Professional Documents

Culture Documents

Banking 160801 SU (Kenanga)

Uploaded by

Faizal FazilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking 160801 SU (Kenanga)

Uploaded by

Faizal FazilCopyright:

Available Formats

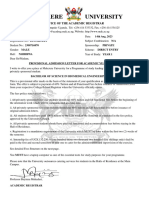

Sector Update

01 August 2016

Banking

NEUTRAL

BNM Stats (June 2016) Momentum Still Downwards

By Ahmad Ramzani Ramli l ahmadramzani@kenanga.com.my

In June, loans growth continued to decelerate and asset quality has deteriorated slightly on YoY

basis. However, the improved annualized loans growth has reinforced our expectations of loans

growth of 5-6% for 2016 supporting by the recent cut in OPR. We maintain our NEUTRAL stance on

the sector with no clear catalysts in sight internally nor externally. CIMB is our only OUTPERFORM

call in the banking universe while the others are rated as MARKET PERFORM.

No let-up in system loans growth with all segments continuing to decelerate but

annualized growth surged ahead. June 2016 system loans growth slowed further

(+5.6% YoY vs. May 16: +6.2% YoY) with both household and business segments

moderating from the previous month. The former moderated at +7.1% YoY (May 16:

+7.3% YoY) while the latter was slower at +4.2% YoY (May 16: 5.1% YoY). Essentially,

the slower growth was caused by higher loan repayments (Ytd-16: +2.3% YoY) which

outpaced the decline in loan disbursements (Ytd-16: -5.1% YoY). When annualised,

industry loans advanced 2.8% YoY (vs. May 16: +2.2% YoY), still below our expectation of

5-6% for 2016. However, the surge in annualized growth suggested the likelihood of a

gradual pickup ahead boosted by the cut in OPR recently.

Both Loan Applications and Approvals fell. Leading indicators showed a blip in

momentum for June as loan applications were slower at +3.9% YoY (vs. May 16: +8.9%

YoY) as demand for business loan was flat at +12.8% YoY (vs. May 16: +12.8% YoY)

with a fall in demand for household loan at -5.2% YoY (vs. April 16: +5.5%). The fall in demand for household loans was

exacerbated by: (i) demand decline for passenger cars (-0.8% YoY vs. May 16: +0.5% YoY), ii) lower demand for property

financing, which fell 7.1% YoY from a growth of 7.1% YoY in May, and (iii) further fall in personal use at 23.6% YoY (vs May 16:

-17.1% YoY). Compounding the fall in demand was the fall in approvals by 21% vs. May 16 of +2.2% as the approval rate for

business loan fell by 25.9% YoY vs. Mays rise of 12.5% YoY while household loan approvals declined further by 15.0% vs.

Mays fall of 9.0%. The fall in household approvals was again led by decline in approvals for purchase of residential property

and passenger cars of 20.1% YoY and 8.1% YoY, respectively (May 16: -11.2% YoY and -14.0% YoY, respectively). Overall

system loan approval rate (MoM) slowed by 4ppts in June to 39.9% and for YTD it was slower by 40bps to 41.5%.

Asset quality deteriorated and LLC regressed YoY. On a YoY basis, asset quality deteriorated as system net impaired loans

ratio went up by 3bps to 1.27% due to net impaired loans outpacing loans growth at +8.5% YoY vs. +5.6% YoY. The business

segment led the way in deterioration as its impaired loans moderated +12.4% YoY (vs. May 16: +14.4% YoY) and the

household segment slowed to +0.7% YoY (vs May 16: +1.9% YoY). The business segment saw slower deterioration

underpinned by slower impairments in purchase of non-residential property and construction at +24.5% YoY and +38.4% YoY,

respectively (May 16: +32.0% YoY and +39.5% YoY respectively). The moderate rise in impairments in the household segment

was capped by a moderate rise in impairments in purchase of residential property at 1.0% YoY (May 16: +3.1% YoY) and a fall

in purchase of passenger cars at 15.5% (May 16: -13.8%). On a MoM basis, net impaired loans ratio deteriorated by 2bps to

1.27%. Meanwhile, loan loss coverage deteriorated YoY to 89.5% (-1.7ppts MoM and -8.0ppts YoY) as impaired loans grew at

+8.1% YoY while provisioning fell by 0.8%.

Excess liquidity continued to narrow MoM and interest spread tightened MoM. System deposits continued to decline in

June albeit slower (-0.5% YoY vs. May 16: -0.4% YoY) compared to system loans growth (+5.6% YoY vs. May 16: +6.2% YoY).

Hence, the industry loan-deposit-ratio rose marginally by 21bps MoM to 87.5%. Likewise, with falling deposits, excess liquidity

to total deposit base fell 20bps to 12.5% MoM. However, the percentage of current account and savings account (CASA)

improved slightly by 40bps to 25.9% MoM, thanks to improvement in savings deposits by +3.8% (May 16: +3.4%). The interest

spread between average lending rate (ALR) and 3-month fixed deposit rate (FDR) was up by 6bps to 1.48% where the former

was up by 6bps to 4.61% and the latter was flat 3.13%, respectively. We expect the spread to constrict moving forward (as

banks have revised downwards their lending rates) and continue to be tight as liquidity is still narrow; thus, stiff price-based

competition will continue to plague the market.

No change in our NEUTRAL stance. We reiterate our NEUTRAL call on the sector. We see no change in our views on the

structural and cyclical headwinds such as; (i) moderate economy, (ii) moderate loans growth, (iii) constricting liquidity

environment, (iv) narrowing NIM, (v) weak capital market activities, and (v) higher credit costs, plaguing the banking industry.

Furthermore, there are no concrete catalysts and/or any game changers going forward. The improved annualised loans growth

indicates loan growth is trending upwards and will be supported by the cut in OPR recently.

We have only an OUTPERFORM call for CIMB. We see value in CIMB with its Fwd. PBV trading at 0.9x compared to the

industrys Fwd. PBV of 1.5x. The rest of banking stocks under our coverage are rated as MARKET PERFORM.

