Professional Documents

Culture Documents

Axis Long Term Equity

Uploaded by

Abhishek Singh RathoreOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Axis Long Term Equity

Uploaded by

Abhishek Singh RathoreCopyright:

Available Formats

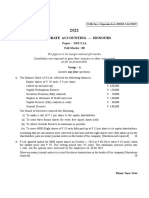

FACTSHEET

31st March 2016

Investment Style

FUND STYLE

PORTFOLIO

Value

Company Name

Rating

Blend

Growth

Large

Mid

Small

Market Cap

TYPE OF SCHEME / INVESTMENT OBJECTIVE

An Open-ended Equity-Linked Savings Scheme with a

3 year lock in. Eligible investors in the Scheme (who are

Assessee as per the ELSS Rules) are entitled to deductions

of the amount invested in Units of the Scheme under Section

80C of the Income Tax Act, 1961 to such extent and subject

to such conditions as may be notified from time to time.

To generate income and long-term capital appreciation

from a diversified portfolio of predominantly equity

and equity-related securities. However, there can be no

assurance that the investment objective of the Scheme will

be achieved.

DATE OF ALLOTMENT

29th December 2009

FUND MANAGER

Jinesh Gopani

Work experience: 14 years

He

has

been

managing

1st April 2011

this

LATEST NAV (`) as on 31st March 2016.

Regular Plan

Growth

Dividend

fund

since

Direct Plan

% of

Assets

Company Name

% of

Assets

Banks 16.72

HDFC Bank Limited

8.18

Kotak Mahindra Bank Limited

6.88

ICICI Bank Limited

1.66

Finance 14.78

HDFC Limited

5.71

Bajaj Finance Limited

2.62

Sundaram Finance Limited

2.35

Gruh Finance Limited

2.26

Multi Commodity Exchange of India Limited

1.84

Pharmaceuticals 10.25

Sun Pharmaceuticals Industries Limited

5.70

Divis Laboratories Limited

1.77

IPCA Laboratories Limited

1.67

Cadila Healthcare Limited

1.12

Software 10.24

Tata Consultancy Services Limited

6.45

Tech Mahindra Limited

1.40

Info Edge (India) Limited

1.35

MindTree Limited

1.05

Consumer Durables

7.14

TTK Prestige Limited

3.12

Bata India Limited

2.01

Symphony Limited

2.01

Auto Ancillaries

6.85

Motherson Sumi Systems Limited

3.36

Bosch Limited

1.78

WABCO India Limited

1.72

Auto 6.37

Maruti Suzuki India Limited

4.65

Eicher Motors Limited

1.72

Chemicals 4.47

Pidilite Industries Limited

4.47

Consumer Non Durables

3.51

Nestle India Limited

2.38

Coffee Day Enterprises Limited

1.13

Construction Project

3.49

Larsen & Toubro Limited

3.49

Industrial Products

3.23

Cummins India Limited

2.31

Astral Poly Technik Limited

0.92

Pesticides 2.53

PI Industries Limited

2.53

Power 2.31

Torrent Power Limited

2.31

Transportation 1.34

Blue Dart Express Limited

1.34

Industrial Capital Goods

0.86

Siemens Limited

0.86

Telecom - Equipment & Accessories

0.80

Astra Microwave Products Limited

0.80

Textile Products

0.62

Page Industries Limited

0.62

Other Equity (less than 0.50% of the corpus)

0.39

Total Equity

95.90

Debt, Cash & Other Receivables

4.10

S&P BSE 200

FUND SIZE (`)

Monthly Average AUM

Latest AUM

(as on 31 March 2016)

st

7,319.06 Crore

7,817.96 Crore

STATISTICAL MEASURES (3 years)

Standard deviation

14.57%

Beta 0.88

Sharpe Ratio*

1.25

Mar 28, 2013 Mar 31, 2014 Mar 31, 2015

Current Value of

Since

To Mar 31,

To Mar 31,

To Mar 31,

Investment if

Inception

2014

2015

2016

` 10,000 was

Absolute

Absolute

Absolute

invested on

CAGR (%)

Return (%)

Return (%)

Return (%)

inception date

Axis Long Term Equity Fund - Growth

S&P BSE 200 (Benchmark)

Nifty 50 (Additional Benchmark)

Axis Long Term Equity Fund - Direct Plan - Growth

S&P BSE 200 (Benchmark)

Nifty 50 (Additional Benchmark)

35.40%

17.19%

17.98%

36.76%

17.19%

17.98%

62.03%

31.93%

26.65%

64.51%

31.93%

26.65%

SECTOR ALLOCATION (%)

Source: www.fimmda.org

Please note that as per AMFI guidelines for factsheet,

the ratios are calculated based on month rolling returns

(absolute) for last 3 years.

