Professional Documents

Culture Documents

Job Order Costing Systems

Uploaded by

Nived Lrac Pdll SgnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Job Order Costing Systems

Uploaded by

Nived Lrac Pdll SgnCopyright:

Available Formats

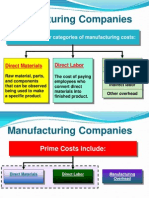

PRODUCT COSTING

SYSTEMS

(JOB ORDER COSTING AND PROCESS COSTING SYSTEM)

WHAT IS JOB ORDER COSTING SYSTEM

A system for assigning manufacturing costs to an individual product or

batches of products. Generally, the JO costing is used only when the

products manufactured are sufficiently different from each other.

Examples are:

Carpentry works for furniture and fixtures, cabinets and the like

Buildings and houses

Other products of which the customer has specified a particular

design.

JOB ORDER COSTING SYSTEM

The Job Cost Record or Cost Sheet

Since there is a significant variation in the products manufactured, a job cost record

for each item, job or special order.

The job cost record will report the direct materials and direct labor actually used

plus the manufacturing overhead assigned to each job.

The job cost records also serve as the subsidiary ledger or documentation for the

cost of the work-in-process inventory, the finished goods inventory, and the

cost of goods sold.

JOB ORDER COSTING SYSTEM

The accounting department is responsible to record all manufacturing costs (direct

materials, direct labor and manufacturing overhead) on the job cost sheet. A separate

job cost sheet is prepared of each individual job.

All necessary details about the job and costs incurred to complete the job are

written on the job cost sheet.

The job cost sheet is part of the accounting record. It is used as a subsidiary ledger

to WIP account because it contains all details about the job in process.

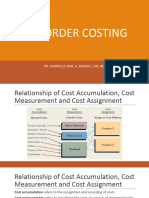

JOB ORDER COSTING SYSTEM

Bill of

Materials

Other

Documents

/evidences

Employee

Time

Ticket

Determine

Direct

Material

Needs

Determine

Direct

Labor

Cost

Determine

and

measure

Non-Mfg

Costs

Determine

and

Measure

Overhead

Costs

Predetermi

ned and

Applied

OH

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT MATERIALS COST

Accept an order

Determine and purchase direct material

requirements (Basis: Bill of Materials)

Issue direct materials to production (Use the

Materials Requisition Form)

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT MATERIALS COST

Bill of Materials

It is a document that lists the type and quantity of direct materials required to

manufacture a standard product as customized for a specific design.

Materials Requisition Form (MRF)

It is a document used to record the issuances of direct materials in starting the

production process. An authorized person from the production department writes the

type, quantity and job number (to which the materials cost is to be charged) on the MRF.

A complete MRF is also used by the accounting department to record the direct

materials on the Job Cost Sheet of the related job order.

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT MATERIALS COST

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT MATERIALS COST

Journal entry to record the flow of materials:

When materials are purchased:

Materials

xxxx

Cash or Accounts Payable

xxxx

#

When materials are issued

Work-in-Process

xxxx

Materials

xxxx

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT LABOR COST

Direct labor hours worked, direct labor rate per hour, and total amount in

pesos for each for each individual job or task is recorded on a document

known as time ticket or employee time ticket.

A separate time ticket is prepared by each worker for every working day.

Accounting department collects all time tickets at the end of the day.

These time tickets are used to record DLC on the Job Cost sheet of each

individual job order.

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT LABOR COST

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING DIRECT LABOR COST

Journal entry to record direct labor cost:

Work-in-Process

Cash or Wages Payable

#

xxxx

xxxx

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING MANUFACTURING OVERHEAD

Usually consists of both variable and fixed components.

Examples are indirect materials, indirect labor, depreciation, salary of

production manager, property taxes, fuel, electricity, grease used in

machines, and insurance.

Unlike DM and DL, MOH is an indirect cost that cannot be directly

assigned to each individual job. This problem is solved by using a rate that

is computed at the beginning of each period. This rate is known as

predetermined overhead rate

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING MANUFACTURING OVERHEAD

As stated earlier, the predetermined OH rate is computed at the beginning of the period

and is used to apply manufacturing overhead cost to jobs throughout the period.

