Professional Documents

Culture Documents

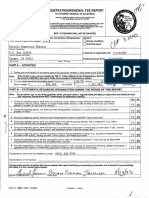

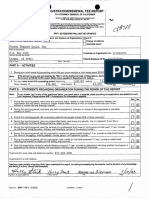

FTG RRF 2000

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG RRF 2000

Uploaded by

L. A. PatersonCopyright:

Available Formats

.

:.".~',;~

do

,.

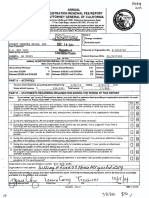

2001

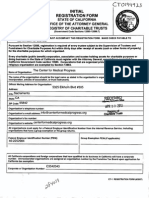

REGISTRATIONIRENEWAL

MAIL TO:

p'egistryof

Charitable Trusts

P.O. Bo)( 903447

Sacramento, CA 94203-4470

-=: REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

,=-- ~--STREET

Sections 1~586 and 12S87, California Govemment Code

11 CCR Se<:lions 311 Bnd 312

ADDRESS:

1300 I Street, Room 1130

Sacramento, CA 95814

Telephone: (916) 445-2021

Failure to submit this report annually no later than four months and fifteen days

after the end of the organization's accounting period will reSUlt in the loss of

your tax exemption and the assessment of a minimum tax 01 S800, plus

interest, andlor fines or filing penalties as defined in Government Code Section

12586.1 (Recentlvenacted).

.

WEBSITE ADDRESS:

http://caag.state.ca.us/charitiesl

Enter State Charity

RRF-1 EXTENSIONS WILL NOT BE GRANTED

Registration

Number,

Name, and Address

of Organization

Check

Below:

o

o

II, I, " II, l. I, " rI, I, " II " I, I, ,II, rrI, I, I I IrI, lr I, I II

J

36499

FOREST

THEATRE

CARMEL

CA

PO SOX 2325

GUILD,

J , ,

J , ,

INC.

Federal

PART

....

1.

-A. - ACTIVITIES...

-.

or Organization.

Corporate

93921-2325

._--_. --.

_ ...

---.'

~

...

..

-------_.-._.-

..

Employer

.~- '--

No.

__

___

.'0

o

o

D0244720

237227328

1.0. No.

'

if:

Change of address

Initial report'

Amended

report

Final report

._

Yes

During your most recent full accounting period did your gross receipts or total assets equal $100,000 or

more?

No

X

(a)

If the answer is yes, you are required by Title 11 of the California Code of Regulations,

311 and 312, to

~, attach a check in the amount of $25.00 to this report. Make check payable to Department of Justice.

2_

For'yoar most recent fuJI accounting period (beginning

:

Gross receipts. $

234,733

01

Total assets $

01

,00

ending

2,500

pO

12 ,31

Actual

) list:

Estimated

PART 8 - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

If you answer "yes" to any of the questions below, you must attach a separate sheet providing an explanation and

details for each "yes" response. Please review_RRF-1 Instructions for infonnation required.

Yes

1_

During this reporting period, were there any contracts, loans, leases or other financial transactions between

the organization and any officer, director or trustee thereof either directly or with an entity in which any such

officer, director or trustee had any financial interest?

2_

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's

charitable property or funds?

3_

During this reporting period, did nonprogram expenditures exceed at least 50% of gross revenues?

4.

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you

ftled-aFOim 472CJWlttr1he1nlefnarRevel'ilie-8ei'ViCfe-,-anacnacopi

-' .- -.

..--

5.

During this reporting period, were the services of a professional fundraiser or fundraising counsel used? If

"yes," provide an attachment listing the name, address, and telephone number of the service provider.

6.

During this reporting period, did the organization receive any govemmental funding? If so, provide an

attachment listing the name of the agency, mailing address, contact person, and tetephone number.

_ .... -

Organization's area code and telephone number (

831

James H. Price

Printed Name

) 626-1681 -__ ~

I declare under penalty of perjury that I have examined this report, including accompanying

correct and complete.

./

No

_

documents,

and to the best of my knowledge

Treasurer

Tille

and belief, it is true,

1/3/01

Dale

You might also like

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNo ratings yet

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonNo ratings yet

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonNo ratings yet

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonNo ratings yet

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonNo ratings yet

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonNo ratings yet

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonNo ratings yet

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonNo ratings yet

- CA Charity Annual Report FormDocument1 pageCA Charity Annual Report FormagbufzbfNo ratings yet

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonNo ratings yet

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonNo ratings yet

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonNo ratings yet

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonNo ratings yet

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNo ratings yet

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonNo ratings yet

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonNo ratings yet

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNo ratings yet

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- FTG RRF 2013Document1 pageFTG RRF 2013L. A. PatersonNo ratings yet

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonNo ratings yet

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonNo ratings yet

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfNo ratings yet

- Public Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pagePublic Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaWAKESHEEP Marie RNNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationNo ratings yet

- '!'iiltio T!LB Ard: IffundedDocument3 pages'!'iiltio T!LB Ard: IffundedEmily GloverNo ratings yet

- rrf1 FormDocument5 pagesrrf1 Formsalman_fbNo ratings yet

- Period Covered Filing DeadlineDocument10 pagesPeriod Covered Filing DeadlineHaftari HarmiNo ratings yet

- 2010 One Caribbean Exempt App RedactedDocument43 pages2010 One Caribbean Exempt App RedactedJimmy VielkindNo ratings yet

- American Energy Alliance 2011Document35 pagesAmerican Energy Alliance 2011cmf8926No ratings yet

- Bittick Peggy S 00065283 442341 000 2009Document24 pagesBittick Peggy S 00065283 442341 000 2009Texas WatchdogNo ratings yet

