Professional Documents

Culture Documents

View Attachment

Uploaded by

Alvin NgOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

View Attachment

Uploaded by

Alvin NgCopyright:

Available Formats

Locked Bag 7834 Canberra Bc, ACT 2610

Date of Issue

11 July 2016

Your Reference Number

CLK2SS054 J246403363002

305 269 740J

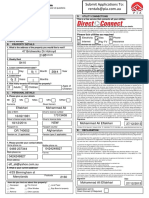

Post this form to:

PO Box 7800

Canberra Bc ACT 2610

Mr Alvin A Ng

3a Five Crown Gr

DONCASTER EAST VIC 3109

SS054.1412(Page 1 of 6 )

Renewing your

Health Care Card

Purpose of this form

The information asked for on this form will be used to decide if you are still eligible for a Health Care Card.

You can renew your Health Care Card online. Go to our websitehumanservices.gov.au/centrelink and select Customer online accounts.

Returning your form

Check that all required questions are answered and that the form is signed and dated.

If you are returning this form and any supporting documents, you need to do thiswithin 21 days so we can process your application or

claim. If you cannot do this within 21 days, contact us for extra time. If extra time is required, you must contact us at the earliest possible

date to make an arrangement.

You can return this form and/or any supporting documents:

online - submit your documents online. For more information about how to lodge documents online, go to

humanservices.gov.au/submitdocumentsonline

by post

in person - if you are unable to submit this form and any supporting documents online or by post, you can provide them in person

to one of our Service Centres.

Income limit

You will get a new Health Care Card if your (and your partners) income in the 8 weeks ending on

11 JULY 2016 is less than $ 4288.00.

Note: Your income limit may change if your personal circumstances have changed, for example, if you have become partnered

(married, registered partner or de facto of the opposite-sex or same-sex) since lodging your last claim.

If you do not complete this form and send it back you will not get a new Health Care Card.

If you are partnered, your partner must also answer the questions and sign the form.

1/1-1

Renewing your Health Care Card SS054.1412

(Page 2 of 6 )

Personal Details

1

Has your address changed from the above address?

No

Yes

What is your new address?

Postcode

Are you partnered?

No

Yes

Partners full name?

Do you have any dependent children?

No

Yes

Have the details you previously provided to the Australian Government Department

of Human Services about your dependent child(ren) changed in the last 8 weeks?

No

Full name

Please provide details below.

If there is not enough space, please attach a separate list.

Your dependent child

A full-time student

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

Are you or your children receiving an income tested Australian Government payment (other than Family Tax Benefit) or

have you claimed such a payment (eg. Youth Allowance, ABSTUDY, or a Service Pension)?

No

Yes

Yes

Name

Type of payment

Are you enrolled in, or do you intend to enrol in a course of secondary studies?

A secondary course is a course of study approved by the Department of Education. This usually means you are doing the equivalent of

full time year 10, 11 or 12 studies.

No

Yes

If yes, you will need to complete and attach a Study details form (Mod St)

if you have not already provided this to us. If you do not have this form, go to our website

humanservices.gov.au/forms

Income details

6

Self-employed

YOU

Are you (or your partner) self-employed

(such as a primary producer, sub-contractor,

or in your own business)?

No

Yes

No

Yes

If Yes, state net income from self-employment for the last

financial year.

If Yes, you must provide:

last available tax notice of assessment

last available tax return

evidence of current income from your business.

Net income means the amount left after business deductions

allowed under social security law, but before tax. Net income

must include amounts you paid into a personal

superannuation fund for which you can claim a tax deduction

on your individual tax return.

$

160713 BCH - 104801

YOUR PARTNER

BL- 2

Income details continued

7

Renewing your Health Care Card SS054.1412

(Page 3 of 6 )

Earned or received income

YOU

Did you (or your partner) earn or receive an income

from ANY source during the past 8 weeks?

No

Do NOT include any Parental Leave Pay, Dad and Partner

Pay or funding from the National Disability Insurance Scheme.

If Yes, state source of income (e.g. employer name, compensation,

income from boarders or lodgers, annuities or regular gifts or

payments from government departments other than

the Department of Human Services).

If Yes, you must provide:

payslips for the last 8 weeks (if you received an amount for

Parental Leave Pay and your employer does not show these

amounts separately on your payslips you must write Includes

Parental Leave Pay clearly on your payslips), or

a letter from your employer stating gross wages for

the last 8 weeks (including voluntary superannuation

contributions such as amounts salary sacrificed to a super

fund but NOT including Parental Leave Pay amounts), or

if compensation, annuities or regular gifts - papers

which show who pays it and how much.

