Professional Documents

Culture Documents

Infra 100 Global Release

Uploaded by

STP DesignCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Infra 100 Global Release

Uploaded by

STP DesignCopyright:

Available Formats

NEWS

Six Indian infrastructure projects find place in Infrastructure 100:

World Markets Report

New Delhi, 13 November 2014 KPMG Internationals Infrastructure 100: World Markets

Report highlights key trends driving infrastructure investment around the world. A global panel

of industry experts identifies 100 of the worlds most innovative, impactful infrastructure projects

showing how governments are coming together with the private sector to overcome funding

constraints to finance and build projects that can improve quality of life both solving immediate

needs and planning for future societal demands.

The report looks at infrastructure based on the dynamics of four key markets: mature

international markets (like Canada, Australia, U.K.), economic powerhouses (including the U.S.

and BRIC countries), smaller established markets (like Chile, Sweden, New Zealand, Korea),

and emerging markets. The panel of independent industry experts evaluated over 400 diverse

and compelling projects to ultimately select the final 100, based on:

Scale How does the scale of the project relate to similar developments in its class?

Feasibility Is the project plan feasible and sustainable?

Complexity How challenging or complex is it to get stakeholder support?

Innovation Is there a particular challenge the project overcomes?

Impact on society Does it improve quality of life or promote economic growth?

With a total estimated value of over USD1.73 trillion, the 100 projects illustrate a range of

infrastructure investment, some with a potentially transformative impact that could change the

face of nations.

The six Indian projects, which have been considered for this report are Gujarat

International Finance Tec-City (GIFT), Mundra Ultra Mega Power Plant, Interceptor

Sewage System, Yamuna Expressway, Delhi Metro and Narmada Canal Solar project.

ABCD

Meeting the funding challenge

The Infrastructure 100 report also brings to light affordability concerns and the need for

governments to make difficult choices about where to spend with funding in short supply.

Balancing the aspirations of a nation with the need for true social benefit is not an easy

challenge.

Each country has its own approach to developing and funding infrastructure, yet all share the

universal challenge of creating the right conditions to attract investment so desperately needed,

says James Stewart, KPMGs Chairman of Global Infrastructure. Private capital continues

to play a critical role, but investors need economic and political stability before committing.

Consistency and sustainability are key in setting policy, the right regulatory environment and

establishing a steady deal flow through project pipelines.

Speaking from the Indian infrastructure sector perspective, Arvind Mahajan, Head of

Government and Infrastructure, KPMG in India says, Indias infrastructure sector story has

been a roller coaster ride. While the past few years have seen a decline in interest around the

infrastructure sector, the new government is taking a number of measures to revive investment.

We believe this could lead to a re-rating of Indian infrastructure.

Attracting private investment

The report illustrates the critical role of private investment in meeting the infrastructure

challenge, with different investment dynamics in each market category:

Economic powerhouses have significant infrastructure needs either to support rapid

growth and urbanisation or to rebuild, repair or upgrade aging assets. The panel of industry

experts identified a surprisingly high reliance on public sector debt sources.

Emerging markets represent a frontier for private finance in infrastructure, although a lack of

funds, inadequate planning, and unstable political environments have limited the availability of

projects that could attract private money.

Mature international markets A combination of privatisation, regulation and a wide range of

investors has heightened competition for infrastructure in these markets. An increasing trend for

asset sales or privatisation is identified in the report.

ABCD

Smaller established markets tend to favour domestic financing, with international financiers

restricted by the lack of major projects, competitive local capital and currency risk. However,

KPMGs report notes an increasing need for these markets to consider collaborative, crossborder infrastructure projects that deliver regional economic growth and bring the scale of major

projects that international investors are seeking.

-Building for the future

The report strikes a note of caution over the limited supply of specialist talent that can pose a

big threat to the momentum of infrastructure development. It also touches on new technology

and questions when it will have a meaningful impact on the infrastructure industry in the same

way it has transformed other sectors. However, the report also acknowledges the continued

ability of the sector to innovate, with trends such as capital recycling and asset management

helping to make better use of budgets and generate vital funds for further investment.

ENDS

About the Infrastructure 100: World Markets Report

This report is the result of in-depth discussions by a distinguished panel of independent industry

experts from around the world. It looks at infrastructure in four key markets: mature International

markets; economic powerhouses; smaller established markets; and emerging markets. The

independent judging panels assessed hundreds of project submissions based on feasibility,

social impact, technical and/or financial complexity, innovation and impact on society to

ultimately select the final 100.

