Professional Documents

Culture Documents

Passive Income Tax Base Tax Rate

Uploaded by

Bianca DeslateCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Passive Income Tax Base Tax Rate

Uploaded by

Bianca DeslateCopyright:

Available Formats

TAXED ON

Gains from dealings in property

Gain from sale of ORDINARY

ASSETS

Passive investment income

Interest Income

Currency bank deposit & yield,

monetary benefit from deposit

substitutes, trust funds, etc

From foreign currency deposits

w/ offshore banking unit (OBU)

or foreign currency deposit unit

(FCDU) in the Philippines

Long term deposit/investment

[savings, trust funds, deposit

substitutes, investments]

Pre-terminated long term

investment (should actually be

based on expired term)

Interest income of a depository

bank (under the expanded

foreign currency system);

foreign currency transactions w/

non-residents, OBU's in the

Phils, local commercial banks

including branches of foreign

banks authorized by BSP to

transact business w/ foreign

currency deposit system

Interest income of depository

banks (under the expanded

foreign currency system) from

foreign currency loans to

residents other than OBU's in

the Phils. or other depository

banks under the expanded

system

Other interest income derived

from the Philippines

(between individuals)

Other interest income derived

from outside the Philippines

- tenant who paid to a

landowner under CARP

- from a duly registered

cooperative

BSP prescribed form of

DESLATE 1

RC

NRC

RA

NRAETB

NRANETB

5-32%

DC

RFC

NRFC

30%

20% FT

20% FT

20% FT

20% FT

25% FT

20% FT

20% FT

30%

7.5% FT

EXEMPT

7.5% FT

EXEMPT

EXEMPT

7.5% FT

7.5% FT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

N/A

10% FT

10% FT

20% FT on foreign

loans contracted after

Aug. 1, 1988

25% FT

5% FT (4 to <5 yrs)

12% FT (3 to <4 yrs)

20% FT (< 3 yrs)

5% FT (4 to <5 yrs)

12% FT (3 to <4 yrs)

20% FT (< 3 yrs)

5% FT (4 to <5 yrs)

12% FT (3 to <4 yrs)

20% FT (< 3 yrs)

5% FT (4 to <5 yrs)

12% FT (3 to <4 yrs)

20% FT (< 3 yrs)

25% FT

5-32%

5-32%

5-32%

5-32%

25% FT

5-32%

EXEMPT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

investments maturing more

than five years

Expanded foreign currency

deposit system by non-resident

citizens/aliens

Dividend income

Cash/property dividends (FMV

amt) from domestic corp

OR

Share in distributable net

income after tax of a

partnership, assoc, joint acct,

joint venture, or consortium

taxable as a corp

Cash/property dividends from a

foreign corp. doing business

in Phils.

" " foreign corp outside Phils.

Royalties

Passive income

Paid by a domestic corp. to

[on books, literary works,

musical compositions]

[cinematographic films]

- for non-resident

cinematographic film owner,

lessor, distributor (28 B (2) )

Paid by a foreign corp. to

Rent

Prizes

Within Philippines

> P10,000

< P10,000

Outside Philippines

EXEMPT

10% FT

10% FT

20% FT

25% FT

EXEMPT

EXEMPT

15% FWT1

- inter-corporate dividends are exempt from tax

- but once declared to its SH, they have to pay

taxes on them

5- 32% FT

5-32% FT

5-32% FT

5-32% FT

25% FT

30% FT

5-32% FT

EXEMPT

EXEMPT

EXEMPT

EXEMPT

30% FT

EXEMPT

EXEMPT

20% FT

10% FT

20% FT

10% FT

20% FT

10% FT

20% FT

10% FT

25% FT

25% FT

20% FT

20% FT

30% FT

20% FT

25% FT

25% FT

??

30%

30% FT

??

30% FT

??

5-32%

5-32%

EXEMPT

5-32%

EXEMPT

5-32%

EXEMPT

25% FT

EXEMPT

25% FT

30% FT

??

20& FT

5-32% FT

5-32%

20% FT

5-32% FT

5-32% FT

20% FT

5-32% FT

EXEMPT

20% FT

5-32% FT

EXEMPT

25% FT

25% FT

EXEMPT

30% FT

??

