Professional Documents

Culture Documents

1-4 Deductions Flowchart

Uploaded by

oddsey0713Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1-4 Deductions Flowchart

Uploaded by

oddsey0713Copyright:

Available Formats

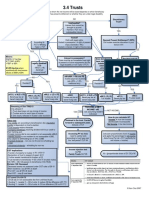

1.

4 Deductions Flowchart

General

Deductions (s8-1)

First Limb: Individual incurred in

gaining or producing AI

Second Limb: Business

necessarily incurred

- Ronpibon Tin clearly adapted and

appropriate for

Incurred

Presently existing liability

TR97/7

Carrying on a business:

-extent of system and org (Ferguson)

-scale of activity (Thomas, Walker)

-repetition of transactions (Whitfords)

-intention to make profit (Stone)

Incidental

Natural Consequence of producing

AI?

- The Herald Weekly Times

Positive limbs

Loss or Outgoing?

- Charles Moore

To the Extent?

- Ronpibon Tin

Relevant?

Essential Character: Business vs

Living expense?

- Lumley v Hayley

YES

Capital?

1) Once and for all

-Vallambrosa Rubber Co Ltd v Farmer

2) Enduring Benefit

- British Insulated

3) Process vs Structure

- Sun Newspaper Ltd v FCT

NO

Negative limbs

Personal/Domestic?

- Lumney v Hayley

Business vs Living

Apportionment

- Ronpibon Tin not up to

the courts what TP should

spend, rather what they

did spend

- Ure v FCT

Relates to earning

exempt income,

or non-exempt non

assessable

income (s23AI-K)

Specifically

denied under part

of Act (s12-5 - list)

YES

Specific

Deductions (s8-5)

Other refer to page 2

Plant? s45-40

articles, machinery,

tools and rolling stock

- Wangaratta Woolen

Mills v FCT

Prime cost s40-75

Held

Depreciating Asset?

Plant? s45-40

Capital Works?

Division 40

s40-25(1)

decline in value of

depn assets held

Division 43

s43-10

- construction expenditure area?

- pool of construction exp

- TP used to produce AI

ASSUMED

- ICI v FCT

Neither

Depreciating asset? s40-30

- has a useful life

- reasonably expected to

decline in value

- excl land, trading stock,

intangibles outside of s4030(2)

YES

CGT

Diminishing value

s40-70

Yes

Involuntary disposals s40-365

-lost/destroyed

-acq by AUS govt

Choices:

A) may include AI bal adj (no election)

B) acq replacement asset(s) and

reduce the cost, or base value if 1) acq

1yr before and after invol disposal, and Splitting ( s40-115)/merging (s402) Used/installed ready for use for

125) assets

wholly taxable purpose by end of

-treated as if you stopped holding and

income year which it started to be held

started holding new assets

-cost allocated reasonably s40-205

-cost added for merged assets

*no bal adj s40-295

Prepayments

Prepayment?

1) Deductible under s8-1

2) >$1000

3) Not required by law, or paid

under contract of service?

Yes

Held

Stopped holding/using Balancing adjustments s40-295

TV > AV

AI s40-285(1)

D s40-285(2)

TV < AV

TV=proceeds less disposal cost s40-300/

315

Capital works? s43-20(1)-(3)

AV=WDV s40-85

- building

* business portion only

- extension

CGT Event K7

s104-235

- alteration

- improvement to building

Div 43 prevails over

2.5% over 40years

Div 40 (s40-45(2)),

s43-25

UNLESS expenditure

YES

Refer to 2-5 flowchart

is plant s43-20(2)(e) &

for more detail!

