Professional Documents

Culture Documents

FMCG Sector Analysis

Uploaded by

Aamir AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMCG Sector Analysis

Uploaded by

Aamir AliCopyright:

Available Formats

FMCG SECTOR ANALYSIS

The Indian FMCG industry represents nearly 2.5% of the countrys GDP.

The industry has tripled in size in past 10 years and has grown at 17%CAGR in the

last 5 years driven by rising income levels, increasing urbanisation, and strong rural

demand and favourable demographic trends.

The sector accounted for 1.9% of the nations total FDI inflows in April 2000September 2012. Cumulative FDI inflows into India from April 2000 to April 2013 in

the food processing sector stood at 9,000.3 crore, accounting for 0.96% of overall

FDI inflows while the soaps, cosmetics and toiletries, accounting for 0.32% of overall

FDI at `3,115.5 crore.

Food products and personal care together make up two-third of the sectors

revenues.

Rural India accounts for more than 700 million consumers or 70% of the Indian

population and accounts for 50% of the total FMCG market.

With changing lifestyle and increasing consumer demand, the Indian FMCG market

is expected to cross $80 billon by 2026 in towns with population of up to 10 lakh.

India's labour cost is amongst the lowest in the world, after China & Indonesia,

giving it a competitive advantage over other countries.

Unilever Plc.s $5.4 billion bid for a 23% stake in Hindustan Unilever is the largest

Asia Pacific cross border inbound merger and acquisition (M&A) deal so far in FY14

and is the fifth largest India Inbound M&A transaction on record till date.

Excise duty on cigarette has been increased in the Union Budget for 2014-15, which

would hit major industrial conglomerates like ITC, VST Industries in the short term.

TOTAL REVENUE IS 288.1 BILLION DOLLARS

USA; 17

INDIA; 46.6

87

CHINA; 65.6

JAPAN; 71.9

USA

INDIA

CHINA

JAPAN

UK

Advantages of India

Large and growing youth population

India is among the world's youngest nations, with a median age of 25 years as

compared to 43 in Japan and 36 in the US.

This coupled with a large population and rapidly evolving consumer preferences,

has translated into a large market opportunity for FMCG players .

The youth segment (1024 years age group) constitutes nearly 25 per cent of the

population and is of significant interest to all FMCG companies .

Emergence of organized retail business

Real estate development in the country, such as the construction of shopping malls

and hypermarkets, are opening up new business channels for FMCG companies.

Growing Urbanization

Indian cities are expected to add 379 million people to the consumer base for FMCG

companies, as the urbanization rate is expected to increase from the current 30 to

45 per cent in the next 40 years.

Increasing disposable income

1. According to recent industry estimates, household income in the top 20 boom

cities in India is projected to grow at 10 per cent annually by 2018.

2. Further, the top 100 cities in India contribute between 5060 per cent of the

overall consumption spends.

3. Rural areas expected to be the major driver for FMCG, as growth continues to

be high in these regions. Rural areas saw a 16 per cent, as against 12 per

cent rise in urban areas.

GROWTH PATTERN OF THE FMCG SECTOR FOR PAST 5 YEARS

47.3

FINANCIAL YEAR 2014

36.8

FINANCIAL YEAR 2012

34.8

FINANACIAL YEAR 2011

30.2

FINANACIAL YEAR 2010

24.2

FINANCIAL YEAR 2009

0

10

15

20

25

30

35

40

45

50

Column1

PORTERS FIVE FORCES MODEL

Rivalry among competitors- Its vary fierce as market is saturated and all

sorts of tactics like price wars, promotional activities etc. are done to snatch

the market share.

Potential entry of new entrants- Highly viable as price effectiveness is only

factor.

Substitute products- Plenty of substitute products are available.

Bargaining power of suppliers- Low as a number of suppliers are present

for this sector.

Bargaining power of consumer- Very high as switching costs are very low

and customers are never reluctant to try new things off the shelf.

You might also like

- Industry OverviewDocument42 pagesIndustry OverviewBharat NarulaNo ratings yet

- Organised Retail in Northern and Western States: S L TalwarDocument5 pagesOrganised Retail in Northern and Western States: S L Talwarsshri177No ratings yet

- Business Environment Assignment 1Document17 pagesBusiness Environment Assignment 1Suraj BoseNo ratings yet

- SM-II Report - Section-C - Group-10 PDFDocument20 pagesSM-II Report - Section-C - Group-10 PDFroguembaNo ratings yet

- Final Project of Vishal Mega Mart............Document59 pagesFinal Project of Vishal Mega Mart............Nisha Ankit Kapoor0% (1)

- Trends in FMCGDocument32 pagesTrends in FMCGTrijoy GhoshNo ratings yet

- 1.1 Introduction To RetailingDocument31 pages1.1 Introduction To RetailingShefali JainNo ratings yet

- Sector Report PDFDocument1 pageSector Report PDFJoshua AndrewsNo ratings yet

- FMCG in Indian EconomyDocument71 pagesFMCG in Indian Economysiriusdoc100% (1)

- Industry Analysis FinalDocument39 pagesIndustry Analysis FinalJaldeep JasoliyaNo ratings yet

