Professional Documents

Culture Documents

Keywords: Ratio Analysis, Tool Analysis, Finance Work

Uploaded by

Albert EnglisherOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Keywords: Ratio Analysis, Tool Analysis, Finance Work

Uploaded by

Albert EnglisherCopyright:

Available Formats

ABSTRACT

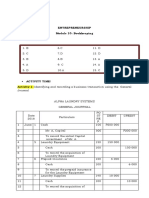

Andi Fadlun Muhammad. 2016. THE ANALYSIS OF FINANCE RATIO AS THE TOOL TO

KNOW THE FINANCE WORK AT KARYA NANDA CORPORATION, UNIT OF BONEBONE, LUWU UTARA REGENCY. Supervised by Samsul Bachri and Sri Wahyuni Mustafa

This research aims at to know the liquidity ratio, solvability, and rentability ratio to the finance

work of Karya Nanda Coorporation, unit of Bone-Bone, North Luwu regency. One of the basic

in conducting this research is to know the finance work of Karya Nanda Corporation to reach

equity. By using the analysis method like ratio will be able to describe or to view about the good

or bad condition or finance position of a company. The analysis method which is used is

descriptive quantitative data analysis. The result of this research shows that the liquidity ratio

like current ratio can count the circulating assets with current liabilities for four years is

114,88%, 116,36%, 121,72%, and 123,06% in the criteria of not good. In the result of solvability

ratio in Total Debt to Equity Ratio in counting the total debt with own capital with score

608,85%, 584,19%, 483,96%, and 494,04%, shows that the corporation ability to benefitted the

own capital in assure of debt is not really good, where the business corporation of Karya Nanda

is still insolvable to fulfill the short time obligation, while the Total Debt to Total Asset by

counting the total of liabilities with the total of assets for four years in a series are 79,01%,

77,86%, 75,28%, and 75,25%. It shows that the Karya Nanda corporation is in good condition. In

the rentability ratio in the counting of Return On Asset (ROA) counts the equity with total assets

8,00%, 8,80%, 9,15%, and 9,51% shows that the corporation ability to result the benefit is quite

good or rentable. In Return On Equity, by calculating the equity by own capital is 61,66%,

66,06%, 58,83%, and 62,44% is quite rentable to get maximal equity.

Keywords: Ratio analysis, tool analysis, finance work

You might also like

- Individual Analysis 100027685Document3 pagesIndividual Analysis 100027685Chethan Ram NarayanNo ratings yet

- A Study On Financial Performance of Mesprosoft PVT LTD: Presented by Ajmal Sidhan P General MbaDocument9 pagesA Study On Financial Performance of Mesprosoft PVT LTD: Presented by Ajmal Sidhan P General MbaAnjali BalakrishnanNo ratings yet

- Financial Performance Analysis Through Position Statements of Selected FMCG CompaniesDocument8 pagesFinancial Performance Analysis Through Position Statements of Selected FMCG Companiesswati jindalNo ratings yet

- Analisa Rasio Keuangan Pengaruhnya Terhadap Kinerja Bank Perkreditan Rakyat Di Wilayah Kabupaten TegalDocument6 pagesAnalisa Rasio Keuangan Pengaruhnya Terhadap Kinerja Bank Perkreditan Rakyat Di Wilayah Kabupaten TegalAnissaNo ratings yet

- A Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedDocument8 pagesA Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedBabasaheb JawalgeNo ratings yet

- Relationship Between Working Capital Management and ProfitabilityDocument5 pagesRelationship Between Working Capital Management and ProfitabilityEditor IJIRMFNo ratings yet

- International Journal of Accounting ResearchDocument8 pagesInternational Journal of Accounting Researchsant1.massisNo ratings yet

- An Assignment On Financial Performance Analysis of 5 Power and Gas Power CompaniesDocument25 pagesAn Assignment On Financial Performance Analysis of 5 Power and Gas Power CompaniesShahriar Ali DolonNo ratings yet

- Impact of Leverage Ratio On ProfitabilityDocument9 pagesImpact of Leverage Ratio On ProfitabilitySaadia SaeedNo ratings yet

- A Comparative Study On MRF & Good Year Financial PerformanceDocument9 pagesA Comparative Study On MRF & Good Year Financial Performancechelsea fabrinaNo ratings yet

- A Study On Capital Structure Analysis of Tata Motors LimitedDocument5 pagesA Study On Capital Structure Analysis of Tata Motors LimitedAntora HoqueNo ratings yet

- Impact of Liquidity On Profitability of Nepalese Commercial BanksDocument8 pagesImpact of Liquidity On Profitability of Nepalese Commercial BanksWelcome BgNo ratings yet