Note: Letters and payslips must have your employers

name and address on them.

YOUR PARTNER

Yes

No

Yes

Gross amount received for the last 8 weeks

$

If you receive income from more than 1 source, please

attach a separate list.

Note: The last 8 weeks referred to above is the 8

week period ending on the date printed under the

heading Income limit located at the start of this form.

8

Do you (or your partner) receive any fringe benefits

provided by an employer (e.g. use of a car as part of

a salary package, rent/mortgage paid)?

Fringe benefits means a benefit received as part

of earned income but not as a wage or salary.

YOU

No

YOUR PARTNER

Yes

No

Yes

If Yes, attach details that indicate the type of fringe benefit

and its value, and whether or not the amount is grossed-up

or not grossed up

Savings accounts

Give details below of all accounts held by you (and/or

your partner) in banks, building societies or credit unions.

Attach proof of all account balances

(e.g. ATM slip, statements, passbooks).

Include savings accounts, cheque accounts, term

deposits, joint accounts, accounts you hold in trust or

under any other name, or money held in church or

charitable development funds.

Accounts and term deposits outside Australia should be

included, with the current balance in the type of currency

in which it is invested. We will convert this into

Australian dollars.

Do NOT include shares, managed investments or an account

used exclusively for funding from the National Disability

Insurance Scheme.

Name of bank, building Account number

society or credit union (this may not be

your card number)

Type of account Balance of

account

10 Shares

Currency if not

AUD

Partners

share

YOU

Do you (and/or your partner) own any shares, options,

rights, convertible notes or other securities LISTED on

an Australian Stock Exchange

(e.g. ASX, NSX, APX or Chi-X) or a stock exchange outside

Australia?

Your

share

YOUR PARTNER

No

Yes

No

Yes

If Yes, give details below

Attach the latest statement for each share holding.

Include shares traded in exempt stock markets.

Do NOT include managed investments.

Name of company

Number of shares ASX code (if known) Country if not

or other securities

Australia

Your

share

Partners

share

%

%

2/1-1

%

%

Income details continued

Renewing your Health Care Card SS054.1412

11 Do you (and/or your partner) own any shares, options

or rights in PUBLIC companies, NOT listed on a stock

exchange?

Do NOT include managed investments.

(Page 4 of 6 )

YOU

YOUR PARTNER

No

Yes

If Yes, give details below

No

Yes

Attach the latest statement detailing your share holding for

each company (if available).

Name of company

Type of shares

Number of shares

12 Managed investments

Current market

value

YOU

YOUR PARTNER

No

Include:

investment trusts

personal investment plans

life insurance bonds

friendly society bonds.

Do NOT include:

conventional life insurance policies

funeral bonds, superannuation or rollover investments.

APIR code is commonly used by fund managers to

identify individual financial products.

If Yes, give details below

Name of product

(e.g. investment

trust)

Partners

share

Do you (and/or your partner) have any managed

investments in and/or outside Australia?

Name of company

Your

share

Yes

No

Yes

Attach a document which gives details (e.g. certificate with

number of units or account balance) for each investment.

Type of product/

Number

option (e.g.

of units

balanced, growth)

APIR code

(if known)

Current Market Currency Your

value

if not AUD share

Partners

share

13 Superannuation YOU should answer this question ONLY if you are over age pension age or claiming Age Pension. YOUR

PARTNER should answer this question ONLY if they are over age pension age or claiming Age Pension.

The qualifying age for Age Pension is currently 65 years.

From 1 July 2017, the qualifying age for Age pension will increase from 65 years to 65 years and 6 months. The

qualifying age will then rise by 6 months every 2 years, reaching 67 years by 1 July 2023. See table below.

Date of Birth

1 July 1952 to 31 December 1953

1 January 1954 to 30 June 1955

1 July 1955 to 31 December 1956

From 1 January 1957

Qualifying age at

65 years and 6 months

66 years

66 years and 6 months

67 years

Do you (or your partner) have any money invested in

superannuation where the fund is still in accumulation

phase and not paying a pension?

YOU

Include:

superannuation funds such as retail, industry, corporate

or employer and public sector

retirement savings accounts

Self Managed Superannuation Funds (SMSF) and Small

APRA Funds (SAF) if the funds are complying.

