Professional Documents

Culture Documents

Mock Compre

Uploaded by

RegenLudeveseCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mock Compre

Uploaded by

RegenLudeveseCopyright:

Available Formats

Page 1 of 8

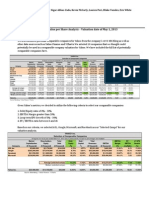

CEBU CPAR CENTER

M0CK COMPREHENSIVE EXAMINATION

Visit-http://www.cebu-CPAR.com

1. The liabilities section of the balance sheet of Pug Company on December 31, 2005

detailed the following:

Accounts payable

Notes payable-trade

Bank note payable -10%

Bank note payable 12%

Accrued expenses

Accrued interest payable

Mortgage note payable 6%

Bonds payable 10% due June 30, 2006

2,000,000

2,500,000

800,000

1,000,000

350,000

500,000

4,000,000

5,000,000

The 10% bank note payable is issued on January 1, 2005, payable on demand and

interest is payable every six months. The 12% bank note payable is a two-year note

issued on July 1, 2004.

The 6%, 10 year mortgage note was issued on October 1, 2002. Terms of the note give

the holder to demand payment if the company fails to make monthly interest payment.

On December 31, 2005, Pug is three months behind in paying its required interest.

What is the total amount of current liabilities on December 31, 2005?

a. P10,150,000

c. P15,750,000

b. P16,150,000

d. P15,150,000

2. To increase sales, Quezon Company inaugurated a promotional campaign on June 30,

2005. Quezon placed a coupon redeemable for a premium in each package of cereal

sold at P200. Each premium costs P100. A premium is offered to customers who send

in 5 coupons and a remittance of P30. The distribution cost per premium is P20.

Quezon estimated that only 60% of the coupons issued will be redeemed. For the six

months ended December 31, 2005, the following is available:

Packages of cereal sold

Premiums purchased

Coupons redeemed

100,000

10,000

40,000

What is the estimated liability for coupons on December 31, 2005?

a. P1,080,000

c. P360,000

b. P1,000,000

d. P720,000

3. A new product introduced by Wilkenson Promotions carries a two-year warranty against

defects. The estimated warranty costs related to dollar sales are as follows:

Year of sale ..............................

Year after sale ...........................

3 percent

5 percent

Sales and actual warranty expenditures for the years ended December 31, 2004 and

2005, are as follows:

2004

2005

Sales

P 8,000,000

10,000,000

Actual Warranty

Expenditures

P200,000

700,000

What amount should Wilkenson report as its estimated liability as of December 31,

2005?

a. P540,000

c. P 40,000

b. P240,000

d. P740,000

Page 2 of 8

4. National Appliance Center sells washing machines that carry a three-year warranty

against manufacturer's defects. Based on company experience, warranty costs are

estimated at P60 per machine. During the year, National sold 48,000 washing

machines and paid warranty costs of P340,000. In its income statement for the year

ended December 31, National should report warranty expense of

a. P2,200,000

c. P680,000

b. P2,880,000

d. P960,000

5. On November 5, 2005, a Calauag Company truck was in an accident with an auto

driven by Macalelon. Calauag received notice on January 15, 2006, of a lawsuit for

P4,000,000 damages for personal injuries suffered by Macalelon. Calauags counsel

believes it is probable that Macalelon will be awarded an estimated amount in the

range between P2,000,000 and P3,000,000, and no amount is a better estimate of

potential liability than any other amount. The accounting year ends on December 31,

and the 2005 financial statements were issued on March 31, 2006. What amount of

provision should Calauag accrue at December 31, 2005?

a. P4,000,000

c. P2,500,000

b. P3,000,000

d. P2,000,000

6. On March 1, 2004, Bohol Company borrowed P5,000,000 and signed a 2-year note

bearing interest at 12% per annum compounded annually. Interest is payable in full at

maturity on February 28, 2006. What amount should Bohol report as a liability for

accrued interest at December 31, 2005?

a. P1,200,000

c. P1,160,000

b. P1,100,000

d. P

0

7. On March 1, 2005, Tiaong Company issued 10,000 of its P1,000 face value bonds at

95 plus accrued interest. Tiaong Company paid bond issue cost of P1,000,000. The

bonds were dated November 1, 2004, mature on November 1, 2014, and bear interest

at 12% payable semiannually on November 1 and May 1. What amount did Tiaong

receive from the bond issuance?

