Professional Documents

Culture Documents

FTG RRF 2003

Uploaded by

L. A. PatersonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG RRF 2003

Uploaded by

L. A. PatersonCopyright:

Available Formats

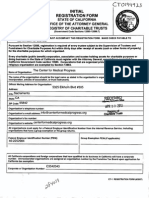

I

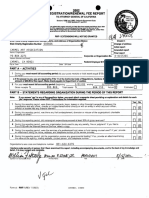

.ISTRATION/RENEWAL FEERE~

cs

MAIL TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

TO ATIORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code

11 Cal. Code Regs. Sections 311 and 312

Failure to submit this report annually no later than four months and fifteen days after

the end of the crqanlzation'a accountina period may result in the loss of tax

exemption and the assessment of a mlnlmum tax of $800, plus interest, andlor fines

or filing penalties as defined in Government Code Section 12586.1.

WEBSITE ADDRESS:

http://ag.ca.gov/charities/

IRS FORM 990 EXTENSIONS WILL BE HONORED

Enter State Charity Registration Number, Name, and Address of Organization:

Check if:

State Charity Registration Number 36499

nChange

of address

D Amended

Forest Theatre Guild, Inc.

report

Name of Organization

--I Corporate or Organization No. ..:D:..-..,;O:,:2::..4.::..4.::..7.:.,;2;;;,O:::..-t

r::P-:'.':-'O:....:..,.. ::-:B::..o":'x:.:..-2=-3;;;,2;;;,5,.,.Address (Number and Street)

r;:C:,::a:..::r-::;m;.:::e.::.l,!,.'

_C:::..:A:..:........:9:....:3:....:9:...:2;.=l:City or Town

':.":"'"7'--::=-:-State

-r Federal

Employer 10 No. ...:2:..::3:..,.-....:.7-=2.;;;,2..;,.7,::..32;;;.,.8.:...--t

ZIP Code

PART A -ACTIVITIES

Note:

2

Yes

If the answer is yes, you are required by Title 11 of the California Code of Regulations, Sections 311 and 312, to attach a check in

the amount of $25.00 to this report. Make check payable to Department of Justice.

For your most recent full accounting period (beginning

1/01/03

Gross receipts $

236, 271 .

Total assets $

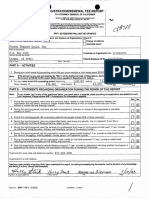

PART B - STATEMENTS

Note:

No

REGARDING ORGANIZATION

ending

12,1.31/03)

25, 000

Actual

list:

Estimated

IRl

DURING THE PERIOD OF THIS REPORT

If you answer 'yes' to any of the questions below, you must attach a separate sheet providing an explanation and details for each

'yes' response. Please review RRF-1 instructions for information required.

During this reporting period, were there any contracts, loans, leases or other financial transactions between the

organization and any officer, director or trustee thereof either directly or with an entity in which any such officer,

director or trustee had an financial interest?

2

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable

ro ert or funds?

.3

During this re

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you filed a

Form 4720 with the Internal Revenue Service, attach a co .

During this reporting period, were the services of a professional fund-raiser or fund-raising counsel used? If 'yes,' provide

an attachment listing the name, address, and tele hone number of the service rovider.

During this reporting period, did the organization receive any governmental funding? If so, provide an attachment listing

the name of the agenc , mailing address, contact erson, and tele hone number.

During this reporting period, did the organization hold a raffle for charitable purposes? If 'yes,' provide an attachment

indicatin the number of raffles and the date s the occurred.

Does the organization conduct a vehicle donation program? If 'yes,' provide an attachment indicating whether the program is

o erated b the charit or whether the organization contracts with a commercial fund-raiser.

Yes

No

O~aniz~ion'sareacodeand~lephonenumber~8~3~1_-~6~2~6::..-~1~~68~1~~~~~~~~~~~~~~~~~~~~~~~~~~

Organization's e-mail address

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge

and belief, it is rue, correct nd complete.

CAVA9801L 01115/04

RRF-l (1/04)

'1',\

I,

,,1 ,'

.;'

-j

"

. ,-;:

:'~

I"

,,',.