- Consumer Market in India C 1145Document6 pagesConsumer Market in India C 1145Sanjay TulsankarNo ratings yet

- Chapter 1: Industry ProfileDocument77 pagesChapter 1: Industry ProfileSumit PandeyNo ratings yet

- Summer Training Project Vishal Mega MartDocument65 pagesSummer Training Project Vishal Mega MartMukesh Rana100% (6)

- Comparative Analysis Between FMCG and Infrastructure Sector: Portfolio ManagementDocument14 pagesComparative Analysis Between FMCG and Infrastructure Sector: Portfolio ManagementShivam GuptaNo ratings yet

- Sem 1 Final ProjectDocument2 pagesSem 1 Final ProjectShilpi SahNo ratings yet

- Scope of FMCG Sector in Rural IndiaDocument37 pagesScope of FMCG Sector in Rural IndiaGunjangupta550% (2)

- Demonetization Impact On FMCG Sector in IndiaDocument9 pagesDemonetization Impact On FMCG Sector in IndiaKrutarthChaudhariNo ratings yet

- Demonetization-Impact On FMCG Sector in IndiaDocument8 pagesDemonetization-Impact On FMCG Sector in IndiaarcherselevatorsNo ratings yet

- Retail Industry in 2015 - 2Document7 pagesRetail Industry in 2015 - 2Savan BhattNo ratings yet

- FMCG January 2016Document52 pagesFMCG January 2016Rafaa DalviNo ratings yet

- A Study On Expectations of Rural Consumer Towards Organized Retailing: A ReviewDocument10 pagesA Study On Expectations of Rural Consumer Towards Organized Retailing: A ReviewAnkush MehtaNo ratings yet

- Retail Market Opportunity and ThreatsDocument30 pagesRetail Market Opportunity and ThreatsRashed55No ratings yet

- The Impact of Fast Moving Consumer Goods During The Covid-19 Pandemic Period With Special Reference To Chennai CityDocument12 pagesThe Impact of Fast Moving Consumer Goods During The Covid-19 Pandemic Period With Special Reference To Chennai Cityqhimtjbjw7No ratings yet

- Indian Consumer MarketsDocument12 pagesIndian Consumer Marketsvishal1723No ratings yet

- Growth: Online RetailDocument4 pagesGrowth: Online RetailrajNo ratings yet

- TheGreat Indian Retail StoryDocument28 pagesTheGreat Indian Retail StoryBishwajeet Pratap SinghNo ratings yet

- Vishal Mega Mart 1Document49 pagesVishal Mega Mart 1shyamgrwl5No ratings yet

- HR Strategies in Retail IndustryDocument105 pagesHR Strategies in Retail IndustryRakesh Singh100% (1)

- A Project Report On Brand Positioning of Big BazaarDocument78 pagesA Project Report On Brand Positioning of Big BazaarsudhirNo ratings yet

- Report On ColgateDocument41 pagesReport On ColgateSaurav GautamNo ratings yet

- Sunrise Sector of Indian Economy: Information TechonologyDocument5 pagesSunrise Sector of Indian Economy: Information Techonology110- Karishma verhaniNo ratings yet

- Industry Awareness (IA) Indian Institute of Management, IndoreDocument25 pagesIndustry Awareness (IA) Indian Institute of Management, IndoreSaurabh KumarNo ratings yet

- India Retail Report 2009 Detailed SummaryDocument12 pagesIndia Retail Report 2009 Detailed SummaryShabbir BarwaniwalaNo ratings yet

- Overview of FMCG SectorDocument4 pagesOverview of FMCG SectorAkhilesh SharmaNo ratings yet

- Impact of Slowdown On Retail PlayersDocument10 pagesImpact of Slowdown On Retail PlayersVishal SinghNo ratings yet

- Ad Trends in IndiaDocument24 pagesAd Trends in IndiaSukrutiAdwantNo ratings yet

- Fast Moving Consumer GoodsDocument2 pagesFast Moving Consumer GoodsaryanjangidNo ratings yet

- Chapter 2Document36 pagesChapter 2Ajinkya AdhikariNo ratings yet

- Evolution of The Service SectorDocument18 pagesEvolution of The Service Sectoraabha jadhav0% (1)

- Overview of Industry As Whole FMCG SectorDocument61 pagesOverview of Industry As Whole FMCG SectorAtul DuttNo ratings yet

- Comparative Vishal Mega Mart and V MartDocument79 pagesComparative Vishal Mega Mart and V MartAshutoshSharma50% (2)

- Retail PPT 61108Document46 pagesRetail PPT 61108jaysaradarNo ratings yet

- Urban Vs RuralDocument6 pagesUrban Vs RuralniteshpurohitNo ratings yet

- Chapter 1: Introduction: 1.1 General Introduction About FMCG SectorDocument40 pagesChapter 1: Introduction: 1.1 General Introduction About FMCG SectorJayshree GadweNo ratings yet

- Suyash Agarwal Research Report2023Document62 pagesSuyash Agarwal Research Report2023Lucky SrivastavaNo ratings yet