a. P8,500,000

c. P9,500,000

b. P8,900,000

d. P9,900,000

8. On December 31, 2005, Atimonan Company issued 8,000 of its 8%, 10-year P1,000

face value bonds with detachable stock warrants at 120. Each bond carried a

detachable warrant for two shares of Atimonans P100 par value common stock at a

specified option price of P150. Immediately after issuance, the market value of the

bonds ex-warrants was P8,100,000 and the market value of the warrants was

P900,000. In its December 31, 2005 balance sheet, what amount should Atimonan

report as bonds payable?

a. P8,000,000

c. P8,100,000

b. P8,640,000

d. P9,600,000

9. Lara Company showed the following balances in connection with its noncurrent

liabilities on December 31, 2005.

Bonds payable 10%, maturing December 31, 2010

Bonds payable 12%, maturing December 31, 2015

Discount on bonds payable

Premium on bonds payable

Bond issue cost

10,000,000

8,000,000

800,000

500,000

200,000

The discount is related to the 10% bonds payable and the premium and bond issue

cost are applicable to the 14% bonds payable. No bonds were retired during 2005.

How much interest expense on the bonds payable should Lara report in its 2005

income statement?

a. P2,070,000

c. P1,870,000

b. P2,090,000

d. P1,890,000

Page 3 of 8

10. On April 1, 2004, Jerry Company sold 12,000 of its P1,000 11%, 5-year face value

bonds at 96. The bonds are dated April 1, 2004 and interest payment dates are April 1

and October 1, and the company uses the straight-line method of bond discount

amortization. On March 31, 2005, Jerry took advantage of favorable prices of its stock

to extinguish all of the bonds by issuing 800,000 shares of its P10 par value common

stock. At this time, accrued interest was paid in cash. The companys stock was selling

for P30 per share on March 1, 2005. The increase in additional paid in capital due to

the conversion of Jerrys bonds is

a. P4,000,000

c. P3,616,000

b. P3,520,000

d. P

0

11. As an inducement to enter a lease, Legaspi Company, a lessor, grants Daraga

Company, a lessee, nine months of free rent under a five year operating lease. The

lease is effective on July 1, 2005, and provides for monthly rental of P500,000 to begin

April 1, 2006. In Daragas income statement for the year ended June 30, 2005, rent

expense should be reported as

a. P3,825,000

c. P1,500,000

b. P4,500,000

d. P5,100,000

12. Tabaco Company leased equipment for its entire nine-year useful life, agreeing to pay

P1,000,000 at the start of the lease term on January 1, 2004, and P1,000,000 annually

on each January 1, for the next eight years. The present value on January 1, 2004, of

the nine lease payments over the lease term, using the rate implicit in the lease which

Tabaco knows to be 10% was P6,330,000. The January 1, 2004, present value of the

lease payments using Tabacos incremental borrowing rate of 12% was P5,970,000.

Tabaco made a timely second lease payment. What amount should Tabaco report as

capital lease liability in its December 31, 2005 balance sheet?

a. P4,863,000

c. P4,970,000

b. P4,467,000

d. P5,330,000

13. Bran Company leased equipment for its entire 10 year economic life, agreeing to pay

P1,000,000 at the start of the lease term on January 1, 2005 and P1,000,000 annually

on each January 1 for the next nine years. The present value factors using the implicit

rate in the lease which is 10% for an annuity due with ten payments: 6.76 and for an

ordinary annuity with ten payments: 6.15. Bran properly recorded the finance lease

and depreciated the asset using the straight line method. What is the current portion of

the lease liability on December 31, 2005?

a. P324,000

c. P424,000

b. P466,400

d. P516,040

14. On January 2, 2005, Trent Company signed an 8-year noncancelable lease for a new

machine requiring P1,500,000 annual payments at the beginning of each year. The

machine has a useful life of 12 years with no residual value. Title passes to Trent at the

lease expiration date. Trent uses the straight-line depreciation for all of its plant assets.

