Professional Documents

Culture Documents

FTG Irs Form 990-Ez 2010

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG Irs Form 990-Ez 2010

Uploaded by

L. A. PatersonCopyright:

Available Formats

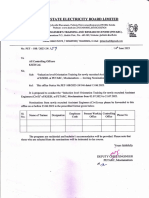

Short Form

Return of Organization Exempt From Income Tax

990-EZ

Form

For the 2010 calendar year, or tax year beginning

Check if applicable:

Name change

Initial return

Terminated

2010

Sponsoring organizations of donor advised funds, organizations that operate one or more hospital facilities,

and certain controlling organizations as defined in section 512(b)(13) must file

Form 990 (see instructions). All other organizations with gross receipts less than $200,000

and total assets less than $500,000 at the end of the year may use this form.

^ The organization may have to use a copy of this return to satisfy state reporting

requirements.

Department of the Treasury

Internal Revenue Service

Address change

0 M B No. 1545-1150

Under section 501(c), 527, or 4947(aX1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

OpjBn to;Publlc

inspectlon;:''''r,*'

, 2010, and ending

Forest Theatre Guild, Inc.

P . O . B o x 2325

C a r m e l , CA 93921

Employer Identification number

Telephone number

23-7227328

831-626-1681

Amended return

F Group Exemption

Number.

Application pending

G

I

Accounting Method:

Website:

WWW.

X Cash

[_J Accrual

Other (specify)

J

K

Tax-exempt status (ck only one) - X 501(c)(3)

501(c)(

(insert no.)

14947(a)(1) or

j 527

Check

|_J if the organization is not a section 509(a)(3) supporting organization and its gross receipts are normally not more than

$50,000. A Form 990-EZ or Form 990 return is not required though Form 990-N (e-postcard) may be required (see instructions). But if the

organization chooses to file a return, be sure to file a complete return.

Add lines 5b 6c, and 7b, to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total

assets (Part II, line 25, column (B) below) are $500,000 or more, file Form 990 instead of Form 990-EZ

f o r e s t ^ e a t e r q u i l d . org

Check

if the organization is not

required to attach Schedule B (Form

990, 990-EZ, or 990-PF).

$

97,161.

[PartJJ Revenue, Expenses, and Changes in Net Assets or Fund Balances (See the instructions for Part 1.)

Check If the organization used Schedule 0 to respond to any question in this Part I

1

2

Contributions, gifts, grants, and similar amounts received..

Membership dues and assessments

Investment income

35,658.

61,503.

Program service revenue Including government fees and contracts

5 a Gross amount from sale of assets other than inventory

5a

b Less: cost or other basis and sales expenses

5b

Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a)

5c

Gaming and fundraising events

Gross income from gaming (attach Schedule G if greater than $15,000) ..

6a

Gross income from fundraising events (not including $

of contributions

from fundraising events reported on line 1) (attach Schedule G if the sum

of such gross income and contributions exceeds $15,000)

6b

c Less: direct expenses from gaming and fundraising events

6c

Net income or (loss) from gaming and fundraising events (add lines 6a and

6b and subtract line 6c)

7 a Gross sales of inventory, less returns and allowances

6d

7a

b Less: cost of goods sold

- f.^

7b

c Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a).

^Ofi

Other revenue (describe In Schedule 0 )

Total revenue. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8.

7c

97,161.

10

Grants and similar amounts paid (list In Schedule O)

11

12

Benefits paid to or for members

13

Professional fees and other payments to independent contractors.

14

Occupancy, rent, utilities, and maintenance

15

Printing, publications, postage, and shipping

16

Other expenses (describe in Schedule O)

17

Total expenses. Add lines 10 through 16

18

Excess or (deficit) for the year (Subtract line 17 from line 9)

19

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with end-of-vear

figure reported on prior year's return)

^

20

Other changes in net assets or fund balances (explain in Schedule O ) . . . .

21

Net assets or fund balances at end of year. Combine lines 18 through 20.

12.

11

Salaries, other compensation, and employee benefits

21.

Jll.

14

.See..Schedule. Q .

BAA For Paperwork Reduction Act Notice, see the separate instructions.

TEEA0803L

02/10/11

21.

18

109,750.

109,750.

-12,589.

19

15,744.

16

17

20

21

3,155.

Form 990-EZ (2010)

Form 990-EZ (2010) Forest Theatre Guild, Inc.

Part II

23-7227328

Page

Balance Sheets, (see the instructions for Part II.)

Check if the organization used Schedule 0 to respond to any question in this Part 11

22

23

24

25

(A) Beginning of year

15,744.

Cash, savings, and investments

Land and buildings

Other assets (describe in Schedule O)

Total assets

Statement of Program Service Accomplishments

15,744. 25

0, 26

15,744, 27

(see the instrs for Part III.)

Check if the organization used Schedule 0 to respond to any question in this Part III

[x|

What is the organization's primary exempt purpose? .'^pp . S n h p c i n l e 0

Describe what was achieved in carrying put the organization s exempt purposes. In a clear and concise manner,

describe the services provided, the number of persons benefited, and other relevant information for each

program title.

28

3,155.

24

Net assets or fund balances (line 27 of column (B) must agree with line 21) .

Part III

(B) End of year

23

26 Total liabilities (describe in Schedule O)

27

22

3,155.

0.

3,155.

Expenses

(Required for section

501 (c)(3) and 501 (c)(4)

organizations and section

4947(;a)(1) trusts; optional

for others.)

Sae_Schedul_a.

(Grants $

) If this amount includes foreign grants, check here .

28 a

(Grants $

) If this amount includes foreign grants, check here .

29 a

(Grants $

) If this amount includes foreign grants, check here .

Other program services (describe in Schedule O ) .

30 a

(Grants $

) If this amount includes foreign grants, check here .

Total

rogram

service

expenses

(add

lines 28a through 31a)

^

.