*View a complete list of the 100 projects online at: www.kpmg.com/infrastructure100

About KPMG in India

KPMG in India is the Indian member firm of KPMG International and was established in

September 1993. It strives to provide rapid, performance-based, industry-focussed and

technology-enabled services, which reflect a shared knowledge of global and local industries and

its experience of the Indian business environment. KPMG in India provides services to over 2,700

international and national clients in India and has offices in Ahmedabad, Bengaluru, Chandigarh,

Chennai, Delhi, Hyderabad, Kochi, Kolkata, Mumbai and Pune.

For further information:

Subir Moitra

Director Marketing & Communications

KPMG in India

09811199613

smoitra@kpmg.com

Vidya Mohan

Associate Director

KPMG in India

09820770846

vidyamohan@kpmg.com

ABCD

You might also like

- Chapter - 1Document63 pagesChapter - 1Abhijeet DasNo ratings yet

- Infra MGMTDocument12 pagesInfra MGMTTHIMMAIAH BAYAVANDA CHINNAPPANo ratings yet

- Managing Infrastructure Projects in Developing CountriesDocument41 pagesManaging Infrastructure Projects in Developing CountriesAlice S LunguNo ratings yet

- 7 QueDocument5 pages7 QueTEJASSATHVARANo ratings yet

- Strategic Management Assignment 1Document4 pagesStrategic Management Assignment 1isha lalwaniNo ratings yet

- Diamond Model of Porter With Reference To Indian Automobile IndustryDocument7 pagesDiamond Model of Porter With Reference To Indian Automobile IndustrySupersamKhan0% (1)

- Accenture High Performance in Infrastructure and Construction OptDocument16 pagesAccenture High Performance in Infrastructure and Construction OptPreetham SamuelNo ratings yet

- Ratio Analysis Study of Hydraulic IndustryDocument59 pagesRatio Analysis Study of Hydraulic Industrysai suvas100% (1)

- MGI Reinventing Construction Executive Summary PDFDocument20 pagesMGI Reinventing Construction Executive Summary PDFtth28288969No ratings yet

- MPV's PaperDocument12 pagesMPV's PaperTHIMMAIAH BAYAVANDA CHINNAPPANo ratings yet

- Research Paper On Real Estate IndiaDocument7 pagesResearch Paper On Real Estate Indiafyt3rftv100% (1)

- Chapter-I: Industry Profile & Company ProfileDocument61 pagesChapter-I: Industry Profile & Company ProfileSaloni Jain 1820343No ratings yet

- Engineering Procurement & Construction Making India Brick by Brick PDFDocument96 pagesEngineering Procurement & Construction Making India Brick by Brick PDFEli ThomasNo ratings yet

- Priyanshu Sharma A90904623101Document25 pagesPriyanshu Sharma A90904623101Debanjan DattaNo ratings yet

- Generation and Screening of IdeasDocument20 pagesGeneration and Screening of IdeasAnkit chauhanNo ratings yet

- A Summer Project Report ON: Debt Restructuring Options & Indian Port SectorDocument75 pagesA Summer Project Report ON: Debt Restructuring Options & Indian Port SectorsatyamehtaNo ratings yet

- Research Paper On Financial Sector ReformsDocument6 pagesResearch Paper On Financial Sector Reformsafeawjjwp100% (1)

- Investment Procss of Unicon (Tufail)Document55 pagesInvestment Procss of Unicon (Tufail)Tufail KhanNo ratings yet

- Indian MFG IndustryDocument3 pagesIndian MFG Industryharsh_2404No ratings yet

- Research Paper On Indian Real EstateDocument4 pagesResearch Paper On Indian Real Estateudmwfrund100% (1)

- Small Scale IndustryDocument94 pagesSmall Scale IndustryRajat SharmaNo ratings yet

- Os ProjectDocument41 pagesOs ProjectRositaNo ratings yet

- UNIDO Investment Project Preparation and Appraisal (IPPA)Document6 pagesUNIDO Investment Project Preparation and Appraisal (IPPA)seaforte03No ratings yet

- Indian industrial environment post-independenceDocument6 pagesIndian industrial environment post-independenceabhi2calmNo ratings yet

- Evaluating Global Competitiveness Using the 12 Pillars IndexDocument25 pagesEvaluating Global Competitiveness Using the 12 Pillars IndexMARCK ANTHONY RANGANo ratings yet

- Promoting Competition and EntrepreneurshipDocument38 pagesPromoting Competition and EntrepreneurshipSuresh DevarajiNo ratings yet