Aggregate lease payments have a present value on January 2, 2005 of P5,400,000

based on an appropriate interest rate. For 2005, Trent should record depreciation

expense for the leased machine at

a. P1,500,000

c. P675,000

b. P 450,000

d. P325,000

15. Cabusao Company is indebted to Ragay Company under a P5,000,000, 10^% threeyear note dated December 31, 2002. Because of financial difficulties, Cabusao owed

accrued interest of P500,000 on the note at December 31, 2005. Under a debt

restructuring on December 31, 2005, Ragay Company agreed to settle the note and

accrued interest for a tract of land having a fair value of P3,500,000. The acquisition

cost of the land is P1,000,000. The income tax rate is 32%. In its 2005 income

statement Cabusao should report gain on restructuring at

a. P4,000,000

c. P1,500,000

b. P2,720,000

d. P1,020,000

Page 4 of 8

16. Camarines Company is a dealer in machinery. On January 1, 2005, a machinery was

leased to another enterprise with the following provisions:

Annual rental payable at the end of each year

Lease term and useful life of machinery

Cost of machinery

Residual value-unguaranteed

Implicit interest rate

PV of an ordinary annuity of 1 for 5 periods at 10%

PV of 1 for 5 periods at 10%

2,000,000

5 years

5,000,000

1,000,000

10%

3.79

0.62

At the end of the lease term on December 31, 2009, the machinery will revert to

Camarines. The perpetual inventory system is used. Camarines incurred initial direct

costs of P200,000 in finalizing the lease agreement. Camarines Company should

report profit on the sale at

a. P5,800,000

c. P3,200,000

b. P6,000,000

d. P3,000,000

17. Bacolod Company provided the following data in its memorandum records for a defined

benefit plan on January 1, 2005.

Fair value of plan assets

Unamortized past service cost

Accrued benefit obligation

Prepaid/accrued benefit cost

12,000,000

1,000,000

( 9,000,000)

4,000,000

The remaining average vesting period for the employees covered by the past service

cost is 5 years. Transactions affecting the plan for 2005 are:

Service cost

Interest cost

Expected and actual return on plan on assets

Contribution to the plan

Benefits paid to retirees

What is the 2005 total benefit expense?

a. P2,800,000

b. P3,000,000

3,500,000

500,000

1,200,000

2,300,000

2,500,000

c. P3,500,000

d. P5,400,000

18. Mara Company provided the following comparative information concerning its defined

benefit plan in its memorandum records:

January 1, 2005 December 31, 2005

Fair value of plan assets

10,000,000

11,500,000

Unamortized past service cost

1,500,000

1,350,000

Accrued benefit obligation

12,500,000

13,035,000

Unrecognized actuarial gain

1,700,000

1,620,000

The transactions for 2005 related to the defined benefit plan are:

Current service cost

Interest cost

Expected return on plan assets

Contribution to the plan

Benefits paid to retirees

Unexpected decrease in accrued benefit obligation

Amortization period of past service cost and actuarial gain

The actual return on plan assets in 2005 is

a. P1,200,000

c. P1,000,000

b. P1,905,000

d. P2,000,000

2,000,000

1,000,000

1,200,000

2,800,000

2,300,000

165,000

10 years

Page 5 of 8

19. Binalbagan Company obtains the following from its actuary on January 1, 2005?

Accrued benefit obligation

Market related asset value

Unrecognized net loss

9,000,000

10,000,000

1,500,000

During 2005, the actuary determined the current service and interest cost at

P4,000,000. The expected and actual return on plan assets was P1,000,000. The

average remaining service period of the covered employees is 10 years. What is the

total benefit expense for 2005?

a. P3,000,000

c. P3,150,000

b. P3,060,000

d. P3,050,000

20. Manapla Company computed a pretax financial income of P15,000,000 for the year

ended December 31, 2005. In preparing the tax return, the following differences are

noted between financial income and taxable income.

