Professional Documents

Culture Documents

FTG Irs Form 990-Ez 2009

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG Irs Form 990-Ez 2009

Uploaded by

L. A. PatersonCopyright:

Available Formats

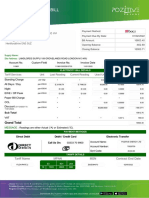

Form

Short Form

Return of Organization Exempt From Income Tax

990-EZ

Department of the Treasury

Internal Revenue Service

Under section 501(c), 527, or4947(aX1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

2009

Sponsoring organizations of donor advised funds and controlling organizations as defined in section 512(b)(13) must file Form

990. All other organizations with gross receipts less than $500,000 and total assets less than $1,250,000 at the end of the year

may use this form.

The organization may have to use a copy of this return to satisfy state reporting

requirements.

Open to Public

Inspection

For the 2009 calendar fear, or tax year beginning

Check if applicable:

Address change

Name change

Initial return

Termination

Amended return

OtvlB No. 1545-1150

D

Please

use IRS

label or

print or

type.

See

Specific

Instructions.

Attorney GeneraTs Office

Forest Theatre Guild, I n c .

P.O. Box 2325

Carmel, CA 93921

Employer Identification number

23-7227328

Telephone number

my

1 9

831-626-1681

Group Exemption

Ragistryt

^

Number.

ChariteWftTflJWtff

G Accounting method: x | Cash n

Section 501 (cX3) organizations and4947(a)(1) nonexempt charitable trusts

must attach a completed Schedule A (Form 990 or 990-EZ),

Other (specify)

Application pending

*

Accrual

Check " I I if the organization is not

required to attach Schedule B (Form 990,

990-EZ, or 990-PF).

Website:

J

K

Tax-exempt status (check only one) - |X| 501(c) ( 3 )

(insert no.) | |4947(a)(nor I I 527

Check

M if the organization is not a section 509(a)(3) supporting organization and its gross receipts are normally not more than

$25,000.

), A l ^ r m 990-EZ or Form 990 return is not required, but if the organization chooses to file a return, be sure to file a complete return.

Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts; if $500,000 or more, file Form 990

instead of Form 990-EZ

:

www. foresttheaterguild. org

86,829.

Baltllfiil Revenue, Expenses, and Changes in Net Assets or Fund Balances (See the instructions for Part I.)

1

2

Contributions, gifts, grants, and similar amounts received..

Program service revenue including government fees and contracts.

Membership dues and assessments

4 Investment income

5 a Gross amount from sale of assets other than inventory

64,437.

22,392.

5a

b Less: cost or other basis and sales expenses

5b

c Gain or (loss) from sale of assets other than inventory (Subtract In 5b from In 5a)

6

Special events and activities (complete applicable parts of Schedule G). If any amount is from gaming, check here,

a Gross revenue (not including $

of contributions

reported on line 1)

6a

b Less: direct expenses other than fundraising expenses

6b

c Net income or (loss) from special events and activities (Subtract line 6b from line 6a)

7 a Gross sales of inventory, less returns and allowances

7a

b Less: cost of goods sold

7b

c Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a).

8

9

7c

Other revenue (describe

86,829.

Total revenue. Add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8

10

11

Grants and similar amounts paid (attach schedule)

Benefits paid to or for members

J L

vi_

12

Salaries, other compensation, and employee benefits

T2_

13

Professional fees and other payments to independent contractors.

14

15

Occupancy, rent, utilities, and maintenance

Printing, publications, postage, and shipping

16

Other expenses (describe

17

Total expenses. Add lines 10 through 16.

i i .

17

18

Excess or (deficit) for the year (Subtract line 17 from line 9)

18

72,151.

86,707.

122,

19

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with end-of-year

figure reported on prior year's return)

19

20

Other changes in net assets or fund balances (attach explanation)

15,622.

21

15,744.

21

Ji14

Jli.

See Statement 1

Net assets or fund balances at end of year. Combine lines 18 through 20.

iPItt^lliijil Balance Sheets,

14,556.

if Total assets on line 25, column (B) are $1,250,000 or more, file Form 990 instead of Form 990-EZ.

15,622.

22

Cash, savings, and investments

23

24

Land and buildings

Other assets (describe

25

Total assets

26

27

Totalliabilities (describe

)

Net assets or fund balances (line 27 of column (B) must agree with line 21)

22

15,744.

23

)

BAA For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

TEEA0803L

01/30/10

24

15,622.

0.

15,622.

25

26

27

15,744.