PP7004/02/2013(031762)

Page 1 of 10

Banking

Sector Update

01 August 2016

Fig 1: Industry Loan Growth by Breakdown

Fig 2: Industry Loans Growth by Economic Purpose

16.0%

30.0%

14.0%

25.0%

12.0%

20.0%

10.0%

15.0%

8.0%

6.0%

10.0%

4.0%

5.0%

2.0%

0.0%

Business Loans

Household Loans

Total Loans

Working capital

Passenger cars

Non-residential property

Construction

Residential property

Source: BNM, Kenanga Research

Fig 3: Industry Loan Applications Growth by Breakdown

Fig 4: Industry Loan Application Growth by Economic Purpose

80.0%

140.0%

120.0%

100.0%

80.0%

60.0%

40.0%

20.0%

0.0%

-20.0%

-40.0%

-60.0%

-80.0%

60.0%

40.0%

20.0%

0.0%

-20.0%

-40.0%

Business Loan

Household Loan

Working capital

Passenger Cars

Total Loans Applied

Non-residential Property

Construction

Residential Property

Source: BNM, Kenanga Research

Fig 5: Loan Approvals Rate by Breakdown

Fig 6: Loan Approvals Rate by Economic Purpose

105.0%

90.0%

95.0%

85.0%

80.0%

75.0%

70.0%

65.0%

55.0%

60.0%

45.0%

50.0%

35.0%

25.0%

40.0%

15.0%

5.0%

30.0%

Business Loan

Household Loan

Total Loans Approved Rate

Working capital

Non-residential property

Passenger cars

Construction

Residential property

Source: BNM, Kenanga Research

PP7004/02/2013(031762)

Page 2 of 10

Banking

Sector Update

01 August 2016

Fig 8: Impaired loans ratio breakdown

Fig 7: Impaired Loans Growth Rate Breakdown

10.00%

80.0%

9.00%

60.0%

8.00%

7.00%

40.0%

6.00%

5.00%

20.0%

4.00%

0.0%

3.00%

2.00%

-20.0%

Working capital

Passenger cars

Non-residential property

Construction

May-16

Jan-16

Mar-16

Nov-15

Jul-15

Sep-15

May-15

Jan-15

Mar-15

Nov-14

Jul-14

Sep-14

May-14

Jan-14

Mar-14

Nov-13

Jul-13

Sep-13

May-13

Jan-13

Mar-13

Nov-12

Jul-12

Sep-12

May-12

Jan-12

Mar-12

1.00%

-40.0%

0.00%

Residential property

Working capital

Passenger cars

Non-residential property

Construction

Residential property

Source: BNM, Kenanga Research

Fig 9: Industry Net Impaired Loans Ratio

Fig 10: Industry Loan Loss Reserve

45,000

3.5%

40,000

3.0%

110.0%

105.0%

100.0%

95.0%

2.5%

35,000

90.0%

85.0%

80.0%

2.0%

30,000

75.0%

70.0%

65.0%

20,000

1.0%

60.0%

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

1.5%

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

25,000

Loan Loss Reserve

Total Impaired Loan

Net Impaired Loan Ratio (%)

Source: BNM, Kenanga Research

Fig 11: Industry Loan Disbursements

Fig 12: Industry Loan Repayment

120,000

80%

120,000

40.0%

70%

100,000

60%

30.0%

100,000

50%

20.0%

80,000

40%

80,000

10.0%

30%

60,000

20%

60,000

0.0%

10%

40,000

40,000

0%

-10%

20,000

-10.0%

20,000

-20.0%

-20%

Total Disbursed

Growth Rate (% YoY)

-30.0%

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

Apr-16

Oct-15

Jan-16

Jul-15

Apr-15

Oct-14

Jan-15

Jul-14

Apr-14

Oct-13

Jan-14

Jul-13

Apr-13

Oct-12

Jan-13

Jul-12

Apr-12

Oct-11

Jan-12

Jul-11

Apr-11

Oct-10

Jan-11

Jul-10

Apr-10

Oct-09

Jan-10

Jul-09

Apr-09

Oct-08

Jan-09

Jul-08

Apr-08

-30%

Jan-08

Total Repaid (RM'm)

Growth Rate (% YoY)

Source: BNM, Kenanga Research

PP7004/02/2013(031762)

Page 3 of 10

Banking

Sector Update

01 August 2016

Fig 13: Industry Deposits

Fig 14: Industry Excess Liquidity

1,800,000

16%

330,000

29%

14%

310,000

27%

290,000

25%

270,000

23%

250,000

21%

230,000

19%

210,000

17%

190,000

15%

2%

170,000

13%

0%

150,000

11%

1,600,000

12%

1,400,000

10%

8%

1,200,000

6%

1,000,000

4%

Total Deposits (RM'm)

Apr-16

Jan-16

Jul-15

Oct-15

Apr-15

Jul-14

Oct-14

Jan-15

Apr-14

Jan-14

Jul-13

Oct-13

Apr-13

Jan-13

Jul-12

Oct-12

Apr-12

Jul-11

Oct-11

Jan-12

Apr-11

Jan-11

Jul-10

Oct-10

Apr-10

-2%

Jan-10

600,000

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

800,000

Excess Liquidity (RM'm)

% Excess Liquidity/Total Deposits

Growth Rate (% YoY)

Source: BNM, Kenanga Research

Fig 15: Loan to Deposit Ratio

Fig 16: CASA

1,800.00

500.00

30.0%

88.0%

450.00

25.0%

86.0%

400.00

90.0%

1,600.00

1,400.00

84.0%

20.0%

350.00

82.0%

1,200.00

1,000.00

300.00

78.0%

250.00

76.0%

800.00

74.0%

600.00

72.0%

Total loans (RMbn)

Total deposits (RMbn)

15.0%

80.0%

Loan-to-Deposit ratio (%)

10.0%

200.00

5.0%

150.00

0.0%

CASA (RMbn)

Excess liquidity (RMbn)

CASA/Total Deposit (%)

% Excess Liquidity/Total Deposits

Source: BNM, Kenanga Research

Fig 17: Interest Rate Spread

4.0 (%)

3.5

3.0

2.5

2.0

1.5

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

1.0

Interest Spread (Average Lending Rate - 3Mth FDR)

