estate value prediction using regression modelsAimane CAFNo ratings yet

- Economic predictions with big data: Sparse or dense modellingDocument5 pagesEconomic predictions with big data: Sparse or dense modellingbillpetrrieNo ratings yet

- Experimental Modeling: Dr. G. Suresh KumarDocument30 pagesExperimental Modeling: Dr. G. Suresh KumarShakeb RahmanNo ratings yet

- Error and Data AnalysisDocument38 pagesError and Data AnalysisisiberisNo ratings yet

- Probability Distributions ExplainedDocument38 pagesProbability Distributions ExplainedswingbikeNo ratings yet

- Basic Regression AnalysisDocument5 pagesBasic Regression AnalysisAnantha VijayanNo ratings yet

- Evaluation of Analytical DataDocument58 pagesEvaluation of Analytical DataJoyce Mariele RomeroNo ratings yet

- Case Reyem AffairDocument22 pagesCase Reyem AffairVishal Bharti100% (3)

- Multiple Regression: X X, Then The Form of The Model Is Given byDocument12 pagesMultiple Regression: X X, Then The Form of The Model Is Given byezat syafiqNo ratings yet

- Evans Analytics2e PPT 08Document73 pagesEvans Analytics2e PPT 08qunNo ratings yet

- Power properties of the Sargan test with measurement errorsDocument6 pagesPower properties of the Sargan test with measurement errorsismetgocerNo ratings yet

- Forecasting Cable Subscriber Numbers with Multiple RegressionDocument100 pagesForecasting Cable Subscriber Numbers with Multiple RegressionNilton de SousaNo ratings yet

- S1181 U03 NotesDocument5 pagesS1181 U03 NotesLoganHarperNo ratings yet

- M07 Julita Nahar PDFDocument8 pagesM07 Julita Nahar PDFNadya NovitaNo ratings yet

- Nonparametric Quantile EstimationDocument32 pagesNonparametric Quantile EstimationMannyNo ratings yet

- Answers Review Questions EconometricsDocument59 pagesAnswers Review Questions EconometricsZX Lee84% (25)

- Data Visualisations TechniquesDocument4 pagesData Visualisations TechniquesMbusoThabetheNo ratings yet

- Uncertanties and Intro Pupil BookletDocument23 pagesUncertanties and Intro Pupil Bookletapi-322008295No ratings yet

- Whittemore1997.Multistage SamplingDocument14 pagesWhittemore1997.Multistage SamplingarmanNo ratings yet

- Statistics Chapter 1 SummaryDocument53 pagesStatistics Chapter 1 SummaryKevin AlexanderNo ratings yet

- Dynamic Central Place Theory: Results Simulation Approach: Roger W. WhiteDocument18 pagesDynamic Central Place Theory: Results Simulation Approach: Roger W. WhiteAtul Saini100% (1)

- Scientific Notation and Significant FiguresDocument18 pagesScientific Notation and Significant FiguresLawrence AnDrew FrondaNo ratings yet

- Non-Linear Analysis On Exxon Mobil Share PricesDocument12 pagesNon-Linear Analysis On Exxon Mobil Share PricesSorin George MarinNo ratings yet

- Coordinate Transformation Uncertainty Analysis in Large-Scale MetrologyDocument9 pagesCoordinate Transformation Uncertainty Analysis in Large-Scale Metrologyjorge david Otalora muñozNo ratings yet

- Introduction To Machine Learning Week 2 AssignmentDocument8 pagesIntroduction To Machine Learning Week 2 AssignmentAkash barapatreNo ratings yet

- 5.2 - Sampling Distribution of X ̅ - Introduction To Statistics-2021 - LagiosDocument15 pages5.2 - Sampling Distribution of X ̅ - Introduction To Statistics-2021 - LagiosAmandeep SinghNo ratings yet

- Learn Statistics Fast: A Simplified Detailed Version for StudentsFrom EverandLearn Statistics Fast: A Simplified Detailed Version for StudentsNo ratings yet

- Analog Rep 2Document14 pagesAnalog Rep 2sadyehclenNo ratings yet

- UEEA2333 Analog Electronics Tutorial SolutionsDocument3 pagesUEEA2333 Analog Electronics Tutorial SolutionssadyehclenNo ratings yet