,.

"

, : , ..... J:

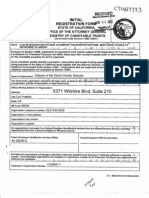

RECEIVED

MAY

17,2004

Attorney Genet'a]"

Registry of Charitabl" ,..

I'

~,

You might also like

- Oakland Community Land Trust - Founding Documents 1999Document75 pagesOakland Community Land Trust - Founding Documents 1999auweia1No ratings yet

- Fco Rail Scrap 08 - 04Document11 pagesFco Rail Scrap 08 - 04Raghavendra100% (1)

- Andrew Morin and Adelaide Grandbois (Family Reunion Works)Document87 pagesAndrew Morin and Adelaide Grandbois (Family Reunion Works)Morin Family Reunions History100% (3)

- Safety Data Sheet: According To Regulation (EC) No. 1907/2006 (REACH)Document7 pagesSafety Data Sheet: According To Regulation (EC) No. 1907/2006 (REACH)alinus4yNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonNo ratings yet

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonNo ratings yet

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNo ratings yet

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonNo ratings yet

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonNo ratings yet

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonNo ratings yet

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonNo ratings yet

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonNo ratings yet

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonNo ratings yet

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonNo ratings yet

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonNo ratings yet

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNo ratings yet

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonNo ratings yet

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonNo ratings yet

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonNo ratings yet

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonNo ratings yet

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonNo ratings yet

- Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageAnnual Registration Renewal Fee Report To Attorney General of CaliforniaagbufzbfNo ratings yet

- FTG RRF 2013Document1 pageFTG RRF 2013L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonNo ratings yet

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNo ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonNo ratings yet

- FTG RRF 2000Document1 pageFTG RRF 2000L. A. PatersonNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfNo ratings yet

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachNo ratings yet

- Form CRI 200 Short Form Registration Verification Statement PDFDocument5 pagesForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyNo ratings yet

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNo ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- Ag990 AnnualreportDocument2 pagesAg990 AnnualreportDaniel_Johnson_1322No ratings yet

- Filled 139092Document2 pagesFilled 139092doomcomplexNo ratings yet

- IRS Form 13909Document2 pagesIRS Form 13909whoiscolleenlynnNo ratings yet

- f13909 (Completed) PDFDocument2 pagesf13909 (Completed) PDFAnonymous HCUEwQNG5100% (2)

- CWCS AG RegistrationDocument2 pagesCWCS AG RegistrationWilliamsburg GreenpointNo ratings yet

- SPR 23637 N 7204Document10 pagesSPR 23637 N 7204Balaramkishore GangireddyNo ratings yet

- BUSLIC Business Licence FormDocument10 pagesBUSLIC Business Licence Formcrew242No ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1No ratings yet

- Jul 01 IRS Complaint Form - 13909 (1) Re Media MattersDocument2 pagesJul 01 IRS Complaint Form - 13909 (1) Re Media MattersERICofFLNo ratings yet

- The New IRS Form 3949 A Revised in March 2014Document3 pagesThe New IRS Form 3949 A Revised in March 2014Freeman Lawyer100% (1)

- TCF-ICEE Credit Application 11 081Document1 pageTCF-ICEE Credit Application 11 081jasonparker80No ratings yet

- CDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Document27 pagesCDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Peter M. HeimlichNo ratings yet

- Charitable Obligations of The WalrusDocument47 pagesCharitable Obligations of The WalrusCANADALANDNo ratings yet

- PHN SAMPLE AppDocument3 pagesPHN SAMPLE AppRosemaryCastroNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Special Meeting Minutes October 1, 2018 11-05-18Document1 pageSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 10-25-18Document6 pagesMPRWA Agenda Packet 10-25-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument30 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument7 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Monthly Reports August 10-02-18Document48 pagesMonthly Reports August 10-02-18L. A. PatersonNo ratings yet

- City Council Agenda 10-02-18Document3 pagesCity Council Agenda 10-02-18L. A. PatersonNo ratings yet

