Professional Documents

Culture Documents

FTG RRF 2013

Uploaded by

L. A. PatersonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG RRF 2013

Uploaded by

L. A. PatersonCopyright:

Available Formats

IN:

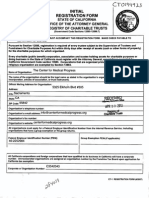

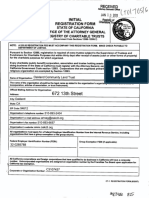

ANNUAL

REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

'MAIL Tm

Registry of Charitable Trusts

P .0. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

Sections 12586 and 12587, California Government Code

11 Cal. Code Regs. sections 301-307, 311 and 312

Failuro to oubmlt tblo rctport aQpually no Later tha11 foou mantb11 and fifteen days alter tbct

end ol tbe orgalllzatlop's ~~ountlng ponod may 111ot1lt LA tbolo .. ol tax exempUob and

lhct a.. eument ot a miAimum tax ol $800. ph11 iRtonot, and/ot finn or lilln g pnaJUes

dctlinod tn GovemmeRt Codo S.~tloo 12586.1. IRS utenslo11 Will bo bonorod.

WEBSITE ADDRESS:

http://ag.ca.gov/charities/

~IE,(Cfk,

State Charity Registration Number 3 6 4 9 9

FOREST THEATRE GUILD, INC

Check if:

~eoo~cWoc DChange of address

DAmended report

Name of Organization

J-F.~;.;::::=.I---=C:::.A.:.......:9:...3=-.::.9.::2.=1:__ _ _ _ _ _ _ _=-=-=.,..-,,....-------I Federal Employer ID No. ..;;;2-"3'---7_2:::....::.2_7-=3-"2'-8'----------1

Slate

ZIP Code

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections 301-307, 311 and 312)

Make Check Payable to Attorney General's Registry ol Charitable Trusts

Gross Annual Revenue

Fee

Less than $25,000

Between $25,000 and $100,000

0

$25

Gross Annual Revenue

Fee

Between $100,001 and $250,000

Between $250,001 and $1 million

$50

$75

Gross Annual Revenue

Fee

Between $1,000,001 and $10 million

Between $10,000,001 and $50 million

Greater than $50 million

$150

$225

$300

PART A - ACTIVITIES

For your most recent full accounting period (beginning

Gross annual revenue

1/01/13

$ _ _ _ _ _ _. .:1:.. :1=..0::.. .t. .,. .:9;..::1::..;0:::.. :. . .

Total assets

ending

12/31/13

--=:::c!....::....::::.!.....::.:..::....-

)list:

$ _______.;:;.1..:...7..L....;;9'-6~3-'-.

PART 8- STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

If you answer 'yes' to any of the questions below, you must attach a separate sheet providing an explanation and details for each

'yes response. Please review RRF-1 instructions for information required.

Durin~

this reporting period, were there any contracts, loans, leases or other financial transactions between the

organtzation and any officer, director or trustee thereof either directly or with an entity in which any such officer,

director or trustee had any financial interest?

2

Yes

No

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable

ro ert or tunds?

During this reporting period, did non-program expenditures exceed 50% of gross revenues?

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you filed a

Form 4720 with thelnternal Revenue Service, attach a copy.

During this reporting period, were the services of a commercial fundraiser or fundraising counsel for charitable

purposes used? If 'yes,' provide an attachment listing the name, address, and telephone number of the service

provider.

During this reporting period, did the organization receive any governmental funding? If so, provtde an attachment listing

the name of the a enc , mailin address, contact erson, and tele hone number.

During this reporting period, did the organization hold a raffle for charitable purposes? If 'yes,' provide an attachment

indicatin the number of raHies and the date s the occurred.

Does the organization conduct a vehicle donation program? If 'yes,' provide an attachment indicating whether

the program is operated by the charity or whether the organization contracts with a commercial fundraiser for

charitable purposes.