Source: BNM, Kenanga Research

PP7004/02/2013(031762)

Page 4 of 10

Banking

Sector Update

01 August 2016

Table 1: Breakdown of Industry Loans

Jun-16

May-16

% MoM

Jun-15

% YoY

Dec-15

% Ytd

347,169.2

346,962.3

0.1%

328,437.1

5.7%

349,173.1

-0.6%

Purchase of fixed assets other

than land and building

9,859.5

9,638.4

2.3%

10,379.1

-5.0%

10,060.0

-2.0%

Purchase of securities

70,645.9

71,123.4

-0.7%

75,602.9

-6.6%

75,185.1

-6.0%

Purchase of transport vehicles

8,947.4

8,816.2

1.5%

9,562.1

-6.4%

9,128.7

-2.0%

Other purpose

64,035.9

63,338.7

1.1%

64,589.5

-0.9%

64,338.3

-0.5%

Purchase of non-residential

property

203,273.9

201,796.5

0.7%

189,938.2

7.0%

196,990.7

3.2%

Construction

44,313.9

43,860.8

1.0%

39,754.0

11.5%

42,656.1

3.9%

Business Loan

748,245.6

745,536.2

0.4%

718,262.9

4.2%

747,532.1

0.1%

Purchase of residential property

457,401.1

453,879.3

0.8%

414,568.0

10.3%

437,035.4

4.7%

Purchase of passenger cars

159,260.2

159,359.1

-0.1%

158,672.4

0.4%

160,681.8

-0.9%

Personal use

64,837.9

64,584.1

0.4%

61,319.5

5.7%

63,701.9

1.8%

Credit card

35,324.0

35,017.4

0.9%

34,723.0

1.7%

36,043.9

-2.0%

140.2

139.9

0.2%

148.8

-5.8%

144.2

-2.8%

Household Loan

716,963.4

712,979.9

0.6%

669,431.7

7.1%

697,607.2

2.8%

Total Loans Outstanding

1,465,209

1,458,516

0.5%

1,387,695

5.6%

1,445,139

1.4%

RMm

Working capital

Purchase of consumer durables

Source: BNM

Table 2: Breakdown of Industry Loan Applications

RMm

Jun-16

May-16

% MoM

Jun-15

% YoY

Ytd-15

Ytd-14

% YoY

Working capital

18,452.4

19,066.3

-3.2%

20,787.8

-11.2%

101,796.5

90,767.3

12.2%

502.6

3,704.7

-86.4%

338.9

48.3%

5,695.2

3,322.7

71.4%

3,409.5

2,623.1

30.0%

1,951.4

74.7%

15,126.8

17,739.9

-14.7%

580.0

232.4

149.5%

290.2

99.9%

2,278.6

2,110.8

8.0%

Other purpose

5,138.1

2,654.7

93.5%

1,705.0

201.3%

21,578.5

15,109.6

42.8%

Purchase of non-residential

property

7,034.1

7,117.2

-1.2%

8,382.0

-16.1%

39,478.6

49,368.5

-20.0%

Construction

6,545.4

3,471.6

88.5%

3,471.4

88.6%

20,993.4

20,333.4

3.2%

Business Loan

41,662.2

38,870.0

7.2%

36,926.8

12.8%

206,947.7

198,752.2

4.1%

Purchase of residential property

17,932.3

18,670.9

-4.0%

19,296.8

-7.1%

101,353.1

101,889.7

-0.5%

Purchase of passenger cars

7,811.7

6,209.0

25.8%

7,878.5

-0.8%

39,072.7

42,770.4

-8.6%

Personal use

4,687.8

4,480.6

4.6%

6,133.9

-23.6%

31,515.9

28,878.3

9.1%

Credit card

4,125.3

4,094.0

0.8%

3,146.9

31.1%

21,590.0

14,399.3

49.9%

0.1

0.0

80.0%

0.7

-88.8%

29.3

68.3

-57.1%

Household Loan

34,557.3

33,454.5

3.3%

36,456.9

-5.2%

193,560.9

188,005.9

3.0%

Total Loans Applied

76,219.5

72,324.5

5.4%

73,383.6

3.9%

400,508.7

386,758.1

3.6%

Purchase of fixed assets other

than land and building

Purchase of securities

Purchase of transport vehicles

Purchase of consumer durables

Source: BNM

PP7004/02/2013(031762)