- Wa0001Document27 pagesWa0001sadyehclenNo ratings yet

- ScheduleDocument1 pageSchedulesadyehclenNo ratings yet

- T3 FiltersDocument2 pagesT3 FilterssadyehclenNo ratings yet

- Ch7 Power Amps6 v2Document73 pagesCh7 Power Amps6 v2sadyehclenNo ratings yet

- Ch2b Data Converter v2Document37 pagesCh2b Data Converter v2sadyehclenNo ratings yet

- Ch1 Feedback and StabilityDocument88 pagesCh1 Feedback and Stabilitysadyehclen100% (1)

- Ch2a Op Amp v3Document66 pagesCh2a Op Amp v3sadyehclenNo ratings yet

- Engineering and Science UEEA1333 Bachelor of Engineering (Hons) Analogue Electronics Year 1, 2 Mr. NG Choon Boon 201401Document2 pagesEngineering and Science UEEA1333 Bachelor of Engineering (Hons) Analogue Electronics Year 1, 2 Mr. NG Choon Boon 201401sadyehclenNo ratings yet

- Ch5 Non-Linear CircuitsDocument29 pagesCh5 Non-Linear CircuitssadyehclenNo ratings yet

- T3 FiltersDocument2 pagesT3 FilterssadyehclenNo ratings yet

- Filters and Tuned Amplifiers DesignDocument79 pagesFilters and Tuned Amplifiers DesignsadyehclenNo ratings yet

- Ch6 RegulatorsDocument62 pagesCh6 RegulatorssadyehclenNo ratings yet

- Engineering and Science UEEA1333 Bachelor of Engineering (Hons) Analogue Electronics Year 1, 2 Mr. NG Choon Boon 201401Document2 pagesEngineering and Science UEEA1333 Bachelor of Engineering (Hons) Analogue Electronics Year 1, 2 Mr. NG Choon Boon 201401sadyehclenNo ratings yet

- UTAR ANALOGUE ELECTRONICS TUTORIAL SOLUTIONSDocument3 pagesUTAR ANALOGUE ELECTRONICS TUTORIAL SOLUTIONSsadyehclenNo ratings yet

- UEEA2333 Assignment 2014Document3 pagesUEEA2333 Assignment 2014sadyehclenNo ratings yet

- T2 OpampDocument2 pagesT2 OpampsadyehclenNo ratings yet

- Covyy: E Y E EyDocument3 pagesCovyy: E Y E EysadyehclenNo ratings yet

- Receipt of Lab Report Submission (To Be Kept by Student)Document2 pagesReceipt of Lab Report Submission (To Be Kept by Student)sadyehclenNo ratings yet

- T5 RegulatorDocument3 pagesT5 RegulatorsadyehclenNo ratings yet

- T4 OscDocument3 pagesT4 OscsadyehclenNo ratings yet

- ANALOGUE ELECTRONICS TUTORIAL QUESTIONSDocument2 pagesANALOGUE ELECTRONICS TUTORIAL QUESTIONSsadyehclenNo ratings yet

- ANALYSIS OF TIME SERIES DATADocument7 pagesANALYSIS OF TIME SERIES DATAsadyehclenNo ratings yet

- Pusat Bimbingan Sri Inderawasih Mathematics Form 1 Test 1: Lembaga PeperiksaanDocument5 pagesPusat Bimbingan Sri Inderawasih Mathematics Form 1 Test 1: Lembaga PeperiksaansadyehclenNo ratings yet

- Paper 3 All in 1Document11 pagesPaper 3 All in 1sadyehclenNo ratings yet

- Maths2015 SyllabusDocument40 pagesMaths2015 Syllabuspvr2k1No ratings yet

- UEMH4333 Tutorial 3Document2 pagesUEMH4333 Tutorial 3sadyehclenNo ratings yet

- Seminar Fasa 1 - Paper 3Document23 pagesSeminar Fasa 1 - Paper 3sadyehclenNo ratings yet

- Presentation MH BI LatestDocument8 pagesPresentation MH BI LatestsadyehclenNo ratings yet