31a

32

29

30

31

32

Partly I List of Officers, Directors, Trustees, and Key Employees.

List each one even if not compensated, (see the instructions for Part IV.

Check if the organization used Schedule O to respond to any question in this Part IV.

fa

(b) Title and average hours (c) Compensation (If

(d) Contributions to

(e) Expense account

(a) Name and address

per week devoted

not paid, enter -0-.) employee benefit plans and and other allowances

to position

deferred compensation

J M B J ^

MOSSBERG

_Pp_BpX_9_7

C A R M E L , CA 93921

_Pp_B_OX_5_596

C A R M E L , C A 93921 "

_CRYS_TAL H O N N

_ S M _ C M L P S _& 5TH

C A R M E L , CA 93921

_BRI^M_GROSSI

_3 012_ C O M O M N T _ R 0 ^

P E B B L E B E A C H , CA 93953"

W I L L J M _BJRCH_

_Pp_B_pX_2_325

C a r m e l , CA 93921

JAEmT_MALEK

_Pp_B_pX_l_734

P E B B L E B E A C H , C A 93953"

jJEFFJ^Y J H O M P S O N

J - l i . J J D _yAL];Y_(;ENTro_ _

C a r m e l V a l l e y , CA 93924

_jpAMA_TOP^_

_PP_^X_7_342

C A R M E L , C A 93921

J^I ITH_ DE_CKE^R

_L I G H T H O U S E

P A C I F I C G R O V E , CA 93950

_LEI^GH_GI^Y

_4 0 3 jP3JNI_PER(^ A V ^

P A C I F I C G R O V E , CA 93950

Vice President

0

0.

0.

President

Secretary

0.

Trustee

0

t ;

Treasurer

0

"0:

Trustee

0

"0:

Trustee

0

Trustee

0

'V.

Trustee

0

Trustee

0

TEEA0812L

02/18/11

T.

Form

990-EZ

(2010)

Form 990-EZ (2010)

Forest Theatre Guild, Inc.

23-7227328

Party I Other Information (Note the statement requirements in tlie instructions for Part V.)

Page 3

See Schedule 0

Check if the organization used Schedule 0 to respond to any question in this Part V

33

Yes

Did the organization engage in any activity not previously reported to the IRS? If 'Yes,' provide a detailed description of

each activity in Schedule 0

33

34

Were any significant changes made to the organizing or governing documents? If 'Yes,' attach a conformed copy of the amended documents if they reflect

a change to the organization's name. Otherwise, explain the change on Schedule 0 (see instructions)

34

35

If the organization had income from business activities, such as those reported on lines 2, 6a, and 7a (among others), but not reported on Form 990-T,

explain in Schedule 0 why the organization did not report the income on Form 990-T.

36

a Did the organization have unrelated business gross income of $1,000 or more or was it a section 501(c)(4), 501(c)(5), or

501(c)(6) organization subject to section 6033(e) notice, reporting, and proxy tax requirements?

35a

b If 'Yes,' has it filed a tax return on Form 990-T for this year (see instructions)?

35 b

Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during the

year? If 'Yes,' complete applicable parts of Schedule N

37a Enter amount of political expenditures, direct or indirect, as described in the instructions,

38a Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were

any such loans made in a prior year and still outstanding at the end of the tax year covered by this return?

39

36

37 b

38 a

38b

N/A

39 a

N/A

N/A

Section 501(c)(7) organizations. Enter:

a Initiation fees and capital contributions included on line 9

b Gross receipts, included on line 9, for public use of club facilities

39 b

4 0 a Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under:

section 4911

0 ^ ; section 4912

0 . ; section 4955

0 .

b Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit

transaction during the year or did it engage in an excess benefit transaction in a prior year that has not been reported

on any of its prior Forms 990 or 990-EZ? If 'Yes,' complete Schedule L, Part I

c Section 501 (c)(3) and 501 (c)(4) organizations. Enter amount of tax imposed on organization

managers or disqualified persons during the year under sections 4912, 4955, and 4958

42 a The organization's

books are in care of

Located at

0 _

None

Jlebecca J a r r y m o : ^

40 e

0.

e All organizations. At any time during the tax year, was the organization a party to a prohibited tax

shelter transaction? If 'Yes,' complete Form 8886-T

List the states with which a copy of this return is tiled

40 b

0.

d Section 501 (c)(3) and 501 (c)(4) organizations. Enter amount of tax on line 40c reimbursed

by the organization

41

JL

0.

37a I

b Did the organization file Form 1120-POL for this year?

b If 'Yes,' complete Schedule L, Part II and enter the total

amount involved

No

Telephoneno. - _ 8 3 1 - _ 6 2 6 - _ 1 6 8 : i ^

ZIP-t-A" 93921

232_5^ _Carmel_j^

b At any time during the calendar year, did the organization have an interest in or a signature or other authority over a

financial account in a foreign country (such as a bank account, securities account, or other financial account)?

Yes

If 'Yes,' enter the name of the foreign country:..

No

42 b

42c

~X

See the instructions for exceptions and filing requirements for Form I D F 90-22.1, Report of a Foreign Bank and Financial Accounts.

c At any time during the calendar year, did the organization maintain an office outside of the U.S.?

If 'Yes,' enter the name of the foreign country:..

43

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 - Check here

and enter the amount of tax-exempt interest received or accrued during the tax year

^ ^ S Fom990-E?''"

N/A

N/A

43

' ' i ^ s t i a d of^Form 990-EZ^'^^'

organization filed a Form 720 to report these payments? If 'No/provide

44b

X

X

TEEA0812L

02/18/11

44c

an explanation

No

44a

hospital facilities during the year? If 'Yes,' Form 990 must be completed

c Did the organization receive any payments for indoor tanning services during the year?