OrgantzattOn's email address

I declare under penal of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge

and belief, it is true o ct and complete.

l~o'("o_. Gee.

CAVA9801L

\rec.cS~J re.<

01121114

RRF-1 (3-05)

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonNo ratings yet

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonNo ratings yet

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonNo ratings yet

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonNo ratings yet

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonNo ratings yet

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonNo ratings yet

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonNo ratings yet

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonNo ratings yet

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNo ratings yet

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonNo ratings yet

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonNo ratings yet

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonNo ratings yet

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonNo ratings yet

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonNo ratings yet

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNo ratings yet

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonNo ratings yet

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonNo ratings yet

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonNo ratings yet

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonNo ratings yet

- Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageAnnual Registration Renewal Fee Report To Attorney General of CaliforniaagbufzbfNo ratings yet

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonNo ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNo ratings yet

- FTG RRF 2000Document1 pageFTG RRF 2000L. A. PatersonNo ratings yet

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNo ratings yet

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- Donor's TaxDocument8 pagesDonor's TaxRenalyn GardeNo ratings yet

- '!'iiltio T!LB Ard: IffundedDocument3 pages'!'iiltio T!LB Ard: IffundedEmily GloverNo ratings yet

- Oakland Community Land Trust - Founding Documents 1999Document75 pagesOakland Community Land Trust - Founding Documents 1999auweia1No ratings yet

- BIR - DONOR'S TaxDocument5 pagesBIR - DONOR'S TaxKim EspinaNo ratings yet

- Filing of Confidential InformationDocument7 pagesFiling of Confidential InformationeunjijungNo ratings yet

- US Internal Revenue Service: p1546Document24 pagesUS Internal Revenue Service: p1546IRSNo ratings yet

- LTR Comm Empl Stop WithholdingDocument17 pagesLTR Comm Empl Stop WithholdingBar RiNo ratings yet

- Public Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pagePublic Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaWAKESHEEP Marie RNNo ratings yet

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachNo ratings yet

- Att 2106515418374 20140503Document4 pagesAtt 2106515418374 20140503Maria Gracia Pereda GinocchioNo ratings yet

- Demand Letter - Estafa JasserDocument2 pagesDemand Letter - Estafa JasserHenson Golocan94% (16)

- Ag990 AnnualreportDocument2 pagesAg990 AnnualreportDaniel_Johnson_1322No ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesfatmaaleahNo ratings yet

- rrf1 FormDocument5 pagesrrf1 Formsalman_fbNo ratings yet

- View Report PDFDocument15 pagesView Report PDFRecordTrac - City of OaklandNo ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Debt Validation Letter TemplateDocument3 pagesDebt Validation Letter TemplateGreg Wilder100% (1)

- IRS Filing Against ObamaDocument3 pagesIRS Filing Against ObamaTheWhiteHats100% (4)

- CDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Document27 pagesCDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Peter M. HeimlichNo ratings yet

- CWCS AG RegistrationDocument2 pagesCWCS AG RegistrationWilliamsburg GreenpointNo ratings yet

- Transfer Taxes: Donor'S TaxDocument8 pagesTransfer Taxes: Donor'S TaxracrabeNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- Adopting City Council Meeting Dates For 2019 12-03-18Document3 pagesAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Holiday Closure 12-03-18Document3 pagesHoliday Closure 12-03-18L. A. PatersonNo ratings yet

- Minutes 12-03-18Document7 pagesMinutes 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Document5 pagesMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- Mprwa Minutes October 25, 2018Document2 pagesMprwa Minutes October 25, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- Mprwa Minutes April 26, 2016Document2 pagesMprwa Minutes April 26, 2016L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- SwiggyDocument9 pagesSwiggyEsha PandyaNo ratings yet

