Professional Documents

Culture Documents

Farm Bureau Wellmark Health Insurance

Uploaded by

Greg JohnsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Farm Bureau Wellmark Health Insurance

Uploaded by

Greg JohnsonCopyright:

Available Formats

GET THE

EDUCAT!t

MATTERS

BEST

OF BOTH

.. 11=

welimark.+,V

FARM BUREAU

Products available at Farm Bureau Financial Services

2016 FARM BUREAU INDIVIDUAL AND FAMILY PLANS

GET THE

Well mark"

BEST

+.v.

Wellmark Blue Cross Blue Shield of Iowa

Wellmark Health Plan of Iowa, Inc.

OF BOTH

1.=

FARM BUREAU

Products available at Farm Bureau Financial Services

Picking a new health insurance plan can

INSIDE:

be overwhelming. But with the help of this

Decoding the jargon . . . . . . . . .

Narrowing your options . . . . . . .

guide, you'll know some key questions to ask

Farm Bureau ExclusiveCopayPlans

Farm Bureau Exclusive

High-Deductible Health Plans . . . ..

CopayWellmark Blue RewardsPlans..

yourself so you can enroll in a health plan that

best fits your life and budget. You'll also find

Understanding your benefits

10

important information about different types of

coverage, networks and all the Wellmark Blue

Cross and Blue Shield plans offered by Farm

Bureau that meet your personal needs.

MORE THAN JUST

HEALTH INSURANCE

Trust your local Farm Bureau agent to help

protect you and your family from medical

costs. Becoming a member of the Iowa

FarmBureau is a simple and powerful way

By choosing Wellmark and Farm Bureau, you

to support your fellow Iowans,while having

specialadvantagesright at yourfingertips.

can feel confident joining the hundreds of

With Farm Bureau,you haveexclusive

accessto insurance service options, along

thousands of Iowans who have already picked

with discounts on entertainment and

travel. Find out how you can harnessthe

a Wellmark Blue Cross and Blue Shield plan.

power of community today.

We've been providing trusted coverage and

customer service to Iowans for 75 years, and

we look forward to serving you.

Plan Comparison Guide 2016 I 1

DECODING THE JARGON

Before choosingyour health plan, understand these key terms.

>

Premium - What you'll pay each month for your health

insurance benefits.

>

Coinsurance - Your share of the costs for a covered health

care service, calculated as a percent. You must typically reach

your deductible before your coinsurance applies. However,

dependingon your plan benefits, your deductible maybe waived.

>

Deductible - The amount you owe for health care services

that your plan covers before your health plan begins to pay.

Some plans waive the deductible for certain services, which

- means your benefits kick in immediately.

>

Out-of-pocket maximum (OPM)- The most you pay during a

policy period (usuallya year) before your health plan beginsto

pay 100 percent of the allowed amount. This doesn't include

your premium or the cost for health care your health plan

doesn't cover.

>

Personal doctor- The provider you choose as your personal

family physician at the time you enroll in your Wellmark health

plan. Choosinga personal doctor can lead to better health

outcomes because he/she knows your family history, oversees

all treatments, manages chronic conditions, knows your

prescriptions, helps you havea healthy lifestyle and assists

with coordinating care.

>

>

In-network - An in-network provider is one who has an

agreement with Wellmark to provide services to members for a

negotiatedrate. Using providersthat are in-network meansyou'll

pay lessout of your own pocket for care, savingyou money.

>

Out-of-network - An out-of-network provider does not have

an agreement with Wellmark to provide services to members at

a negotiated rate. If you use an out-of-network provider, you'll

pay more out-of-pocket for services than if you used an

in-network provider. You may also be responsible for paying

the difference between the amount a provider charges for the

service and the maximum amount that Wellmark will pay for

that procedure or service.

>

Benefit year - A 12-month period of benefits coverage under

your health plan. For individual and family plans, this runs

Jan. 1 to Dec. 31. You'll see this term with regards to the OPM

accumulations. Amounts you spend out-of-pocket for

applicable covered items and services from Jan. 1 to Dec. 31

will go toward the OPM.

>

Open Enrollment Period (OEP)- The OEPis the yearly time

period when you can make adjustments to your health

coverage for the next year.

>

Special Enrollment Period (SEP)- An SEP is a window of time

when you can apply for health coverageor make a changeto

your current coveragedue to a qualifying life event. Qualifying

life eventsare major changes like getting married, havinga baby

or losing coveragethrough a moveor job loss. The only way you

can change your coverageoutside of the OEPis through an SEP.

Copay - A fixed amount (for example, $15) you pay for a

coveredhealth care service, usuallywhen you receivethe service.

>

>

Silver, Gold or Platinum) based on the portion of claims paid by

the insurer. Metallic tiers make it easier for you to compare

plans and, typically, the more coveragea plan offers, the more

you'll pay in premiums. At Wellmark, we have plans for

individuals and families in the Bronze, Silver and Gold tiers.

Primary care provider (PCP)- A type of provider that delivers

primary care. PCPs includefamily practitioners,general

practitioners, internal medicine practitioners, obstetricians/

gynecologists,pediatricians,physicianassistantsand advanced

registered nurse practitioners.

Metallic tiers - Due to the Affordable Care Act (ACA),the

federal government created four categories of coverage or

"metallic tiers." Plansare assigned a metallic tier (Bronze,

WHAT'S AN HSA?

2 I PlanComparisonGuide2016

NARROWING YOUR OPTIONS

Considerthese important questions when choosing a plan.