- Maj. Terry McBurney IndictedDocument8 pagesMaj. Terry McBurney IndictedUSA TODAY NetworkNo ratings yet

- The Impact of School Facilities On The Learning EnvironmentDocument174 pagesThe Impact of School Facilities On The Learning EnvironmentEnrry Sebastian71% (31)

- NAT Order of Operations 82Document39 pagesNAT Order of Operations 82Kike PadillaNo ratings yet

- Pita Cyrel R. Activity 7Document5 pagesPita Cyrel R. Activity 7Lucky Lynn AbreraNo ratings yet

- Oxford Digital Marketing Programme ProspectusDocument12 pagesOxford Digital Marketing Programme ProspectusLeonard AbellaNo ratings yet

- Case 5Document1 pageCase 5Czan ShakyaNo ratings yet

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriNo ratings yet

- Malware Reverse Engineering Part 1 Static AnalysisDocument27 pagesMalware Reverse Engineering Part 1 Static AnalysisBik AshNo ratings yet

- Mercedes BenzDocument56 pagesMercedes BenzRoland Joldis100% (1)

- PRODUCTDocument82 pagesPRODUCTSrishti AggarwalNo ratings yet

- Honda Wave Parts Manual enDocument61 pagesHonda Wave Parts Manual enMurat Kaykun86% (94)

- India: Kerala Sustainable Urban Development Project (KSUDP)Document28 pagesIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADNo ratings yet

- LM1011 Global ReverseLogDocument4 pagesLM1011 Global ReverseLogJustinus HerdianNo ratings yet

- Algorithms For Image Processing and Computer Vision: J.R. ParkerDocument8 pagesAlgorithms For Image Processing and Computer Vision: J.R. ParkerJiaqian NingNo ratings yet

- ASMOPS 2016 - International Invitation PHILIPPINEDocument4 pagesASMOPS 2016 - International Invitation PHILIPPINEMl Phil0% (3)

- Non Circumvention Non Disclosure Agreement (TERENCE) SGDocument7 pagesNon Circumvention Non Disclosure Agreement (TERENCE) SGLin ChrisNo ratings yet

- En dx300lc 5 Brochure PDFDocument24 pagesEn dx300lc 5 Brochure PDFsaroniNo ratings yet

- Difference Between Text and Discourse: The Agent FactorDocument4 pagesDifference Between Text and Discourse: The Agent FactorBenjamin Paner100% (1)

- Ancient Greek Divination by Birthmarks and MolesDocument8 pagesAncient Greek Divination by Birthmarks and MolessheaniNo ratings yet

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- GROSS DOMESTIC PRODUCT STATISTICS (Report) - Powerpoint PresentationDocument37 pagesGROSS DOMESTIC PRODUCT STATISTICS (Report) - Powerpoint PresentationCyryhl GutlayNo ratings yet

- Origins and Rise of the Elite Janissary CorpsDocument11 pagesOrigins and Rise of the Elite Janissary CorpsScottie GreenNo ratings yet

- Journal Entries & Ledgers ExplainedDocument14 pagesJournal Entries & Ledgers ExplainedColleen GuimbalNo ratings yet

- Sharp Ar5731 BrochureDocument4 pagesSharp Ar5731 Brochureanakraja11No ratings yet

- Decision Maths 1 AlgorithmsDocument7 pagesDecision Maths 1 AlgorithmsNurul HafiqahNo ratings yet

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Instrumentation Positioner PresentationDocument43 pagesInstrumentation Positioner PresentationSangram Patnaik100% (1)

- Simply Put - ENT EAR LECTURE NOTESDocument48 pagesSimply Put - ENT EAR LECTURE NOTESCedric KyekyeNo ratings yet

- Do You Agree With Aguinaldo That The Assassination of Antonio Luna Is Beneficial For The Philippines' Struggle For Independence?Document1 pageDo You Agree With Aguinaldo That The Assassination of Antonio Luna Is Beneficial For The Philippines' Struggle For Independence?Mary Rose BaluranNo ratings yet

- 08 Sepam - Understand Sepam Control LogicDocument20 pages08 Sepam - Understand Sepam Control LogicThức Võ100% (1)