Computation of Applied Manufacturing Overhead:

Applied MOH = Predetermined OH Rate x Amt of the allocation based incurred by the job

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING MANUFACTURING OVERHEAD

Ex: Suppose the GX Company has completed a job order. The time tickets show that the

workers have worked for 27 hours to complete the job. The predetermined OH rate

computed at the beginning of the period is P8 per DL hour. The MOH cost would be

applied to this job as follows:

= P8 x 27 DL hours

= P 216.00

JOB ORDER COSTING SYSTEM

MEASURING AND RECORDING MANUFACTURING OVERHEAD

Journal entry to record MOH cost:

Work-in-Process

Manufacturing Overhead

#

xxxx

xxxx

JOB ORDER COSTING SYSTEM

TREATMENT OF NON MANUFACTURING COSTS

No effect on the production costs of the company because

these are treated as period costs

Not included in the manufacturing overhead account but are

charged directly to income statement.

Examples are: sales commission, rent of office building,

advertising expense and depreciation of office equipment.

JOB ORDER COSTING SYSTEM

TREATMENT OF NON MANUFACTURING COSTS

Example: GX Company uses job order costing system and has

incurred the following non-manufacturing costs in the most

recent period:

1. Selling and administrative salary

P 60,000

2. Depreciation on office furniture

14,000

3. Advertising expenses

84,000

4. Other selling and administrative expenses 16,000

JOB ORDER COSTING SYSTEM

TREATMENT OF NON MANUFACTURING COSTS

Journal entry:

1.

Salaries Expenses

60,000

Cash or Salaries and Wages Payable

2.

Depreciation Expense

60,000

14,000

Accumulated Depreciation

3 & 4.

14,000

Advertising Expenses

84,000

Other Selling and Admin Expenses

16,000

Cash or Accounts Payable

100,000

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

Debit

Credit

Direct

Materials

Credit

Direct

Labor Cost

Credit

Manufact

uring

Overhead

WORK

IN

PROCESS

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

Journal Entry:

Work-In-Process

xxxx

Direct Materials

xxxx

Direct Labor

xxxx

MOH

xxxx

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

Credit

Work In

Process

Debit

Finished Goods

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

Journal Entry:

Finished Goods

Work-In-Process

#

xxxx

xxx

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

The total cost transferred from the work-in-process account to the

finished goods account during the period is equal to the cost of goods

manufactured for that period.

At the end of a period, the cost of incomplete jobs remain in the work-inprocess account and is shown as work-in-process inventory in assets

section of the balance sheet.

Next period these represents the opening balance of the work in process

account.

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

When finished goods are shipped to customers, the cost of finished goods

are transferred from finished goods account to cost of goods sold

account.

If a job is completed according to specification of a particular customer,

the complete job is shipped to the customer immediately and the

manufacturing cost associated with the job is charged to the cost of goods

sold.

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

Sales and the transfer of cost from finished goods to cost of goods sold account are

recorded by making the following journal entries:

Sales on Account:

Accounts Receivable

xxxx

Sales

xxxx

Cash Sales:

Cash

xxxx

Sales

xxxx

JOB ORDER COSTING SYSTEM

FINISHED GOODS AND COST OF GOODS SOLD

When cost is transferred to cost of goods sold account:

Cost of Goods Sold

Finished Goods

xxxx

xxxx

JOB ORDER COSTING SYSTEM

OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

This is the difference between the MOH applied to WIP and

MOH cost actually incurred.

JOB ORDER COSTING SYSTEM

OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

This is normal in manufacturing business because overhead is

applied to WIR using a predetermined OH rate.

Over or under applied MOH is actually the debit or credit

balance of manufacturing overhead account

Actual MOH costs are debited and applied MOH costs are

credited to MOH account

JOB ORDER COSTING SYSTEM

OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

Actual

OH

Applied

OH

Incurred

Applied to

WIP

DEBITED

CREDITED

JOB ORDER COSTING SYSTEM

OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

JOB ORDER COSTING SYSTEM

DISPOSITION OF OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

FG

CGS

WIP

OVER OR

UNDER

APPLIED MOH

JOB ORDER COSTING SYSTEM

DISPOSITION OF OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

WHEN MOH IS UNDER

APPLIED

WHEN MOH IS OVER APPLIED

MOH

xxxx

Work in Process

xxxx

Finished Goods

xxxx

Work-In Process

xxxx

Cost of Goods Sold

xxxx

Finished Goods

xxxx

Cost of Goods Sold

xxxx

MOH

xxxx

JOB ORDER COSTING SYSTEM

DISPOSITION OF OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

CGS

OVER OR

UNDER

APPLIED MOH

JOB ORDER COSTING SYSTEM

DISPOSITION OF OVER OR UNDER-APPLIED MANUFACTURING OVERHEAD

WHEN MOH IS UNDER

APPLIED

MOH

Cost of Goods Sold xxxx

MOH

WHEN MOH IS OVER APPLIED

xxxx

xxxx

Cost of Goods Sold xxxx

JOB ORDER COSTING SYSTEM

THANK YOU.