When looking at your plan options, remember to not only consider your potential costs for today, but alsofuture costs. Rememberthat

costs are more than just your monthly premium. Out-of-pocket expensescome from things like deductible amounts, copayments and

coinsurance for doctor visits, hospital stays, lab work, prescription drugs, and emergency room visits.

o What kind of network best fits your needs?With Wellmark, e What components of a health plan contribute to the total

you feel protected knowing you can get the coverageyou need

when and where you need it. Youcan choose from three types

of networks:

>

>

>

out-of-pocket cost?

> Monthly premiums are a large part of the overall cost of health

insurance.What you pay each month on premiums does not

go toward your deductible or out-of-pocket maximum (OPM),

but should be considered when picking a health plan.

Wellmark Blue PPOSM plans give you the freedom and

convenience to get health care from any provider who

participates with a Blue Cross Blue Shield plan. Keep in

mind, choosing a network provider will reduce your out

of-pocket costs.

>

Wellmark Blue HMosMplans cover care here in Iowa.

100 percent of hospitals and 96 percent of doctors from

Iowa are in the network. Don't worry - you can still get

out-of-state coverage in emergency and accidental

injury situations.

Deductibles for in-network and out-of-network services

are another part of your total costs. A plan with a higher

deductible may saveyou money in monthly premiums, but

you may haveto cover a larger portion of your health care

services before benefits begin.

>

OPMsalso affect your costs. Typically,the higher the OPM,

the lower the monthly premium.

Wellmark Blue RewardsPOSSM plans let you choose how to

use it everytime you need care. The amount you pay out-of

pocket is determined by the tier your provider is in, and you'll

pay less by seeing Blue Rewardsproviders. The Wellmark

Blue RewardsPOS network plans are unique to Wellmark

and evenallow you to earn rewardsfor healthy behavior.

o Are you interested in potentially saving money on your taxes or

saving for your retirement? Choosinga high-deductible health

plan and putting dollars in a tax-advantaged health savings

account (HSA)to payfor qualified medical expensesis one way

to keep your premium down. Plus,the funds you put into your

HSAare generally tax-deductible.

o Are your prescriptions covered at the cost-share level you want

to pay?Everyplan covers prescription drugs a little differently.

Before choosing a plan, be sure to understand the different tiers

of the Blue Rx Essentials='drug plan. For a quick overviewof the

tiers, turn to page 10 of this guide. You can also easilysearch for

your specific prescription drug on Wellmark.com.Just look for

the Wellmark Drug List.

Wellmark helps you feel secure through the "what ifs"

You may be healthy today, but what happens if you havea health issue tomorrow?

When considering a plan from Wellmark, make sure you're comfortable with how

much you may haveto pay out-of-pocket for health care costs if the "what if"

happens. Either way, Wellmark's plans help you feel confident knowing you'll be able

to get the health care you need when and where you need it.

Quick Tip: Usethe questions on page 13 to assessyour needs for today and tomorrow.

PlanComparisonGuide2016 I 3

FARM BUREAU EXCLUSIVE COPAY PLANS

EnhancedBluesM Gold

....... \

$1,000/

$2,000

11

20%

40%

$3,500/

$7,000

$6,5001

$14,000

Not

applicable

$18,900

Not

applicable

$19,200

Not

applicable

Unlimited

Unlimited

Unlimited

Unlimited

Unlimited

Unlimited

Unlimited

Unlimited

1000 PPO/HMO

Single / Family"

$1,0001

HMO

$

$2,000

SILVER-OO

Completeblue'"

Silver 2500

PPO/HMO

Single / Family2

jj I

1\

1$

$2,5001

PPO ~

CompleteBlueSM

Silver 3500

PPO/HMO

1$

$3,5001

$7,000

HMO

$

~

SimplyBlueSM Bronze

30%

30%

Not

applicable

50%

Not

applicable

50%

$3,5001

$7,000

$6,8501

$13,700

$9,8501

$6,8501

$13,700

$6,6001

$13,200

$9,6001

Single / Family2

$5,000

20%

30%

$5,000

$2,5001

HMO

SILVER-OO

BRONZE-O

$3,5001

gl

$7,000

$5,000/

$10,000

30%

50%

Not

applicable

50%

$6,6001

$13,200

$6,8501

$13,700

$13,700

$9,8501

$18,700

Not

applicable

5000 PPO/HMO

Single / Family2

$5,0001

HMO

$10,000

50%

Not

applicable

$6,8501

As a young adult, you may not go to the doctor for anything other than a

yearly preventive exam. However, you also may not have the disposable

income to pay for medical costs if a catastrophic event happens. That's

why you may want to consider benefit-rich plans with a monthly premium

you can build into your budget:

ALAN

Age: Mid 20s

Status: Single

4 I PlanComparisonGuide 2016

>

>

>

CompleteBlue Silver 3500 HMO (See above)

EnhancedBlue Gold 1000 HMO (See above)

myBlue HSNM Gold 2100 HMO (See page 6)

0=

PCP3: $25 copay

Non-PCP: $50 copay

Ded~ctible and

coinsurance

apply

Ded.uctibleand

coinsurance

apply

Ded.uctible and

coinsurance

apply

Not

applicable

Deductible and

coinsurance

apply

Not

applicable

Ded.uctible and

coinsurance

apply

Ded.uctible and

comsurance

apply

Deductible and

coinsurance

apply

Deductibleand

coinsurance

apply

Deductible

and

.

