Professional Documents

Culture Documents

Monticello City Grant Funding Docs

Uploaded by

The Petroglyph0 ratings0% found this document useful (0 votes)

34 views47 pagesMore USDA funding

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMore USDA funding

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views47 pagesMonticello City Grant Funding Docs

Uploaded by

The PetroglyphMore USDA funding

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 47

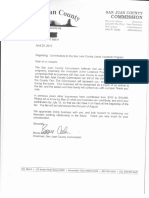

United States Department of Agriculture

Rural Development

‘Salt Lake Giy, Utah

March 23, 2006

The City of Monticello

PO Box 457

17 North 100 East

Monticello, UT 84535,

ATTN: GREG MARTIN

SUBJECT: LETTER OF CONDITIONS

$38,500 FY2006 BUSINESS ENTERPRISE GRANT (RBEG)

PLUS $28,000 FY2005 RBEG FUNDING FOR A TOTAL OF $66,500

WIND RESOURCE ASSESSMENT FEASIBILITY STUDY

‘This letter establishes the conditions that must be understood and agreed to by the City of

Monticello before further consideration can be given to funding a Rural Business

Enterprise Grant (RBEG) in the amount not to exceed a total of $66,500 between FY2006

funding of $38,500 and FY2005 funding of $28,000.

This letter of conditions does not constitute grant approval, nor does it ensure that funds

are or will be available for the project.

This letter of conditions addresses the total $66,500 RBEG request for the project.

‘The total amount of $66,500 needed to fund the project has been split between two

funding cycles. $38,500 has been funded from the FY2006 & $28,000 total has been

funded from the F¥Y2005 allocation. Neither the FY2005 $28,000 RBEG funds nor

the FY 2006 $38,500 RBEG funds will be disbursed until all project funding is in

place.

Please complete and return the attached Form RD 1942-46 "Letter of Intent to Meet

Conditions" if you desire that further consideration be given to your application.

Please note that USDA-Rural Development reserves the right to discontinue processing x,

this request, and withdraw your application if Form RD 1942-46 “Letter of Intent to Meet {?

Conditions” is not executed by the City of Monticello within 1 week of the date of this oe

letter of conditions.

Please also complete and return the attached Form RD 1940-1 "Request for Obligation

of Funds" if you desire that further consideration be given to this RBEG request. Please

only remit to this office Form RD 1940-1, and keep the attached RD Instruction

1942-G, Attachment 1, Section B “General Requirements for Administration of

Rural Business Enterprise and Television Demonstration Grants” for your reference.

4125 South Stato St, #4311, Salt Lake City, UT 84188, Phone (801) 524-4920, Fax (801) 524-4406

commited tthe ture ofa communtiee

‘Rural Development an Equal Opportunity Lender, Provider, and Employer. Complains of disceminaton should be sent

1 USDA, Director, Office of Civil Fights, Washington, D. C. 20250-9610

This RBEG will be considered approved on the date a fully executed and signed copy of

Form 1940-1, "Request for Obligation of Funds" is returned to you by this office. You

may fax the signed Forms RD 1942-46 and 1940-1 to this office to expedite processing of

this request. Our fax number is (801) 524-4406.

‘Throughout this letter or any form or document used in connection with the grant,

whenever the words "Farmers Home Administration” (FmHA) or "Rural Economic and

‘Community Development" (RECD) may appear, the words "United States of America" or

"USDA Rural Development" or “agency” may be substituted.

Any changes in project cost, source of funds, scope of work or any other significant

changes in the project or entity must be reported to and approved by USDA-Rural

Development by written amendment to this letter. Failure to obtain prior approval of

changes to the project cost, source of funds, scope of work or budget can result in

suspension or termination of RBEG grant funds.

This Grant request is subject to the following:

PURPOSE

CITY OF MONTICELLO must use RBEG proceeds to promote the economic

development of multiple small and emerging rural businesses, except as noted below in

accordance with section 6014 of the 2002 farmbill. Businesses assisted with this RBEG

must be located in, and primarily serve a rural area. Rural areas for the RBEG program

are defined as communities with a population of 50,000 or less, and not located adjacent

to urban areas of more than 50,000 population. For the State of Utah, it is easier to list

communities that are not eligible for the RBEG program. The following communities are

considered urban (50,000 or more population as listed in the 2000 census) and are NOT.

eligible areas for this program: Ogden, Layton, Salt Lake, Sandy, West Valley, West

Jordan, Taylorsville, Orem, and Provo. Also, the following listed communities are

adjacent to the above listed urban areas, and are also ineligible areas for this program:

North Ogden, South Ogden, Harrisville, Washington Terrace, Riverdale, East Layton,

Clearfield, Syracuse, Kaysville, Centerville, Woods Cross, Bountiful, North Salt Lake,

South Salt Lake, Magna, Kearns, Taylorsville, Holladay, Sugar House, Murray, Midvale,

Jordan, West Jordan, South Jordan, Draper, Pleasant Grove, Lindon, Lakeview, Ironton,

and Springville. All other communities in Utah are eligible rural areas for this program.

‘Small and emerging businesses for the RBEG program are defined as having fewer than

50 new employees, and less than $1 million in gross revenues, EXCEPT that the small

and emerging limitation will not apply to businesses with a principal office that is located

on the land of an existing or former Native American Reservation and located in a city,

town, or unincorporated area that has a population of not more than 5,000 inhabitants.

The specific purpose of this RBEG is to assist CITY OF MONTICELLO fund a “Wind

Resource Assessment” project that will provide accurate and reliable wind resource data,

which hopefully lead to a wind power project. Project will be used to purchase and

install four (4) towers with anemometers for a total project cost of $ 70,000. The City of

Monticello is working with several land owners

RBEG proceeds will be used to purchase and install equipment needed to install four

towers with anemometers for wind resource assessment.

(1) The funding is also contingent upon ‘The City of Monticello’ being verified as a VY

duly organized and recognized public body, with the legal authority to operate,

maintain, and manage the project funded in whole or in part with this grant.

SOURCES AND USE OF FUNDS

SOURCE OF FUNDS

USDA-Rural Development (RBEG) FY 2005 State Office Funds —-—-----—- $28,000

USDA-Rural Development (RBEG) FY2006 State Office Funds -—-—------- 38,500

Total USDA RD funds ~ $66,500

CITY OF MONTICELLO (Matching Funds-Cash)- 3,500

Total $70,000

A. CITY OF MONTICELLO will maintain a separate ledger on the construction,

contracts, equipment, labor, etc. funded with this RBEG.

All matched funds for this project must deposited into this separate account at the

same time the RBEG is closed.

Matched funds will be expended before, or as equitably pro-rated with RBEG

proceeds for like purposes.

The City of Monticello will provide matching funds of $3,500 will be in the form of

cash.

The City of Monticello will have to provide appropriate permits, licenses, etc.

necessary in order to purchase, build and operate the Wind Resource Assessment

towers and show that is in compliance with zoning, local, state & other applicable

laws, ordinances, etc.

»

v9

m

No grants funds will be disbursed unless all of the funds necessary to fund the total

project are available.

USE OF FUNDS

Construction & Installation of Equipment for 4 anemometer towers:

1. Four towers with anemometers @ $12,000 e: $ 48,000

2. Labor, installation of 4 towers @ $4,000 —- 16,000

3, Land contracts @ $500/yr/tower for 2 yrs 4,000

4. Consultation for placement of anemometers = 2,000

TOTAL PROJECT COST: $70,000

ORGANIZATION

Eligible applicants for the RBEG program are limited to public bodies, private non-profit

organizations, or Federally-recognized Indian Tribes.

A. This letter of Conditions is issued on the basis that the City of Monticello is a duly

organized and recognized public body, with the legal authority to operate, maintain,

and manage the project funded in whole or in part with this grant

1. The City of Monticello must provide USDA-Rural Development with a legal

opinion (multi-opinion letter) ensuring that the City of Monticello is a duly

organized and recognized public body, and has the legal authority to operate,

maintain, and manage the project funded with this request.

Ti Cay Mtoe eet provide USDA Riel Detelopmen iO. a cums 1)

Certificate of Good Standing (or equivalent Certificate of Existence) from the

State of Utah, .

OFFICE OF GENERAL COUNSEL REVIEW

A. The Office of General Counsel (OGC) (legal counsel for USDA-Rural Development)

is required to review the organizational documents and legal opinion (multi-opinion

letter), for the City of Monticello, and render an opinion to this office that the City of

‘Monticello is a duly formed, organized and recognized and has the legal authority to

operate, maintain, and manage the project funded with this request.