Uhedule

Yes

y^''- 'f 'Yes,' Form 990 must be completed instead

in

44d

Form 990-EZ (2010)

Form 990-EZ (2010)

Forest Theatre Guild, Inc.

23-7227328

Page'

Yes

45

Is any related organization a controlled entity of the organization within the meaning of section 512(b)(13)?

a Did the organization receive any payment from or engage in any transaction with a controlled entity within the meaning

of section 512(b)(13)? If 'Yes,' Form 990 and Schedule R may need to be completed instead of Form 990-E2 (see Inst.)

46

45 a

Did the organization engage, directly or indirectly, in political campaign activities on behalf of or in opposition to

candidates for public office? If 'Yes,' complete Schedule C, Part f

Part VI

No

45

46

Section 501 (cX3) organizations and section 4947(aXl) nonexempt charitable trusts only. A I section

501(c)(3) organizations and section 4947(a)(1) nonexempt ciiaritabie trusts must answer questions

47-49b and 52, and complete tine tables for lines 50 and 51.

Check if the organization used Schedule O to respond to any question in this Part VI

Yes

47

Did the organization engage in lobbying activities? If 'Yes,' complete Schedule C, Part II

47

48

Is the organization a school as described in section 170(b)(1)(A)(ii)? If 'Yes,' complete Schedule E .

48

49a Did the organization make any transfers to an exempt non-charitable related organization?

49 a

No

X

X

X

b If 'Yes,' was the related organization a section 527 organization?

49 b

Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key

employees) who each received more than $100,000 of compensation from the organization. If there is none, enter 'None.'

50

(a) Name and address of each employee paid

more than $100,000

(b) Title and average

hours per week

devoted to position

(c) Connpensation

(d) Contributions to employee

benefit plans and

deferred compensation

(e) Expense

account and

other allowances

None

f Total number of other employees paid over $100,000 ,

51

Complete this table for the organization's five highest compensated independent contractors who each received more than $100 000 of

compensation from the organization. If there is none, enter 'None.'

, v v^i

(a) Name and address of each independent contractor paid more than $100,000

(b) Type of service

(c) Compensation

None

d Total number of other independent contractors each receiving over $100,000

X

--.IMK.CIC

Sign

Here

Date

Print/Type preparer's name

No

^.leparer ^ul^le^ man onicer; is paseg on an intormalion of which preparer has any knowledge

Signature of officer

Yes

Preparer's signature

Date

J. Daniel Clarke

Paid

J. Daniel Clarke

Preparer F i r m s name J . D a n i e l C l a r k e

Use Only F i r m s address

280 R e e s i d e A v e

M o n t e r e y , CA 93940

May the IRb discuss this return with the preparer shown above? See instructinn<;

BAA

TEEA0812L

02/18/11

9/13/11

Check

if

self-employed

Firm's EIN

Phone no.

PTIN

N/A

N/A

375-6230

|X| Yes n No

( 8 3 1 )

Form 990-EZ (2010)

OMB No. 1545-0047

SCHEDULE A

2010

Public Charity Status and Public Support

(Form 990 or 990-EZ)

Complete if the organization is a section 501(cX3) organization or a section

4947(aX1) nonexempt charitable trust.

Department of the Treasury

Internal Revenue Service

Attach to Form 990 or Form 990-EZ.

Open.to Public

Inspection,

See separate instructions.

Name of the organization

Employer identification number

Forest Theatre Guild, Inc.

23-7227328

Part I Reason for Public Charity Status (All organizations must complete this part.) See instructions.

The organization is not a private foundation because It is: (For lines 1 through 11, check only one box.)

A church, convention of churches or association of churches described in section 170(bX1XAXi)-

A school described in section 170(bXlXAXii)- (Attach Schedule E.)

A hospital or a cooperative hospital service organization described in section 170(bX1XAXiii).

A medical research organization operated in conjunction with a hospital described in section 170(bX1XAXiii)- Enter the hospital's

name, city, and state:

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in section

170(bX1XAXiv). (Complete Part II.)

A federal, state, or local government or governmental unit described in section 170(bX1XAXv).

An organization that normally receives a substantial part of its support from a governmental unit or from the general public described

in section 170(bX1XAXvi). (Complete Part II.)

_ | A community trust described in section 170(bX1XAXvi). (Complete Part II.)

An organization that normally receives: (1) more than 33-1/3% of its support from contributions, membership fees, and gross receipts

from activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33-1/3% of its support from gross

investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after

June 30, 1975. See section 509(aX2). (Complete Part III.)

10

An organization organized and operated exclusively to test for public safety. See section 509(aX4).

11

An organization organized and operated exclusively for the benefit of, to perform the functions of, or carry out the purposes of one or

more publicly supported organizations described in section 509(a)(1) or section 509(a)(2). See section 509(aX3). Check the box that

descnbes the type of supporting organization and complete lines l i e through l l h .

a Qlype I

b Q l y p e II

c Q l y p e III - Functionally integrated

d Q

Type III - Other

[_J By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons

other than foundation managers and other than one or more publicly supported organizations described in section 509(a)(1) or

section 509(a)(2).

If the organization received a written determination from the IRS that is a Type I, Type II or Type III supporting organization,

checkk1 tnis DOX

Since August 17, 2006, has the organization accepted any gift or contribution from any of the following persons?

(i)

(ii)

(iii)

A person who directly or indirectly controls, either alone or together with persons described in (ii) and (iii)

below, the governing body of the supported organization?

A family member of a person described in (i) above?

(11) EIN

(iii) Type of organization

(described on lines 1 -9

above or IRC section

(see instructions))

(iv) Is the

organization in

column (1) listed in

your governing

document?

Yes

(A)

(B)

(C)

(D)

(E)

Total

D A

r . . D . ^ . .

1.

n . J . . - ^ ; -

TEEA0401L

12/23/10

No

iig(i)

iig(ii)

11 g (iii)

A 35% controlled entity of a person described in (i) or (ii) above?