cornsurance

apply

Not

applicable

Deductibleand

coinsurance

apply

Not

applicable

Deductible and

coinsurance

apply

PCP3: $40 copay

Non-PCP: $70 copay

Deductibleand

coinsurance

apply

Deductible and

coinsurance

apply

Deductible and

coinsurance

apply

Ded.uctible and

comsurance

apply

PCP3: $40 copay

Non-PCP: $70 copay

Not

applicable

Deductible and

coinsurance

apply

Not

applicable

Ded.uctible and

coinsurance

apply

PCP3: $60 copay

Non-PCP: Deductible

and coinsurance apply

Deductible and

coinsurance

apply

Deductible and

coinsurance

apply

Deductible and

coinsurance

apply

Ded.uctible and

comsurance

app~

PCP3: $25 copay

Non-PCP: $50 copay

-PCP3: $40 copay

Non-PCP~$70 copay

PCP3: $40 copay

Non-PCP: $70 copay

PCP3: $60 copay

. Non-PCP: Deductible

and coinsuranceapply

Ded.uctible and

comsurance

apply

I

I

I

I

I

I

Ded.uctible and

coinsurance

apply

Not

applicable

Not

applicable

Ded.uctibleand

coinsurance

apply

Not

applicable

Ded.uctible and

coinsurance

app~

Deductiblewaived

/"t~ I Tier

1. $5

$300 co a

D

dit

d)

waIve I a mt e

$300 copay

(waivedif admitted)

Deductibleand

.

comsurance

apply

$350 ~~.

(waivedif admitted)

$350 copay

(waivedifadmitted)

$350 copay

(waivedif admitted)

$350 copay

(waivedifadmitted)

Premium

Tier 2: $35

Tier 3: $70

Preferred specialty: $100

Non-preferredspecialty:

50% coinsurance

Deductiblewaived

Tier 1: $5

Tier 2: $35

Tier 3: $70

Preferred specialty: $100

Non-preferred specialty:

50% coinsurance

Deductible waived

Tier 1: $5

Tier 2: $35

Tier 3: $70

Preferred specialty: $100

Non-preferred specialty:

50% coinsurance

Deductible and

coinsurance

apply

Deductible and

coinsurance apply

Not

applicable

Ded.uctible and

coinsurance

apply

Not

applicable

Deductibleand

coinsurance

apply

Not

applicable

Deductibleand

coinsurance

apply

How do copay and coinsurance amounts work with my plan?

With a copay plan, you'll have a certain amount you have to pay out-of-pocket for regular

doctor visits and prescription drugs. Your deductible is typically waived for these services.

Deductible and coinsurance may still apply for major services like surgery or hospitalization.

Both in-network and out-of-network services apply toward a single deductible. However, out-of-pocket costs for in-network services apply to the in-network out-of-pocket maximum only. Out-of-pocket costs for

out-of-network services apply to the out-of-network out-of-pocket maximum.

The family deductible can be met through any combination of family members. No one member will be required to meet more than the single deductible amount to receive benefits for covered services

during a benelit period.

The primary care office copay applies to family practitioners, general practitioners, internal medicine practitioners, obstetricians/gynecologists, pediatricians, physician assistants and advanced registered nurse

practitioners. This lower office copay also applies to in-network chiropractors, physical therapists, occupational therapists, speech pathologists, and in some cases, mental health or chemical dependency visits. All

other in-network practitioners are subject to the non-primary care office copay. The copay applies per practitioner, per date of service.

Plan Comparison

Guide 2016 I 5

FARM BUREAU EXCLUSIVE HIGH-DEDUCTIBLE HEALTH PLANS

myBlue HSAsM Gold 2100

PPO/HMO

Single 1 Family1

0%

$3,5001

$7,000

0%

0%

$3,5001

$7,000

$6,0001

$12,000

0%

$6,0001

$12,000

0%

SILVER-OO

I/,"

J I

1\

BRONZE-O

Single 1 Family

$2,1001

$4,200

myBlue HSAsM Bronze

6000 PPO/HMO

1$

myBlue HSAsM Silver 3500 1 $

PPO/HMO

Single 1 Family

$2,1001

$4,200

1\

'II

1/

II

1$

I

HMO

$

0%

20%

1

I

I

Not

applicable

30%

Not

applicable

50%

Not

applicable

I

I

I

I

$2,1001

$4,200

$4,2001

$8,400

Unlimited

$2,1001

$4,200

Not

applicable

Unlimited

$7,0001

$10,000

Unlimited

$3,5001

$7,000

$3,5001

$7,000

$6,0001

$12,000

$6,0001

$12,000

Not

applicable

Unlimited

$9,5001

$18,000

Unlimited

Not

applicable

Unlimited

Some Wellmark health plans may help you save for medical costs

and your future. A high-deductible health plan, paired with HSA

contributions, can earn interest and be invested, so it's a great way

JOE AND MARTHA

Age: Mid 50s

Status: Married and looking

forward to retirement

6 I PlanComparisonGuide2016

to save. It can also help you plan for medical costs after you reach

age 65. Interest and investment earnings are generally not subject

to federal income tax. Any remaining balance you have in your HSA

rolls over each year. That's why you may want to consider:

>

>

>

myBlue HSA Silver 3500 PPO (See above)

myBlue HSA Bronze 6000 PPO (See above)

Completefslue-" Silver 3500 PPO (See page 4)

0=

Deductible applies

Deductible and

coinsurance

apply

Deductible

applies

Deductible and

coinsurance apply

Deductible

applies

Deductible and

coinsurance apply

Deductible

applies

Premium

Deductible

applies

Deductible applies

Not

applicable

Deductible

applies

Not

applicable

Deductible

applies

Not

applicable

Deductible

applies

Deductible

applies

Deductible-applies

Deductible and

coinsurance

apply

Deductible

applies

Deductible and

coinsurance apply

Deductible

applies

Deductible and

coinsurance apply

Deductible

applies

Deductible

applies

Deductible applies

Not

applicable

Deductible

applies

Not

applicable

Deductible

applies

Not

applicable

Deductible

applies

Deductible

applies

Deductible applies

Deductible and

coinsurance

apply

Deductible

applies

Deductible and

coinsurance apply

Deductible

applies

Deductible and

coinsurance apply

Deductible

applies

Deductible

applies

Deductible applies

Not

applicable

Deductible

applies

Not

applicable

Deduc.tible

applies

Not

applicable

Deductible

applies

Deductible

applies

What makes myBlue HSA plans different?