B. OGC will also provide this office with grant closing instruction:

C. OGC requires a minimum of 30 days to conduct this review and issue grant closing

instructions

GRANT DISBURSEMENT

This letter of conditions addresses the total $66,500 RBEG request for the project.

The total amount of $66,500 needed to fund the project has been split between two

funding eycles. $38,500 has been funded from the FY2006 allocation & $28,000 has

been funded from the FY 2005 allocation. Neither the FY2005 $28,000 RBEG funds

nor the FY2006 $38,500 RBEG funds will be disbursed until all project funding is in

place.

Grant funds will be disbursed to CITY OF MONTICELLO by Electronic Funds Transfer

(EET) through the Automatic Clearing House (ACH) network. a

USDA-Rural Development will request funds disbursement through the EFT/ACH,

system after acceptable review of Form SF-270 "Request for Advance or

Reimbursement” from CITY OF MONTICELLO as discussed below. Except for grants “7°

for revolving loan funds, grant funds will be disbursed by the USDA-Rural Development /

on a reimbursement basis. All matching funds for this project will be expended before,

or as equitably pro rated with RBEG proceeds for like purposes. J

A. CITY OF MONTICELLO must provide USDA-Rural Development with a properly

completed SF-3881 "Electronic Funds Transfer Payment Enrollment Form"

necessary to establish a ACH electronic funds transfer system a minimum of three

weeks before grants funds will be required:

B. USDA-Rural Development will request funds disbursement through the EFT/ACH

system afier acceptable review of Form SF-270 "Request for Advance or

Reimbursement" from CITY OF MONTICELLO.

1. Form SF-270 "Request for Advance or Reimbursement" must be completed

by CITY OF MONTICELLO and submitted to USDA-RURAL_

DEVELOPMENT to request RBEG funds.

2. USDA-Rural Development will request funds disbursement through the

EFT/ACH system afier acceptable review of Form SF-270. Funds will be sent to

CITY OF MONTICELLO via EFT within 30 days after receipt of a properly

completed SF-270 form.

3. Form SF-270 “Request for Advance or Reimbursement” must be supported with a

invoice for services funded with this request in accordance with the ‘Use of

RBEG Funds’ section of this letter of conditions.

4, Requests cannot exceed one advance every 30 days.

C. CITY OF MONTICELLO shall provide effective control and accountability of all

RBEG funds.

CONTRACTS FOR PROFESSIONAL SERVICES

‘A. Any contracts or other forms of agreement between CITY OF MONTICELLO and

other professional and technical representatives for this project are subject to Rural

Development's concurrence.

B. Fees for such services must be reasonable i.e., not in excess of those ordinarily

charged by the profession for similar work when Rural Development financing is not

involved.

RECORDS AND REPORTS

A. CITY OF MONTICELLO must ensure that this project is completed in accordance

with the scope of work and this letter of conditions.

B. CITY OF MONTICELLO will provide a financial management system which will:

1. Provide accurate, current, and complete disclosure of the financial result of the

RBEG.

2. Include records, which adequately identify the source and application of funds for

the RBEG supporting activities, together with documentation to support the

records. Those records shall contain information pertaining to the RBEG award

and authorizations, obligations, un-obligated balances, assets, liabilities, outlays, |

|

and income.

3. Provide effective control over and accountability for all funds. CITY OF

MONTICELLO shall adequately safeguard all such assets and shall assure that

RBEG proceeds are used solely for authorized purposes.

C., CITY OF MONTICELLO shall constantly monitor performance to ensure that time

schedules are being met, projected work by time periods is being accomplished, and

other performance objectives are being achieved.

D. CITY OF MONTICELLO must submit Form SF-269 ‘Financial Status Report! of. sje, ide ¢

this project on a quarteriy basis (ue 15 working days after the end of each quartet) es?

until all project funds have been disbursed, and the project has been completed. 2

E, CITY OF MONTICELLO must submit a project performance activity report on this,

project on a quarterly basis (due 15 working days after the end of each quarter) until

all project funds have been disbursed, and the project has been completed.

There is no standardized form for the project performance report. However, project

performance reports shall include the following:

1. A comparison of actual accomplishments to the objectives established for that

period.

2. Reasons why established objectives were not met.

3. Problems, delays, or adverse conditions, if any, which have affected or will affect

attainment of overall project objectives, prevent meeting time schedules or

objectives, or preclude the attainment of particular project work elements during,

established time periods, This disclosure shall be accompanied by a statement of

the action taken or planned to resolve the situation,

4, Objectives and timetable established for the next reporting period.

F. A final project performance report will be required with the final SF-269 ‘Financial

status report’ .

G. The Agency will also require CITY OF MONTICELLO to prepare a report suitable

for public distribution describing the accomplishments made through this RBEG.

This report should include an assessment of actual or potential jobs created/saved,

and businesses assisted through this RBEG.

HL This request is subject to audit requirements of 7 CFR 5052--AUDITS OF STATES,

LOCAL GOVERNMENTS, AND NON-PROFIT ORGANIZATIONS.

1. Audits completed in accordance with the Generally Accepted Government

Auditing Standards (GAGAS) will be acceptable if CITY OF MONTICELLO

expends less than $300,000 in Federal funds in any fiscal year. GAGAS

standards are set forth in the "Government Auditing Standards, 1994 Revision”

(commonly referred to as the ‘yellow book’).

a. GAGAS audits must be submitted to this office within 150 days of the "as is"

audit date.

2. Audits completed in accordance with OMB Circular A-133, AUDITS OF

INSTITUTIONS OF HIGHER EDUCATION AND OTHER NONPROFIT

INSTITUTIONS will be required if CITY OF MONTICELLO expends $300,000

or more in Federal funds in any fiscal year.

a. OMB Circular A-133 audits must be submitted to this office within 9 months

afier the end of the grantee's fiscal year.

3. Applicable audits are required in the fiscal year in which RBEG proceeds

are received and years in which work is accomplished that will be paid for with

RBEG proceeds.

I CITY OF MONTICELLO will retain financial records, supporting documents,

statistical records, and all other records pertinent to the grant for a period of at least 3

years after grant closing, or termination of the project, except that the records shall be

retained beyond the 3 year period if audit findings have not been resolved or if

directed by the United States. Microfilm copies may be substituted in lieu of original

records. The Agency and the Comptroller General of the United States, or any of

their duly authorized representative, shall have access to any books, documents,

papers CITY OF MONTICELLO may have pertinent to the RBEG for the purpose of

making audit, examination, excerpts, and transcripts.

COMPLIANCE WITH SPECIAL LAWS AND REGULATIONS

A. CITY OF MONTICELLO shall keep records and submit to the agency, upon request,

timely, complete and accurate compliance reports as the agency may determine to be

necessary to ascertain compliance with the Civil Rights laws and Equal Opportunity

Jaws and program regulations.

B. CITY OF MONTICELLO must keep and provide data on race, gender, and national

origin and any such records, accounts, and other sources of information and facilities

as may be pertinent for the agency to determine whether CITY OF MONTICELLO

has complied or are complying with regulations.

C. CITY OF MONTICELLO must comply with the following:

1, Title VI of the Civil Rights Act of 1964-

a, Title VI states that no person shall, on the grounds of race, color, or national

origin, be excluded from participation in, be denied the benefits of, or be

subject to discrimination under any program or activity receiving Federal

financial assistance.

2. Title IX of the Education Amendments of 1972-

a. Title IX prohibits discrimination on the basis of sex in education programs

and activities receiving Federal financial assistance.

3. Section 504 of The Rehabilitation Act of 1973 as amended (29 U.S.C. 794) and

7. CER Part 15b-

a. No qualified individual with a disability and solely by reason of their

disability may be excluded from using or participating in the benefits of any

facility receiving Department of Agriculture (USDA) Rural Development

assistance.

4. Age Discrimination Act of 1975-

a. Prohibits discrimination based upon age.

5. Other Equal Opportunity and Nondiscrimination Requirements-

a. Beneficiaries of Federal financial assistance must comply with all additional

Federal Civil Rights laws and requirements as applicable to the entity, service,

or program.

COMPLIANCE REVIEW REQUIREMENTS

1, To ensure that these requirements are met, we are obligated to complete periodic

Civil Rights Compliance reviews, and document these reviews on

Form RD 400-8 “Compliance Review” on all RBEG financed projects.

