Professional Documents

Culture Documents

Morning Call June 16 2010

Uploaded by

chibondkingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morning Call June 16 2010

Uploaded by

chibondkingCopyright:

Available Formats

Morning Call 6/16/2010

Stone Street Advisors

ChiBondKing laszlochi@gmail.com

Morning Focus

A lot of macroeconomic headlines hitting the tape in Europe overnight, along with a lot of data beginning at 8:30AM this morning,

so I will get right to the point: European sovereign spreads relative to Bund widened overnight, Spain 10s +13 to 223.5, Portugal

10s +18 to 305.7, Greek 10s +30 to 695, Irish 10s stable at 292. Bonds catching a bid overnight, however as we approach the US

session that demand has tapered off with some positive econ news out of the UK. Asian indices ended higher across the board,

with the exception of China, which remains closed: Australia: 4559 +1.20pct, Nikkei 225 10067 +1.81pct, Hang Seng 20062

+0.05pct.

Notable Overnight Headlines

Asia

NZ consumer confidence rises in Q2 survey (Reuters)

Japan offers 5.098 trillion Yen in Treasury discount bills (Reuters)

South Korea c.bank sells 2-year MSBs at 3.77 pct (Reuters)

S Korea Official: Risky To Begin Exit Strategy Too Early (DJ)

nd

S.Korea PM warns of inflation pressure in 2 half of year (Reuters)

S Korea Fin Min: Should Still Maintain Expansionary Macro Policies (DJ)

South Korea April Leading Index Rises 0.2% On Month Vs. 0.3% Increase In March - Conference Board

JGBs slip as Nikkei hits 1-mth high; 20-yr sale eyed (Reuters)

Australia's RBA: Injects A$1.76B Vs System Deficit A$1.56B (DJ)

Macquarie Leaves 2012, 2013 Crude Oil Forecasts Unchanged (DJ)

Foreign Ownership In Indonesia Govt Bonds IDR148.13T Mon Vs IDR147.28T Fri (DJ)

Australia Q1 Dwelling Starts Jump 34.7% On Year

China easing rules for private-equity funds (MARKETWATCH)

BOJ: Severity In Employment, Income Situation Easing (DJ)

Europe

ECB: Banks Used EUR77.168 Bln In Overnight Deposit Facility, Total Of Settled Covered Bond Buys Reaches EUR57.467B

(DJ)

EU, IMF, US mull 250 bln euro credit line for Spain-report

Turkey Central Bank Sells TRY1 Billion In Repo

ECB's Gonzalez-Paramo warns banks face funding headache (Reuters)

U.K. May Consumer Confidence Slumps To 65 From 75 In April

UK gets 2.53 cover at 2017 linker mini-tender (Reuters)

Fitch sees euro zone breakup as "remote risk" (Reuters)

Spanish/German bond spread at euro lifetime high (Reuters)

UK Cameron: Must Keep Control Of Inflation (DJ)

U.K. May jobless claims fall 30,900 (MARKETWATCH)

France announces hike in retirement age to 62 (MARKETWATCH)

Sweden says nearing budget balance, borrowing to fall (Reuters)

Austria Q1 Jobless Rate At 4.7%, Austria May CPI Up 1.9% On Year

Euro-zone May annual CPI up unrevised 1.6% (MARKETWATCH)

Eurozone May Core CPI Up 0.8% On Year, Consensus 0.8% Rise

Italy May CPI Incl Tobacco Up 0.1% On Month, 1.4% On Year

EU, IMF eye 250bn credit line for Spain: report (MARKETWATCH)

Spain April Business Start-Ups Up 14.6% On Year

See Important Disclosures on page 4

US Pre Open

Economic News

3-mnth euro Libor hits new 6-month high (Reuters)

07:16ET Mortgage Loan Application Volume Rose 17.7% In Week (MBA)

Chile Central Bank Increases Rate For 1st Time In Two Years (DJ)

