Professional Documents

Culture Documents

List of Forms in Up

Uploaded by

Suraj AminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

List of Forms in Up

Uploaded by

Suraj AminCopyright:

Available Formats

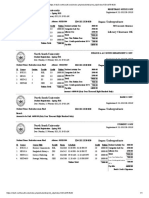

Sl.

No Form number

.

Subject

Concerned

Rule / section

Registration - Forms

1.

Form Number

-VII

Application for Registration by dealers

Rule-32

2.

Form Number

-VII-A

Application for Registration of casual traders

Rule-32A

3.

Form Number

Application for Registration by government dept.

-VII G

4.

Form Number

-VIII

Application for validation of registration certificate

and issue of fresh form of certificate of

registration under VAT

Rule-32(3) /

Sec.-17(5)

5.

Form Number

-IX

Application about tendering voluntary consent for

retention of registration certificate granted under

VAT

Rule-32(4) /

Sec.-18(2)

6.

Form Number

-X

Application about tendering voluntary consent for

retention of registration certificate granted under

VAT after commencement of VAT

Rule-32(5) /

Sec.-18(3)

7.

Form Number

-XI

Certificate of Registration and allotment of TIN

Rule32(8)&(10)

8.

Form Number

-XI A

9.

Form Number

-XII

Casual Traders

Information regarding change of business

Rule-32(1) /

Sec.-17(1)

Sub rule (6)

of Rule-32A

Rule-33 / Sec.75

10.

Form Number

-XIII

Undertaking from surety

Rule-37(3) /

Sec.- 81(6) &

proviso to

Sec.-19(1)

11.

Form Number

-XIV

Application for registration by Transporters etc.

Rule-38

12.

Form Number

-XVI

Certificate of registration for transporters etc.

Rule-38 (5) &

(6)

13.

Form Number

-XXIX

Application for allotment of tax deduction number

Rule-47(1)

14.

Form Number

-XXX

Certificate of allotment of tax deduction number

Rule-47(3)

15.

Form Number Application for condonation of delay in filing of

- LI

Form VII & VIII

Sub-rule (15)

of Rule-32

Return - Forms

1.

Form Number

-XXIV

Return of tax period-monthly / quarterly

Rule-44(2)

2.

Form Number

-XXIV-A

Return of quarterly tax period

Rule-44(10) /

Sec.-6(1)

3.

Form Number

-XXIV-B

Return of monthly tax period

Rule-44(10)(b)

4.

Form Number

-XXIV-C

5.

Form Number

-XXIV-D

6.

Return of a tax period to be filled by dealers

executing works contract

Return of tax for casual dealer

Rule-45(10)

Rule-45(10A)

Form Number

-XXXIV

Advice of refund of VAT

Rule-19(8)

Form Number

Refund payment order

Rule-49(3)

7.

-XXXIII

8.

Form Number

-XXV

Quarterly tax deduction statement

Rule-44(6) /

Sec.-34

9.

Form Number

-XXVI

Acknowledgement and self assessment of

Annual Tax under Section 26 of the UPVAT

Act, 2008

Sub rule (7)

of rule-45

10.

Form Number

-XXVI-A

Form Number

11. -XXVI-B

Acknowledgement and self assessment of

Annual Tax for traders exclusively dealing

purchase and sale within the UP

Sub rule (7) of

rule-45

Acknowledgement and self assessment of Annual

Tax for works contractors

Sub rule (7) of

rule-45

12.

Form Number

-XXVII

Annual Tax deduction statement

Rule-44(9) /

Sec.-34(7)

13.

Form Number

-XXXI

Certificate of tax deduction at source

Rule-48(1)

14.

Form Number

-XXXII

Account of tax deduction certificate

Rule-48(5)

Transporter - Forms

1.

Form Number

-XVII

Declaration by the consigner to be obtained by a

transporter

Rule-38(9)(a)

2.

Form Number

-XVIII

Declaration by the consignee to be obtained

by a transporter

Rule-38(9)(a)

3.

Form Number

-XXI

Transport memo

Rule-40(1)

4.

Form Number

-XXII

Account of transport memo to be maintained by

registered dealers

Rule-40(8)

5.

Form Number

-XV

Information by transporter, carrier or forwarding

agent about registration under the carriage by

road act

Rule-38(2) &

proviso to

rule-38(1)

Stock - Forms

1.

Form Number

-Form-A

Statement of stock on the date of commencement

Rule-20(1)(a)

of the VAT Act

Challan - Forms

1.