JOB ORDER COSTING SYSTEM

ILLUSTRATIVE EXAMPLE

During the year 2015, Bebe Company started two jobs Job A and Job B. Job A consisted

of 1,000 units and Job B consisted of 500 units. At the end of the year, Job A was completed

but Job B was in process. The information about manufacturing overhead cost applied to

Job A and B was as follows:

Job A: P 65,000; Job B:P 35,000. The actual OH cost by the company during 2015 was

P108,000. Out of 1,000 units in Job A, 750 units had been sold before the end of 2015.

Required: Calculate over or under applied MOH and make journal entries required to

dispose off over or under applied MOH assuming:

a.

It is disposed off by allocating between FG inventory and cost of goods sold account.

b.

It is disposed off by transferring the entire amount to cost of goods sold account.

You might also like

- Job OrdercostingDocument31 pagesJob OrdercostingGunawan Setio PurnomoNo ratings yet

- Financial Tools Week 5 Block BDocument9 pagesFinancial Tools Week 5 Block BBelen González BouzaNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingJomar Teneza100% (1)

- Normal CostingDocument3 pagesNormal CostingLucy, Parallag LyraNo ratings yet

- Systems Design: Job-Order CostingDocument46 pagesSystems Design: Job-Order CostingRafay Salman MazharNo ratings yet

- Lesson 10 Costing SystemsDocument8 pagesLesson 10 Costing SystemsSuhanna DavisNo ratings yet

- Job Order Costing Syste1 PDFDocument19 pagesJob Order Costing Syste1 PDFgosaye desalegn100% (2)

- Job Order CostingDocument23 pagesJob Order CostingChandan Dev67% (3)

- Module 3 - Overhead Allocation and ApportionmentDocument55 pagesModule 3 - Overhead Allocation and Apportionmentkaizen4apexNo ratings yet

- Job Costing: 1. Whether Actual or Estimated Costs Are UsedDocument16 pagesJob Costing: 1. Whether Actual or Estimated Costs Are UsedalemayehuNo ratings yet

- Definition of Job Order CostingDocument8 pagesDefinition of Job Order CostingWondwosen AlemuNo ratings yet

- Cost 1 Chapt-3 - 1Document38 pagesCost 1 Chapt-3 - 1Tesfaye Megiso BegajoNo ratings yet

- Product Costing in Batch ProductionDocument38 pagesProduct Costing in Batch ProductionOmar Bani-KhalafNo ratings yet

- Cost 1 Chapt-3Document43 pagesCost 1 Chapt-3Tesfaye Megiso BegajoNo ratings yet

- Am Unit - IvDocument31 pagesAm Unit - IvTamilan Dhinesh Tamilan DhineshNo ratings yet

- Module For Managerial Accounting-Job Order CostingDocument17 pagesModule For Managerial Accounting-Job Order CostingMary De JesusNo ratings yet

- Job Order Costing SystemDocument4 pagesJob Order Costing Systemgosaye desalegnNo ratings yet

- Job-Order Costing System ExplainedDocument46 pagesJob-Order Costing System Explainednicero555No ratings yet

- Steps in Job CostingDocument8 pagesSteps in Job CostingBhagaban DasNo ratings yet

- Managerial Accounting: Chapter 2: Job Order Costing - Calculating Unit Product CostsDocument5 pagesManagerial Accounting: Chapter 2: Job Order Costing - Calculating Unit Product CostsBogdan MorosanNo ratings yet

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- Job Order Cost Accounting: Study ObjectivesDocument39 pagesJob Order Cost Accounting: Study ObjectivesNanik DeniaNo ratings yet

- Acctg201 JobOrderCostingLectureNotesDocument20 pagesAcctg201 JobOrderCostingLectureNotesaaron manacapNo ratings yet

- Chapter 2 - Cost Accounting CycleDocument16 pagesChapter 2 - Cost Accounting CycleJoey Lazarte100% (1)