- 1595 6054 1 PBDocument18 pages1595 6054 1 PBTikaNo ratings yet

- 69-Article Text-431-1-10-20221208Document12 pages69-Article Text-431-1-10-20221208prettymaskerrNo ratings yet

- Jurnal Pendukung 5Document17 pagesJurnal Pendukung 5ARIF MUDJIONONo ratings yet

- A Comparative Study On MRF & Good Year Financial PerformanceDocument10 pagesA Comparative Study On MRF & Good Year Financial Performancechelsea fabrinaNo ratings yet

- St. Paul University Surigao Surigao City, Philippines: Summary, Conclusions, and RecomendationsDocument9 pagesSt. Paul University Surigao Surigao City, Philippines: Summary, Conclusions, and RecomendationsDianna Tercino IINo ratings yet

- Report On Performance Analysis of Ceramic Industry in Bangladesh.Document30 pagesReport On Performance Analysis of Ceramic Industry in Bangladesh.Mun Ir Shan0% (2)

- Capital AdequacyDocument12 pagesCapital Adequacypapa oforiNo ratings yet

- WIP1Document25 pagesWIP1Aliasgar ZaverNo ratings yet

- Review of Literature 1Document3 pagesReview of Literature 1amuliya v.sNo ratings yet

- Links For Related ResearchDocument4 pagesLinks For Related ResearchElinet AldovinoNo ratings yet

- Analysis of Impact of Working Capital Management On Profitability of Adani Wilmar Ltd.Document6 pagesAnalysis of Impact of Working Capital Management On Profitability of Adani Wilmar Ltd.Shruti UpadhyayNo ratings yet

- Working Capital PropertyDocument27 pagesWorking Capital PropertyHaris HanifNo ratings yet

- Impact of Bank Internal Factors On Profitability of Commercial Banks in Sri Lanka: A Panel Data AnalysisDocument14 pagesImpact of Bank Internal Factors On Profitability of Commercial Banks in Sri Lanka: A Panel Data Analysisnuwany2kNo ratings yet

- Project ArticleDocument12 pagesProject ArticleAkash SNo ratings yet

- FinancialPerformanceAnalysis GIMDocument16 pagesFinancialPerformanceAnalysis GIMdemionNo ratings yet

- JurnalDocument10 pagesJurnalaj1622ajengNo ratings yet

- Working Capital Management and Corporate Profitability: Empirical Evidences From Nepalese Manufacturing SectorDocument16 pagesWorking Capital Management and Corporate Profitability: Empirical Evidences From Nepalese Manufacturing SectorJulia ConceNo ratings yet

- Cogs PDFDocument14 pagesCogs PDFRa KumalaNo ratings yet

- Thesis of BBS 4 Year - OriginalDocument42 pagesThesis of BBS 4 Year - Originalशुन्य बिशालNo ratings yet

- LSBM307 Ass1. Accounting and Finance Research PDocument13 pagesLSBM307 Ass1. Accounting and Finance Research PkavitaNo ratings yet

- Jurnal Artikel Wan Nurul Fatin Annisa - NoDocument10 pagesJurnal Artikel Wan Nurul Fatin Annisa - NoShikamaru NaraNo ratings yet

- Review of Literature For Altman Z ScoreDocument5 pagesReview of Literature For Altman Z ScoreLakshmiRengarajanNo ratings yet

- Analisis Rasio Likuiditas Rasio SolvabilDocument24 pagesAnalisis Rasio Likuiditas Rasio SolvabilCieeeebaperNo ratings yet

- Rastogi (2013) Working Capital Management Nasional FertilizerDocument4 pagesRastogi (2013) Working Capital Management Nasional FertilizerRahmadhani PutriNo ratings yet

- The Impact of Corporate Governance On The Profitability of Nepalese EnterpriseDocument10 pagesThe Impact of Corporate Governance On The Profitability of Nepalese EnterpriseAyush Nepal100% (1)

- Arjun FinalDraftDocument17 pagesArjun FinalDraftspiderverse.arunNo ratings yet

- ANALYSISDocument14 pagesANALYSISAnika Tabassum RodelaNo ratings yet

- Liquidity Management and Its Impact On Banks Profitability: A Perspective 0f PakistanDocument6 pagesLiquidity Management and Its Impact On Banks Profitability: A Perspective 0f PakistaninventionjournalsNo ratings yet

- Review of LiteratureDocument10 pagesReview of Literatureamuliya v.sNo ratings yet

- Nilutpul SirDocument11 pagesNilutpul SirTarekNo ratings yet

- 1487 Israt Jahan 5105Document10 pages1487 Israt Jahan 5105Shahnewaj ShaanNo ratings yet

- A Study On Working Capital Management of Shanthi Gears LTDDocument15 pagesA Study On Working Capital Management of Shanthi Gears LTDKarthika ArvindNo ratings yet

