Professional Documents

Culture Documents

Comm Rev ABELLA NOTES PDF

Uploaded by

Marian SantosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comm Rev ABELLA NOTES PDF

Uploaded by

Marian SantosCopyright:

Available Formats

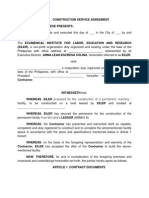

Commercial Law Review

Dean Eduardo Abella

MORTGAGE

Introduction

- Under the NCC (Book V), there are accessory contracts securing principal

obligations (special contracts). These include pledge, mortgage, antichresis,

guaranty, and suretyship.

Definition

- a mortgage is a contract where the property is recorded (in the register of

deeds of the city and/or province) to secure a principal obligation

- example: If a mortgaged property is in Batangas City, it must be

registered in both the City and Province of Batangas (Batangas City is

the provincial capital).

- an accessory contract, collateral or security for an obligation

Return of Excess

Claim

for

Deficiency

Not required

- No recovery under the Recto

Law

(NCC 1484 on installment sale

of personal property where the

mortgage is constituted over the

object of sale to secure the

payment of the purchase price).

For Recto Law to be applied,

mortgage must be constituted

over the object of the installment

sale.

Required

- Recovery if not under the

Recto Law

FROM: Principal Debtor

E: Obligation is solidary with the

Mortgagor

They are valid only if there is a principal contract.

Basic Principles

1.) Accessory Contract only exists if there is a principal contract

2.) Mortgagor is the owner of thing mortgaged

3.) Mortgage is extinguished if the principal obligation is extinguished

Scope: It may be constituted over:

(1) Personal Property (Chattel Mortgage)

(2) Real Property (Real Estate Mortgage)

Object

Scope

Foreclosure

EJ Foreclosure

Registration

CM

REM

Personal property

Real property

Existing and valid obligations;

Includes future obligations

Includes voidable, unenforceable, rescissible and natural

obligations

Extrajudicial only

EJ or Judicial

No right of redemption

Right of Redemption

RD of mortgagors residence +

location of property + LTO

(motor vehicles)

CHATTEL MORTGAGE

Governing Law: Act No. 1508

CHATTEL MORTGAGE LAW

ACT NO. 1508

This act is considered repealed by the New Civil Code.

The ratio is that pactum commissorium is void and the Chattel Mortgage Law

considers a Chattel Mortgage as a conditional sale which becomes absolute

upon default

In Jurisprudence:

In one case there was a house that was subject to a chattel mortgage. The

reason was that the land belonged to one person and the house to another.

The Court ruled that as between the parties there is a valid chattel mortgage

as under NCC 1159, stipulations of parties valid between themselves.

However, it is not binding on other persons.

1|SMILE. Keep on moving forward!

Commercial Law Review

Dean Eduardo Abella

Collateral issue: The register of deeds was not justified in refusing to record

chattel mortgage over the house; it is a ministerial duty on the part of the

register

Q: May personal property also be classified as real?

A: Yes, but it is binding only as between the parties

If object is motor vehicle it should be registered with the LTO. It should be first

registered with register of deeds. After, which, register with the LTO.

Practical: Bring two copies, first to Register of Deeds then have him stamp the

copy. Bring the second copy to the LTO.

Mortgagor may or may not be the principal debtor.

While registration may be notice to world, it is still not in accordance with law.

A problem arises when the principal debtor defaults.

Definition

- Chattel Mortgage is defined in the NCC as a contract whereby personal

property is recorded in the chattel mortgage registry as security for the

performance of an obligation.

Where to Register: Residence of the mortgagor

CM is to be recorded in the Register of Deeds of the City or Province where

the mortgagor resides.

Note: There is no Register of Deeds in Municipalities.

Why: Because it can be easily moved

Nature of Requirement:

Not for the validity of the mortgage

But for Constructive Notice to the world

TRIVIA: Forms of Construction Notice:

Public Instrument, Publication, Registration

Form of Registration: Affidavit of Good Faith

- It is a sworn declaration of both the mortgagor and mortgagee that they

executed the mortgage in good faith to secure a valid obligation and not for the

purpose of fraud

- IF LACKING:

a) the mortgage is still valid between the parties

b) it is invalid as to third persons because the mortgage cannot be registered

without the affidavit

Q: If an affidavit of good faith is omitted is there a valid chattel mortgage?

A: Yes, general ObliCon rule. Affidavit of good faith is for purposes of

registration. If there is no affidavit, it is not binding on third persons. Affidavit of

good faith may be demanded.

Q: What if mortgagor and property are in different locations?

A: Register first in the city or province where the mortgagor resides then where

the property is found.

REMEDIES OF THE CREDITOR:

1.) Sue for specific performance if the obligation is for a sum of money

mortgagee abandons mortgage by suing the principal debtor. If suit is

brought, mortgagor may demand release of mortgage.

2.) Foreclose the mortgage under the Chattel Mortgage Law

- ABSOLUTE REQT: CREDITORS POSSESSION of the thing

mortgaged because it must be sold in a public auction

- How does the creditor acquire possession:

Demand for the delivery of the object after default. If concealed, sue

for replevin.

- Who attends to the foreclosure sale:

Sheriff or

Notary public

- What is the process of foreclosure:

a. Petition for EJ Foreclosure with the sheriff or notary public

b. Notice of Auction Sale by the Sheriff/NP after the receipt of

the petition

- Posted in at least 3 public places,

e.g. City/Municipal Hall, Barangay Hall, Hall of Justice

- there is no law that requires the sheriff or np to

make sure that the notices stay where posted

Q: If somebody took the posted notice, will

proceeding be invalidated?

A: No, it will not, posting is enough.

- Copy furnished to the mortgagor at least 10 days before

the auction sale, otherwise the sale would be void

c. Sale to the Highest Bidder

- If sold to the mortgagee, he has no obligation to deliver any

amount

Commercial Law Review

Dean Eduardo Abella

- If sold to a third party, the latter delivers the amount of the bid to

S/NP

d. Certificate of Sale

- Whoever is the highest bidder gets certificate of sale from

sheriff or notary.

Hypothetical Q: Mortgagor did not see necessity of recording release of

mortgage. Went to get a second loan from mortgagee. He merely returned the

release of mortgage, is the mortgage revived?

A: No, obligation it secured is already extinguished

- CAFS is not required

- Note: It is ironic that the remedy is supposed to be extra-judicial or

out of court and yet sheriff is not allowed to accept the petition unless

the court fees required are paid (SC Circular March 2000)

3.

Referral and Payment of Fees

4.

Notice of Auction Sale

- By Whom Issued: Sheriff, NP

- Where: Where the property is situated

- How:

a) Notice in at least three public places in City or Province where the

property is located

b) Publication in a newspaper of general circulation, once a week for

two consecutive weeks

- NOTE: Publisher must be accredited by the court and

assigned the publication by raffle

REAL ESTATE MORTGAGE

Governing Law: ACT 3135

It is a special law creating the right of the mortgagee to foreclose the REM

extrajudicially

- Should notice be furnished to the mortgagor? No because

publication is constructive notice to all (This is opposed to

the EJ Foreclosure of Chattel Mortgages where notice to the

mortgagor is required)

How to extrajudicially foreclose a REM

3135 refers to the Rule 39 of the Rules of Court

1. The Mortgagor must expressly authorize the mortgagee to sell the

mortgaged property in case of default, either in the deed of mortgage

or in a separate instrument

- EXAMPLE: In case of default, the bank shall be authorized to sell,

as it is hereby authorized to sell.

- INSUFFICIENT: Banks use printed deeds of REM with the following

provision: In case of default, the Bank can extrajudicially foreclose

pursuant to Act No. 3135. According to a SC Circular, mere

reference to Act No. 3135 is not enough.

- Thus now, in case of default, the bank must be expressly authorized

to sell the property mortgaged.

- Note: Just copy the wording/form of the law

2.

