Professional Documents

Culture Documents

Ufr 2nd Quarter 072.73

Uploaded by

prabindraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ufr 2nd Quarter 072.73

Uploaded by

prabindraCopyright:

Available Formats

Main Road ,Hetauda-4,Makwanpur Phone no. 057-524674,Fax no.

057-524673

Unaudited Financial Statement

nd

th

As at 2 Quarter Poush 30 ,072 (14 Jan. 2016) of the fiscal year 2072-73

S.N.

1

1.1

1.2

1.3

1.4

1.5

1.6

1.7

2

2.1

2.2

2.3

2.4

0

0

0

0

0

0

0

0

0

0

2.5

2.6

2.7

3

3.1

3.2

A

3.3

3.4

3.5

B

3.6

3.7

C

3.8

D

3.9

3.10

E

3.11

F

3.12

3.13

G

4

4.1

4.2

4.3

4.4

4.5

4.6

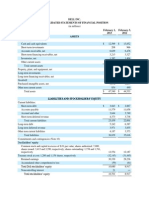

Particulars

Total Capital & Liabilities (1.1 to 1.7)

Paid-up Capital

Reserves and Surplus

Debenture and Bond

Borrowings

Deposits (a+b)

a. Domestic Currency

b. Foreign Currency

Income Tax Liabilities

Other Liabilities

Total Assets (2.1 to 2.7)

Cash & Bank Balance

Money at call and short Notice

Investments

Loans & Advances (a+b+c+d+e+f)

a. Real Estate Loan

(Rs.In '000)

1538805.40

118000.00

91290.48

Corresponding

Previous

Previous Year

Quarter Ending

Quarter Ending

1480368.33

1161631.56

118000.00

118000.00

81079.14

29597.80

1247444.51

1247444.51

1182745.82

1182745.82

942960.12

942960.12

82070.40

1538805.41

129851.10

297912.99

706.30

1019116.14

0.00

98543.37

1480368.33

142534.53

242226.63

706.30

999493.19

0.00

71073.64

1161631.57

109235.28

144163.50

10706.30

823423.87

0.00

This Quarter

Ending

1. Residential Real Estate Loan (Except Personal Home Loan upto Rs 10 million)

2. Business Complex & Residential Apartment Construction Loan

3. Income generating Commercial Complex Loan

4. Other Real Estate Loan (Including Land Purchase & Plotting)

105556.07

104245.21

b. Personal Home Loan of Rs. 10 million or less

c. Margin Type Loan

384915.21

378604.47

d. Term Loan

337356.95

315329.09

e. Overdraft Loan / TR Loan / WC Loan

191287.91

201314.42

f. Others

14074.89

14887.16

Fixed Assets

Non Banking Assets

77143.98

80520.52

Other Assets

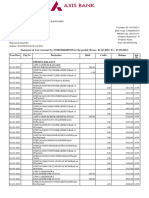

Profit and Loss Account

71114.92

31876.26

Interest income

32782.75

16770.15

Interest Expense

38332.17

15106.11

Net Interest Income (3.1-3.2)

958.76

383.85

Fees Commission and Discount

7658.00

4148.79

Other Operating Income

45.84

32.46

Foreign Exchange Gain/Loss (Net)

46994.77

19671.22

Total Operating Income (A+3.3+3.4+3.5)

9403.61

5304.60

Staff Expenses

8805.60

4153.57

Other Operating Expenses

28785.57

10213.04

Operating profit Before Provision (B-3.6-3.7)

14807.67

7533.14

Provision for Possible Loss

13977.89

2679.90

Operating profit (C-3.8)

0.00

0.00

Non Operating Income/Expenses (Net)

8783.24

4072.43

Write Back of Provision for Possible Loss

22761.13

6752.33

Profit From Regular Activities (D+3.9+3.10)

Extraordinary Income/Expenses (Net)

22761.13

6752.33

Profit Before Bonus and Taxes (E+3.11)

2069.19

613.85

Provision For Staff Bonus

6207.58

1841.55

Provision For Tax

14484.36

4296.94

Net Profit/Loss (F-3.12 -3.13)

Ratios

17.25%

16.72%

Capital Fund to RWA

4.19%

3.53%

Non Performing Loan (NPL) to Total Loan

81.30%

Total Loan Loss Provision to total NPL

82.57%

5.41%

5.32%

Cost of Funds

70.71%

72.61%

CD Ratio (Calculated as per NRB Directives)

Base Rate (for class "A" banks )

Additional Information (Optional)

Average Yield (Local Currency)

Net Interest Spread (Local Currency)

Return on Equity

Return on Assets

Note: Figures are subject to change as per the requirement by statutory/regulatory authorities.