- Analisis Rasio Likuiditas, Rasio Leverage, Dan Rasio Profitabilitas Terhadap Perubahan LabaDocument20 pagesAnalisis Rasio Likuiditas, Rasio Leverage, Dan Rasio Profitabilitas Terhadap Perubahan LabaSuganda SlowNo ratings yet

- Jetir2105840 Paper Analysis of Bank Performance Using Camel ApproachDocument10 pagesJetir2105840 Paper Analysis of Bank Performance Using Camel ApproachDr Bhadrappa HaralayyaNo ratings yet

- Working Capital Management in Indian Steel Industry: A Case Study of SailDocument6 pagesWorking Capital Management in Indian Steel Industry: A Case Study of SailShikha MishraNo ratings yet

- The Influence of The Debt To Equity Ratio, Inventory Turn Over, and Current Ratio Against The Return On Equity in The Pharmaceutical Sector CompaniesDocument10 pagesThe Influence of The Debt To Equity Ratio, Inventory Turn Over, and Current Ratio Against The Return On Equity in The Pharmaceutical Sector CompaniesVincent SusantoNo ratings yet

- DP 1Document12 pagesDP 1MiftazizahNo ratings yet

- Working Capital Management in Tata Steel LimitedDocument8 pagesWorking Capital Management in Tata Steel LimitedImpact JournalsNo ratings yet

- Performance Evaluation PDFDocument10 pagesPerformance Evaluation PDFsiddhartha karNo ratings yet

- Final Report PDFDocument39 pagesFinal Report PDFChandrashekar BNNo ratings yet

- 1 The - Study - of - Effect - of - Good - Corporate - Governance - oDocument5 pages1 The - Study - of - Effect - of - Good - Corporate - Governance - oWendy Sri MurtinaNo ratings yet

- Ratio Analysis - NATRAJ OILDocument8 pagesRatio Analysis - NATRAJ OILRaja MadhanNo ratings yet

- Impact of Working Capital Management in The Profitability of Hindalco Industries LimitedDocument7 pagesImpact of Working Capital Management in The Profitability of Hindalco Industries LimitedMuhammad Khuram ShahzadNo ratings yet

- Sankarlal Agrawal College of Management StudiesDocument58 pagesSankarlal Agrawal College of Management StudiesRavi JoshiNo ratings yet

- Jurnal Bhs InggrisDocument24 pagesJurnal Bhs InggrisDita Asri HastutiNo ratings yet

- Balanced Scorecard for Performance MeasurementFrom EverandBalanced Scorecard for Performance MeasurementRating: 3 out of 5 stars3/5 (2)

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014From EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014No ratings yet

- Materi MidDocument4 pagesMateri MidAlbert EnglisherNo ratings yet

- School Is Bad For Children (John Holt) : Reading IvDocument1 pageSchool Is Bad For Children (John Holt) : Reading IvAlbert EnglisherNo ratings yet

- ESP Assignment: Faculty of Language and Literature State University of Makassar 2010Document10 pagesESP Assignment: Faculty of Language and Literature State University of Makassar 2010Albert EnglisherNo ratings yet

- Management Talk: Muhammad Amin RasyidDocument34 pagesManagement Talk: Muhammad Amin RasyidAlbert EnglisherNo ratings yet

- ThesisDocument1 pageThesisAlbert EnglisherNo ratings yet

- English For Specific Purposes (ESP) and English For General Purposes (EGP)Document24 pagesEnglish For Specific Purposes (ESP) and English For General Purposes (EGP)Albert EnglisherNo ratings yet

- Transition PeriodDocument2 pagesTransition PeriodAlbert EnglisherNo ratings yet

- Writing Assignment: BY: ALBER F. PAGALLA (085 204 097) EDY KURNIAWAN (085 204 098) Education CDocument6 pagesWriting Assignment: BY: ALBER F. PAGALLA (085 204 097) EDY KURNIAWAN (085 204 098) Education CAlbert EnglisherNo ratings yet

- Working With TeacherDocument12 pagesWorking With TeacherAlbert EnglisherNo ratings yet

- Poetry LiteratureDocument1 pagePoetry LiteratureAlbert EnglisherNo ratings yet

- Scoring Form English Drama ShowDocument2 pagesScoring Form English Drama ShowAlbert EnglisherNo ratings yet

- Taking A Peek at LombokDocument2 pagesTaking A Peek at LombokAlbert EnglisherNo ratings yet

- Geography: Development of Canadian CultureDocument4 pagesGeography: Development of Canadian CultureAlbert EnglisherNo ratings yet

- Syllabus of English For Teeangers ClassDocument3 pagesSyllabus of English For Teeangers ClassAlbert EnglisherNo ratings yet

- Culture of Australia 1Document5 pagesCulture of Australia 1Albert EnglisherNo ratings yet