If Yes, give details below

Attach the latest statement for each superannuation investment.

If you are a SMSF or SAF, attach the financial returns and member

statement for the fund.

Name of institution/fund manager

Name of fund

No

Date of

joining/investment

YOUR PARTNER

Yes

Yes

Current market Owned by

value

$

160713 BCH - 104801

No

You

Your partner

BL- 4

Income details continued

Renewing your Health Care Card SS054.1412

14 Trusts

YOU

Are you or have you (and/or your partner) been involved

in a private trust in any of the ways detailed below?

You (and/or your partner) may be, or have been involved

in a trust as:

a trustee

an appointor

a beneficiary

OR have:

made a loan to a private trust

made a gift of cash, assets, or private property to a private

trust in the last 5 years

relinquished control of a private trust in the last 5 years

a private annuity

a life interest

an interest in a deceased estate.

A private trust includes a non-complying Self Managed

Superannuation Fund or a non-complying Small APRA Fund.

15 Companies

No

(Page 5 of 6 )

YOUR PARTNER

Yes

No

Yes

If Yes, you (and/or your partner) will need to complete and

attach a Private Trust form (Mod PT) if you have not already

provided this to us. If you do not have this form, go to our

website humanservices.gov.au/forms

YOU

YOUR PARTNER

Are you or have you (and/or your partner) been involved

in a private company in any of the ways detailed below?

No

You (or your partner) may be, or have been in the last 5

years:

a director of a company

a shareholder of a company

OR have:

made a loan to a private company

transferred shares in a private company

made a gift of cash, assets or property to a private company.

If Yes, you (and/or your partner) will need to

complete and attach a Private Company form (Mod

PC) if you have not already provided this to us. If you

do not have this form, go to our website

humanservices.gov.au/forms

16 Lump sum payments

In the last 12 months, have you (or your partner)

received a lump sum payment that you have not

already advised on this form?

Do NOT include:

compensation, insurance or damages lump sum payments

funding from the National Disability Insurance Scheme.

Type of lump sum

Who paid it?

Yes

No

YOU

YOUR PARTNER

No

Yes

If Yes, give details below

No

Amount paid

Date paid

Yes

Who received this lump sum

payment?

$

17 Compensation, insurance and/or damages

Yes

You

YOU

Your partner

YOUR PARTNER

Since you last claimed or renewed your Low Income

Health Care Card have you (or your partner) CLAIMED

or are you ABLE TO CLAIM compensation, insurance

and/or damages?

No

Include:

workers compensation/damages as a result of a work injury

third party damages as a result of a motor vehicle accident

personal accident and sickness insurance or income

replacement/protection insurance

sporting injury compensation

public liability compensation

medical negligence compensation

damages paid to victims of crime or as a result of criminal

injuries.

If Yes, you (and/or your partner) will need to complete and

attach a Compensation and damages form (Mod C) if you

have not already provided this to us. If you do not have this

form, go to our website humanservices.gov.au/forms

3/1-1

Yes

No

Yes

Income details continued

Renewing your Health Care Card SS054.1412

18 Gifts

YOU

In the last 5 years, have you (or your partner) given

away, sold for less than their value, or surrendered

a right to, any cash, assets, property or income?

No

(Page 6 of 6 )

YOUR PARTNER

Yes

No

Yes

If Yes, give details below

Include forgiven loans and shares in private companies.

Note: If you give away assets or sell them for less than their

value your claim for a Health Care Card could be affected.

What you gave away or sold for less

than its market value (e.g. money,

car, second home, land, farm)

Date given

or sold

What it

was worth

What you

got for it

Your

share

19 Other income

Partners

share

YOU

Do you (or your partner) receive income from

property or other assets not already mentioned

above (e.g. rent payments)?

Do NOT include funding from the National Disability

Insurance Scheme.

Was this gift to a

Special Disability

Trust (SDT)?

No

Yes

YOUR PARTNER

No

Yes

No

Yes

If Yes, you must provide a copy of last available tax return

or other papers which show income and mortgage details.

If Yes, state annual income

$

20 Income streams

YOU

YOUR PARTNER

Do you (and/or your partner) receive income from any

income stream products?

