Professional Documents

Culture Documents

FICO Scores: Statistical Analysis

Uploaded by

raqibappOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FICO Scores: Statistical Analysis

Uploaded by

raqibappCopyright:

Available Formats

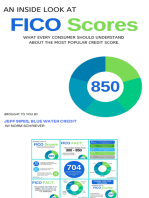

FICO Scores

Statistical Analysis

Mortgage and credit card lenders, employers, insurance companies, landlords, and

others use FICO scores developed by the !rm Fair, Isaac & Co. Credit scores are

compiled using statistical analysis of ones credit history. FICO credit scores range from

300 to 850.

Important Elements

FICO credit scores are now generally revealed with a persons credit report from the

three main credit reporting agencies. The !ve major components in a credit report and

the relative weight of each include:

Past Payment Performance (35%)

Amount of Debt (30%)

Length of Credit History (15%)

New Credit (10%)

Types of Credit (10%)

Change in Score

Credit scores can drop very quickly if the maximum amount is charged on credit cards

or even just a few bills are paid late.

Credit Scores & Interest Rates

The higher the credit score, the less an individual can expect to pay in interest on a loan.

For example, on a $300,000 30-year, !xed-rate mortgage:

FICO Score Interest Rate* Monthly Payment

760-850

3.301%

$1,314

700-759

3.523%

$1,351

680-699

3.7%

$1,381

660-679

3.914%

$1,417

640-659

4.344%

$1,492

620-639

4.89%

$1,590

SOURCE: MYFICO.COM.

* Interest rates stated here are for illustration purposes only. Rates change daily, but the

relationship between credit scores and interest rates remains the same.

2016 Financial Knowledge Network, LLC.

You might also like

- Understanding FICO ScoresDocument1 pageUnderstanding FICO ScoresFrancisco NeumanNo ratings yet

- YourcreditscoreDocument6 pagesYourcreditscoreapi-309082881No ratings yet

- Foreclosure Damage - A Longlasting HitDocument6 pagesForeclosure Damage - A Longlasting Hit83jjmackNo ratings yet

- WCG - CRDT RPT 3 11-28-08Document2 pagesWCG - CRDT RPT 3 11-28-08Bill TaylorNo ratings yet

- Fico ScoreDocument3 pagesFico ScoreBill BobbittNo ratings yet

- Credit TipsDocument13 pagesCredit TipsMatthew Cody SnyderNo ratings yet

- University of Michigan Pat Hammett Six Sigma Program: The Life of A Mortgage Loan Case Study OverviewDocument4 pagesUniversity of Michigan Pat Hammett Six Sigma Program: The Life of A Mortgage Loan Case Study OverviewNaveen KumarNo ratings yet

- Slideshow 17Document25 pagesSlideshow 17CariElpídioNo ratings yet

- KaneDocument3 pagesKaneapi-238384490No ratings yet

- Img 20161025 0003Document1 pageImg 20161025 0003api-298901459No ratings yet

- Marketing of Financial ServicesDocument12 pagesMarketing of Financial ServicesLavina AgarwalNo ratings yet

- Finance AssignmentDocument3 pagesFinance Assignmentapi-289243802No ratings yet

- Buyhouse 1030 MathDocument3 pagesBuyhouse 1030 Mathapi-260610944No ratings yet

- Fincance ProjectDocument3 pagesFincance Projectapi-302073423No ratings yet

- Analyzing Credit ScoreDocument2 pagesAnalyzing Credit ScorereadaaalotNo ratings yet

- Credit ScoresDocument2 pagesCredit ScoresAditya SinghalNo ratings yet

- CR RatingDocument7 pagesCR RatingCynthia DelaneyNo ratings yet

- Lendingclub Corporation: Washington, D.C. 20549Document11 pagesLendingclub Corporation: Washington, D.C. 20549CrowdfundInsiderNo ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- SpeakDocument3 pagesSpeakInvincible BaluNo ratings yet

- Buying A House Math 1030-1Document3 pagesBuying A House Math 1030-1api-341229603No ratings yet

