Professional Documents

Culture Documents

B

Uploaded by

ανατολή και πετύχετεCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B

Uploaded by

ανατολή και πετύχετεCopyright:

Available Formats

http://quotes.wsj.com/PH/XPHS/atn/historical-prices/download?

mod_view=page&num_rows=180&range_days=180&sta

http://quotes.wsj.com/PH/XPHS/web/historical-prices/download?mod_view=page&

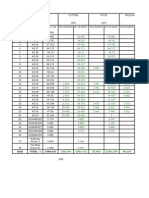

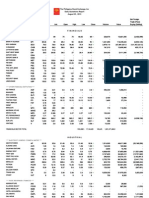

BEST FIRM DAILY ANALYSIS

Tuesday, March 22, 2016

SYMBOL

2GO

Close 10 day SMA Vol Analysis

7.38

184130

CMF

50 SMA

Bearish

Bullish

Bullish

Bullish

Bullish

HH,HL,LL

RSI

STS

63.97

85.54

7.36

7.47

Bullish

80.51 100.00

58.91

59.22

Bullish

Bearish

65.54

76.51

737.53

752.81

FibSupport FibResistance

ABS

59.2

72984

AC

747.5

460326

AEV

64.25

1563147

Bullish

Bullish

Bullish

78.94

94.44

64.05

64.55

AGF

246100

Bullish

Bullish

Bullish

56.78

35.48

2.89

3.08

AGI

16

8104790

Bullish

Bullish

Bullish

73.52

84.38

15.98

16.12

ALI

36.95

12522160

Bullish BIG

Bearish

Bullish

Bullish

72.89

82.18

36.83

37.60

ANI

4.93

1421700

Bullish BIG

Bearish

Bullish

Bearish

38.84

41.96

4.59

4.97

AP

43.45

2438930

Bearish

Bullish

53.24

36.54

43.39

44.27

APC

0.57

1222600

#DIV/0!

Bullish

69.82

93.33

0.55

0.57

AR

0.004

97700000

#DIV/0!

Bearish

46.10

0.00

0.004

0.004715

ARA

1.63

557700

Bearish

Bullish

65.09

72.97

1.60

1.70

ATN

0.285

2249000

#DIV/0!

Bullish

84.05

91.53

0.29

0.29

BDO

104.9

2873306

Bearish

Bullish

Bullish

69.59

82.05

104.85

105.69

BHI

0.066

2249000

Bearish

Bullish

Bullish

70.83

84.21

0.07

0.07

BLOOM

5.3

11526540

Bullish

Bullish

Bearish

73.96

81.82

5.19

5.41

BSC

0.24

378000

#DIV/0!

Bullish

57.55

50.00

0.24

0.24

CAL

3.44

509300

Bearish

Bullish

Bullish

66.20

69.81

3.39

3.56

CEI

0.129

7738000

#DIV/0!

Bullish

Bullish

62.56

66.67

0.129

0.129715

CNPF

18.98

1370500

Bearish

Bullish

Bullish

84.95

95.00

18.95

19.04

COAL

0.49

2166000

#DIV/0!

Bullish

66.52

60.00

0.48

0.49

COSCO

7.31

2236090

Bullish

Bullish

48.45

16.67

7.30

7.40

CPG

0.56

5044800

Bearish

Bullish

Bearish

52.09

60.00

0.55

0.56

CROWN

2.55

1217800

Bullish

Bullish

Bullish

71.59

90.48

2.43

2.59

CYBR

0.495

14115400

#DIV/0!