2. Compliance reviews will be performed before the grant is closed, and at least

every 3 years thereafter, as long as the RBEG financed project is used for the

original or similar purpose for which assistance was intended

a, Toassist us in this process, we request that you complete the enclosed

“Civil Rights Compliance Review” check-sheet. Please complete and

return this check-sheet to our office as soon as possible, so that we can

complete the required compliance review prior to grant closing.

3. In order for the agency to properly complete civil rights compliance reviews,

you must provide racial/ethnic and gender data for CITY OF

MONTICELLO and borrowers/clients served by CITY OF MONTICELLO.

a. Racial data shall be categorized by: American Indian or Alaska Native, Asian,

Black or African American, Native Hawaiian or other Pacific Islander, and

White.

b. Ethnicity data shall be categorized by Hispanic or Latino, Not Hispanic or

Latino,

4, CITY OF MONTICELLO must set up an internal process to collect this

required data from your clients to provide to the agency upon request.

5. The following will be reviewed for compliance:

a, Various types of racial/ethic and gender data on applicants to CITY OF

MONTICELLO and clients served from the RBEG request, and racial/ethic and

gender data on employees of CITY OF MONTICELLO.

1. This can be accomplished by revising CITY OF MONTICELLO’s

admissions application to include statistical data and a disclosure

statement.

cr

a. The statistical data should include racial/ethnic and gender data. There

should be a category for a statement such as, “I do not wish to furnish this

information.”

'b. The disclosure statement should read, “The following information is

requested by the Federal Government for certain types of Federal

Assistance, in order to monitor compliance with equal credit opportunity

laws. You ate not required to furnish this information, but are encouraged

to do so. The law requires that CITY OF MONTICELLO may neither

discriminate on the basis of this information nor on whether you choose to

furnish it. However, if you choose not to furnish it, under Federal

regulations, CITY OF MONTICELLO is required to note race/ethnicity on

the basis of visual observation or surname. If you do not wish to furnish

the above information, please check the box below.”

1. CITY OF MONTICELLO must review the above material to

assure that the disclosures satisfy all requirements to which CITY

OF MONTICELLO is subject under applicable State law for the

particular type of program.

2. Each application will carry the equal opportunity logo, “This is an

Equal Opportunity Program. Discrimination is prohibited by

Federal Law. Complaints of discrimination may be filed with the

USDA, Director, Office of Civil Rights, Washington, D.C.

20250”.

A summary of actions for each application (rejected, withdrawn, ete.)

1, Records should be maintained on an annual basis.

4. User fees or charges for service- including reasons that certain

individuals are charged different or higher rates than others.

. Racial/ethnic and gender data of CITY OF MONTICELLO

employees, board members. For example, what efforts have been

made to attract minority and persons with disabilities to the board of

directors or similar governing body.

£. Methods used by CITY OF MONTICELLO to inform the community

of the availability of services. All written materials, such as

pamphlets, brochures, letterhead, handouts, newspaper articles and ads

should have the non-discrimination statement printed on them,

Example: “Equal Opportunity Lender/Agency ”.

g. Methods whereby special accommodations are made by CITY OF

MONTICELLO to persons with disabilities, for example, accessible

by wheelchairs or access to TDD or relay service for persons with

hearing impairment. Facility should have an accessible route through

common use areas to meet the Americans with Disabilities

Act/Accessibility Guidelines (ADA/AG) or Section 504 of the

Rehabilitation Act of 1973. (Refer to the Uniform Federal

‘Accessibility Standard (UFAS) and ADA/AG, Section 4.3)

1. The ADA/AG handbook may be accessed through the internet at

the following address: www.access-board, gov/ufas/ufas-html

2. Accessibility guidelines may be accessed through the internet at

the following address:

www.access-board.gov/adaag/htmV/adaag.htm

. In accordance with 7 CFR Subtitle A, Section 15b.8, if your

organization has not complied with accessibility standards, a self-

evaluation has to be conducted with the assistance of person(s)

knowledgeable of accessibility issues.

a. The self-evaluation should address but not be limited to ramp

and parking, entrance to an office, and restrooms).

b. A Transition Plan should be developed outlining your plan of

action by which all accessibility requirements will be met. If

applicable, RBS will request a Self-Evaluation and Transition

Plan.

©. Accessible parking spaces shall be designated as reserved for

persons with disabilities by a sign showing the symbol of

accessibility. A vehicle parked in the space shall not obscure

such signs.

d. CITY OF MONTICELLO should have a designated accessible

restroom for

persons with disabilities. The restroom must be accessible in

accordance with the Uniform Federal Accessibility Standard

(UFAS) and ADA/AG, Section 4.22.

h. Bulletin board(s) displayed in a public area(s) with “And Justice for

All” and an “Equal Employment Opportunity is the Law” posters.

‘You are reminded that you may be subject to additional civil rights

Jaws and regulations. Although Rural Development does not enforce

these laws, if, in the course of a compliance review, Rural Development

detects a potential violation of these laws, Rural Development is obligated

to refer the potential violation to the appropriate enforcement agency.

6. Since we are required by law to report non-compliance in these requirements,

please ensure that you have a mechanism in place to capture this required data.

7. In addition, all RBEG’s used for construction projects are subject to the

Americans with Disabilities Act, Title II of 1990.

OTHER CONDITIONS

Debarment certifications-

A. CITY OF MONTICELLO is required to comply with Rural Development Instruction

1940-M with respect to debarment procedures. Forms AD-1047, "Certification

Regarding Debarment, Suspension, and Other Responsibility Matters-Primary

Covered Transactions" and Form AD-1048, "Certification Regarding Debarment,

Suspension, Incligibility and Voluntary Exclusion-Lower Tier Covered Transactions"

will be used for this purpose.

1

CITY OF MONTICELLO must obtain certifications on Form AD-1048

‘Certification Regarding Debarment, Suspension, Ineligibility and

Voluntary Exclusion-Lower Tier Covered Transactions" from any person or

entity you do business with as a result of this government assistance certifying

that they are not debarred or suspended from government assistance.

a. AD-1048 certifications will need to be executed by contractors for business

development technical assistance, and all presenters utilized by CITY OF

MONTICELLO for this project.

B, Fidelity bond coverage will be required on all persons of CITY OF MONTICELLO

authorized to receive and/or disburse Federal funds. Coverage may be provided

either for all individuals or persons, or through a "blanket" coverage providing

protection for all appropriate persons.

C. CITY OF MONTICELLO further agrees to the terms and conditions of the enclosed

RD Instruction 1942-G, Attachment 1, Section B.

The following items attached for your reference and use:

a, Form RD 1942-46, "Letter of Intent to Meet Conditions"

b. Form RD 1940-1,."Request for Obligation of Funds"

c. RD Instruction 1942-G, Attachment 1, Section B “General Requirements for

Administration of Rural Business Enterprise and Television Demonstration Grants”

I. Scope of Work

Form SF-270 "Request for Advance or Reimbursement"

Form $F 3881 “Electronic Funds Transfer Payment Enrollment Form”

. Form SF-269 "Financial Status Report"

Form RD 400-1 “Equal Opportunity Agreement”

Form RD 400-4 “Assurance Agreement”

Form RD 400-8 “Compliance Review”

“Civil Rights Compliance Review” checksheet

“And Justice For All” poster

“Equal Employment Opportunity is the Law” poster

n, Form AD-1048 "Certification Regarding Debarment, Suspension, Ineligibility and

Voluntary Exclusion-Lower Tier Covered Transactions"

Please contact Roger Koon, if you have any questions. Roger may be contacted by phone

at 801.524.4301.

Richard Carrig

Rural Business and Cooperative Programs Director

USDA Rural Development

Ce: Roger Koon

10

RD Instruction 1942-6 ‘

Attachment 1

Page 8

(Revision 2)

M. Grant cancellation. Grants may be cancelled by the grant approval

official by use of Form RD 1940-10, "Cancellation of U.S. Treasury Check

and/or Obligation.* The State Director will notify the applicant by letter

that the grant has been cancelled. A copy of the letter will be sent to

the applicant's attorney and engineer and to the Regional Attorney, occ, if

the Regional Attorney has been involved.

N. Grant servicing. Grants will be serviced in accordance with Subpart 2

of Part 1951 of this chapter.

©. Subsequent grants. subsequent grants will be processed in accordance

with the requirements set forth in this subpart.

