Professional Documents

Culture Documents

Financial Analysis & Reporting Part II Course I - Oral Version

Uploaded by

antoineOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis & Reporting Part II Course I - Oral Version

Uploaded by

antoineCopyright:

Available Formats

FINANCIAL ANALYSIS & REPORTING

Accounting, Law, Finance & Economics Department

EDHEC M1FE

ANNE SCOLAIRE / ACADEMIC YEAR 2014-2015

Intervenant/Lecturer: Amandine GERARD

Part I : IAS interpretation for financial analysts

I.

II.

III.

1.

2.

1.

2.

3.

1.

2.

3.

Framework

Definition and principles : IAS 1 Presentation of FS

IAS 7 : Statement of cash flows

Assets and Liabilities

IAS 16 & 38 : Tangible and intangible assets

IAS 19 : Employee Benefits

IAS 37 : Provisions and Contingent Liabilities

Impairment & Goodwill

IAS 36 : Impairment of assets

IFRS 3: Assets in value acquisition

IAS 39 : Financial Instruments, recognition & measurement

IV. Peripherical treatments

1.

2.

3.

IAS 10 : Events after the reporting period

IAS 21 : The effects of changes in foreign exchange rates

IAS 23 : Borrowing costs

Framework

IAS : Definition and accounting principles

Main goal: to provide a true and fair view of the operations of the business to the

readers.

Four broad sets of codes :

Tax laws of the country;

Laws governing corporate reporting;

Laws and regulations of the body controlling the securities market;

Guidelines of the professional accounting bodies

Two models :

The Anglo-American Model (GAAP)

The Continental European Model (IFRS)

IAS : Definition and accounting principles

IASC (1973)

IASB (2000)

Before 2000

IAS

After 2000

IFRS

IAS 1 : Presentation of financial statements

Objective is to provide information about the financial position, financial

performance and cash flows of a company that is useful to a wide range of

users in making economic decisions. Financial statements also show the

results of managements stewardship of the resources entrusted to it .

Five conventions :

Accrual basis of accounting

Going concern

Prudence

Comparability

Substance over form

IAS 1 : Presentation of financial statements

Main items presented in the financial statements:

The balance sheet

The profit and loss statements (or income statement)

The cash flow statement

The statement of changes in equity

The notes to financial statements, with three sub-divisions

1. description of accounting policies

2. Information required by accounting standards

3. Additional information necessary for a fair presentation of financial statements.

IAS 7: Statement of cash flows

Cash flow from operating activities

Direct

Method

Cash flow from financing activities

Indirect

Method

Cash flow from investing activities

Net change in cash or cash equivalents

Ideally, the cash flow statement should:

Give an idea of the financial structure of the firm and its cash obligations.

Provide additional information about changes in assets, liabilities and working capital, which are not

captured in the income statement or the balance sheet.

Improve cross sectional analysis across enterprises by eliminating the effect of different accounting

policies.

Serve as an indicator of certainty, timing of future cash-flows.

IAS 7: Statement of cash flows, Direct Method

Cash flows from operating activities

Cash received from customers (+)

Cash paid to suppliers and employees (-)

Other operating inflows (+)

Other operating outflows (-)

Interests and dividends paid* (-)

Income taxes paid (-)

=

Net cash from operating activities I

Cash flows from investing activities

Purchase of fixed assets (-)

Proceeds from sales of fixed assets (+)

Acquisition of subsidiaries and affiliates (-)

Disposal of subsidiaries and affiliates (+)

Interests and dividends received (+)

=

Net cash from investing activities II

Cash flows from financing activities

Issuance of share capital (+)

Capital repayments (-)

Issuance of bonds (+)

Bonds repayments (-)

Payment of finance lease liabilities (-)

Interests and dividends paid* (-)

=

Net cash from financing activities III

Net cash flow IV = I + II + III

* This item may be classified either in cash flow from operating activities or in cash flow from financing activities.

IAS 7: Statement of cash flows, indirect method

Cash flows from operating activities

Net income (+)

Non-cash expenses (Depreciation and provision increases) (+)

Reversal of provisions (-)

Non-operating losses (+)

Non-operating gains (like interests and dividends received) (-)

Interests paid* (+)

Decrease in current assets (Accounts receivable, prepaid expenses, inventories) (+)

Increase in current assets (Accounts receivable, prepaid expenses, inventories) (-)

Increase in current liabilities (Accounts payable, accrued liabilities, deferred taxes) (+)

Decrease in current liabilities (Accounts payable, accrued liabilities, deferred taxes) (-)

=

Cash from operating activities I

* This item may be classified either in cash flow from operating activities or in cash flow from financing activities.

10

IAS 7: Statement of cash flows

Cash flows from investing activities

Purchase of fixed assets (-)

Proceeds from sales of fixed assets (+)

Acquisition of subsidiaries and affiliates (-)

Disposal of subsidiaries and affiliates (+)

Interests and dividends received (+)

=

Net cash from investing activities II

Cash flows from financing activities

Issuance of share capital (+)

Capital repayments (-)

Issuance of bonds (+)

Bonds repayments (-)

Payment of finance lease liabilities (-)

Interests and dividends paid* (-)

=

Net cash from financing activities III

=

Net cash flow IV = I + II + III

* This item may be classified either in cash flow from operating activities or in cash flow from financing activities.