Data as on 31st March 2016.

Source: ACEMF

PORTFOLIO TURNOVER* (1 year)

0.52 times

MINIMUM INVESTMENT AMOUNT (`)

500/500

MINIMUM ADDITIONAL PURCHASE AMOUNT (`)

500/500

-6.04%

-7.86%

-8.86%

-5.02%

-7.86%

-8.86%

18.67%

6.68%

6.60%

24.45%

9.24%

8.43%

29,185

14,992

14,916

20,344

13,324

13,004

Date of

inception

29-Dec-09

01-Jan-13

Past performance may or may not be sustained in future. Calculations are based on Growth Option NAV. Since inception returns are calculated

on ` 10 invested at inception. Since inception returns for Axis Long Term Equity Fund - Growth Option & Direct Plan - Growth Option are

calculated from 29th December 2009 & 1st January 2013 respectively. Direct Plan was introduced on 1st January 2013.

Jinesh Gopani manages 3 schemes. Please refer to annexure on Page 19 for performance of all schemes managed by the fund manager.

*Risk-free rate assumed to be 9.00%

(MIBOR as on 31-03-16)

* Based on equity, equity derivatives and Fixed Income

Securities transactions only. CBLO/Repo/FD/Margin

FD/MFU/SLB are not considered.

100%

SCHEME PERFORMANCE

(as on 31st March 2016)

29.19

30.34

19.08 25.85

BENCHMARK

Net Assets

Banks 16.72

Finance 14.78

Pharmaceuticals 10.64

Software

10.24

Consumer Durables

7.14

Auto Ancillaries

6.85

Auto 6.37

Chemicals 4.47

Consumer Non Durables

3.51

Construction Project

3.49

Industrial Products

3.23

Pesticides 2.53

Power

2.31

Transportation 1.34

Industrial Capital Goods

0.86

Telecom - Equipment & Accessories

0.80

Textile Products

0.62

DIVIDENDS

Option

Regular Dividend

Record Date

Dividend (` Per unit)

Individuals/

Others

HUF

NAV per unit (Cum Dividend)

January 25, 2016

2.25

2.25

21.2217

January 22, 2015

2.00

2.00

24.2942

January 6, 2014

1.00

1.00

14.6918

MINIMUM SIP INSTALLMENT AMOUNT (`)

500/500

LOAD STRUCTURE

Entry load

- Not applicable

Exit load

- Nil

Please note that after the payment of dividend, the NAV falls to the extent of dividend, distribution tax and cess wherever applicable.

Past performance may or may not be sustained in future.

Face Value of units is ` 10

Dividends disclosed above are since the inception of the fund.