Wellmark's myBlue HSA plans are actually qualified high-deductible health plans (HDHPs).

They're different from any other health plan because they don't include co payments and

coinsurance for in-network services. That means you pay the full cost for care (excluding

preventive care) and prescriptions until you reach your deductible. With a qualified HDHP,

you can open a health savings account (HSA). These are savings accounts you can use to

set aside money, which grows tax free, and then withdraw funds from, generally on a

tax-free basis. You can use this money to pay for qualified medical expenses, like doctor's

office visits and prescription drugs. Any interest gained is also typically not subject to federal

income tax.

Both in-network and out-or-network services apply toward a single deductible. However, out-of-pocket costs lor in-network services apply to the in- network out-of-pocket maximum only. Out-of-pocket costs lor

out-ai-network services apply to the out-of-network out-of-pocket maximum.

For the myBlue HSA bronze and silver health plans, no one member will be required to meet more than the single deductible. For the myBlue HSA gold health plan, the entire lamily deductible must be met

before benefits are payable.

Plan Comparison Guide 2016

I 7

COPAY WELLMARK BLUE REWARDssM PLANS

Blue

RewardssM

GOLD-OOO

pas

1000

Single / Familyl

Blue

RewardssM

SILVER-OO

pas

1500

Single / Family2

Blue

RewardssM

BRONZE-O

5500

Single / Family2

pas

Tier 1 = Wellmark Blue Rewards pas providers

$1,0001

$2,000

$2,0001

$4,000

$1,5001

$3,000

$3,0001

$6,000

$5,5001

$11,000

$6,6001

$13,200

Tier 2 = Wellmark Blue

$4,0001

$8,000

20%

$6,0001

$12,000

30%

$8,0001

$16,000

50%

pas providers

30%

40%

50%

40%

50%

60%

$2,0001

$4,000

$4,0001

$8,000

$6,5001

$13,000

$6,8501

$13,700

$9,0001

$18,000

$6,8501

$13,700

$6,8501

$13,700

$9,0001

$18,000

Tier 3 = Out-of-network providers

LET WELLMARK HELP YOU SAVE.

Wellmark, Hy-Vee3 and UnityPoint Health are excited to collaborate to bring you three plan

options called Wellmark Blue Rewards.

Blue Rewards plans are only available in certain counties. Visit WellmarkBlueRewards.com to see if it's offered in the county you live.

By choosing one of these plans, you have access to:

wellmark."

A quality Wellmark plan that lets

you choose how to use your

benefits when you need care.

8 I Plan ComparisonGuide2016

II

UnityPoint Health

The physicians and hospitals

of UnityPoint Health are located

where you live, work and play.

With this access, you'll see the

lowest out-of-pocket costs

when you get care from Blue

Rewards providers.

HqVoo.

Coverage for prescriptions

filled exclusively at Hy-Vee

pharmacies, as well as

consultations with registered

Hy-Vee dietitians for a copay.

Rewards for healthy

behavior. With Blue Rewards,

you have the chance to earn

rewards for behaviors that

support better health.

$6,0001

$10,000

0=

PCP4: $15

Non-PCP: $30

Deductible and

coinsurance

apply

PCp4: $30

Non-PCP: $60

PCP4: $45

Non-PCP: $90

Deductible and

coinsurance

app~

Ded.uctible and

comsurance

apply

Ded.uctible and

comsurance

app~

Ded.uctible and

coinsurance

apply

Deductible and

coinsurance

apply

Ded.uctible and

comsurance

app~

Deductible and

coinsurance

apply

Deductible and

coinsurance

apply

Ded.uctible and

coinsurance

app~

Deductible and

coinsurance

apply

Deductible and

coinsurance

apply

$250 copay

(waivedif admitted)

$350 copay

(waivedif admitted)

Deductible and

coinsurance apply

Premium

Hy-Vee Pharmacies Only5

Deductible waived

Tier 1 drugs: $10

Tier 2 drugs: $35

Tier 3/preferred specialty: $70

Non-preferredspecialty drugs: 50% coinsurance

Hy-Vee PharmaciesOnly5

Deductible waived

Tier 1 drugs: $10

Tier 2 drugs: $35

Tier 3/preferred specialty: $70

Non-preferredspecialty drugs: 50% coinsurance

Hy-Vee PharmaciesOnly5

Deductible applies (waivedfor Tier 1)

Tier 1 drugs: $25

Tier 2, Tier 3/Preferred specialty,

Non-preferredspecialty drugs: Tier 1

deductible and coinsurance apply

How do Blue Rewards plans work?

Well mark Blue Rewards POSSM plans combine elements of both PPO and HMO plans. The amount you

pay out-of-pocket is determined by the level of provider care you choose, so if you see a Blue Rewards

provider, you'll spend less on health care expenses. You can also earn rewards for healthy behavior.

With Blue Rewards, you have coverage when seeing BlueCard providers outside of Iowa. Depending

on the plan you choose, the BlueCard deductible and BlueCard out-of-pocket maximum (OPM) may

be the same as when receiving care from a Tier 2 Wellmark Blue POS provider. The BlueCard

deductible and OPM may also be the same as when receiving care from an out-of-network provider.