No

Yes

If Yes, give details below

No

An income stream product is a regular series of

payments which may be made for a lifetime or a fixed

period by:

a financial institution

a retirement savings account

a superannuation fund

a Self Managed Superannuation Fund (SMSF)

a Small APRA Fund (SAF)

You (and/or your partner) will need to attach a

Details of income stream product form (SA330) or a

similar schedule, for each income stream product.

The form or similar schedule must be completed by your

product provider or the trustee of the Self Managed

Superannuation Fund (SMSF) or Small APRA Fund (SAF)

or the SMSF administrator.

Yes

If you do not have this form, go to our website

Types of income streams include:

humanservices.gov.au/forms

account-based pension (also known as allocated pension)

market linked pension (also known as term allocated

pension)

annuities

defined benefit pension (e.g. CompSuper pension, State

Super pension)

superannuation pension (non-defined benefit).

Name of product

Type of income stream

Product reference

Commencement

Your

provider/SMSF/SAF

number

date

share

Partners

share

%

21 Permission to enquire

YOU

Do you give permission for your

partner to discuss your Health Care

Card with us?

You can change this authority at any time.

No

YOUR PARTNER

Yes

No

Yes

22 IMPORTANT INFORMATION

Privacy and your personal information

Your personal information is protected by law, including thePrivacy Act 1988, and is collected by the Australian Government Department of

Human Services for the assessment and administration of payments and services. This information is required to process your application

or claim.

Your information may be used by the department or given to other parties for the purposes of research, investigation or where you have

agreed or it is required or authorised by law.

You can get more information about the way in which the Department of Human Services will manage your personal information, including

our privacy policy at humanservices.gov.au/privacy or by requesting a copy from the department.

Statement

I declare that

I understand that

the information I have provided in this form is complete and correct.

giving false or misleading information is a serious offence.

Your signature

Your partners signature (if applicable)

Date

Date

160713 BCH - 104801

BL- 6

You might also like

- Common Law Private Trust (With Out EIN)Document14 pagesCommon Law Private Trust (With Out EIN)Sim Cooke98% (59)

- Birth Certificates InfoDocument8 pagesBirth Certificates Infovigilence01100% (11)

- Certainty of IntentionDocument7 pagesCertainty of Intentionstra100% (1)

- Trusts and CourtDocument5 pagesTrusts and Courtsaffo40100% (4)

- Choosing The Executor or TrusteeDocument22 pagesChoosing The Executor or TrusteeSeasoned_Sol100% (1)

- Application For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesDocument18 pagesApplication For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesVincent HardyNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaNo ratings yet

- Motion To Dismiss Fraud On The Court Marra Filed VersionDocument23 pagesMotion To Dismiss Fraud On The Court Marra Filed Versionaprilcharney100% (3)

- CV Daniel PDFDocument3 pagesCV Daniel PDFDanielWildSheepZaninNo ratings yet

- MyafDocument2 pagesMyaffNo ratings yet

- Tax Return 2016Document18 pagesTax Return 2016kezia dugdale0% (1)

- Su004 190109enDocument31 pagesSu004 190109enPrashanthNo ratings yet

- Wage Easy ATO Payment Summaries (2018 Jun 28)Document1 pageWage Easy ATO Payment Summaries (2018 Jun 28)Haillander Lopes viannaNo ratings yet

- Your Centrelink Statement For Youth Allowance: Reference: 280 993 398VDocument3 pagesYour Centrelink Statement For Youth Allowance: Reference: 280 993 398Vbob0% (1)

- Emergency Recovery Payment Grant A199480158Document2 pagesEmergency Recovery Payment Grant A199480158HenhamNo ratings yet

- Medicare Enrolment Form (MS004) PDFDocument13 pagesMedicare Enrolment Form (MS004) PDFDanielWildSheepZaninNo ratings yet

- Your Centrelink Statement For Disability Support Pension: Reference: 204 552 505CDocument3 pagesYour Centrelink Statement For Disability Support Pension: Reference: 204 552 505CChellii McgrailNo ratings yet

- Westpac Choice: Stacey Greenwood Reginald 36 Reginald Pde Craigmore Sa 5114Document26 pagesWestpac Choice: Stacey Greenwood Reginald 36 Reginald Pde Craigmore Sa 5114stacyNo ratings yet

- Income Tax Notes LecturesDocument11 pagesIncome Tax Notes LecturesPam G.No ratings yet

- 26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Document1 page26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Garo KhatcherianNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Linh Do DocumentDocument16 pagesLinh Do DocumentAnonymous 8wlUd8u100% (1)

