Professional Documents

Culture Documents

Apps - Hrmsorissa.gov - in Portal Page Portal HRMS Bill FR

Uploaded by

Pramod KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apps - Hrmsorissa.gov - in Portal Page Portal HRMS Bill FR

Uploaded by

Pramod KumarCopyright:

Available Formats

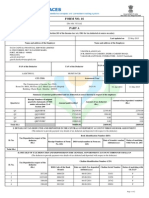

Bill Front page

Page 1 of 2

KLDTOU001

Schedule LIII - Form No. 188

Bill No. 48/2015-16

Detailed Pay Bill of Permanent/Temporary Establishment of the DISTRICT CULTURE OFFICER, KALAHANDI

(O.T.C.Form No.22)

for the month of NOVEMBER 2015

District : KALAHANDI

Ben Ref No: 20153900043

Token No: 11249

Space for classification stamp of manuscript entries of classification to be

filled in by Drawing Officer, Name of detailed heads and corresponding

amounts should be recorded by him in adjacent column.

Demand no

Major head

Sub Major head

Minor head

Sub head

Detail head

Plan Status

Charge/Voted

Sector

32

2205

00

001

0306

01003

0-NP

Voted

0-NONE

VOUCHER

of

for

PayofpermanentEstablishment

PayoftemporaryEstablishment

- PAY

24450

156

403

- DA

- HRA

29096

2445

Deduct-

2. In the Remarks col.umn 15 should be recorded all unusal permanent

events such as death, retirements, transfers and first appointments which

find no place increment certificates or absentee statement.

3. When the increment claimed operates to carry a Government Servant

Govt. to efficiency bar it should be supported by a declaration that the

Government servants in question is fit to pass the bar (S.T.R. 6).

4. Names of Government servants in inferior services as well as those

mentioned [S.T.R.55(3)] may be omitted from pay bill (S.T.R.55).

5. A red line should be drawn right across the sheet after each section of

the punishment and under it is totals of columns 4,5,6 and 7 and 8 of the

section should be shown in red ink.

6. In cases where the amount of leave salary is based on average pay

separate statement showing the calculation of average pay duly attested by

Drawing Officer should be attachment to this bill vide [S.T.R.55 (3)].

7. The names of men holding post substantively should be entered in order

of Seniority as measured by substantive pay drawn and below those will be

shown the parts left vacant and the men officiating in the vacancies.

8. Officiating pay should be record in the section of the bill appropriate to

that in which the Government servant officiates and transit pay should be

recorded in the same section as that in which the duty pay of the Government

servant after transfer is recorded.

9. The following abbreviations should be use in this and in all other

document, submitted with pay bill.

Totaldeductions

LAP

LIP

OD

LS

CA

TP

Under suspension

Vacant

Post Life Insurance

Last Pay Certificate

Subsistence grant

SP

A

I

LP

Sub grant

Total

GA

GPF

IT

LIC

PT

RS

list

136

55545

N.B 55545

1.Hold over amounts should be entered in red ink in the appropriate col.

58816

3,4,5 and 6 as the case may be and ignored in totalling. Leave salary the

amount of which is not known, should Similarly be entered in red in col. 4 at 55832

3043

the same rate as pay if he has remained on duty (S.T.R. 55).

Leave on average pay

Leave on quarter average pay

On other duty

Leave Salary

Conveyance allowance

Transit pay

NetTotal

55991 00

6380

5000

2000

5789

200

1936900

3662200

10. In cases where any fast one sesiocladeo in pay bill, a separate schepe

showing the particulars of deduction relating to each fund should accompany

the bill.

FOR THE USE OF THE ACCOUNT GENERAL'S OFFICE

Admitted Rs.

Object Rs.

Auditor

Superitendent

Gazetted Officer

http://apps.hrmsorissa.gov.in/portal/page/portal/HRMS/Bill%20Front%20page?billNo=4...

11/28/2015

Bill Front page

Page 2 of 2

S.T.R. means Subsidiary Rules under the Orissa Treasury Rules.

The deduct entries relating to the Provident fund should be posted separately for the Sterling and Ordinary Brand as.

http://apps.hrmsorissa.gov.in/portal/page/portal/HRMS/Bill%20Front%20page?billNo=4...