The coinsurance amount for BlueCard providers is always the same as when seeing out-of-network

providers. For more information on out-of-pocket costs when seeing BlueCard providers, along with

how they apply to your OPM, visit WellmarkBlueRewards.com.

1

Both Tier 1 and Tier 2 deductible amounts count toward each other, but do not apply toward BlueCard or Tier 3 out-of-network deductibles. Tier 1, Tier 2 and BlueCard expenses count toward each others

out-of-pocket maximums WPM), and out of network expenses apply to Tier 3 OPM. Tier 1 and Tier 2 out-of-pocket maximum amounts will also count toward each other.

The family deductible can be metthrough any combination offamily members. No one member will be required to meet more than the single deductible amountto receive benefits for covered services during a

benefit period.

Hy-Vee is an independent company providing affinity/rewards services in support of the Blue Rewards program.

The primary care office copay applies to family practitioners, general practitioners, internal medicine practitioners, obstetricians/gynecologists, pediatricians, physician assistants and advanced registered nurse

practitioners. This lower office copay also applies to in-network chiropractors, physical therapists, occupational therapists, speech pathologists, and in some cases, mental health or chemical dependency visits. All

other in-network practitioners are subject to the non-primary care office copay. The copay applies per practitioner, per date of service.

You may only fill prescriptions at Hy-Vee pharmacies with limited exceptions. You can get more information about prescriptions filled at other pharmacies in your policy manual, which you will receive

after enrollment.

Plan Comparison Guide 2016 I 9

UNDERSTANDING YOUR BENEFITS

No matter which plan you choose, feel secure knowing you are always covered with

Essential Health Benefits (EHBs).

Preventive and wellness service and chronic

disease management

o

e

Pediatric services, including vision care

Emergency services

Prescription drugs

o Ambulatory patient services

o

o

o

o

C

Hospitalization

Laboratory services

Maternity and newborn care

Mental health and substance use disorder services,

including behavior health treatment

Rehabilitative and habilitative services and devices

PREVENTIVE BENEFITS

PEDIATRIC BENEFITS

At Wellmark, we design our insurance plans with you in mind. All

the plans in this booklet cover preventive care from in-network

and participating providers at no cost to you. Preventive services

include things like physical exams, immunizationsand screenings.

If you choose an HMO or Blue Rewards plan, you must see your

designated personal doctor or OB/GYNfor your annual wellness

and gynecological exam.

Children, under age 19, covered under your plan are now

protected with vision benefits.

PRESCRIPTION

PEDIATRICVISION - Wellmark's pediatric vision benefits

are administered through Avesis', Wellmark's preferred

vision vendor.

>

Benefits are available for children under age 19. Your

deductible is waived for all plans except myBlue HSA.

myBlue HSA plans will waive the deductible for routine

vision exams only.

>

For myBlue HSA plans where the deductible and out-of

pocket maximum (OPM) are equal- once the deductible/

OPM are reached - there's no additional cost to you for

pediatric benefits.

>

The details

DRUG BENEFITS

All plans have the Blue Rx EssentialssM drug plan to help cover

your medication costs.

BENEFIT LEVELS

>

Drug Tier 1: Most affordabledrugs

Includes most generics and select brand name drugs.

>

Drug Tier 2: Preferred drugs

Drugs are listed as preferred becausethey havebeen proven to

be effective and favorably priced compared to other drugs that

treat the same condition.

>

One routine vision exam per benefit year at no cost

One frame and one pair of lenses per benefit year or

contact lenses instead of frames and lenses

- Up to $130 for one frame per benefit year (80%

coinsurance for covered charges more than $130)

Drug Tier 3: Non-preferred drugs

Non-preferred drugs have not been found to be any more

- Up to $130 per benefit year for non-medically

necessary contact lenses (85% coinsurance for

covered charges more than $130)

cost effective than preferred brands.

>

Preferred specialty and non-preferred specialty drugs

Preferred specialty drugs have been proven to be effective

and favorably priced compared to other drugs that treat the

same condition.

Non-preferred specialty drugs havenot been found to be any

more cost effective than preferred specialty drugs. You must

get your specialty drugs from one of two specialty pharmacy

providers, Hy-Vee PharmacySolutions (HPS)or CVS Caremark

Specialty Pharmacy. Both are experts that specializein the

delivery and clinical managementof specialty drugs.

To find out more, visit WeI/mark. com and view the WeI/mark Drug

List. Be sure to look at the Blue Rx Essentials drug plan.

10 I Plan Comparison Guide 2016

Medically necessary contact lenses

To find out if your provider participates in the pediatric vision

plan, visit WeI/mark. com and click on "Find a Doctor or

Hospital". Then click on "Vision Providers (Avesis)" under

the "Other" category.

These policies do not include pediatric dental services as described under

the federal Patient Protection and Affordable Care Act. This coverage is

available in the insurance market and can be purchased in a stand-alone

product. Please contact your insurance carrier, producer or Iowa's

Partnership Marketplace Exchange if you wish to purchase pediatric

dental coverage or a stand-alone dental service product.

I

Well mark's pediatric vision coverage is administered by Avesis, an independent company

providing network and claims administration on behalf of Wellmark for the pediatric vision

benefits.

What else is covered?

Here's a high-level look at what's covered by Wellmark's health plans. You will receive a complete list with

your policy manual once you enroll in a Wellmark plan. For detailed cost information look at your Summary

of Benefits and Coverage(SBC).