- Customer Reference Number: 208 603 901T: If Not Delivered: Locked Bag 7834 Canberra BC, ACT 2610Document2 pagesCustomer Reference Number: 208 603 901T: If Not Delivered: Locked Bag 7834 Canberra BC, ACT 2610Jacob WoodNo ratings yet

- Manpreet Kaur USQ Application FormDocument5 pagesManpreet Kaur USQ Application FormGagandeep KaurNo ratings yet

- Income Statement: Llillliltll) Ilililtil)Document1 pageIncome Statement: Llillliltll) Ilililtil)Indy EfuNo ratings yet

- Child Care Subsidy (0028112904)Document9 pagesChild Care Subsidy (0028112904)ammar naeemNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Document2 pagesNotice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Vaccine ScamNo ratings yet

- Equity & Trust IDocument1,022 pagesEquity & Trust ISandra ChowNo ratings yet

- Australian Passport Renewal Application: Providing Two Identical Photographs of YourselfDocument2 pagesAustralian Passport Renewal Application: Providing Two Identical Photographs of YourselfAnonymous mi90esG9No ratings yet

- SR Notice of Assessment 2015Document1 pageSR Notice of Assessment 2015Ded MarozNo ratings yet

- Customer Services OnlineDocument1 pageCustomer Services OnlineBrendan Han YungNo ratings yet

- Chorinho Pacoqui o Du SilvaDocument9 pagesChorinho Pacoqui o Du SilvaAlejo GarciaNo ratings yet

- Barry 2003 ITRDocument6 pagesBarry 2003 ITRGreg O'MearaNo ratings yet

- Business Activity Statement: Summary of AmountsDocument2 pagesBusiness Activity Statement: Summary of AmountsSimona StratulatNo ratings yet

- Form Submission: ConfirmationDocument4 pagesForm Submission: ConfirmationDaniela De La HozNo ratings yet

- Income Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483Document2 pagesIncome Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483DanielWildSheepZaninNo ratings yet

- The Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceDocument4 pagesThe Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceRaza RNo ratings yet

- HR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaDocument3 pagesHR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaKiran PNo ratings yet

- Prefill 2019Document2 pagesPrefill 2019Usama AshfaqNo ratings yet

- PAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051Document1 pagePAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051hungdahoangNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Document1 pagePAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Danish MuhammadNo ratings yet

- IMMI Grant Notification PDFDocument3 pagesIMMI Grant Notification PDFsheela baral0% (1)

- Grant For Crisis Payment S303833612Document2 pagesGrant For Crisis Payment S303833612anthony rudduck100% (1)

- Customer Reference Number: 306 934 336C: We Have Balanced Your Child Care SubsidyDocument3 pagesCustomer Reference Number: 306 934 336C: We Have Balanced Your Child Care SubsidyawalNo ratings yet

- Pandemic Leave Disaster Payment: Claim ForDocument8 pagesPandemic Leave Disaster Payment: Claim ForSarah VirziNo ratings yet

- School and Institutional Trust Lands Administration, 2010 Annual ReportDocument40 pagesSchool and Institutional Trust Lands Administration, 2010 Annual ReportState of UtahNo ratings yet

- Centrelink PaygDocument1 pageCentrelink PaygChandra BhattNo ratings yet

- About Sanda Islam Your Family Assistance: Reference: 605 730 292XDocument3 pagesAbout Sanda Islam Your Family Assistance: Reference: 605 730 292XAriful RussellNo ratings yet

- 29 Calneggia DRDocument6 pages29 Calneggia DRJohn ReidNo ratings yet

- Overpayment M249802319Document2 pagesOverpayment M249802319Simon ChownNo ratings yet

- Income and Asset Statement (Financial Planner) - G324503937Document2 pagesIncome and Asset Statement (Financial Planner) - G324503937Adam BookerNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Document1 pagePAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Anonymous JytY5quhSgNo ratings yet

- Child Care Subsidy (0028112904) PDFDocument9 pagesChild Care Subsidy (0028112904) PDFammar naeemNo ratings yet

- 58 Kingaroy DRDocument9 pages58 Kingaroy DRJohn ReidNo ratings yet

- Income Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Document2 pagesIncome Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Annie LamNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JhanhNo ratings yet

- Roberto Ecsay Et Al Vs CADocument1 pageRoberto Ecsay Et Al Vs CAAliceNo ratings yet