Page 5 of 10

Banking

Sector Update

01 August 2016

Table 3: Breakdown of Industry Loan Approvals

RMm

Jun-16

May-16

% MoM

Jun-15

% YoY

Ytd-16

Ytd-15

% YoY

Working capital

6,940.3

9,309.2

-25.4%

11,568.5

-40.0%

41,344.4

44,627.7

-7.4%

360.3

319.8

12.7%

198.9

81.2%

1,550.4

2,958.3

-47.6%

1,781.3

1,975.0

-9.8%

1,421.2

25.3%

9,386.9

12,198.0

-23.0%

544.8

287.1

89.8%

182.3

198.8%

2,098.3

1,482.8

41.5%

Other purpose

1,185.9

1,815.3

-34.7%

2,855.3

-58.5%

11,076.6

10,802.5

2.5%

Purchase of non-residential

property

3,260.9

2,309.8

41.2%

3,396.4

-4.0%

15,567.9

21,720.9

-28.3%

Construction

1,457.5

2,362.2

-38.3%

1,347.2

8.2%

7,173.4

9,123.3

-21.4%

Business Loan

15,531.0

18,378.1

-15.5%

20,969.9

-25.9%

88,197.9

102,913.5

-14.3%

Purchase of residential property

8,007.4

7,603.2

5.3%

10,025.0

-20.1%

41,579.0

52,730.0

-21.1%

Purchase of passenger cars

3,901.1

3,145.2

24.0%

4,242.9

-8.1%

19,920.5

24,886.0

-20.0%

Personal use

1,483.7

1,382.0

7.4%

1,577.9

-6.0%

8,101.7

8,273.3

-2.1%

Credit card

1,503.6

1,487.1

1.1%

1,684.2

-10.7%

8,399.4

7,683.2

9.3%

0.1

0.5

-80.7%

0.3

-64.4%

28.0

37.6

-25.6%

Household Loan

14,895.9

13,617.9

9.4%

17,530.3

-15.0%

78,028.6

93,610.0

-16.6%

Total Loans Approved

30,426.9

31,996.1

-4.9%

38,500.1

-21.0%

166,226.6

196,523.5

-15.4%

Purchase of fixed assets other

than land and building

Purchase of securities

Purchase of transport vehicles

Purchase of consumer durables

Source: BNM

Table 4: Breakdown of Industry Loan Approvals Rate

RMm

Jun-16

May-16

Ytd-16

Ytd-15

Working capital

37.6%

48.8%

40.6%

41.3%

Purchase of fixed assets other than land and

building

71.7%

8.6%

27.2%

22.9%

Purchase of securities

52.2%

75.3%

62.1%

64.9%

Purchase of transport vehicles

93.9%

123.5%

92.1%

91.5%

Other purpose

23.1%

68.4%

51.3%

60.2%

Purchase of non-residential property

46.4%

32.5%

39.4%

37.9%

Construction

22.3%

68.0%

34.2%

39.6%

Business Loan

37.3%

47.3%

42.6%

44.0%

Purchase of residential property

44.7%

40.7%

41.0%

40.2%

Purchase of passenger cars

49.9%

50.7%

51.0%

51.2%

Personal use

31.7%

30.8%

25.7%

24.7%

Credit card

36.4%

36.3%

38.9%

39.5%

Purchase of consumer durables

116.0%

1082.2%

95.4%

95.4%

Household Loan

43.1%

40.7%

40.3%

39.7%

Total Loans Approval Rate

39.9%

44.2%

41.5%

41.9%

Source: BNM

PP7004/02/2013(031762)

Page 6 of 10

Banking

Sector Update

01 August 2016

Table 5: Breakdown of Industry Loan Disbursements

RMm

Jun-16

May-16

% MoM

Jun-15

% YoY

Ytd-15

Ytd-14

% YoY

51,863.2

54,164.9

-4.2%

56,763.6

-8.6%

305,983.6

299,550.3

2.1%

643.3

187.9

242.3%

482.8

33.2%

1,663.1

2,134.7

-22.1%

Purchase of securities

1,880.0

2,373.6

-20.8%

1,577.8

19.2%

13,284.3

14,347.3

-7.4%

Purchase of transport

vehicles

584.4

590.8

-1.1%

460.5

26.9%

2,694.5

2,860.8

-5.8%

Other purpose

4,853.1

3,862.2

25.7%

7,821.1

-37.9%

29,386.8

28,637.3

2.6%

Purchase of non-residential

property

4,180.7

3,419.0

22.3%

5,005.4

-16.5%

23,115.3

29,333.0

-21.2%

Construction

2,584.8

2,099.5

23.1%

2,823.0

-8.4%

13,544.9

16,558.8

-18.2%

Business Loan

66,589.5

66,697.9

-0.2%

74,934.2

-11.1%

389,672.4

393,422.2

-1.0%

Purchase of residential

property

6,937.7

6,854.1

1.2%

7,937.2

-12.6%

42,080.7

46,251.3

-9.0%

Purchase of passenger cars

3,620.0

3,114.7

16.2%

3,987.8

-9.2%

19,741.9

23,151.5

-14.7%

Personal use

2,562.4

2,516.1

1.8%

2,444.8

4.8%

14,109.2

14,722.1

-4.2%

Credit card

9,052.4

9,326.8

-2.9%

8,911.8

1.6%

54,821.6

53,411.1

2.6%

3.8

4.0

-4.3%

8.7

-56.3%

23.9

221.7

-89.2%

Household Loan

22,176.3

21,815.6

1.7%

23,290.3

-4.8%

130,777.3

137,757.8

-5.1%

Total Loans Disbursed

88,765.8

88,513.6

0.3%

98,224.4

-9.6%

520,449.7

531,180.0

-2.0%

Working capital

Purchase of fixed assets

other than land and building

Purchase of consumer

durables

Source: BNM

Table 6: Breakdown of Total Deposits by Holder

Jun-16

May-16

% MoM

Jun-15

% YoY

Dec-15

% Ytd

Federal Government

21,602.4

19,588.8

10.3%

23,117.7

-6.6%

15,564.1

38.8%

State Government

35,252.8

35,131.0

0.3%

33,777.3

4.4%

32,580.8

8.2%

Statutory authorities

47,405.0

49,049.8

-3.4%

47,020.6

0.8%

44,049.1

7.6%

Financial institutions

281,992.9

278,330.8

1.3%

311,849.4

-9.6%

288,778.6

-2.3%

Business enterprises

555,909.3

560,194.6

-0.8%

560,504.1

-0.8%

574,515.8

-3.2%

Individuals

632,217.8

628,584.5

0.6%

605,833.3

4.4%

612,053.7

3.3%

Others

100,691.0

100,546.5

0.1%

101,915.4

-1.2%

103,529.2

-2.7%

1,675,071.2

1,651,837.2

1.4%

1,684,017.8

-0.5%

1,671,071.2

0.2%

RMm

Total Deposits by Holder (RM'm)

Source: BNM

PP7004/02/2013(031762)