>

>

Physician services

>

Organ and tissue transplants

Anesthesia services

Heart

Physician office and outpatient visits

Lung

Radiology

Pancreas

Pathology and other diagnostic services

Kidney

Surgery and surgical assistance

Simultaneous pancreas/kidney

Inpatient hospital visits

Small bowel

Physician office services

Liver

X-ray, laboratory and pathology services

performed in the physician's office

Bone marrow/stem cell transfers

>

Diabetesoutpatient self-managementtraining and

patient management from an approved provider

>

>

Physical,occupational or speech therapy services

Hearing exams due to illness or injury

Spinal manipulations (Limits may apply)

Eye exams due to illness or injury

>

Durable medical equipment

Supplies used to treat the covered person

during the visit

Allergy testing

Common exclusions

There are some services that are not usually covered by your health plan. We've listed the most common, but

for a detailed list, look at the policy manual you'll receive when you enroll in a Wellmark plan.

>

Services not determined to be medically

necessary

>

Routine vision services

Except as noted in the Pediatric Vision section

>

>

Elective abortions

>

>

>

Counseling

>

>

Artificial insemination; in vitro fertilization or any

related fertility or infertility transfer procedure

Massagetherapy

Cosmetic services

Except in the following instances; surgery that

has the primary purpose of restoring function

lost or impaired as a result of an illness or

injury, or birth defect. Breast reconstruction

after a mastectomy.

>

>

>

Investigational and experimental treatment

Wigs

Acupuncture

Weight reduction programs

Routine foot care

PlanComparisonGuide2016 I 11

Easy ways to pay

Once you decide on a Wellmark plan, you then have another choice - which easy way to pay fits you best.

All billing periods are based on the calendar year and you can make payments either:

o

o

e

Quarterly (Electronic FundsTransfer only)

Semi-annually

Annually

Monthly (Electronic FundsTransfer only)

You can even set up automatic withdrawal from a savings or checking account. If you would rather have a

paper bill, you can get those on a semi-annual or annual payment frequency.

What to expect next

You've picked your plan and made your payment selection, what's next?

o You'll receive your completed application. Check to make sure all of the information for both you and

your family members on your policy is correct.

o Watch for your Wellmark ID card in the mail. That card is packed with all the information you need.

Make sure everything is accurate, and show your card to your doctor, hospital or any other health care

provider to access your benefits.

Register for myWellmark - it takes just a few quick steps. myWeiI mark is your personalized health

website that makes it easyfor you to manageyour plan.

Members get even more options.

As a Wellmark member, we offer you opportunitiesto get more from your health care benefits.

Lean on our resources for more information, support and discounts when you need them.

Personal

Health

Assistant

2417

Any time you need help,

PersonalHealthAssistant

24/7 is here to answer

your health concerns,

direct you to providers

or resources, and offer

solutions for everyday

health care problems.

BlueCard

Program

With the BlueCard

program, you can travel with peace of

mind, knowingthat 96 percent of hospitals

and 92 percent of physiciansnationwide

are in the Blue Crossand Blue Shield

network.' With a PPOplan, you also have

accessto doctors and hospitals in more

than 200 countries aroundthe world. With

our Wellmark Blue HMO plans, you're

typically only protected in emergency

situations when traveling outside Iowa.

wellmark .

v.

Blue365.

myWell mark

Because health is a big deai

Blue365 Program

This member program

gives you exclusive

access to discounts and

resources to help you live

a healthier lifestyle. Visit

Wellmark.com/Blue365.

I

12 I PlanComparisonGuide 2016

myWeiI mark is your

personalized health

website that makes it

easy for you to

manageyour plan.

You can even access

it on your smartphone

by downloading the

Wellmark mobile app.

Blue Cross and Blue Shield Association, 2014.

HEALTH INSURANCE ASSESSMENT

Use this worksheet to assessyour health insurance needs.

HEALTH INSURANCE INFORMATION

o

o

If yes, do you... (Circleone) Buy it yourself / Purchasethrough an employer

What is your premium?

Do you have health insurance now?(Circle one)

/month;

o What is your deductible?

Copay

Out-of-pocket max

e

-0

Yes 1 No

Network

/year

Coinsurance

Pharmacy copay/deductibles:

If you had a major medical bill delivered to you today, how much could you spend toward your deductible or coinsurance?

How haveyou usedyour health insurance most often in the past year?

How many doctor visits did your family have last year?

Are you willing to consider a plan with higher out-of-pocket costs in return for a lower premium or would you prefer lower out-of

pocket costs at a higher premium?

Have you ever considered using a health savings account (HSA) for you and your family?

(Circle one) Yes / No / Don't know what an HSA is

Do you know if your family doctor, specialist or medical provider is in-network on your current plan?

4D

Do you, or any of your family members, currently receive medical services, or plan to receive medical services this year, from a

provider outside the state of Iowa?If so, who are the providers you plan on using?

Do you, or any of your family members travel outside the state of Iowa on a regular basis?If so, where do you travel most?

f.D

Do you have ongoing prescription drug costs?

If so, haveyou checked the Wellmark Drug List to see if the drugs are covered, on which tier, and at what cost-share?

I "')'1:\'/J.fill 11",,11"'-.

tIl

I'

IL'iil

PlanComparisonGuide 2016 I 13

Ready to enroll in a plan? Need help deciding?

We are here to help!

>

Talk to your authorized Farm Bureau agent or find one at Wellmark.com.

>

Visit Wellmark.com to compare your options, shop for a plan and get a personalized

rate quote. All you have to do is:

o

o

Compare your options by looking at available plans side by side.

Add your desired plan to the shopping cart and enroll.

Answer a few questions to help you decide which plan best fits your needs.