(1) Name of supported

organization

Yes

No

(v) Did you notify

the organization in

column (1) of

your support?

Yes

No

(vi) Is the

organization in

column (!)

organized in the

U.S.?

Yes

No

(vii) Amount of support

Schedule A (Form 990 or 990-EZ) 2010

Forest Theatre Guild, Inc.

23-7227328

Page 2

Part II I Support Schedule for Organizations Described in Sections 170(bX1XAXiv) and 170(bX1XAXvi)

(Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under Part

organization fails to qualify under the tests listed below, please complete Part III.)

If the

Section A. Public Support

Calendar year (or fiscal year

beginning in)

1

Gifts, grants, contributions, and

membership fees received. (Do

not include 'unusual g r a n t s . ' ) . .

Tax revenues levied for the

organization's benefit and

either paid to it or expended

on its behalf

The value of services or

facilities furnished by a

governmental unit to the

organization without charge . . .

Total. Add lines 1 through 3 . . .

The portion of total

contributions by each person

(other than a governmental

unit or publicly supported

organization) included on line 1

that exceeds 2% of the amount

shown on line 11, column (f) ..

(a) 2006

(b) 2007

(c) 2008

(d) 2009

(f) Total

V

t

Public support. Subtract line 5

from line 4

. . ..

Section B. Total Support

Calendar year (or fiscal year

beginning in)

(e)2010

(a) 2006

(b) 2007

(c) 2008

(d) 2009

1 i

(e)2010

(f) Total

Amounts from line 4

Gross income from interest,

dividends, payments received

on securities loans, rents,

royalties and income from

similar sources

Net income from unrelated

business activities, whether or

not the business is regularly

carried on

10

Other income. Do not include

gain or loss from the sale of

capital assets (Explain in

Part IV.>

11

Total support. Add lines 7

through 10

12

Gross receipts from related activities, etc (see instructions).

13

First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3)

organization, check this box and stop here

^

'

12

Section C. Computation of Public Support Percentage

14

Public support percentage for 2010 (line 6, column (f) divided by line 11, column (f)).

15

Public support percentage from 2009 Schedule A, Part II, line 14

14

15

a n H O r g a n i s a t i o n

did not check the box on line 13, and the line 14 is 33-1/3% or more, check this box

and stop here. The organization qualifies as a publicly supported organization

V

^

H

"

o.^anization did not check a box on line 13 or 16a, and line 15 is 33-1/3% or more, check this box

^

and stop here. The organization qualifies as a publicly supported organization

^

r,

17a 10%-facts-and-circumstances test - 2010. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10%

or more, and if the organization meets the 'facts-and-circumstances' test, check this box and stop here. Explain in Part IV how

the organization meets the 'facts-and-circumstances' test. The organization qualifies as a publicly supported o ganizat on

n?mnfp

^

Organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 10%

n nStfon mirfJhf

the 'facts-and-circumstances' test, check this box and stop here. Explain in Part IV how the

organization meets the facts-and-circumstances' test. The organization qualifies as a publicly supported organization

Private foundation. If the organization did not check a box on line 13, 16a. 16b, 17a, or 17b, check this box and see instructions.

BAA

Schedule A (Form 990 or 990-EZ) 2010

TEEA0402L 12/23/10

Forest Theatre Guild

Part III

^ 1 ^ ^

Support Schedule for Organizations Described in Section 509(aX2)

(Complete only if you checked the box on line 9 of Part 1 or if the organization failed to qualify under Part II. If the organization fails

to qualify under the tests listed below, please complete Part II.)

Section A. Public Support

Calendar year (or fiscal yr beginning in)

1 Gifts, grants, contributions

and membership fees

received. (Do not include

any 'unusual grants.')

2 Gross receipts from admissions, merchandise sold or

services performed, or facilities

furnished in any activity that is

related to the organization's

tax-exempt purpose

3

(a) 2006

(b) 2007

(c) 2008

135,410.

121,309.

142,188.

64,437.

35,658.

499,002.

206,052.

285,329.

255,752.

22,392.

61,503.

831,028.

(d) 2009

(e)2010

( 0 Total

Gross receipts from activities

that are not an unrelated trade

or business under section 513.

Tax revenues levied for the

organization's benefit and

either paid to or expended on

its behalf

The value of services or

facilities furnished by a

governmental unit to the

organization v^/ithout charge . . .

6 Total. Add lines 1 through 5 . . .

7 a Amounts included on lines 1,

2, and 3 received from

disqualified persons

0.

0.

341,462.

406,638.

397,940.

86,829.

97,161.

0.

1,330,030.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

b Amounts included on lines 2

and 3 received from other than

disqualified persons that

exceed the greater of $5,000 or

1% of the amount on line 13

for the year.

c Add lines 7a and 7b

8

Public support (Subtract line

7c from line 6.)

- "

Section B. Total Support

Calendar year (or fiscal yr beginning in)

9 Amounts from line 6

10a Gross income from interest,

dividends, payments received

on securities loans, rents,

royalties and income from

similar sources

b Unrelated business taxable

income (less section 511

taxes) from businesses

acquired after June 30, 1975 ,.

(a) 2006

(b) 2007

(c) 2008

341,462.

406,638.

397,940.

(d) 2009

(e)2010

86,829.

1,330,030.

( 0 Total

97,161.

1,330,030.

0.

0.

c Add lines 10a and 10b

11 Net income from unrelated business

activities not included in line 10b,

whether or not the business is

regularly carried on

0.

0.

0.

0.

0.

0.

0.

12

Other income. Do not include

gain or loss from the sale of

capita^assets (Explain in

13

Total support. (Add ins 9,10c, 11, and 12.)

14

First five years. If the Form 990

organization, check this box and stop here.

341,462.

406,638.

397,940.

86,829.

97,161.