11

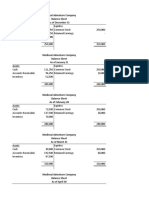

IAS 7: Statement of cash flows

Application : Net working capital and FCF, STP SA, Foundation Q11, March 2011

Profit and Loss (M)

Balance Sheet (M)

Assets

Cash

Accounts receivable

Inventories

Variable assets

Net fixed assets

Liabilities

Accounts payable

Short term loan

Accrued liabilities

Sum of short term debt

Long term loan

Total debt

Equity

Capital stock

Retained earnings

Total equity

2010

4

54

54

112

2009

3

45

60

108

90

202

75

183

32

20

22

74

28

16

18

62

45

119

45

107

15

68

83

202

15

61

76

183

2010

360

-306

54

2009

300

-255

45

Deprecation

EBIT

-9

45

-7

38

Financial Expenses

Income before taxes

-7

38

-6

32

Income taxes (40%)

Net income

-15

23

-13

19

Sales

Operational costs (excluding depreciation)

EBITDA

a) Calculate the net working capital for 2010

b) Calculate change in net working capital in

2010 over 2009, and comment

12

IAS 7: Statement of cash flows, application

Application : CF statement by the indirect method, Foundation Q5 Sept 4, Company ABC

Balance sheet :

Assets

Cash

Receivables

Inventories

Fixed Assets

Accumulated depreciation

Investment in associated comapnies

Goodwill

Liabilities and equity

Accounts payable

Bonds payable

Deferred income taxes

Capital stock

Additional paid in capital

Retained earnings

13

2002

240

385

800

4500

-1500

1000

950

6375

2003

120

490

1060

6438

-1740

1050

980

8398

412

300

263

2400

900

2100

6375

634

700

283

3200

1300

2281

8398

IAS 7: Statement of cash flows, application

Application : CF statement by the indirect method, Foundation Q5 Sept 4, Company ABC

Profit and Loss 2003

Sales

Cost of goods sold

(including depreciation)

Gross profit

20000

-13227

6773

General and selling expenses

Amortization of goodwill

Share of profits assosicated companies (*)

-5280

-50

85

Financial Expenses

-50

Income before taxes

Income taxes :

Current

deferred

Net income

(*) no dividends received

1478

700

20

-720

758

Calculate the Free Cash Flow From Operating Activities for ABC in 2003

14

Assets and Liabilities

15

IAS 16 : Property, plant and equipment

IAS 16 defines property, plant and equipment as tangible assets that:

Are held for use in the production or supply of goods and services, for rental to others, or

for administrative purposes, and

Are expected to be used during more than one period.

Items of property, plant and equipment are initialy recognised at cost, and depreciated.

The aim here is to value each asset at its fair value

Active market or not?

16

IAS 16 : Property, plant and equipment

IAS 16 allows firms to transfer from the revaluation surplus to retained earnings an amount

equal to the difference between depreciation based on the revalued amount and depreciation

based on the asset's historical cost. The revaluation of an asset generates deferred taxes that

are deducted from the revaluation surplus.

When there is a decrease in the value of the asset:

If the asset had not been revalued before, the impairment loss is charged directly to the

income statement.

If the asset had been revalued upwards before, first the revaluation surplus is reduced and

only the residual impairment is charged to the income statement.

17

IAS 16/ IAS 40 : Investment property

Fair value

If not:

Adjusting current prices of properties of a different nature, condition or location,

Adjusting recent prices of similar properties on less activ markets,

Discounting estimates of future (pre-tax) cash flows that the investment property should

generate

If the fair value model is chosen, revaluation rules differ significantly from those applicable to

property, plant and equipment:

active market for similar property.

1) measurement at each balance sheet date (whereas IAS 16 requires only a periodic revaluation).

2) Immediat recognition for changes in fair value, in the income statement (according to IAS 16, they

are recognised directly in Balance Sheet)

18

IAS 38 : Intangible assets

An intangible asset is recognised if, and only if :

It is probable that it will generate future economic benefits (ie positive cash flows)

Its cost can be measured reliably

Some items cannot be recognised as intangible assets regarding IAS 38, when they are

generated internally. (goodwill, brands, publishing titles and customer lists)

Intangible assets are measured initially at cost, later they also can be evaluated at faire value.

They are distinguished in two classes:

Those with a finite useful life

Those with an indefinite useful life

19

IAS 16 : LVMH, extract from consolidated statement, 2012

IAS 16 : LVMH, extract from consolidated statement, 2012

IAS 38 : Intangible assets : the special case of R&D

Research is defined as an original and planned investigation undertaken with the prospect of

gaining new scientific or technical knowledge and undertaking., in contrast to development,

which means, the application of research findings or other knowledge to a plan or design for

the production of new or substantially improved materials, devices, products, processes,

systems or services prior to commencement of commercial production or use.