Nondeductible expense

Nontaxable revenue

Estimated warranty cost that was recognized as expense

in 2005 but deductible for tax purposes when paid

Excess tax depreciation over financial depreciation

What is the current tax expense for 2005 if the tax rate is 32%?

a. P5,440,000

c. P4,800,000

b. P5,600,000

d. P5,120,000

2,000,000

1,000,000

1,500,000

500,000

21. Matalam Company has one temporary difference at the end of 2005 that will reverse

and cause taxable amounts of P2,000,000 in 2006 and P3,000,000 in 2007. Matalams

pretax financial income for 2005 is P20,000,000 and the tax rate is 32%. There are no

deferred taxes on January 1, 2005. The income tax payable for 2005 should be

a. P4,800,000

c. P6,400,000

b. P5,760,000

d. P5,440,000

22. The accounts below appear in the December 31, 2005 trial balance of Dumaguete

Company:

Authorized common stock

30,000,000

Unissued common stock

5,000,000

Subscribed common stock

3,000,000

Subscription receivable

1,000,000

Additional paid in capital

10,000,000

Retained earnings unappropriated

6,000,000

Retained earnings appropriated

2,000,000

Revaluation surplus

4,500,000

Treasury stock, at cost

1,500,000

In its December 31, 2005 balance sheet , Dumaguete should report total equity at

a. P49,000,000

c. P43,500,000

b. P48,000,000

d. P58,000,000

23. The stockholders equity section of Norm Company revealed the following information

on December 31, 2005:

Preferred stock, P100 par

5,000,000

Additional paid in capital-preferred

2,000,000

Common stock, P50

3,200,000

Additional paid in capital-common

500,000

Subscribed common stock

800,000

Retained earnings-appropriated

250,000

Unrealized loss on available for sale securities

600,000

Subscription receivable-common

400,000

Retained earnings- unappropriated

3,500,000

Treasury stock

1,000,000

Page 6 of 8

How much is the contributed capital of Norm Company as of December 31, 2005?

a. P10,100,000

c. P11,100,000

b. P11,500,000

d. P10,500,000

24. Victorias Company reported the following in its statement of stockholders equity on

January 1, 2005:

Common stock, P50 par value, authorized 1,000,000 shares,

issued 500,000 shares

Additional paid-in capital

Retained earnings

Less: Treasury stock, at cost, 100,000 shares

Total stockholders equity

25,000,000

25,000,000

15,000,000

65,000,000

7,000,000

58,000,000

The following transactions occurred in 2005:

June 1

40,000 shares of treasury stock were sold for P3,200,000.

August 31

200,000 shares of previously unissued common stock were sold for

P120 per share.

October 1

Distribution of a 2-for-1 stock split, resulting in the common stocks per

share par value being halved.

Victorias accounts for treasury stock under the cost method. In Victorias Companys

statement of stockholders equity, the number of outstanding shares should be

a. 1,400,000

c. 1,280,000

b. 1,320,000

d. 2,280,000

25. On June 1, Mason Company issued 80,000 shares of its P10 par common stock to

Dixon for a tract of land. The stock had a fair market value of P18 per share on this

date. On Dixon's last property tax bill, the land was assessed at P960,000. Mason

should record an increase in Additional Paid-In Capital of

a. P960,000

c. P400,000

b. P640,000

d. P160,000

26. On August 1, 2005, B. Doran Company reacquired 4,000 shares of its P15 par value

common stock for P18 per share. What journal entry should Doran make to record the

acquisition of treasury stock?

a. Treasury Stock

60,000

Additional Paid-In Capital

12,000

Cash

72,000

b. Treasury Stock

60,000

Retained Earnings

12,000

Cash

72,000

c. Retained Earnings

72,000

Cash

72,000

d. Treasury Stock

72,000

Cash

72,000

27. Manjuyod Company was organized on January 1, 2003. On that date it issued 500,000

shares of its P10 par value common stock at P15 per share. During the period January

1, 2003 through December 31, 2005, Manjuyod reported net income of P3,000,000 and

paid cash dividends of P500,000. On January 5, 2005, Manjuyod purchased 50,000

shares of its common stock at P20 per share. On December 31, 2005, 45,000 treasury

shares were sold at P30 per share and retired the remaining treasury shares. What is

the total stockholders equity on December 31, 2005?

a. P10,250,000

c. P10,850,000

b. P10,500,000

d. P10,350,000

Page 7 of 8

28. In connection with a stock option plan for the benefit of key employees, Matanao

Company intends to distribute treasury shares when the options are exercised. These

shares were originally bought at P70 per share. On January 1, 2005, Matanao granted

stock options for 50,000 shares at P150 per share as additional compensation for

services to be rendered over the next two years. The options are exercisable during a

4-year period beginning January 1, 2007, by grantees still employed by Matanao.