0.

15,744.

Form 990-EZ (2009)

r ^ r ./ ^ V/

jiirtllirai statement of Program Service Accomplishments (See the instructions.)

I WMV' *-

Expenses

(Reguired for section

501(c)(3) and (4)

organizations and section

4947(a)(1) trusts; optional

for others.)

What is the organization's primary exempt purpose? communitv educational service

Describe what was achieved in carrying out the organization's exempt purposes. In a clear and concise manner,

describe the services provided, the number of persons benefited, or other relevant information for each

program title.

28 See Statement 2

(Grants $

) If this amount includes foreign grants, check here

(Grants $

) If this amount includes foreign grants, check here

29 a

(Grants $

) If this amount includes foreign grants, check here

Other program services (attach schedule )

(Grants $

.

,

) If.th is amount includes foreign grants, check here

l 3 2 ; Total program'setvice expense^^^

.

r.;..

.

f"

30 a

28 a

29

30

31

^

"

31a

32

iiattt^iyjll List of Officers, Directors Trustees, and Key Em p l o y e e s .

.' Viia) Name>nd.a'ddressf

J,

List each one even if not compensated. (See.the; instrs.)

(b) Title and .average; hours . (c) Compensation (If .: (d) Contributionsito'' ; (e),Expense account

,., per w/eek devoted > "

not,paid,.enter-0-.) employee benefit plans and and other allowances

to position

deferred compensation.

Rebecca Barrymore

Secretary

P.O. Box 2325 '

0

Camel, CA 93921

Safwat. Ma-lek

^ . Vice, President

P.O. Box 1734

0

Pebble Beach, CA 93953

_Bri^^_G^ssi

Treasurer

_3012, Cormorant Road

'

Pebble Beach, CA 93953

Crystal Horn

Director

C/0 FTG @ P.O. Box 2325

0

Carmel, CA 93921

"

Jlamish_'ryler_ - _ _ _ _ _ _ _ _ _ _ :

Executive Prod

25 Sandpiper Road

Seas'idfev^CA'93955'- ^Keith Decker '

'Director

C/0 FTG @ P.O. Box 2325

o

Carmel, CA 93921

DeJ^y _

Executive Direc

_360 .Spen^eer^ #6

[

0

Monterey, CA 93940

Barbara'Mossberq_

: President

P.O. Box 97

0

CArmel, CA 93921

Joanna Tubman

Trustee

P.O. Box 7342

0

Carmel, CA 93921

BAA

TEEA0812L

0W30/10

0.

.

0.

0.

0.

0.

0.

0.

0.

0.

0.

3,000.

0.

0.

..0.

0..

11,556.

0.

0'.

0.

0.

0.

0.

0.

Form 990-EZ (2009)

Form 990-EZ (2009)

Forest Theatre Guild, Inc.

23-7227328

llRa'rtl^MI Other Information (Note the statement requirements in the instrs for Part V.)

Page 3

See Statement^

Yes

33

Did the organization engage In any activity not previously reported to the IRS? If 'Yes,' attach a detailed description of

each activity

33

34

Were any changes made to the organizing or governing documents? If 'Yes,' attach a conformed copy of the changes ..

34

35

If the organization had income from business activities, such as those reported on lines 2,6a, and 7a (among others), but not reported on Form 990-T,

attach a statement explaining why the organization did not report the income on Form 990-T.

a Did the organization have unrelated business gross income of $1,000 or more or was it subject to section 6033(e) notice

reporting, and proxy tax requirements?

35a

b If 'Yes,' has it filed a tax return on Form 990-T for this year?

35 b

36

Did the oraanlzatlon undergo a liquidation, dissolution, termination, or significant disposition of net assets during the

year? If 'Yes,' complete applicable parts of Schedule N

37a Enter amount of political expenditures, direct or indirect, as described in the instructions,

X

X

36

0.

37 a

No

b Did the organization file Form 1120-POL for this year?

37 b

38a Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were

38 a

b If 'Yes,' complete Schedule L, Part II and enter the total

amount involved

39

38 b

N/A

39 a

N/A

N/A

Section 501(c)(7) organizations. Enter:

a Initiation fees and capital contributions included on line 9

b Gross receipts, included on line 9, for public use of club facilities

39 b

40a Section 501(c)(3) organizations. Enter amount of tax Imposed on the organization during the year under:

section 4911

0 . ; section 4912

0 . ; section 4955

0.

b Section 501 (c)(3) and 501 (c)(4) organizations. Did the organization engage In any section 4958 excess benefit

transaction during the year or is it aware that it engaged in an excess benefit transaction with a disqualified person in a

prior year, and that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ? If

' Y e s , c o m p l e t e Schedule L, Part I

.....:..,.,,

c Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax Imposed on organization

managers or disqualified persons during the year under sections 4912, 4955, and 4958.,

d Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax on line 40c reimbursed

by the organization . . . ; .