- Pre-Filling Report 2017: Taxpayer DetailsDocument2 pagesPre-Filling Report 2017: Taxpayer DetailsUsama AshfaqNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Document1 pagePAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Fook NgoNo ratings yet

- Go Versus The Estate of The Late Felisa BuenaventuraDocument2 pagesGo Versus The Estate of The Late Felisa BuenaventuraTrem GallenteNo ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- Verification of Medical Condition(s) : Instructions For The Customer Information For The DoctorDocument3 pagesVerification of Medical Condition(s) : Instructions For The Customer Information For The DoctorElise SloperNo ratings yet

- Tax Statement 2014 CbhsDocument1 pageTax Statement 2014 CbhsChandra BhattNo ratings yet

- Partner Details: This Form Lets Us Know You Are PartneredDocument19 pagesPartner Details: This Form Lets Us Know You Are PartneredgouthamreddysNo ratings yet

- Pandemic Leave Disaster Payment: Claim ForDocument9 pagesPandemic Leave Disaster Payment: Claim ForKkc KrishnaNo ratings yet

- 2011 Census Household FormDocument18 pages2011 Census Household FormsmurfsiftNo ratings yet

- Dfadsfadfagffdfasdfadfadfas FaDocument16 pagesDfadsfadfagffdfasdfadfadfas FaTyrone DomingoNo ratings yet

- Ir524 PDFDocument2 pagesIr524 PDFTiffany Morris0% (1)

- EFP LifestyleQuestionnaire Electronic 0214Document28 pagesEFP LifestyleQuestionnaire Electronic 0214sanjaifromusaNo ratings yet

- PdataDocument6 pagesPdataRazor11111No ratings yet

- First National Bank of Omaha and Katherine D. Clark, Trustees of The Margaret H. Doorly Family Trusts v. United States, 565 F.2d 507, 1st Cir. (1977)Document17 pagesFirst National Bank of Omaha and Katherine D. Clark, Trustees of The Margaret H. Doorly Family Trusts v. United States, 565 F.2d 507, 1st Cir. (1977)Scribd Government DocsNo ratings yet

- Beams 12ge LN23Document28 pagesBeams 12ge LN23Setia Nurul MNo ratings yet

- Adille V CADocument4 pagesAdille V CAeieipayadNo ratings yet

- FinQuiz - Smart Summary, Study Session 4, Reading 10Document5 pagesFinQuiz - Smart Summary, Study Session 4, Reading 10Tam T NguyenNo ratings yet

- Faq - AifDocument15 pagesFaq - Aifvaishnavi aNo ratings yet

- Henrietta Golding - McNair Cheated Banks & ClientsDocument49 pagesHenrietta Golding - McNair Cheated Banks & ClientsDavid L Hucks0% (1)

- Order in The Matter of GBC Enterprise LimitedDocument24 pagesOrder in The Matter of GBC Enterprise LimitedShyam SunderNo ratings yet

- John Doe FeeDocument4 pagesJohn Doe FeeDennis LeeNo ratings yet

- Miguel vs. CADocument6 pagesMiguel vs. CAFranzMordenoNo ratings yet

- Extraordinary Shareholders' Meeting - MinutesDocument84 pagesExtraordinary Shareholders' Meeting - MinutesBVMF_RINo ratings yet

- Ra 3591 - PdicDocument7 pagesRa 3591 - PdicIzobelle Pulgo100% (2)

- Form 801Document3 pagesForm 801Beatriz AlvaradoNo ratings yet

- UntitledDocument21 pagesUntitledViseshSatyannNo ratings yet

- 8 Ramli CaseDocument25 pages8 Ramli CaseFarah Najeehah ZolkalpliNo ratings yet

- Old Colony Co. v. Comm'r., 301 U.S. 379 (1937)Document5 pagesOld Colony Co. v. Comm'r., 301 U.S. 379 (1937)Scribd Government DocsNo ratings yet

- DBP V ClargesDocument15 pagesDBP V ClargesErika Bianca ParasNo ratings yet

- STANLIB Ghana ProfileDocument16 pagesSTANLIB Ghana ProfileenatagoeNo ratings yet

- Rajasthan Trust ActDocument13 pagesRajasthan Trust ActGopal AgarwalNo ratings yet

- Diaz, Et - Al. vs. Gorricho and AguadoDocument2 pagesDiaz, Et - Al. vs. Gorricho and AguadoMyaNo ratings yet