- Job Costing Vs Process CostingDocument20 pagesJob Costing Vs Process CostingappleandmangoNo ratings yet

- Methods of Cost Accounting MethodsDocument40 pagesMethods of Cost Accounting MethodsWilliam Veloz DiazNo ratings yet

- Chapter 3 AccountingDocument3 pagesChapter 3 Accountingmirzaaish112233No ratings yet

- Cac NotesDocument14 pagesCac Notescoco credo100% (1)

- Job Order Costing Overhead ConceptsDocument51 pagesJob Order Costing Overhead ConceptsYMNo ratings yet

- Cost Accouting-JOCDocument3 pagesCost Accouting-JOCAli ImranNo ratings yet

- AdvantagesDocument6 pagesAdvantagesAqsa_afridi0062No ratings yet

- Cost AccountingDocument11 pagesCost AccountingAfzal AbdullaNo ratings yet

- Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument48 pagesProduct Costing and Cost Accumulation in A Batch Production Environmentivyling29No ratings yet

- Ch.4 Job CostingDocument39 pagesCh.4 Job Costingvinn albatraozNo ratings yet

- ACCA105Document2 pagesACCA105Shane TabunggaoNo ratings yet

- 2Document3 pages2El - loolNo ratings yet

- Systems Designs - Job and Process CostingDocument49 pagesSystems Designs - Job and Process Costingjoe6hodagameNo ratings yet

- Measuring and Recording Manufacturing Overhead CostDocument2 pagesMeasuring and Recording Manufacturing Overhead CostAngelicaNo ratings yet

- Chap 20Document23 pagesChap 20Usama KhanNo ratings yet

- Determine Product Costs with Costing Systems (39Document11 pagesDetermine Product Costs with Costing Systems (39Cherwin bentulanNo ratings yet

- Manufacturing Costs ExplainedDocument30 pagesManufacturing Costs Explainedzahid_mahmood3811100% (1)

- Job Order CostingDocument39 pagesJob Order CostingCharisse Ahnne Toslolado100% (1)

- Methods of CostingDocument21 pagesMethods of CostingsweetashusNo ratings yet

- Chapter 20Document49 pagesChapter 20Pranav Shandil100% (1)

- Class - 5Document36 pagesClass - 5harsheen kaurNo ratings yet

- Job Costing: Job Costing Is A Form of Specific Order Costing and It Is Used When ADocument6 pagesJob Costing: Job Costing Is A Form of Specific Order Costing and It Is Used When AsserwaddaNo ratings yet

- Job CostingDocument15 pagesJob CostingRoshna RamachandranNo ratings yet

- Job Batch Costing GuideDocument21 pagesJob Batch Costing GuidesamiNo ratings yet

- Updated Ej Foh-Wip-Job Order Cost SystemDocument29 pagesUpdated Ej Foh-Wip-Job Order Cost SystemStephany PolinarNo ratings yet

- Management AccountingDocument246 pagesManagement AccountingsaraNo ratings yet

- MANAC Session-4Document29 pagesMANAC Session-4Aastha SharmaNo ratings yet

- ACC221 CostAccounting JobOrderDocument1 pageACC221 CostAccounting JobOrdermilkyode9No ratings yet

- Lecture 3 - Cost & Management Accounting - March 3, 2019 - 3pm To 6pmDocument3 pagesLecture 3 - Cost & Management Accounting - March 3, 2019 - 3pm To 6pmBhunesh KumarNo ratings yet

- Job OrderDocument53 pagesJob OrderAdilla DillaNo ratings yet

- Chapter 6 Manufacturing Overhead Accounting Overapplied UnderappliedDocument39 pagesChapter 6 Manufacturing Overhead Accounting Overapplied UnderappliedmerryNo ratings yet

- 1Document4 pages1El - loolNo ratings yet

- Cost Accounting Chapter 1Document10 pagesCost Accounting Chapter 1cece.11.29.22No ratings yet

- 05 Job Order CostingDocument86 pages05 Job Order CostingchingNo ratings yet

- Nueva Ecija Kamandag Elite Eagles ClubDocument1 pageNueva Ecija Kamandag Elite Eagles ClubNived Lrac Pdll SgnNo ratings yet

- EAGLEISMDocument4 pagesEAGLEISMNived Lrac Pdll SgnNo ratings yet

- Project BE CAREFUL - LayoutDocument1 pageProject BE CAREFUL - LayoutNived Lrac Pdll SgnNo ratings yet