Chile lifts key interest rate to 1% (MARKETWATCH)

ABC News Consumer Comfort Index Falls To -45 As Of June 13 From -43 As Of June 6

U.S. House approves small business tax relief (MARKETWATCH)

Equities

BAC, BP - BofA Tells Traders Not To Do Oil Deals With BP More Than 1 Year Out (Reuters)

RIG - Fitch Lowers Transocean Outlook To Negative On Oil Spill Cleanup Worries (DJ)

BP - BP CDS spreads soar, hit all-time high (MARKETWATCH)

WYNN- WSJ: Wynn Reduces Some Staff, But Restores Others to Full Time (DJ)

APOL, CECO: US to go after deceptive colleges, delays job rule (Reuters)

Interesting Morning Reading

Eli Radke on Simple Trading Advice: http://mytradingnet.com/blog/2010/06/15/want-simple-trading-advice-do-not-use/

Joe Weisenthal on BP (ed. Note: Insomnia Edition): http://www.businessinsider.com/meanwhile-this-is-happening-right-

now-2010-6

John Carney, CNBC on Banking Reform: http://www.cnbc.com/id/37708061

Macro Man: An Englishmans Home Is His Retirement Policy: http://macro-man.blogspot.com/2010/06/englishmans-

home-is-his-

retirement.html?utm_source=twitterfeed&utm_medium=twitter&utm_campaign=Feed%3A+MacroMan+%28Macro+Man

%29

David Blanchflower (Bloomberg) Unemployment Hurts More Than Inflation:

http://www.bloomberg.com/apps/news?pid=20601039&sid=aHU3sPFwC56c

Notable Bond Market/Economic Events

Bond Auctions (1PM ET)

o None

Upcoming Bond Auctions (This Week)

o None. See you next week.