0.

1,330,030.

Section C. Computation of Public Support Percentage

15

Public support percentage for 2010 (line 8, column (f) divided by line 13, column (f)).

16

Public support percentage from 2009 Schedule A, Part III, line 1 5 . . . .

Section D. Computation of Investment Income Percentage

17

Investment income percentage for 2010 (line 10c, column (f) divided by line 13, column (f))

18

Investment income percentage from 2009 Schedule A, Part III, line 17

16

100.0 %

100.0 %

17

0.0 %

15

0.0 %

18

ftnnf^^r'i^i^hln

'J It? o/sanization did not check the box on line 14, and line 15 is more than 33-1/3%, and line 17

IS not more than 33-1/3%, check this box and stop here. The organization qualifies as a publicly supported organization

' ' Mnp

"'.^anization did not check a box on line 14 or line 19a, and line 16 is more than 33-1/3%, and

line 18 IS not more than 33-1/3%, check this box and stop here. The organization qualifies as a publicly supported organization

Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions

BAA

TEEA0403L 12/29/10

Schedule A (Form 990 or 990-EZ) 2010

Schedule A (Form 990 or 990-EZ) 2010

Forest Theatre Guild, Inc.

23-7227328

Page4

Part ly I Supplemental Information. Complete this part to provide the explanations required by Part II, line 10;

Part II, line 17a or 17b; and Part III, line 12. Also complete this part for any additional information.

(See instructions).

BAA

Schedule A (Form 990 or 990-EZ) 2010

TEEA0404L

09/08/10

SCHEDULE 0

Supplemental Information to Form 990 or 990-EZ

(Form 990 or 990-EZ)

Complete to provide information for responses to specific questions on

Form 990 or 990-EZ or to provide any additional Information.

Attach to Form 990 or 990-EZ.

Department of the Treasury

Internal Revenue Service

Name of the organization

OMB No. 1545-0047

2010

Open to Public

Inspection

Employer identification number

Forest Theatre Guild, Inc.

23-7227328

. - F o r m 990:LEj:^Paji_l!l - _ Q r 5 a n i z a t i o n 3 _ P r i m a j y _ E x e m p t ^ ^ ^

. c o m m u n i t y edu^ay_pnal_ se^ryice

. -FpJini ??Pi.EZi.Pa_rtJ!Li-Lne 28 -_St.tement pf_Prqgra^tti Se^rvice AccpmBlishments

.

of i^eifi^?snius^iciar^^ _&_ theatre_ te^chnician^s_ c r e a t i r ^ ^ . P j o ^ ^ i n g . an^L _

Jiroc^cUoris i)f

ISI^ND"_ anc^ "ALJCE"_ as w e n _ as i)ther_

J o r _10 ,_q00 _ti)_12_, Oq^O_ p e o p l e in_the jqommujii^_ fo^r_ a_p^riod_q^f_ 14 _t:o _1_8_

at _the J o r e j t _Theat_re _iii_C^a_rmel_ anc^ the_ His_toric_State Jhe^a_tre _in_Downt_own

. J1?Btej'eY.._ _Bring;ing_t_he _pjefo_rming_arts J:i>_yie_cojimur^tY. ^ n d jducjtii^_Y.quth _in

_ t h e _ t h e a t _ r e _a_rts

w i y i _ the_ p a r t i c ^ i p a t i ^ n _ o _ f _ l o _ c a l j c h 0 j ) l s

in_the

_Pi:oduction_q^f

_Fj>rm ??PiEZ^Paj1_V - F^eaa^rdina Jran^fers As^sociated with P^rsojial_^nef|t Contracts_

_indirectly^

_o_n_a pers_orial_ b e r ^ f it_ c o i ^ r a c t ?

No

_ _pid _the i5gajiiza_tion_, _d'i^ing_ the_ ye^aj:^ _p_ay j n r e m i u m s , d i r e c t l y or

.

cor^ra^c_t?._

B A A For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ.

No

TEEA4901L

10/26/1 O

Schedule O (Form 990 or 990-EZ) 2010

2010

Schedule 0 - Supplemental Information

Page 2

Forest Theatre Guild, Inc.

23-7227328

Form 990-EZ, Part 1, Line 16

Other Expenses

AUTOMOTIVE

BANK FEES

BOARD SUPPORT & RECRUITMENT

BOOKEEPING SERVICES

C O N C E S S I O N S U P P L I E S & FOOD.

CONCESSION T-SHIRTS & HOODIES

CONSULTING SERVICES

COSTUMER

DIRECTOR

DONATIONS

DUES & SUBSCRIPTIONS

ENTERTAINMENT

FILM RENTAL

FIREWOOD

HOUSE MANAGER

INSURANCE

INSURANCE REFUND

L E G A L & A C C O U N T I N G FEES

LIGHTING

L O A D IN

LOAD OUT

MARKETING

MASTER CARPENTER

MISCELLANEOUS

M P C S T U D E N T R E G FEES

OFFICE SUPPLIES

OTHER ADIMINISTRATION

PAYROLL EXPENSES

POSTAGE

PRINTING

PRODUCTION EXPENSES

PROPS MASTER

RENT

RIGHTS & ROYALTIES

SET C O N S T R U C T I O N

SET D E S I G N E R

SET M A T E R I A L S

STAGE M A N A G E R

T A X E S & FEES

TRANSPORTATION

UTILITIES

WEB PROMOTIONS

WEBSITE PROMOTION

Total $

2,016.

1,964.

550.

4,050.

3,598.

1,674.

300.

2,000.

4,500.

926.

1,264.

905.

271.

50.

2,100.

2,116.

-875.

2,450.

3,050.

881.

1,576.

18,962.

2,000.

617.

936.

2,266.

964.

844.

316.

1,812.

11,561.

1,500.

2,333.

560.

9,711.

2,000.

1,178.