IAS 38, specifies that :

Costs incurred in the research phase should be expended immediately;

If costs incurred in the development phase meet the recognition criteria for intangible assets, such

costs should be capitalised. However, once costs have been expensed during the development phase,

they cannot be capitalised later.

In US GAAP, all development costs must be expended when incurred.

22

Roche Holding example

Source Roche Holding, Presentation slides, annual results 2012

Novartis LCZ696 anouncement (2014/09/01)

Source Bloomberg

IAS 19 : Employee benefits

Apart from the regular salaries, employers provide various other benefits to employees. One of

the major categories of such benefits is retirement benefits.

Retirement benefits

Defined

benefit plans

(UK, US)

Defined

contribution

plans (France)

25

IAS 19 : Employee benefits, examples

British Airways, UK, extract from 2010 annual report

A) Pension obligations

Employee benefits, including pensions and other postretirement benefits (principally post-retirement healthcare benefits) are

presented in these financial statements in accordance with IAS 19 Employee Benefits. The Group has both defined benefit and

defined contribution plans. A defined contribution plan is a pension plan under which the Group pays fixed contributions into a

separate entity. The Group has no legal or constructive obligations to pay further contributions if the fund does not hold sufficient

assets to pay all employees the benefits relating to employee service in the current and prior periods. Typically benefit plans define an

amount of pension benefit that an employee will receive on retirement, usually dependent on one or more factors such as age, years

of service and compensation.

Past service costs are recognised when the benefit has been given. The financing cost and expected return on plan assets are

recognised within financing costs in the periods in which they arise. The accumulated effect of changes in estimates, changes in

assumptions and deviations from actuarial assumptions (actuarial gains and losses) that are less than ten per cent of the higher of

pension benefit obligations and pension plan assets at the beginning of the year are not recorded. When the accumulated effect is

above ten per cent the excess amount is recognised on a straight-line basis in the income statement over the estimated average

remaining service period.

The fair value of insurance policies which exactly match the amount and timing of some or all benefits payable under the scheme are

deemed to be the present value of the related obligations.

B) Termination benefits

Termination benefits are payable when employment is terminated by the Group before the normal retirement date, or whenever an

employee accepts voluntary redundancy in exchange for these benefits. The Group recognises termination benefits when it is

demonstrably committed to either terminating the employment of current employees according to a detailed formal plan without

possibility of withdrawal, or providing termination benefits as a result of an offer made to encourage voluntary redundancy.

Other employee benefits are recognised when there is deemed to be a present obligation.

26

IAS 19 : Employee benefits, examples

International Airlines Group, UK, extract from 2012 annual report

27

IAS 19 : Employee benefits, pensions

From January 1, 2013,

European listed companies

will have to adopt the new

IAS 19 standard for pension

accounting. Under the

revised standard:

(1) companies will no

longer be allowed to apply

an assumed return on

pension assets that exceeds

the discount rate the

company uses in calculating

the present value of its

pension liabilities

(2) The corridor method

will be eliminated.

Source Goldman Sachs Global Investment Research, 19th October 2012

Deutsche Post example

Source Deutsche Post, FY 2012, Analysts presentation

Other employees benefits

Fiat group example

Source Fiat Group, 2012 Annual report

Fiat group example

Source Fiat Group, 2012 Annual report

Fiat group example

Fiat group example

IAS 37 : Provisions

Provisions are generally defined as liabilities of uncertain timing or amount.

To recognise a provision under IAS 37, the company should have a present

obligation resulting from a past event.

The event must have already occurred.

Restructuring costs are provisions under some condition:

1) the company has a detailed plan;

2) it has started its implementation or

3) has communicated the plan to those affected by it.

34

IAS 37 : Provisions, example

Siemens, Germany, extracts from 2008 annual report

Civil litigation

In February 2007, an alleged holder of Siemens AG American Depositary Shares filed a derivative lawsuit with the Supreme Court of the State of New York

against certain current and former members of Siemens AGs Managing and Supervisory Boards as well as against Siemens AG as a nominal defendant, seeking

various forms of relief relating to the allegations of corruption and related violations at Siemens. The suit is currently stayed.

In July 2008, OTE filed a lawsuit against Siemens AG in the district court of Munich, Germany seeking to compel Siemens to disclose the outcome of its internal

investigations with respect to OTE. OTE seeks to obtain information with respect to allegations of undue influence and/or acts of bribery in connection with

contracts concluded with OTE from 1992 to 2006. On September 25, 2008, Siemens was served with the complaint by the district court.

The Company has become aware of media reports that in June 2008 the Republic of Iraq filed an action requesting unspecified damages against 93 named

defendants with the United States District Court for the Southern District of New York on the basis of findings made in the IIC Report. Siemens S.A.S France,

Siemens A.. Turkey and OSRAM Middle East FZE, Dubai are reported to be among the 93 named defendants. None of the Siemens affiliates have been served to

date.