Market price of Matanao stock was P200 per share at the grant date. The fair value of

each stock option is P60 on grant date. No stock options were terminated during 2005.

In Matanaos 2005 income statement, what amount should be reported as

compensation expense pertaining to the options?

a. P1,500,000

c. P1,250,000

b. P1,750,000

d. P 750,000

29. On January 1, 2005, Mabel Company established a fixed stock option plan for its senior

employees. At total of 200,000 options were granted that permit employees to purchase

200,000 shares of P50 par common stock at P100 per share. Each option had a fair

value of P42 on the grant date. Options are exercisable beginning January 1, 2008 and

can be exercised anytime during 2008. The market price for Mabel common stock on

January 1, 2005 was P130. What is the compensation expense for the year 2005?

a. P6,000,000

c. P2,000,000

b. P8,400,000

d. P2,800,000

30. On January 1, 2004, Bansalan Company offered its top management stock

appreciation right with the following terms:

Predetermined price

Number of shares

Service period

Exercise date

P100 per share

50,000 shares

3 years

January 1, 2007

The stock appreciation right is to be exercised on January 1, 2007. The quoted prices

of Bansalan Company stock are 100, 124, and 151 on January 1, 2004, December 31,

2004 and December 31, 2005, respectively. What amount should Bansalan charge to

compensation expense for the year ended December 31, 2005 as a result of the stock

appreciation right?

a. P1,700,000

c. P1,200,000

b. P1,300,000

d. P 500,000

31. Nabunturan Companys stockholders equity comprised of 50,000shares of P100 par

common stock, P2,000,000 of additional paid-in capital and retained earnings of

P1,500,000. Stock dividend of 10% was declared when the stock is selling for P120 per

share. What should be the total contributed capital immediately after the issuance of

the stock dividend?

a. P7,000,000

c. P7,600,000

b. P9,100,000

d. P7,500,000

32. Rex Company was organized on January 1, 2000. After 5 years of profitable

operations, the equity section of the balance sheet on December 31, 2004 was as

follows:

Common stock, P50 par, 1,000,000 shares authorized

400,000 shares issued and outstanding

20,000,000

Additional paid in capital

5,000,000

Retained earnings

10,000,000

On January 20, 2005, Rex Company reacquired 50,000 shares of common stock at

P100 per share. The treasury stock is recorded at cost. On March 1, 2005, the

company issued a 20% stock dividend. The market value of the stock is P100 on this

date. On June 30, 2005 the company declared a P5 cash dividend per share payable

on September 10, 2005. The company reported net income of P8,000,000 for the year

ended December 31, 2005. What should be the balance of retained earnings on

December 31, 2005?

Page 8 of 8

a. P16,250,000

b. P12,400,000

c. P11,850,000

d. P18,900,000

33. The following information pertains to Babak Company:

* Dividends on its 50,000 shares of 10%, P100 par value cumulative preferred

stock have not been declared or paid for 3 years.

* Treasury stock was acquired at a cost of P1,000,000 during the year. The treasury

stock had been reissued as of year-end.

What amount of retained earnings should be appropriated as a result of these items?

a. P1,500,000

c. P2,500,000

b. P1,000,000

d. P

0

34. The stockholders equity of Sunny Company on December 31, 2005, consists of the

following capital balances:

Preferred stock, 10% cumulative, 3 years in arrears, P100 par,

P110 liquidation price 150,000 shares

15,000,000

Common stock, P100 par, 200,000 shares

20,000,000

Subscribed common stock, net of subscription receivable of

P4,000,000

6,000,000

Treasury common stock, 50,000 shares at cost

4,000,000

Additional paid in capital

3,000,000

Retained earnings

20,000,000

The book value per share of the common stock is

a. P156.00

b. P190.00

c. P172.00

d. P286.67

35. Bindayan Company has incurred heavy losses since its inception. At the

recommendation of its president and CEO, the board of directors voted to implement

quasi-reorganization, through reduction of par value subject to stockholders approval.