Economic Releases For Today

o 8:30AM ET

Building Permits, cons. 630k

PPI, cons. -0.5pct

Core PPI, cons. +0.1pct

Housing Starts, cons. 650k

o 9:15AM ET

Capacity Utilization, cons. 74.6pct

Industrial Production, cons. 0.9pct

o 10:30AM ET

Crude Inventories, cons. -1.5m

o 5:45PM ET Bernanke Speaks, BOE Mervyn King Speaks

See Important Disclosures on page 4

Market Summary 7AM

Futures Currencies Fixed Income

Symbol Last Chg Symbol Last Chg Symbol Last Symbol Last

DOW 10298 -34 EURUSD 1.228 -0.0052 2s5s 133.00 US2Y .74

SP500 1104.5 -4.75 GBPUSD 1.4802 -0.0008 2s10s 255.00 US5Y 2.07

NSDQ 1886.5 -6.75 EURJPY 112.33 -0.43 2s30s 346.00 US7Y 2.74

ZB 123'05 +0'14 USDCAD 1.0285 0.0026 5s10s 122.00 US10Y 3.29

ZN 120'010 +0'045 USDJPY 91.52 0.04 5s30s 213.00 US30Y 4.20

ZF 116'295 +0'027 NZDUSD 0.6972 0.0009 10s30s 91.00 UK5Y 2.22

ZT 109'035 +0'015 UK10Y 3.51

CLN0 76.47 -0.47 UK30Y 4.29

See Important Disclosures on page 4

Morning Call 6/16/2010

Stone Street Advisors

ChiBondKing laszlochi@gmail.com

Disclosure/Legal

THE MATERIAL CONTAINED IN THIS DOCUMENT IS INFORMATIONAL ONLY , AND IS NOT INTENDED AS AN OFFER OR A SOLICITATION TO

BUY OR SELL ANY SECURITIES. T HE AUTHOR IS NOT ACTING AS AN ADVISOR OR FIDUCIARY IN ANY RESPECT IN CONNECTION WITH

PROVIDING THIS INFORMATION AND NO INFORMATION OR MATERIAL CONTAINED WITHIN THIS DOCUMENT IS TO BE RELIED UPON FOR

THE PURPOSE OF MAKING OR COMMUNICATING INVESTMENT OR OTHER DECISIONS NOR CONSTRUED AS EITHER PROJECTIONS OR

PREDICTIONS . I NVESTORS MUST MAKE THEIR OWN INDEPENDENT DECISIONS REGARDING ANY SECURITIES , FINANCIAL INSTRUMENTS

OR STRATEGIES MENTIONED HEREIN. PLEASE CONTACT YOUR FINANCIAL ADVISOR TO DETERMINE THE SUITABILITY OF THE MATERIAL

CONTAINED HEREIN TO YOUR INVESTMENT GOALS, OBJECTIVES AND RISK CRITERIA. T HE MATERIAL CONTAINED IN THIS DOCUMENT IS

INTENDED FOR QUALIFIED INVESTORS ONLY . T HE PERSON OR PERSONS INVOLVED IN THE PREPARATION OR ISSUANCE OF THE

INFORMATION CONTAINED IN THE MATERIAL WITHIN THIS DOCUMENT MAY DEAL AS PRINCIPAL IN ANY OF THE SECURITIES

MENTIONED , AND MAY HAVE A LONG OR SHORT POSITION IN ( INCLUDING POSSIBLY A POSITION THAT WAS ACCUMULATED ON THE

BASIS OF THE MATERIAL PRIOR TO IT BEING DISSEMINATED AND / OR A POSITION INCONSISTENT WITH THE INFORMATION WITHIN THIS

DOCUMENT ), ACCORDINGLY , INFORMATION INCLUDED IN OR EXCLUDED FROM THIS DOCUMENT IS NOT INDEPENDENT FROM THE

PROPRIETARY INTERESTS OF THE AUTHOR , WHICH MAY CONFLICT WITH YOUR INTERESTS . C ERTAIN TRANSACTIONS , INCLUDING THOSE

INVOLVING FUTURES , OPTIONS, DERIVATIVES AND HIGH YIELD SECURITIES , GIVE RISE TO SUBSTANTIAL RISK AND ARE NOT SUITABLE

FOR ALL INVESTORS . FOREIGN CURRENCY DENOMINATED SECURITIES ARE SUBJECT TO FLUCTUATIONS IN EXCHANGE RATES THAT

COULD HAVE AN ADVERSE EFFECT ON THE VALUE OR PRICE OF OR INCOME DERIVED FROM ANY INVESTMENTS DISCUSSED HEREIN.

UNLESS OTHERWISE SPECIFICALLY STATED , ALL STATEMENTS CONTAINED WITHIN THIS DOCUMENT (INCLUDING ANY VIEWS, OPINIONS

OR FORECASTS ) ARE SOLELY THOSE OF THE INDIVIDUAL ( S) MAKING THE STATEMENT , AS OF THE DATE INDICATED ONLY , AND ARE

SUBJECT TO CHANGE WITHOUT NOTICE . C HANGES TO ASSUMPTIONS MADE IN THE PREPARATION OF SUCH MATERIALS MAY HAVE A

MATERIAL IMPACT ON RETURNS . T HE AUTHOR OR AUTHORS DOES NOT UNDERTAKE A DUTY TO UPDATE THESE MATERIALS OR TO

NOTIFY YOU WHEN OR WHETHER THE ANALYSIS HAS CHANGED . WHILE THE INFORMATION CONTAINED WITHIN THIS DOCUMENT IS

BELIEVED TO BE RELIABLE , NO REPRESENTATION OR WARRANTY, WHETHER EXPRESS OR IMPLIED, IS MADE AND NO LIABILITY OR

RESPONSIBILITY IS ACCEPTED BY THE AUTHOR OR AFFILIATED PARTIES AS TO THE ACCURACY OR COMPLETENESS THEREOF.