- Value of Infrastructure InvestmentDocument5 pagesValue of Infrastructure InvestmentSTP DesignNo ratings yet

- Research Paper On Construction Industry in IndiaDocument4 pagesResearch Paper On Construction Industry in Indiagw0pajg4100% (1)

- Financial Engineering's Scope and Innovations Transforming Financial SystemsDocument10 pagesFinancial Engineering's Scope and Innovations Transforming Financial SystemsMohsen Pourebadollahan CovichNo ratings yet

- Chapter 2 External ScanningDocument38 pagesChapter 2 External ScanningSmruti RanjanNo ratings yet

- Summer Internship ProjectDocument32 pagesSummer Internship ProjectNaina JageshaNo ratings yet

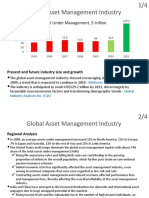

- Asset Management Industry - 6 December 2010Document14 pagesAsset Management Industry - 6 December 2010Tariq HaqueNo ratings yet

- 03 Literature Review of Constructing IndustryDocument9 pages03 Literature Review of Constructing IndustryFüñKý ßøýNo ratings yet

- Enhancing Smes Access To Green Finance About The AuthorDocument5 pagesEnhancing Smes Access To Green Finance About The Authorrammi1318No ratings yet

- Park ANalysis To NepalDocument11 pagesPark ANalysis To NepalSubham DahalNo ratings yet

- (BUAD 6600, Summer 2022) : Supply Chain StrategyDocument39 pages(BUAD 6600, Summer 2022) : Supply Chain StrategylogeshNo ratings yet

- India's Global Competitiveness in the Era of GlobalisationDocument28 pagesIndia's Global Competitiveness in the Era of GlobalisationAbhrajit SettNo ratings yet

- Infrastructure Recent TrendsDocument16 pagesInfrastructure Recent TrendsArchit SharmaNo ratings yet

- 03 IB Unit 2 SEM 5Document26 pages03 IB Unit 2 SEM 5godlistengideon7No ratings yet

- Financial Report CP0611Document50 pagesFinancial Report CP0611Richa DuaNo ratings yet

- ED Unit 3 Part (A&B) (Q&A)Document28 pagesED Unit 3 Part (A&B) (Q&A)Kalaivani SubburajNo ratings yet

- 18cs51 Module V NotesDocument19 pages18cs51 Module V NotesAayush SahNo ratings yet

- Monograph On Micro, Small and Medium Enterprises (Msmes) : The Institute of Cost & Works Accountants of IndiaDocument21 pagesMonograph On Micro, Small and Medium Enterprises (Msmes) : The Institute of Cost & Works Accountants of IndiaSsNo ratings yet

- Value Creation in IndustrialsDocument72 pagesValue Creation in IndustrialsJorge GalvezNo ratings yet

- Other Explananation...........Document9 pagesOther Explananation...........adhilNo ratings yet

- India's Engineering Sector On Growth TrajectoryDocument1 pageIndia's Engineering Sector On Growth Trajectoryvenkat_09No ratings yet

- Equity ResearchDocument14 pagesEquity ResearchMohit ModiNo ratings yet

- India's industrial water and effluent treatment market analysisDocument8 pagesIndia's industrial water and effluent treatment market analysisVinisha JamesNo ratings yet

- Impact of Globalisation on Indian Stock MarketDocument27 pagesImpact of Globalisation on Indian Stock MarketNadeem Lone0% (3)

- Module - 5 Syllabus (18CS51) Micro and Small EnterprisesDocument21 pagesModule - 5 Syllabus (18CS51) Micro and Small Enterpriseshimanshu malikNo ratings yet

- EY Making India Brick by Brick PDFDocument96 pagesEY Making India Brick by Brick PDFRKVSK1No ratings yet

- Strategic Management Creating Competitive Advantages Canadian 4Th Edition Dess Solutions Manual Full Chapter PDFDocument43 pagesStrategic Management Creating Competitive Advantages Canadian 4Th Edition Dess Solutions Manual Full Chapter PDFdisfleshsipidwcqzs100% (5)

- Money Isn't Everything (But We Need $57 Trillion For Infrastructure) - McKinsey & CompanyDocument3 pagesMoney Isn't Everything (But We Need $57 Trillion For Infrastructure) - McKinsey & CompanyNeil SmithNo ratings yet