The mortgagee must execute a verified petition

Q: How is it initiated?

A: Prepare a verified petition to foreclose the REM. The sheriff or a

notary public may handle this. The mortgagee himself may do it, but it

is often the sheriff or notary public.

- Where filed: Sheriff or Notary public

- REQT: CORRECT DESCRIPTION OF PROPERTY, Otherwise the

notice would be void

- How to Prove: Ask for a Certificate of Notice or Affidavit of

Publication and a copy of issue of the newspaper

5.

Scrutiny of the Title of the Property

- If the property is wrongly described in the publication, then the entire

proceedings would be void

- REMEDY: Inform the publisher and correct the issue

6.

Auction Sale

- Q: If there is a written agreement between the mortgagor and

mortgagee to postpone the auction sale, is it valid? YES, because it is

not contrary to law, morals, good customs, public order or policy.

However, in case of postponement, the notice requirements should

be complied with again as in the case of Nepomuceno Productions

vs. PNB.

- Three possible results of an auction sale

a. Bid exceeds the amount of the obligation: the excess is

returned to the mortgagor

Commercial Law Review

Dean Eduardo Abella

b.

c.

*If tender is refused: the remedy is specific performance. The amount

may not be consigned because for consignation to be allowed, there

must be a debt due.

Bid is less than the amount of the obligation: the deficiency

is recoverable

Mortgagor himself is the highest bidder: There is no need for

the amount of the bid to be delivered to the sheriff or no.

*NOTE: Present the Certificate of Title from the Register of Deeds

with the annotation of the Certificate of Sale.

NOTE: There is no longer any requirement of having at least 2

bidders.

7.

8.

- What is the Certificate of Redemption: It cancels the certificate of

sale

Certificate of Sale

- By whom issued: sheriff or np

- What to do: Register ASAP with RD BEC the one-year Right of

Redemption commences within one year from the date of registration

- When is the Redemption Period:

GR: 1y from registration of certificate of sale (NOT 12m)

Redemption

- Nature: Right, Not a Duty; it may not be forced on the mortgagor

- It is a property right arising from property

- Real property

- Real rights

E: 90d or before the registration of tile over the property,

whichever comes first IF the mortgagor is a juridical person

and the mortgagee is a bank (General Banking Act)

- Is the right of redemption waivable? NO. Express waivers within the

period of redemption is not allowed because it is contrary to public

policy. HOWEVER, waiver may be done by not exercising the right.

- Who Exercises Right of Redemption:

a. Mortgagor

b. His successors-in-interest

c. Judgment creditor of mortgagor

- How is it Exercised:

there must be a valid tender of the redemption price

within the redemption period

- When is tender valid: If there is tender of the full amount of

in legal tender

- What is the redemption price:

a) If there is a special law that created the mortgage and there is an

indication of redemption price, then follow that.

b) If it is a bank, it depends on the law.

c) If another person:

1.) Bid price

2.) 1% interest per month on the bid price

3.) Taxes and charges paid by the highest bidder

4.) 1% interest per month on the taxes and charges paid

The Supreme Court construed this as 12% per annum.

- To whom must the amount be tendered:

Highest bidder or Sheriff/NP conducting the auction, whoever is less

intimidating

- Is it transferable? YES, either onerously or gratuitously.

Redemption is a real right over real property. The right may be

inherited by succession

9.

Acquisition of Title

- When to obtain title to the property: When the period of redemption

expired without anyone redeeming the property

- How: 2 ways

a. Have the Sheriff/NP issue a Final Certificate of Sale

b. Execute an Affidavit of Non-Redemption, which is less

expensive than the first

c. Pay BIR the taxes upon the expiration of the redemption

period

- Why do it: The BIR requires: (1) certificate authorizing registration

and (2) the tax clearance certificate

a. DST within five days from the month following the expiry of

the redemption period

b. CGT / Withholding Taxes 30 days from expiration of the

redemption period

c. VAT

d. Transfer Taxes of LGUs

- Pay the amount of taxes to the LGU

Commercial Law Review

Dean Eduardo Abella

- Update all realty taxes

- Obtain a Clearance from the local treasurer

- Go to the RD for the issuance of a TCT

- What is the tax base:

Before, it was the bid price.

By reason of a BIR Circular dated July 2012, the tax base is now the

highest of:

(a) Bid Price or

(b) Market Value in the Tax Declaration or

(c) BIR Valuation

10. Possession of the Property

- How: Ex parte petition for the Issuance of a Writ of Possession

- It is in the nature of a motion

- Nature:

General Rule: Ministerial duty of the court BUT if filed before the end

of the redemption period, a bond is required.

Exception: Not ministerial if there is another person with a better right.

Ex. Lessee

- REQD: GF of Applicant! Thus, the applicant must inquire into the (a)

TCT and (b) rights of the current possessor to qualify as a buyer in

good faith; otherwise, he will have no right of possession.

New buyer in good faith doctrine: Looking at certificate of

title is no longer enough; you must look at the right of the

person in actual possession of the property. Failure to do so

does not qualify one as a buyer in good faith.

Practical Matters: When Register of Deeds issues Certificate of Title, he

issues at least 2, the original and the owners copy.

There are at least 2 because co-owners may each want a copy of the

certificate of title. In which case, the co-owners duplicate should be prepared

with the original. If you are buying from co-owners, you must get all other

copies so that they may be annotated.

Remedy or the issuance of the writ of possession is the same in extrajudicial

foreclosure, judicial foreclosure and execution sale. There is no remedy if a

third party has a better right.

Q: Can PDCs be used as chattel mortgaged property?

A: Legally, yes.

Case: Person borrowed from bank. Parents executed a Real Estate Mortgage.

Borrower issued post-dated checks. The checks were dishonored. The bank

sued the borrower for BP22.

Remedies for bank are as follows:

1.) Civil Collection

2.) BP22

3.) Foreclosure

Filing of BP22 is an abandonment of the mortgage.

If buyer of mortgaged land already owns the land and the prior owner does not

want to leave, file an ex parte Petition for Issuance of Writ of Possession.

Practical Matters: Attach all certified true copies of documents in the petition

title, deed of mortgage, final certificate of sale, BIR clearance (tax clearance,

certificate authorizing registration)

Commercial Law Review

Dean Eduardo Abella

DOCUMENT OF TITLE

Governing Laws:

NCC (Sales)

Code of Commerce

Warehouse Receipts Act

Definition

It is an instrument or document where the bailee acknowledges goods and

contains an undertaking to deliver the goods

- DIFF with Instrument under the Negotiable Instruments Law

1) Coverage: NCC covers GOODS to be transported or safely kept.

NIL covers sums certain in money, except other properties that may

also be covered.

2) Modes of Endorsement

- In DTs, endorsements must be IN BLACK or ESPECIALLY

- In NIs, it may be blank, especially, conditional, qualified, or

restrictive

Examples of Documents of Title

- Bill of Lading, issued by common carriers (Code of Commerce)

- Warehouse Receipt, issue by warehousemen (under the Warehouse

Receipts Act and the General Bonded Warehouse Act).

- Quedan, a warehouse receipt that covers rice, sugar, or tobacco

Who issues DTs:

Common carriers

Warehousemen

Forms of DTs to facilitate trade

1. Negotiable IF it contains words of negotiability, i.e. to order, to bearer,

or those with equivalent words or phrases (e.g. holder, possessor)

2. Non-Negotiable

What if it contains deliver to bearer with a red stamp in big font of

NON-NEGOTIABLE: It is negotiable even if the bailee intends it to

be non-negotiable, as long as it contains words of negotiability.

How to Negotiate Documents of Title

1. To Order Instruments: Indorsement (Blank or Special) and Delivery

2. To Bearer: Delivery

If Originally To Bearer, then specially endorsed and delivered, the

transferee must also negotiate by endorsment and delivery.

