Professional Documents

Culture Documents

FinalASFInvestorReportingStandards PDF

Uploaded by

deeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FinalASFInvestorReportingStandards PDF

Uploaded by

deeCopyright:

Available Formats

American Securitization Forum:

Recommended Definitions and Investor Reporting Standards for

Modifications of Securitized Residential Mortgage Loans

December, 2007

Background:

The American Securitization Forum (ASF) 1 is publishing these Recommended Definitions and

Investor Reporting Standards for Modifications of Securitized Residential Mortgage Loans (the

"ASF Loan Modification Reporting Standards," or "Standards") as part of its continuing efforts

to inform its members and promulgate relevant securitization industry guidance in light of the

widespread challenges confronting the subprime residential mortgage markets.

In June 2007, ASF published a Statement of Principles, Recommendations and Guidelines for the

Modification of Securitized Subprime Residential Mortgage Loans (the "June ASF Statement").

The purpose of that statement, together with several follow-up ASF initiatives since that time 2 , is

to establish a common framework relating to the structure and interpretation of loan modification

provisions in securitization transactions, thereby promoting greater uniformity, clarity and

certainty of application of those provisions throughout the industry. ASF's overall goal in

issuing recommended guidance on these topics is to facilitate wider and more effective use of

loan modifications and other loss mitigation options in appropriate circumstances.

The June ASF Statement included the following recommendations, among others:

Greater clarity, transparency and consistency should be established regarding how

any interest reduction or forgiveness of principal resulting from a loan

modification should be reflected for purposes of investor reporting, and for

purposes of allocating payments for the cash flow waterfall.

The American Securitization Forum is a broad-based professional forum through which participants in the

U.S. securitization market advocate their common interests on important legal, regulatory and market

practice issues. ASF members include over 375 firms, including issuers, investors, servicers, financial

intermediaries, rating agencies, financial guarantors, legal and accounting firms, and other professional

organizations involved in securitization transactions. The ASF also provides information, education and

training on a range of securitization market issues and topics through industry conferences, seminars and

similar initiatives. For more information about ASF, its members and activities, please go to

www.americansecuritization.com. ASF is an affiliate of the Securities Industry and Financial Markets

Association ( SIFMA).

2

ASF Statement on Reimbursement of Counseling Expenses in Residential Mortgage-Backed

Securitizations, October 10, 2007; ASF Streamlined Foreclosure and Loss Avoidance Framework

For Securitized Subprime ARM Loans, December 2007.

Recommended Definitions and Investor Reporting Standards for

Modifications of Securitized Residential Mortgage Loans

As an urgent, high priority matter, ASF should develop guidelines under which

delinquency triggers and cumulative loss triggers in securitization operative

documents, which control whether excess cash flow may be released to the

residual, should be interpreted in a manner consistent with the parties' intent and

in a manner that appropriately reflects any loan modifications that have occurred.

Securitization operative documents should clearly state, for purposes of

"delinquency triggers" or "cumulative loss triggers" which control whether excess

cash flow may be released to the residual, the following: (a) whether and under

what conditions a modified loan is to be considered "current," and (b) whether

and how any interest rate reduction or forgiveness of principal resulting from a

loan modification should be treated as a realized loss.

The following ASF Loan Modification Reporting Standards are intended to be responsive to the

above recommendations contained in the June ASF Statement. These ASF Loan Modification

Reporting Standards are an important body of companion guidance to accompany ASF's

Streamlined Foreclosure and Loss Avoidance Framework for Securitized Subprime ARM Loans

(the ASF Streamlined Framework), which ASF is publishing simultaneously with these

Standards.

Consistent with the June Statement, ASF is in the process of developing additional guidance on

the treatment of modified loans for purposes of delinquency and cumulative loss trigger

calculations, and will be issuing that further guidance shortly.

Scope and Implementation:

These ASF Loan Modification Reporting Standards are intended to apply to monthly investor

reporting of loan modification activity for securitizations of residential mortgage loans generally,

including but not limited to subprime mortgage securitizations. The scope of the recommended

guidance does not include non-securitized (i.e., portfolio) loans. However, ASF recommends

that consistency of reporting for all modification activity should be pursued whenever possible.