- Assignment 3Document3 pagesAssignment 3Inès ChougraniNo ratings yet

- Buying A HouseDocument3 pagesBuying A Houseapi-242207683No ratings yet

- Chapter 2 1 Intl CLEARDocument8 pagesChapter 2 1 Intl CLEARChris FloresNo ratings yet

- Score 4.39.90Document4 pagesScore 4.39.90Aravindh MassNo ratings yet

- Credit Score Research PapersDocument7 pagesCredit Score Research Papershxmchprhf100% (1)

- Credit AppraisalDocument4 pagesCredit AppraisalAbhishek RanjanNo ratings yet

- First National Bank interest rate risk analysisDocument4 pagesFirst National Bank interest rate risk analysisRoohani WadhwaNo ratings yet

- (Gurgaon) (Mumbai) : US Mortgage Process OriginationDocument9 pages(Gurgaon) (Mumbai) : US Mortgage Process OriginationAshish RupaniNo ratings yet

- Guide To Understanding Credit GuideDocument11 pagesGuide To Understanding Credit GuideRobert Glen Murrell JrNo ratings yet

- Score CardDocument20 pagesScore CardCariElpídioNo ratings yet

- IIT Kharagpur Report Analyzes Link Between Credit Ratings & Corporate ValuationDocument26 pagesIIT Kharagpur Report Analyzes Link Between Credit Ratings & Corporate ValuationHarsh Vyas100% (1)

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Lc160808 PresentationDocument28 pagesLc160808 PresentationCrowdfundInsiderNo ratings yet

- Account_Opening_DisclosuresDocument7 pagesAccount_Opening_DisclosureschelseamfwilsonNo ratings yet

- Buying A House ProjectDocument4 pagesBuying A House Projectapi-275968399No ratings yet

- I Got All These Questions Collected From Our MembersDocument15 pagesI Got All These Questions Collected From Our MembersvishalNo ratings yet

- Credit FundamentalsDocument15 pagesCredit FundamentalsCody LongNo ratings yet

- Contoh PowerpointDocument29 pagesContoh PowerpointNamanyaNo ratings yet

- $1,000,000 Mortgage Total Cost Analysis Jumbo Report Peter BoyleDocument2 pages$1,000,000 Mortgage Total Cost Analysis Jumbo Report Peter BoylePeter BoyleNo ratings yet

- Credit, Collection and Compliance Application # 7 - Credit Score 101Document3 pagesCredit, Collection and Compliance Application # 7 - Credit Score 101Gabriel Matthew Lanzarfel GabudNo ratings yet

- Credit Report and BorrowingDocument32 pagesCredit Report and Borrowingparkerroach21No ratings yet

- Mycibil Understanding CirDocument3 pagesMycibil Understanding Cirarun1aNo ratings yet

- Credit Scoreand ReportDocument10 pagesCredit Scoreand ReportMortgage ResourcesNo ratings yet

- Quick Credit Reference Guide (DC17 - )Document12 pagesQuick Credit Reference Guide (DC17 - )Horace0% (1)

- Business LoansDocument25 pagesBusiness LoansMai TiếnNo ratings yet

- New Credit Card Law: BasicsDocument2 pagesNew Credit Card Law: BasicsJerry419No ratings yet

- Understanding Credit ScoresDocument3 pagesUnderstanding Credit ScoresKevin LeeNo ratings yet

- Muhlenkamp Fund Semi Annual 10Document31 pagesMuhlenkamp Fund Semi Annual 10eric695No ratings yet

- Buyingahouse 1Document4 pagesBuyingahouse 1api-251852099100% (1)

- You've To Score Big in Credit ReportDocument4 pagesYou've To Score Big in Credit ReportPankaj PilaniwalaNo ratings yet

- FoirDocument6 pagesFoirArulshanmugavel SvNo ratings yet

- Unit 4 Credit - For WEBSITEDocument46 pagesUnit 4 Credit - For WEBSITEASHISH KUMARNo ratings yet

- Understand how banks assess creditworthiness through key parametersDocument4 pagesUnderstand how banks assess creditworthiness through key parametersrs9999No ratings yet

- An Inside Look at FICO Scores: What every consumer should understand about the most popular credit score.From EverandAn Inside Look at FICO Scores: What every consumer should understand about the most popular credit score.No ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 3Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 3raqibappNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 4Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 4raqibappNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged)Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged)raqibappNo ratings yet