Bullish

65.18

62.07

0.49

0.50

DAVIN

5.95

10284440

Bullish

Bullish

70.16

75.43

5.82

6.13

DD

39.5

3892650

Bullish

Bullish

91.77

97.54

39.06

39.67

DIZ

7.88

91780

Bullish

Bullish

64.53

68.00

7.84

7.90

DMC

13.74

6170940

Bullish

Bullish

Bullish

74.26

96.00

13.61

13.79

DMPL

11.48

217840

Bearish

Bearish

Bearish

49.80

0.00

11.46

11.71

DNL

9.31

5905090

Bullish

Bullish

61.87

80.41

9.23

9.38

EDC

5.93

17464840

Bearish

Bullish

50.69

28.77

5.91

6.05

EEI

7.18

491510

Bearish

Bullish

52.53

56.52

7.12

7.20

EMP

7.2

4402420

Bearish

Bearish

Bearish

43.45

8.18

7.19

7.41

FGEN

20.75

4526530

Bearish

Bullish

Bearish

47.18

48.21

20.72

21.25

FLI

1.81

23547300

Bearish

Bullish

Bullish

86.48

90.91

1.78

1.83

FNI

0.83

60506400

Bearish

Bullish

62.89

70.00

0.83

0.85

FOOD

0.73

116200

#DIV/0!

Bullish

58.72

60.00

0.72

0.75

Bullish BIG

Bullish BIG

Bullish BIG

Bullish BIG

Bullish BIG

Bearish BIG

Bullish BIG

Bearish BIG

Bullish

Bullish

Bearish

Bearish

Bearish

FPI

0.213

155000

#DIV/0!

Bullish

Bearish

35.20

23.81

0.21

0.21

GEO

0.285

2496000

Bearish

Bullish

Bearish

44.09

14.29

0.2845

0.292153

GERI

1.04

6484300

Bearish

Bullish

Bullish

63.71

63.64

1.04

1.08

GLO

2230

175511.5

Bullish

Bullish

Bullish

76.81 100.00 2197.09

GMA7

6.93

233050

Bullish

Bullish

Bullish

62.48

88.37

6.92

6.97

GSMI

11.4

3240

#DIV/0!

Bearish

Bullish

56.83

22.22

11.40

11.41

H2O

3.36

10100

#DIV/0!

Bullish

Bearish

94.67

76.27

3.32

3.39

HOLCM

13.9

32650

#DIV/0!

Bullish

53.65

68.18

13.83

13.90

HOUSE

7.8

511270

Bearish

Bullish

80.15

77.32

7.79

7.96

IDC

3.5

2163200

Bullish

Bullish

77.47

91.60

3.44

3.53

IMI

5.68

400870

Bearish

Bullish

Bullish

62.53

65.71

5.63

5.70

ION

3.06

4932000

Bullish

Bullish

Bullish

75.34 100.00

2.77

3.08

IS

0.28

111037000

Bullish

Bullish

ISM

1.37

3536300

Bullish

Bullish

LC

0.285

60638000

Bearish

LIB

3.62

1002900

LPZ

6.48

LTG

Bullish BIG

Bullish BIG

Bullish BIG

Bullish

2232.24

73.92

73.91

0.2728

0.280487

Bearish

72.32

71.43

1.33

1.39

Bullish

Bearish

43.35

11.11

0.2812

0.28882

Bearish

Bearish

Bearish

40.99

34.67

3.61

3.66

6073860

Bearish

Bullish

Bullish

73.32

93.13

6.43

6.55

15.9

3395930

Bearish

Bullish

Bullish

44.87

57.78

15.82

16.03

MAC

2.75

61800

#DIV/0!

Bullish

81.42

95.24

2.75

2.75

MACAY

37.4

540

#DIV/0!

Bearish

31.43

81.36

37.40

37.40

MARC

2.13

726900

Bullish

Bullish

Bearish

61.12

38.18

2.11

2.15

MAXS

21.3

1272340

Bullish

Bullish

Bullish

83.28

91.80

20.92

21.61

MB

0.55

46500

#DIV/0!

Bullish

Bullish

47.74

57.14

0.55

0.55

MBT

87.35

3475629

Bearish

Bullish

Bullish

84.78

97.84

87.05

87.55

MCP

2.78

33053900

Bullish

Bullish

72.82

78.57

2.77

2.86

MED

0.58

1838600

#DIV/0!

