Professional Documents

Culture Documents

FTG RRF 2002

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG RRF 2002

Uploaded by

L. A. PatersonCopyright:

Available Formats

'::5'

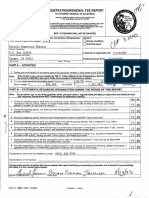

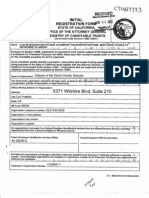

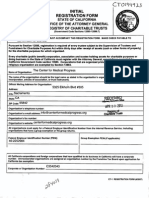

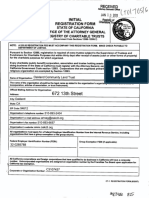

REGISTRATION/RENEWAL

MAIL: TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento,

CA 94203-4470

Telephone: (916) 445-2021

TO ATTORNEY

GENERAL

Sections12586 and 12587, CaliforniaGovernmentCode

11 Cal.CodeRegs.Sections311 and 312

RRF-1 EXTENSIONS

Enter State Charity

Registration

Registration

'1\v1

Failureto submitthis reportannuallyno laterthan four monthsand fifteen days after

the end of the organization'saccountinaperiodmar result in the loss of tax

exemptionandtne assessmentof a minimumtax 0 $800, plus interest,andlor fines

or filing penaltiesas definedin GovernmentCodeSection12586.1.

WEBSITE ADDRESS:

http://ag.ca.gov/charities/

State Charity

FEE REPORT

OF CALIFORNIA

Number,

Number

Name, and Address

C?fi1I'I(

WILL NOT BE GRANTED

of Organization:

Check if:

36499

Forest Theatre Guild, Inc.

Change

of address

Amended

report

Nameof Organization

P.O. Box 2325

Corporate

or Organization

No.

Address(NumberandStreet)

Carmel, CA 93921

Federal Employer

Cityor Town

D-0244720

23-7227328

ID No.

State ZIP Code

PART A - ACTIVITIES

Yes

No

IXI

..

During your most recent full accounting

For your most recent full accounting

Gross receipts

Note:

period

REGARDING

1/01/02

(beginning

230,681.

PART B - STATEMENTS

or total assets equal $100,000

If the answer is rs,6'0u

are required b~ Title 11 of the California Code of Regulations,

the amount of $ 5.0 to this report. Ma e check payable to Department of Justice.

Note:

2

period did your gross receipts

Total assets

ORGANIZATION

ending

311 and 312, to attach a check in

Estimated

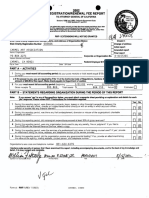

DURING THE PERIOD OF THIS REPORT

I!f you answer 'yes' to any of the westions

below,lo0u must attach a separate

I'yes' response. Please review RR -1 Instructions

or information

required.

sheet providing

an explanation

and details

for each

Yes

During this reporting period, were there any contracts, loans, leases or other financial transactions

between the

organization and any officer, director or trustee thereof either directly or with an entity in which any such officer,

director or trustee had any financial interest?

During this reporting

property or funds?

period, was there any theft embezzlement,

During this reporting

period,

During this reporting period, were any organization funds used to pay any penalty,

Form 4720 with the Internal Revenue Service, attach a copy.

During this reporting period, were the services of a professional fund-raiser or fund-raising

an attachment listing the name, address, and telephone number of the service provider.

During this re~orting period, did the organization

receive any Jovernmental

funding?

the name of t e agency, mailing address, contact person, an telephone number.

During this reporting period, did the organization

hold a raffle for charitable

indicating the number of raffles and the date(s) they occurred.

did non program

expenditures

diversion

or misuse of the organization's

area code and telephone

Organization's

e-mail address

I declare

under penalty

ls 'me,

of perjury

number

fine or judgment?

purposes?

If you filed a

counsel

If so, provide

an attachment

If 'yes,' provide

ee., ~..R'

Form ct - RRF-1 (REV 12/2002)

listing

an attachment

'

whether

the program

!Xl

!Xl

Ixl

n

n

n

n

used? If 'yes,' provide

is

that I have examined

this report,

110LLv Sk,ck

including

accompanying

Mln{/t&;/JG

Title

PrintedName'

CARA9801

L 01106/03

documents,

and to the best of my knowledge

.lJ;Rbc-/bL

sb /1L3

Datr

No

n

n

831-626-1681

CO'jd and c:mPlete,

Signatureof authorize!officer

charitable

exceed at least 50% of gross revenues?