For Statutory Details & Risk Factors please refer to the last page of the Factsheet.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Review On Inflation in India-Causes, Its Impacts, Trends and Measures To ControlDocument4 pagesA Review On Inflation in India-Causes, Its Impacts, Trends and Measures To ControlAbhishek Singh RathoreNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Curriculum Vitae: Manishankar SharmaDocument3 pagesCurriculum Vitae: Manishankar SharmaAbhishek Singh RathoreNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Conformation Message: TH TH TH THDocument2 pagesConformation Message: TH TH TH THAbhishek Singh RathoreNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Investor Behaviour Towards Investing in Equity Market: Part 1Document6 pagesInvestor Behaviour Towards Investing in Equity Market: Part 1Abhishek Singh RathoreNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Abhishek Singh Cover LetterDocument1 pageAbhishek Singh Cover LetterAbhishek Singh RathoreNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Title I Organization and Function of The Bureau of Internal RevenueDocument170 pagesTitle I Organization and Function of The Bureau of Internal RevenueheymissrubyNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Study On Analysis of Financial Statements of Bharti AirtelDocument48 pagesA Study On Analysis of Financial Statements of Bharti AirtelVijay Gohil74% (23)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Security Analysis and Portfolio ManagementDocument114 pagesSecurity Analysis and Portfolio ManagementSimha SimhaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Multiple Choice QuestionsDocument82 pagesMultiple Choice QuestionsJohn Rey EnriquezNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Dll. Business Finance Week 1Document9 pagesDll. Business Finance Week 1Mariz Bolongaita AñiroNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- IGCSE Business Studies RevisionDocument27 pagesIGCSE Business Studies RevisionMightyManners82% (11)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Pfe Chap02Document32 pagesPfe Chap02Gabriela Madalina MateiNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Vale Annual ReportDocument255 pagesVale Annual Reportkrishnakant1No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- AZN-GLOBAL-Annual Report - FullYear 2006 PDFDocument184 pagesAZN-GLOBAL-Annual Report - FullYear 2006 PDFMurad EltaherNo ratings yet

- Uber Technologies Financial AnalysisDocument14 pagesUber Technologies Financial AnalysisSimonNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Acfroga7o6ywzjrtxysu Mha3muo Mduq Fqortb7h06wupac9plvezur4djyjvvnppchpcl4wv Xondclp6wr Ezdg 6nw7pu0nbn8atwobfi5rygqujtbovyaqycpne1eezwwzixznscvjh3qDocument4 pagesAcfroga7o6ywzjrtxysu Mha3muo Mduq Fqortb7h06wupac9plvezur4djyjvvnppchpcl4wv Xondclp6wr Ezdg 6nw7pu0nbn8atwobfi5rygqujtbovyaqycpne1eezwwzixznscvjh3qmaria evangelistaNo ratings yet

- Cash Flow ProblemsDocument9 pagesCash Flow ProblemsSILLA SAIKUMARNo ratings yet

- CBCS - BCOM - HONS - Sem-5 - COMMERCE - DSE 5.2 A - CORPORATE ACCOUNTING-10992Document7 pagesCBCS - BCOM - HONS - Sem-5 - COMMERCE - DSE 5.2 A - CORPORATE ACCOUNTING-10992R3shav JaiswalNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableCristle ServentoNo ratings yet

- Working Capital at SbiDocument65 pagesWorking Capital at SbiRahul ShrivastavaNo ratings yet

- Analysis SumsDocument11 pagesAnalysis SumsJessy NairNo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- International Tax OutlineDocument126 pagesInternational Tax OutlineMa Fajardo50% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- LeveragesDocument50 pagesLeveragesPrem KishanNo ratings yet

- Concepts and Review of LiteratureDocument35 pagesConcepts and Review of LiteratureAkn NanthanNo ratings yet

- Assement Exam-Dysas 1st Quarter-P1Document5 pagesAssement Exam-Dysas 1st Quarter-P1JohnAllenMarillaNo ratings yet

- Syndicate 5 Freeport Stakeholder AnalysisDocument11 pagesSyndicate 5 Freeport Stakeholder AnalysisMuhammad Daniala Syuhada100% (1)

- 26 Tax L. Rev. 369 PDFDocument272 pages26 Tax L. Rev. 369 PDFaweinerNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- DR Bart DiLiddo, VectorVest and The Art of Stock Market Investing - Business inDocument9 pagesDR Bart DiLiddo, VectorVest and The Art of Stock Market Investing - Business insjalum22No ratings yet

- Conceptual Frameworks and Accounting Standards PDFDocument58 pagesConceptual Frameworks and Accounting Standards PDFJieyan Oliveros0% (1)

- Probate Final Account Guide 06-2Document2 pagesProbate Final Account Guide 06-2GinaNo ratings yet

- Account ListDocument96 pagesAccount ListNikit ShahNo ratings yet

- Quiz 2 SpreadsheetDocument3 pagesQuiz 2 SpreadsheetAnesNo ratings yet

- Cma FormatDocument14 pagesCma FormatMahesh ShindeNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)