- Lampiran Proposal (Anggaran)Document4 pagesLampiran Proposal (Anggaran)Albert EnglisherNo ratings yet

- Language & Power 1Document4 pagesLanguage & Power 1Albert EnglisherNo ratings yet

- Attendence List English Course KKN Unm XXV SMPN 2 Gilireng: No Name Class Meeting KetDocument1 pageAttendence List English Course KKN Unm XXV SMPN 2 Gilireng: No Name Class Meeting KetAlbert EnglisherNo ratings yet

- Language & Power 3Document3 pagesLanguage & Power 3Albert EnglisherNo ratings yet

- File Xi Ips 1 FitriDocument1 pageFile Xi Ips 1 FitriAlbert EnglisherNo ratings yet

- Gender Differences in CommunicationDocument2 pagesGender Differences in CommunicationAlbert EnglisherNo ratings yet

- Nota Penjualan Xi Social 1 ShopDocument1 pageNota Penjualan Xi Social 1 ShopAlbert EnglisherNo ratings yet

- Remedial Bahasa InggrisDocument1 pageRemedial Bahasa InggrisAlbert EnglisherNo ratings yet

- "Lic Mutual Fund": Master of Business AdministrationDocument22 pages"Lic Mutual Fund": Master of Business Administrationitsme_venkatesh_bsNo ratings yet

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Accounts ReceivablesDocument7 pagesAccounts ReceivablesShafiq KhanNo ratings yet

- Masters Technological Institute of MindanaoDocument3 pagesMasters Technological Institute of MindanaoPang SiulienNo ratings yet

- Entrepreneurship Module 10: Bookkeeping What I KnowDocument23 pagesEntrepreneurship Module 10: Bookkeeping What I KnowDos DosNo ratings yet

- 04 The Value of Common StocksDocument5 pages04 The Value of Common StocksMộng Nghi TôNo ratings yet

- AC-MGT102 Reviewer (Quiz)Document10 pagesAC-MGT102 Reviewer (Quiz)ABM-5 Lance Angelo SuganobNo ratings yet

- 11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Document18 pages11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Clarisse PelayoNo ratings yet

- Exercise 13 Statement of Cash Flows - 054924Document2 pagesExercise 13 Statement of Cash Flows - 054924Hoyo VerseNo ratings yet

- IC Internal Audit Checklist 8624Document3 pagesIC Internal Audit Checklist 8624Tarun KumarNo ratings yet

- Solution Manual For Advanced Accounting 5E - JeterDocument16 pagesSolution Manual For Advanced Accounting 5E - JeterAlif NurjanahNo ratings yet

- Basics of Accounting MCQDocument9 pagesBasics of Accounting MCQGoogle User100% (3)

- Corporate Governance MechanismsDocument16 pagesCorporate Governance MechanismsNthambi MiriamNo ratings yet

- Mock 1 - Nurnajihah ZakariaDocument8 pagesMock 1 - Nurnajihah Zakarianajihah zakariaNo ratings yet

- SANICO, MARY CONIE T. Financial Statements of Sakag-Kabuhi Inc.Document12 pagesSANICO, MARY CONIE T. Financial Statements of Sakag-Kabuhi Inc.Luigi Enderez BalucanNo ratings yet

- Week 2BDocument38 pagesWeek 2BJessicaNo ratings yet

- Knowledge, Innovation, & Entrepreneurship: From Perpective of Strategic ManagementDocument32 pagesKnowledge, Innovation, & Entrepreneurship: From Perpective of Strategic ManagementArinartNo ratings yet

- Takeover Handbook PDFDocument68 pagesTakeover Handbook PDFPhill NamaraNo ratings yet

- Chapter 4Document28 pagesChapter 4Mahnoor AzfarNo ratings yet

- Beams11 - PPT 16Document49 pagesBeams11 - PPT 16naufal bimoNo ratings yet

- Notes 3 CORPORATIONDocument10 pagesNotes 3 CORPORATIONVictor Angelo AlejandroNo ratings yet

- Cost HandoutDocument31 pagesCost HandoutTilahun GirmaNo ratings yet

- Financial Analysis 2Document2 pagesFinancial Analysis 2Sylvia GynNo ratings yet

- The Double Entry System For Assets, Capital and LiabilitiesDocument2 pagesThe Double Entry System For Assets, Capital and LiabilitiesAung Zaw HtweNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Principle of Accounts SBADocument31 pagesPrinciple of Accounts SBApadmini outarNo ratings yet

- S.I. 134 of 2019 Security ExchangeDocument215 pagesS.I. 134 of 2019 Security Exchangetaps tichNo ratings yet

- Risk and ReturnDocument40 pagesRisk and ReturnKisan BhagatNo ratings yet

- CH 09Document13 pagesCH 09Sami KhanNo ratings yet