40 b

0.

0.

e All organizations. At^ahy time during the tax year, was the organization a piarty to a prohibited tax

shelter transaction? If 'Yes,' complete Form 8886-T

41

List the states with which a copy of this return is filed

42 a The organization's

books are In care of

Located at

0

40 e

None

Safwat Malek

Box 2 3 2_5^ _Carme_l_^ _CA

Telephone no.

ZIP-I-4 -

J31-_626-_1681_

9 3 9 2 1

b At any time during the calendar year, did the organization have an Interest in or a signature or other authority over a

financial account in a foreign country (such as a bank account, securities account, or other financial account)?

Yes

If 'Yes,' enter the name of the foreign country:.!

See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of a Foreign Bank and Financial Accounts.

c At any time during the calendar year, did the organization maintain an office outside of the U.S.?

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 - Check here

and enter the amount of tax-exempt interest received or accrued during the tax year

^ Q

>-| 43

Did the organization maintain any donor advised funds? If 'Yes,' Form 990 must be completed instead

of Form 990-EZ.

45

Is any related organization a controlled entity of the organization within the meaning of section 512(b)(13)? If 'Yes '

Form 990 must be completed Instead of Form 990-EZ

\

BAA

TEEA0812L

01/30/10

N/A

N/A

Yes

44

' -J

42c

If 'Yes,' enter the name of the foreign country:..

43

No

42 b

No

44

45

Form 990-EZ (2009)

Form 990-EZ (2009) Forest Theatre G u i l d ,

Inc.

23-7227328

Page 4

Section 501(c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts only. All section

501(c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts must answer questions

46-49b and complete the tables for lines 50 and 51.

46

Yes

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates

for public office? If 'Yes,' complete Schedule C, Part I

46

47

Did the organization engage in lobbying activities? If 'Yes,' complete Schedule C, Part II

47

48

Is the organization a school as described in section 170(b)(l)(A)(ii)? If 'Yes,' complete Schedule E

48

49a Did the organization make any transfers to an exempt non-charitable related organization?

X

X

X

49 a

49 b

b If 'Yes,' v/as the related organization a section 527 organization?

50

No

Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key

(b) Title and average

hours per week

devoted to position

(a) Name and address of each employee paid

more than $100,000

(c) Compensation

(d) Contributions to employee

benefit plans and

deferred compensation

(e) Expense

account and

other allowances

None

-

vi.ii'-Ti

^

.."i"

~ ~ ~

;.

'-A- .Vi'O

f Total number of other employees paid over $100,000 .

51

Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000 of

compensation from the organization. If there is none, enter 'None.'

(a) Name and address of each independent contractor paid nnore than $100,000

(b) Type of service

(c) Compensation

None

d Total number of other independent contractors each receiving over $100,000.

Under penalties of perjury, 1 declare that 1 have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature of officer

Date

Type or print name and title.

Paid

Preparer's

Use

Only

Preparer's

signature

F i r m s name (or

empioyedV

zip + 4'

Date

11/14/10

J. Daniel Clarke

280 Reeside Ave.

Monterey, CA 93940

Check if

self.

employed

EIN

Phone no.

May the IRS discuss this return v\/ith the preparer shown above? See instructions . . .

BAA

TEEA0812L

01/30/10

Preparer's Identifying Number

(See instructionsj

X N/A

N/A

(831) 375-6230

.. X Yes 1 1

No

Form 990-EZ (2009)

OIVIB No. 1545-0047

SCHEDULE A

(Form 990 or 990-EZ)

2009

Public Charity Status and Public Support

Complete if the organization is a section 501 (cX3) organization or a section 4947(aX1)

nonexempt charitable trust.

Department of the Treasury

Internal Revenue Service

Open,to Public

inspection

- Attach to Form 990 or Form 990-EZ. See separate instructions.

Name of tfie organization

Employer identification number

Forest Theatre Guild, Inc.

23-7227328

iBSaili Reason for Public Charity Status (All orqanizations must complete this part.) See instructions

The organization is not a private foundation because it is: (For lines 1 through 11, check only one box.)