Form Number

-I

Treasury Form 209(1) - Challan for Depositing

Money

Rule -12

Miscellaneous - Forms

1.

Form Number

-II

D.C.R.

Rule -14

2.

Form Number

-III

Verification of Receipt of Tax etc.

Rule-14

3.

Form Number

-IV

Information regarding discontinuance of business

Rule-16 / Sec.3(5)

4.

Form Number

-V

Certificate to be issued by selling agent to

principal

Rule-17

5.

Form Number

-VI

Certificate to be issued by purchasing agent to

principal

Rule-17

6.

Form Number

-XIX

Declaration by the person who stores the goods in

Rule-38(9)(b)

godown, cold storage or warehouse

Form Number

Declaration by the person who receives goods

7.

Rule-38(9)(b)

-XX

from godown, cold storage or warehouse

8.

Form Number

-XXIII

Audit report by specified authority

Rule-42

9.

Form Number

-XXVIII

Notice of assessment and demand

Rule-45(2)

10.

Form Number

-XXXIII-A

Adjustment order and voucher

Rule-49(10)

11.

Form Number

-XXXV

Form of indemnity bond

Rule-49(15)

12.

Form Number

-XXXVI

Interest payment order

Rule-50(1)

13.

Form Number

-XXXVII

Form of summons to appear in person and / or to

produce documents

Rule-51 / Sec.47(3)

14.

Form Number

-XXXVIII

Form of declaration for import

Rule-53(3)(a)

15.

Form Number

-XXXIX

Form of declaration for import for other than

registered dealer

Rule-56(1)(a)

16.

Form Number

-XL

Trip sheet

Rule-53(6)

17.

Form Number

-XLI

Register to be maintained by registered dealer

who obtain declaration forms from the issuing

authority

Rule-55(9)

18.

Form Number

-XLII

Application for obtaining declaration for import

form-other than registered dealer

Rule-56(2)

19.

20.

Form Number

-XLIII

Application for obtaining the transit authorization

Form Number

-XLIV

Application for obtaining the Transit authorization

for transit of goods carried from outside the State

by rail, river, air, post or courier at any place inside Rule-57(1)

the State for transporting outside the State by

road

Rule-57(1)

21.

From Number- APPLICATION FOR ISSUE OF CERTIFICATE OF

ENTITLEMENT

XLV

sub rule (1) of

rule-70

22.

From Number- REPORT OF THE ASSESSING AUTHORITY ON THE

APPLICATION FOR ISSUE OF CERTIFICATE OF

XLVI

ENTITLEMENT

sub rule (3) of

rule-70

From NumberCERTIFICATE OF ENTITLEMENT

XLVII

From Number- STATEMENT OF NET TAX PAYABLE AND EARNED

24.

INPUT TAX CREDIT

XLVIII

23.

25.

From Number

XLIX

26.

From Number

L

Application for refund in case of

personnel

of

foreign

diplomatic

consulate, UNO etc

sub rule (4) of

Section 42

official or

mission or rule 50A

Register of vat goods purchased within the State

http://comtax.up.nic.in/vat/vf-eng/vform-eng.htm

sub rule (4) of

rule-70

Rule-28

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- UPI Procedural Guidelines - PDF 26112019 OnwebsiteLIVE 0Document141 pagesUPI Procedural Guidelines - PDF 26112019 OnwebsiteLIVE 0Andy_suman100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tax QuestionsDocument261 pagesTax QuestionsPocaGuri100% (1)

- Invoice Zoom YKB 2022Document2 pagesInvoice Zoom YKB 2022Dian ElgaNo ratings yet

- JLORENO Globe Billing 719Document3 pagesJLORENO Globe Billing 719noibagng928krNo ratings yet

- Chapter 6 Household Behavior and Consumer ChoiceDocument43 pagesChapter 6 Household Behavior and Consumer ChoiceTori BankruptNo ratings yet

- Gross Domestic ProductDocument1 pageGross Domestic ProductSuraj AminNo ratings yet

- Sap Fico Interview Questions by Pragna TechnologiesDocument87 pagesSap Fico Interview Questions by Pragna TechnologiesSuraj AminNo ratings yet

- What Are Sap Modules - Sap Fi, Sap Co, Sap SD, Sap HCM, Sap MM, Sap QM, Sap PPDocument11 pagesWhat Are Sap Modules - Sap Fi, Sap Co, Sap SD, Sap HCM, Sap MM, Sap QM, Sap PPSuraj AminNo ratings yet