Section B

TIT. Responsibilities of the Grantee

‘This section contains information regarding the responsibilities of the

grantee for receipt of monies under the RBE/television demonstration grant

program. This section shall become a permanent attachment to Form RD 19401 as

outlined in Section A, paragraph IT. H. of this Attachment. These requirements do

not supersede the requirenent for receipt of Federal funds as stated in Parts

3015, 3016, and 3019 of the Uniform Federal Assistance Regulations; however,

specific areas related to the RBE/television demonstration grant program are cited

below. (Revised 07-16-03, PN 361.)

Grantee agrees to:

A. Comply with property management standards established by 7 CPR Parts

3015, 3016, and 3019 for real and personal property. ‘Personal property"

means property of any kind except real property. It may be tangible -

having physical existence - or intangible - having no physical existenc

such as patents, inventions, and copyrights. | *Nonexpendable personal

property" means tangible personal property having a useful life of more

than 1 year and an acquisition cost of $300 or more per unit. A grantee

may use its own definition of nonexpendable personal property provided that

such definition would at least include all tangible personal property as

defined above. "Expendable personal property” refers to all tangible

personal property other than nonexpendable property. when real property or

nonexpendable property is acquired by a grantee with project funds, title

shall not be taken by the Federal Government but shall be vested in the

grantee subject to the following conditions: (Revised 07-16-03, PN 361.)

(08-20-92)

RD Instruction 1942-¢

‘Attachment 1

Page 9

a. When title is transferred either to the Federal Government

or to a third party and the grantee is instructed to ship the

property elsewhere, the grantee shall be reimbursed by the

benefiting Federal’ agency with an amount which is computed by

applying the percentage of the grantee participation in the

cost Of the original grant project or program to the current

fair market value of the property, plus any reasonable shipping

or interim storage costs incurred.

2. Use of other real or nonexpendable personal property for which

the grantee has title.

a. The grantee shall use the property in the project or

program for which it was.acquired as long as needed, whether or

not the project or program continues to be supported by Federal

funds. When it is no longer needed for the original project or

program, the, grantee shall use the property in connection with

its other federally sponsored activities in the following order

of priorit;

4. Activities sponsored by Ania.

ii, Activities sponsored by other Federal agencies:

b. Shared use. During the time that nonexpendable personal

property is held for use on the project or program for which it

was acquired, the grantee shall make it available for use on

other projects or programs if such other use will not interfere

with the work on the project or progran for which the property

was originally acquired. First preference for such other use

shall be given to projects or programs sponsored by FnHA;

second preference shall be given to projects or programs

sponsored by other Federal agencies. If the property is owned

by the Federal Government, use for other activities not

sponsored by the Federal Government shall be permissible if

authorized by PmHA. User charges should be considered, if

appropriate.

3. Disposition of real or nonexpendable personal property. when

the grantee no longer needs the property as provided in Section B,

paragraph III A 2 of this Attachment, the property may be used for

other activities in accordance with the following standard:

@. Personal property with a unit acquisition cost of less than

$1,000, ‘The grantee may use the property for other activities

without reimbursement to the Federal Government or sell the

Property and retain the proceeds.

SPECIAL PN

(08-20-92)

SPECIAL PN

RD Instruction 1942-6

Attachment 1

Page 11

ii. Sources of the property including grant or

‘other a agreement number.

iv. Whether title vests in the grantee or the

Federal Government.

W. Acquisition date (or date received, if the

property was furnished by the Federal

Government) and cost.

Wis Percentage (at the end of the budget year)

of Federal participation in the cost of the

project or program for which the property was

acquired. (Not applicable to property furnished

by the Federal Government).

xii. Location, use, and condition of the

Property and the date the information was

reported.

viii. Unit acquisition cost.

4x. Ultimate disposition data, including date

of disposal and sales price or the method used

to determine current fair market value where a

grantee compensates the Federal agency for its

share.

b. Property owned by the Federal Governnent must be

marked to indicate Federal ownership.

S.A physical inventory of property shall be taken

and the results reconciled with the property records

at least once every 2 years. Any differences between

guantities determined by the physical inspection and

those shown in the accounting records shall be

investigated to determine the causes of the

difference. The grantee shall, in connection with

the inventory, verify the existence, current

utilization, and continued need for’ the property.

RD Instruction 1942-6

Attachment 1.

Page 13

(Revision 1)

B. Cause said program to be completed within the total sums available

to it, including said grant, in accordance with the program plan and any

necessary modifications thereof prepared by grantee and approved by

grantor.

C. Permit periodic inspection of the program operations by a

representative of grantor.

D. Make the program available to all persons in grantee's service area

without regard to race, color, national origin, religion, sex, marital

status, age, physical or mental handicap who have also received Pui

related assistance from the grantee.

E. Not use grant funds to replace any financial support previously

provided or assured from any other source. The grantee agrees that the

general level of expenditure by the grantee for the benefit of program

area and/or program covered by this attachment shall be maintained and

not reduced as a result of the Federal share of funds received under

this grant.

F, No nonexpendable personal property to be owned or used by the

borrower or its affiliate(s) for use other than the grant purposes will

be acquired wholly or in part with grant funds.

G. Use of the property including land, land improvement, structures,

and appurtenances thereto, for authorized purposes of the grant as long

as needed. The grantee shall obtain approval of the grantor before

using the real property for other purposes when the grantee determines

that the property is no longer needed for the original grant purposes.

H. Provide financial management systems which will include:

1, Accurate, current, and complete disclosure of the financial

results of each grant. Financial reporting will be on an accrual

basis.

2. Records which identify adequately the source and application of

funds for grant-supporting activities. Those records shall contain

information pertaining to grant awards and authorizations,

obligations, unobligated balances, assets, liabilities, outlays, and

income.

3. Bffective control over, and accountability for, all funds.

Grantees shall adequately safeguard all such assets and shall ensure

that they are used solely for authorized purposes.

4, Aecounting records supported by source documentation.

(08-20-92) SPECIAL PN

RD Instruction 1942-6

Attachment 1.

Page 148

(Added 07-17-02, PN 348)

0. In contracts in excess of $2,000 and in other contracts in excess of

$2,500 which involve the employment of mechanics or laborers, to include

a provision for compliance with Sectidns 103 and 107 of the Contract

Work Hours and Safety Standards Act (40 U.S.C. 227-330) as supplemented

by Department of Labor regulations (29 CFR, Part 5). Applies only where

Davis Bacon requirements apply.

P, Include in all contracts in excess of $100,000 a provision for

compliance with all applicable standards, orders, or regulations issued

pursuant to the Clear Air Act of 1970. Violations shall be reported to

the grantor and the Regional Office of the Environmental Protection

agency.

(08-20-92) SPECIAL PN

c2se0004 me

REQUEST FOR ADVANCE eo Soo

OR REIMBURSEMENT 1 CU ADVANCE = [[]_-REIMBURSE-

oo or Cessn

ims eRe

(See nso on back) ae! | qa Daccrua

{FEL SOOT ABT NO ORATOR EEGETTO |RSS oT Eparraraer reas

Tenner ona commoner vena omnes?

presow aor

Camorneanrcton [reeanensscoonmaamn |B Pano COVERED BY THe REQUEST

a Secon aT ora aT

STREET RE TET

se ne

sant sr

tease Sc

on, se, oy, st

ozP coe ez as:

a ‘COMPUTATION OF AMOUNT OF REIMBURSEMENTS/ADVANGES REQUESTED

PROGRAMSIFUNCTIONSIACTIVITIES Be ea o le

Tora

Ta faa

cance s s ‘ s 0.00

Less: Cumulative progam income 0.00

Spun ap

en 0.00 200 200 0.00

7 ES erat carom ET aRE

pote 000

2. Total (Sum of ines ¢ & d) 9.00 0.00 9.00 9.00

{Non Far har of amarante 009

4. Fado tar ct antonio 0.00

1 ada pana ountd 0.00

Tics os ow ona

_aninus tine h a o 0.00 0.00 0.00 0.00

7 Adee equ

ton ven opecos |_ 1m 0.00

oy Patel pero

agency for use In making ee Li)

a ae

= [ALTERNATE COMPUTATION FOR ABVANGES ONLY

8. Estimated Fedral cash outays that will ba made during period covered by the advance s

Las Esta ben Fedora a fgg laden pres

¢Anareqmaed anna : 200

‘AUTHORIZED FOR LOCAL REPRODUCTION

(Corded on Rovers)

‘STANDARD FORMZTO (Rov. 7-97)

Prosutbedby OM Coa A102 and A110

=

(CERTIFICATION

GRC AER CENSOR. SRE REaREST

| certty that 10 the best of my soured

eonledgo abot he data on

‘oro are coectand all cute

Mteremade in cordance with te, |

‘fant condone or thr agromant_ | NBCRPANTED WANE HOTTIE Soe

Sra at payments do and has rat Screg

Ben previa requested

"Tis pace or agenay use

em

Pubic reporting burden for this collection of informatio is estimated to average 60 minutes per

response, incuding time for reslowig isructons, searching exiting data sources, gathering end

‘maintaining the data nooded, and completing and rviowing the collection of information. Send

‘comments regarding the burden estimate or any other aspect of his collation a information,

Including suggestions for reducing this burden, tote Offoe of Management and Budget, Paperwork,

Roduction Project (0848-0004), Washington, DC 20603.