1

A church, convention of churches or association of churches described in section 170(bX1XAXi)-

A school described in section 170(bX1XAXii)- (Attach Schedule E.)

A hospital or cooperative hospital service organization described in section 170(bX1XAX'ii)-

[ J A medical research organization operated in conjunction with a hospital described in section 170(bX1XAXiii)- Enter the hospital's

name, city, and state:

I An organization operated for the benefit of a college or university owned or operated by a governm^tal'uSt"desaibedTn~sec7ion

I'170(bX1XAXiv). (Complete Part II.)

6

7

8

_

^

U

A federal, state, or local government or governmental unit described in section 170(bX1XAXv).

An organization that normally receives a substantial part of its support from a governmental unit or from the general public described

in section 170(bX1XAXvi). (Complete Part 11.)

A community trust described in section 170(b)OXAXvi). (Complete Part II.)

>'9,

An,organization that normally receives: (1) more than 33-1/3 % of its support from contributions, membership fees, and gross receipts

from activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33-1/3 % of its support from gross

investment income and unrelated business taxable income (less section 511 tax) frorti businesses acquired by the organization after

June 30, 1975. See section 509(aX2). (Complete Part III.)

m

y

y

10

An organization organized and operated exclusively to test for public safety. See section 509(aX4).

11

An organization organized and operated exclusively for the benefit of, to perform the functions of, or carry out the purposes of one or

more

supported organizations described in section 509(a)(1) or section 509(a)(2). See section 509(aX3). Check the box that

descril s the type of supporting organization and complete lines l i e through l l h .

a _

Q T y- p e l '

'

b Q l y -

pell =

c J Type III - Functionally integrated

d | _ | Type I I I - O t h e r

' e Q ] By checking this box, I certify that the oi-ganization is not controlled directly or indirectly by one or more disqualified persons other

than foundation managers and other than one or more publicly supported organizations described in section 509(a)(1) or section

509(a)(2).

If the organization received a written determination from the IRS that is a Type I, Type

check this box

.;

or Type I I I supporting organization.

Since August 17, 2006, has the organization accepted any gift or contribution from any of the following persons?

(i)

a person who directly or indirectly controls, either alone or together with persons described in (ii) and (iii)

below, the governing body of the supported organization?

(ii)

a family member of a person described in (i) above?,

(ii) EIN

(ill) Type of organization

(described on lines 1 -9

above or IRC section '

(see Instructions))

(Iv) Is the

(V) Did you notify

(vl) Is the

organization in col. the organization in organization in col.

(I) listed in your

col. (i) of

(1) organized in the

governing

your support?

U.S.?

document?

Yes

Total

No

ng(i)

llg(ii)

11 g (iii)

(iii), .a .35% controlled,entity,o,f,a .person described in (i) or (ii) above?

:.(l) Name of Supported

. Organization ,

Yes

No

Yes

No

Yes

(vll) Amount of Support

No

BAA For Privacy Act and Papenvork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ.

TEEA0401L

02/05/10

Schedule A (Form'990 or 990-EZ) 2009

Schedule A (Form 990 or 990-EZ) 2009 Forest Theatre Guild, Inc

23-7227328

IBIrtllil Support Schedule for Organizations Described in Sections 170(b)(1)(Ayiv) and 170(b)(1)(Ayvn

Page 2

(Complete only if you checked the box on line 5, 7, or 8 of Part I.)

Section A. Public Support

Calendar year (or fiscal year

beginning in)

1

Gifts, grants, contributions and

membership fees received. (Do

not include 'unusual grants.')..

Tax revenues levied for the

oraanization's benefit and

either paid to it or expended

on its behalf

The value of services or

facilities furnished to the

organization by a governmental

unit without charge. Do not

include the value of services or

facilities generally furnished to

the public without charge

Total. Add lines 1 -through 3 . . .

The portion of total

contributions by, each person

(other than a governmental

unit or publicly supported

organization) included on line 1

that exceeds 2% of the amount

shown on line 11, column (f) ..

Public support. Subtract line 5

from line 4

1"

(a) 2005

(b) 2006

(c) 2007

(d) 2008

(e) 2009

(f) Total

(a) 2005

(b) 2006

(c) 2007

(d) 2008

(e) 2009

(f) Total

Section B. Total Support

Calendar year (or fiscal year

beginning In) 7

Amounts from line 4

8

-

Gross income from interest,

dividends, payments received

on securities loans, rents,

royalties and income form sirhilar sources . . . .