Bullish

60.74

27.27

0.58

0.58

MEG

4.11

36431200

Bullish

Bullish

71.39

83.33

4.06

4.15

MER

321.2

290790

Bullish BIG

Bullish

Bullish

49.48

27.19

316.77

323.49

MPI

5.99

33418100

Bearish BIG

Bullish

Bullish

Bearish

56.65

64.44

5.98

6.02

MRC

0.093

7937000

#DIV/0!

Bullish

Bearish

52.01

40.00

0.0901

0.09391

MWC

26.75

932500

Bullish

Bullish

Bullish

49.72

65.38

26.57

26.80

NIKL

5.58

6408990

Bearish

Bullish

Bearish

63.07

45.16

5.50

5.68

NOW

0.88

13839200

Bullish

Bullish

60.18

70.37

0.86

0.90

OM

0.52

26100

#DIV/0!

Bearish

14.34

0.00

0.52

0.53

OPM

0.01

20200000

#DIV/0!

Bullish

51.99

50.00

0.01

0.01

ORE

1.3

172900

#DIV/0!

Bullish

63.22

77.78

1.29

1.30

OV

0.012

119160000

#DIV/0!

Bullish

52.93

50.00

0.01

0.01

PA

0.034

105160000

Bullish

Bullish

56.65

57.14

0.03

0.03

PCOR

10.3

10255860

Bearish

Bullish

62.55

83.45

10.22

10.38

PF

169.1

27121

#DIV/0!

Bullish

72.42

97.35

168.30

169.30

PGOLD

37

3897450

Bullish

Bullish

63.79

82.22

36.25

37.55

PHA

0.45

886000

#DIV/0!

Bullish

66.54

54.55

0.45

0.46

Bullish BIG

Bullish BIG

Bearish BIG

Bullish BIG

Bearish BIG

Bullish

Bearish

Bullish

Bearish

PHES

0.23

896000

Bullish BIG

#DIV/0!

Bearish

46.64

47.37

0.23

0.23

PIP

3.99

553900

Bullish BIG

Bearish

Bullish

Bullish

82.26

97.75

3.90

4.01

PLC

0.97

40622500

Bullish

Bullish

Bullish

66.42

81.25

0.95

0.97

PNX

4.34

564600

#DIV/0!

Bullish

90.86

98.33

4.29

4.35

POPI

1.99

710600

Bearish

Bullish

34.49

44.44

1.98

2.02

PPC

2.65

368900

Bullish

Bullish

Bearish

44.67

9.43

2.64

2.69

PSPC

1.75

460400

Bearish

Bullish

Bullish

47.98

81.48

1.71

1.77

PX

5.89

5910776.3

Bullish

Bullish

Bearish

68.74

71.80

5.88

6.05

PXP

2.25

8215400

Bearish

Bullish

Bullish

63.25

54.70

2.22

2.63

REG

2.75

5100

#DIV/0!

Bullish

51.96 100.00

2.75

2.75

RFM

4.15

3623600

Bullish

Bullish

Bullish

66.95

74.19

4.10

4.19

RLC

28.65

2965150

Bearish

Bullish

Bearish

63.67

61.63

28.40

29.70

RLT

0.46

67000

#DIV/0!

Bullish

Bullish

65.87 100.00

0.45

0.46

ROCK

1.5

436100

Bullish

Bullish

54.64

66.67

1.49

1.50

ROX

4.8

78040

#DIV/0!

Bearish

Bearish

51.58

58.14

4.79

4.97

RRHI

70.8

2508570

Bearish

Bullish

Bearish

68.53

87.14

70.17

71.70

RWM

3.82

6161500

Bullish

Bullish

Bullish

51.19

31.11

3.74

3.89

SBS

6.15

1823840

Bullish

Bullish

Bullish

62.62

50.69

6.14

6.33

SCC

132.5

637530

Bearish

Bullish

Bearish

61.90

54.01

130.47

135.13

SECB

162.3

1177742

Bullish

Bullish

Bullish

88.80

95.09

161.17

163.16

SEVN

104.5

119301

#DIV/0!

Bullish

69.80

91.67

101.26

105.08

SFI

0.161

7219000

Bullish

Bullish

57.33

66.67

0.16

0.16

SGI

1.12

552900

#DIV/0!