The Company remains subject to corruption-related investigations in the United States and other jurisdictions around the world. As a result, additional criminal

or civil sanctions could be brought against the Company itself or against certain of its employees in connection with possible violations of law, including the

FCPA. In addition, the scope of pending investigations may be expanded and new investigations commenced in connection with allegations of bribery and other

illegal acts. The Companys operating activities, financial results and reputation may also be negatively affected, particularly due to imposed penalties, fines,

disgorgements, compensatory damages, third-party litigation, including by competitors, the formal or informal exclusion from public procurement contracts or

the loss of business licenses or permits. As previously reported and as described above, the Munich district court imposed a fine in October 2007 and the

Company recorded a provision in fiscal 2008 in connection with the investigations. However, no additional charges or provisions for any such penalties, fines,

disgorgements or damages have been recorded or accrued as management does not yet have enough information to estimate such amounts reliably. The

Company expects that additional expenses and provisions will need to be recorded in the future for penalties, fines, damages or other charges, which could be

material, in connection with the investigations. The Company will also have to bear the costs of continuing investigations and related legal proceedings, as well

as the costs of on-going remediation efforts. Furthermore, changes affecting the Companys course of business or changes to its compliance programs beyond

those already taken may be required, including any changes that may be mandated in connection with a resolution of the ongoing investigations.

35

IAS 37 : Contingent liabilities

When the conditions necessary for recognising a provision are not met, the company

may have a contingent liability, with no impact on earnings.

They are only mentioned in the notes to the accounts.

An example of a contingent liability is a surety given by the parent company to

secure a bank loan of a subsidiary.

36

Impairment & Goodwill

37

IAS 36 : Impairment of assets

IAS 36 prescribes the procedures that must be applied in estimating the recoverable

amount of an asset:

Its fair value less costs to sell

And its value to use

To identify assets that might be impaired, the company must assess at each

reporting date whether there is any indication that an asset may be impaired.

The enterprise must annually test for impairment :

Intangible assets whose useful life is indefinite;

Intangible assets not yet available for use (as for example development costs)

Goodwill acquired in a business combination.

IAS 36 stipulates that these assets must be affected by their cash-generating unit

(CGU).

38

IFRS 3: Assets value in acquisitions

IFRS 3 was amended in march 2004, and replaced IAS 22, to provide a framework for asset

valuation in case of acquisitions.

If the price exceeds the faire value of the net assets acquired, then the excess is called

goodwill.

If the fair value of net assets exceeds the price, goodwil is negative. In that case, negative

goodwill*, also badwill, is recognised immediately in income.

Goodwill is recorded as an asset, it should be recorded at its cost minus the possible value

losses. Each year, the comany has to make an impairment to justify the goodwill and if the

value dropped, records as a loss in the P&L.

Ex. : Lafarge with Orascom, Pernod Ricard with V&S Absolut

*the official term is excess of acquirers interest in the net fair value of acquirees identifiable assets, liabilities

and contingent liabilities over cost

39

IAS 16 : LVMH, extract from consolidated statement, 2012

IAS 39, Financial Instruments: Recognition

IAS 39 covers accounting for financial assets, which applies to financial instrument in

general. There are four main categories in the financial assets :

Financial assets at fair value through profit or loss

Held-to-maturity investments

Loans and receivables

Available-for-sale assets

To avoid frequent classification changes, IAS 39 provides that a company cannot reclassify a financial asset into or

out of the fair-value-through-profit-or-loss category while it is held. Similarly, it cannot classify any financial asset

as held-to-maturity if it has, during the current period or the two preceding years, sold or reclassified more than

an insignificant amount of held-to-maturity investments before maturity.

41

IAS 39, Financial Instruments: Measurement

Recognition:

On initial recognition, all financial assets are measured at fair value plus (except for

those of the fair-value-through-profit-or-loss category) transaction costs.

After initial recognition, valuation rules are as follows:

- held-to-maturity investments and loans and receivables are measured at

amortised cost using the effective interest method;

- investments in equity instruments that are not quoted on an active market

are measured at cost;

- all other financial assets (including derivatives that are not hedging

instruments) are measured at fair value.

42

Peripherical treatments

43

IAS 10 : Events after the reporting period

Events after the reporting period are defined by the events occuring after the closing

exercise date (BS date) and before the financial statements publication.

Its available for the favorable and unfavorable events.

We can distinguish two types of events:

The ones who come to clarify an existing situation at the closing date (you have to adjust).

Situations which occur after the closing date (no necessity to adjust)

Example : Company A records in provision for exercise N, an amount of 100 Mls for a lawsuit

event.

The closing exercise is 31/12/N.

The financial statements disclosure ate is 03/09/N+1.

The 20th of February N+1, we have got the verdict, Company A losses and has to pay to company B, 80 Mls.

Does the CFO needs to adjust the Financial statements ?