Net incorne from.unrelated

business activities, whether or

not the business is regularly

carried o n . . ;

10

Other income. Do not include

gain or loss from the sale of

capital assets (Explain in

Part I V . > . . . . . . .

11

Total support. Add lines 7

through 10

12

Gross receipts from related activities, etc. (see instructions)

13

First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501 (c)(3)

organization, check this box and stop here .

12

Section C. Computation of Public Support Percentage

14

Public support percentage for 2009 (line 6, column (f) divided by line 11, column (f).

14

15

Public support percentage from 2008 Schedule A, Part II, line 14

15

16a 33-1/3 support test - 2009. If the organization did not check the box on line 13, and'the line 14 is 33-1/3

and stop here. The organization qualifies as a publicly supported organization

%

%

1 or more, check this box

b 33-1/3 support test - 2008. if the organization did not check a box on line 13, or 16a, and line 15 is 33-1/3% or more, check this box

and stop here. The organization qualifies as a publicly supported organization

17a 10%-facts-and-circumstances test - 2009 If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10%

or more; and if the organization meets the 'facts-and-circumstances' test, check this box and stop here. Explain in Part IV how

the organization meets the 'facts-and-circumstances' test. The organization qualifies as a publicly supported organization

'

b 10%-facts-and-circunistances test - 2008. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 10%

or more, and if, the organization meets the 'facts-and-circumstances' test, check this box and stop here. Explain in Part IV how the

organization meets the 'facts-and-circumstances' test. The organization qualifies as a publicly supported organization..'

18

Private foundation. If the organization did not check a box on line, 13, 16a, 16b, 17a, or 17b, check this box and see instructions ..

BAA

Schedule A (Form 990 or 990-EZ) 2009

TEEA0402L

10/08/09

Schedule A (Form 990 or 990-EZ) 2009

mm

Forest Theatre

Guild,

23-7227328

Inc.

Support Schedule for Organizations Described in Section 509(aX2)

Page 3

(Complete only if you checked the box on line 9 of Part I.)

Section A. Public Support

Calendar year (or fiscal yr beginning in)>1 Gifts, grants, contributions and

membership fees received. (Do

not include 'unusual g r a n t s . ' ) . .

2 Gross receipts from

admissions, merchandise sold

or services performed, or

facilities furnished in a activity

that is related to the

organization's tax-exempt

purpose

3 Gross receipts from activities that are

not an unrelated trade or business

under section 513

4 Tax revenues levied for the

organization's benefit and

either paid to or expended on

its behalf

5 The value of services or

facilities furnished by a

governmental unit to the

organization without c h a r g e ' . . .

(a) 2005

(b) 2006

(c) 2007

(d) 2008

114,574.

135,410,

121,309,

142,188,

64,437.

577,918.

170,096.

206,052.

285,329.

255,752.

22,392.

939,621.

284,670.

341,462

406,638,

397,940,

86,829

( 0 Total

0.

6 Total. Add lines 1 through 5 . . .

7 a Amounts included on lines 1,

2, 3 received from disqualified

persons

.,.:......b Amounts included on lines 2

and 3 received from other than

disqualified persons that

exceed the greater of 1 % of

the amount on line 13 for the .

year

1,517,539.

0.

0.

c Add lines 7a and 7b.. ^ ..

8

(e) 2009

Public support (Subtract line

7c from line 6.)

1,517,539.

Section B. Total Support

Calendar year (or fiscal yr beginning in) '

9 Amounts from line_6

10a Gross income from interest,

dividends, payments received

on securities loans, rents,

royalties and income form

similar sources

(a) 2005

(b) 2006

(c) 2007

(d) 2008

284,670.

341,462.

406,638.

397,940.

(e) 2009

( 0 Total

86,829.

1,517,539.

0.

b Unrelated business taxable

income (less section 511

taxes) from businesses

acquired after June 30, 1975 ..

c Add lines 10a and 10b : . : . . . ; .

11 Nefincome from unrelated business

activities not included inline 10b,

whether or not the business is

regularly carried bn'.';.: ..".;.

0.

0.

0.

0.

0.

0.

0.

0.

12 Other income. Do not include

gain or loss from the sale of

capital assets (Explain in

Part IV.)

\ .

13

Total support,

14

First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3)

'

organization, check this box and stop h e r e .

(add ins 9,10c, I t , and 12.)

0.

1,517,539.