This documentis intended to be usedsolelyfor illustrativepurposes, and providessimplified informationand

examples of a general nature. It is not intended as legalor tax advice, nor as an indication that you are eligibleto

contribute to an HSA, and should not be construed as such. Consultyour tax advisor for specific tax adviceand

for more informationabout tax savings.

This brochure is a briefsummary of policiespresented, which are subject to exclusions, limitations,reductions

in benefits,and terms under which the policiesmay be renewed or discontinued.For costs and complete details

of the coverage,call or write your authorized insuranceagent or Wellmark.

Also, please note, this is a general descriptionof coverage.It is not a statement of contract. Actual coverageis

subject to the terms and conditions specifiedin the policyitselfand enrollmentregulations in force when the

policybecomes effective.

GET THE BEST OF BOTH

wellmark.+,'

Wellmark BlueCross Blue Shieldof Iowa :

Wellmark Health Plan of Iowa, Inc.

Products available

1.=

FARM BUREAU

at Farm Bureau Financial

Services

Wellmark Blue Cross and Blue Shield of Iowa and WellmarkHealth Plan of Iowa, Inc. are Independent Licenseesof the Blue Cross and Blue Shield Association.

Blue Cross", Blue Shield, the Cross and Shield symbols and BlueCard are registered marks and SimplyBlueSM, CompleteBlueSM, CompleteBlue MaxsM,

EnhancedBlueSM, EnhancedBlue MaxSM, myBlue HSAsM, Blue Rx Essentiats-" and Blue Rewards=' are service marks of the Blue Cross and Blue Shield ASSOciation,

an Association of Independent Blue Cross and Blue Shield Plans.

Wellmark is a registered mark of Wellmark, Inc.

2015 Wellmark, Inc.

M-53952 09115

BCBSI-150

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Seasons of Life by Jim RohnDocument111 pagesThe Seasons of Life by Jim RohnChristine Mwaura97% (29)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Benokraitis, Benokraitis Nijole Vaicaitis - Marriages & Families - Changes, Choices, and Constraints-Pearson (2015)Document617 pagesBenokraitis, Benokraitis Nijole Vaicaitis - Marriages & Families - Changes, Choices, and Constraints-Pearson (2015)colleen100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Joann Creator's Studio Class Catalog - Jan/Feb 2019 - Iowa City Course CalendarDocument12 pagesJoann Creator's Studio Class Catalog - Jan/Feb 2019 - Iowa City Course CalendarGreg JohnsonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Facelift at Your Fingertips - An Aromatherapy Massage Program For Healthy Skin and A Younger FaceDocument136 pagesFacelift at Your Fingertips - An Aromatherapy Massage Program For Healthy Skin and A Younger Faceugur gebologluNo ratings yet

- MechanismDocument17 pagesMechanismm_er100No ratings yet

- Orchestra Iowa School Music Education (2018/2019)Document7 pagesOrchestra Iowa School Music Education (2018/2019)Greg JohnsonNo ratings yet

- Quality of Good TeacherDocument5 pagesQuality of Good TeacherRandyNo ratings yet

- Palo Alto Firewall VirtualizationDocument394 pagesPalo Alto Firewall VirtualizationRyanb378No ratings yet

- Math 7: "The Nearest Approximation To An Understanding of Life Is To Feel It and Realize It To The Fullest."Document16 pagesMath 7: "The Nearest Approximation To An Understanding of Life Is To Feel It and Realize It To The Fullest."benjamin ladesma0% (1)

- (PDF) Teach Your Baby Math - Glenn DomanDocument200 pages(PDF) Teach Your Baby Math - Glenn Domansugapovex0% (1)

- The Role of Historical Cultural Memory in Uzbek Documentary CinemaDocument5 pagesThe Role of Historical Cultural Memory in Uzbek Documentary CinemaResearch ParkNo ratings yet

- Colzer Air Purifier Model 1556Document16 pagesColzer Air Purifier Model 1556Greg JohnsonNo ratings yet

- BlueCross BlueShield Iowa Alliance Select Provider Directory From 1 Jan 1993Document88 pagesBlueCross BlueShield Iowa Alliance Select Provider Directory From 1 Jan 1993Greg JohnsonNo ratings yet

- Kirkwood Community College Continuing Education Winter 2021/2022 ClassesDocument18 pagesKirkwood Community College Continuing Education Winter 2021/2022 ClassesGreg JohnsonNo ratings yet

- Sabrent SATA To USB Adapter User GuideDocument20 pagesSabrent SATA To USB Adapter User GuideGreg JohnsonNo ratings yet

- Jolt Charger User Manual 7120-15Document3 pagesJolt Charger User Manual 7120-15Greg JohnsonNo ratings yet

- Panera 2018 Summer SandwichesDocument2 pagesPanera 2018 Summer SandwichesGreg JohnsonNo ratings yet

- Computer Classes - Spring 2019 at Kirkwood Community CollegeDocument16 pagesComputer Classes - Spring 2019 at Kirkwood Community CollegeGreg JohnsonNo ratings yet

- When To Salute - Military Protocol Guide To Showing RespectDocument20 pagesWhen To Salute - Military Protocol Guide To Showing RespectGreg JohnsonNo ratings yet

- Norco Shoulder Pulley Pamphlet User Guide Owners Manual Instruction BookletDocument9 pagesNorco Shoulder Pulley Pamphlet User Guide Owners Manual Instruction BookletGreg JohnsonNo ratings yet

- PacSafe Bag FeaturesDocument9 pagesPacSafe Bag FeaturesGreg JohnsonNo ratings yet

- 'Meow: MM M Icpl'S 'Document3 pages'Meow: MM M Icpl'S 'Greg JohnsonNo ratings yet