Page 7 of 10

Banking

Sector Update

01 August 2016

Table 7: Breakdown of Industry Loan Repayments

RMm

Jun-16

May-16

% MoM

Jun-15

% YoY

Ytd-16

Ytd-15

% YoY

51,519.2

49,951.2

3.1%

51,047.3

0.9%

307,325.8

287,522.5

6.9%

354.8

349.8

1.4%

625.5

-43.3%

2,033.8

2,230.5

-8.8%

2,294.0

2,248.2

2.0%

2,093.2

9.6%

17,641.5

15,041.3

17.3%

597.9

522.3

14.5%

562.6

6.3%

3,138.3

3,077.4

2.0%

Other purpose

4,020.4

3,040.3

32.2%

6,348.3

-36.7%

28,992.9

31,082.2

-6.7%

Purchase of non-residential

property

3,430.6

3,757.9

-8.7%

3,705.7

-7.4%

21,835.2

22,474.3

-2.8%

Construction

2,325.5

2,176.2

6.9%

2,956.1

-21.3%

12,311.6

16,384.3

-24.9%

Business Loan

64,542.4

62,045.8

4.0%

67,338.6

-4.2%

393,279.1

377,812.4

4.1%

Purchase of residential

property

4,695.3

5,024.2

-6.5%

4,656.0

0.8%

28,995.4

28,494.2

1.8%

Purchase of passenger cars

3,851.7

4,008.7

-3.9%

3,755.5

2.6%

23,028.4

22,285.9

3.3%

Personal use

2,220.4

2,368.8

-6.3%

2,282.2

-2.7%

13,537.3

13,669.2

-1.0%

Credit card

9,478.3

9,779.1

-3.1%

9,216.4

2.8%

58,429.9

56,610.6

3.2%

3.8

5.4

-29.8%

6.5

-41.5%

29.6

115.6

-74.4%

20,249.5

21,186.3

-4.4%

19,916.5

1.7%

124,020.6

121,175.6

2.3%

84,791.9

83,232.1

1.9%

87,255.1

-2.8%

517,299.7

498,988.0

3.7%

Working capital

Purchase of fixed assets other

than land and building

Purchase of securities

Purchase of transport vehicles

Purchase of consumer

durables

Household Loan

Total Loans Repaid (RM'm)

Source: BNM

Table 8: Breakdown of Impaired Loans

RMm

Jun-16

May-16

% MoM

Jun-15

% YoY

Dec-15

% Ytd

Working capital

8,723.6

8,174.0

6.7%

8,182.6

6.6%

8,432.0

3.5%

Purchase of fixed assets other

than land and building

105.6

125.9

-16.2%

162.3

-35.0%

174.7

-39.6%

Purchase of securities

409.9

416.8

-1.6%

376.0

9.0%

372.9

9.9%

Purchase of transport vehicles

243.1

250.0

-2.8%

125.5

93.7%

103.8

134.3%

Other purpose

1,201.1

1,256.7

-4.4%

1,401.7

-14.3%

1,522.3

-21.1%

Purchase of non-residential

property

2,023.0

2,045.2

-1.1%

1,625.2

24.5%

1,786.5

13.2%

Construction

3,367.9

3,306.6

1.9%

2,434.0

38.4%

2,494.4

35.0%

Business Loan

16,074.2

15,575.2

3.2%

14,307.2

12.4%

14,886.6

8.0%

Purchase of residential property

5,107.3

5,143.6

-0.7%

5,056.2

1.0%

5,030.2

1.5%

Purchase of passenger cars

1,404.3

1,525.1

-7.9%

1,661.6

-15.5%

1,512.8

-7.2%

Personal use

1,228.9

1,270.6

-3.3%

1,000.6

22.8%

1,191.7

3.1%

483.9

487.2

-0.7%

447.5

8.1%

479.8

0.9%

2.2

1.7

29.1%

2.1

4.3%

1.4

48.7%

Household Loan

8,226.5

8,428.2

-2.4%

8,168.0

0.7%

8,216.0

0.1%

Total Non-Performing Loans

24,300.7

24,003.4

1.2%

22,475.3

8.1%

23,102.5

5.2%

Credit card

Purchase of consumer durables

Source: BNM

PP7004/02/2013(031762)

Page 8 of 10

Banking

Sector Update

01 August 2016

Peer Comparison

Price

(29 Jul

2016)

Mkt Cap

(RM)

(RMm)

FY14/15

FY15/16

Affin Holdings

2.13

4,138.5

11.3

Alliance Financial Group

3.98

6,068.9

11.4

AMMB Holdings

4.30

12,961.0

8.0

BIMB Holdings

4.04

6,418.3

11.7

CIMB Group

4.39

38,319.7

Hong Leong Bank

13.12

26,924.4

Malayan Banking

8.02

Public Bank

19.50

RHB Bank

5.09

NAME

Est.

Div.

Yld.

Fwd

ROE

P/BV

FY16/17

(%)

(%)

(x)

FY14/15

FY15/16

FY16/17

FY15/16

FY16/17

(RM)

Rating

10.0

9.9

4.0

4.8

0.5

365.5

412.2

417.4

12.8

1.3

2.23

MP

11.6

11.1

4.2

10.9

1.2

530.8

522.1

545.0

-1.6

4.4

4.04

MP

10.0

9.0

4.8

8.6

0.8

1,617.5

1,302.2

1,437.3

-19.5

10.4

4.63

MP

10.9

11.1

3.7

13.5

1.8

547.5

590.2

577.7

7.8

-2.1

4.18

MP

13.4

11.7

10.1

3.5

8.0

0.9

2,849.5

3,261.5

3,786.2

14.5

16.1

4.87

OP

12.1

15.0

13.4

3.1

10.1

1.4

2,233.1

1,795.0

2,012.7

-19.6

12.1

13.45

MP

80,270.8

11.7

12.7

11.6

5.5

10.1

1.2

6,835.9

6,335.1

6,895.2

-7.3

8.8

9.07

MP

75,299.1

14.9

15.1

14.2

2.8

15.8

2.4

5,062.2

4,993.0

5,287.7

-1.4

5.9

20.05

MP

20,411.1

14.1

10.9

9.4

2.0

10.3

1.0

1,448.4

1,873.5

2,170.3

29.3

15.8

6.51

MP

270,811.8

12.9

13.1

12.0

3.8

11.3

1.5

-0.8

9.5

PER (x)

Net Profit Growth

(%)

Net Profit (RMm)

Target Price

Banking

Mkt. Cap Weighted Average

Non-Bank Money Lender

AEON Credit Service (M)

14.20

2,044.8

9.0

8.5

8.0

4.5

21.3

2.2

228.2

241.4

255.8

5.8

6.0

15.12

OP

Malaysia Building Society

0.69

4,001.2

15.5

26.2

20.0

1.4

3.0

0.5

257.6

152.6

200.3

-40.8

31.3

1.11

UP

6,046.0

13.3

20.2

15.9

2.5

9.2

1.1

-25.0

22.7

Mkt. Cap Weighted Average

Source: Bloomberg, Kenanga Research

PP7004/02/2013(031762)

Page 9 of 10

Banking

Sector Update

01 August 2016

Stock Ratings are defined as follows:

Stock Recommendations

OUTPERFORM

MARKET PERFORM

UNDERPERFORM

: A particular stocks Expected Total Return is MORE than 10% (an approximation to the

5-year annualised Total Return of FBMKLCI of 10.2%).