NOTE: Once it has been especially endorsed, negotiate by

endorsement and delivery all the time thereafter

EXCEPT IF the last endorsement is in blank, then just deliver it

subsequently

DIFFERENCE WITH NI: Endorsement in a bearer NI has no effect.

BILL OF LADING

Governing Law: Code of Commerce

Kinds:

Bill of Lading Common carrier of goods by water

Waybill by trucks on land

Airwaybill by aircrafts, airlines

Formal Requirements

1. It must be printed

2. It must contain the complete name and address of the printer

3. It must contain the telephone number of the printer.

4. It must contain the TIN Number of the printer.

Content of B/L (Code of Commerce)

1.) Complete name and address of consignor/shipper.

2.) Complete name and address of consignee.

3.) Complete name and address of the carrier/shipee (NCC).

4.) Complete description of goods including marks and markings, e.g.

Numbers on crates, Names in pomelo crate from Davao

5.) Amount of fare

6.) Stipulations on limited liability

- Nature: Contract of Adhesion but it is not prohibited; it is only

interpreted against the party who cause the ambiguity

Q: Are printed stipulations on Bill of Lading binding on the shipper

even if the shipper does not sign?

A: GR: Yes, a contract is perfected by mere consent. Here, consent is

implied even if it is signed only by the carriers representative.

EXCEPTION: There is no consent if print is too small that the shipper

could not have read it as in the Shewaram Case.

Commercial Law Review

Dean Eduardo Abella

Effect of Issuance of a B/L: Disputable presumption that the carrier received

the goods. It is not conclusive.

Purposes of Documents of Title and Bills of Lading

1.) As a Receipt

2.) As a Written Contract between parties

3.) As a Symbol, standing for the goods mentioned therein (Symbol)

WAREHOUSE RECEIPT

Governing Law: GENERAL BONDED WAREHOUSE ACT governs the

conduct and business of warehousing

Who issues WR: Warehouseman.

Requirements for Issuance

1. Annual license from DTI Director.

2. Bond must be posted before the issuance of a license, to answer for

damages to goods suffered while the goods are in storage. The bond

is coterminous with the license.

3. Insurance against fire over all the goods stored in the warehouse.

Is there a prescribed minimum area for warehouses? NONE.

What is its difference with a Customs-Bonded Warehouse: WH is licensed and

bonded, while a customs-bonded WH is a facility by importers of raw materials.

2.) He must surrender the original to the warehouseman.

3.) He must express his willingness to sign the receipt upon delivery of

the goods to him.

Liens of the Warehouseman

Nature: Possessory and Waivable by parting with the goods

1.) Storage fees

2.) Other arrangements with the depositor, e.g. premium and interest for

additional insurance coverage

3.) Cost of packaging and repackaging (though the latter is illegal)

Q: What should warehouseman do with the original receipt?

A: Cancel it. If he fails to cancel it and the receipt falls into the hands of

someone in good faith and who got it for value, warehouseman is liable to the

person.

Q: May goods covered by a document of title be levied upon on attachment for

execution?

A: Yes.

Effect of Loss of Original Receipt

- The claimant must file an action in court to prove his ownership or right over

the goods. In practice, the claimant merely posts a bond with the

warehouseman.

- It would be the claimants problem because he cannot oblige the

warehouseman to deliver the goods without the original receipt

- To protect the warehouseman, the claimant must post a bond for the value of

the goods.

What if a warehouseman issues more copies of WH receipts: He must indicate

that it is only a copy and not the original. Otherwise, he is liable to a TP who

receive it in GF and for value

If a warehouseman issues more than one copy of a warehouse

receipt, he should indicate on copies that they are merely copies and

not the original. If he fails to indicate it as a copy and a person in good

faith received the receipt for value, he would be entitled to the goods

as if his warehouse receipt were original.

Negotiability of WH Receipts

A warehouse receipt is negotiable or non-negotiable.

Effect of Negotiation: Transferee acquires the direct right to receive goods from

the warehouseman. However, the right is conditioned upon the following:

1.) Person claiming the goods must first satisfy the liens of the

warehouseman.

Commercial Law Review

Dean Eduardo Abella

TRUTH IN LENDING ACT

BULK SALES LAW

Purpose of the law: To enable persons borrowing money or buying goods on

installment or credit to know the actual cost in money of the credit.

Purpose of the law: To protect creditors from fraudulent schemes of their

debtors

History: When cost of money had gone beyond a profitable rate and the

interest was also subject to the usury law, banks thought of other ways to

make money. Banks started charging different fees to avoid the usury law. In

effect, every move by the bank had a price (Processing fee, application fee,

appraisal fee). Thus, the law obliges lenders to fully disclose all charges

before the consummation of the transaction.

Acts covered and regulated:

1. Sale, assignment, mortgage, or other forms of transfer of all or

substantially all of the stocks of goods, wares or merchandise other

than in the ordinary course of business

2. Sale, assignment, mortgage, or other forms of transfer of all or

substantially all of the businesses of a person, the business/es

themselves

3. Sale, assignment, mortgage, or other forms of transfer of all or

substantially all of fixtures and equipment used in the conduct of

business

How: Disclosure Statement.

Prior to consummation, person lending money or selling on credit/installment

should deliver to the debtor a written statement showing the breakdown of the

charges. Note that this is already after a meeting of the minds. (Section 4)

WHY All or Substantially All: These are extraordinary transfers

Content of Disclosure Statement

1.) Cash Price less down payment = amount to be financed

2.) Payable in XX installments

3.) Total amount to be paid in installments

4.) Total Cost

5.) Other charges

Regulating Body: Monetary Board of the BSP is the body that oversees the

implementation of the law. Violation of the Act is a crime; penalty is fine of

P100 to P2000 and imprisonment of at least 1 month but not more than 5

years.

Case: Solidbank extended a credit line of P200k to a client, not just as an

ordinary loan but also as a standby source of funds which earns no interest

unless it is drawn. When the borrower draws money, the credit diminishes and

he pays only what is actually received. But, there were accumulated service

fees which were not made available to the borrower.

Credit Line when bank sets aside a certain amount for client that

client may draw on at any time.

SC did not allow Solidbank to collect amount because the additional charges

were not indicated in the promissory notes.

In 2009, there was another case where the fees were included in the

promissory notes but there was no delivery of disclosure statements, collection

still not allowed.

Note: Not every sale is covered. Sales in the ordinary course of business is

not covered, e.g. If all goods were sold while engaged in the wholesale

business.

Requirements: Must be strictly complied with; OTHERWISE, Void sale

1. Notify the creditors in writing of the intended transfer at least 10 days

before the intended transaction

2. Deliver to the prospective transferees, a sworn statement stating the

full names and addresses of creditors and the amounts due them.

3. Furnish a copy to the Director of the Bureau of Commerce/Bureau of

Domestic Trade a copy of the sworn statement

Note: Transfer without compliance with requirements is void even if the

buyer acted in GF; the buyer is considered a trustee.

Exemptions from Requirements:

1. Judicial sales (execution, assignee in insolvency)

2. Sales or transfers of property exempt from execution

3. Sale by manufacturer of his own products

4. Written waiver by the creditors

SC: Sale of a foundry shop (Horseshoe maker/metal fabricator)

Commercial Law Review

Dean Eduardo Abella

SECRECY OF BANK DEPOSITS

(R.A. No. 1405)

Purpose of the law: To encourage people to deposit their money in banks for

the purpose of promoting the national economy.

Scope: Includes investments in government securities

Reserve Requirements

What: Percentage of deposit received by the bank is to be deposited with the

BSP

How much: Percentage depends on the deposit liabilities

1. Highest Checking

2. Medium- Savings

3. Low Time Deposit

Q: How does BSP use reserve requirements to manage money supply? Why

is there a need to manage money supply?

A: If there were a lot of money in circulation, prices would go up. The reserve

requirement is also there in order for the BSP to have money to lend to banks.