- Diskusi 3. D1-Anissa Asyahra-20.05.51.0253-Manajemen Keuangan 2Document8 pagesDiskusi 3. D1-Anissa Asyahra-20.05.51.0253-Manajemen Keuangan 2Anissa AsyahraNo ratings yet

- Masters VlerickDocument16 pagesMasters VlerickAndree MaldonadoNo ratings yet

- Catalog: Welcome To Marketplace Books..Document32 pagesCatalog: Welcome To Marketplace Books..prashantNo ratings yet

- Reading List First Semester 2017-2018Document15 pagesReading List First Semester 2017-2018NajjaSheriff007No ratings yet

- Fundamental RulesDocument41 pagesFundamental RulesSrikanth KovurNo ratings yet

- The Basic Tools of FinanceDocument25 pagesThe Basic Tools of FinanceVivek KediaNo ratings yet

- The Sumerian SwindleDocument447 pagesThe Sumerian SwindleqwzrtzNo ratings yet

- Pre Course Assignment Jan 2014Document80 pagesPre Course Assignment Jan 2014K D100% (2)

- Portfolio Strategy Asia Pacific: The Goldman Sachs Group, IncDocument20 pagesPortfolio Strategy Asia Pacific: The Goldman Sachs Group, IncNivasNo ratings yet

- Consignment Class WorkDocument4 pagesConsignment Class WorkHarsh GossainNo ratings yet

- 9 CNG Cost Components PDFDocument9 pages9 CNG Cost Components PDFReno SaibihNo ratings yet

- Aml Case StdyDocument5 pagesAml Case Stdyammi25100% (2)

- How To Get Rich (Without Getting Lucky)Document36 pagesHow To Get Rich (Without Getting Lucky)Maxim Averin100% (3)

- Day 1 PM - SEC Rules Updates and Common SEC Findings PDFDocument144 pagesDay 1 PM - SEC Rules Updates and Common SEC Findings PDFNelson GarciaNo ratings yet

- Zach DeGregorio Civil Complaint Filed 01-03-2022Document261 pagesZach DeGregorio Civil Complaint Filed 01-03-2022DamienWillisNo ratings yet

- Rosenthal CoverLetter2 BlackRock Feb2021Document1 pageRosenthal CoverLetter2 BlackRock Feb2021Mitchell RosenthalNo ratings yet

- Running Head: The Valuation of Wal-Mart 1Document9 pagesRunning Head: The Valuation of Wal-Mart 1cdranuragNo ratings yet

- The Red-Bearded BaronDocument6 pagesThe Red-Bearded BaronSarith Sagar100% (2)

- Feasibility of Implementation of Right To Education Act - Pankaj Jain, Ravindra DholakiaDocument6 pagesFeasibility of Implementation of Right To Education Act - Pankaj Jain, Ravindra Dholakiachittaranjan.kaul6122No ratings yet

- UntitledDocument108 pagesUntitledapi-178888035No ratings yet

- Team Energy Vs CirDocument1 pageTeam Energy Vs CirHarold EstacioNo ratings yet

- Chapter 8Document8 pagesChapter 8Kurt dela Torre100% (1)

- UntitledDocument19 pagesUntitledAditya Anand 60No ratings yet

- Test 2Document1 pageTest 2Jo JoyNo ratings yet

- Project EXIDEDocument52 pagesProject EXIDErasiljohnson100% (1)

- 1 - IjarahDocument31 pages1 - IjarahAlishba KaiserNo ratings yet

- Investment Principles and Checklists OrdwayDocument149 pagesInvestment Principles and Checklists Ordwayevolve_us100% (2)

- Accenture V Commission G.R. 190102 (Digest)Document3 pagesAccenture V Commission G.R. 190102 (Digest)mercy rodriguezNo ratings yet

- GWERU RESIDENTS AND RATESPAYERS ASSOCIATION - AmendedDocument16 pagesGWERU RESIDENTS AND RATESPAYERS ASSOCIATION - AmendedClive MakumbeNo ratings yet