Section C. Computation of Public Support Percentage

15

Public support percentage for 2009 (line 8, column (f) divided by line 13, column (f))

15

100.0%

16

Public support percentage from 2008 Schedule A, Part III, line 15

16

100.0%

17

0.0%

Section D. Computation of Investment Income Percentage

17

Investment income percentage for 2009 (line 10c, column (0 divided by line 13, colurVin (f))

18

Investment income percentage from 2008 Schedule A, Part III, line 17

.1..

18

19a 33-1/3 support tests - 2009. If the organization did not check the box on line 14, and line 15 is more than 33-1/3%, and line 17 is not

more than 33-1/3%, check this box and stop here!; The organization qualifies as a publicly supported organization

0.0%

^

^

^

b 33-1/3 support tests - 2008. If the oraanization did not check a box on line 14 or 19a, and line 16 is more than 33-1/3%, and line 18

IS not more than 33-1/3%, checkithis box and stop here. The organization qualifies as a publicly supported organization

i

20

BAA

Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions !

TEEA0403L , 02/15/10

'

Schedule A (Form 990 or 990-EZ) 2009

Forest Theatre Guild, Inc.

23-7227328

Page 4

iBSR|l\g Supplemental Information. Complete this part to provide the explanations required by Part II, line 10;

Part II, line 17a or 17b; and Part III, line 12. Provide any other additional information. See instructions.

Schedule A (Form 990 or 990-EZ) 2009

BAA

TEEA0404L

02/05/10

Schedule A (Form 990 or 990-EZ) 2009

Form

8868

Application for Extension of Time To File an

Exempt Organization Return

(Rev April 2009)

Department of the Treasury

Internal Revenue Service

O M B N o . 1545-1709

File a separate application for each return.

If you are filing for an Automatic 3-Month Extension, complete only Part I and check this box

If you are filing for an Additional (Not Automatic) S-Month Extension, complete only Part II (on page 2 of this form).

Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868.

Part I

Automatic 3-IVIonth Extension of Time. Only submit original (no copies needed).

A corporation required to file Form 990-T and requesting an automatic 6-month extension - check this box and complete Part I only

AH other corporations

income tax returns.

(including

1120-C filers), partnerships,

'

REMICS, and trusts must use Form 7004 to request an extension of time to file

Electronic Filing (e-fUe). Generally, you can electronically file Form 8868 if you want a 3-month automatic extension of time to file one of the

returns noted below (6 months for a corporation required to file Form 990-"n. However, you cannot file Form 8868 electronically if (1) you want

the additional (not automatic) 3-month extension or (2) you file Forms 990-BL, 6069, or 8870, group returns, or a composite or consolidated

Form 990-T. Instead, you must submit the fully completed and signed page 2 (Part II) of Form 8868. For more details on the electronic filing of

this form, visit www.irs.gov/efile and click on e-file for Charities & Nonprofits.

Type or

print

File by the

due date for

filing your

return. See

instructions.

Name of Exempt Organization

Employer identification number

Forest Theatre Guild, Inc.

23-7227328

Number, street, and room or suite number. If a P.O. box, see instructions.

'

P.O. Box 2325

City, town or post office, state, and ZIP code. For a foreign address, see instructions.

Carmel, CA 93921

Check type of return to be filed (file a separate application for each return):

Form 990

Form 990-BL

X Form 990-EZ

Form 990-PF

The books are in the care o f .

Form 990-T (corporation)

Form 4720

Form 990-T (section 401 (a) or 408(a) trust)

Form 5227

Form 990-T (trust other than above)

Form 6069

Form 1041-A

Form 8870

Safwat Malek

Telephone No. * ' J 3 1 - _ 6 2 6 - _ 1 6 8 1 _

FAX No. * ' _ 8 3 1 - _ 6 2 6 - _ 0 7 7 2 _ _ _ _

If the organization does not have an office or place of business in the United States, check this box .

If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN)

check this box..

. If it is for part of the group, check this box.

If this is for the whole group.

and attach a list with the names and EINs of all members

the extension will cover.

I request an automatic 3-month (6 months for a corporation required to file Form 990-T) extension of time

until _ 8 / ] ^

, 2 0 J . 0 _ , to file the exempt organization return for the organization named above.

The extension is for the organization's return for:

X calendar year 2 0 _ 0 9 _ or

tax year beginning

,20

, and ending

If this tax year is for less than 12 months, check reason:

Initial return

,20

Q

Final return

[ ] ] Change in accounting period

3 a If this'application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any

nonrefundable credits. See instructions

3a

0.

b If this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax payments

made. Include any prior year overpayment allowed as a credit

3b

0.

c Balance Due. Subtract line 3b from line 3a. Include your payment with this form, or, if required,

deposit with FTD coupon or, if required, by using EFTPS (E ectronic Federal Tax Payment System).