EXEMPT

Sec. 28 (5b): condition is that of tax credit

DESLATE 2

10% FT

You might also like

- Income Taxation of Individuals: Citizens: Citizens Resident Non-ResidentsDocument6 pagesIncome Taxation of Individuals: Citizens: Citizens Resident Non-Residentskirsten_bri16No ratings yet

- Passive Income Subject To Final TaxDocument2 pagesPassive Income Subject To Final TaxKyle LauritoNo ratings yet

- TAXATION LAW HIGHLIGHTSDocument4 pagesTAXATION LAW HIGHLIGHTSJM BermudoNo ratings yet

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinNo ratings yet

- Income Tax Chart - Individual TaxpayersDocument2 pagesIncome Tax Chart - Individual TaxpayersAlthia Joy AlisingNo ratings yet

- Tax On Individuals Part 2Document10 pagesTax On Individuals Part 2Tet AleraNo ratings yet

- RR 2-98 - Implementing Republic Act No. 8424Document41 pagesRR 2-98 - Implementing Republic Act No. 8424Vince Lupango (imistervince)No ratings yet

- Income TaxDocument4 pagesIncome TaxLea Samantha GallardoNo ratings yet

- Accounting TaxationDocument2 pagesAccounting TaxationAia Sophia SindacNo ratings yet

- Module No 3 - INCOME TAXATION PART1ADocument6 pagesModule No 3 - INCOME TAXATION PART1APrinces S. RoqueNo ratings yet

- 4 Income Tax Tables Final PDFDocument8 pages4 Income Tax Tables Final PDFwilliam091090No ratings yet

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

- TRAIN Tax Rates On Passive Income in The PhilippinesDocument1 pageTRAIN Tax Rates On Passive Income in The Philippinesgwynethvm03No ratings yet

- Implementing RA 8424 on expanded withholding taxDocument35 pagesImplementing RA 8424 on expanded withholding taxBon BonsNo ratings yet

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- Income Tax On Resident Foreign CorporationDocument6 pagesIncome Tax On Resident Foreign CorporationElaiNo ratings yet

- 2010 Tax Matrix - Special RatesDocument2 pages2010 Tax Matrix - Special Ratescmv mendozaNo ratings yet

- Chapter 5 - Final Income TaxationDocument13 pagesChapter 5 - Final Income TaxationBisag AsaNo ratings yet

- Module 2 BACC 14A Income Taxation Train LawDocument59 pagesModule 2 BACC 14A Income Taxation Train LawFranzing LebsNo ratings yet

- RR 2-98Document21 pagesRR 2-98Joshua HorneNo ratings yet

- Tables of Tax RatesDocument2 pagesTables of Tax RatesJanz SerranoNo ratings yet

- For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument5 pagesFor Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionMarvin H. Taleon IINo ratings yet

- Quarterly percentage tax rates and stock transaction tax ratesDocument4 pagesQuarterly percentage tax rates and stock transaction tax ratesKathrine CruzNo ratings yet

- Chapter 2.1 - Income Subject To Final TaxDocument30 pagesChapter 2.1 - Income Subject To Final Taxjudel ArielNo ratings yet

- Final Income TaxesDocument13 pagesFinal Income TaxesEar TanNo ratings yet

- Final Income Tax Rates and RulesDocument26 pagesFinal Income Tax Rates and RulesJason MablesNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- Tax Rates - SPSPS ReviewDocument10 pagesTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioNo ratings yet

- A. Final Withholding Tax 1. Passive IncomeDocument7 pagesA. Final Withholding Tax 1. Passive IncomePrincess Corine BurgosNo ratings yet

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoNo ratings yet

- TAX 1 ReviewerDocument3 pagesTAX 1 ReviewerMarrielDeTorresNo ratings yet

- Income Tax On CorporationDocument54 pagesIncome Tax On CorporationJamielene Tan100% (1)

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDocument28 pagesFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- Individual Taxpayer Sources and RatesDocument2 pagesIndividual Taxpayer Sources and RatesEstudyante BluesNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- Answers On Module 5Document2 pagesAnswers On Module 5John Kyzher SabeñaNo ratings yet

- RR 2-98Document85 pagesRR 2-98Elaine LatonioNo ratings yet

- Tax ReviewerDocument62 pagesTax ReviewerFelixberto Jr. BaisNo ratings yet

- Implementing regulations for expanded withholding taxDocument74 pagesImplementing regulations for expanded withholding taxRichard CaneteNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Tax ChartsDocument33 pagesTax ChartsDavid TanNo ratings yet

- Passive-Income MidtermsDocument2 pagesPassive-Income MidtermsJessa Belle EubionNo ratings yet

- Section 28 Non Resident Foriegn Corp.Document5 pagesSection 28 Non Resident Foriegn Corp.lamadridrafaelNo ratings yet