You might also like

- Morning Call July 7 2010Document4 pagesMorning Call July 7 2010chibondkingNo ratings yet

- Morning Call - June 11 2010Document4 pagesMorning Call - June 11 2010chibondkingNo ratings yet

- Morning Call June 17 2010Document5 pagesMorning Call June 17 2010chibondkingNo ratings yet

- Morning Call - June 2 2010Document10 pagesMorning Call - June 2 2010chibondkingNo ratings yet

- Morning Call June 28 2010Document4 pagesMorning Call June 28 2010chibondkingNo ratings yet

- Morning Call June 14 2010Document4 pagesMorning Call June 14 2010chibondking100% (1)

- Morning Call - June 7 2010Document7 pagesMorning Call - June 7 2010chibondkingNo ratings yet

- Morning Call - June 3 2010Document7 pagesMorning Call - June 3 2010chibondkingNo ratings yet

- Morning Call July 26 2010Document3 pagesMorning Call July 26 2010chibondkingNo ratings yet

- Ranges (Up Till 12.00pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.00pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470No ratings yet

- Morning Call June 21 2010Document5 pagesMorning Call June 21 2010chibondkingNo ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.53am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.53am HKT) : Currency Currencyapi-290371470No ratings yet

- Daily FX STR Europe 30 June 2011Document9 pagesDaily FX STR Europe 30 June 2011timurrsNo ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument5 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Important Meetings Today: Morning ReportDocument3 pagesImportant Meetings Today: Morning Reportnaudaslietas_lvNo ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.08pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.08pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.25am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.25am HKT) : Currency Currencyapi-290371470No ratings yet

- Daily Currency Briefing: The Beginning of The End?Document4 pagesDaily Currency Briefing: The Beginning of The End?timurrsNo ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Morning Call - June 1 2010Document2 pagesMorning Call - June 1 2010chibondkingNo ratings yet

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470No ratings yet

- He After: ECONOMIC DATA With ImpactDocument5 pagesHe After: ECONOMIC DATA With Impactfred607No ratings yet

- Ranges (Up Till 11.05am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.05am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Fiscal Cliff Averted: Morning ReportDocument3 pagesFiscal Cliff Averted: Morning Reportnaudaslietas_lvNo ratings yet

- Phpcu 2 NCKDocument6 pagesPhpcu 2 NCKfred607No ratings yet

- MRE121015Document3 pagesMRE121015naudaslietas_lvNo ratings yet

- Daily FX STR Europe 27 July 2011Document8 pagesDaily FX STR Europe 27 July 2011timurrsNo ratings yet

- PHP 1 Ezpt IDocument5 pagesPHP 1 Ezpt Ifred607No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- ODT Note 1 Unloved TreasuriesDocument2 pagesODT Note 1 Unloved Treasuriesrichardck61No ratings yet

- Daily FX STR Europe 27 June 2011Document8 pagesDaily FX STR Europe 27 June 2011timurrsNo ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- New Debt Solution in Place For Greece: Morning ReportDocument3 pagesNew Debt Solution in Place For Greece: Morning Reportnaudaslietas_lvNo ratings yet

- Ranges (Up Till 11.35am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.35am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.58am HKT) Asians: Currency CurrencyDocument2 pagesRanges (Up Till 11.58am HKT) Asians: Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Market Over-View: Paul@gmdgroup - Co.ukDocument58 pagesMarket Over-View: Paul@gmdgroup - Co.ukapi-87733769No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- AUG 06 UOB Global MarketsDocument2 pagesAUG 06 UOB Global MarketsMiir ViirNo ratings yet

- Markets Overview: Highlights AheadDocument3 pagesMarkets Overview: Highlights Aheadpj doveNo ratings yet

- Chinese PMI Disappoints: Morning ReportDocument3 pagesChinese PMI Disappoints: Morning Reportnaudaslietas_lvNo ratings yet

- Daily Comment RR 04jul11Document3 pagesDaily Comment RR 04jul11timurrsNo ratings yet