PLEASE DO NOT RETURN YOUR COMPLETED FORM TO THE OFFICE OF MANAGEMENT

‘AND BUDGET. SEND IT TO THE ADDRESS PROVIDED BY THE SPONSORING AGENCY.

INSTRUCTIONS

Please type or pint legibly. Items 1, 3, 5, 9, 10, 11¢, 11f 11g, 111,12 and 19 are sell-explanatory, specific

Instructions for other item are as follows:

Enty

2. Indicate whether request is prepared on cash or accrued

expenditure basis. All requests for advances shall be

prepared on a cash basis.

4, Enter the Fodoral grant number, or other identifying

number assigned by the Federal sponsoring agency. If

the advance or reimbursement is for more than one grant

‘or other agreement, insert N/A; then, show the aggregate

amounts. On a separate sheet, list each grant or

agreement number and the Federal share of outlays

made against the grant or agreement.

6. Enter the employer identification number assigned by the

US. Internal Revenue Service, or the FICE (institution)

code if requested by the Federal agency.

7. This space Is reserved for an account number or other

‘dentitying number that may be assigned by the recipient.

8 Enter the month, day, and year for the beginning and

Not:

1

tending ofthe period covered in this request. If the request

is for an advance or for both an advance and

reimbursement, show the period that the advance will

cover. If the request is for reimbursement , show the

period for which the reimbursement is requested.

‘The Federal sponsoring agencies have the option of

requiring recipients to complete items 11 oF 12, but not

both. Item 12 should be used when only a minimum

‘amount of information is needed to make an advance and

‘outlay information contained in item 11 can be obtained in

a timely manner from other reports

1. The purpose of the vetcal columns (a), (b) and () i to

provide space for separate cost breakdowns when a

project has been planned and budgeted by program,

funeton, or

tem

ita.

1b.

14.

18,

Enty

activity. If additional columns are needed, use as many

‘additional forms as needed and indicate page number in

space provided in upper right; however, the summary

totals of all programs, functions, or activities should be

shown in the "total" column on the first page.

Enter in ‘as of dato," the month, day, and year of the

tending of the accounting period to which this amount

applies. Enter program outlays to date (net of refunds,

rebates, and discounts), in the appropriate columns. For

requests prepared on a cash basis, outlays are the sum

of actual cash disbursements for goods and services,

the amount of indirect expenses charged, the value of in-

kind contributions applied, and the amount of cash

advances and payments made to subcontractors and.

subrecipients. For requests prepared on an accrued,

expenditure basis, outlays are the sum of the actual

cash disbursements, the amount of indirect expenses

incurred, and the not increase (or decrease) in the

‘amounts owed by the recipient for goods and other

property received and for services performed by

‘employees, contracts, subgrantees and other payees.

Enter the cumulative cash income received to date, it

requests are prepared on a cash basis. For requests

prepared on an accrued expenditure basis, enter the

‘cumulative income earned to date. Under either basis,

center only the amount applicable to program income that

was required to be used for the project or program by

the terms ofthe grant or other agreement.

Only when making requests for advance payments,

conter the total estimated amount of cash outlays that will

bbe made during the period covered by the advance.

‘Complete the certification before submiting this request.

‘srA0170 FORUE7O (767 Bask

FINANGIAL STATUS REPORT

(Long Form)

(Follow insiructions on the back)

‘ouch Repo Suites

FF Aaa nd Oipneatond Barat

FE Fa ra tha ei Naa FeSDRAZ Cua Ae Pas

By Feces homey he.

0348-0039

Reset Ggaiaaten Naps ad carpe a

ss ang EP a)

[a pie Goan Nebr

[= Retin Aasount mbar ota Je PraiRopot [7 Basa

From: (oD, Yu)

e Fanangct Paod (See rans)

[Pes Goat te Rapa

fe ono, Yex) | Fem: eon On, Yeu [Pe ono, Ye)

Prom Ropees | __ ths Punt mute

a Tanta

Roti als 0

Wako i as em tes Bond)

Rechlents share of et outay, consisting of:

fe Titty ning) anton

oer Fs avers adhd bs ona HUGH ew

1 Foga Razne maw arc wih nang col

Ate eit ola neon cara TE

1 Tecpel sr fale Samat nara Lod)

ereselshaectneonaje (nessa)

Tar igs ato

ake

T Resin sat agus Siang

sigs

cee See

oe

eeetea tesa

Tatas ahr fs] am)

ferrets ond

Fo aa PE

Ubinas a Fase nas iw oma ro

2. Oataedrepam are sham on ter candor 92818

00!

Dabs ropa recog he sn alate

5 Uhaabosed pagan hase

Ta oa icone aid Sm tines Fane)

0.00]

Je Tipe cas ae 97 apna bod

Br Provaona

1 Predetermined Brit Dries

Specs Ea

Teak Foie Sa

_goveming gilt.

Raa: Rc sy xan Saad roa ot SGTO Taio iy Fada Rag eRe SONGS wi

Ha GetcanTealy to te bat of my onic and bec ali ropo scared and compete ada al ouays an

ngs obtatons afr he purposes st forth inte award docimants,

[pete Pied ane ar Tite

Feetone Gee coe, rambo tran)

Sse ohatoraod Cong OE

Ds Rapa Sais

Froico Eon alo

mater Sinsad Form Rec 7)

Prertaty OMB Chevars102 an 10

20-408 0.139 Face)

Peeps aren ors caacton tomatoe ara aerage 20 mind er eso rig ine reir auton,

FINANCIAL STATUS REPORT

hong Far)

‘arn ering cata srs, garg an marae dis ons, an arpa ove een tomato, Sr cent

‘epg be tren evr ey ent apo er cease ot aon cng eagonsoe tangs aes, whe Os

game rt Bue Paper Reson Pj (340 O09), Vcnngtn De 2500

PLEASE DO NOT RETURN YOUR COMPLETED FORM TO THE OFFICE OF MANAGEMENT AND

BUDGET,

Pease type or print legibly. The folowing general instructions explain how to use the form isl, You may need actions

Information to compete cetain tems correctly, of to decde whether a specie tom ie applcable to tie award. Usual,

such informaton wi be found in the Federal agency's grant regulations of the terms and condtions ofthe award (e.g.

how to calculate the Federl share, the permissible uses of program income, the value of inkind contrbutons, elt). You

may also contact the Federal agency direct

item

4

40.

1a

nity

2and3, Settextanotoy,

Ener the Employer ieriication Number (EN)

_assgned by tho US. riral Revenue Serves,

‘Space reserved for an account bet oF oer

‘dong umber aslgned by he reapont

Chock yes only Hts Is the last repeat forthe

vid own nto 8.

Seteptnatoy,

Unless you have rected othr insrusions om

‘ne anardng agency, enter Be begining od

fndng datea of the cent nng period tis

23 muyear progam, the Federal agency mght

requre cumulative reporng trough consecutive

fuing periods. that cas, tar the beating

and ending dates of the grant prod, andin the rest

of these hsivctons,subatte the fem “pant

eto for "unas peed

Settexplanatory

‘The purpose of eaunns, and Iti o how be

‘fect of bis reporing|periads transacions on

‘camulatie fenci efatue. The amounts entered

falum I wil mal be Be same ae hase bh

talus Hof the previous reper In to. same

funding period. Wis the fst or only report of

‘he funding parc, lave cobs | ant bank.

you need to adjust amounts entered on previous

reports, fons the cole | eny on his report

‘id atach an explanation.