Immediately prior to the restatement on December 31, 2005. Bindayan Companys

stockholders equity was as follows:

Common stock, P100 par 500,000 shares

Additional paid in capital

Retained earnings (deficit)

50,000,000

15,000,000

(10,000,000)

The stockholders approved the quasi reorganization on December 31,2005 to be

accomplished by a reduction in inventory of P2,000,000, a reduction in property, plant

and equipment of P6,000,000, and writeoff of goodwill at P5,000,000. To eliminate the

deficit, Bindayan should reduce common stock by

a. P23,000,000

c. P13,000,000

b. P10,000,000

d. P 8,000,000

- end of examination Good Luck

You might also like

- Intermediate Accounting Prac Mock ExamsDocument72 pagesIntermediate Accounting Prac Mock ExamsIris Claire ClementeNo ratings yet

- Final Exam Fin 2Document3 pagesFinal Exam Fin 2ma. veronica guisihanNo ratings yet

- Page 1 of 4 Chapter 4 - Intermediate Accounting 3Document4 pagesPage 1 of 4 Chapter 4 - Intermediate Accounting 3happy2408230% (1)

- Financial Accounting 2 ExamDocument9 pagesFinancial Accounting 2 ExamEzekiel MalazzabNo ratings yet

- Final Term Debt RestructuringDocument8 pagesFinal Term Debt RestructuringAG VenturesNo ratings yet

- Financial Accounting Chapter 9 - 1Document45 pagesFinancial Accounting Chapter 9 - 1Bruku100% (1)

- Fa2prob5 2Document3 pagesFa2prob5 2jayNo ratings yet

- Lease calculation problemDocument7 pagesLease calculation problemGelo Owss33% (9)

- Chapter 28 LeaseDocument5 pagesChapter 28 LeaseGelmar GloriaNo ratings yet

- Retirement Seatwork New Answer Key - With Asset CeilingDocument25 pagesRetirement Seatwork New Answer Key - With Asset CeilingsweetEmie031No ratings yet

- Fa2prob9 1Document2 pagesFa2prob9 1Mobi Dela Cruz0% (3)

- Hotcake Mix Premium Expense and Liability CalculationDocument4 pagesHotcake Mix Premium Expense and Liability CalculationChristian N MagsinoNo ratings yet

- ROGEN AssignmentDocument9 pagesROGEN AssignmentRogen Paul GeromoNo ratings yet

- Assignment On Debt InvestmentDocument15 pagesAssignment On Debt InvestmentLuis Jethro Gozo Talam0% (1)

- Iac 11 Current Liabilities PDFDocument9 pagesIac 11 Current Liabilities PDFClarisse Pelayo0% (1)

- AnnounceDocument14 pagesAnnounceskydawn0% (1)

- Accounting for share capital and retained earningsDocument4 pagesAccounting for share capital and retained earningsGlen JavellanaNo ratings yet

- ExamDocument7 pagesExamKristen WalshNo ratings yet

- Shareholders' Equity Prac 1Document10 pagesShareholders' Equity Prac 1yaj8cruzada67% (3)

- Compound Financial Instrument PDFDocument4 pagesCompound Financial Instrument PDFidontcaree123312100% (1)

- SQE - Financial Accounting and Reporting - Second Year - March 31, 2011Document11 pagesSQE - Financial Accounting and Reporting - Second Year - March 31, 2011Jerimiah MirandaNo ratings yet

- 5th Year BU - KLAT-Answer KeyDocument76 pages5th Year BU - KLAT-Answer KeyShaira Rehj Rivera100% (1)

- Chapter 27 Earnings and Book Value Per ShareDocument19 pagesChapter 27 Earnings and Book Value Per ShareNhel AlvaroNo ratings yet

- Retake: Financial Accounting and ReportingDocument21 pagesRetake: Financial Accounting and ReportingJan ryanNo ratings yet

- 2Document14 pages2MARIANo ratings yet

- Answer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parDocument5 pagesAnswer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parGenelayn TalabocNo ratings yet

- Intacc Reviewer Quiz #1Document39 pagesIntacc Reviewer Quiz #1UNKNOWNN0% (1)

- Cost AccountingDocument6 pagesCost AccountingValierry VelascoNo ratings yet

- FAR First Pre BoardDocument18 pagesFAR First Pre BoardKIM RAGANo ratings yet

- Financial Accounting and Reporting II Final Quiz QuestionsDocument7 pagesFinancial Accounting and Reporting II Final Quiz QuestionsjemsNo ratings yet