- MPRWA Agenda Closed Session 10-25-18Document1 pageMPRWA Agenda Closed Session 10-25-18L. A. PatersonNo ratings yet

- Minutes Mprwa September 27, 2018Document2 pagesMinutes Mprwa September 27, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- 2015 LGA Citizens CharterDocument64 pages2015 LGA Citizens CharterErnan BaldomeroNo ratings yet

- COMPETENCIES-MODULES g4Document7 pagesCOMPETENCIES-MODULES g4Sassa IndominationNo ratings yet

- Chemical Bonding & Molecular Structure QuestionsDocument5 pagesChemical Bonding & Molecular Structure QuestionssingamroopaNo ratings yet

- Tiktoksellercenter Batchedit 20231224 All Information TemplateDocument25 pagesTiktoksellercenter Batchedit 20231224 All Information Templatedmonkey.mercariNo ratings yet

- Karnataka Act No. 26 of 2020 The Karnataka Epidemic Diseases Act, 2020Document9 pagesKarnataka Act No. 26 of 2020 The Karnataka Epidemic Diseases Act, 2020Rajendra PNo ratings yet

- 10000018182Document665 pages10000018182Chapter 11 DocketsNo ratings yet

- MudarabaDocument18 pagesMudarabaMuhammad Siddique BokhariNo ratings yet

- Spouses Luigi M. Guanio and Anna Hernandez-Guanio vs. Makati Shangri-La Hotel and Resort, Inc. G.R. No. 190601Document5 pagesSpouses Luigi M. Guanio and Anna Hernandez-Guanio vs. Makati Shangri-La Hotel and Resort, Inc. G.R. No. 190601robdeqNo ratings yet

- Think Equity Think QGLP 2018 - Applicaton FormDocument18 pagesThink Equity Think QGLP 2018 - Applicaton FormSHIVAM CHUGHNo ratings yet

- Article 19.1 DSU CommentaryDocument17 pagesArticle 19.1 DSU CommentaryAkshat KothariNo ratings yet

- MD Sirajul Haque Vs The State and OrsDocument7 pagesMD Sirajul Haque Vs The State and OrsA.B.M. Imdadul Haque KhanNo ratings yet

- DiffusionDocument15 pagesDiffusionRochie DiezNo ratings yet

- Labor BreakfastDocument1 pageLabor BreakfastSunlight FoundationNo ratings yet

- Beloved Community Village 3.0Document12 pagesBeloved Community Village 3.0Michael_Lee_RobertsNo ratings yet

- Pangil, LagunaDocument2 pagesPangil, LagunaSunStar Philippine NewsNo ratings yet

- CORPO Case Doctrines Lex TalionisDocument20 pagesCORPO Case Doctrines Lex TalionisJustin YañezNo ratings yet

- Ancient JerusalemDocument201 pagesAncient JerusalemCristian PetrescuNo ratings yet

- Tutorial 3Document2 pagesTutorial 3YiKai TanNo ratings yet

- Nietzsche and The Origins of ChristianityDocument20 pagesNietzsche and The Origins of ChristianityElianMNo ratings yet

- Roy Colby - A Communese-English DictionaryDocument156 pagesRoy Colby - A Communese-English DictionaryTim Brown100% (1)

- TpaDocument11 pagesTpaVijay SinghNo ratings yet

- UC Express 3.0 Softphone GuideDocument4 pagesUC Express 3.0 Softphone Guideb1naryb0yNo ratings yet

- Sane Retail Private Limited,: Grand TotalDocument1 pageSane Retail Private Limited,: Grand TotalBhaskarNo ratings yet

- JWB Thesis 05 04 2006Document70 pagesJWB Thesis 05 04 2006Street Vendor ProjectNo ratings yet

- Tort Part 1Document92 pagesTort Part 1matthew WilliamsNo ratings yet

- Petition To Determine HeirshipDocument4 pagesPetition To Determine Heirshipjnylaw20020% (1)

- 17025-2017..1Document109 pages17025-2017..1حسام رسمي100% (2)