Bullish

58.57

54.55

1.09

1.13

SLI

0.84

2539500

Bearish

Bullish

64.80

77.78

0.83

0.85

SM

994.5

334865

Bullish BIG

Bearish

Bullish

Bullish

73.52

90.53

990.01

1002.99

SMC

77.5

724628

Bullish BIG

Bullish

Bullish

Bearish

68.88

74.63

76.82

77.55

SMPH

22.15

16318590

Bullish BIG

Bullish

Bullish

Bullish

67.96

81.82

21.63

22.40

SOC

0.77

111600

#DIV/0!

Bullish

48.40

36.36

0.77

0.77

SPH

2.45

509400

Bullish BIG

#DIV/0!

Bearish

Bearish

53.70

40.00

2.41

2.45

SPM

2.2

14700

Bullish BIG

#DIV/0!

Bearish

Bearish

42.75

47.37

2.14

2.20

SRDC

0.8

#DIV/0!

Bearish

100.00 #####

0.80

0.80

SSI

3.41

7068600

Bearish

Bullish

39.71

40.82

3.37

3.50

STI

0.53

3797200

Bearish

Bullish

64.44

57.14

0.53

0.54

STR

5.9

14610

Bullish BIG

#DIV/0!

Bullish

54.28 100.00

5.69

5.91

SUN

1.04

1875500

Bullish BIG

Bullish

Bullish

59.61

75.00

1.02

1.06

TA

2.7

11501700

Bearish

Bullish

Bearish

72.31

77.78

2.70

2.75

TECH

17.8

340280

Bearish

Bearish

Bearish

40.92

1.22

17.77

18.02

TEL

1962

287270.5

Bullish

Bearish

39.55

83.19 1952.54

1975.46

TFHI

165

88473

Bullish

Bullish

Bearish

65.05

71.16

153.55

165.78

TUGS

1.26

318900

#DIV/0!

Bullish

Bearish

57.38

42.11

1.23

1.26

UNI

0.31

3925000

#DIV/0!

Bullish

55.60

28.57

0.3098

0.313577

VITA

0.77

11200900

Bearish

Bullish

62.86

41.38

0.77

0.79

Bearish BIG

Bullish BIG

Bullish BIG

Bearish BIG

Bullish BIG

Bearish

Bearish

Bearish

VLL

4.68

7346300

Bullish

Bullish

VMC

4.6

1065800

#DIV/0!

Bearish

VUL

1.15

120300

#DIV/0!

Bullish

WEB

22.2

265610

Bullish

Bearish

WIN

0.193

1335000

59.74

73.53

4.63

4.70

44.78

20.83

4.60

4.60

Bearish

61.24

23.08

1.14

1.16

Bullish

27.82

75.68

22.06

22.21

#DIV/0!

Bearish

45.09

3.85

0.19

0.20

16.98

3503430

Bearish

Bullish

68.31

64.31

16.96

17.21

YEHEY

4.77

35100

#DIV/0!

Bullish

54.57

52.63

4.77

4.77

ZHI

0.295

234000

#DIV/0!

Bullish

52.91

75.00

0.295

0.295

Bearish BIG

Bearish

Bearish

LEGEND

10 DAY VOL SMA

An analysis of 10 day simple moving average of volume of a stock.

VOLUME ANALYSIS

If today's volume exceeds the price of a 10 day sma VOLUME , the stock is bullish,if not, it is bearish

CMF(Chaikin Money Flow)

the indicator uses the difference between a 3-day exponentially-weighted moving average (EMA) of the

accumulation/distribution line and the 10-Day EMA of the Accumulation/Distribution Line

50 SMA

An analysis of 50 day simple moving average OF THE CLOSING PRICE of a stock.

HH,HL, LL

HH stands for Higher High, HL stands for Higher Low, and LL stands for Lower Low

If a stock have a HH and HL condition, it is BULLISH because it creates a new high in the HIGH and new high for the LOW of a stock for that day.