- Ranges (Up Till 11.15am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.15am HKT) : Currency Currencyapi-290371470No ratings yet

- Markets Overview: Highlights AheadDocument3 pagesMarkets Overview: Highlights Aheadpj doveNo ratings yet

- Better in The US, But OECD Still Worried: Morning ReportDocument3 pagesBetter in The US, But OECD Still Worried: Morning Reportnaudaslietas_lvNo ratings yet

- Ranges (Up Till 12.10pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.10pm HKT) : Currency Currencyapi-290371470No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Flat Friday, But Stocks End Week Sharply Lower: Midnight Trader 4:16 PM, Jun 25, 2010Document30 pagesFlat Friday, But Stocks End Week Sharply Lower: Midnight Trader 4:16 PM, Jun 25, 2010Albert L. PeiaNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- FI Chartbook - 12/8/2010 (Data Up To 12/7)Document26 pagesFI Chartbook - 12/8/2010 (Data Up To 12/7)chibondkingNo ratings yet

- US Bond Auction StatisticsDocument23 pagesUS Bond Auction StatisticschibondkingNo ratings yet

- Fixed Income Chartbook: List of FiguresDocument9 pagesFixed Income Chartbook: List of FigureschibondkingNo ratings yet

- US Bond Auction Statistics (As of 11/16/2010)Document21 pagesUS Bond Auction Statistics (As of 11/16/2010)chibondkingNo ratings yet

- US Bond Auction Statistics - December 2010Document27 pagesUS Bond Auction Statistics - December 2010chibondkingNo ratings yet

- Breakfast With Dave 082310Document13 pagesBreakfast With Dave 082310chibondkingNo ratings yet

- US Bond Auction Statistics - October 2010Document19 pagesUS Bond Auction Statistics - October 2010chibondkingNo ratings yet

- Swaps and Swaps Yield CurveDocument4 pagesSwaps and Swaps Yield Curvevineet_bmNo ratings yet

- SSA - STIRS Update - July 2010Document4 pagesSSA - STIRS Update - July 2010chibondkingNo ratings yet

- US Bond Auction Statistics - 11/29/2010Document21 pagesUS Bond Auction Statistics - 11/29/2010chibondkingNo ratings yet

- SSA End of Day - July 28 2010Document3 pagesSSA End of Day - July 28 2010chibondkingNo ratings yet

- (Bank of America) Introduction To Cross Currency SwapsDocument6 pages(Bank of America) Introduction To Cross Currency Swapszerohedges100% (2)

- Morning Call June 14 2010Document4 pagesMorning Call June 14 2010chibondking100% (1)

- Morning Call July 26 2010Document3 pagesMorning Call July 26 2010chibondkingNo ratings yet

- Morning Call June 21 2010Document5 pagesMorning Call June 21 2010chibondkingNo ratings yet

- Bear Stearns RMBS Residuals PrimerDocument48 pagesBear Stearns RMBS Residuals PrimerBrad Samples100% (1)

- Us Index Option Strategies - BNP ParibasDocument14 pagesUs Index Option Strategies - BNP Paribaschibondking100% (1)

- BAML NA Growth AnalysisDocument7 pagesBAML NA Growth AnalysischibondkingNo ratings yet

- Morning Call - June 7 2010Document7 pagesMorning Call - June 7 2010chibondkingNo ratings yet

- Statistical Summary - May 18 2010Document8 pagesStatistical Summary - May 18 2010chibondkingNo ratings yet

- Morning Call - June 3 2010Document7 pagesMorning Call - June 3 2010chibondkingNo ratings yet

- Morning Call - June 1 2010Document2 pagesMorning Call - June 1 2010chibondkingNo ratings yet

- Chapter 9 - PPT (New)Document43 pagesChapter 9 - PPT (New)Syarifah NourazlinNo ratings yet