These Standards are intended to establish a common, minimum recommended framework for

investor reporting of loan modification activity in securitizations. Individual transaction

participants may elect to report additional loan modification details.

Servicers, trust administrators and other entities having responsibilities for securitization investor

reporting are encouraged to implement these Standards as soon as practicable, including

reporting prospective loan modification activity for existing transactions. For new deals,

transaction participants are encouraged to incorporate these Standards into operative documents

that set forth investor reporting requirements.

Finally, with the adoption of the ASF Streamlined Framework, servicers should consider

collecting and reporting loan modification data for the various segments of loans that are set

-2-

Recommended Definitions and Investor Reporting Standards for

Modifications of Securitized Residential Mortgage Loans

forth in that guidance, as these are likely to be relevant to the ongoing evaluation of the efficacy

of the loan modification recommendations set forth therein.

Summary of ASF Loan Modification Reporting Standards:

Part (A)--Definition of Modified Loan:

This definition is intended to identify actions taken with respect to a mortgage loan that

constitute a loan modification, as distinct from other, less formal revisions to the payment terms

of the loan, such as a trial period or forbearance arrangement. Accordingly, the definition of

"Modified Loan" includes a revision to the contractual payment terms of the mortgage note that

is agreed to by the servicer and borrower. The definition then sets forth a reasonably

comprehensive, but not necessarily exclusive, list of actions that fit within this overarching

definition. This definition does not include foreclosure, short sales, or any other final disposition

of mortgage loans.

Part (B)--Recommended Loan Modification Data Fields:

This section of the Statement identifies and provides a brief description of the specific individual

data fields for investor reports. Importantly, all of these reporting fields are intended to capture

data at the individual loan level. This is intended to facilitate flexibility in aggregating loan-level

data to produce pool-level reports, or other aggregated presentations of individual loan

characteristics. The promulgation of specific data reporting templates and file formats was

outside the scope of this initial project. This may be the focus of additional work, to the extent

that developing standardized reporting templates and file formats may be helpful. Reporting

fields applicable exclusively to adjustable-rate mortgages are denoted with an asterisk; certain

other reporting fields are applicable only if they relate to particular loan types (e.g., balloon

loans, IO loans).

-3-

Recommended Definitions and Investor Reporting Standards for

Modifications of Securitized Residential Mortgage Loans

A) Definition of Modified Loan:

"Modified Loan" includes the following: With respect to any mortgage loan, a revision to the

contractual payment terms of the related mortgage note, agreed to by the servicer and borrower,

including without limitation the following:

1. Capitalization of any amounts owing by adding such amount to the outstanding principal

balance;

2. Extension of the maturity;

3. Change in amortization schedule;

4. Reduction or other revision to the mortgage note interest rate;

5. Extension of the fixed-rate payment period of any adjustable rate mortgage loan;

6. Reduction or other revision to the note interest rate index, gross margin, initial or periodic

interest rate cap, or maximum or minimum mortgage rate of any adjustable rate mortgage

loan;

7. Forgiveness of any amount of interest and/or principal owed by the related borrower;

8. Forgiveness of any principal and/or interest advances that are reimbursed to the servicer

from the securitization trust; and

9. Forgiveness of any escrow advances of taxes and insurance and/or any other servicing

advances that are reimbursed to the servicer from the securitization trust.

B) Recommended Loan Modification Data Fields:

Data Reporting Field

Description

1. Modified Loan Amount

2. Modification Effective Payment Date

3. Ending Actual Balance

4. Ending Scheduled Balance

5. Total Capitalized Amount

6. Pre-Modification Interest Rate

7. Post-Modification Interest Rate

Beginning actual unpaid principal

balance owed by the borrower as of the

Modification Effective Payment Date.

Date on which first payment is due under

the modified terms.

Actual outstanding principal balance as

of the monthly cutoff date.

Scheduled principal balance as of the

monthly cutoff date.

Total amount owing under the loan and

added to the Ending Actual Balance.

Interest rate of the loan immediately

preceding the Modification Effective

Payment Date.

Interest rate of the loan as of the

Modification Effective Payment Date.