- Cost of Land and Buildings Purchased by Esculent CoDocument7 pagesCost of Land and Buildings Purchased by Esculent Coprey kunNo ratings yet

- 2019 Intacc2A MA1 CLiabilitiesDocument1 page2019 Intacc2A MA1 CLiabilitiesAlyssa MabalotNo ratings yet

- COMPRE PROB - LIABILITIES Wit Ans KeyDocument152 pagesCOMPRE PROB - LIABILITIES Wit Ans Keyjae100% (2)

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Examination About Investment 15Document3 pagesExamination About Investment 15BLACKPINKLisaRoseJisooJennieNo ratings yet

- Receivables Financing EntriesDocument2 pagesReceivables Financing Entriesralphalonzo100% (3)

- Analyze Financial Statements with Common-Size StatementsDocument33 pagesAnalyze Financial Statements with Common-Size StatementsAiden Pats100% (1)

- MSQ KeyDocument18 pagesMSQ KeyAlvin John San Juan50% (2)

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Quiz 1 & 2 (Far)Document26 pagesQuiz 1 & 2 (Far)Leane MarcoletaNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- ACC 577 Quiz Week 4Document11 pagesACC 577 Quiz Week 4MaryNo ratings yet

- Book Value, Earnings Per Share, Share-Based CompensationDocument3 pagesBook Value, Earnings Per Share, Share-Based CompensationmarygraceomacNo ratings yet

- Liabilities BSA 5-2sDocument7 pagesLiabilities BSA 5-2sJustine GuilingNo ratings yet

- Winding Up111Document9 pagesWinding Up111Jenever Leo SerranoNo ratings yet

- Final ConceptualDocument40 pagesFinal ConceptualParkiee JamsNo ratings yet

- Problem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Document6 pagesProblem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Actg SolmanNo ratings yet

- MB2 2013 Ap Set BDocument6 pagesMB2 2013 Ap Set BMary Queen Ramos-UmoquitNo ratings yet

- Acquisition & Interest Date Interest Earned Interest Income Discount Amortization Book Value 01/01/12 12/31/12 12/31/13Document4 pagesAcquisition & Interest Date Interest Earned Interest Income Discount Amortization Book Value 01/01/12 12/31/12 12/31/13Gray JavierNo ratings yet

- Income Taxes Problem SolvingDocument3 pagesIncome Taxes Problem SolvingLara FloresNo ratings yet

- Current Liabilities Millan PDFDocument7 pagesCurrent Liabilities Millan PDFRhodelyn BananiaNo ratings yet

- Notes Receivable - Ia 1Document4 pagesNotes Receivable - Ia 1Aldrin CabangbangNo ratings yet

- Mock CompreDocument8 pagesMock ComprejNo ratings yet

- FormulaDocument10 pagesFormulaAngel Alejo Acoba100% (1)

- 21 - Intangible AssetsDocument6 pages21 - Intangible AssetsralphalonzoNo ratings yet

- Problem 1Document14 pagesProblem 1Jerry DiazNo ratings yet

- 2 InvestmentsDocument4 pages2 InvestmentsAdrian MallariNo ratings yet

- Preliminary Exam - Intermediate Accounting 3Document2 pagesPreliminary Exam - Intermediate Accounting 3ALMA MORENA0% (1)

- FAR LONG QUIZ 2 Form AnalysisDocument17 pagesFAR LONG QUIZ 2 Form AnalysisshaniaNo ratings yet

- Financial Quali - ADocument9 pagesFinancial Quali - ACarl AngeloNo ratings yet

- 06-Receivables TheoryDocument2 pages06-Receivables TheoryRegenLudevese100% (4)

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Mock CompreDocument8 pagesMock CompreRegenLudevese100% (2)

- Final Preboar1Document28 pagesFinal Preboar1RegenLudeveseNo ratings yet

- Act-6j03 Comp2 1stsem05-06Document12 pagesAct-6j03 Comp2 1stsem05-06RegenLudeveseNo ratings yet

- C02 Sample Questions Feb 2013Document20 pagesC02 Sample Questions Feb 2013Elizabeth Fernandez100% (1)