REDISCOUNTING FACILITY

- Promissory notes are used as security

Note: It is illegal for a bank officer or employee to disclose any information

regarding bank deposits and government securities.

Exceptions:

1. Written authority from depositor himself Self explanatory

2. In case of impeachment ex. Clarissa Ocampo

3. Court order in case of bribery, dereliction of duty of public officer,

violation of Anti-graft and Corrupt Practices Act, extending to the

spouses and relatives, close friends and associates in cases of

AGCPA

4. Where deposit is the subject matter of litigation Must be read

literally, e.g. settlement of estate; wife channels funds out of a

corporation

5. By Order of the CA in relation to the Anti-Money Laundering Act

6. Examination of books of banks by the BSP

7. Independent auditors they are not bank employees/officers

GENERAL BANKING ACT OF 2000

Definition: BANK

- It is a corporation authorized by the Monetary Board to accept deposits from

the public and to grant loans.

Kinds of Banks

1. Universal Banks

2. Commercial Banks

3. Thrift Banks

a. Savings and Mortgage Bank retail banks catering small

deposits; accepts deposits of small depositors for homebuilding purposes (Amount is smaller than those of the

universal banks, e.g. P500 in BPI Family Bank)

b. Private Development Bank accepts deposits and grants

loans; once the bank runs out of capital, it can invite the DBP

to invest in it and DBP would require membership in its BOD;

Development is in its corporate name

c. Stock Savings and Loan Associations it can be non-stock,

where it cannot accept deposits from the public but only from

the restricted groups of persons.

4. Cooperative Bank

5. Rural Bank

6. Islamic Bank

Commercial Bank

Definition: It is not defined in law. The law only identifies its powers and

functions:

1) To accept deposits subject to withdrawal by check.

However, the BSP may license other banks to accept similar deposits

2) To open letters of credit.

MB licensed savings bank to do the same, e.g Ph Business Bank

3) To engage in allied enterprises

4) To exercise the powers of a corporation

As a matter of right, only commercial banks should accept deposits in checking

accounts/current accounts/commercial accounts/demand deposit

1.) May issue letters of credit

2.) Lend money

Commercial Law Review

Dean Eduardo Abella

3.) Trading of government securities

4.) Foreign transactions

5.) Safety deposit box

Ownership of Other Banks

KB can own 100% of just one other KB. There is no limit on the number of

smaller banks it can own.

Why: To encourage merger or consolidation.

Commercial bank limit is 35% of equity, but still with a maximum of 25% per

industry.

Universal Bank

Nature: Actually a commercial bank, but also authorized by Monetary Board to

engage in the business of an investment house.

Functions and Powers:

1) To accept deposits subject to withdrawal by check.

2) To open letters of credit.

3) To engage in business of investment house

4) To engage in allied or non-allied enterprises. Non-allied enterprises

have nothing to do with banking.

5) To sell life or non-life insurance policies cross-selling with

insurance companies where bank owns 5% of outstanding shares

Definition of an Investment House

Q: What is an investment house?

A: It is a quasi-bank with two major functions:

1.) Rediscounting of receivables one entity goes to an Investment

House and as collateral pledges its receivables. (Ex. Business sells

on credit and needs capital again, so it borrows from an Investment

House)

2.) Underwriting for securities where a corporation offers to the market

securities for sale with certain commitments (ex. In corporation that

needs more capital that cant be raised from stockholders securities

only if 20 or more persons) Get SEC approval first, then have them

sold by securities underwriters

UB can own 100% of just one other UB or KB. There is no limit on the number

of smaller banks it can own.

Q: if Universal Bank invests allied or non-allied, what is the limit?

A: Equivalent to 50% of net worth but only up to 25% in a single enterprise

Thrift Bank

Kinds:

1. Savings and mortgage - To lend money to those that want to

construct houses. For small depositors (small amounts of money).

Banks prefer big depositors as maintenance costs are the same

2. Private development bank organized for development of

community. If it needs additional capital, it may invite DBP to invest

with it. To recognize it, check corporate name, it always has

development in its name.

3. Stock savings and loan associations Theres also a non-stock but

not bank. If non-stock no ACS. If stock, may accept deposits from

general public, if non-stock only from limited clientele (ex. AFPLSAI

restricted only to AFP, PNP and family members; MESALA, Meralco

employees including the Lopez group) Many corporations have

savings and loan associations and a credit union.

Cooperative Bank

What: It is one set up and owned by cooperatives. There are no individual

stockholders, all are cooperatives. Under cooperative office, but bank under

the BSP.

Rural Bank

What: It is organized to provide banking services in rural communities, to

farmers/tenants or simply stated, in rural areas. It is recognizable by Rural in

its corporate name.

Islamic Banks

Example: House of Investment, Inc. and State Investment House, Inc.

Ownership of Other Banks

Note: There is only one, owned by the government of the DBP as a controlling

SH.

10

Commercial Law Review

Dean Eduardo Abella

Why: There are no interests earned on deposits because it is considered

immoral, but there may be profit sharing.

LENDING MONEY

All banks should be organized as a stock corporation and comply with the

requirements of the Monetary Board for licensing. Before a corporation can be

organized, it must go through bank. After requirements submitted to the

Monetary Board and completed, endorsement by Monetary Board to SEC,

which then has a ministerial duty to register it.

Is the bank allowed to lend any amount?

No. The amount of money lent must be secured by titled real properties and it

must be subject to the Single Borrowers Limit, the maximum amount which

any borrower may borrow. DOSRI may borrow from banks on the condition

that it is approved by the BOD in a meeting of the BOD with quorum, without

counting the officer involved in the quorum and approval votes, unless the loan

is part of a package, e.g. fringe benefits.

There is paid-up capital required by the Monetary Board. There is a period

increase in paid-up capital in order for banks to be more stable.

What is the amount of the SBL: 20% of net worth of the bank but may be

increased by 10% of its net worth provided that the additional liabilities of any

borrower are adequately secured by trust receipts, shipping documents,

warehouse receipts or other similar documents transferring or securing title

covering readily marketable, non-perishable goods which must be fully covered

by insurance.

Q: How many directors may a bank have?

A: 5-15, odd or even, no law obliges the BOD number to be odd. If

consolidated, it may have a maximum of 21.

For banks to open branches and ATMs, it must first obtain a permit from the

MB.

Banks should have employees on permanent basis.

There must be two independent directors who are neither officers nor

employees of the bank.

Do the SBL and DOSRI include legitimate interests only? No, it includes

illegitimate interests.

Directors and officers not just anybody may be a director or officer. There is

the fit and proper rule.

What is the remedy for SBL: Syndicated Loans where loans from several

banks are obtained.

Fit and proper rule Monetary Board came out with qualifications.

Must be a college grad.

If secured by real property: Loans may be secured by Real Property; however,

according to Section 37, the maximum amount that may be lent is 75% of the

appraised value of the land. If it has improvements, the value lent is not to

exceed 60% of the appraised value of improvements. Improvements must be

insured.

Quorum in meetings GBA allows meeting via tele- or video-conferencing

Bank should not acquire treasury shares of its own

Treasury Shares shares already issued by a corporation but which

shares a corporation reacquires in its own name.

Subscribed and Issued Shares no difference between them in terms of rights

REGULATION OF BANKS

Under the law, only corporations under supervision of the Monetary Board may

use Bank or Banking in corporate name.

Banks are prohibited from directly engaging in the business of insurance as an

insurer BUT UB can sell insurance policies of insurance companies which it

may own.

If a bank acquires treasury shares, they should be gotten rid of in 6 months.

Under the General Banking Act, bank should cause to be published at least

every quarter their financial statements.

Clearing House Bangko Central Lending facility for purpose of collecting

checks drawn on one bank but deposited in another.

11

Commercial Law Review

Dean Eduardo Abella

Ex. BPI Katipunan depositor deposited checks from other banks such as

Metrobank and Allied Bank.