44

IAS 21: The effects of changes in foreign exchange rates

IAS 21 is centred on the concept of functional currency defined as the currency of the

primary economic environment in which entity operates .

How to record your foreign currency transactions? On initial recognition, at the spot exchange

rate between the functional currency and the foreign currency at the date of the transaction.

How to record your foreign activity at the reporting date (end of the period)?

Foreign currency monetary items are reported at closing rate;

Non-monetary items which are carried at historical cost are reported using the exchange rate at the

transaction date;

Non-monetary items which are carried at fair value are translated at the exchange rate which existed

when the value was determined

How to record your foreign activity in the financial statements?

Assets and liabilities : the closing date rate;

Revenues and expenses: the exchange rate at the date of the transaction (or a periodic average

exchange rate)

45

IAS 21: The effects of changes in foreign exchange rates

Example : On 01.10.N, a non-US company sold goods for USD 10000.

At the balance sheet date (06.30.N), the amount is still due from the client.

The spot exchange rate was:

- on January, 10: 1 CU = 0.6092 USD

- on June, 30: 1 CU = 0.6190 USD.

On 01.10.N, the firm recognizes revenues for CU = 16'414.97 (10 000/0.6092)

However, the balance sheet as at June 30, N, will carry the accounts receivable not at CU 16414.97 but at the rate as of June

30, N. Thus, the balance sheet figure will be:

16'155.08 (10 000/0.6190)

This difference of (16414.97 - 16155.08) = 259.89 CU is a holding loss. This loss is not due to a drop in sale prices but to a

change in the exchange rate between the USD and CU. Here the reporting currency had appreciated and so for the same USD

amount one gets less units of CU.

Say the payment is received on July 31, N and the exchange rate on that date is 1 CU = 0.6080 USD.

For the purpose of reporting in the financial statements for the period, July 31, N to June 30, N+1:

The amount received in CU is 10000 / 0.6080 = 16447.36

The exchange gain will be 16447.36 - 16155.08 = 292.28

The actual gain from the transaction date to the settlement date is 16447.36 - 16414.97 = 32.39

However, this amount has been recognized in two phases as a loss of CU 259.89 in year ending June 30, N and a gain of CU

292.28 for the year ending June 30, N+1.

46

IAS 23: Borrowing costs

Regarding the borrowing assets, the main question is, should they be capitalised

(value part of an asset) or treated like charges?

Current IAS 23 admits both solutions:

Borrowing costs must be recognised as an expense when incurred

Nevertheless, firms may also capitalise borrowing costs that are directly attributable to the

construction of certain assets (allowed alternative treatment)

Conditions for capitalisation : assets are those that take a substantial period of time

to get ready for their intended use or sale .

Real estate assets;

Items for equipment whose manufacturing period is particularly long;

Inventories that take a susbstantial period of time to mature.

47

Exercise to prepare for next lecture

(October, 20th/21st)

Use Excel template available on Blackboard

48

IAS 7: Statement of cash flows, application

Application : CF statement by the direct method, Company Black & Co

Balance sheet : (in million of UM)

Assets

Cash

Account receivable

Inventories

Advance

Variable assets

Hardware/equipment

Furniture

Accumulated depreciation

Sum

other assets

2011

6,9

133,4

202,7

5,7

348,7

2010

12

116,6

168,8

6,6

304

101,6

94,5

-78,6

117,5

7,7

473,9

Long term loan

81,1 Other debts

94,5 Total debt

-67,4

108,2 Equity

2 Capital stock

414,2 Retained earnings

Total equity

Liabilities

Accounts payable

Short term loan

Fiscal debt

Sum of short term debt

49

117,5

68,8

4,3

190,6

91,1

53,3

7,6

152

57,3

7,4

255,3

48

8,3

208,3

56

162,6

218,6

473,9

50

155,9

205,9

414,2

IAS 7: Statement of cash flows, application

Application : CF statement by the direct method, Company Black & Co

Profit and Loss

Sales

Cost of goods sold

Gross profit

Operating expenses

Wages

Tax wages

Stamping

Advertising

subscription

Profesional charges

Depreciation

Water, electrivity

Rental

Insurance

Maintenance

Traveling

Phone

Office automation expenses

Others

Sum

Operating profit

Other charges

Interest expense

Income taxes :

Sum

Net income

2011

789,7

518,8

270,9

2010

774,1

497,2

276,9

92,6

6,9

3,8

6,1

1,2

3,6

11,2

6,4

33

14,1

9,3

8,8

7,2

12

7,7

223,9

47

89,5

6,7

3,4

5

1,1

3

14,4

5,7

33

10,6

8,6

7

6,6

12,8

6,6

214

62,9

18,3

4,3

22,6

24,4

12,1

7,6

19,7

43,2

50

The company distributed 17,7 M UM

dividend for 2011, and 25 M UM for

2010.