- Denon 625R / 425R Receiver User Guide Owners ManualDocument20 pagesDenon 625R / 425R Receiver User Guide Owners ManualGreg JohnsonNo ratings yet

- SimpliHome Cosmopolitan City Essex End Table Wynden Hall Home DecorDocument10 pagesSimpliHome Cosmopolitan City Essex End Table Wynden Hall Home DecorGreg JohnsonNo ratings yet

- Iowa Tourism - Touring The Great Mississippi River RoadDocument14 pagesIowa Tourism - Touring The Great Mississippi River RoadGreg JohnsonNo ratings yet

- Brochure To Public Libraries of Cedar Rapids IowaDocument2 pagesBrochure To Public Libraries of Cedar Rapids IowaGreg JohnsonNo ratings yet

- Apple AirPod Charging Case Replacement Instruction BookletDocument6 pagesApple AirPod Charging Case Replacement Instruction BookletGreg JohnsonNo ratings yet

- OSP Designs Sierra Side Table Assembly and Care GuideDocument4 pagesOSP Designs Sierra Side Table Assembly and Care GuideGreg JohnsonNo ratings yet

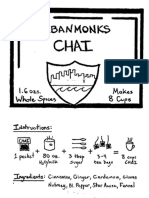

- Urban Monks ChaiDocument3 pagesUrban Monks ChaiGreg JohnsonNo ratings yet

- Subaru History - Drive Magazine Winter 2017Document2 pagesSubaru History - Drive Magazine Winter 2017Greg JohnsonNo ratings yet

- Epica Clear Plastic Shower Curtain LinerDocument3 pagesEpica Clear Plastic Shower Curtain LinerGreg JohnsonNo ratings yet

- Sushi Menu at New Pioneer Coop - Iowa City - CoralvilleDocument4 pagesSushi Menu at New Pioneer Coop - Iowa City - CoralvilleGreg JohnsonNo ratings yet

- P4400 Kill-a-Watt Meter Packaging and ManualDocument3 pagesP4400 Kill-a-Watt Meter Packaging and ManualGreg JohnsonNo ratings yet

- Direct Mailing Thank You CardDocument2 pagesDirect Mailing Thank You CardGreg JohnsonNo ratings yet

- 2017 Iowa City Solar Eclipse GuideDocument2 pages2017 Iowa City Solar Eclipse GuideGreg JohnsonNo ratings yet

- Soleusair Air Conditioner 10000 BtuDocument21 pagesSoleusair Air Conditioner 10000 BtuGreg JohnsonNo ratings yet

- Maggie's Farm Pizza Menu - Iowa City RestaurantDocument2 pagesMaggie's Farm Pizza Menu - Iowa City RestaurantGreg JohnsonNo ratings yet

- Iowa Wineries and Wine Tasting BrochureDocument2 pagesIowa Wineries and Wine Tasting BrochureGreg JohnsonNo ratings yet

- Kirkwood 2017 Fall Computer CoursesDocument15 pagesKirkwood 2017 Fall Computer CoursesGreg JohnsonNo ratings yet

- Vee 2003Document14 pagesVee 2003Syed faizan Ali zaidiNo ratings yet

- LSAP 423 Tech Data 25kVA-40KVA - 3PH 400VDocument1 pageLSAP 423 Tech Data 25kVA-40KVA - 3PH 400Vrooies13No ratings yet

- Chapter 12Document52 pagesChapter 12Mr SaemNo ratings yet

- 1ST Periodical Test ReviewDocument16 pages1ST Periodical Test Reviewkaren rose maximoNo ratings yet

- The Issue of Body ShamingDocument4 pagesThe Issue of Body ShamingErleenNo ratings yet

- Academic Language Use in Academic WritingDocument15 pagesAcademic Language Use in Academic WritingDir Kim FelicianoNo ratings yet

- Eca Important QuestionsDocument3 pagesEca Important QuestionsSri KrishnaNo ratings yet

- UNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMDocument1 pageUNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMAlejandro PortoNo ratings yet

- Etoposide JurnalDocument6 pagesEtoposide JurnalShalie VhiantyNo ratings yet

- School newspaper report teaches Present PerfectDocument2 pagesSchool newspaper report teaches Present PerfectMiro MiroNo ratings yet

- Lecturer No 1 - Transformer BasicDocument1 pageLecturer No 1 - Transformer Basiclvb123No ratings yet

- Edtpa Lesson Plan 1Document3 pagesEdtpa Lesson Plan 1api-364684662No ratings yet

- Hazop Recommendation Checked by FlowserveDocument2 pagesHazop Recommendation Checked by FlowserveKareem RasmyNo ratings yet

- Unit 5 Vocabulary Basic 1 Match 1-10 With A-J To Make Innovations and InventionsDocument6 pagesUnit 5 Vocabulary Basic 1 Match 1-10 With A-J To Make Innovations and InventionsCristina Garcia50% (2)

- Theories of Translation12345Document22 pagesTheories of Translation12345Ishrat FatimaNo ratings yet

- ATM ReportDocument16 pagesATM Reportsoftware8832100% (1)

- MarasiNews Issue 12Document47 pagesMarasiNews Issue 12Sunil Kumar P GNo ratings yet

- Aemses Sof Be LCP 2021 2022Document16 pagesAemses Sof Be LCP 2021 2022ROMEO SANTILLANNo ratings yet

- Delhi Police ResultDocument26 pagesDelhi Police ResultExam Aspirant100% (1)

- SPH3U Formula SheetDocument2 pagesSPH3U Formula SheetJSNo ratings yet

- Hci01 HumanComputerInteraction OverviewDocument140 pagesHci01 HumanComputerInteraction OverviewAlexSpiridonNo ratings yet