-4-

Recommended Definitions and Investor Reporting Standards for

Modifications of Securitized Residential Mortgage Loans

8. Post-Modification Margin

9. Post-Modification Periodic Interest

Caps*

10. Post-Modification Lifetime Interest

Caps*

11. Pre-Modification P&I Payment

12. Post-Modification P&I Payment

13. Pre-Modification Maturity Date

14. Post-Modification Maturity Date

15. Pre-Modification Interest Reset

Period (If changed.)*

16. Post- Modification Interest Reset

Period (If changed.)*

17. Pre-Modification Initial Reset Date*

18. Post-Modification Initial Reset Date,

and Next Reset Date*

19. Fixed to ARM (Y/N)

20. ARM to Fixed (Y/N)

21. IO to Fully Amortizing (Y/N)

22. Fully Amortizing to IO (Y/N)

Margin as of the Modification Effective

Payment Date.

Maximum interest rate which can be

charged in an adjustment period, as of the

Modification Effective Payment Date.

Maximum interest rate which can be

charged over the life of the loan, as of the

Modification Effective Payment Date.

Total principal and interest payment

amount preceding the Modification

Effective Payment Date.

Total principal and interest payment

amount as of the Modification Effective

Payment Date.

Original maturity date of the loan. (If

there is more than one modification over

the life of the loan, subsequent premodification maturity date would reflect

the value immediately preceding the most

recent Modification Effective Payment

Date reported.)

Maturity date of the loan as of the

Modification Effective Payment Date.

Original duration of the Interest Reset

Period of the loan.

Duration of the Interest Reset Period of

the loan as of the Modification Effective

Payment Date.

First interest reset date under the original

terms of the loan.

Initial interest reset date as of the

Modification Effective Payment Date,

and the subsequent reset date.

Change in loan status from fixed rate to

ARM.

Change in loan status from ARM to fixed

rate.

Change in loan status from IO to fully

amortizing.

Change in loan status from fully

amortizing to IO.

-5-

Recommended Definitions and Investor Reporting Standards for

Modifications of Securitized Residential Mortgage Loans

23. Pre-Modification IO Term

(If applicable.)

24. Post-Modification IO Term

(If applicable.)

25. Balloon Payment Amount

26. Balloon Payment Date

27. Forgiven Principal Amount

28. Forgiven Interest Amount

Term of IO preceding the Modification

Effective Payment Date.

Term of IO as of the Modification

Effective Payment Date.

Cumulative amount of balloon principal

payment due.

Date on which Balloon Payment Amount

is due.

Amounts owing and payable of principal

forgiven.

Gross amount of interest forgiven.

*Applicable to adjustable-rate mortgages only.

-6-

You might also like

- GF&Co: JPM - Out of ControlDocument45 pagesGF&Co: JPM - Out of Controldavid_dayen3823100% (1)

- Porter Bankruptcy CSLS19 Apr 10Document11 pagesPorter Bankruptcy CSLS19 Apr 10researcher333No ratings yet

- Ocwen Transfer Project Management PlanDocument5 pagesOcwen Transfer Project Management PlanForeclosure FraudNo ratings yet

- MERS Tips & Hints 2011-07Document1 pageMERS Tips & Hints 2011-07WARWICKJNo ratings yet

- 5th Cir. CT - Appeal - FDCPA Louisiana PDFDocument27 pages5th Cir. CT - Appeal - FDCPA Louisiana PDFRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- Basic Acctg Homework - 1 PDFDocument3 pagesBasic Acctg Homework - 1 PDFChe MerluNo ratings yet

- How To Rectify Your Bad Credit - Credit TriangleDocument5 pagesHow To Rectify Your Bad Credit - Credit TriangleCredit TriangleNo ratings yet

- Pleading in Intervention - (TIME STAMPED)Document27 pagesPleading in Intervention - (TIME STAMPED)AC Field100% (1)

- Fannie Mae REMIC Trust AgreementDocument84 pagesFannie Mae REMIC Trust Agreementwinstons2311No ratings yet

- Fdcpa Discovery 2 Page OrderDocument2 pagesFdcpa Discovery 2 Page OrderjoelawdallasNo ratings yet

- IndyMac OneWest Why They Do Not Do Loan ModificationsDocument9 pagesIndyMac OneWest Why They Do Not Do Loan Modificationstraderash1020No ratings yet