- Final Withholding Tax FWT and CapitalDocument39 pagesFinal Withholding Tax FWT and CapitalJessa HerreraNo ratings yet

- Tax NotesDocument6 pagesTax NotesDeloria DelsaNo ratings yet

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoNo ratings yet

- BIR Revenue Regulation No. 02-98 Dated 17 April 1998Document74 pagesBIR Revenue Regulation No. 02-98 Dated 17 April 1998wally_wanda93% (14)

- Withholding Tax Bir Issuances & ProvisionsDocument22 pagesWithholding Tax Bir Issuances & ProvisionsJm CruzNo ratings yet

- Income Tax On CorporationDocument53 pagesIncome Tax On CorporationLyka Mae Palarca IrangNo ratings yet

- Final Income Taxation Features, Rationale and ApplicationDocument6 pagesFinal Income Taxation Features, Rationale and ApplicationKristel Nuyda LobasNo ratings yet

- Percentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedDocument4 pagesPercentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedAndrea TanNo ratings yet

- Passive Income TAX RateDocument2 pagesPassive Income TAX RateApril BoreresNo ratings yet

- Income Tax Part IIIDocument6 pagesIncome Tax Part IIImary jhoyNo ratings yet

- Table For Income Tax Summary of RatesDocument1 pageTable For Income Tax Summary of Ratesmike rapistaNo ratings yet

- Chapter 2 InctaxDocument14 pagesChapter 2 InctaxLiRose SmithNo ratings yet

- J.K. Lasser's Your Income Tax 2018: For Preparing Your 2017 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2018: For Preparing Your 2017 Tax ReturnNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Day 06 - INCDocument27 pagesDay 06 - INCBianca DeslateNo ratings yet

- RR No. 026-24Document38 pagesRR No. 026-24Bianca DeslateNo ratings yet

- CH 4Document4 pagesCH 4Bianca DeslateNo ratings yet

- 2019legislation - Revised Corporation Code Comparative Matrix PDFDocument120 pages2019legislation - Revised Corporation Code Comparative Matrix PDFlancekim21No ratings yet

- Holy See Vs RosarioDocument2 pagesHoly See Vs RosarioBianca DeslateNo ratings yet

- My Agency DigestsDocument2 pagesMy Agency DigestsBianca DeslateNo ratings yet

- Day 06 - INC-2Document27 pagesDay 06 - INC-2Bianca DeslateNo ratings yet

- 035 - Anglo Norwegian Fisheries CaseDocument8 pages035 - Anglo Norwegian Fisheries CaseBianca DeslateNo ratings yet

- Digests - Better VersionDocument24 pagesDigests - Better VersionBianca Deslate100% (1)

- Republic Act No 8043Document7 pagesRepublic Act No 8043Libay Villamor IsmaelNo ratings yet

- Liability of Parties2 DigestsDocument10 pagesLiability of Parties2 DigestsBianca DeslateNo ratings yet

- Agustin Vs CADocument2 pagesAgustin Vs CABianca DeslateNo ratings yet

- Civ Pro Angara Vs FedmanDocument2 pagesCiv Pro Angara Vs FedmanHoney BiNo ratings yet

- Goodman Vs GaulDocument1 pageGoodman Vs GaulBianca DeslateNo ratings yet

- CH 4Document4 pagesCH 4Bianca DeslateNo ratings yet

- Civil Service AppointmentsDocument7 pagesCivil Service AppointmentsBianca DeslateNo ratings yet

- Other LawsDocument2 pagesOther LawsBianca DeslateNo ratings yet

- Insurance I. Definition: Aboitiz Shipping vs. New India Assurance (2006)Document3 pagesInsurance I. Definition: Aboitiz Shipping vs. New India Assurance (2006)Bianca DeslateNo ratings yet

- Agency: Nielson and Company, Inc. Vs Lepanto Consolidated Mining CompanyDocument6 pagesAgency: Nielson and Company, Inc. Vs Lepanto Consolidated Mining CompanyBianca DeslateNo ratings yet

- Fores V MirandaDocument1 pageFores V MirandaBianca DeslateNo ratings yet

- 1, Law Firm of Raymundo Armovit Vs CADocument1 page1, Law Firm of Raymundo Armovit Vs CABianca DeslateNo ratings yet

- Office of The Ombudsman Vs ReyesDocument2 pagesOffice of The Ombudsman Vs ReyesBianca Deslate100% (4)

- Maryland v. King SCOTUS OpinionDocument50 pagesMaryland v. King SCOTUS OpinionDoug MataconisNo ratings yet