Interest rate on Deposit & Loan and Advance

Saving deposit: 4.5% to 6.5%, Fixed Deposit: 6.25% to 10.5%, Loan: 10.5% to 18%

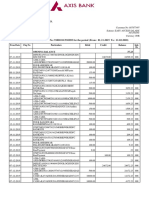

83264.56

493071.91

233707.14

13380.26

15753.23

58349.39

59047.17

25758.87

33288.30

947.48

7670.86

54.61

41961.25

6935.55

8415.02

26610.68

7703.51

18907.17

600.00

1157.86

20665.03

20665.03

1878.64

5635.91

13150.48

14.41%

4.01%

92.49%

4.88%

76.26%

You might also like

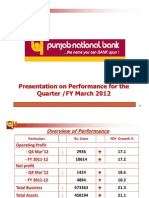

- 2nd Quarter Results 2011 12Document1 page2nd Quarter Results 2011 12satyendra_upreti2011No ratings yet

- Standard Chartered Bank Nepal Ltd. Naya Baneshwor, KathmanduDocument1 pageStandard Chartered Bank Nepal Ltd. Naya Baneshwor, Kathmandukheper1No ratings yet

- Ashwin 2070Document2 pagesAshwin 2070nayanghimireNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Statement of Finanacial Position (Annexure-B of The Format) (Rs. in '000)Document12 pagesStatement of Finanacial Position (Annexure-B of The Format) (Rs. in '000)saxenaNo ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Ar 2005 Financial Statements p55 eDocument3 pagesAr 2005 Financial Statements p55 esalehin1969No ratings yet

- Financial Highlights: Hinopak Motors LimitedDocument6 pagesFinancial Highlights: Hinopak Motors LimitedAli ButtNo ratings yet

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Document30 pagesWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNo ratings yet

- Samba Bank Pakistan Ratio Analysis.Document22 pagesSamba Bank Pakistan Ratio Analysis.Mariam ZiaNo ratings yet

- Income Statement (In Inr MN) Income: Asian PaintsDocument11 pagesIncome Statement (In Inr MN) Income: Asian Paintsavinashtiwari201745No ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementKaushal KumarNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument110 pagesDemonstra??es Financeiras em Padr?es InternacionaisMPXE_RINo ratings yet

- Petroleum BSA 06 10Document44 pagesPetroleum BSA 06 10Haji Suleman AliNo ratings yet

- Budget Variance Ytd Sept. 2011Document67 pagesBudget Variance Ytd Sept. 2011Raja RamNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- 06 Financial HighlightsDocument1 page06 Financial HighlightsKhaira UmmatienNo ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- HDFC Life and IciciDocument5 pagesHDFC Life and IciciSubhashNo ratings yet

- Ho Beefs Announcement 3 Q 2014Document10 pagesHo Beefs Announcement 3 Q 2014mmccNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Indian Bank: Profit and Loss StatementDocument33 pagesIndian Bank: Profit and Loss StatementKaushaljm PatelNo ratings yet

- Income Statement (In Inr MN) Income: Asian PaintsDocument16 pagesIncome Statement (In Inr MN) Income: Asian Paintsavinashtiwari201745No ratings yet

- Form 990-P F: Return of Private FoundationDocument26 pagesForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesNo ratings yet

- GulahmedDocument8 pagesGulahmedOmer KhanNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Accounting Suggested AnswersDocument6 pagesFinancial Accounting Suggested Answersaqsa_22inNo ratings yet

- Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Annual ReportDocument1 pageAnnual ReportAnup KallimathNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Marathon SDN BHD Statement of Cash Flow For The Year Ended 31 December 20X8 RM'000 RM'000 Cash Flow From Operating ActivitiesDocument3 pagesMarathon SDN BHD Statement of Cash Flow For The Year Ended 31 December 20X8 RM'000 RM'000 Cash Flow From Operating ActivitiesArissa LaiNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Ess 2022 Chapter 5 eDocument9 pagesEss 2022 Chapter 5 eDahamNo ratings yet

- Central Release of Last Year But Received During The Current Year Actual O.B. As On 1st April of The YearDocument6 pagesCentral Release of Last Year But Received During The Current Year Actual O.B. As On 1st April of The YearmridanishjNo ratings yet

- Analyst Mar 12Document36 pagesAnalyst Mar 12Abhinav WadhawanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Dell IncDocument6 pagesDell IncMohit ChaturvediNo ratings yet

- UNION BUDGET 2009-10 AT A GLANCEDocument5 pagesUNION BUDGET 2009-10 AT A GLANCEsdNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Document2 pagesUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNo ratings yet