See instructions

3c

0.

Caution. If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Fonm 8 8 7 9-EO for

payment instructions.

BAA For Privacy Act and Paperwork Reduction Act Notice, see instructions.

FIF20501L

03/n/09

Form 8868 (Rev. 4-2009)

Form 8868 (Rev 4-2009)

Page 2

If you are filing for an Additional (Not Automatic) 3-IVIonth Extension, complete only Part II and check this box

Note. Only complete Part II if you have already been granted an automatic 3-month extension on a previously filed Form 8868.

If you are filing for an Automatic 3-IVIonth Extension, complete only Part I (on page 1).

Bartlllll Additional (Not Automatic) 3-Month Extension of Time. Only lie the original (no copies needed).

Type or

print

File by the

extended

due date for

filing the

return. See

instructions.

Name of Exempt Organization

Employer Identification number

Forest Theatre Guild, Inc.

23-7227328

Number, street, and room or suite number. If a P.O. box, see instructions.

For IRS use only

^- -

J. Daniel Clarke

280 Reeside Ave.

City, town or post office, state, and ZIP code. For a foreign address, see instructions.

Monterey, CA 93940

Check type of return to be filed (File a separate application for each return):

Form 990

Form 990-PF

Form 990-BL

Form 990-T (section 401(a) or 408(a) trust)

Form 1041-A

Form 6069

Form 4720

Form 8870

Form 990-T (trust other than above)

Form 5227

STOP! Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed Form 8868.

X Form 990-EZ

*"_Safwat_Malek

_831-_626-_1681

The books are in care of.

Telephone No.

FAX No.

'

If the organization does not have an office or place of business in the United States, check this box

If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN)...

whole group, check this box . . . ^ . Q . If it is for part of the group, check this box ,

. If this is for the

and attach a list with the names and EINs of all

members the extension is for.

I request an additional 3-month extension of time until _ 1 1 / 1 5 _

For calendar year _ 2 0 0 ^ , or other tax year beginning _

If this tax year is for less than 12 months, check reason:

20_10.

20

Initial return

and ending _

Q Final return

,20

_ Change in accounting period

State in detail why you need the extension.. _ J a ^ y e : ^

_gatl^r_i_nformation necessary to _fil^ a_coiii]^te _and ^ccurat^^

le^lQ.-

8a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any '

nonrefundable credits. See instructions

8a

b If this application is for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax

payments made. Include any prior year overpayment allowed as a credit and any amount paid previouslv

with Form 8868

8b

c Balance Due. Subtract line 8b from line 8a. Include your payment with this form, or, if required, deposit

with FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System). See instrs....

8c

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief it is true

correct, and complete, and that I am authorized to prepare this form.

Signature

BAA

Title

Date

FIFZ0502L 03/11/09

Form 8868 (Rev 4-2009)

2009

Federal Statements

Page 1

Forest Theatre Guild, Inc.

23-7227328

Statement 1

Form 990-EZ, Part I, Line 16

Other Expenses

Film Production Costs

FTG Direct Fundraising.

Marketing

Membership Expenses

Miscellaneous Admin

Production Costs

Total $

12,485.

13,444.

3, 923.

1,229.

11,284.

29, 786.

72,15T7

Statement 2

Form 990-EZ, Part III, Line 28

Statement of Program Service Accomplishments

Education of performers, musicians, & theatre technicians creating, producing and

performing stage productions of "Bandido!" and "Annie" as well as other

performances for 10,000 to 12,000 people in the community for a period of 14 to 18

weeks at the Forest Theatre in Carmel and the Historic State Theatre in Downtown

Monterey. Bringing the preforming arts to the community and educating youth in

the thea:tre'"arts with the participation of local schools in the production of

varies stage performances.

Statement 3

Form 990-EZ, Part V

Regarding Transfers Associated with Personal Benefit Contracts

(a) Did the organization, during the year, receive any funds, directly or

indirectly, to pay premiums on a personal benefit contract?

(b) Did the organization, during the year, pay premiums, directly or

indirectly, on a personal benefit contract?