- IFC Helps Expand Infrastructure in Emerging MarketsDocument12 pagesIFC Helps Expand Infrastructure in Emerging MarketsjanakarajNo ratings yet

- Decade of Impact: Assessing India's Impact Investing Landscape 2010-2019Document56 pagesDecade of Impact: Assessing India's Impact Investing Landscape 2010-2019meenaldutiaNo ratings yet

- Infrastructure Finance: The Business of Infrastructure for a Sustainable FutureFrom EverandInfrastructure Finance: The Business of Infrastructure for a Sustainable FutureRating: 5 out of 5 stars5/5 (1)

- WHO A67 DIV1-enDocument95 pagesWHO A67 DIV1-enSTP DesignNo ratings yet

- Infrastructure Opportunities in Brazil: Primary & Secondary MarketsDocument5 pagesInfrastructure Opportunities in Brazil: Primary & Secondary MarketsSTP DesignNo ratings yet

- SL - No State/UT Active Naef Total Number Foreign Companies RegisteredDocument4 pagesSL - No State/UT Active Naef Total Number Foreign Companies RegisteredrickysainiNo ratings yet

- BBB RAK Government ParticipantsDocument1 pageBBB RAK Government ParticipantsSTP DesignNo ratings yet

- Pinsent Masons and Cebr Infrastructure ReportDocument5 pagesPinsent Masons and Cebr Infrastructure ReportSTP DesignNo ratings yet

- Almedalen Pres at KPMG Event FlatfileDocument5 pagesAlmedalen Pres at KPMG Event FlatfileSTP DesignNo ratings yet

- Study On Project Schedule and Cost Overruns: Expedite Infrastructure ProjectsDocument5 pagesStudy On Project Schedule and Cost Overruns: Expedite Infrastructure ProjectsSTP DesignNo ratings yet

- Infra Report 2Document5 pagesInfra Report 2STP DesignNo ratings yet

- WA Grain Freight Review ReportDocument5 pagesWA Grain Freight Review ReportSTP DesignNo ratings yet

- Infra ReportDocument5 pagesInfra ReportSTP DesignNo ratings yet

- KPMG Colombia Infrastructure Opportunities Final OctoberDocument5 pagesKPMG Colombia Infrastructure Opportunities Final OctoberSTP DesignNo ratings yet

- Demystifying Chinese Investment in Australia April 2016Document5 pagesDemystifying Chinese Investment in Australia April 2016STP DesignNo ratings yet

- Infrastructure in Depth PhilippinesDocument5 pagesInfrastructure in Depth PhilippinesSTP DesignNo ratings yet

- A Better Way To Manage Our Infrastructure - Getting The Best Prices, Making The Best ChoicesDocument5 pagesA Better Way To Manage Our Infrastructure - Getting The Best Prices, Making The Best ChoicesSTP DesignNo ratings yet

- Value of Infrastructure InvestmentDocument5 pagesValue of Infrastructure InvestmentSTP DesignNo ratings yet

- KPMG Public ReportDocument19 pagesKPMG Public ReportSTP DesignNo ratings yet

- Competitive Alternatives: KPMG's Guide To International Business Location CostsDocument5 pagesCompetitive Alternatives: KPMG's Guide To International Business Location CostsSTP DesignNo ratings yet

- Productivity Report Infrastructure Path To Progress AuDocument3 pagesProductivity Report Infrastructure Path To Progress AuSTP DesignNo ratings yet

- Un Pan 95933Document5 pagesUn Pan 95933STP DesignNo ratings yet

- Success Failure Urban Transportation Infrastructure ProjectsDocument5 pagesSuccess Failure Urban Transportation Infrastructure ProjectsSTP DesignNo ratings yet

- Infrastructure 100 - World Markets ReportDocument5 pagesInfrastructure 100 - World Markets ReportSTP DesignNo ratings yet

- India Soars HighDocument5 pagesIndia Soars HighSTP DesignNo ratings yet

- Construction and Insurance 2015Document5 pagesConstruction and Insurance 2015STP DesignNo ratings yet

- Expect The Unexpected - Building Business Value in A Changing WorldDocument5 pagesExpect The Unexpected - Building Business Value in A Changing WorldSTP DesignNo ratings yet

- Foresight Emerging Trends 2016Document12 pagesForesight Emerging Trends 2016STP DesignNo ratings yet

- Compalt2016 Execsum enDocument12 pagesCompalt2016 Execsum enSTP DesignNo ratings yet

- Cities Infrastructure A Report On SustainabilityDocument5 pagesCities Infrastructure A Report On SustainabilitySTP DesignNo ratings yet