If a stock have a LL condition, this means a stock is BEARISH because it creates a new low in the HIGH and new low for the LOW of a stock for that day.

RSI(Relative Strenght Index)

a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100.

Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30.

STS(Stochastics

Readings above 80 for the 20-day Stochastic Oscillator would indicate that the underlying security was trading near the top of its 20-day high-low

range and it is considered OVERBOUGHT. Readings below 20 occur when a security is trading at the low end of its high-low range and it is

considered OVERSOLD.

SUPPORT AND RESISTANCE

SUPPORT is a level where the price tends to find support as it falls. This means the price is more likely to "bounce" off this level

rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely to

continue falling until meeting another support level

RESISTANCE is a level where the price tends to find resistance as it rises. This means the price is more likely to "bounce" off this

level rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely

to continue rising until meeting another resistance level.

The Materials Contained here are for guidance & Educational Purposes Only. All Indicators are carefully

analyzed to help assist traders in getting RELIABLE RESOURCES and INFORMATIONS that they can use

in their strategy in trading and further study.Due diligence before attempting to follow the signals stated

above.Thank You

ODIELON O. GAMBOA

You might also like

- Master List of All My IndicatorsDocument8 pagesMaster List of All My IndicatorsAlex Treviño100% (3)

- Remedial Law Case DigestDocument815 pagesRemedial Law Case DigestTaj Martin100% (13)

- 2007-2013 Political Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Document168 pages2007-2013 Political Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh92% (85)

- Labor Law - Craver - Fall 2003 - 3Document45 pagesLabor Law - Craver - Fall 2003 - 3champion_egy325No ratings yet

- Remedial Law Memory AidDocument38 pagesRemedial Law Memory AidIm In TroubleNo ratings yet

- Evidence: Course OutlineDocument12 pagesEvidence: Course Outlineανατολή και πετύχετεNo ratings yet

- Complaint Affidavit SampleDocument2 pagesComplaint Affidavit SampleDonna Gragasin78% (125)

- Bfa Dailyanalysis (2) AsdadDocument4 pagesBfa Dailyanalysis (2) Asdadανατολή και πετύχετεNo ratings yet

- Best Firm Daily Analysis: Thursday, March 17, 2016Document4 pagesBest Firm Daily Analysis: Thursday, March 17, 2016ανατολή και πετύχετεNo ratings yet

- Best Firm Daily Analysis: Friday, March 18, 2016Document4 pagesBest Firm Daily Analysis: Friday, March 18, 2016ανατολή και πετύχετεNo ratings yet

- Bfa DailyanalysisDocument4 pagesBfa Dailyanalysisανατολή και πετύχετεNo ratings yet

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerNo ratings yet

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerNo ratings yet

- Philippine stock technical guideDocument9 pagesPhilippine stock technical guidewindsingerNo ratings yet

- Stock CodeDocument17 pagesStock CodeTimberevilake HardjosantosoNo ratings yet

- Fibonacci and Clouds 21 February 2016Document3 pagesFibonacci and Clouds 21 February 2016Jun GomezNo ratings yet

- ADocument8 pagesAali imranNo ratings yet

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerNo ratings yet

- Best Portfolio Shares InvestmentsDocument4 pagesBest Portfolio Shares Investmentssathi2317411No ratings yet

- Daily Calls: November 8, 2016Document18 pagesDaily Calls: November 8, 2016SathishKumarNo ratings yet

- Trader's Daily Digest - 19.04.2016Document7 pagesTrader's Daily Digest - 19.04.2016Sudheera IndrajithNo ratings yet

- Technical Analysis Signals Summary Sheet 2-11-03 13Document14 pagesTechnical Analysis Signals Summary Sheet 2-11-03 13Randora LkNo ratings yet

- Option Chain (Equity Derivatives) : Calls Chart OI CHNG in OI IV LTP Net CHNGDocument9 pagesOption Chain (Equity Derivatives) : Calls Chart OI CHNG in OI IV LTP Net CHNGDipesh TekchandaniNo ratings yet