Calculate the Free Cash Flow From

Operating, Investing and financing

Activities for Black & Co in 2011

Case study presentation

(November, 3rd/4th)

A good way to review your mid-term exam

51

Case study presentation

Pick up one of the three following companies:

Jazztel, Spanish telcos operator, download 2013 Report & Financial Statement, focus from point

6.7 with notes

Ladbrokes, UK Gaming, focus from point 57 in 2013 Annual Report

Vodafone Group, European leader telcos operator, download 2013 financial statements report

only

You have to analyze changes in CF statements between 2013 & 2012, and comment about the main

impacts/risks of some International Accounting Standards treatments.

You can choose your group, five persons maximum per group, 15 minutes presentation

I will pick up 4 groups randomly

If the work is great, I will give a bonus (I improve your mid-term grade by 1)

If the work is very bad, you will have a penalty (I reduce your mid-term grade by 1)

All documents are available on related companies webiste, investor relations section

52

Sources

Extracts from course manual AZEC/ILPIP, 2008, Financial Accounting and Financial Statement

Analysis, Chapter 5, Assets, liabilities and shareholders equity

Extracts from course manual AZEC/ILPIP, 2008, Financial Accounting and Financial Statement

Analysis, Chapter 7, Foreign currency transactions

Comptabilit Internationale : les IAS/IFRS en Pratique, Christel DECOCK GOOD, Franck

DOSNE, Connaissance de la gestion, Economoca, 2nd Edition

53

You might also like

- Financial-Analysis-and-Reporting Study Material-Central Mindanao UniversityDocument22 pagesFinancial-Analysis-and-Reporting Study Material-Central Mindanao UniversityAngelito Han-awon100% (2)

- Syllabus Financial Reporting and Analysis - Level One ModuleDocument8 pagesSyllabus Financial Reporting and Analysis - Level One ModuleJazzer NapixNo ratings yet

- Financial Analysis and Reporting 1Document4 pagesFinancial Analysis and Reporting 1Anonymous ryxSr2No ratings yet

- Financial Analysis and ReportingDocument5 pagesFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- Module 1 Financial Analysis and ReportingDocument22 pagesModule 1 Financial Analysis and ReportingJane Carla Borromeo100% (1)

- Cangque A Bapf 103 Ba Module 1 For CheckingDocument27 pagesCangque A Bapf 103 Ba Module 1 For CheckingArmalyn Cangque100% (1)

- With Activities Bapf-106 Ba - Module-3Document20 pagesWith Activities Bapf-106 Ba - Module-3Armalyn Cangque100% (1)

- Financial Analysis and Reporting SyllabusDocument9 pagesFinancial Analysis and Reporting SyllabusJpoy Rivera100% (4)

- FM 2 and ELECT 2 Financial Analysis and Reporting OBE SyllabusDocument12 pagesFM 2 and ELECT 2 Financial Analysis and Reporting OBE SyllabusJay Bee Salvador83% (6)

- FM 8 Module 2 Multinational Financial ManagementDocument35 pagesFM 8 Module 2 Multinational Financial ManagementJasper Mortos VillanuevaNo ratings yet

- Bangko Sentral NG Pilipinas (BSP)Document27 pagesBangko Sentral NG Pilipinas (BSP)Ms. Joy100% (2)

- Special Topics in Financial MGTDocument1 pageSpecial Topics in Financial MGTBen CruzNo ratings yet

- Central Banking and Monetary Policy PDFDocument43 pagesCentral Banking and Monetary Policy PDFWindyee TanNo ratings yet

- Investment and Portfolio Management - Course Syllabus 2018Document5 pagesInvestment and Portfolio Management - Course Syllabus 2018Aki Lou Bats67% (3)

- Elements of Finance Mariano Chapter5Document38 pagesElements of Finance Mariano Chapter5Loi Bermundo100% (1)

- Fundamentals of Financial MarketDocument13 pagesFundamentals of Financial MarketOhimai-Uzebu Joshua100% (1)

- FM 12 Reporting and AnalysisDocument12 pagesFM 12 Reporting and AnalysisMark Anthony Jr. Yanson50% (2)

- Global Finance and Electronic Banking - DiscussionDocument1 pageGlobal Finance and Electronic Banking - DiscussionBenjamen KamzaNo ratings yet

- Cangque A Bapf 106 Ba Module 2 For Checking (Recovered)Document24 pagesCangque A Bapf 106 Ba Module 2 For Checking (Recovered)Armalyn CangqueNo ratings yet

- Chapter 1 Monetary Policy IntroductionDocument53 pagesChapter 1 Monetary Policy IntroductionBrian Ferndale Sanchez GarciaNo ratings yet

- FM 8 Module 1 Financial Planning and ForecastingDocument16 pagesFM 8 Module 1 Financial Planning and ForecastingJasper Mortos VillanuevaNo ratings yet

- Course Code and Title: Lesson Number: Topic: Role of The Relationship Manager ProfessorDocument8 pagesCourse Code and Title: Lesson Number: Topic: Role of The Relationship Manager ProfessorJha Jha CaLvezNo ratings yet