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachNo ratings yet

- Kurt Miller FinancialDocument28 pagesKurt Miller FinancialThe Valley IndyNo ratings yet

- Bruno 1993 Financial Disclosure (GY-01)Document15 pagesBruno 1993 Financial Disclosure (GY-01)Albany Times UnionNo ratings yet

- Texas Court of Appeals Judge District 13 Place 3 Candidate Gregory Thomas Perkes 2010 Ethics FormDocument51 pagesTexas Court of Appeals Judge District 13 Place 3 Candidate Gregory Thomas Perkes 2010 Ethics FormTexas WatchdogNo ratings yet

- Irs Tax ExemptDocument59 pagesIrs Tax ExemptPopeye2112100% (1)

- TVLC Voluntary Petition Chapter 11 2016-11-08Document271 pagesTVLC Voluntary Petition Chapter 11 2016-11-08LivermoreParentsNo ratings yet

- Reporting Requirements For Charities and Not For Profit OrganizationsDocument15 pagesReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- American Energy Alliance 2008Document24 pagesAmerican Energy Alliance 2008cmf8926No ratings yet

- FYI 406 Your Rights Under The Tax LawDocument2 pagesFYI 406 Your Rights Under The Tax LawFuji guruNo ratings yet

- 08 B RQST IRS To Correct Bad Payer DataDocument4 pages08 B RQST IRS To Correct Bad Payer Datatonyallen0070% (1)

- NGO Prequal Vol 2Document10 pagesNGO Prequal Vol 2EMery ChristmasNo ratings yet

- Ag990 AnnualreportDocument2 pagesAg990 AnnualreportDaniel_Johnson_1322No ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- Dispute To Creditor For Charge OffDocument4 pagesDispute To Creditor For Charge Offrodney75% (20)

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Holiday Closure 12-03-18Document3 pagesHoliday Closure 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Adopting City Council Meeting Dates For 2019 12-03-18Document3 pagesAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Document5 pagesMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNo ratings yet

- Minutes 12-03-18Document7 pagesMinutes 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Mprwa Minutes April 26, 2016Document2 pagesMprwa Minutes April 26, 2016L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Mprwa Minutes October 25, 2018Document2 pagesMprwa Minutes October 25, 2018L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- Create a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulseDocument3 pagesCreate a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulsebrandy57279No ratings yet

- BMS Technical ManualDocument266 pagesBMS Technical Manualiago manziNo ratings yet

- Equipment, Preparation and TerminologyDocument4 pagesEquipment, Preparation and TerminologyHeidi SeversonNo ratings yet

- Waves and Thermodynamics, PDFDocument464 pagesWaves and Thermodynamics, PDFamitNo ratings yet

- (Variable Length Subnet MasksDocument49 pages(Variable Length Subnet MasksAnonymous GvIT4n41GNo ratings yet

- Robocon 2010 ReportDocument46 pagesRobocon 2010 ReportDebal Saha100% (1)

- Amul ReportDocument48 pagesAmul ReportUjwal JaiswalNo ratings yet

- IMM Indian Oil Case Group 3Document13 pagesIMM Indian Oil Case Group 3Soniya AgnihotriNo ratings yet

- ExpDocument425 pagesExpVinay KamatNo ratings yet

- Investigatory Project Pesticide From RadishDocument4 pagesInvestigatory Project Pesticide From Radishmax314100% (1)

- Application D2 WS2023Document11 pagesApplication D2 WS2023María Camila AlvaradoNo ratings yet

- NGPDU For BS SelectDocument14 pagesNGPDU For BS SelectMario RamosNo ratings yet

- Class Ix - Break-Up SyllabusDocument3 pagesClass Ix - Break-Up Syllabus9C Aarib IqbalNo ratings yet

- IELTS Vocabulary ExpectationDocument3 pagesIELTS Vocabulary ExpectationPham Ba DatNo ratings yet

- ĐỀ SỐ 3Document5 pagesĐỀ SỐ 3Thanhh TrúcNo ratings yet

- Radio Theory: Frequency or AmplitudeDocument11 pagesRadio Theory: Frequency or AmplitudeMoslem GrimaldiNo ratings yet

- CGV 18cs67 Lab ManualDocument45 pagesCGV 18cs67 Lab ManualNagamani DNo ratings yet

- The Singular Mind of Terry Tao - The New York TimesDocument13 pagesThe Singular Mind of Terry Tao - The New York TimesX FlaneurNo ratings yet

- Basic Five Creative ArtsDocument4 pagesBasic Five Creative Artsprincedonkor177No ratings yet

- Tygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingDocument4 pagesTygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingAluizioNo ratings yet

- Post Marketing SurveillanceDocument19 pagesPost Marketing SurveillanceRamanjeet SinghNo ratings yet

- Health Education and Health PromotionDocument4 pagesHealth Education and Health PromotionRamela Mae SalvatierraNo ratings yet

- Environmental Technology Syllabus-2019Document2 pagesEnvironmental Technology Syllabus-2019Kxsns sjidNo ratings yet

- IP68 Rating ExplainedDocument12 pagesIP68 Rating ExplainedAdhi ErlanggaNo ratings yet

- SQL Server 2008 Failover ClusteringDocument176 pagesSQL Server 2008 Failover ClusteringbiplobusaNo ratings yet

- Tender34 MSSDSDocument76 pagesTender34 MSSDSAjay SinghNo ratings yet

- CGSC Sales Method - Official Sales ScriptDocument12 pagesCGSC Sales Method - Official Sales ScriptAlan FerreiraNo ratings yet

- Give Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishDocument12 pagesGive Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishANNA MARY GINTORONo ratings yet

- C Exam13Document4 pagesC Exam13gauravsoni1991No ratings yet

- Product CycleDocument2 pagesProduct CycleoldinaNo ratings yet