- 4 Cheesman Vs IacDocument3 pages4 Cheesman Vs IacMichelle SilvaNo ratings yet

- Case Digests 185Document2 pagesCase Digests 185Bianca DeslateNo ratings yet

- My Agency DigestsDocument2 pagesMy Agency DigestsBianca DeslateNo ratings yet

- Unmasking Leadership Motivation Final PaperDocument5 pagesUnmasking Leadership Motivation Final PaperBianca DeslateNo ratings yet

- FIFA PaperDocument6 pagesFIFA PaperBianca DeslateNo ratings yet

- PNV-08 Employer's Claims PDFDocument1 pagePNV-08 Employer's Claims PDFNatarajan SaravananNo ratings yet

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocument16 pagesNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- 2015-16 VDC Lease Body - FinalDocument9 pages2015-16 VDC Lease Body - FinalAndrew BimbusNo ratings yet

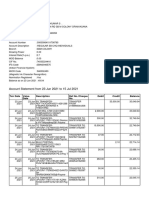

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- North IrelandDocument6 pagesNorth IrelandnearwalllNo ratings yet

- I Ifma FMP PM ToDocument3 pagesI Ifma FMP PM TostranfirNo ratings yet

- Shubham MoreDocument60 pagesShubham MoreNagesh MoreNo ratings yet

- Visa InterviewDocument1 pageVisa InterviewVivek ThoratNo ratings yet

- AgribusinessDocument6 pagesAgribusinessshevadanzeNo ratings yet

- Cadbury, Nestle and Ferrero - Top Chocolate Brands in IndiaDocument24 pagesCadbury, Nestle and Ferrero - Top Chocolate Brands in Indiaaartitomar47_8332176No ratings yet

- Advanced Zimbabwe Tax Module 2011 PDFDocument125 pagesAdvanced Zimbabwe Tax Module 2011 PDFCosmas Takawira88% (24)

- AM.012 - Manual - UFCD - 0402Document23 pagesAM.012 - Manual - UFCD - 0402Luciana Pinto86% (7)

- The Builder's Project Manager - Eli Jairus Madrid PDFDocument20 pagesThe Builder's Project Manager - Eli Jairus Madrid PDFJairus MadridNo ratings yet

- SGI Monthly Newsletter Title Under 40 CharactersDocument13 pagesSGI Monthly Newsletter Title Under 40 Charactersgj4uNo ratings yet

- Account Opening ProcessDocument3 pagesAccount Opening Processsaad777No ratings yet

- Icade Annual Report 2012 Reference DocumentDocument470 pagesIcade Annual Report 2012 Reference DocumentIcadeNo ratings yet

- Emcee Script For TestimonialDocument2 pagesEmcee Script For TestimonialJohn Cagaanan100% (3)

- 3.cinthol "Alive Is Awesome"Document1 page3.cinthol "Alive Is Awesome"Hemant TejwaniNo ratings yet

- Griffin Chap 11Document34 pagesGriffin Chap 11Spil_vv_IJmuidenNo ratings yet

- Whitepaper - State of Construction TechnologyDocument16 pagesWhitepaper - State of Construction TechnologyRicardo FigueiraNo ratings yet

- Βιογραφικά ΟμιλητώνDocument33 pagesΒιογραφικά ΟμιλητώνANDREASNo ratings yet

- Bank Recovery SuitDocument6 pagesBank Recovery SuitAAnmol Narang100% (1)

- 21PGDM177 - I&E AssignmentDocument6 pages21PGDM177 - I&E AssignmentShreya GuptaNo ratings yet

- Living To Work: What Do You Really Like? What Do You Want?"Document1 pageLiving To Work: What Do You Really Like? What Do You Want?"John FoxNo ratings yet

- Internal Quality Audit Report TemplateDocument3 pagesInternal Quality Audit Report TemplateGVS RaoNo ratings yet

- Cagayan de Oro Revenue Code of 2015Document134 pagesCagayan de Oro Revenue Code of 2015Jazz Adaza67% (6)

- FM S Summer Placement Report 2024Document12 pagesFM S Summer Placement Report 2024AladeenNo ratings yet

- EMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaDocument17 pagesEMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaRaktim PaulNo ratings yet

- Yuri Annisa-Olfa Resha - Int - Class - Financial StatementsDocument16 pagesYuri Annisa-Olfa Resha - Int - Class - Financial StatementsolfareshaaNo ratings yet

- Supply Chain Management: Session 1: Part 1Document8 pagesSupply Chain Management: Session 1: Part 1Safijo AlphonsNo ratings yet