- Monetary Policy Department: Fortnightly Statement: Trends of Major Economic Indicators-June 30, 2014 I. Money and CreditDocument3 pagesMonetary Policy Department: Fortnightly Statement: Trends of Major Economic Indicators-June 30, 2014 I. Money and Creditleo_monty007No ratings yet

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Document9 pagesStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88No ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Balance sheet and cash flow analysisDocument1,832 pagesBalance sheet and cash flow analysisjadhavshankar100% (1)

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- Half-Year 2013 Results: Belek - TurquieDocument28 pagesHalf-Year 2013 Results: Belek - TurquieEugen IonescuNo ratings yet

- Form No 2E: ITS-2E Naya SaralDocument1 pageForm No 2E: ITS-2E Naya Saralgotdilip4No ratings yet

- Electrona Corporation Financial Statements 1995-1998Document18 pagesElectrona Corporation Financial Statements 1995-1998Anonymous HVLVK4No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- SMTP Iv Soh 0 L 4 N RHig SGi JW QT Ex W69 CMG ZAYz 5 MWVDocument1 pageSMTP Iv Soh 0 L 4 N RHig SGi JW QT Ex W69 CMG ZAYz 5 MWVprabindraNo ratings yet

- Quad TradeDocument27 pagesQuad TradeprabindraNo ratings yet

- Devkota, M.D. & Bhatta, M.R. (2011) - Newborn Care Practices of Mothers in A Rural Community in Baitadi, Nepal. Health Prospect, 10 (1) : PP 5-9Document3 pagesDevkota, M.D. & Bhatta, M.R. (2011) - Newborn Care Practices of Mothers in A Rural Community in Baitadi, Nepal. Health Prospect, 10 (1) : PP 5-9prabindraNo ratings yet

- 10307001Document51 pages10307001prabindraNo ratings yet

- Commodity Bye LawsDocument42 pagesCommodity Bye LawsprabindraNo ratings yet

- OFF2017004 Offer Nepal AirlinesDocument1 pageOFF2017004 Offer Nepal AirlinesprabindraNo ratings yet

- SB RegulationDocument27 pagesSB RegulationprabindraNo ratings yet

- Powerful Forecasting With MS Excel Sample PDFDocument257 pagesPowerful Forecasting With MS Excel Sample PDFprabindraNo ratings yet

- Commodity Bye LawsDocument42 pagesCommodity Bye LawsprabindraNo ratings yet

- Parabolic SAR (Wilder)Document4 pagesParabolic SAR (Wilder)prabindraNo ratings yet

- Wiccan Spells: JappyDocument97 pagesWiccan Spells: JappyJasper86% (7)

- A Study On Determinants of Good Newborn Care Practices in The Suburban Areas of Kathmandu (A Case Study of Raniban, Boharatar and Balaju Height)Document1 pageA Study On Determinants of Good Newborn Care Practices in The Suburban Areas of Kathmandu (A Case Study of Raniban, Boharatar and Balaju Height)prabindraNo ratings yet

- Monthly - Statistics - 2073-03 (Mid July, 2016)Document45 pagesMonthly - Statistics - 2073-03 (Mid July, 2016)prabindraNo ratings yet

- Securities Issue and Allotment Guidelines 2074Document33 pagesSecurities Issue and Allotment Guidelines 2074prabindra100% (2)

- Parabolic SAR (Wilder)Document6 pagesParabolic SAR (Wilder)prabindraNo ratings yet

- SampleDocument1 pageSampleprabindraNo ratings yet

- QuestionnaireDocument11 pagesQuestionnaireprabindraNo ratings yet

- Sample 2Document1 pageSample 2prabindraNo ratings yet

- AHPCDocument98 pagesAHPCprabindraNo ratings yet

- Creating A Sine Wave in ExcelDocument12 pagesCreating A Sine Wave in ExcelSubin JacobNo ratings yet

- Capital Plan Board Minute 1Document1 pageCapital Plan Board Minute 1prabindraNo ratings yet

- Capitalization Vs DCFDocument8 pagesCapitalization Vs DCFprabindraNo ratings yet

- Monthly - Statistics 2073 06 (Mid Oct, 2016)Document49 pagesMonthly - Statistics 2073 06 (Mid Oct, 2016)prabindraNo ratings yet

- DCF Analysis and Excel FunctionsDocument10 pagesDCF Analysis and Excel FunctionsJimmy JoyNo ratings yet

- Monthly ReportDocument2 pagesMonthly ReportprabindraNo ratings yet

- Monthly - Statistics - 2073-03 (Mid July, 2016)Document45 pagesMonthly - Statistics - 2073-03 (Mid July, 2016)prabindraNo ratings yet