: A particular stocks Expected Total Return is WITHIN the range of 3% to 10%.

: A particular stocks Expected Total Return is LESS than 3% (an approximation to the

12-month Fixed Deposit Rate of 3.15% as a proxy to Risk-Free Rate).

Sector Recommendations***

OVERWEIGHT

NEUTRAL

UNDERWEIGHT

: A particular sectors Expected Total Return is MORE than 10% (an approximation to the

5-year annualised Total Return of FBMKLCI of 10.2%).

: A particular sectors Expected Total Return is WITHIN the range of 3% to 10%.

: A particular sectors Expected Total Return is LESS than 3% (an approximation to the

12-month Fixed Deposit Rate of 3.15% as a proxy to Risk-Free Rate).

***Sector recommendations are defined based on market capitalisation weighted average expected total

return for stocks under our coverage.

This document has been prepared for general circulation based on information obtained from sources believed to be reliable but we do not

make any representations as to its accuracy or completeness. Any recommendation contained in this document does not have regard to

the specific investment objectives, financial situation and the particular needs of any specific person who may read this document. This

document is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees.

Kenanga Investment Bank Berhad accepts no liability whatsoever for any direct or consequential loss arising from any use of this document

or any solicitations of an offer to buy or sell any securities. Kenanga Investment Bank Berhad and its associates, their directors, and/or

employees may have positions in, and may effect transactions in securities mentioned herein from time to time in the open market or

otherwise, and may receive brokerage fees or act as principal or agent in dealings with respect to these companies.

Published and printed by:

KENANGA INVESTMENT BANK BERHAD (15678-H)

8th Floor, Kenanga International, Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia

Telephone: (603) 2166 6822 Facsimile: (603) 2166 6823 Website: www.kenanga.com.my

PP7004/02/2013(031762)

Chan Ken Yew

Head of Research

Page 10 of 10

You might also like

- Investor DigestDocument10 pagesInvestor DigestDenny BimatamaNo ratings yet

- Economy Report Oct 2009Document17 pagesEconomy Report Oct 2009PriyankaNo ratings yet

- Punjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDocument14 pagesPunjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDavid ThambuNo ratings yet

- Nedbank Se Rentekoers-Barometer - September 2014Document4 pagesNedbank Se Rentekoers-Barometer - September 2014Netwerk24SakeNo ratings yet

- MSME Pulse Report Analyzes Commercial Lending TrendsDocument11 pagesMSME Pulse Report Analyzes Commercial Lending TrendsVinod ChanrasekharanNo ratings yet

- (Kotak) ICICI Bank, January 31, 2013Document14 pages(Kotak) ICICI Bank, January 31, 2013Chaitanya JagarlapudiNo ratings yet

- BFSI Sector ReportDocument33 pagesBFSI Sector ReportSAGAR VAZIRANINo ratings yet

- HDFC Bank Rs 485: All Around Strong Performance HoldDocument8 pagesHDFC Bank Rs 485: All Around Strong Performance HoldP VinayakamNo ratings yet

- Economy Report Nov 2009Document14 pagesEconomy Report Nov 2009PriyankaNo ratings yet

- Vietnam Banking Industry Analysis - V1Document10 pagesVietnam Banking Industry Analysis - V1Khoi NguyenNo ratings yet

- Headline Published OnDocument8 pagesHeadline Published OnAmol GadeNo ratings yet

- Stock of The Funds Advisory Today - Buy Stock of Union Bank's With Target Price Rs.152/shareDocument28 pagesStock of The Funds Advisory Today - Buy Stock of Union Bank's With Target Price Rs.152/shareNarnolia Securities LimitedNo ratings yet

- Bank: UNITED BANK LIMITED - Analysis of Financial Statements Financial Year 2004 - Financial Year 2009Document5 pagesBank: UNITED BANK LIMITED - Analysis of Financial Statements Financial Year 2004 - Financial Year 2009Muhammad MuzammalNo ratings yet

- US Banks Break Revenue Records in Q2'22Document4 pagesUS Banks Break Revenue Records in Q2'22Fatima NoorNo ratings yet

- Rs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundDocument23 pagesRs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundSohail HanifNo ratings yet

- Indepth Banking Sector Review 9-Months '06 (21st November 2006)Document14 pagesIndepth Banking Sector Review 9-Months '06 (21st November 2006)AyeshaJangdaNo ratings yet

- NBP Bank InternshipreportDocument6 pagesNBP Bank Internshipreportwaqas609No ratings yet

- US GDP Growth and Impact on Stock MarketDocument170 pagesUS GDP Growth and Impact on Stock Marketazizi akmalNo ratings yet

- HDFC Bank: CMP: INR537 TP: INR600 NeutralDocument12 pagesHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalNo ratings yet

- Q1 2013 Economic Outlook Survey ResultsDocument4 pagesQ1 2013 Economic Outlook Survey ResultsAnonymous Feglbx5No ratings yet

- Qs - Bfsi - Q1fy16 PreviewDocument8 pagesQs - Bfsi - Q1fy16 PreviewratithaneNo ratings yet

- Crisil Sme Connect Dec09Document32 pagesCrisil Sme Connect Dec09Rahul JainNo ratings yet

- Quarterly Banking Profile: Insured Institution PerformanceDocument30 pagesQuarterly Banking Profile: Insured Institution Performancesubsidyscope_bailoutNo ratings yet

- Data Scan: China July Expenditure DataDocument3 pagesData Scan: China July Expenditure Dataapi-162199694No ratings yet

- 2010 February HFCDocument13 pages2010 February HFCAmol MahajanNo ratings yet

- Nedbank Se Rentekoers-Barometer Vir Mei 2015Document4 pagesNedbank Se Rentekoers-Barometer Vir Mei 2015Netwerk24SakeNo ratings yet