11/28/2015

You might also like

- Application For A US PassportDocument6 pagesApplication For A US PassportAbu Hamza SidNo ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Transmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument2 pagesTransmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueLayne Kendee100% (2)

- Square Pharma Valuation ExcelDocument43 pagesSquare Pharma Valuation ExcelFaraz SjNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Court rules on nullification of title in ejectment caseDocument1 pageCourt rules on nullification of title in ejectment caseNapolyn FernandezNo ratings yet

- ISO 50001 Audit Planning MatrixDocument4 pagesISO 50001 Audit Planning MatrixHerik RenaldoNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605alona_245883% (6)

- Chaitanya Candra KaumudiDocument768 pagesChaitanya Candra KaumudiGiriraja Gopal DasaNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Agreement InvestmentDocument5 pagesAgreement InvestmentEricka Kim100% (6)

- Bir Atp MemoDocument10 pagesBir Atp Memobge5No ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- Government Accounting Process Quiz AnswersDocument5 pagesGovernment Accounting Process Quiz AnswersVon Andrei Medina67% (3)

- Construct Basic Sentence in TagalogDocument7 pagesConstruct Basic Sentence in TagalogXamm4275 SamNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Audit of Allocations to LGUsDocument7 pagesAudit of Allocations to LGUsRhuejane Gay MaquilingNo ratings yet

- Instructions for Preparing PayrollDocument1 pageInstructions for Preparing PayrollS Madhusudhana RaoNo ratings yet

- Schedule LIII - Form No. 188: KRDETE005Document2 pagesSchedule LIII - Form No. 188: KRDETE005Gayatree NandaNo ratings yet

- BillFrontPage 53761551Document1 pageBillFrontPage 53761551Mihir ranjan MohantaNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasJanice BautistaNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Pay and AllowancesDocument23 pagesPay and AllowancesRavi KumarNo ratings yet

- BillFrontPage 54393802Document1 pageBillFrontPage 54393802GhunduNo ratings yet

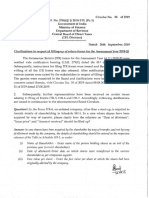

- Clarification Regarding Annual Returns and Reconciliation StatementDocument4 pagesClarification Regarding Annual Returns and Reconciliation StatementTIRLOK NATH JaggiNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Streamlined BIR Transfer Pricing GuidelinesDocument3 pagesStreamlined BIR Transfer Pricing GuidelinesJejomarNo ratings yet

- Audit Points Treasury Bills SystemDocument37 pagesAudit Points Treasury Bills SystemRajaniseer SrinivasanNo ratings yet

- TurboTax Federal Free Edition 2015Document4 pagesTurboTax Federal Free Edition 2015SandeepNo ratings yet

- Treasuries, PAO: Don'tsDocument11 pagesTreasuries, PAO: Don'tsExecutive Engineer R&BNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- 0605Document6 pages0605Ivy TampusNo ratings yet

- GST Annual Return ClarificationDocument3 pagesGST Annual Return ClarificationMukesh ChhadvaNo ratings yet

- Circular 26 2019Document4 pagesCircular 26 2019SnehNo ratings yet

- District Check ListsDocument1 pageDistrict Check ListsAzeem NaeemNo ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- Character Council of Greater Cincinnati and Northern Kentucky, IRS 990s, 2000 To The Present (2014), Most Recent FirstDocument229 pagesCharacter Council of Greater Cincinnati and Northern Kentucky, IRS 990s, 2000 To The Present (2014), Most Recent FirstPeter M. HeimlichNo ratings yet

- Press Release Clarification Regarding Annual Returns and Reconciliation StatementDocument3 pagesPress Release Clarification Regarding Annual Returns and Reconciliation StatementSujata OjhaNo ratings yet

- ITR AssignmentDocument8 pagesITR AssignmentEkta VermaNo ratings yet

- 3641-F (Y) Wages ClarificationDocument2 pages3641-F (Y) Wages ClarificationTeesta Mechanical DivisionNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2Boss NikNo ratings yet

- Notes On Withholding Tax and Income Tax FilingDocument20 pagesNotes On Withholding Tax and Income Tax FilingnengNo ratings yet

- Notice 138Document13 pagesNotice 138Farhan AliNo ratings yet

- RR No 21-2018Document3 pagesRR No 21-2018Larry Tobias Jr.No ratings yet

- RMO 21-2015 FT Final PDFDocument6 pagesRMO 21-2015 FT Final PDFGoogleNo ratings yet

- RMC No. 76-2020Document11 pagesRMC No. 76-2020Bobby LockNo ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Accounting Handbook For Regional Controllers PDFDocument66 pagesAccounting Handbook For Regional Controllers PDFAntara DeyNo ratings yet