- The Philippines at The Crossroads To Economic GlobDocument24 pagesThe Philippines at The Crossroads To Economic GlobSheilla PamittanNo ratings yet

- Order Reservation FormDocument1 pageOrder Reservation FormNived Lrac Pdll SgnNo ratings yet

- Pasig City COVID Vaccination PlanDocument48 pagesPasig City COVID Vaccination PlanNived Lrac Pdll SgnNo ratings yet

- Skeletal Workforce Schedule: Mayors OfficeDocument1 pageSkeletal Workforce Schedule: Mayors OfficeNived Lrac Pdll SgnNo ratings yet

- Implications of The SC Ruling On The Mandanas-GarciaDocument45 pagesImplications of The SC Ruling On The Mandanas-GarciaNived Lrac Pdll SgnNo ratings yet

- CLSU Cooperating Agency FormDocument1 pageCLSU Cooperating Agency FormNived Lrac Pdll SgnNo ratings yet

- Mayors OfficeDocument1 pageMayors OfficeNived Lrac Pdll SgnNo ratings yet

- The Issues and Challenges of Local Government Units in The Era of Population AgeingDocument22 pagesThe Issues and Challenges of Local Government Units in The Era of Population Ageingsheng cruzNo ratings yet

- Mayors OfficeDocument1 pageMayors OfficeNived Lrac Pdll SgnNo ratings yet

- Organizational Changes in Danish Local Governments After 2007 ReformDocument22 pagesOrganizational Changes in Danish Local Governments After 2007 ReformNived Lrac Pdll SgnNo ratings yet

- Decentralization CorruptionDocument33 pagesDecentralization CorruptionNived Lrac Pdll SgnNo ratings yet

- Kabalikat Application Form Regular MemberDocument1 pageKabalikat Application Form Regular MemberNived Lrac Pdll SgnNo ratings yet

- DBM Dilg Joint Memorandum Circular No 2021 1 Dated August 11 2021Document56 pagesDBM Dilg Joint Memorandum Circular No 2021 1 Dated August 11 2021Tristan Lindsey Kaamiño AresNo ratings yet

- DBM Circular Letter No. 2000 - 11Document2 pagesDBM Circular Letter No. 2000 - 11Nived Lrac Pdll Sgn100% (2)

- Act Creating New Nueva Ecija CapitalDocument16 pagesAct Creating New Nueva Ecija CapitalNived Lrac Pdll SgnNo ratings yet

- DBM Dilg JMC No 2021 3 Dated September 13 2021Document10 pagesDBM Dilg JMC No 2021 3 Dated September 13 2021carmanvernonNo ratings yet

- Nomination Form2 (Other Alumni Awards)Document2 pagesNomination Form2 (Other Alumni Awards)Nived Lrac Pdll SgnNo ratings yet

- A Conceptual Design: Prepared byDocument18 pagesA Conceptual Design: Prepared byNived Lrac Pdll SgnNo ratings yet

- Tugon PowerpointDocument49 pagesTugon PowerpointNived Lrac Pdll SgnNo ratings yet

- A Conceptual Design: Prepared byDocument18 pagesA Conceptual Design: Prepared byNived Lrac Pdll SgnNo ratings yet

- Joint Memorandum Circular (JMC) No. 2021Document49 pagesJoint Memorandum Circular (JMC) No. 2021Nicey RubioNo ratings yet

- SCDocument6 pagesSCLesterNo ratings yet

- .A.O. No. 70Document1 page.A.O. No. 70BabangNo ratings yet

- Republic Act No. 526 - An Act Creating The City of CabanatuanDocument27 pagesRepublic Act No. 526 - An Act Creating The City of CabanatuanNived Lrac Pdll SgnNo ratings yet

- App PPMPDocument187 pagesApp PPMPNived Lrac Pdll SgnNo ratings yet

- CLSU Operational Plan 2019Document35 pagesCLSU Operational Plan 2019Nived Lrac Pdll SgnNo ratings yet

- An Act Converting The Municipality of Muñoz in The Province of Nueva Ecija Into A Component City To Be Known As The Science City of MuñozDocument2 pagesAn Act Converting The Municipality of Muñoz in The Province of Nueva Ecija Into A Component City To Be Known As The Science City of MuñozNived Lrac Pdll SgnNo ratings yet