Clearing house is where banks swap checks they received drawn on other

banks. Physically there is no cash involved, but transactions recorded.

Under present rules, if within 24 hours a bank dishonors check, check should

be returned or else considered cleared.

Bank cannot declare dividends if clearing house account are overdrawn. There

is only movement of cash if clearing house account is overdrawn.

PHILIPPINE DEPOSIT

INSURANCE CODE

History

In the 1960s to the 70s, there were so many bank closures leading to the loss

of the publics confidence. To restore faith in banking that is vital to the

economy, the Uniform Currency Act was repealed and the PDIC was created.

What is insured: Savings, current, time deposits (credit-debtor relationship).

The PDIC insures only deposits in savings, current or time accounts, not any

other investments even if made with or through a bank. It excludes money

market transactions, and marginal deposits (amount required to open a L/C).

Q: Why are money market placements not insured in PDIC?

A: They are not deposits but investments. There is no debtor-creditor

relationship.

Money Market Placements transactions through bank but bank is

not borrower. Borrowers are other corporations that need to borrow

for a short time. Reason for Money Market Placements is that normal

loans take time. Bank is an intermediary between the borrower and

lender in the Money Market Placement.

It is lending to another person. Advanced is that in case of bank

closure, you make get Promissory Note by borrower.

Joint Accounts: It is insured separately and independently. Before, when a

bank is ordered closed, all deposits of a person in different accounts in

different banks will be collated. In the present law, joint accounts are insured

separately. So, it is P500k per sole account per bank, and a total of P500k for

all joint accounts combined per bank.

Definition: A joint account is an account in the name of 2 or more

persons. It is indicated by the words and/or (survivorship account,

each can withdraw on his own) and and (all depositors required to

sign withdrawal slip).

Kinds of Joint Accounts:

a. & - all depositors must sign the withdrawal slip

b. &/or or survivorship accounts withdrawal may be made through

the signature of one or all

Under the law, deposits in joint account are presumed co-owned in equal parts

unless the contrary is proved.

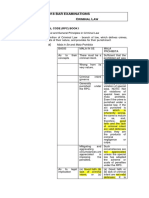

Example 1:

Sir

Sir + Wife Joint

Account

Sir + GF Joint

Account

Amount

Recoverable by Sir

Example 2:

Sir

Sir + Wife Joint

Account

Sir + GF1 Joint

Account

Sir + GF2 Joint

Account

Amount

Recoverable by Sir

490k

500k

500k

990k

490k

500k

500k

500k

990k

What is the maximum indemnity: P500k per person per bank in the

Philippines, whether in Philippine or foreign currency. If it is a foreign currency

deposit unit, indemnity amount in pesos on the day the bank is ordered closed.

12

Commercial Law Review

Dean Eduardo Abella

New Central Bank Act

Purpose of law: Because of the bankruptcy of the Central Bank, the Bangko

Sentral was created, having a corporate existence and is controlled by a

board, the Monetary Board.

Composition of MB

1. BSP Governor. The BSP Governor has a term of 6 years, except

when it is to fill a vacancy for an unexpired term. He may be reappointed once for a total term of 12 years.

2. Cabinet Member depends on the President who to send, currently it

is DTI Secretary

3. 5 Fulltime members from the private sector so that the BSP will not

become a dumping ground of political lame ducks. Private sector

representatives need not necessarily be from privately owned private

corporations. They may come from GOCCs such as the DBP, SSS,

GSIS but the appointment is staggered for a 6-year term. They may

be re-appointed once for a total term of 12 years.

Prohibition to Join Private Banks - Within the period of 2 years from

separation from the Monetary Board, neither the governor nor the full time

directors may serve in any capacity in corporations under the supervision of

the Monetary Board (banks, quasi-banks and investment houses), except if he

would be representing the interest of the Philippine Government.

Business: The Monetary Board is obliged to meet every other week because

it has to closely monitor the prices and take action. In every meeting, there

should be a quorum of at least 4. To pass a resolution, at least 4 members

should concur. If the Governor cannot attend, he should send a Deputy

Governor. If the Secretary cant attend, he should send an Undersecretary.

Functions of the BSP

1.) Supervision of the banking system

2.) Manages currency and money supply

3.) Gold purchasing

Q; What is MONEY?

A: Any medium of exchange, anything could be money

Money vs. Currency

Currency is defined by law as notes and coins issued by the BSP and are in

circulation.

Currency has 2 qualifications:

1.) Issued by the BSP

2.) In circulation, meaning out of the BSP vaults

TRIVIA

BSP prints the notes and mints the coins. Production is local but materials are

imported. Notes are not paper; they are cloth. The cost of materials is very

high.

The currency is called Peso. Its symbol is the capital letter P. There are 2

other countries that use Peso; they are Argentina and Mexico. Part of Peso is

called a Centavo. The sign for a Centavo is the small letter c.

A note contains 2 sets of serial numbers; they are located at the upper left and

lower right. They also have 2 signatures on them, one belongs to the

Philippine President, and the other belongs to the BSP Governor.

The life of a note is estimated to be 5 years, but in Metro Manila, it is merely 1

year. If the estimated life is over, it is withdrawn and demonetized, i.e. it loses

the character of money.

Q: May a damaged note be replaced or accepted for deposit?

A: Yes, it may, but it must fulfill the following requirements:

1. If damaged, there must be at least 3/5 of the note present.

2. It must have at least one set of complete serial numbers

3. It must have at least one signature present

4. There must be no intentional defacement (Its a crime). BSP issued a

circular for banks not to accept for deposit or replacement notes

showing intentional defacement.

Coins have a much longer existence. Damaged coins may also be replaced if

there is no sign of filing, clipping or perforation; the reason for this is that the

metal content would be diminished. Ideally, the amount stated is the total cost

of making coins; however, Philippine coins are worth more than their stated

value.

In case of possession of damages coins, the possessor is presumed to have

caused the damage.

The year in front of the coin is the year it was minted.

Q: What is LEGAL TENDER?

A: Legal tender is currency in such quantity prescribed by law to be accepted

in payment of obligations.

13

Commercial Law Review

Dean Eduardo Abella

All Philippine notes are legal tender for all obligations. However, coins are

legal tender only up to a certain amount.

A Monetary Board Circular changed the amount of what may be legal tender

for coins. All centavo coins are legal tender up to P100 while all one peso

coins are legal tender up to P1000. Contrast this with the law that states that

for coins worth 10 centavos or less, they are legal tender only up to P20, while

coins worth 25 centavos and up are legal tender only up to P50.

14

Commercial Law Review

Dean Eduardo Abella

LETTER OF CREDIT

Q: Why is there a need to specificy the beneficiary? Why not just bearer or

order?

A: Because of obligations to each other.

Governing law: Code of Commerce, which deals with merchants.

Definition: L/C

- It is a letter addressed by a merchant to another merchant to enable the

person names in the letter to attend to a commercial transaction.

- A form of bank facility or accommodation to enable persons to have a

commercial transaction where the buyer is assured of the delivery of the goods

he is buying and the seller is assured of payment.

What is a COMMERCIAL TRANSACTION

It is buy and sell.

Who is a MERCHANT

He is a person, natural or juridical,

having the capacity to engage in commerce and regularly engages in it

Regularly engages means habitual, not necessarily a big volume of

transaction

If a natural person:

1.) At least 18 years of age

2.) With the capacity to enter into contracts of sale

If a juridical person partnerships and stock corporations

1.) Organized according to law

2.) SEC Certificate of Registration (corporations)

Persons Involved

1. The sender or maker, who is a merchant

2. The addressee who is also a merchant, and

3. The beneficiary or person name in the letter who may or may not be a

merchant.

Requirements for a Letter of Credit

1.) The person to whom credit is extended is stated. It must not be a

bearer instrument.

2.) The amount or maximum amount of credit to be extended to that

person shall be stated. It must not be an open L/C. Addressee must

not have the discretion as to how much is to be given under the L/C.