- Capital Plan Board Minute 1 PDFDocument1 pageCapital Plan Board Minute 1 PDFprabindraNo ratings yet

- Monthly - Statistics 2073 06 (Mid Oct, 2016)Document49 pagesMonthly - Statistics 2073 06 (Mid Oct, 2016)prabindraNo ratings yet

- Monthly - Statistics - 2073-03 (Mid July, 2016)Document45 pagesMonthly - Statistics - 2073-03 (Mid July, 2016)prabindraNo ratings yet

- Parabolic SAR (Wilder)Document6 pagesParabolic SAR (Wilder)anishghoshNo ratings yet

- 26as Ay 21-22Document4 pages26as Ay 21-22Madhu MohanNo ratings yet

- Introduction To Tally Software and Its FeaturesDocument28 pagesIntroduction To Tally Software and Its FeaturesMichael WellsNo ratings yet

- Recruitment Challan FormDocument2 pagesRecruitment Challan Formdeepak kumarNo ratings yet

- Backup JUNEDocument416 pagesBackup JUNEraisyarainNo ratings yet

- Allied Bank of PakistanDocument47 pagesAllied Bank of Pakistanmuhammadtaimoorkhan75% (8)

- September 13, 2018 Statement PDFDocument6 pagesSeptember 13, 2018 Statement PDFAnonymous MNcPT60% (1)

- A. VasudevanDocument6 pagesA. Vasudevanashwin1596No ratings yet

- Banking Regulation Act 1949Document35 pagesBanking Regulation Act 1949sidd2450No ratings yet

- Chapter 1Document95 pagesChapter 1Quỳnh Chi NguyễnNo ratings yet

- Kotak Mahindra BankDocument113 pagesKotak Mahindra BankAryan GouthamNo ratings yet

- Report On Dhaka BankDocument43 pagesReport On Dhaka BankRidwan KingdomNo ratings yet

- Treasury Hand BookDocument213 pagesTreasury Hand Bookvenudreamer67% (3)

- Indian Overseas BanksDocument15 pagesIndian Overseas BanksAnkit SainiNo ratings yet

- Statement of Axis Account No:921010048487932 For The Period (From: 01-03-2023 To: 27-09-2023)Document10 pagesStatement of Axis Account No:921010048487932 For The Period (From: 01-03-2023 To: 27-09-2023)anita vermaNo ratings yet

- Literature Review of Jamuna BankDocument6 pagesLiterature Review of Jamuna Bankafdtakoea100% (1)

- Meenakshi Mills Mad HCDocument21 pagesMeenakshi Mills Mad HCTushar ChoudharyNo ratings yet

- Statement of Axis Account No:918010113912893 For The Period (From: 01-11-2019 To: 11-02-2020)Document4 pagesStatement of Axis Account No:918010113912893 For The Period (From: 01-11-2019 To: 11-02-2020)Avinash DondapatyNo ratings yet

- Credit Appraisal in MuthootDocument30 pagesCredit Appraisal in MuthootNISHI1994100% (1)

- Statement of Account: Juanima Porter 102 Bonita CT SUMMERVILLE SC 29485-0000Document5 pagesStatement of Account: Juanima Porter 102 Bonita CT SUMMERVILLE SC 29485-0000Kelley73% (15)

- The Co-Operative Societies Rules, 1927Document33 pagesThe Co-Operative Societies Rules, 1927Muzaffar IqbalNo ratings yet

- Consumer Perception Towards HDFC BankDocument55 pagesConsumer Perception Towards HDFC BankMohammad KhadeerNo ratings yet

- 03NITCEEZV201617Document118 pages03NITCEEZV201617executive engineerNo ratings yet

- RFBT New Topics Flashcards - QuizletDocument74 pagesRFBT New Topics Flashcards - QuizletJulia MirhanNo ratings yet

- Types of Financial Institutions and Their Role in Economic DevelopmentDocument3 pagesTypes of Financial Institutions and Their Role in Economic Developmentwahid_04050% (2)

- Industrial FinanceDocument11 pagesIndustrial Financedesaijpr90% (10)

- EIOPA-14-052-Annex IV V - CIC TableDocument4 pagesEIOPA-14-052-Annex IV V - CIC Tablevireya chumputikanNo ratings yet

- Barangay - Acctg. System - Edited.emrDocument104 pagesBarangay - Acctg. System - Edited.emrAnnamaAnnama100% (2)

- Activity Based CostingDocument26 pagesActivity Based CostingVishal BabuNo ratings yet

- Estatement Chase AprilDocument6 pagesEstatement Chase AprilAtta ur RehmanNo ratings yet

- QuizDocument1 pageQuizAbegail PanangNo ratings yet