Enter total grass progam oulays.incide

‘Sebursoments of cash roalzod as program inca

If mat iome wil algo be shown on nee 10s oF

10g. Do ret ince program incame that will be

shown en ines Yor r 105

For rpors prepared on a cash bass, outlays are

the sum of actus cash abusementa for rect

oes for goods and sere, the amount of nsrect

‘expense charged the value of nnd contbutons

‘poled, and the ameant of cash advances and

Payments mae to. subrecipents For reports

Prepared on an accrul basis, outays ar tho sam

‘factual cash csburaamens for diet charges fer

{pode and eros, he iount of hect expense

Incued, tha value of inknd contra apie,

snd te nat nereate or decrease i the amounts

‘vod bythe reipiont or goods and ether propery

‘ceived, for senices performed by employees,

corractrs, subgrarees and her payees, ard

‘other amounts becoming owed under programs for

‘whieh no cutent eeroes or performances. are

Foguted, such as annus, insurance clans, an

‘er benefit payments

tem

10.

102,

Not:

10,

10%

so

tom.

109,

tte

ue.

M18,

a

te

Not:

Ent.

Enter ary roi related fo outays reported on the

form tat ar bing weoed as a reducion ef expenditure

‘ater than income, and were el aca neti cut of

the amount shown as oudaye on ne 103,

Ent tho amount of program income that was used in

‘cordance withthe desuconateatve,

Program noone used in accordance wih other

‘loratvs Is erred on Ines , fad &. Rehblnts

feporing on cath basis shoud ener th amo of

20h inome reeeed on an acual bau, onto te

Program income eared. Pregram income may of may

hot have been nod in an appltionbusget enor

{budget on te oward document facial come Ie

fom a eilrent source oF le sriicanty diferent

amount, ai an explanation or uso Go remarks

secon,

e.t.9.h end}. Set-explanatay

Enter the tial amount of uniguated obigators,

lecusng unguided ebtgatons to eubgrantees and

contractors

LUniquistesobtgstons ona cash bel are eilgstons

Incurred, but not ya pa. On an accrual asi, they ae

bigatensincured, but for which an ou has net yet

been eooded

‘Do net neue ay amounts on Se TOK that have been

Incided on nos 108 and 10,

‘onthe fina oper ie OK mat be 2

Set-explanatory

(nthe roport ne 10m must tobe zero

0,P.9.t, and Seltersonstoy

Satteelenaton,

Ente the indirect cost rate in offect dsing the epetng

atiod

Enfer the amount ofthe base again! which the rate

was eppiod.

Ente the toll amu of inect costs charged ding

the repo pelos

Enter tha Federal share ofthe amountin 1

mor than on rate was infect dng the period

shaun in le 8, each a schedule showing the bases

‘gaint which the aiferent rales were sppled, the

Tespoctve rates, tha calendar periods thy were in

sted, amwounis of indest expense charged to the

Project_and the Feceral share of Indret expense

‘charged io the project date.

‘5.280 Bak Row. 757)

ACH VENDORIMISCELLANEOUS PAYMENT OMB No, 1510-0055

ENROLLMENT FORM

Expiration Date 01/31/2000

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains payment-

related information processed through the Vendor Express Program. Recipients of these payments should bring this

information to the attention of their financial institution when presenting this form for completion.

PRIVACY ACT STATEMENT

The following information is provided to comply with the Privacy Act of 1974 (P.L. 93-579). All infor-

mation collected on this form is required under the provisions of 31 U.S:C. 3322 and 31 CFR 210. This

information will be used by the Treasury Department to transmit payment data, by electronic means to

vendors financial institution. Failure to provide the requested information may delay or prevent the

receipt of payments through the Automated Clearing House Payment System.

‘AGENCY INFORMATION

FEDERAL PROGRAM AGENCY

AGENCY IDENTIFIER: IASENGY LOCATION CODE (ALG} KOR FORMAT:

Cleon em ere

[ADDRESS

(CONTACT PERSON NAME: TELEPHONE NUMBER:

"RODITIONAL FORWATION.

PAYEE/COMPANY INFORMATION

Tan SSHNO. OR TAXPAYER 1D NO.

[ADDRESS

[CONTACT PERSON NAME: FFELEPHONE NUMBER:

FINANCIAL INSTITUTION INFORMATION

TAME:

ADDRESS:

[AGH COORDINATOR NAME: [TELEPHONE NUMBER:

INE-DIGIT ROUTING TRANSIT NUMBER:

DEPOSTOR AGOUNT THES

DEPOSTTOR ACCOUNT NONBER: TOCRBOK NOWBERE

[TYRE OF ACCOUNT:

Dictectane Csavives Ctocksox

‘SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: TELEPHONE NUMBER:

{Cou be the same as ACH Coacinter)

NSN TSO SS aT TET

1

uspa. Position 5 ron arrnoven

Form RD 40-8 On No. 05750018,

(Rev. 8.00)

DATE OF REVIEW COMPLIANCE REVIEW a

[coUNTY

rennin by Rc

SOURCE OF FUND: Sf anil Asitace trong

s U.S:beparnentaf Agile) ease NEE

iret insured DATE LOAN OR GRANT CLOSED

TYPE OF ASSISTANCE, CORRH and LH Organization

Housing Preservation Grant] Water and Waste Disposal Loan or Grant Intermediary Relending Program

Crees Cloraring Association DURurat Housing Site Loans

roc DIE Cooperative cooperative Service

CIBat Loans Cicommunity Facies

Bother

NAME OF BORROWER ORGANIZATION OR ASSOCIATION.

ADDRESS OF BORROWER

1, STATISTICAL INFORMATION

(For the purpose ofthis report, the erm "PARTICIPANTS" will be used to describe

PURCHASER" OR Potential Users for pre-loan closing compliance reviews, as applicable.

Aw.

POPULATION

{EMBERS,” OCCUPANTS," "SITE

PARTICIPANTS

LAST REVIEW

ETHNICITY No | % | No

% | vo %

Hispanic or Latino

[Not Hispanic or

Latino

TOTAL

MALE

FEMALE,

ot morgaeran mea our auc as

POPULATION PARTICIPANTS

AQ.

THIS REVIEW _LAST REVIEW

RACE no | % |xo | |x |

American

Indian/Alaskan

‘Native

Asian

Black oF

African

American

Native

Hewalian

White

TOTAL

Mate

Female

AQ).

EMPLOYEES: EMPLOYEES

MALE FEMALE MALE FEMALE

eranicrty | No. | % | No | % | No | % eranicrty | No. | % | No | % | No | ®

Hispanic or Latino Hispanic or Latino

Not Hispanic or

BOARD OF

A@).cont. EMPLOYEES DIRECTORS

RACE wo | % [xo] % | no | « RACE No. | % | xo] % | no | x

‘American ‘American

Indian/Alaskan IndisevAlaskan

Native Native

‘Asian Asian

Black or Black or

‘Aftican Afiean

American American

Native Native

Hawaiian Hawaiian

white white

TOTAL TOTAL

11. APPLICATION INFORMATION (Project, Facility, Complex of Lendet)

BO. Number of

Applicaton Received Number of

‘This Review Last Review Applications Approved

ETHNICITY No. % No. ® No. ® No, %

Hispanic or

Latino

[Not Hispanic or

Latino

TOTAL

Male

ToraL | Female

Family

Ba) Number of

Applicaton Received Number of Number of

This Review Last Review Appliestions Approved Applications Rejected

RACE Ss % No. % No. * No. %

American Indian/

Alaskan Native

Asian

Black or Aftican

American

[Native Hawaiian

White

TOTAL

Mal

ToraL | Female

Family

[A, Are racial and gender of the participants and the number of employees in proportion to the population percentages?

- -Oves (No

B, Number of participants as of lat review: Date of last review:

. Are all interested individuals permitted to file an application (written or otherwise) for participation? ..

If"NO" explain why not:

ves Oo

. Does or wil secipient of financial assistance maintain adequate records on the receipt and disposition of applications, including a

list of applicants wishing to become participants? - Ces Ono

ia

10" what action is being taken to establish adequate records:

1°YEs

number of applicants wishing to become participants on list _

[Number on list from minority group

E, Number of applications received from prospective participants since last review: Total

If zero skip to HL

From minority group applicants

P, Number of applications which have been withdrawn or rejected since last review:

From minority group applicants

G. Number of applications now pending on which no action has been taken: Total

‘group applicants...