No

No

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Revenue Regulations No. 02-40Document39 pagesRevenue Regulations No. 02-40saintkarri92% (12)

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Adopting City Council Meeting Dates For 2019 12-03-18Document3 pagesAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Minutes 12-03-18Document7 pagesMinutes 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Holiday Closure 12-03-18Document3 pagesHoliday Closure 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Document5 pagesMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- Mprwa Minutes October 25, 2018Document2 pagesMprwa Minutes October 25, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Mprwa Minutes April 26, 2016Document2 pagesMprwa Minutes April 26, 2016L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Board Resolution FormatDocument3 pagesBoard Resolution Formatjayanthi_kondaNo ratings yet

- L1 - JN - Financial Statement Analysis 2024 V1Document66 pagesL1 - JN - Financial Statement Analysis 2024 V1niketshah75oNo ratings yet

- Form Dispute FormDocument1 pageForm Dispute Formramnik20098676No ratings yet

- Ar Form 2a - Deed of AssignmentDocument1 pageAr Form 2a - Deed of AssignmentKawaii YoshinoNo ratings yet

- Modi Bats For Unlocking Economy, Cms Divided: He Conomic ImesDocument12 pagesModi Bats For Unlocking Economy, Cms Divided: He Conomic ImesyodofNo ratings yet

- Mark Scheme (Standardisation) Summer 2009: GCE Economics (6353/01)Document10 pagesMark Scheme (Standardisation) Summer 2009: GCE Economics (6353/01)An' EwNo ratings yet

- Mutual FundDocument18 pagesMutual FundAnkit Chhabra100% (2)

- Wall Street Courier Services, Inc. PayslipDocument1 pageWall Street Courier Services, Inc. PayslipAimee TorresNo ratings yet

- Lesson 12. Internal - Rate - of - Return - MethodDocument3 pagesLesson 12. Internal - Rate - of - Return - MethodOwene Miles AguinaldoNo ratings yet

- Harvard Risk Management Career OpportunityDocument7 pagesHarvard Risk Management Career OpportunityLeo Kolbert100% (1)

- Defination of MoneyDocument23 pagesDefination of MoneyNasir MuhammadNo ratings yet

- EAIF Review 2009Document33 pagesEAIF Review 2009Marius AngaraNo ratings yet

- TempBillDocument1 pageTempBillNilesh UmaretiyaNo ratings yet

- Partnership Accounting Practical Accounting 2Document13 pagesPartnership Accounting Practical Accounting 2random17341No ratings yet

- Asset Pricing and Welfare Analysis With Bounded Rational InvestorsDocument15 pagesAsset Pricing and Welfare Analysis With Bounded Rational InvestorsZasha RanaNo ratings yet

- HDFC Childrens Gift Fund KIM April 2019Document56 pagesHDFC Childrens Gift Fund KIM April 2019Abhishek AgarwalNo ratings yet

- 7 Bank Marketing Strategies To Increase DepositsDocument10 pages7 Bank Marketing Strategies To Increase DepositsBalwinder SinghNo ratings yet

- Module 1 - Fundamentals of Auditing and Assurance ServicesDocument29 pagesModule 1 - Fundamentals of Auditing and Assurance ServicesEnya ViscoNo ratings yet

- Introduction TABDocument2 pagesIntroduction TABShreshtha ShahNo ratings yet

- IIPC Report Morocco Luetjens Scheck FinalDocument58 pagesIIPC Report Morocco Luetjens Scheck Finalhubba180No ratings yet

- Sseagt 1 Aw Final Low en (2) Tcm78-355169 SCANIADocument17 pagesSseagt 1 Aw Final Low en (2) Tcm78-355169 SCANIAVinay TigerNo ratings yet

- SEC Case No. OIG-496Document76 pagesSEC Case No. OIG-496Investor ProtectionNo ratings yet

- Novus OverlapDocument8 pagesNovus OverlaptabbforumNo ratings yet

- Packers Amp Movers ProjectDocument57 pagesPackers Amp Movers Projectabdullah100% (2)

- CashTOa JPDocument11 pagesCashTOa JPDarwin LopezNo ratings yet

- Preparing Investment BriefDocument23 pagesPreparing Investment BriefislamanggaNo ratings yet

- Solved Jim and Andrea Kerslake Want To Open A Restaurant inDocument1 pageSolved Jim and Andrea Kerslake Want To Open A Restaurant inAnbu jaromiaNo ratings yet

- Business 2257 Tutorial #1Document12 pagesBusiness 2257 Tutorial #1westernbebeNo ratings yet

- AAOIFI Footprint Layout Final Report 1Document226 pagesAAOIFI Footprint Layout Final Report 1bilal12941No ratings yet