Cost Base (s110-25)

43-50(1)

Balancing Adjustments

Change of ownership or interests

s40-295

-formation/dissolution of a partnership

-variation in the partnership

constitution, or interest of partners

*s40-300(2) item 5 triggered to deem

disposal at MV, BUT s40-340 joint

election can be made to ignore bal adj

Held? s40-40

- see table, earlier items

take priority

-economic user = holder

Balancing Adjustments Other

info

- TV for luxury car is multiplied by

(57009 +2nd element/total cost)

-Where disposal is undervalued,

MV substituted s40-300 Item 6

*consider GST implications on

disposal

Apportion over the

period with a max

10yrs

s82KZMA,D

*AI under s6-5

Business

Requirement:

1) STS/Individual

2) <12 months

Business, STS or

deduction in full

Individual? STS/Individual

-orApportion over period with max

10yrs s82KZM

Repairs s25-10

-Ongoing repairs s25-10

restoring item to org condition (W

Thomas)

-Entirety - TR97/23, not a repair if replacing entirety

Repairs do not change nature or improve

-Initial repairs not deductible, factored into price at acquisition (Law

Shipping Co)

COST BASE for CGT

IF NOT REPAIR

Other

Prepaid salary excluded prepayment s82KZL(1)

Substantiation ONLY applies to ind and ptnerships (s900-5)

- work expenses >$300 s900-30, travel s900-50

Borrowing expense s25-25 - <$100

write-off, >$100

write-off

over period or 5yrs

Bad debt s25-35 must be existing debt, must have been brought

into acct through AI or loan previously

Tax-related expense s25-5 GST not incl, but ded under s8-1

Super Contrib s82AAC by employers on behalf ded; s82AAS

s82AAT eligible)

governs self-employed (ie<10% income is salary

Entertainment denied under s32-5, exceptions under s32-20,32-50

CLP72

Leave payments s26-10 Cannot deduct accruals, only incurred

Stock obsolescence s70-50 revalue below s70-45

Business capital expenditure s40-880 blackhole expenditure

relating to business structure and issuing of shares (2.3 Cap Allow)

Deduction for WIP s25-95 if WIP can b completed within 12mths

Interest deductible when withholding tax is paid s26-25

Ken Choi 2007

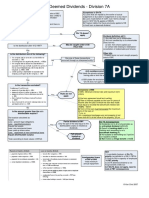

1.4 Deductions Flowchart p2

Specific Deductions

Car Expense Div 28, s900-70

Ken Choi 2007

You might also like

- 1-8 GST - GST Payable or ITC AvalDocument2 pages1-8 GST - GST Payable or ITC Avaloddsey0713No ratings yet

- 3 5 PartnershipsDocument1 page3 5 Partnershipsoddsey0713No ratings yet

- 1-5 Trading StockDocument1 page1-5 Trading Stockoddsey0713No ratings yet

- 3-4 TrustsDocument1 page3-4 Trustsoddsey0713No ratings yet

- 3-3 Company LossesDocument1 page3-3 Company Lossesoddsey0713No ratings yet

- 2-3 Capital AllowancesDocument1 page2-3 Capital Allowancesoddsey0713No ratings yet

- Does FBT Apply?: Div 13 ExclusionsDocument1 pageDoes FBT Apply?: Div 13 Exclusionsoddsey0713No ratings yet

- 1-3 Assessable IncomeDocument2 pages1-3 Assessable Incomeoddsey0713No ratings yet

- 2-4,5 Capital WorksDocument1 page2-4,5 Capital Worksoddsey0713No ratings yet

- 3-3 Franking AccountDocument1 page3-3 Franking Accountoddsey0713No ratings yet

- 4-3 Part IVA General AntiAvoidanceDocument1 page4-3 Part IVA General AntiAvoidanceoddsey0713No ratings yet

- 3-3 Div 7A Deemed Divs - VLDocument1 page3-3 Div 7A Deemed Divs - VLoddsey0713No ratings yet

- Executing-The-Creative Design Elements and Layout Styles With ADS As ExamplesDocument47 pagesExecuting-The-Creative Design Elements and Layout Styles With ADS As Examplesoddsey0713No ratings yet

- Creating Effective Ads PPT 4 MGMTDocument22 pagesCreating Effective Ads PPT 4 MGMToddsey0713No ratings yet

- T6 Chapter 5 Solutions To The Essential ActivitiesDocument12 pagesT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713No ratings yet

- T7 Chapter 6 Solutions To The Essential ActivitiesDocument26 pagesT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713No ratings yet

- T5 Chapters 4 and 8 Solutions To The Essential ActivitiesDocument18 pagesT5 Chapters 4 and 8 Solutions To The Essential Activitiesoddsey0713No ratings yet

- Case Summaries 1 193Document54 pagesCase Summaries 1 193oddsey0713100% (1)