TH, LOCATION OF THE FACILITY

‘A. Does the location ofthe facility or complex have the effect of denying access to any person on the basis of race, color, national

origin, age, sex, or disability? yes Ono

B. Describe the racial makeup of the area surrounding the facility (f area is not the same as population).

TV, USE OF SERVICES AND FACILITIES

‘A, Are ll participants required to pay the same fees, assessments, and charges per unit forthe use ofthe facilites? C] Yes INO

If°NO, expla

B. Explain how charges for services, ie., rent, connestion, end user fees are assessed,

Is the use ofthe services or the facilities restricted in any manner because of race, color, or national origin? Dyes Ono]

If"YES", explain:

[Dus there evidence that individuals, in a protecied class, are provided different services , charged different or higher rate amounts

than others? CO yesCNo

If "YES", explain

B

ist the methods used by the recipient to inform the community ofthe availability of services or benefits of the facility

(newspaper, radio, tv, ete).

Do these methods reach the minority group population equally with the rest of the community’ _ Yes No

G. Are appropriate Equal Opportunity posters conspicuously displayed? (And Justice For All and the Faic Housing poster)

_O Yes ONO

H. Do written materials, i.e. ads, pamphlets, brochures, handbooks and manuals, have a nondiserimination statement, Fair Housing,

and/or accessibility logo or Equal Opportunity statement? Yes LINO

1. Deseribe the efforts of the recipient to attract minorities, females, and persons with disabilities to serve on the advisory board,

board of directors or similar boards.

I Indicate whether the facility is being properly maintained and whether services are provided on @ timely basis.

Describe any resrictions that may exist on the use ofthe facility Le. no playgrounds Tor children: restrictions on use by

‘minorities, segregated or prohibited by age or disability of tenant or other participants.

K. Describe any restrictions that may exist on the use of the facility, i.e. no playgrounds for children; restrictions on use by

‘minorities, segregated or prohibited by age or disability of tenant or other participants.

LL. If participation is restricted by age of beneficiary, please indicate any Federal statute, or sate or local ordinance which may permit

such restrictions,

‘Wi. How does tis facility compare-with other similar fallities in the area serving low income beneficlaries which are privately or

federally financed by other agencies.

‘Answer N for RRH and LH onl

[N. Does the organization's Operating Rules provide for standard reasons for eviction? _

If"YES,” specify:

“Are these reasons stipulated in the Lease Agreements? ves no

If not, how are they made known to participants?

Y. ACCESSIBILITY REQUIREMENTS (DISABILITY)

(For All Programs Funded By Rural Development)

‘A. Does the facility ot project have an accessible route through common use areas? — ~. OyesONo

'B, Has a self-evaluation for Section 504 of the Rehabilitation Act been conducted and a transition plan developed forall steuctural

barriers? "____ DyesONo

C. Does this facility or project have a Telecommunication Device for the Deaf (TDD) or participate in a relay service?

- DYESONO

If not is this part ofthe self-evaluation and transition plan?

D. Describe reasonable accommodations made by the ecipient for making the program acces

‘VI. ACCESSIBILITY REQUIREMENTS FOR RURAL RENTAL HOUSING

‘A. Does the complex meet the 5% accessibility requirement of $04 ofthe Rehabilitation Act of 1973 for facilities built after June

1982? COyes No

-- Ovestno

B. Are the units occupied by persons with disabilities in need of the special design features?

. I not, indicate what outreach has been conducted utilizing appropriste org

eed of such units.

ions and advertising to reach the individuals in

VI. ACCESSIBILITY REQUIREMENTS FOR COMMUNITY FACILITIES.

(Health Care Facilities)

‘A. List methods used by healthcare providers to communicate withthe hearing impaired in the emergency room.

BB List methods used to communicate waivers and consent to Wealment requirements to persons with disabilities, including those with

impaired sensory or speaking skills.

C. Are there restrictions in delivery of serviees forthe treatment of alcohol, drug addiction or other related illnesses?

(Aids, Hepatitis) Oves Oxo

‘VIII. COMPLEXES AND FACILITIES THAT PROVIDE HOUSING

(Nursing Homes, Retirement Group, Raral Renal)

‘A. Does the facility have an approved A\fimative Fair Housing Marketing Plan? _ __Oves Ono

B. Is there copy of the most recently approved plan being used and conspicuously posted? Oves Oxo

. 1s management meeting the objectives ofthe plan? _ Ono

1 not, is there an updated plan in place?

TX, PROGRAMS THAT CREATE EMPLOYMENT

{ATs there evidence that individuals in a protected class are requited to meet diferent employment selection criteria than non-

minorities? ves Ono

B.Is there evidence that individuals of « protected elas are being terminated in a disproportionate rate than non-minority employees?

- i: Dyes Ovo

C. Do recipients that employ fiteen or more persons have a designated person to coordinate is efforts to comply with Section 504 of

the Retabiltation Act of 19732 Oves Oxo

1D. Has the recipient provided reasonable accommodations to the known physical or mental impairment of employees with

disabilities? Oves Ono

‘X. CONTACTS WITH INDIVIDUALS AFFILIATED WITH THE FACILITY OR COMPLEX

A. List contacts made with a diverse selection of tenants, users, patients, employees, and others affiliated with the facility or complex.

List by name, race, sex, and disability (if provided).

'B, Summarize comments made by the person(s) contacted.

XI. COMMUNITY CONTACTS

A. List contacts made with community leaders and organizations representing minorities, females, families with children, and

individuals with disabilities. Include the date and the method of contact

B. Summari

comments made by person(s) contacted.

XII, PAST ASSISTANCE FROM RD OR OTHER FEDERAL AGENCY

A List past loans or other federal financial ass

tance from other agencies.

B, Does the recipient have a pending application with RD or another Federal agency’?

‘XII CIVIL RIGHTS COMPLIANCE HISTORY

Provide a history ofthe followin

A. Compliance Review. Has this recipient had a finding of non-compliance by RD or another federal agency? Oves Oxo

BB. Discrimination Complaints. Has @ complaint of prohibited discrimination been fled against this recipient in the past three (3)

years? Oves Dino

. Law Suit, Has a law suit based on prohibited discrimination been filed against this recipient in the past three (3) years? If so,

° ° °

‘White

o ° ° o

TOTAL ° ° ° ° ° ° o o

Male ° ° ° 0

roraL | Female e 0 ° °

Family ° ° ° 0

A. Ae racial and gender ofthe participants and the number of employees in proportion tothe population percentages?

yes ONO

1B. Number of participants as of last review: Date of lst review:

. Are all interested individuals permitted to file an application (written or otherwise) for participation?

TE"NO” explain why not

YES ONO

1D. Does or will recipient of financial assistance maintain adequate records on the receipt and disposition of applications, including a

list of applicants wishing to become participants? yes Tino

{f"NO" what action is being taken to establish adequate records:

If"YES" number of applicants wishing to become participants On Hist nna

‘Number on list from minority group

E, Number of applications received from prospective participants since last review: Total.

If zero skip to HL

From minority group applicants.

F, Number of applications which have been withdrawn or rejected since last review: Teal

From minority group applicants

G. Number of applications now pending on which no action has been taken: Total

‘From minority group applicanls..

TI LOCATION OF THE FACILITY

‘A. Does the location of the facility or complex have the effect of denying access to any person on the basis of race, color, national

origin, age, sex, or disability? aww IYES INO

‘B. Describe the racial makeup of the area surrounding the facility (iC area is not the same as population),

Rural Community with S8t AI/AN, and 38% white representing 96% of the city's population.

TV-USE OF SERVICES AND FACILITIES

‘A. Are all participants required to pay the same fees, assessments, and charges per unit forthe use of the facilities? .... Yes NO

"NO", explain:

BB. Explain how charges for services, i., rent, connection, and user fees are assessed,

Fees for service, billed on a monthly basis, which is based on usage.

C. Is the use ofthe services or the facilities restricted in any manner because of race, colo, or national origin? 1D Yes ENO

IP"YES", explain:

1 Ts there evidence that individu ina protected lass are provided Gifferen services, changed differen or higher ats amoanls

than others? 1D YESEINO

IC*YES', explain

E. List the methods used by the recipient to inform the community of the availablity of services or benefits ofthe Facility

(newspaper, adio, , ee.). County public notices/advertisement, and word of mouth.