Does the organization conduct a vehicle donation program? If 'yes,' provide an attachment indicating

operated by the charity or whether the organization contracts with a commercial fund-raiser.

Organization's

an~'

Sections

12/31/02) list:

43,470. ActuallRl

or more?

!Xl

!Xl

!Xl

!Xl

!Xl

~l~n.\t

1'I\""'''J''!l:1 .10 t..t~~\'Ill

S,F'.l~~.;CJA~.uO~'V

..

You might also like

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonNo ratings yet

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonNo ratings yet

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonNo ratings yet

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonNo ratings yet

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonNo ratings yet

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonNo ratings yet

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonNo ratings yet

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNo ratings yet

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonNo ratings yet

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNo ratings yet

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonNo ratings yet

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonNo ratings yet

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonNo ratings yet

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonNo ratings yet

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonNo ratings yet

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonNo ratings yet

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonNo ratings yet

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonNo ratings yet

- Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageAnnual Registration Renewal Fee Report To Attorney General of CaliforniaagbufzbfNo ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNo ratings yet

- FTG RRF 2013Document1 pageFTG RRF 2013L. A. PatersonNo ratings yet

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonNo ratings yet

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonNo ratings yet

- FTG RRF 2000Document1 pageFTG RRF 2000L. A. PatersonNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- Oakland Community Land Trust - Founding Documents 1999Document75 pagesOakland Community Land Trust - Founding Documents 1999auweia1No ratings yet

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNo ratings yet

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationNo ratings yet

- f13909 (Completed) PDFDocument2 pagesf13909 (Completed) PDFAnonymous HCUEwQNG5100% (2)

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfNo ratings yet

- Filled 139092Document2 pagesFilled 139092doomcomplexNo ratings yet

- Form CRI 200 Short Form Registration Verification Statement PDFDocument5 pagesForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyNo ratings yet

- CWCS AG RegistrationDocument2 pagesCWCS AG RegistrationWilliamsburg GreenpointNo ratings yet

- Ir524 PDFDocument2 pagesIr524 PDFTiffany Morris0% (1)

- IRS Form 13909Document2 pagesIRS Form 13909whoiscolleenlynnNo ratings yet

- Electronic Funds Transfer (Eft) Authorization Agreement: Page 1 of 3Document3 pagesElectronic Funds Transfer (Eft) Authorization Agreement: Page 1 of 3JayNo ratings yet

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachNo ratings yet

- SPR 23637 N 7204Document10 pagesSPR 23637 N 7204Balaramkishore GangireddyNo ratings yet

- TCF-ICEE Credit Application 11 081Document1 pageTCF-ICEE Credit Application 11 081jasonparker80No ratings yet

- How To Dispute Credit Report Errors: October 2011Document6 pagesHow To Dispute Credit Report Errors: October 2011hello98023No ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1No ratings yet

- The New IRS Form 3949 A Revised in March 2014Document3 pagesThe New IRS Form 3949 A Revised in March 2014Freeman Lawyer100% (1)

- BOCS Application For Charitable ContributionsDocument1 pageBOCS Application For Charitable ContributionsmabradleyartNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (5)

- FW 10Document1 pageFW 10Florence Smith SlusarskiNo ratings yet

- PA Notary Application and InstructionsDocument2 pagesPA Notary Application and InstructionsThe Pennsylvania NotaryNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- Minutes Mprwa September 27, 2018Document2 pagesMinutes Mprwa September 27, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Special Meeting Minutes October 1, 2018 11-05-18Document1 pageSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument30 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument7 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 10-25-18Document6 pagesMPRWA Agenda Packet 10-25-18L. A. PatersonNo ratings yet

- MPRWA Agenda Closed Session 10-25-18Document1 pageMPRWA Agenda Closed Session 10-25-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Monthly Reports August 10-02-18Document48 pagesMonthly Reports August 10-02-18L. A. PatersonNo ratings yet

- City Council Agenda 10-02-18Document3 pagesCity Council Agenda 10-02-18L. A. PatersonNo ratings yet

- Print For ZopfanDocument31 pagesPrint For Zopfannorlina90100% (1)

- Posting and Preparation of Trial Balance 1Document33 pagesPosting and Preparation of Trial Balance 1iTs jEnInONo ratings yet

- Baltik Remedial Law ReviewerDocument115 pagesBaltik Remedial Law ReviewerrandellgabrielNo ratings yet

- (Azizi Ali) Lesson Learnt From Tun Daim E-BookDocument26 pages(Azizi Ali) Lesson Learnt From Tun Daim E-BookgabanheroNo ratings yet