- Brand New World: How Paupers, Pirates, and Oligarchs are Reshaping BusinessFrom EverandBrand New World: How Paupers, Pirates, and Oligarchs are Reshaping BusinessNo ratings yet

- Resurgent Africa: Structural Transformation in Sustainable DevelopmentFrom EverandResurgent Africa: Structural Transformation in Sustainable DevelopmentNo ratings yet

- The Chinese Consumer Market: Opportunities and RisksFrom EverandThe Chinese Consumer Market: Opportunities and RisksLei TangNo ratings yet

- Dot.compradors: Power and Policy in the Development of the Indian Software IndustryFrom EverandDot.compradors: Power and Policy in the Development of the Indian Software IndustryNo ratings yet

- The Small Business Guide to China: How small enterprises can sell their goods or services to markets in ChinaFrom EverandThe Small Business Guide to China: How small enterprises can sell their goods or services to markets in ChinaNo ratings yet

- Bar GraphDocument16 pagesBar Graph8wtwm72tnfNo ratings yet

- CRM Case Study PresentationDocument20 pagesCRM Case Study PresentationAnonymous QVBtzHYmxC100% (1)

- Monmouth Student Template UpdatedDocument14 pagesMonmouth Student Template Updatedhao pengNo ratings yet

- Industry Multiples in India: March 2019 - Seventh EditionDocument47 pagesIndustry Multiples in India: March 2019 - Seventh EditionharishNo ratings yet

- Atlantic Computer: A Bundle of Pricing Options Group 4Document16 pagesAtlantic Computer: A Bundle of Pricing Options Group 4Rohan Aggarwal100% (1)

- Status Report of The Pan European Corridor XDocument52 pagesStatus Report of The Pan European Corridor XWeb BirdyNo ratings yet

- Major Recessionary Trends in India and Ways To Overcome It: Presented byDocument34 pagesMajor Recessionary Trends in India and Ways To Overcome It: Presented byYogesh KendeNo ratings yet

- Consumer SurplusDocument7 pagesConsumer SurplusKarpagam MahadevanNo ratings yet

- 2016 ICPA Question PaperDocument65 pages2016 ICPA Question Paper22funnyhrNo ratings yet

- Presented by DR Jey at BIRD LucknowDocument16 pagesPresented by DR Jey at BIRD LucknowvijayjeyaseelanNo ratings yet

- ch01 Introduction Acounting & BusinessDocument37 pagesch01 Introduction Acounting & Businesskuncoroooo100% (1)

- Customizing Iss Pis Cofins For CBT v2 1Document33 pagesCustomizing Iss Pis Cofins For CBT v2 1roger_bx100% (1)

- For: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXDocument2 pagesFor: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXLiza L. PadriquezNo ratings yet

- Resumo BTG Pactual PDFDocument206 pagesResumo BTG Pactual PDFJulio Cesar Gusmão CarvalhoNo ratings yet

- Our Friends at The Bank PDFDocument1 pageOur Friends at The Bank PDFAnnelise HermanNo ratings yet

- Ch7 HW AnswersDocument31 pagesCh7 HW Answerscourtdubs78% (9)

- Model Project For Milk Processing Plant - NABARDDocument39 pagesModel Project For Milk Processing Plant - NABARDPraneeth Cheruvupalli0% (1)

- Accrual Process For Perpetual Accruals - PoDocument8 pagesAccrual Process For Perpetual Accruals - PokolleruNo ratings yet

- Chapter 6 - Entry and ExitDocument53 pagesChapter 6 - Entry and ExitMia Sentosa100% (2)

- Chapter-1: 1.1 Categorization of PostsDocument15 pagesChapter-1: 1.1 Categorization of PostsJyothi PrasadNo ratings yet

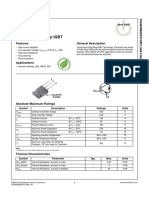

- FGH60N60SFD: 600V, 60A Field Stop IGBTDocument9 pagesFGH60N60SFD: 600V, 60A Field Stop IGBTManuel Sierra100% (1)

- Interweave Knits Sum13Document124 pagesInterweave Knits Sum13Michelle Arroyave-Mizzi100% (25)

- Tata-Corus Acquisition: Group2Document25 pagesTata-Corus Acquisition: Group2Bharti GuptaNo ratings yet

- Excerpt PDFDocument10 pagesExcerpt PDFAvish GreedharryNo ratings yet

- ICICIdirect HDFCBank ReportDocument21 pagesICICIdirect HDFCBank Reportishan_mNo ratings yet

- Irfz 48 VDocument8 pagesIrfz 48 VZoltán HalászNo ratings yet

- Bir Form No. 1914Document1 pageBir Form No. 1914Mark Lord Morales BumagatNo ratings yet

- Lecture 9 - MOS Transistor DynamicsDocument60 pagesLecture 9 - MOS Transistor DynamicsRogin Garcia GopezNo ratings yet

- Introduction To Financial Accounting Session 1 PDFDocument53 pagesIntroduction To Financial Accounting Session 1 PDFdivya kalyaniNo ratings yet

- M N DasturDocument2 pagesM N DasturAnonymous 5lZJ470No ratings yet