- Sharekhan Top Picks: January 01, 2013Document7 pagesSharekhan Top Picks: January 01, 2013Rajiv MahajanNo ratings yet

- EV 160801 Jun16 MS (Kenanga)Document3 pagesEV 160801 Jun16 MS (Kenanga)Faizal FazilNo ratings yet

- MFM Jul 15 2011Document13 pagesMFM Jul 15 2011timurrsNo ratings yet

- Bajaj Capital Centre For Investment Research: Buy HDFC BankDocument9 pagesBajaj Capital Centre For Investment Research: Buy HDFC BankShikhar KumarNo ratings yet

- NFIB ReportDocument23 pagesNFIB ReportsrdielNo ratings yet

- Wholesale borrowing rates likely to fall in FY15Document73 pagesWholesale borrowing rates likely to fall in FY15girishrajsNo ratings yet

- CASA Accretion: Key Points Supply DemandDocument11 pagesCASA Accretion: Key Points Supply DemandDarshan RavalNo ratings yet

- Crisil Sme Connect Aug12Document60 pagesCrisil Sme Connect Aug12Ravindra BagateNo ratings yet

- SEM AY16 - 17 External PublicationDocument12 pagesSEM AY16 - 17 External PublicationSwastik AgarwalNo ratings yet

- Tanzania Mortgage Market Update 30 Sept 18 - FinalDocument11 pagesTanzania Mortgage Market Update 30 Sept 18 - FinalAnonymous FnM14a0No ratings yet

- Indusind Bank: Picture PerfectDocument12 pagesIndusind Bank: Picture PerfectumaganNo ratings yet

- Initiating Coverage HDFC Bank - 170212Document14 pagesInitiating Coverage HDFC Bank - 170212Sumit JatiaNo ratings yet

- U.S. Bank Balance Sheet Trends: Not Too Hot Yet: Financial InstitutionsDocument9 pagesU.S. Bank Balance Sheet Trends: Not Too Hot Yet: Financial Institutionsapi-227433089No ratings yet

- IIP April 2012-06-12-2012Document3 pagesIIP April 2012-06-12-2012shruti_dasgupta20No ratings yet

- Kenyan Banks - Could Equity Be A Victim of Its Own SuccessDocument22 pagesKenyan Banks - Could Equity Be A Victim of Its Own SuccessMukarangaNo ratings yet

- Nordic Companies in China Less Optimistic: - But They Continue To Expand Their PresenceDocument6 pagesNordic Companies in China Less Optimistic: - But They Continue To Expand Their PresenceSEB GroupNo ratings yet

- Indian CV Industry An UpdateDocument17 pagesIndian CV Industry An UpdateSantanu KararNo ratings yet

- Asset Quality: That Sinking Feeling!Document33 pagesAsset Quality: That Sinking Feeling!Ronitsinghthakur SinghNo ratings yet

- 2019 6 GS Conference Non-Deal RoadshowDocument66 pages2019 6 GS Conference Non-Deal RoadshowAkashaNo ratings yet

- Studiu SeptDocument3 pagesStudiu SeptGeorge ManeaNo ratings yet

- Weekly Wrap: Investment IdeaDocument4 pagesWeekly Wrap: Investment IdeaAnonymous 0JhO3KdjNo ratings yet

- Viet Nam-Update: Yield MovementsDocument3 pagesViet Nam-Update: Yield Movementscrazyfrog1991No ratings yet

- Can Fin Homes LTD (NSE Code: CANFINHOME) - Alpha/Alpha + Stock Recommendation For May'13Document21 pagesCan Fin Homes LTD (NSE Code: CANFINHOME) - Alpha/Alpha + Stock Recommendation For May'13shahavNo ratings yet

- Monetary Policy Review Sept 2014Document7 pagesMonetary Policy Review Sept 2014tirthanpNo ratings yet

- Banking: Near Term Headwinds To Stay Remain SelectiveDocument13 pagesBanking: Near Term Headwinds To Stay Remain SelectiveumaganNo ratings yet

- RBI Cautiously Holds RatesDocument4 pagesRBI Cautiously Holds RatesMeenakshi MittalNo ratings yet

- Crisil Sme Connect Apr12Document56 pagesCrisil Sme Connect Apr12Vidya AdsuleNo ratings yet

- Regional GDP Growth Slows Further to 4.7% in 1Q12Document9 pagesRegional GDP Growth Slows Further to 4.7% in 1Q12enleeNo ratings yet

- Icici Bank: Wholesale Pain, Retail DelightDocument12 pagesIcici Bank: Wholesale Pain, Retail DelightumaganNo ratings yet

- Current Macroeconomic Situation in Nepal Based on First Six Months of 2008/09Document10 pagesCurrent Macroeconomic Situation in Nepal Based on First Six Months of 2008/09Monkey.D. LuffyNo ratings yet

- September 7th, 2012: Market OverviewDocument9 pagesSeptember 7th, 2012: Market OverviewValuEngine.comNo ratings yet

- Kenanga Today-160809 (Kenanga)Document12 pagesKenanga Today-160809 (Kenanga)Faizal FazilNo ratings yet

- Activity Report: Student Signature: Supervisor Signature: Dat eDocument1 pageActivity Report: Student Signature: Supervisor Signature: Dat eFaizal FazilNo ratings yet

- Osk Report Trading Stocks 20160815 RHB Retail Research AvEA145379190957b1103acc16cDocument10 pagesOsk Report Trading Stocks 20160815 RHB Retail Research AvEA145379190957b1103acc16cFaizal Fazil100% (1)

- EV 160801 Jun16 MS (Kenanga)Document3 pagesEV 160801 Jun16 MS (Kenanga)Faizal FazilNo ratings yet

- Malaysia External Trade: June Exports Unexpectedly Rises 3.4% YoyDocument4 pagesMalaysia External Trade: June Exports Unexpectedly Rises 3.4% YoyFaizal FazilNo ratings yet

- Market Pulse - 3aug16Document5 pagesMarket Pulse - 3aug16Faizal FazilNo ratings yet

- FBM Klci - Daily: Near Term ConsolidationDocument3 pagesFBM Klci - Daily: Near Term ConsolidationFaizal FazilNo ratings yet