- Cangque A Bapf 106 Ba Module 3 For CheckingDocument17 pagesCangque A Bapf 106 Ba Module 3 For CheckingArmalyn CangqueNo ratings yet

- Monetary Policy & Central BankingDocument34 pagesMonetary Policy & Central BankingjorgethNo ratings yet

- The Financial System of The Philippines: and Selected Items of Monetary and Fiscal PoliciesDocument16 pagesThe Financial System of The Philippines: and Selected Items of Monetary and Fiscal PoliciesJohn Marthin ReformaNo ratings yet

- Syllabus For Financial ManagementDocument3 pagesSyllabus For Financial ManagementRio DhaniNo ratings yet

- Financial Management 1 Midterm ReviewerDocument7 pagesFinancial Management 1 Midterm Reviewerkurdapiaaa100% (1)

- Financial Planning and ForcastingDocument34 pagesFinancial Planning and ForcastingFarhan JagirdarNo ratings yet

- Financial Controllership SyllabusDocument12 pagesFinancial Controllership SyllabusYuuki Touya CaloniaNo ratings yet

- Cangque A Bapf 106 Ba Module 1 For CheckingDocument27 pagesCangque A Bapf 106 Ba Module 1 For CheckingArmalyn Cangque100% (1)

- Analysis of Financial Statements Of: Presented by AyeshaDocument30 pagesAnalysis of Financial Statements Of: Presented by AyeshaaaaaNo ratings yet

- Special Topics in Finance ManagementDocument5 pagesSpecial Topics in Finance ManagementThrishxian James GrefalNo ratings yet

- Investment and Portfolio Management 5Document51 pagesInvestment and Portfolio Management 5madihashkh100% (1)

- Capital MarketDocument106 pagesCapital MarketJayar DimaculanganNo ratings yet

- Global Finance With Electronic Banking PaperDocument10 pagesGlobal Finance With Electronic Banking PaperJennica Cruzado100% (1)

- Global Finance With Electronic BankingDocument53 pagesGlobal Finance With Electronic BankingMissy Acoy100% (1)

- Course Syllabus ACCO 20093 Financial Markets v2019Document6 pagesCourse Syllabus ACCO 20093 Financial Markets v2019Rizza100% (1)

- COURSE SYLLABUS (Reporting and Financial Analysis 2020)Document6 pagesCOURSE SYLLABUS (Reporting and Financial Analysis 2020)Armalyn CangqueNo ratings yet

- Investment and Portfolio Chapter 4Document48 pagesInvestment and Portfolio Chapter 4MarjonNo ratings yet

- Special Topics in Financial ManagementDocument3 pagesSpecial Topics in Financial ManagementPaglinawan Al KimNo ratings yet

- Special Topics in Financial ManagementDocument36 pagesSpecial Topics in Financial ManagementChristel Mae Boseo100% (1)

- Philippine Banking SystemDocument2 pagesPhilippine Banking SystemXytusNo ratings yet

- Investment & Portfolio Mgt. SyllabusDocument7 pagesInvestment & Portfolio Mgt. SyllabusEmi YunzalNo ratings yet

- Chapter 1Document4 pagesChapter 1Lyn AmbrayNo ratings yet

- Financial Controllership Course SyllabusDocument2 pagesFinancial Controllership Course SyllabusReiner GGay100% (1)

- Forecasting Financial StatementsDocument30 pagesForecasting Financial StatementsChris Jays100% (1)

- The Philippine Financial SystemDocument5 pagesThe Philippine Financial SystemReliza Salva Regana0% (1)

- Syllabus Financial ManagementDocument8 pagesSyllabus Financial ManagementValery Joy CerenadoNo ratings yet

- Presentation of Financial StatementsDocument66 pagesPresentation of Financial StatementsCherryvic Alaska - KotlerNo ratings yet

- Accounting 1 BSA OBE Funda 1Document5 pagesAccounting 1 BSA OBE Funda 1Yuri Walter AkiateNo ratings yet

- Fin. 6 - Monetary Policy and Central Banking 2017Document8 pagesFin. 6 - Monetary Policy and Central Banking 2017Carlo BaculoNo ratings yet

- An Introduction To Money and The Financial System: Chapter OverviewDocument13 pagesAn Introduction To Money and The Financial System: Chapter Overviewmyungjin mjinNo ratings yet

- Cash Management SystemDocument65 pagesCash Management SystemmsdNo ratings yet

- Security Analysis Prelim ModuleDocument19 pagesSecurity Analysis Prelim ModuleCasey AbelloNo ratings yet

- 02 PPT Financial Statement AnalysisDocument31 pages02 PPT Financial Statement AnalysisReza Muhammad100% (2)

- Chapter 1.PAS 1 - Presentation of Financial StatementsDocument29 pagesChapter 1.PAS 1 - Presentation of Financial StatementsJohnmichael CorozaNo ratings yet

- Syllabus For Investment Analysis and Portfolio ManagementDocument5 pagesSyllabus For Investment Analysis and Portfolio Managementవెంకటరమణయ్య మాలెపాటి0% (1)