If the requirements are not met, it is called a Letter of Recommendation. A

letter of credit cannot be in negotiable form.

Kinds:

1.) Domestic all parties in the same country; good for 6 months

2.) Foreign different countries; good for 12 months

Who issues L/Cs: Commercial banks as a general rule are allowed to issue

letters of credit, but Monetary Board may allow other banks to issue Letters of

Credit.

How do L/Cs work

1. Buyer and seller are insecure

2. Buyer goes to the full service branch of a bank to open a L/C in favor

of the seller

3. Bank requires a marginal deposit, the amount required by banks of

the purpose of opening L/C

4. Bank remits the amount to the seller only after the seller presents

proof of delivery

Example

BPI QC requests BPI Cebu to open a L/C in favor of a seller in Cebu.

BPI Cebu communicates to the Cebuano seller to ship the goods and upon

proof of such delivery, BPI Cebu will pay him. Shipper thus ships the goods

and the shipping company issues a bill of lading. If the goods are delivered to

the common carrier and it issues a B/L, it is considered as delivery to the

buyer.

BPI Cebu gets the B/L from the seller, pays the seller, forwards the B/L to BPI

Manila.

Buyer pays BPI Manila, claims the B/L, and receives the goods under the B/L

from the carrier.

What is the benefit of L/Cs to banks

Service fees and interest on advance.

Example: Purchase price is P200k. The marginal deposit required is

P120k, from which the bank advances P80k to the seller. Interest on

the P80k advanced by the bank is payable by the buyer to the bank.

What is a Letter of Credit Trust Receipt Line

A trust receipt is a receipt with undertakings. In lieu of a 100% marginal

deposit, the buyer has the option to execute a Trust Receipt in addition to the

marginal deposit. Under the Trust Receipt, the bank releases the B/L to

15

Commercial Law Review

Dean Eduardo Abella

enable the buyer to acquire the goods which he would sell and either (a) use

the proceeds thereof in paying the bank within a stipulated period, and/or (b)

return the goods unsold.

What are TRUST RECEIPTS

- A trust receipt is a receipt with undertakings.

- In a trust receipt transaction, the entruster, who has security interests over

the goods, entrusts those goods to the entrustee so that the entrustee may sell

those goods and remit the proceeds of the sale within the stipulated period. If

the amount owing to the entruster has not been met within the period, the

entrustee is to return the goods not sold.

- Trust receipts are issued to guarantee debts due to failure to pay the amount

bank advanced in the Letter of Credit.

Undertakings of the Entrustee

1. To sell the goods and from the proceeds of the sale, remit the amount

owing to the entruster within the period stipulated. The proceeds

mentioned include the profits as long as there is still an amount owing

to the entrustee.

2. If the amount owed cannot be remitted, to return the goods within the

period.

Consequences of the Entrustees Failure:

- Before, there are two views

1. Violation of a TR is a criminal act under Art. 315 of the RPC.

2. Violation of a TR only leads to civil liability.

- NOW, the TR Law explicitly provides for criminal liability and requires the

entrustee to insure the goods against all risks.

When a document has the same stipulations as a promissory note along with

undertakings present in a trust receipt, then it is still considered a trust receipt.

In banks, the transaction is often called an L/C-T/R line because of the

interrelation of the 2 transactions.

CREDIT INSTALLMENT SALES

- It is the use of TR but is not a trust receipt by provision of law because the

buyer did not intend to sell the goods sold but to use it.

Parties to a T/R

- Entrustee

- Entruster, who has security interests over the goods, e.g. holder of a B/L

which is a document of title

SC: In a TR, the entruster is the theoretical owner of the goods as he

advanced the full payment of the goods.

Note: Trust receipts may be between individuals

Effect of Returning Goods to Entruster

- The entrustee has the option of returning all of the goods to the entruster if

the due date is near and he has not sold the goods to avoid a prosecution for

estafa. In this event, the bank would be the one to sell the goods and deduct

the proceeds from the debt of the entrustee.

- Returning the goods does not extinguish the obligation to pay the amount

advanced by the bank.

Why is there a need for the Trust Receipts Law:

The bankruptcy of bank became rampant from their failure to collect from

borrowing importers who did not remit any amount to the banks after they have

claimed the goods. The P.D. regulating trust receipts was made to protect the

banking system. The PD requires the entrustee to insure the goods against all

risks.

16

Commercial Law Review

Dean Eduardo Abella

COMMON CARRIERS

Definition: A common carrier is a person natural or juridical who is regularly

engaged in the transportation of goods, passengers or both, offering its

services to the public for a fee.

Elements

1.) Transporting goods, passengers or both.

2.) Offering service to the public

3.) For a fee

The common carrier is at liberty to transport what they want.

Q: What is the public?

A: It is not necessarily the general public; it may merely be a narrow segment

of the public, e.g. school bus operator is a common carrier; pipeline is also

considered a common carrier, transporting fuel, and its clients are Shell and

Caltex.

Q: Do you need a motor vehicle?

A: No.

Importance of Classification: The diligence required of a common carrier is

extraordinary diligence.

CARRIAGE OF GOODS

When to exercise ED:

General Rule: Extraordinary diligence is to be exercised when

the goods are unconditionally placed at the disposal of the common carrier,

until the goods shall have been delivered to the consignee or

until consignee has been informed of arrival of the goods and given a

reasonable opportunity to claim the goods.

Reasonable opportunity is dependent upon the circumstances.

Exception: When the shipper exercises the right of stoppage in transitu.

Q: In case of stoppage in transit, what is the relationship of the common carrier

to the shipper?

A: The common carrier is merely a bailee, where the diligence required is only

that of a good father of a family.

Exception to the exception: Eordinary Diligence if the shipper asks for delivery

back to himself.

Q: Is the common carrier an insurer of the goods?

A: No, the common carrier is not an insurer against all risks related to

transportation.

When may the CC avoid liability for loss or damage to goods:

1.) When the proximate and only cause is a storm, earthquake, lightning,

or other natural calamity.

2.) When the proximate and only cause is an act of a public enemy in

times of war, whether civil or international.

3.) When the proximate and only cause is the character of goods or a

defect in the container or packaging.

4.) When the proximate and only cause is the act or omission of the

shipper himself.

5.) When the proximate and only cause is the order of a competent

public authority.

REQD: There must be no unnecessary delay in the prosecution of the

voyage. The carrier should not have committed an improper deviation.

The diligence required is still extraordinary diligence (BUT, according to

NCC 1739, it is only Due Diligence).

Q: If not one of these five occurred, might the carrier excuse itself from

liability?

A: Yes it may, but it is the obligation of the Common Carrier to prove that

under the circumstances, it exercised extraordinary diligence. The burden of

proof is on the common carrier.

Q: If one of these five occurred, is there a chance to recover from the common

carrier?

A: Yes, but the burden of proof is on the shipper to prove that there is failure to

exercise the required standard of care, still extraordinary diligence.

Q: May a common carrier and shipper validly stipulate on a standard of care

less than extraordinary?

A: Yes, but it must conform to the following requirements:

1.) Must be in writing and signed by both parties

2.) It must be supported by consideration other than to transport (ex.

Discount)

3.) The stipulated standard of care must not be less than that of a good

father of a family.

4.) If there are other stipulations, they must be fair and reasonable.

17

Commercial Law Review

Dean Eduardo Abella

There are 2 prestations in a bilateral contract to transport. With respect to the

carrier its prestation is the promise of the shipper to pay the fare. With respect

of the shipper, it is the promise of the carrier to transport the goods.

Standards of Care:

1.) Utmost diligence of a very cautious person (transportation of person)

2.) Extraordinary diligence (transportation of goods)

3.) Good father of a family.

Note: There is no name for the standard of care in between

extraordinary diligence and that of a good father of family.

The shipper also has the obligation to minimize damage to itself.

CARRIAGE OF PASSENGERS

Q: When should diligence start?