- Hernandez Vs Go - A.C. No. 1526Document4 pagesHernandez Vs Go - A.C. No. 1526Kevin GalegerNo ratings yet

- Activity 2:: Date Account Titles and Explanation P.R. Debit CreditDocument2 pagesActivity 2:: Date Account Titles and Explanation P.R. Debit Creditemem resuentoNo ratings yet

- الضرائب المؤجلة بين قواعد النظام المحاسبي المالي والنظام الجبائي في الجزائر -دراسة حالة مؤسسةenpc سطيفDocument21 pagesالضرائب المؤجلة بين قواعد النظام المحاسبي المالي والنظام الجبائي في الجزائر -دراسة حالة مؤسسةenpc سطيفali lakridNo ratings yet

- 4.31 T.Y.B.Com BM-IV PDFDocument7 pages4.31 T.Y.B.Com BM-IV PDFBhagyalaxmi Raviraj naiduNo ratings yet

- Rights of An Arrested PersonDocument4 pagesRights of An Arrested PersonSurya Pratap SinghNo ratings yet

- Fido Client To Authenticator Protocol v2.1 RD 20191217Document133 pagesFido Client To Authenticator Protocol v2.1 RD 20191217euophoria7No ratings yet

- Sop EnglishDocument42 pagesSop Englishapi-236690310No ratings yet

- God Sees The Truth But Waits Leo Tolstoy AnalysisDocument3 pagesGod Sees The Truth But Waits Leo Tolstoy AnalysisKeithNo ratings yet

- California Code of Civil Procedure Section 170.4 Striking 170.3Document1 pageCalifornia Code of Civil Procedure Section 170.4 Striking 170.3JudgebustersNo ratings yet

- Work Allocation - Department of Financial Services - Ministry of Finance - Government of IndiaDocument3 pagesWork Allocation - Department of Financial Services - Ministry of Finance - Government of IndiaTushar ShrivastavNo ratings yet

- HRM CaseDocument4 pagesHRM Caseujhbghjugvbju0% (1)

- Passing Off Action Under Trade Mark LawDocument15 pagesPassing Off Action Under Trade Mark LawPappu KumarNo ratings yet

- 04 Dam Safety FofDocument67 pages04 Dam Safety FofBoldie LutwigNo ratings yet

- Macroeconomics Adel LauretoDocument66 pagesMacroeconomics Adel Lauretomercy5sacrizNo ratings yet

- Legal Ethics Part 2Document66 pagesLegal Ethics Part 2OnieNo ratings yet

- QNNPJG lSUK0kSccrTSStqeIPoUAJF27yLdQCcaJFO0Document1 pageQNNPJG lSUK0kSccrTSStqeIPoUAJF27yLdQCcaJFO0Viktoria PrikhodkoNo ratings yet

- 147-Tangga-An v. Philippine Transmarine Carriers, Inc., Et Al. G.R. No. 180636 March 13, 2013Document8 pages147-Tangga-An v. Philippine Transmarine Carriers, Inc., Et Al. G.R. No. 180636 March 13, 2013Jopan SJNo ratings yet

- People Vs ParanaDocument2 pagesPeople Vs ParanaAnonymous fL9dwyfekNo ratings yet

- National Seminar A ReportDocument45 pagesNational Seminar A ReportSudhir Kumar SinghNo ratings yet

- CG Covid Risk Assessment - Hirers - Nov 2021Document8 pagesCG Covid Risk Assessment - Hirers - Nov 2021hibaNo ratings yet

- Dell EMC Partner Training GuideDocument23 pagesDell EMC Partner Training GuideDuško PetrovićNo ratings yet

- Classical Liberalism, Neoliberalism and Ordoliberalism-Elzbieta MaczynskaDocument23 pagesClassical Liberalism, Neoliberalism and Ordoliberalism-Elzbieta MaczynskaSávio Coelho100% (1)

- Reducing Samples of Aggregate To Testing Size: Standard Practice ForDocument5 pagesReducing Samples of Aggregate To Testing Size: Standard Practice FormickyfelixNo ratings yet

- PreviewDocument9 pagesPreviewVignesh LNo ratings yet

- DRAC Combined 07.04.2023Document39 pagesDRAC Combined 07.04.2023Ankit DalalNo ratings yet

- Icici Declaration - Itm (Online Training)Document2 pagesIcici Declaration - Itm (Online Training)Vivek HubanurNo ratings yet