- SyllabusDocument3 pagesSyllabusOffice AcadNo ratings yet

- IAS 7 Statement of Cash FlowsDocument28 pagesIAS 7 Statement of Cash FlowsEynar MahmudovNo ratings yet

- IFRS Chapter - 21 Statements of Cash FlowsDocument35 pagesIFRS Chapter - 21 Statements of Cash FlowsKaran DayrothNo ratings yet

- L03 - TS - Properties, Derivation and TheoriesDocument19 pagesL03 - TS - Properties, Derivation and TheoriesantoineNo ratings yet

- Competition and Business Strategy in Historical Perspective: Pankaj GhemawatDocument38 pagesCompetition and Business Strategy in Historical Perspective: Pankaj GhemawatDongelxNo ratings yet

- Conrail Questions BanksBankruptcy 2016Document1 pageConrail Questions BanksBankruptcy 2016antoineNo ratings yet

- MerrillLynch DEFM14A 20081103Document216 pagesMerrillLynch DEFM14A 20081103antoineNo ratings yet

- VikalpaDocument2 pagesVikalpaantoineNo ratings yet

- Excercise - TBDocument2 pagesExcercise - TBammadey21@gmail.comNo ratings yet

- Ent 2 UaceDocument4 pagesEnt 2 UacedanielzashleybobNo ratings yet

- DSS02 Manage Service Requests and Incidents - Icq - Eng - 1214Document28 pagesDSS02 Manage Service Requests and Incidents - Icq - Eng - 1214LorenzoNo ratings yet

- Sample Quiz 1 KeyDocument6 pagesSample Quiz 1 KeyHammadJavaid ConceptNo ratings yet

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Acfn 2011 Chapter One Introduction To Accounting & Business: Seek Wisdom, Elevate Your Excellence & Serve HumanityDocument74 pagesAcfn 2011 Chapter One Introduction To Accounting & Business: Seek Wisdom, Elevate Your Excellence & Serve HumanityMikias Bekele100% (1)

- SABIC Intrinsic ValueDocument3 pagesSABIC Intrinsic ValueAnonymous rOv67RNo ratings yet

- Work SheetDocument5 pagesWork SheetkebronNo ratings yet

- R Pcpar Government AccountingDocument11 pagesR Pcpar Government Accountingdoora keys100% (1)

- 5 Supply Chain Management and Customer ServiceDocument42 pages5 Supply Chain Management and Customer ServiceSandeep SonawaneNo ratings yet

- Fixed Asset Process Control QuestionnaireDocument2 pagesFixed Asset Process Control QuestionnaireSwathi Dutta50% (2)

- Week 2-Basic Cost ManagementDocument21 pagesWeek 2-Basic Cost ManagementRichard Oliver CortezNo ratings yet

- Course Contents - MARKETING MANAGEMENT BBA - OLD CAMPUSDocument3 pagesCourse Contents - MARKETING MANAGEMENT BBA - OLD CAMPUSJuanid masoodNo ratings yet

- TQ For FABM 1 (Midterm)Document5 pagesTQ For FABM 1 (Midterm)SHIERY MAE FALCONITINNo ratings yet

- BeckerDocument30 pagesBeckerRanie Syafiqah JafferieNo ratings yet

- Financial Statement 2014Document355 pagesFinancial Statement 2014Akmal Idrus100% (1)

- Micro - Economies and Diseconomies of ScaleDocument9 pagesMicro - Economies and Diseconomies of ScaleTanvi ShahNo ratings yet

- Bank and NBFC - MehalDocument38 pagesBank and NBFC - Mehalsushrut pawaskarNo ratings yet

- Porter's Five Forces PDFDocument10 pagesPorter's Five Forces PDFAniketKulkarniNo ratings yet

- Model Exam 1Document25 pagesModel Exam 1rahelsewunet0r37203510No ratings yet

- Finalcial Capital BudgetingDocument17 pagesFinalcial Capital BudgetingVijay KumarNo ratings yet

- Patagonia - Marketing PlanDocument26 pagesPatagonia - Marketing Plantrangiabao0% (1)

- Demand AssigmentDocument11 pagesDemand AssigmentPiyush PãlNo ratings yet

- Special JournalsDocument9 pagesSpecial JournalsnikNo ratings yet

- MM Tables in Sap MMDocument59 pagesMM Tables in Sap MMIshan Patel100% (1)

- Worksheet Chapter 5Document3 pagesWorksheet Chapter 5Hesham AbdallaNo ratings yet

- Assignment 1Document2 pagesAssignment 1mayen DauNo ratings yet

- Final Exam 10Document15 pagesFinal Exam 10Nadira RoslanNo ratings yet

- Vidhyoday - BCK Revision ChartsDocument21 pagesVidhyoday - BCK Revision Chartsmishrakumkum526No ratings yet

- Far Eastern Univrsity Cost Accounting CanvassDocument8 pagesFar Eastern Univrsity Cost Accounting CanvassSharmaine FranciscoNo ratings yet