- Full Deposition of The Soon To Be Infamous Cheryl Samons RE Deutsche Bank National Trust Company, As Trustee For Morgan Stanley ABS Capital Inc, Plaintiff, vs. Belourdes Pierre - 50 2008 CA 02855Document138 pagesFull Deposition of The Soon To Be Infamous Cheryl Samons RE Deutsche Bank National Trust Company, As Trustee For Morgan Stanley ABS Capital Inc, Plaintiff, vs. Belourdes Pierre - 50 2008 CA 02855Foreclosure Fraud100% (1)

- Got $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing ConductDocument21 pagesGot $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing Conduct83jjmackNo ratings yet

- Foreclosure Checklist of ComplianceDocument3 pagesForeclosure Checklist of CompliancetracybiermannNo ratings yet

- Giannasca FARII 08-21-2020 Final As FiledDocument61 pagesGiannasca FARII 08-21-2020 Final As FiledRussinatorNo ratings yet

- Mrs V JPMC Doc 151-17, Amended RICO Statement, March 6, 2017Document48 pagesMrs V JPMC Doc 151-17, Amended RICO Statement, March 6, 2017FraudInvestigationBureau100% (2)

- Nurses' Six Rights For Safe Medication Administration: by Michelle Colleran CookDocument4 pagesNurses' Six Rights For Safe Medication Administration: by Michelle Colleran CookJosephmeledathu RobinNo ratings yet

- HART v. RUSHMOREDocument8 pagesHART v. RUSHMORECapital & Main100% (1)

- Lending Regulation TableDocument5 pagesLending Regulation TableThaddeus J. CulpepperNo ratings yet

- ITIL Process Swimlane DiagramsDocument6 pagesITIL Process Swimlane Diagramssrik1011No ratings yet

- Bank of America: 4Q11 Financial ResultsDocument40 pagesBank of America: 4Q11 Financial ResultsBing LiNo ratings yet

- Foreclosure Mills Working in ColussionDocument2 pagesForeclosure Mills Working in ColussionPAtty Barahona100% (1)

- Kim V JP Morgan Chase Bank, N.A. - 3.75 Billion of Chase-WAMU Mortgages Are Voidable!!Document38 pagesKim V JP Morgan Chase Bank, N.A. - 3.75 Billion of Chase-WAMU Mortgages Are Voidable!!83jjmackNo ratings yet

- Zarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011Document30 pagesZarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011DeontosNo ratings yet

- New Century Capital Corporation Secondary Marketing PoliciesDocument86 pagesNew Century Capital Corporation Secondary Marketing Policies83jjmack100% (1)

- Deutsche MemoDocument16 pagesDeutsche Memochunga85No ratings yet

- Zarro Inference 4 Memorandum of Respondents Jpmorgan Chase Bank, N.A. and Chase Home Finance LLC in Response To Order To Show Cause - January 5, 2011Document51 pagesZarro Inference 4 Memorandum of Respondents Jpmorgan Chase Bank, N.A. and Chase Home Finance LLC in Response To Order To Show Cause - January 5, 2011DeontosNo ratings yet

- LPS Internal Emails Foreclosed in Wrong Party NameDocument3 pagesLPS Internal Emails Foreclosed in Wrong Party NamecloudedtitlesNo ratings yet

- Order Granting in Part Cross-Motion For Summary JudgmentDocument14 pagesOrder Granting in Part Cross-Motion For Summary JudgmentPaul GrecoNo ratings yet

- BAC, Nor NB Holdings Is A Successor To Countrywide Financial Corp or CW Home Loans Inc.Document21 pagesBAC, Nor NB Holdings Is A Successor To Countrywide Financial Corp or CW Home Loans Inc.Tim Bryant100% (4)

- Securitization: Day 1 ActivitiesDocument4 pagesSecuritization: Day 1 ActivitiesNye LavalleNo ratings yet

- FHA Handbook 4000.1 12-30-16Document1,009 pagesFHA Handbook 4000.1 12-30-16timlegNo ratings yet

- Stan Cooper and Neeraj Methi V DJSP Enterprises, Inc David J. Stern and Kumar GursahaneyDocument30 pagesStan Cooper and Neeraj Methi V DJSP Enterprises, Inc David J. Stern and Kumar GursahaneyForeclosure FraudNo ratings yet