2,000.

11,130.

88.

1,906.

500.

1,200.

109,750.

Form

8868

Application for Extension of Time To File an

Exempt Organization Return

(Rev January 2011)

Department of the Treasury

Internal Revenue Service

OMB No. 1545-1709

^ File a separate application for each return.

If you are filing for an Automatic 3-IVlonth Extension, complete only Part I and check this box.

If you are filing for an Additional (Not Automatic) 3-IVIonth Extension, complete only Part II (on page 2 of this form).

Do not complete PartII unlessyou have already been granted an automatic 3-month extension on a previously filed Form 8868.

Electronic filing (e-file). You can electronically file Form 8868 if you need a 3-month automatic extension of time to file (6 months for a

corporation required to file Form 990-T), or an additional (not automatic) 3-month extension of time. You can electronically file Form 8868 to

request an extension of time to file any of the forms listed in Part I or Part II with the exception of Form 8870, Information Return for Transfers

Associated With Certain Personal Benefit Contracts, which must be sent to the IRS in paper format (see instructions). For more details on the

electronic filing of this form, visit www.irs.gov/efile and click on e-file for Charities & Nonprofits.

Part 1 I Automatic 3-IVIonth Extension of Time. Only submit original (no copies needed).

A corporation required to file Form 990-T and requesting an automatic 6-month extension - check this box and complete Part I only

All other corporations (Including 1120-C filers), partnerships, REMICS, and trusts must use Form 7004 to request an extension of time to file

income tax returns.

Type or

print

File by the

due date for

filing your

return. See

instructions.

Name of exempt organization

Employer Identification number

Forest Theatre Guild, Inc.

23-7227328

Number, street, and room or suite number. If a P.O. box, see Instructions.

P . O . B o x 2325

city, town or post office, state, and ZIP code. For a foreign address, see instructions.

C a m e l , CA 93921

Enter the Return code for the return that this application is for (file a separate application for each return)

[W

Application

Is For

Return

Code

Return

Code

Application

Is For

Form 990

01

Form 990-T (corporation)

Form 990-BL

07

02

Form 1041-A

Form 990-EZ

Form 990-PF

08

03

Form 4720

09

04

Form 5227

Form 990-T (section 401(a) or 408(a) trust)

05

Form 6069

Form 990-T (trust other than above)

10

11

06

Form 8870

12

The books are in the care of..

J^ebecca

Jiarrymor^

Telephone No., " " j j l - j ^ e - j e s i

FAX No. ' _ 8 3 1 - _ 6 2 6 - _ 0 7 7 2

If the organization does not have an office or place of business in the United States, check this box.

If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN)

If this is for the whole group.

check this box. . [ ] . If it is for part of the group, check this box.

Q and attach a list with the names and EINs of all members

^the extension is for.

1

I request an automatic 3-month (6 months for a corporation required to file Form 990-T) extension of time

until _ 8 / l _ 5

, 2 0 _ 1 1 _ , to file the exempt organization return for the organization named above.

The extension is for the organization's return for:

X calendar year 20 1 0

tax year beginning

or

,20

, and ending

If the tax year entered in line 1 is for less than 12 months, check reason:

I Change in accounting period

,20

Q Initial return

Final return

3a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any

nonrefundable credits. See instructions

^

b If this application is for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax

payments made. Include any prior year overpayment allowed as a credit

i l l ^ n c e due. Subtract line 3b from line 3a. Include your payment with this form, if required, by using

EFTPS (Electronic Federal Tax Payment System). See insti^uctions

,

S e n t

ins^t?uctlons'"^

3a

0.

3b

0.

0.

electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO for

BAA For Paperwork Reduction Act Notice, see Instructions.

Form 8868 (Rev. 1-2011)

FIFZ0501L

11/15/10

Page 2

Form 8868 (Rev 1-2011)

If you are filing for an Additional (Not Automatic) 3-IVIonth Extension, complete only Part II and check this box

Note. Only complete Part II if you have already been granted an automatic 3-month extension on a previously filed Form 8868.

If you are filing for an Automatic 3-IVIonth Extension, comolete onlv Part I (on oaae 1).

Type or

print

Number, street, and room or suite number. If a P.O. box, see instructions.

File by the

extended

due date for

filing the

return. See

instructions.

J . Daniel Clarke

280 Reeside A v e .

City, town or post office, state, and ZiP code. For a foreign address, see instructions.

M o n t e r e y , CA 93940

Enter the Return code for the return that this application is for (file a separate application for each return)

Application

Is For

Return

Code

03

Application

Is For

Return

Code

Form 990

01

Form 990-BL

02

Form 1041 -A

08

Form 990-EZ

03

Form 4720

09

Form 990-PF

04

Form 5227

Form 990-T (section 401 (a) or 408(a) trust)

10

05

Form 6069

11

-V

Form 990-T (trust other than above)

06

Form 8870

STOP! Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed Form 8868,

The books are in care of. ^ J ^ e b ^ c a

12

_Barr3Tno^_

Telephone No. " - J 3 1 - _ 6 2 6 - _ 1 6 8 1

FAX No. - _ 8 3 1 - _ 6 2 6-_07 7 2

If the organization does not have an office or place of business in the United States, check this box.

If this is for a Group Return, e n ^ the organization's four digit Group Exemption Number (GEN),

whole group, check this box . . .

. If it is for part of the group, check this box ..

If this is for the

and attach a list with the names and EINs of all

members the extension is for.

I request an additional 3-month extension of time until _11/1_5

, 20 _ 1 1 .

For calendar year _201C^ , or other tax year beginning

,20

If the tax year entered in line 5 is for less than 12 months, check reason:

_ , and ending

, 20

Final return

Initial return

Change in accounting period

State in detail why you need the extension.. _ J ' a j ^ y e : ^

resj)ec1^fui:i^_regue^ts_^di^

^.ther_ijifomatipn_i^ces_sa^ to _f ile_ a_cpmlete _and .accurate

return.