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- LAC Semiannual Report October 2015: Jobs, Wages and the Latin American SlowdownFrom EverandLAC Semiannual Report October 2015: Jobs, Wages and the Latin American SlowdownNo ratings yet

- Bput 1470310707Document118 pagesBput 1470310707Pramod KumarNo ratings yet

- 11revenue Audit Manual Chapter - XiDocument11 pages11revenue Audit Manual Chapter - XiPramod KumarNo ratings yet

- Bput 1470310780Document123 pagesBput 1470310780Pramod KumarNo ratings yet

- Services: Home About Us Services Carrer Trainning Clients Gallery ContactDocument1 pageServices: Home About Us Services Carrer Trainning Clients Gallery ContactPramod KumarNo ratings yet

- Elec Virtual Reality ReportDocument15 pagesElec Virtual Reality ReportINder DǝǝpNo ratings yet

- W.A.T.T.: World Association of Technology TeachersDocument3 pagesW.A.T.T.: World Association of Technology TeachersPramod KumarNo ratings yet

- Lesson 2 The Chinese AlphabetDocument12 pagesLesson 2 The Chinese AlphabetJayrold Balageo MadarangNo ratings yet

- Rapport 2019 de La NHRC de Maurice: Découvrez Le Rapport Dans Son IntégralitéDocument145 pagesRapport 2019 de La NHRC de Maurice: Découvrez Le Rapport Dans Son IntégralitéDefimediaNo ratings yet

- Vivarium - Vol 37, Nos. 1-2, 1999Document306 pagesVivarium - Vol 37, Nos. 1-2, 1999Manticora VenerabilisNo ratings yet

- Addressing Menstrual Health and Gender EquityDocument52 pagesAddressing Menstrual Health and Gender EquityShelly BhattacharyaNo ratings yet

- Chapter 16 Study GuideDocument2 pagesChapter 16 Study GuideChang Ho LeeNo ratings yet

- Penyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di MalaysiaDocument12 pagesPenyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di Malaysia2023225596No ratings yet

- Tayug Rural Bank v. CBPDocument2 pagesTayug Rural Bank v. CBPGracia SullanoNo ratings yet

- Hackers Speaking Test ReviewDocument21 pagesHackers Speaking Test ReviewMark Danniel SaludNo ratings yet

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Document2 pagesForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalNo ratings yet

- Action Plan for Integrated Waste Management in SaharanpurDocument5 pagesAction Plan for Integrated Waste Management in SaharanpuramitNo ratings yet

- Pharma: Conclave 2018Document4 pagesPharma: Conclave 2018Abhinav SahaniNo ratings yet

- Application No. 2140 6100 0550: OJEE FORM F - Application Form For B.Tech (SPECIAL) 2021Document1 pageApplication No. 2140 6100 0550: OJEE FORM F - Application Form For B.Tech (SPECIAL) 2021Siba BaiNo ratings yet

- DEALCO FARMS vs. NLRCDocument14 pagesDEALCO FARMS vs. NLRCGave ArcillaNo ratings yet

- Vodafone service grievance unresolvedDocument2 pagesVodafone service grievance unresolvedSojan PaulNo ratings yet

- 09 - 7th EIRAC Plenary - Sustainable Chain ManagementDocument17 pages09 - 7th EIRAC Plenary - Sustainable Chain ManagementpravanthbabuNo ratings yet

- Social media types for media literacyDocument28 pagesSocial media types for media literacyMa. Shantel CamposanoNo ratings yet

- HB Nutrition FinalDocument14 pagesHB Nutrition FinalJaoNo ratings yet

- F1 English PT3 Formatted Exam PaperDocument10 pagesF1 English PT3 Formatted Exam PaperCmot Qkf Sia-zNo ratings yet

- Learn Financial Accounting Fast with TallyDocument1 pageLearn Financial Accounting Fast with Tallyavinash guptaNo ratings yet

- Sabbia Food MenuDocument2 pagesSabbia Food MenuNell CaseyNo ratings yet

- ACADEMIC CALENDAR DEGREE AND POSTGRADUATE 2023 2024 1 - Page - 1Document2 pagesACADEMIC CALENDAR DEGREE AND POSTGRADUATE 2023 2024 1 - Page - 1cklconNo ratings yet

- Irregular verbs guideDocument159 pagesIrregular verbs guideIrina PadureanuNo ratings yet