- Fannie MaeDocument6 pagesFannie MaeChahnaz KobeissiNo ratings yet

- JPMC v. Butler WDocument6 pagesJPMC v. Butler WDinSFLANo ratings yet

- Case Against US Bnk-BollingbrieffinalDocument104 pagesCase Against US Bnk-BollingbrieffinalNoraNo ratings yet

- WAMU Servicer GuideDocument136 pagesWAMU Servicer GuideHolly Hill100% (2)

- Too Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyDocument8 pagesToo Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyForeclosure FraudNo ratings yet

- 1903 How Does MERS WorkDocument3 pages1903 How Does MERS WorkpattigheNo ratings yet

- 2018-01-17 Ruling Clarifies Statute of Limitations, Damages in Foreclosure CasesDocument3 pages2018-01-17 Ruling Clarifies Statute of Limitations, Damages in Foreclosure Casesdbush1034No ratings yet

- Signature VariationsDocument9 pagesSignature VariationsForeclosure Fraud100% (1)

- Filed Complaint - OcoroDocument36 pagesFiled Complaint - OcoroAnonymous Pb39klJNo ratings yet

- Carrington Mortgage Flyer - 12 25 15Document1 pageCarrington Mortgage Flyer - 12 25 15reyes500No ratings yet

- AttachmentDocument49 pagesAttachmentAlhaji Mamah Sesay0% (1)

- ObjectionBACHomeLoansClaim 11 12Document3 pagesObjectionBACHomeLoansClaim 11 12GrammaWendyNo ratings yet

- Affidavit by Erika Lance of Nationwide Title Clearing Support Protective Order (D.E. 173-MRS V JPMC - 15-00293)Document3 pagesAffidavit by Erika Lance of Nationwide Title Clearing Support Protective Order (D.E. 173-MRS V JPMC - 15-00293)larry-612445No ratings yet

- Bear Stearns Story - Nye LavalleDocument105 pagesBear Stearns Story - Nye LavalleStopGovt WasteNo ratings yet

- Robinson Opinion On MDLDocument31 pagesRobinson Opinion On MDLCelebguardNo ratings yet

- Horry County, SOUTH CAROLINA InjunctionDocument4 pagesHorry County, SOUTH CAROLINA InjunctionDavid L HucksNo ratings yet

- William Roberts Vs America's Wholesale Lender Appellant's OpeningDocument23 pagesWilliam Roberts Vs America's Wholesale Lender Appellant's Openingforeclosurelegalrigh100% (1)

- Robo-Signing Gems VIIIDocument34 pagesRobo-Signing Gems VIIIizraul hidashiNo ratings yet

- Hooker V Northwest Trustee DEFs Declaration 31 Jan 2011Document4 pagesHooker V Northwest Trustee DEFs Declaration 31 Jan 2011William A. Roper Jr.100% (1)

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionFrom EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNo ratings yet

- Navigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaFrom EverandNavigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaRating: 2 out of 5 stars2/5 (3)

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Transfer Pricing in One Lesson: A Practical Guide to Applying the Arm’s Length Principle in Intercompany TransactionsFrom EverandTransfer Pricing in One Lesson: A Practical Guide to Applying the Arm’s Length Principle in Intercompany TransactionsNo ratings yet

- DUI Slideshow v2 PDFDocument58 pagesDUI Slideshow v2 PDFdeeNo ratings yet

- ProcessRecordingandJournalOverview Instructions SampleDocument12 pagesProcessRecordingandJournalOverview Instructions SampledeeNo ratings yet

- DUI Slideshow v2 PDFDocument58 pagesDUI Slideshow v2 PDFdeeNo ratings yet

- ProcessRecordingandJournalOverview Instructions SampleDocument12 pagesProcessRecordingandJournalOverview Instructions SampledeeNo ratings yet

- Proof of Ongoing Foreclosure Fraud and Mortgage Document FabricationDocument18 pagesProof of Ongoing Foreclosure Fraud and Mortgage Document Fabricationdee67% (3)

- Termination of Registration 15-15d - Gs Mortgage Gsamp Trust 2005-He1 - BamsecDocument3 pagesTermination of Registration 15-15d - Gs Mortgage Gsamp Trust 2005-He1 - BamsecdeeNo ratings yet