- Technical Outlook: FBM KlciDocument2 pagesTechnical Outlook: FBM KlciFaizal FazilNo ratings yet

- Malaysia: Company UpdateDocument8 pagesMalaysia: Company UpdateFaizal FazilNo ratings yet

- Cigc Log Book Ijazah (Pippit)Document225 pagesCigc Log Book Ijazah (Pippit)Faizal FazilNo ratings yet

- Trading Stocks: 5959 T0X'/The CDocument10 pagesTrading Stocks: 5959 T0X'/The CFaizal Fazil100% (1)

- Malaysia: Results ReviewDocument10 pagesMalaysia: Results ReviewFaizal FazilNo ratings yet

- Technical Focus - 5aug16Document3 pagesTechnical Focus - 5aug16Faizal FazilNo ratings yet

- ReadmeDocument7 pagesReadmemoisessssNo ratings yet

- EV 160801 Jun16 MS (Kenanga)Document3 pagesEV 160801 Jun16 MS (Kenanga)Faizal FazilNo ratings yet

- Coastal 160802 Cu (Kenanga)Document4 pagesCoastal 160802 Cu (Kenanga)Faizal FazilNo ratings yet

- Polaris IndiaxcultureDocument21 pagesPolaris IndiaxcultureFaizal FazilNo ratings yet

- VAJ1-Piotroski F Score Spreadsheet FreeDocument6 pagesVAJ1-Piotroski F Score Spreadsheet FreeFaizal FazilNo ratings yet

- Market PulseDocument4 pagesMarket PulseFaizal FazilNo ratings yet

- Marketing Ethic AssigmentDocument5 pagesMarketing Ethic AssigmentFaizal FazilNo ratings yet

- Dissertation Proposal Form: Students ParticularsDocument3 pagesDissertation Proposal Form: Students ParticularsFaizal FazilNo ratings yet

- Malaysia Investment Performance Report 2013Document45 pagesMalaysia Investment Performance Report 2013Faizal FazilNo ratings yet

- Business Plan - Docx 3-Star Hospitality and Tourism Devt Centre in Mbarara - UgandaDocument49 pagesBusiness Plan - Docx 3-Star Hospitality and Tourism Devt Centre in Mbarara - UgandaInfiniteKnowledge100% (9)

- Basic Concept of Process Validation in Solid Dosage Form (Tablet) : A ReviewDocument10 pagesBasic Concept of Process Validation in Solid Dosage Form (Tablet) : A Reviewqc jawaNo ratings yet

- Aggregate Demand and Supply: A ReviewDocument36 pagesAggregate Demand and Supply: A ReviewYovan DharmawanNo ratings yet

- Table of Forces For TrussDocument7 pagesTable of Forces For TrussSohail KakarNo ratings yet

- Encore HR PresentationDocument8 pagesEncore HR PresentationLatika MalhotraNo ratings yet

- Nº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRDocument33 pagesNº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRdaniel addeNo ratings yet

- BR18 Mechanical Engineering Robotics Semester VIDocument2 pagesBR18 Mechanical Engineering Robotics Semester VIPRAVEeNo ratings yet

- Product Models Comparison: Fortigate 1100E Fortigate 1800FDocument1 pageProduct Models Comparison: Fortigate 1100E Fortigate 1800FAbdullah AmerNo ratings yet

- Dues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Document52 pagesDues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Greefield JasonNo ratings yet

- (DO-CYT-T1-16) - KASSAHUN ComparisionDocument126 pages(DO-CYT-T1-16) - KASSAHUN ComparisionMohammed AdaneNo ratings yet

- Cambridge IGCSE: GEOGRAPHY 0460/13Document32 pagesCambridge IGCSE: GEOGRAPHY 0460/13Desire KandawasvikaNo ratings yet

- Which Delivery Method Is Best Suitable For Your Construction Project?Document13 pagesWhich Delivery Method Is Best Suitable For Your Construction Project?H-Tex EnterprisesNo ratings yet

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- Variant Configuration Step by Step ConfigDocument18 pagesVariant Configuration Step by Step Configraghava_83100% (1)

- THE MEDIUM SHAPES THE MESSAGEDocument56 pagesTHE MEDIUM SHAPES THE MESSAGELudovica MatildeNo ratings yet

- Application Tracking System: Mentor - Yamini Ma'AmDocument10 pagesApplication Tracking System: Mentor - Yamini Ma'AmBHuwanNo ratings yet

- 77115 Maintenance Battery ChargerDocument4 pages77115 Maintenance Battery ChargerClarence ClarNo ratings yet

- Kooltherm PipeDocument8 pagesKooltherm Pipenaseema1No ratings yet

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Document1 pageSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagNo ratings yet

- AGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFDocument54 pagesAGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFAnonymous rIKejWPuS100% (1)

- UE Capability Information (UL-DCCH) - Part2Document51 pagesUE Capability Information (UL-DCCH) - Part2AhmedNo ratings yet

- Makerere University: Office of The Academic RegistrarDocument2 pagesMakerere University: Office of The Academic RegistrarOPETO ISAACNo ratings yet

- Expert Java Developer with 10+ years experienceDocument3 pagesExpert Java Developer with 10+ years experienceHaythem MzoughiNo ratings yet

- Personal Selling ProcessDocument21 pagesPersonal Selling ProcessRuchika Singh MalyanNo ratings yet

- 38-St. Luke - S vs. SanchezDocument25 pages38-St. Luke - S vs. SanchezFatzie MendozaNo ratings yet

- Common Size Statement: A Technique of Financial Analysis: June 2019Document8 pagesCommon Size Statement: A Technique of Financial Analysis: June 2019safa haddadNo ratings yet

- Part 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Document127 pagesPart 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Duyen Pham75% (4)

- (Unit) Title of The Chapter Name of FacilitatorDocument35 pages(Unit) Title of The Chapter Name of FacilitatorDipesh BasnetNo ratings yet

- Cis285 Unit 7Document62 pagesCis285 Unit 7kirat5690No ratings yet

- 91 SOC Interview Question BankDocument3 pages91 SOC Interview Question Bankeswar kumarNo ratings yet