- The Indian Pharma Industry PDFDocument24 pagesThe Indian Pharma Industry PDFSnehith AlapatiNo ratings yet

- MN5006 Disneyland Paris Resort Case StudyDocument8 pagesMN5006 Disneyland Paris Resort Case Studyadey1234No ratings yet

- Uncertainty and Risk Analysis in Petroleum Exploration and ProductionDocument12 pagesUncertainty and Risk Analysis in Petroleum Exploration and ProductionOladimeji TaiwoNo ratings yet

- Economics - Theory and Practice: Ninth EditionDocument16 pagesEconomics - Theory and Practice: Ninth EditionJun Virador MagallonNo ratings yet

- BANKING LAWS: KEY ROLES OF THE BANGKO SENTRAL NG PILIPINASDocument17 pagesBANKING LAWS: KEY ROLES OF THE BANGKO SENTRAL NG PILIPINASJanice F. Cabalag-De VillaNo ratings yet

- Ch01.Ppt OverviewDocument55 pagesCh01.Ppt OverviewMohammadYaqoob100% (1)

- Net Present Value MethodDocument3 pagesNet Present Value MethodTawanda KurasaNo ratings yet

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerNo ratings yet

- MGT602 Finalterm Subjective-By KamranDocument12 pagesMGT602 Finalterm Subjective-By KamranKifayat Ullah ToheediNo ratings yet

- Rebuilding Iraq's Housing, Urban and Land Management SectorsDocument4 pagesRebuilding Iraq's Housing, Urban and Land Management SectorsChandan SrivastavaNo ratings yet

- AS 26 - 123 To 138Document16 pagesAS 26 - 123 To 138love chawlaNo ratings yet

- PNB Market Analysis and Financial PerformanceDocument9 pagesPNB Market Analysis and Financial PerformancePriyadarshini TyagiNo ratings yet

- Development of Venture Capital in IndiaDocument29 pagesDevelopment of Venture Capital in IndiaĄrpit RāzNo ratings yet

- The Economic Transformation Programme: A Roadmap For Malaysia - Executive Summary RoadmapDocument56 pagesThe Economic Transformation Programme: A Roadmap For Malaysia - Executive Summary RoadmapEncik AnifNo ratings yet

- Celebrity EndorsementDocument13 pagesCelebrity EndorsementMuhammad ZeshanNo ratings yet

- From Camels To Land Rovers - The Economy of DubaiDocument11 pagesFrom Camels To Land Rovers - The Economy of DubaiLela JgerenaiaNo ratings yet

- Understanding Depreciation Expense and MethodsDocument52 pagesUnderstanding Depreciation Expense and MethodsPiyush Malhotra50% (2)

- Black Scholes Model ReportDocument6 pagesBlack Scholes Model ReportminhalNo ratings yet

- TAX CARD 2019Document1 pageTAX CARD 2019Kinglovefriend100% (1)

- Goat Farm BudgetingDocument9 pagesGoat Farm Budgetingqfarms100% (1)

- Inflation Impact On EconmyDocument4 pagesInflation Impact On EconmyRashid HussainNo ratings yet

- Stipulation and Order of Discontinuance by KBC Investments Cayman Islands V Ltd.Document5 pagesStipulation and Order of Discontinuance by KBC Investments Cayman Islands V Ltd.Thierry DebelsNo ratings yet

- 032465913X 164223Document72 pages032465913X 164223March AthenaNo ratings yet

- Bharat Forge LTD Investor Update FY 2003Document12 pagesBharat Forge LTD Investor Update FY 2003Mayukh SinghNo ratings yet

- BIAN Service LandscapeV7 0 PDFDocument1 pageBIAN Service LandscapeV7 0 PDFميلاد نوروزي رهبرNo ratings yet

- Nature of Financial ManagementDocument3 pagesNature of Financial ManagementDurga Prasad100% (6)

- Comparison Table of Luxembourg Investment VehiclesDocument11 pagesComparison Table of Luxembourg Investment Vehiclesoliviersciales100% (1)

- ENTRE2 ND GroupDocument66 pagesENTRE2 ND Groupit is meNo ratings yet

- JLL Zuidas Office Market Monitor 2014 Q4 DEFDocument16 pagesJLL Zuidas Office Market Monitor 2014 Q4 DEFvdmaraNo ratings yet

- BrandDocument31 pagesBrandyadavraj23No ratings yet