Professional Documents

Culture Documents

FTG RRF 2012

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG RRF 2012

Uploaded by

L. A. PatersonCopyright:

Available Formats

1012.

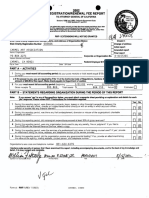

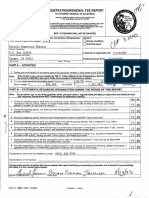

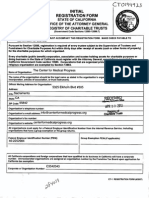

ANNUAL

REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

IN

MAIL TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

Sections 12586 and 12587, California Government Code

11 Cal. Code Regs. sections 301-307, 311 and 312

Failure to submit this report annually no later than four months and fifteen days after the

end of the organization's accounting period may result in the loss of tax exemption and

the assessment of a minimum tax of $800, plus interest, and/or fines or filing penalties as

defined in Government Code Section 12586.1. IRS extensions will be honored.

WEBSITE ADDRESS:

http:llag.ca.govlcharitiesl

MAY 2 l 2013

Check if:

State Charity Registration Number 3 6 4 9 9

~~~----------------------

FOREST THEATRE GUILD,

INC.

0 Change of address

R~istrvof

0 Amended report

Charit9bleI rusts

Name of Organization

p. 0. BOX 2 3 2 5

~A~d~dr~es~s~(N~u~m~be~r-an=d~S~tr~ee~t)----------------------------------------~

Corporate or Organization No. D- 0 2 4 4 7 2 0

~~~~~~--------__,

~-;C:::.A.::RMc.:::,;.:E=.::L::..~,~C=.::Ac.:.......:9::..;3=..9::..;2=-1=------------,,.,....,-........,=-:::--:-------l Federal Employer ID No. ..::2..::3_-....:.7..::2..::2:....;7...::3..::2:....:8'----------t

City or Town

State

ZIP Code

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections 301-307,311 and 312)

Make Check Payable to Attorney General's Registry of Charitable Trusts

Gross Annual Revenue

Fee

Less than $25,000

Between $25,000 and $100,000

0

$25

Fee

Gross Annual Revenue

Between $100,001 and $250,000

Between $250,001 and $1 million

_w_

$75

Gross Annual Revenue

Fee

Between $1 ,000,001 and $1 0 million

Between $10,000,001 and $50 million

Greater than $50 million

$150

$225

$300

PART A- ACTIVITIES

For your most recent full accounting period (beginning

Gross annual revenue

114 8 8 7

1 I 01 I 12

Total assets

ending

12 1 31 I 12

-11

) list:

949

------------~~~~~

PART B- STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

If you answer 'yes' to any of the questions below, you must attach a separate sheet providing an explanation and details for each

'yes' response. Please review RRF-1 instructions for information required.

During this reporting period, were there any contracts, loans, leases or other financial transactions between the

organization and any officer, director or trustee thereof either directly or with an entity in which any such officer,

director or trustee had any financial interest?

2

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable

roper\ or funds?

During this reporting period, did non-program expenditures exceed 50% of gross revenues?

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you filed a

Form 4720 with the Internal Revenue Service, attach a copy.

During this reporting period, were the services of a commercial fundraiser or fundraising counsel for charitable

purposes used? If 'yes,' provide an attachment listing the name, address, and telephone number of the service

provider.

During this reporting period, did the organization receive any governmental funding? If so, provide an attachment listing

the name of the a enc , mailin address, contact erson, and tele hone number.

During this reporting period, did the organization hold a raffle for charitable purposes? If 'yes,' provide an attachment

indicatin the number of raffles and the date s the occurred.

Does the organization conduct a vehicle donation program? If 'yes,' provide an attachment indicating whether

the program is operated by the charity or whether the organization contracts with a commercial fund raiser for

charitable purposes.