- Compalt2016 Report Vol1 enDocument5 pagesCompalt2016 Report Vol1 enSTP DesignNo ratings yet

- Lightning Investors Limited: Valuation ReportDocument5 pagesLightning Investors Limited: Valuation ReportSTP DesignNo ratings yet

- UCH801Document1 pageUCH801AdityaNo ratings yet

- RRB Po GK Power CapsuleDocument59 pagesRRB Po GK Power CapsuleDetective ArunNo ratings yet

- Final Report StarbucksDocument16 pagesFinal Report Starbucksmurary123100% (1)

- Harvard Business ReviewDocument4 pagesHarvard Business Reviewসাদা কালোNo ratings yet

- Conceptualising Global Strategic Sustainability and Corporate Transformational ChangeDocument22 pagesConceptualising Global Strategic Sustainability and Corporate Transformational ChangeIca DoraemonimuetNo ratings yet

- 2017 Beda Taxation Law Pre Week ClearerDocument49 pages2017 Beda Taxation Law Pre Week ClearerShanelle NapolesNo ratings yet

- Cebu Map - Existing Landuse - MetroCebuDocument1 pageCebu Map - Existing Landuse - MetroCebuiamfrancoiseNo ratings yet

- Effect of Higher Cost of LivingDocument3 pagesEffect of Higher Cost of LivingKiu Boon100% (1)

- Managerial Economics: MSL 780 OutlineDocument19 pagesManagerial Economics: MSL 780 OutlineharshaliNo ratings yet

- Annals of Communism SeriesDocument304 pagesAnnals of Communism SeriesAndrésSiepaNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Account Usage and Recharge Statement From 20-Mar-2022 To 09-Apr-2022Document6 pagesAccount Usage and Recharge Statement From 20-Mar-2022 To 09-Apr-2022Nitya UNo ratings yet

- Dizzy With SuccessDocument5 pagesDizzy With Successapi-3851760No ratings yet

- Manage Income & Expenses GuideDocument11 pagesManage Income & Expenses GuideDanna PedrazaNo ratings yet

- Wages For Electrical Chargeman Johor (Rev. 2023)Document4 pagesWages For Electrical Chargeman Johor (Rev. 2023)mohd aizat mohd sayuthiNo ratings yet

- Business Finance Assignment 1Document10 pagesBusiness Finance Assignment 1Amar ChotaiNo ratings yet

- Tool Libraries and Their ImpactDocument14 pagesTool Libraries and Their ImpactBrent Harris100% (1)

- 10000024113Document3,123 pages10000024113Chapter 11 DocketsNo ratings yet

- Nationalisation of BanksDocument6 pagesNationalisation of BanksRishit12340% (1)

- 1. 1, Describe something you don't have now but would like to own in the future. Hẫy miêu tả vật mà bạn bây giờ chưa có, nhưng muốn có trong tương laiDocument3 pages1. 1, Describe something you don't have now but would like to own in the future. Hẫy miêu tả vật mà bạn bây giờ chưa có, nhưng muốn có trong tương laiNguyễn Văn ĐạoNo ratings yet

- NettingDocument17 pagesNettingAnshulGupta100% (1)

- Starbucks Corporation-Case StudyDocument3 pagesStarbucks Corporation-Case StudyAyesha AnsNo ratings yet

- ED CellDocument19 pagesED CellSunil SharmaNo ratings yet

- Macroeconomics 2Document9 pagesMacroeconomics 2Zuka Kazalikashvili100% (1)

- Product CostDocument10 pagesProduct CostApple BaldemoroNo ratings yet

- Profil Individu / Individual Profile: 1.1 Maklumat Akaun / Account InformationDocument9 pagesProfil Individu / Individual Profile: 1.1 Maklumat Akaun / Account InformationsambasivammeNo ratings yet

- Growth and Prospects of Tourism in Odisha: Dr. Kabita Kumari SahuDocument7 pagesGrowth and Prospects of Tourism in Odisha: Dr. Kabita Kumari Sahusmishra2222No ratings yet

- Statutory Corporation and Government CompanyDocument9 pagesStatutory Corporation and Government CompanySanta GlenmarkNo ratings yet

- Karl Marx (1818-1883) : Philosopher, Economist, and SocialistDocument9 pagesKarl Marx (1818-1883) : Philosopher, Economist, and SocialistBurhan HunzaiNo ratings yet

- Shrinking CitiesDocument38 pagesShrinking CitiessalminaNo ratings yet