8a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any

nonrefundable credits. See instructions

8a S

b If this application is for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax

pa^:|ments made. Include any prior year overpayment allowed as a credit and any amount paid previously

Subtract line 8b from line 8a. Include your payment with this form, if required, by usinq

EFTPS (Electronic Federal Tax Payment System). See instructions

8b

8c

accompanying schedules and statements, and to the best of my knowledge and belief, it is true.

Signature

BAA

Titie

Date

FiFZ0502L

11/15/10

Form 8868 (Rev 1-2011)

You might also like

- West Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Document39 pagesWest Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Peter M. HeimlichNo ratings yet

- FTG Irs Form 990-Ez 2008Document12 pagesFTG Irs Form 990-Ez 2008L. A. PatersonNo ratings yet

- Justice 990 2009Document12 pagesJustice 990 2009TheSceneOfTheCrimeNo ratings yet

- Short Form - EZ Return of Organization Exempt From Income TaxDocument6 pagesShort Form - EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrime100% (1)

- katrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZDocument13 pageskatrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZuncleadolphNo ratings yet

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterNo ratings yet

- Irs 990-Ez 2007Document3 pagesIrs 990-Ez 2007api-18678301No ratings yet

- DT 2007 990Document34 pagesDT 2007 990shimeralumNo ratings yet

- Short Form .EZ Return of Organization Exempt From Income Tax 2012Document9 pagesShort Form .EZ Return of Organization Exempt From Income Tax 2012FIXMYLOANNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1No ratings yet

- Institute For Liberty 202641983 2008 076b44aeDocument4 pagesInstitute For Liberty 202641983 2008 076b44aecmf8926No ratings yet

- Threshold Foundation 2007 990Document28 pagesThreshold Foundation 2007 990TheSceneOfTheCrimeNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Document3 pagesShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodieNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- Threshold Foundation 2006 990Document29 pagesThreshold Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Return of Organization Exempt From Income Tax: HE Heartland Institute) 03 (312) 377-4000Document20 pagesReturn of Organization Exempt From Income Tax: HE Heartland Institute) 03 (312) 377-4000shimeralumNo ratings yet

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimeNo ratings yet

- Return of Organization Exempt From Income TaxDocument11 pagesReturn of Organization Exempt From Income TaxEnvironmental Working GroupNo ratings yet

- Tides Foundation 2006 990Document82 pagesTides Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Stanford 990Document208 pagesStanford 990coo9486No ratings yet

- Form 990-EZ: Short Form Return of Organization Exempt From Income TaxDocument8 pagesForm 990-EZ: Short Form Return of Organization Exempt From Income TaxJakara MovementNo ratings yet

- Short Form Form 990-EZ Return of Organization Exempt From Income TaxDocument9 pagesShort Form Form 990-EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrimeNo ratings yet

- NCJC 561348186 - 200712 - 990Document28 pagesNCJC 561348186 - 200712 - 990A.P. DillonNo ratings yet

- Tides Foundation 2008 990Document163 pagesTides Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- Return of Organization Exempt From Income TaxDocument19 pagesReturn of Organization Exempt From Income TaxshimeralumNo ratings yet

- Big 12 990 Report: Fiscal Year 2009Document45 pagesBig 12 990 Report: Fiscal Year 2009HuskieWireNo ratings yet

- KCSPCA/FSAC 2010 IRS Form 990Document28 pagesKCSPCA/FSAC 2010 IRS Form 990Tacia McIlvaineNo ratings yet

- Return of Organization Exempt From Income TaxDocument30 pagesReturn of Organization Exempt From Income TaxshimeralumNo ratings yet

- NCCF 990Document235 pagesNCCF 990Anita LiNo ratings yet

- PDC - 2009 Tax ReturnDocument19 pagesPDC - 2009 Tax ReturnNC Policy WatchNo ratings yet

- Return of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustDocument15 pagesReturn of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustalavifoundationNo ratings yet

- Z Smith Reynolds 586038145 - 200612 - 990PFDocument61 pagesZ Smith Reynolds 586038145 - 200612 - 990PFA.P. DillonNo ratings yet

- Wep 990 2006 581518182 - 200606 - 990Document34 pagesWep 990 2006 581518182 - 200606 - 990A.P. DillonNo ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- 2009 561750279 05ba1360 9Document31 pages2009 561750279 05ba1360 9Fecund StenchNo ratings yet

- LJ LJ: Return of Organization Exempt From Income TaxDocument20 pagesLJ LJ: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Lifeline Humanitarian Organization of Chicago - 2011 Form 990Document24 pagesLifeline Humanitarian Organization of Chicago - 2011 Form 990trb216No ratings yet

- Received: Return of Organization Exempt From Income TaxDocument16 pagesReceived: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- GPTMC - 2011 990Document47 pagesGPTMC - 2011 990juliabergNo ratings yet

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926No ratings yet

- Claude R. Lambe Charitable Foundation 2002Document17 pagesClaude R. Lambe Charitable Foundation 2002cmf8926No ratings yet

- Silicon Valley Community Foundation 2008 990Document481 pagesSilicon Valley Community Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- Farview Foundation 2006 990Document30 pagesFarview Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Olive Branch Foundation 2006 990Document28 pagesOlive Branch Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Farview Foundation 2008 990Document38 pagesFarview Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- ExxonMobil Foundation 2005 990PFDocument174 pagesExxonMobil Foundation 2005 990PFJustin ElliottNo ratings yet

- FTG Irs Form 990 2005Document17 pagesFTG Irs Form 990 2005L. A. PatersonNo ratings yet

- Olive Branch Foundation 2005 990Document21 pagesOlive Branch Foundation 2005 990TheSceneOfTheCrimeNo ratings yet