Yes

No

9

Organization's area code and telephone number 831-626-1681

~~~~~~~----------------------------------------------~

Organization's e-mail address

CAVA9801L 01/25113

RRF-1 (3-05)

291'171

..; sso

You might also like

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonNo ratings yet

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonNo ratings yet

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonNo ratings yet

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonNo ratings yet

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNo ratings yet

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonNo ratings yet

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonNo ratings yet

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonNo ratings yet

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonNo ratings yet

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonNo ratings yet

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonNo ratings yet

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonNo ratings yet

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonNo ratings yet

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonNo ratings yet

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- FTG RRF 2013Document1 pageFTG RRF 2013L. A. PatersonNo ratings yet

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonNo ratings yet

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonNo ratings yet

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonNo ratings yet

- CA Charity Annual Report FormDocument1 pageCA Charity Annual Report FormagbufzbfNo ratings yet

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonNo ratings yet

- FTG RRF 2000Document1 pageFTG RRF 2000L. A. PatersonNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationNo ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- Public Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pagePublic Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaWAKESHEEP Marie RNNo ratings yet

- Pa Rev-72Document12 pagesPa Rev-72Nick Rosati0% (1)

- Period Covered Filing DeadlineDocument10 pagesPeriod Covered Filing DeadlineHaftari HarmiNo ratings yet

- Ag990 AnnualreportDocument2 pagesAg990 AnnualreportDaniel_Johnson_1322No ratings yet

- rrf1 FormDocument5 pagesrrf1 Formsalman_fbNo ratings yet

- CWCS AG RegistrationDocument2 pagesCWCS AG RegistrationWilliamsburg GreenpointNo ratings yet

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiNo ratings yet

- Oakland Community Land Trust - Founding Documents 1999Document75 pagesOakland Community Land Trust - Founding Documents 1999auweia1No ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- Form CRI 200 Short Form Registration Verification Statement PDFDocument5 pagesForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyNo ratings yet

- Blank 4506TDocument2 pagesBlank 4506TRoger PeiNo ratings yet

- IRS Form 4506-TDocument2 pagesIRS Form 4506-TJulie Payne-King100% (2)

- A16 Servicing HelloGoodbye LetterDocument2 pagesA16 Servicing HelloGoodbye LetterRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returndavis_dion22No ratings yet

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (5)

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Document5 pagesMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Adopting City Council Meeting Dates For 2019 12-03-18Document3 pagesAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNo ratings yet

- Holiday Closure 12-03-18Document3 pagesHoliday Closure 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Minutes 12-03-18Document7 pagesMinutes 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Mprwa Minutes April 26, 2016Document2 pagesMprwa Minutes April 26, 2016L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- Mprwa Minutes October 25, 2018Document2 pagesMprwa Minutes October 25, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- MadRiverUnion 10 18 17editionDocument12 pagesMadRiverUnion 10 18 17editionMad River UnionNo ratings yet

- Topic Not For Profit Marketing: Name: Reg. NoDocument28 pagesTopic Not For Profit Marketing: Name: Reg. Nopentagon 5No ratings yet

- January 2020 AA2 QuestionsDocument8 pagesJanuary 2020 AA2 QuestionsSarah RanduNo ratings yet

- Building Third Sector Capacity-Encouraging Surer Funding and Asset TransferDocument25 pagesBuilding Third Sector Capacity-Encouraging Surer Funding and Asset TransferImprovingSupportNo ratings yet

- 2023 UHS MDCAT Vocab 843 Words by SLMN GrammarDocument79 pages2023 UHS MDCAT Vocab 843 Words by SLMN Grammarjamil ahmedNo ratings yet

- FMT Issue 16Document84 pagesFMT Issue 16MarianoRomero100% (1)

- Corporate Social Responsibility Practices in IndiaDocument22 pagesCorporate Social Responsibility Practices in IndiaApratim Bhaskar100% (1)

- My Education ResumeDocument1 pageMy Education ResumeDanica JacobssonNo ratings yet

- BLMOD TYPES and COMPATIBILITYDocument3 pagesBLMOD TYPES and COMPATIBILITYBiswaroopBiswasNo ratings yet

- Monte de Piedad Earthquake Relief Funds DisputeDocument11 pagesMonte de Piedad Earthquake Relief Funds DisputeLeomar Despi LadongaNo ratings yet

- 2013 Miss Achievement Scholarship CompetitionDocument9 pages2013 Miss Achievement Scholarship CompetitionSarah WilliamsNo ratings yet

- FV Sample ProposalsDocument90 pagesFV Sample ProposalsShalom ArayaNo ratings yet

- TAC BylawsDocument16 pagesTAC BylawsJacob BargerNo ratings yet

- Brigada Eskwela Letter DonationsDocument2 pagesBrigada Eskwela Letter DonationsTeacher Ella EngliseraNo ratings yet

- Mother Teresa BiographyDocument6 pagesMother Teresa BiographySocial SinghNo ratings yet

- ResumeDocument2 pagesResumeapi-374835380No ratings yet

- Merrynel - Quipanes. Succession Ass.Document3 pagesMerrynel - Quipanes. Succession Ass.Zjai SimsNo ratings yet

- Ramadhan Timetable 2013 (1433H)Document2 pagesRamadhan Timetable 2013 (1433H)Ben Sellam OmarNo ratings yet

- Google Ad Grants - Free Google Ads For NonprofitsDocument5 pagesGoogle Ad Grants - Free Google Ads For NonprofitsshireenNo ratings yet

- Demonstrating Ethical Behavior and Social ResponsibilityDocument10 pagesDemonstrating Ethical Behavior and Social ResponsibilityNusrat Azim BorshaNo ratings yet

- Donors TaxDocument3 pagesDonors TaxKC MendozaNo ratings yet

- Highway Vernon Ha K: State BoardDocument12 pagesHighway Vernon Ha K: State BoardcerhsNo ratings yet

- Fundraising Letter CampaignDocument2 pagesFundraising Letter Campaignapi-83415991No ratings yet

- Henry DunantDocument25 pagesHenry DunantJames Jackson WongNo ratings yet

- Fundraising Strategy Guide for Small NGOsDocument11 pagesFundraising Strategy Guide for Small NGOsDaniel100% (1)

- Reflections: 50 Glorious Years of Service To HumanityDocument86 pagesReflections: 50 Glorious Years of Service To HumanityCj Singh100% (1)

- CatHouse NewsSpring15Document8 pagesCatHouse NewsSpring15Anupam DasNo ratings yet

- Go Lackawanna 04-22-2012Document48 pagesGo Lackawanna 04-22-2012The Times LeaderNo ratings yet

- ICICIDocument2 pagesICICIs1v2000No ratings yet