- July Seasonality - Global Equity Indices: Changes Since End of JuneDocument3 pagesJuly Seasonality - Global Equity Indices: Changes Since End of Juneapi-245850635No ratings yet

- Daily stock analysis and trading signalsDocument55 pagesDaily stock analysis and trading signalsAlexandreCostaNo ratings yet

- Total Total - I 1398.975Document6 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document6 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document6 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document5 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Total Total - I 1398.975Document5 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Segment wise details of cutting, fit up, welding and assembly of AS34-AS54Document4 pagesSegment wise details of cutting, fit up, welding and assembly of AS34-AS54sajulehNo ratings yet

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehNo ratings yet

- Battery SpecsDocument12 pagesBattery SpecsKrineli Aquino100% (1)

- No Code Value (MN) Vol (Lot) Freq Last +/-Bvol (Lot) Bid OfferDocument2 pagesNo Code Value (MN) Vol (Lot) Freq Last +/-Bvol (Lot) Bid OfferhendraNo ratings yet

- F&O Margin Details for 06.05.2016Document5 pagesF&O Margin Details for 06.05.2016ShanKar PadmanaBhanNo ratings yet

- Philippine Equity ResearchDocument9 pagesPhilippine Equity ResearchgwapongkabayoNo ratings yet

- Indices Auto Saved)Document16 pagesIndices Auto Saved)Ashu LeeNo ratings yet

- Fassonformen Für Oboe Shaper Forms For OboeDocument5 pagesFassonformen Für Oboe Shaper Forms For Oboebaroon1234No ratings yet

- Derivative Report 23 June 2014Document8 pagesDerivative Report 23 June 2014PalakMisharaNo ratings yet

- Philippine Stock Exchange Daily Report Provides Financial Sector Stock Prices and Trading DataDocument7 pagesPhilippine Stock Exchange Daily Report Provides Financial Sector Stock Prices and Trading DatasrichardequipNo ratings yet

- ADocument8 pagesAali imranNo ratings yet

- Derivative Report 25 June 2014Document8 pagesDerivative Report 25 June 2014PalakMisharaNo ratings yet

- General Information Pivot Point - Support Resistance: BSE 100 Nifty Junior More F&O SharesDocument5 pagesGeneral Information Pivot Point - Support Resistance: BSE 100 Nifty Junior More F&O SharesRaif FadhiNo ratings yet

- Monthly Consolidated Volume by Symbol 201101 PDFDocument69 pagesMonthly Consolidated Volume by Symbol 201101 PDFSamarth MathurNo ratings yet

- KLSE Stock Screener PDFDocument4 pagesKLSE Stock Screener PDFleekiangyenNo ratings yet

- Margin PDFDocument5 pagesMargin PDFSandeep OakNo ratings yet

- M 65WDocument52 pagesM 65WChelseaE82No ratings yet

- Six Yrs Per OGDCLDocument2 pagesSix Yrs Per OGDCLMAk KhanNo ratings yet

- Daily F&O Margin DetailsDocument5 pagesDaily F&O Margin DetailsSriNo ratings yet

- Symbol Expiry Month Lot Size Price (RS) Carryover Margin (%) Intraday Margin Future Contract Rs/Lot Carryover Margin Future Contract Rs/LotDocument15 pagesSymbol Expiry Month Lot Size Price (RS) Carryover Margin (%) Intraday Margin Future Contract Rs/Lot Carryover Margin Future Contract Rs/LotkunalmryNo ratings yet

- PL Summary Cash 11-1-2016Document2 pagesPL Summary Cash 11-1-2016bmanojkumarNo ratings yet

- Nifty 50 CA Pre-Open CHNG Prev. CloseDocument6 pagesNifty 50 CA Pre-Open CHNG Prev. CloseSathishKumarNo ratings yet

- Daily stock picks and technical analysis for ICBP, KLBF, JSMR, and SMRADocument2 pagesDaily stock picks and technical analysis for ICBP, KLBF, JSMR, and SMRAgllugaNo ratings yet

- Sky Bet Supreme NovicesDocument3 pagesSky Bet Supreme NovicesmickNo ratings yet