- How To Check If Your Mortgage Is Compromised - (Updated 5-8-2014)Document7 pagesHow To Check If Your Mortgage Is Compromised - (Updated 5-8-2014)dee100% (2)

- 2010 03 24 Countrywide Agreement Attachment 3Document27 pages2010 03 24 Countrywide Agreement Attachment 3deeNo ratings yet

- January 2014 MHA Report Final PDFDocument34 pagesJanuary 2014 MHA Report Final PDFdeeNo ratings yet

- Internship Report For Bank AlfalahDocument60 pagesInternship Report For Bank Alfalahusman ali100% (28)

- (Revised) Loan AgreementDocument5 pages(Revised) Loan AgreementJennilyn TugelidaNo ratings yet

- Financial Management: Short-Term FinancingDocument2 pagesFinancial Management: Short-Term FinancingNicole Athena CruzNo ratings yet

- Mock TestDocument26 pagesMock TestRadhika KushwahaNo ratings yet

- Caselet 1Document4 pagesCaselet 1Amrita JhaNo ratings yet

- 2A Communicative Are You A Saver o A SpenderDocument1 page2A Communicative Are You A Saver o A SpenderPa SolNo ratings yet

- Credit Rating Agency of IndiaDocument32 pagesCredit Rating Agency of Indiafederation110xNo ratings yet

- Dallas County, TX V MERS and Bank of AmericaDocument63 pagesDallas County, TX V MERS and Bank of AmericajohngaultNo ratings yet

- Principle of Accounting 1 - Chapter 1Document34 pagesPrinciple of Accounting 1 - Chapter 1Mbu Javis Enow100% (2)

- Deed Drafting ExerciseDocument9 pagesDeed Drafting Exerciseankita.balNo ratings yet

- Mishkin Fmi09 PPT 12Document53 pagesMishkin Fmi09 PPT 12Thi MaiNo ratings yet

- SUMMARY For INTERMEDIATE ACCOUNTING 2 PDFDocument20 pagesSUMMARY For INTERMEDIATE ACCOUNTING 2 PDFArtisan100% (1)

- TOApayables AnswersDocument14 pagesTOApayables AnswersEunice FulgencioNo ratings yet

- Audit of Receivables and Sales SolutionsDocument16 pagesAudit of Receivables and Sales SolutionsNICELLE TAGLENo ratings yet

- Mortgage of Immovable Property AssignmentDocument17 pagesMortgage of Immovable Property AssignmentNusrat Shaty100% (2)

- Loan Loss ProvisionDocument6 pagesLoan Loss Provisiontanim7No ratings yet

- Kinds of Obligations: Joint and Solidarity: Article 1207Document5 pagesKinds of Obligations: Joint and Solidarity: Article 1207Maryane AngelaNo ratings yet

- WAVE 3.business LawdocxDocument5 pagesWAVE 3.business LawdocxchelissamaerojasNo ratings yet

- Subordination AgreementDocument3 pagesSubordination AgreementNiño Rey LopezNo ratings yet

- TOPA Questions and AnswerDocument14 pagesTOPA Questions and AnswerSamiksha PawarNo ratings yet

- Nia Annual Report 2010Document44 pagesNia Annual Report 2010Junior LubagNo ratings yet

- Homefirst Product Offering: Auto - PrepayDocument1 pageHomefirst Product Offering: Auto - PrepayShobhit NeemaNo ratings yet

- Final Account VdaDocument12 pagesFinal Account VdaShobhit SrivastavaNo ratings yet

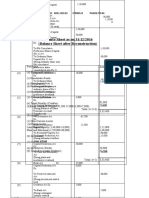

- Balance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)Document8 pagesBalance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)GauravNo ratings yet

- 2 Final Presentation 105Document32 pages2 Final Presentation 105Myra Dela Llana TagalogNo ratings yet

- P1 PDFDocument34 pagesP1 PDFDarwin Competente LagranNo ratings yet

- The Ultimate Guide On How To Improve Your Credit ScoreDocument21 pagesThe Ultimate Guide On How To Improve Your Credit ScoreDave TanNo ratings yet

- Far15 Long Term Liability 1Document9 pagesFar15 Long Term Liability 1Joana TatacNo ratings yet