- Final Preboar1Document28 pagesFinal Preboar1RegenLudeveseNo ratings yet

- FinancialquizDocument4 pagesFinancialquizcontactalok100% (1)

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- Unit 4Document25 pagesUnit 4Vinita ThoratNo ratings yet

- Multinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFDocument33 pagesMultinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFheadmostzooenule.s8hta6100% (8)

- Wealth MaximizationDocument6 pagesWealth Maximizationsanchi_23No ratings yet

- Ie Ifrs 17 First ImpressionsDocument202 pagesIe Ifrs 17 First ImpressionsVarian CitrajayaNo ratings yet

- Ebook Corporate Finance 12Th Edition Ross Test Bank Full Chapter PDFDocument59 pagesEbook Corporate Finance 12Th Edition Ross Test Bank Full Chapter PDFpaullanb7nch100% (8)

- CH 21Document144 pagesCH 21fiorensaNo ratings yet

- Enterprise DCF Model: Module-2Document56 pagesEnterprise DCF Model: Module-2Devika Rani100% (1)

- RegressãoDocument3 pagesRegressãoRory Cristian Cordero RojoNo ratings yet

- Yahoo! Inc. Valuation ProjectDocument8 pagesYahoo! Inc. Valuation ProjectNigar_AbbasNo ratings yet

- Chapter 5 DCF With Inflation and Taxation: 1. ObjectivesDocument17 pagesChapter 5 DCF With Inflation and Taxation: 1. ObjectiveshikaijieNo ratings yet

- Foreign Currency Transaction: Factors Cause Foreign Currency Exchange Rates To ChangeDocument13 pagesForeign Currency Transaction: Factors Cause Foreign Currency Exchange Rates To ChangeJeska QuirozNo ratings yet

- Time Value of MneyDocument3 pagesTime Value of MneyRafaelDelaCruzNo ratings yet

- 33 Responses To The Dreaded Sales ObjectionDocument8 pages33 Responses To The Dreaded Sales ObjectionTrivesh KumarNo ratings yet

- Financial Management - Cost of CapitalDocument23 pagesFinancial Management - Cost of CapitalSoledad Perez50% (2)

- Sources and Uses of Short-Term and Long-Term Funds: LessonDocument8 pagesSources and Uses of Short-Term and Long-Term Funds: LessonI am MystineNo ratings yet

- Response To Osc Re Preliminary InjunctionDocument29 pagesResponse To Osc Re Preliminary Injunctionwalexander59No ratings yet

- Money CreationDocument18 pagesMoney CreationdimitrioschrNo ratings yet

- Discount RateDocument7 pagesDiscount RateAakash MauryNo ratings yet

- Reverse FactoringDocument83 pagesReverse Factoringcamy0529100% (1)

- CTH Financial StatementDocument2 pagesCTH Financial StatementyhuzaimiNo ratings yet

- NOVEMBER/DECEMBER 2020 BUSINESS STUDIES EXAM PAPER 2 MARKING SCHEMEDocument6 pagesNOVEMBER/DECEMBER 2020 BUSINESS STUDIES EXAM PAPER 2 MARKING SCHEMEmartinNo ratings yet

- Introduction to Valuing Securities with DCF and Relative ModelsDocument94 pagesIntroduction to Valuing Securities with DCF and Relative ModelsRaiHan AbeDinNo ratings yet

- Financial Concepts 1Document16 pagesFinancial Concepts 1shaonNo ratings yet

- Project Report of SIEMENSDocument54 pagesProject Report of SIEMENSkamdica100% (4)

- SKI's Working Capital Policy and Cash Conversion Cycle AnalysisDocument4 pagesSKI's Working Capital Policy and Cash Conversion Cycle Analysispspsps12 pspsps112No ratings yet

- CRM EDHEC Case RothmansIncNotesDocument46 pagesCRM EDHEC Case RothmansIncNotesSASNo ratings yet

- ACC501 Solved FinaltermDocument96 pagesACC501 Solved Finaltermdani100% (1)

- 612cba481db62 Mathematics of Investment Module 2 Study GuideDocument3 pages612cba481db62 Mathematics of Investment Module 2 Study GuideOvelia KayuzakiNo ratings yet

- Future Value CalculationsDocument49 pagesFuture Value CalculationsRohit Kanojia77% (13)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)