- T8 Chapters 9 and 7 Solutions To The Essential ActivitiesDocument12 pagesT8 Chapters 9 and 7 Solutions To The Essential Activitiesoddsey0713No ratings yet

- 2006 Planning EvalDocument33 pages2006 Planning EvalSanjay SahooNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Op Transaction History 04!07!2023Document9 pagesOp Transaction History 04!07!2023Sachin PatelNo ratings yet

- Lteif Anthony E03g - ExpensesDocument2 pagesLteif Anthony E03g - ExpensesSaiid GhimrawiNo ratings yet

- IB ChallanDocument1 pageIB ChallanPrasad HiremathNo ratings yet

- Trader's Journal Cover - Brandon Wendell August 2010Document6 pagesTrader's Journal Cover - Brandon Wendell August 2010mleefxNo ratings yet

- Wise & Co. Vs TanglaoDocument5 pagesWise & Co. Vs Tanglaodominicci2026No ratings yet

- Problem 1 Investment in Equity SecuritiesDocument6 pagesProblem 1 Investment in Equity SecuritiesGabriel OrolfoNo ratings yet

- Test 01 Chapters 2 & 3 September 25Document8 pagesTest 01 Chapters 2 & 3 September 25barbara tamminenNo ratings yet

- Strategic Management: Implementing Strategies: Marketing IssuesDocument37 pagesStrategic Management: Implementing Strategies: Marketing IssuesAli ShanNo ratings yet

- IHC Appeal 2014Document2 pagesIHC Appeal 2014isnahousingNo ratings yet

- UST Case Study As of 1993: March 2016Document19 pagesUST Case Study As of 1993: March 2016KshitishNo ratings yet

- Chapter 1 ACCOUNTING IN ACTIONDocument61 pagesChapter 1 ACCOUNTING IN ACTIONWendy Priscilia Manayang100% (1)

- Broker HandbookDocument84 pagesBroker Handbookdfisher1118100% (2)

- Secrets of Successful Forex Gold Trading - Advanced ForexDocument3 pagesSecrets of Successful Forex Gold Trading - Advanced ForexMudasir MuhdiNo ratings yet

- Axis Bank LTD Payslip For The Month of July - 2019Document1 pageAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- Consultants DirectoryDocument36 pagesConsultants DirectoryPeter WahlburgNo ratings yet

- China Shipowner DetailsDocument4 pagesChina Shipowner DetailsTejasNo ratings yet

- Nature of Banking and Functions of A BankerDocument22 pagesNature of Banking and Functions of A BankerYashitha CaverammaNo ratings yet

- FAR 4204 (Receivables)Document10 pagesFAR 4204 (Receivables)Maximus100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Vijay SNo ratings yet

- Teens and Credit Card Debt Passage and WKSHTDocument2 pagesTeens and Credit Card Debt Passage and WKSHTmillboarNo ratings yet

- Branch Accounting ProblemDocument6 pagesBranch Accounting ProblemGONZALES, MICA ANGEL A.No ratings yet

- TaxationnnnDocument12 pagesTaxationnnnRenji kleinNo ratings yet

- Economic Roundtable ReleaseDocument1 pageEconomic Roundtable Releaseapi-25991145No ratings yet

- 1068026189-Special NoticeDocument4 pages1068026189-Special NoticeBVS NAGABABUNo ratings yet

- Stanley Black DeckerDocument9 pagesStanley Black Deckerarnabkp14_7995349110% (1)

- FINANCIAL RISK MANAGEMENT TEST 1 AnswersDocument2 pagesFINANCIAL RISK MANAGEMENT TEST 1 AnswersLang TranNo ratings yet

- Attn: Dealer Code: 1763 Collection Requisition Form Daikin Malaysia Sales & Service Sdn. BHDDocument1 pageAttn: Dealer Code: 1763 Collection Requisition Form Daikin Malaysia Sales & Service Sdn. BHDNg Kit YinNo ratings yet

- Entrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFDocument66 pagesEntrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFmelrosecontrastbtjv1w100% (13)

- Greetings From ICICI BankDocument3 pagesGreetings From ICICI BankNitin MathurNo ratings yet

- Pilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pagePilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib Dahal50% (2)