- Regional Organ Is at IonsDocument16 pagesRegional Organ Is at IonsSuraj AminNo ratings yet

- Financial Analysis eDocument3 pagesFinancial Analysis eSuraj AminNo ratings yet

- Ajeesh PG Project 2 ChapterDocument12 pagesAjeesh PG Project 2 ChapterSuraj AminNo ratings yet

- I Small Business and Corporate EnlrepreneurshipDocument1 pageI Small Business and Corporate EnlrepreneurshipSuraj AminNo ratings yet

- What Is The Role and Importance of Small Scale Industry in IndiaDocument3 pagesWhat Is The Role and Importance of Small Scale Industry in IndiaVishal GuptaNo ratings yet

- Ratio Analysis at Indian Rayon by Rafik KaatDocument76 pagesRatio Analysis at Indian Rayon by Rafik KaatAshish PandeyNo ratings yet

- Market Driven MediaDocument2 pagesMarket Driven MediaSuraj AminNo ratings yet

- Note: Posted Transactions Until The Last Working Day Are ShownDocument36 pagesNote: Posted Transactions Until The Last Working Day Are ShownMuhammad Azhar QaziNo ratings yet

- North South University: ID# 181 1530 030 DegreeDocument1 pageNorth South University: ID# 181 1530 030 DegreeRashaduzzaman RiadNo ratings yet

- AON Kelompok 5Document39 pagesAON Kelompok 5Berze VessaliusNo ratings yet

- Saving Union BankDocument3 pagesSaving Union BankSonu F1No ratings yet

- Plastic MoneyDocument11 pagesPlastic MoneyDILIP JAINNo ratings yet

- Tax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalDocument1 pageTax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalSiwam ChoudharyNo ratings yet

- Jio Fiber InvoiceDocument10 pagesJio Fiber InvoicePiyush Kumar PandeyNo ratings yet

- Benson Enterprises Is Evaluating Alternative Uses For A Three Story ManufacturingDocument1 pageBenson Enterprises Is Evaluating Alternative Uses For A Three Story ManufacturingAmit PandeyNo ratings yet

- Department of Labor: 3cDocument2 pagesDepartment of Labor: 3cUSA_DepartmentOfLaborNo ratings yet

- Estimated Port DisbursementDocument7 pagesEstimated Port DisbursementKhurram RahmanNo ratings yet

- Bandhan Statement SandipDocument4 pagesBandhan Statement SandipIndranilGhosh0% (1)

- Gmail - Booking Confirmation On IRCTC, Train - 22691, 28-May-2022, 3A, GTL - NZMDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 22691, 28-May-2022, 3A, GTL - NZMkridddhNo ratings yet

- Academic Section: Name: Varun Krishna P SDocument4 pagesAcademic Section: Name: Varun Krishna P SVarun Krishna PsNo ratings yet

- Module 7Document10 pagesModule 7Muyco Mario AngeloNo ratings yet

- Eft8502019121306440021 748Document2 pagesEft8502019121306440021 748HermieleneNo ratings yet

- DOKU Payment Page - Bank TransferDocument1 pageDOKU Payment Page - Bank TransferMuhammadSyarifudinNo ratings yet

- Biotechusa KFT Beu21159378Document1 pageBiotechusa KFT Beu21159378Paško RunjićNo ratings yet

- B2B Ecostore - Billing Letter - January 2020 TEMPLATEDocument3 pagesB2B Ecostore - Billing Letter - January 2020 TEMPLATEkevin echiverriNo ratings yet

- Ak MCQDocument130 pagesAk MCQanand vishwakarmaNo ratings yet

- Tax Bar QuestionsDocument14 pagesTax Bar QuestionsPisto PalubosNo ratings yet

- Bar Exam Qs Taxation LawDocument123 pagesBar Exam Qs Taxation LawUlyssesNo ratings yet

- Goods and Service Tax (GST) and Its Impact: Jaspreet KaurDocument3 pagesGoods and Service Tax (GST) and Its Impact: Jaspreet KaurSreekutty KNo ratings yet

- CH 04 Income StatementDocument6 pagesCH 04 Income Statementnreid2701No ratings yet

- LT E-BillDocument2 pagesLT E-BillAnil Singh BishtNo ratings yet

- UBL-04-Jan-2023 11 - 26 - 53Document2 pagesUBL-04-Jan-2023 11 - 26 - 53Mueen HassanNo ratings yet

- TAX ProjectDocument3 pagesTAX ProjectJames Ibrahim AlihNo ratings yet