- FreedomWorks Foundation 521526916 2006 0317E2DASearchableDocument25 pagesFreedomWorks Foundation 521526916 2006 0317E2DASearchablecmf8926No ratings yet

- Form 990-P F: Return of Private FoundationDocument26 pagesForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesNo ratings yet

- Big 12 990 Report: Fiscal Year 2008Document35 pagesBig 12 990 Report: Fiscal Year 2008HuskieWireNo ratings yet

- 2016 OVF 990EZ With SchedulesDocument7 pages2016 OVF 990EZ With SchedulesDaniel R. Gaita, MA, LMSWNo ratings yet

- Urban Alchemy 2020 990Document28 pagesUrban Alchemy 2020 990auweia1No ratings yet

- Return of Organization Exempt From Income TaxDocument30 pagesReturn of Organization Exempt From Income TaxChad BrewbakerNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- MPRWA Agenda Closed Session 10-25-18Document1 pageMPRWA Agenda Closed Session 10-25-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument30 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Minutes Mprwa September 27, 2018Document2 pagesMinutes Mprwa September 27, 2018L. A. PatersonNo ratings yet

- MPRWA Agenda Packet 10-25-18Document6 pagesMPRWA Agenda Packet 10-25-18L. A. PatersonNo ratings yet

- Monthly Reports August 10-02-18Document48 pagesMonthly Reports August 10-02-18L. A. PatersonNo ratings yet

- Special Meeting Minutes October 1, 2018 11-05-18Document1 pageSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument7 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City Council Agenda 10-02-18Document3 pagesCity Council Agenda 10-02-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Financial Assets ReviewDocument3 pagesFinancial Assets ReviewJobelle Candace Flores AbreraNo ratings yet

- Renewable Energy. Wind Resource AssessmentDocument21 pagesRenewable Energy. Wind Resource AssessmentMathias MichaelNo ratings yet

- Cognos LearningDocument12 pagesCognos LearningsygladiatorNo ratings yet

- Amount of Net Taxable Income Rate Over But Not OverDocument1 pageAmount of Net Taxable Income Rate Over But Not OverDennah Faye SabellinaNo ratings yet

- Invitation Letter - Detecting Fraud - MisrepresentationsDocument1 pageInvitation Letter - Detecting Fraud - MisrepresentationsANgel Go CasañaNo ratings yet

- Account Payable ManualDocument57 pagesAccount Payable ManualfaizfaizNo ratings yet

- Tax Invoice: Corporate InformationDocument2 pagesTax Invoice: Corporate InformationPritish JhaNo ratings yet

- Estimates of District / Taluk Domestic Product and Its UseDocument44 pagesEstimates of District / Taluk Domestic Product and Its UsearnabnitwNo ratings yet

- Anta Tirta Kirana 1Document1 pageAnta Tirta Kirana 1yosi widianaNo ratings yet

- Leaflet Lokotrack - st4.8 Product - Spread 4524 12 21 en Agg HiresDocument2 pagesLeaflet Lokotrack - st4.8 Product - Spread 4524 12 21 en Agg Hiresjadan tupuaNo ratings yet

- An Economic Interpretation of The American RevolutionDocument31 pagesAn Economic Interpretation of The American RevolutionShiva GuptaNo ratings yet

- RM CasesDocument17 pagesRM CasesAman Lalit Saini (PGDM 17-19)No ratings yet

- IOCL Oct-22 GPTDocument1 pageIOCL Oct-22 GPTV.S.SharmaNo ratings yet

- Supplement S5: Facility Location ModelsDocument26 pagesSupplement S5: Facility Location ModelsVasu SehgalNo ratings yet

- JMR PH 3Document1 pageJMR PH 3kuldeep singh rathoreNo ratings yet

- CS Harley - May 2013Document16 pagesCS Harley - May 2013Neil CalvinNo ratings yet

- Reaction PaperDocument13 pagesReaction PaperPhilip CastroNo ratings yet

- Fibonacci Trading (PDFDrive)Document148 pagesFibonacci Trading (PDFDrive)ARK WOODYNo ratings yet

- Trainers Manual For Sustainable Cocoa GhanaDocument199 pagesTrainers Manual For Sustainable Cocoa GhanaKookoase Krakye100% (1)

- On Beauty 1 The SalonDocument3 pagesOn Beauty 1 The Salonalessandra LugliNo ratings yet

- Familydollar3yearstrategypptx 12731875821359 Phpapp02Document50 pagesFamilydollar3yearstrategypptx 12731875821359 Phpapp02Rhenno LedhuardoNo ratings yet

- New Partner Admission DeedDocument5 pagesNew Partner Admission DeedKushwanth Soft SolutionsNo ratings yet

- Ae (C)Document1 pageAe (C)Akesh LimNo ratings yet

- OSCM-IKEA Case Kel - 1 UpdateDocument29 pagesOSCM-IKEA Case Kel - 1 UpdateOde Majid Al IdrusNo ratings yet

- Social Innovation Camp - A Toolkit For TroublemakersDocument26 pagesSocial Innovation Camp - A Toolkit For TroublemakersUNDP in Europe and Central Asia100% (1)

- Exploring Succession Planning in Small, Growing FirmsDocument18 pagesExploring Succession Planning in Small, Growing FirmstalalarayaratamaraNo ratings yet

- 1930's Technocracy Movement Howard Scott and LaroucheDocument40 pages1930's Technocracy Movement Howard Scott and Larouchejasper_gregoryNo ratings yet

- TI Cycles Project ReportDocument4 pagesTI Cycles Project ReportGaneshNo ratings yet

- John Carroll University Magazine Fall 2009Document84 pagesJohn Carroll University Magazine Fall 2009johncarrolluniversity100% (1)

- Skylark Skygondola PresentationDocument87 pagesSkylark Skygondola PresentationrohanbagadiyaNo ratings yet