- Bringing Back Structure To Free Text Email Conversations With Recurrent Neural NetworksDocument12 pagesBringing Back Structure To Free Text Email Conversations With Recurrent Neural NetworksraqibappNo ratings yet

- Design Patterns PDFDocument76 pagesDesign Patterns PDFfluptNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 2Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 2raqibappNo ratings yet

- Asset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 02 Overview of Technical AnalysisDocument6 pagesAsset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 02 Overview of Technical AnalysisraqibappNo ratings yet

- SalesDocument1 pageSalesraqibappNo ratings yet

- Asset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 01 IntroductionDocument16 pagesAsset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 01 IntroductionraqibappNo ratings yet

- Simple Portfolio Optimization That WorksDocument164 pagesSimple Portfolio Optimization That WorksraqibappNo ratings yet

- Simple Portfolio Optimization That WorksDocument164 pagesSimple Portfolio Optimization That WorksraqibappNo ratings yet

- Headerless, Quoteless, But Not Hopeless? Using Pairwise Email Classification To Disentangle Email ThreadsDocument9 pagesHeaderless, Quoteless, But Not Hopeless? Using Pairwise Email Classification To Disentangle Email ThreadsraqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 7Document1 pageA Little Journey Inside Windows Memory (Dragged) 7raqibappNo ratings yet

- A NUMA API For Linux - Novell (2005) (Dragged) 2Document1 pageA NUMA API For Linux - Novell (2005) (Dragged) 2raqibappNo ratings yet

- A Novel Hybrid Quicksort Algorithm Vectorized Using AVX-512 On Intel Skylake - 2017 (Paper - 44-A - Novel - Hybrid - Quicksort - Algorithm - Vectorized)Document9 pagesA Novel Hybrid Quicksort Algorithm Vectorized Using AVX-512 On Intel Skylake - 2017 (Paper - 44-A - Novel - Hybrid - Quicksort - Algorithm - Vectorized)raqibappNo ratings yet

- A Comprehensive Study of Main-Memory Partitioning and Its Application To Large-Scale Comparison - and Radix-Sort (Sigmod14i) (Dragged) 2 PDFDocument1 pageA Comprehensive Study of Main-Memory Partitioning and Its Application To Large-Scale Comparison - and Radix-Sort (Sigmod14i) (Dragged) 2 PDFraqibappNo ratings yet

- Why Requests Feels More Pythonic Than Other Python HTTP ClientsDocument1 pageWhy Requests Feels More Pythonic Than Other Python HTTP ClientsraqibappNo ratings yet

- A NUMA API For Linux - Novell (2005) (Dragged)Document1 pageA NUMA API For Linux - Novell (2005) (Dragged)raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged)Document1 pageA Little Journey Inside Windows Memory (Dragged)raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 8Document1 pageA Little Journey Inside Windows Memory (Dragged) 8raqibappNo ratings yet

- Access physical memory with DMA, VMWare, hibernation filesDocument1 pageAccess physical memory with DMA, VMWare, hibernation filesraqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 9Document1 pageA Little Journey Inside Windows Memory (Dragged) 9raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 5Document1 pageA Little Journey Inside Windows Memory (Dragged) 5raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged)Document1 pageA Little Journey Inside Windows Memory (Dragged)raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 4Document1 pageA Little Journey Inside Windows Memory (Dragged) 4raqibappNo ratings yet

- A Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged)Document1 pageA Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged)raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 3Document1 pageA Little Journey Inside Windows Memory (Dragged) 3raqibappNo ratings yet

- Introducing OpenAIDocument3 pagesIntroducing OpenAIraqibappNo ratings yet

- A Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged) 2Document1 pageA Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged) 2raqibappNo ratings yet

- A Comprehensive Study of Main-Memory Partitioning and Its Application To Large-Scale Comparison - and Radix-Sort (Sigmod14i) (Dragged) PDFDocument1 pageA Comprehensive Study of Main-Memory Partitioning and Its Application To Large-Scale Comparison - and Radix-Sort (Sigmod14i) (Dragged) PDFraqibappNo ratings yet