- Nse Futures MarginsDocument5 pagesNse Futures MarginsLikhithaReddyNo ratings yet

- Critical Expiry Week Ahead: Punter's CallDocument5 pagesCritical Expiry Week Ahead: Punter's Callash ravalNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- 2007 MFI BenchmarksDocument42 pages2007 MFI BenchmarksVũ TrangNo ratings yet

- Markets and Commodity Figures: FTSE 100 Index (Pence) GlobalsDocument5 pagesMarkets and Commodity Figures: FTSE 100 Index (Pence) GlobalsTiso Blackstar GroupNo ratings yet

- Daily Stock PricesDocument8 pagesDaily Stock Pricesali imranNo ratings yet

- Bataclan vs. MedinaDocument2 pagesBataclan vs. Medinaανατολή και πετύχετεNo ratings yet

- MTA Curriculum DescriptionDocument3 pagesMTA Curriculum Descriptionανατολή και πετύχετεNo ratings yet

- Chartered Market Technician (CMT) Program Level 2: May 2013 Reading AssignmentsDocument4 pagesChartered Market Technician (CMT) Program Level 2: May 2013 Reading Assignmentsανατολή και πετύχετεNo ratings yet

- Labor Law Outline Key ConceptsDocument49 pagesLabor Law Outline Key Conceptsανατολή και πετύχετεNo ratings yet

- Introduction To PsychologyDocument45 pagesIntroduction To PsychologyKhristine Lerie PascualNo ratings yet

- HR-V1 WebDocument70 pagesHR-V1 WebsouNo ratings yet

- Labor Law ('94)Document25 pagesLabor Law ('94)NopeNo ratings yet

- 2013spr cmt1Document5 pages2013spr cmt1Nguyễn Hữu TuấnNo ratings yet

- PSY Chapter 1Document83 pagesPSY Chapter 1Aedrian M LopezNo ratings yet

- Law 125 SyllabusDocument5 pagesLaw 125 SyllabusJoshua LaronNo ratings yet

- Our Top 3 Swing Trading Setups: Deron WagnerDocument36 pagesOur Top 3 Swing Trading Setups: Deron Wagnerανατολή και πετύχετεNo ratings yet

- PSPC ACTIVIST SHAREHOLDERS DEMAND VALUE CREATIONDocument19 pagesPSPC ACTIVIST SHAREHOLDERS DEMAND VALUE CREATIONανατολή και πετύχετεNo ratings yet

- FAPHL 2016 CONFERENCE PROGRAM FORMAT As of JUNE 23Document5 pagesFAPHL 2016 CONFERENCE PROGRAM FORMAT As of JUNE 23ανατολή και πετύχετεNo ratings yet

- InvesujighDocument13 pagesInvesujighανατολή και πετύχετεNo ratings yet

- Labor Law IntroductionDocument152 pagesLabor Law IntroductionCharnette Cao-wat LemmaoNo ratings yet

- G.R. No. 127899 December 2, 1999: Supreme CourtDocument7 pagesG.R. No. 127899 December 2, 1999: Supreme Courtανατολή και πετύχετεNo ratings yet

- G.R. No. 89606 August 30, 1990: Supreme CourtDocument8 pagesG.R. No. 89606 August 30, 1990: Supreme Courtανατολή και πετύχετεNo ratings yet

- Bfa Dailyanalysis (1) AdaDocument4 pagesBfa Dailyanalysis (1) Adaανατολή και πετύχετεNo ratings yet

- Learning About Content Marketing: by Ric OribianaDocument5 pagesLearning About Content Marketing: by Ric Oribianaανατολή και πετύχετεNo ratings yet

- Soriano's Probation Revocation UpheldDocument11 pagesSoriano's Probation Revocation Upheldανατολή και πετύχετεNo ratings yet

- Stock Market Research Questionnaire InsightsDocument4 pagesStock Market Research Questionnaire Insightsανατολή και πετύχετεNo ratings yet

- Esteban YafghdDocument2 pagesEsteban Yafghdανατολή και πετύχετεNo ratings yet