F. Do these methods reach the minority group population equally with the rest ofthe community? ‘Yes ONO

G. Are appropriate Equal Opportunity posters conspicuously displayed? (And Justice For All and the Fair Housing poster)

: 1 Yes NO

H. Do written materials, ic, ads, pamphlets, brochures, handbooks and manuals, have a nondiscrimination statement, Fair Housing,

andlor accessibility logo or Equal Opportunity statement? 1 Yes {NO

I. Describe the efforts ofthe recipient to attract minorities, females, and persons with disabilities to serve on the advisory board,

board of directors, or similar boards.

Encourage participation regarding appointments, and/or vacancies on Board

J Indicate whether the facility is being properly maintained and whether services are provided on a timely basis.

As a new borrower, it appears that the water system is properly designed and in good

working order. It is anticipated that facility will be adequately maintained.

K. Describe any restrictions that may exist on the use of the facility, ie., no playgrounds for children; restrictions on use by

‘minorities, segregated or prohibited by age or disability of tenant or other participants.

None noted.

K. Describe any restrictions that may exist on the use of the facility, i., no playgrounds for children; restrictions on use by

‘minorities, segregated or prohibited by age or disability of tenant or other participants.

Again, None noted.

L. If participation i restricted by age of beneficiary, please indicate any Federal statue, or state or local ordinance which may permit

such restrictions

None noted.

M, How does this facility compare-with other similar facilities in the area serving low income beneficiaries which are privately or

federally financed by other agencies.

In-line with other similar systems.

“Answer N for RRH and LH onl

'N. Does the organization's Operating Rules provide for standard reasons for eviction? OYEsoNO

IE" YES" specify

‘Are these reasons stipulated in the Lease Agreements? 7 0 yestNo

Tf'not, how are they made known to participants?

V. ACCESSIBILITY REQUIREMENTS (DISABILITY)

(For Alt Programs Funded By Rural Development)

‘A. Does the facility or project have an accessible route through common tse areas? = 2 YESONO

1. Has a self-evaluation for Setion 504 of the Rehabilitation Act been conducted anda transition plan developed forall structural

aries? ___ ByESONO

C. Does this facility or project have a Telecommunication Device for the Deaf (TDD) o participate ina relay service?

ye for area residents. ©

NO

G yYEszNo

Frontier communications provides int

not, is this pat ofthe self-evaluation and transition plan?

D, Describe reasonable accommodations made by the recipient for making the program accessible to individuals with disabilities.

Best Practices. Parking properly identified, and facility, including bathrooms and

public meeting room is fully accessible.

‘VE ACCESSIBILITY REQUIREMENTS FOR RURAL RENTAL HOUSING

‘A. Does the complex meet the 5% accessibility requirement of 504 of the Rehabilitation Act of 1973 for fuclities built after June

19827 OYESONO

OyYEsoNo

B, Are the units oosupied by persons with disabilities in neo of the spesial design features?

. If not, indicate what outreach has been conducted utilizing appropriate organizations and advertising to reach the individuals in

need of such units,

‘VIL ACCESSIBILITY REQUIREMENTS FOR COMMUNITY FACILITIES

(Health Care Facilities)

A. List methods used by health care providers to communicate with the hearing impaired in the emergency room.

B. List methods used to communicate waivers and consent to treatment requirements to persons with disabilities, including those with

impaired sensory or speaking skills.

C. Are there restrictions in delivery of services forthe treatment of alcohol, drug addiction or other related illnesses?

(Aids, Hepatitis) _Oves ONO

‘VEL COMPLEXES AND FACILITIES THAT PROVIDE HOUSING

(@iursing Homes, Retirement Group, Rural Rental)

A. Does the facility have an approved Affirmative Fair Housing Marketing Plan? Oyss No

B. Is there a copy of the most reeently approved plan being used and conspicuously posted? Oyss No

C. Is management meeting the objectives of the plan? Oyss ONO

If not, is there an updated plan in place?

TK PROGRAMS THAT CREATE EMPLOYMENT

‘A. Is there evidence that individuals ina protected class are required to meet different employment selection criteria than non

‘minorities? Oves No

BB. Is there evidence that individuals of a protected class are being terminated in a disproportionate rate than non-minority employees?

ves

C. Do recipients that employ fifteen or more persons have a designated person to coordinate its efforts to comply with Section 504 of

‘th Rehabilitation Act of 19732 Contract relationship-Danny Fleming, Blanding, ur (YES INO

'D. Has the recipient provided reasonable accommodations to the known physical or mental impairment of employees with

disabilities? yes ONO

‘X CONTACTS WITH INDIVIDUALS AFFILIATED WITH THE FACILITY OR COMPLEX

‘A List contacts made with diverse selection of tenants, user, patients, employees, and others afiliated withthe facility or complex

List by namo, race, sex, and disblity (if provided).

Robert Mueller, white, male, BA

Bill Balaz, white, male, NA

Danny Fleming, white, male, NA

Richard Neff, white, ‘wale, NA

‘B. Summarize comments made by the person(s) contacted.

Programs provides services to all comminity residents who have accessibility to water

system connections. Program doesn't track Race, Ethnicity, or Gender of its customer

base or applicants

‘XL. COMMUNITY CONTACTS

‘A. List contacts made with community leaders and organizations representing minorities, females, families with children, and

individuals with disabilities. Include the date and the method of contact,

Clint Howell, Vice-Chairman, MHssp, 435.683.2263

Richard Neff, Secretary, MISSD, 435.683.2226

Marlene, Comunity Member & Business Owner, Mexican Hat, 435.683.2220

‘B, Summarize comments made by person(s) contacted,

‘The above list of community leaders were identified during the compliance review, as

resources, but were not contacted at this time.

XIL PAST ASSISTANCE FROM RD OR OTHER FEDERAL AGENCY

‘A List past loans or other federal financial asistance from other agencies.

NA

B. Does the recipient have a pending application with RD or another Federal agency? cece

‘30D. CIVIL RIGHTS COMPLIANCE

Provide a history of the following:

‘A. Compliance Review. Has this recipient hada finding of non-compliance by RD or another federal agency? CO ves NO

BB. Discrimination Complaints. Has a complaint of prohibited discrimination been filed against this recipient inthe past three (3)

years? OvEs 2 No

(C. Law Suit. Has a law suit based on prohibited discrimination been filed agains this recipient in the past three (3) years? Ifo,

describe and attach copies ofthe law suit YES NO

D. Did the recipient take appropriate corrective or remedial action to achieve compliance with civil laws orto resolve any

discrimination complaint cases or law suits? (yes C1 No

EE, Identify the resources and or contacts used in verifying the recipient's past civil rights compliance history.

Borrower file, and employee interview.

‘XIV. CONCLUSIONS

A. Did your review of the records maintained by the association or organization disclose any evidence of discrimination on the

‘grounds of race, color, national origin, sex, age, or disability inthe services or use ofthe facility? OYes

If "YES," describe in detail such discrimination:

B. Did your contacts with community leaders, including minority leaders, disclose any evidence of discrimination as to race, color,

‘ational origin, sex, age, or disability inthe services or use of the facility?” ~ Oves

‘©. Did your observation ofthis borrower's operations or proposed operations indicate any discrimination on the grounds of race,

color, national origin, sex, age, or disability in the services or use ofthe facility? a Over ZNO

IE"YES," describe in detail such discrimination:

D. Comments for other observations or conclusions

‘Basod upon my observation ofthis borrower's operation or proposed operation and the attitude ofthe Governing Body and

(Officials itis my opinion that the Recipient _¥_Is___Is Not complying with the requirements under Title VI of the

Civil Rights Act of 1964, Seotion 504 of the Rehubilitaion Act of 1973, Age Discrimination Act of 1975, and Title DC of the

Education Amendments Act of 1972.

12-22-2004

DATE ‘COMPLIANCE REVIEW OFFICER

‘XV. RECIPIENT IS IN NON-COMPLIANCE (Complete only if there isa finding of non-comy

A. Sent recipient notice of non-compliance on this date

‘B. Date of compliance meeting,

. Target date for recipient to voluntarily comply

_D. Recipient has complied with al requirements and made all

‘necessary corrective action by this date

, Deseribe all meetings with recipient to achieve compliance.

F- Recipient has refused to voluntarily comply by this date

. Comments:

unos =

TECUEST On ADVANGE __ sven |

OR REIMBURSEMENT 1 [Clapvance ]-REIMBURSE-

ee sr | oom

a

ene Siero [Goa Gea | ccna

|

nat a —