- August Strindberg's ''A Dream Play'', inDocument11 pagesAugust Strindberg's ''A Dream Play'', inİlker NicholasNo ratings yet

- Rosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersDocument7 pagesRosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersMaria AguilarNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesShailac RodelasNo ratings yet

- Sumit Kataruka Class: Bcom 3 Yr Room No. 24 Roll No. 611 Guide: Prof. Vijay Anand SahDocument20 pagesSumit Kataruka Class: Bcom 3 Yr Room No. 24 Roll No. 611 Guide: Prof. Vijay Anand SahCricket KheloNo ratings yet

- CogAT 7 PlanningImplemGd v4.1 PDFDocument112 pagesCogAT 7 PlanningImplemGd v4.1 PDFBahrouniNo ratings yet

- Aff Col MA Part IIDocument90 pagesAff Col MA Part IIAkanksha DubeyNo ratings yet

- Organisation Restructuring 2023 MGMT TeamDocument9 pagesOrganisation Restructuring 2023 MGMT TeamArul AravindNo ratings yet

- Action List 50Document4 pagesAction List 50hdfcblgoaNo ratings yet

- Complete Admin Law OutlineDocument135 pagesComplete Admin Law Outlinemarlena100% (1)

- Nespresso Case StudyDocument7 pagesNespresso Case StudyDat NguyenNo ratings yet

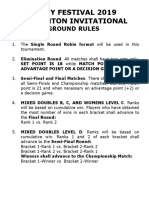

- Ground Rules 2019Document3 pagesGround Rules 2019Jeremiah Miko LepasanaNo ratings yet

- Ib Physics SL - Unit 4 ReviewDocument46 pagesIb Physics SL - Unit 4 ReviewMax HudgenesNo ratings yet

- DBA Daily StatusDocument9 pagesDBA Daily StatuspankajNo ratings yet

- De La Salle Araneta University Grading SystemDocument2 pagesDe La Salle Araneta University Grading Systemnicolaus copernicus100% (2)

- Designing A Peace Building InfrastructureDocument253 pagesDesigning A Peace Building InfrastructureAditya SinghNo ratings yet

- Directions: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankDocument2 pagesDirections: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankRanulfo MayolNo ratings yet

- BIOCHEM REPORT - OdtDocument16 pagesBIOCHEM REPORT - OdtLingeshwarry JewarethnamNo ratings yet

- University of Dar Es Salaam MT 261 Tutorial 1Document4 pagesUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaNo ratings yet

- Reported SpeechDocument2 pagesReported SpeechmayerlyNo ratings yet

- Layos vs. VillanuevaDocument2 pagesLayos vs. VillanuevaLaura MangantulaoNo ratings yet

- 4 Major Advantages of Japanese Education SystemDocument3 pages4 Major Advantages of Japanese Education SystemIsa HafizaNo ratings yet

- Life&WorksofrizalDocument5 pagesLife&WorksofrizalPatriciaNo ratings yet

- Sample Questions 2019Document21 pagesSample Questions 2019kimwell samson100% (1)

- Esse 3600Document15 pagesEsse 3600api-324911878100% (1)

- (Abhijit Champanerkar, Oliver Dasbach, Efstratia K (B-Ok - Xyz)Document273 pages(Abhijit Champanerkar, Oliver Dasbach, Efstratia K (B-Ok - Xyz)gogNo ratings yet

- Calcined Clays For Sustainable Concrete Karen Scrivener, AurÇlie Favier, 2015Document552 pagesCalcined Clays For Sustainable Concrete Karen Scrivener, AurÇlie Favier, 2015Débora BretasNo ratings yet

- Critical Review For Cooperative LearningDocument3 pagesCritical Review For Cooperative LearninginaNo ratings yet

- D8.1M 2007PV PDFDocument5 pagesD8.1M 2007PV PDFkhadtarpNo ratings yet

- Lesson Plan MP-2Document7 pagesLesson Plan MP-2VeereshGodiNo ratings yet