A: When the carrier agrees to take in the person as a passenger.

Q: May the passenger and the carrier stipulate a lower standard of care?

A: No

Q: Is a common carrier insurer against all risks?

A: No, it is not, BUT in case of mechanical defects or when a common carrier

violates a traffic rule, the common carrier is always liable.

Employees Negligence: The common carrier shall be liable for acts

or omission of its employees although said employees may have

acted without or in excess of their authority

Strangers Negligence: For acts or omissions of other passengers or

third persons, if the common carrier could have prevent death or

injury by merely exercising the diligence of a good father of a family

and it failed to do so, the carrier is liable.

Q: When may a common carrier be liable for moral damages?

A: In the following instances:

1.) Death of passengers in favor of the heirs

2.) When passenger suffers physical injuries

3.) When the common carrier acts in bad faith

A common carrier is liable for moral damages against a waitlisted passenger

whose number is called, given a boarding pass, allowed to proceed to the predeparture area but not allowed to board.

CARRIAGE OF GOODS BY SEA ACT

Background

The COGSA is a law of American origin; it was made part of our laws during

the American occupation.

In case of conflict between the Code of Commerce and the COGSA, the

former prevails due to specific provision in the COGSA.

Scope of COGSA

It covers the shipment of goods by sea coming from another country into the

Philippines. The shipment of goods must be covered by a B/L.

It is not applicable to:

1.) Inter-island or coast-wise shipping

2.) Shipment of livestock

3.) Those not covered by BL

4.) Before, COGSA does not apply also to shipment of goods on deck.

But NOW, there is no more transportation on deck because goods are

transported only via containers.

Salient Features

Time of filing claims:

o Apparent Loss or Damage: File it right away, immediately

with the carrier

o Not Apparent: 3 days from delivery

Note: Under general law (Civil Code and Code of Commerce), the

claim must be filed right away if the damage is apparent; if it is not

apparent, it must be filed within 24h from delivery (Code of

Commerce).

Actions of the Carrier on the Claim

o Settle it right away

o Not to act on it

o Reject the claim.

What is the remedy of the consignee in case of rejection: If the claim

is denied, the claim should be filed in court within 1 year from the

delivery of the goods by the common carrier to the arrastre operator.

This is because the transfer of the goods from the carrier to the

arrastre is documented in a tally sheet after an ocular inspection by

the arrastre operator. When the arrastre receives the goods, it

18

Commercial Law Review

Dean Eduardo Abella

inspects the goods and lists the defects in the tally sheet. If there are

defects found, they are formalized in the Bad Order Form.

Q: Is the filing of a claim with the common carrier a condition precedent to

recover from the carrier by complaint in court?

A: Under COGSA, no, it is not required. But under the Code of Commerce, it

is a condition precedent and thus constitutes the cause of action.

Q: When goods are insured and turned over to the arrestre operator and loss

or damage is determined, where and when should the claim by the insurer be

filed?

A: Claim of the consignee must be filed with the insurer also within one year

from delivery to the arrestre operator. The insurer merely subrogates and

steps into the rights of the insured.

Q: If the insurer did not act on the claim of the insured until after 1y, can it

involve prescription?

A: No. Prescription between the insurer and the insured is as stated in the

insurance policy or Insurance Code.

Q: What if the goods are not annotated as damaged in the tally sheet or bad

order form upon turnover to the arratre, but the goods are damaged upon

turnover by the arrastre to the consignee?

A: The suit should be against the arrastre on the basis of quasi-delict since

there is no pre-existing contractual relation between the arrastre and the

consignee.

Q: If the goods are insured but no claim is made by the insured against the

insurer within 1 year from delivery of goods, is the claim against the insurer

barred after one year?

A: No.

Q: What if there is no damage annotation on the tally sheet, and the customs

broker received the goods from the arrastre, but upon delivery by the customs

broker to the consigee, there is damage which is not annotated on the delivery

receipt?

A: Sue the broker on the basis of breach of contract of carriage, because the

customs broker is a common carrier. The ruling is that a customs broker who

offers to transport goods to client as part of services qualifies as a common

carrier.

Q: In case of missing goods, or, if the vessel arrives but the goods are not offloaded, when should the claim be filed?

A: Within one year from the last day when the carrier had the last chance to

deliver the goods to the arrastre operator, e.g. before the ship sails to another

port.

Q: If the prescriptive period is about to expire, can the consignee extend it by

sending a Demand Letter to the carrier?

A: No.

ADMIRALTY

Qualifications to be a Vessel: Not every watercraft is a vessel; it has to have

the following qualifications:

1.) It must not be a mere accessory to another watercraft (ex. Lifeboats)

2.) It must be registered with the MARINA

3.) It must be used to transport goods, passengers or both

4.) It is seagoing

Q: Who may own a vessel?

A: Anybody. If a vessel is owned by more than one person, there is a

disputable presumption that a partnership exists.

Hypothecary Rule

The limited liability of a shipowner.

It is the value of the vessel, plus

earned freightage plus

insurance, if any.

Q: Who participates in admiralty?

A: Those involved in navigation (crew) and housekeeping (compliment)

Crew of a Vessel:

1.) Captain

The title captain is used to refer to the commanding officer of a ship

that goes abroad.

The title master is used to refer to the commanding officer of a ship

that is engaged in local/inter-island travel.

A ship captain has three roles:

a. Represent the owner of the vessel

b. Be the technical director of the vessel

c. Represent the country where the vessel is registered.

2.) Mates (1st, 2nd, 3rd etc.)

3.) Engineers.

19

Commercial Law Review

Dean Eduardo Abella

Contracts in Admiralty:

1.) Charter party

2.) Bottomry

3.) Respondentia

4.) Marine Insurance

Procedure for General Average:

1.) Captain calls a meeting with the representatives of the owners of

cargo.

2.) They make a decision to throw away certain cargo.

3.) If the decision is urgent, the captain may choose from the largest and

of least value proceeding to the smallest of the most value.

Charter Party

Definition: A contract of lease over a vessel

Supercargoes: representatives of owners of cargoes. They sell cargo for the

owner. Generally, they are only able to use profits to buy goods. If they have

a special power of attorney, they may use capital to buy goods.

Kinds:

1.) Bareboat/demise, where the lessor provides only the vessel, without

crew, stores (things you eat), provisions (water and fuel).

2.) Affreightment

3.) Time-charter, or a lease for a specific term of the vessel, with stores

and provisions

4.) Voyage-charter, or a lease of a vessel for a voyage or series of

voyages, with stores and provisions.

According to the Supreme Court, the true charter is the bareboat charter.

The time and voyage charter are merely subtypes of affreightment, which is a

contract of carriage.

Ship Agent: Corporation representing the owner in every port where the

vessel may make a call or stop. The ship agent is in charge of provisioning the

vessel.

Q: What will be the liability of a ship agent for procurement of provisions?

A: A ship agent is solidarily liable with the ship owner for contracts entered into

for provisions of the vessel. This liability is different from that of a mere agent,

who is not liable if he discloses his principal and acts within the authority given

him.

Bottomry: Loan taken by the ship-owner secured by the vessel. If the vessel

sinks, the creditor loses the right to collect and the obligation to pay is

extinguished. If loan exceeds the value of the vessel, the excess is an

ordinary loan.

Respondentia: Loan taken by the cargo owner and secured by the cargo. If

loan exceeds the value of the cargo, the excess is an ordinary loan.

Marine Insurance: Insurance over the vessel or freightage, cargoes or profits

expected from cargo.

Accidents in Admiralty:

1.) Collision, or the impact of two or more moving vessels

As opposed to Allision,

the impact of one stationary and one moving vessel

2.) Arrival under stress, or when a vessel is forced to sail to the nearest

port.

Q: What is the obligation of a ship captain in arrival under

stress?

A: The captain must execute a MARITIME PROTEST, a

sworn statement where the captain relates what transpired.

Husbanding Agent: Agent in charge of freightage and settlement of averages

Q: What are AVERAGES?

A: In admiralty, they refer to damages

Types of Averages:

1.) Gross/General Average, or damages suffered by the vessel or

owners of cargo that shall benefit not only the ship-owner but also the

owners of the other cargo.

2.) Specific/Particular Average or those that do not benefit anyone.

Examples:

a. Natural calamity along route.

b. Avoidance of pirates

c. Loss of provisions

d. Accident that renders the

prosecuting the voyage

vessel

incapable

of

3.) Shipwreck

Q: Is the owner of a barge a party to a contract of carriage?

20

Commercial Law Review

Dean Eduardo Abella

A: No, he is not a party, unless the barge is self-propelled. The contracting

party is the owner of the towing vessel.

Currency of Indemnity: Before, original indemnity used to be fixed in Swiss

Francs; now, this was changed to US Dollars.

Three zones of time in Collision:

1.) First time anytime the danger of collision appears.

2.) Second time from the time the danger appears until it becomes a

practical certainty

3.) Third time from the time it becomes a practical certainty to impact.

What are the fixed liabilities of the carrier

1.) Death of a passenger: $100k, no question asked.

2.) Physical injuries: $100k maximum, depending on the severity of the

injury.

3.) Checked-in articles: $1k per kilo UNLESS a greater value is declared

and the fare corresponding to the bigger value is paid

The value must be proven to be at least $1/kilogram;

otherwise it is only value you can prove.

4.) Hand-carried articles: $1k maximum regardless of weight and actual

value

DOCTRINE OF INSCRUTABLE FAULT:

If there is a collision of two vessels and it cannot be determined who is at fault,

each bears his own loss. However, both ship-owners are solidarily liable for

the damage to all cargoes.

Why are liabilities fixed: Because of the different ways to assess damages

for injuries or loss of goods

WARSAW CONVENTION

What: It is an agreement among sovereign nations for:

1.) Having uniform documents in international air transportation,

2.) Fixing the liabilities for international air carriers.

What to do to claim the full amount:

1.) Declare the value

2.) Pay fare according to the value

Who are the parties:

The signatories are referred to as HIGH CONTRACTING PARTIES.

The Philippines was not an original party because at the time, it was not yet a

state and it had no aircraft. Ph was a party by accession to the US.

What is an INTERNATIONAL AIR TRANSPORTATION:

- One where the port of origin is in one country and the port of destination is in

another

- One where the port of origin is in one country and the port of destination is in

the same country but the agreed stopping place is in another country. This

often occurred when there were multiple colonies, e.g. LA (US) Tokyo

(Japan) Guam (US).

- Movement of goods by land or water to the aircraft

What documents must be uniform:

1.) Passenger Ticket, issued by the carrier

2.) Baggage Check, the white strip of long sticker with a bar code

3.) Airwaybill, it is a B/L

21

Commercial Law Review

Dean Eduardo Abella

PUBLIC SERVICE

Who may render public service

Only

- Ph citizens or

- Corporations with 60% ownership by Ph citizens

According to the SC, there is an employer-employee relationship

between the driver and the operator by reason of the control test.

OLD OPERATOR RULE: If someone is already rendering the service, it must

first be allowed to offer to add the same service

Grandfather Rule: Control test where the citizenship of the

corporation owning another is taken into consideration in determining

the 60% Filipino ownership

Who regulates public service

Under the 1935 Constitution, it was the Public Service Commission.

Now, it is regulated by different government agencies: DOTC, LTFRB, CAB,

MARINA, LGUs (lakes, rivers)

How to engage in public service

1. Application by petition

2. Hearing

3. Issuance of a CERTIFICATE OF PUBLIC CONVENIENCE, a written

authority issued by the government regulator to enable persons to

engage in public service

DIFF WITH CERTIFICATE OF PUBLIC CONVENIENCE AND

NECESSITY: Latter authorizes public service for which service, a

legislative franchise is required. This is because franchises are no

longer exclusively legislative.

Requirements or Qualifications to engage in PS

1. Ph citizenship

2. Willingness to engage in PS

3. Financial capacity why:

a. Acquiring equipment to engage in PS

b. Settling damage claims

KABIT SYSTEM it is an illegal manner of engaging PS by doing it

through others where it does not itself possess of the qualifications

PRIOR APPLICANT RULE: If two or more persons apply to render the same

public service, the one who first filed the application should be granted the

authority.

Example: Boundary System where the driver pays an amount to the

operator of a jeep for use of the motor vehicle for an agreed period.

22

Commercial Law Review

Dean Eduardo Abella

FOREIGN INVESTMENTS ACT

Purpose of law: to encourage and entice foreign investments to bring in more

foreign currency. It was formerly illegal for transactions to be paid in foreign

currency or in relation to foreign currency.

Salient Features

Foreigners can own 100% of any enterprise related to exports so long

as it is not covered by Negative List A & B

Negative List A, activities reserved by the Constitution or other

special laws to Filipinos

e.g. advertising, public service

Negative List B, activities that are exclusively for Filipinos

e.g. those relating to ammunition and firearms (unless the Secretary

of National Defense consents), pyrotechnics, nightclubs, beerhouses,

steambaths, and massage parlours.

Inward Remittance: A foreigner may also own 100% of a domestic

market enterprise if the foreigner remits and makes an investment

worth $200k or equivalent but not in areas where there are health

related risks ex. Bars, beer houses, massage parlors, sauna baths,

dancing halls.

EXCEPTION TO $200k REMITTANCE:

If the enterprise advances technology, as determined by the

DOST and hires more than 50 Filipino employees; the investment

must also be no less than $100k; or

If the alien is a former natural-born Filipino, then he is allowed to

own urban properties with an area of 5000sqm. or rural

properties up to 3 hectares. If both spouses are formerly natural

born Filipinos, their total lands must not exceed the above-stated

land areas, and the land acquired must be in different locations.

Filipino Corporations:

a. Domestic corporations must be at least 60% owned by

Filipinos.

b. Foreign corporations must be 100% Filipino owned.

23

Commercial Law Review

Dean Eduardo Abella

INTELLECTUAL PROPERTY CODE

Governing Law: Intellectual Property Code. It is a compilation of old laws on

patent, copyright, trade marks, trade names, service names, service marks.

The Code is administered by the Intellectual Property Office. The head is the

Director-General who must be at least 40 years of age and a lawyer. The term

of the Director-General is 5 years, eligible for a single re-appointment.

However, the first Director-General appointed has a term of 7 years without reappointment.

Kinds of Intellectual Properties:

1.) Patents

2.) Copyrights

3.) Industrial Designs

4.) Layout or Topography of Integrated Circuits

5.) Trademarks and Tradenames

6.) Geographic indication

7.) Trade-Related Aspects of Intellectual Property Rights

PATENTS

What is a patent: It is issued upon an invention, granting the exclusive right to

mass produce or license the mass production of the invention.

What are patentable inventions?

1. New

2. Involves an inventive step

3. Capable of industrial application

What is NEW:

It is new if it is not part of prior art and if it is a different technology.

eg. Heat-operated microphone

What is an INVENTIVE STEP:

GR: It involves an inventive step if it is not just newly discovered but

involved a process of trying this and that until one finds what works.

eg. X tripped and fell on carabao grass, face first and discovered its

magical effect on pimples. This cannot be patented because it is merely

discovered without any inventive step. BUT IF X first tried guava leaves,

then malunggay leaves, then garlic, then chili, and then flour to make a

paste to cure pimples, then such involved an inventive step and is thus

patentable.

E: Microorganisms

eg Those which improve the digestive process or eat garbage.

What is INDUSTRIAL APPLICATION:

The invention develops a new industry or an existing one for mass

production of the invention. It could lead to development of new or

existing industry.

What are not patentable inventions?

1. Those contrary to law, eg substitutes for shabu or prohibited

ingredients