Professional Documents

Culture Documents

Show All Work To Receive Credit On Each Problem. If No Work Is Provided, No Credit Can Be Given. Label The Answers

Uploaded by

Shrey MangalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Show All Work To Receive Credit On Each Problem. If No Work Is Provided, No Credit Can Be Given. Label The Answers

Uploaded by

Shrey MangalCopyright:

Available Formats

Math with Business Applications

Exam 3 (Written Portion)

20 points possible

Version 2

Name________________________________________

Show all work to receive credit on each problem. If no work is provided, no credit

can be given. Label the answers.

1. (3 pts) A tablet notebook sells for $384. Find the dollar markup and the cost of the

tablet, if it is marked up 200% on cost.

2. (3 pts) An i-clicker is marked up $48 by a book store. Calculate the cost and the

selling price of the i-clicker, if it is marked up 60% on selling price.

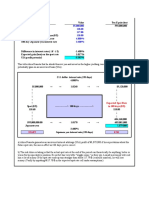

3. On April 2, you purchased 8 cartons of Jelly Belly jelly beans; each carton contains

24 bags of candy. The list price per carton is $24. You also purchased 12 cartons of

Cadbury Crme Eggs; each carton contains 48 eggs individually wrapped for resale.

The list price per carton is $16. You are offered a 20/15 chain discount and cash

terms of 3/10 EOM.

(a) (2 pts) Fill in the purchase invoice below.

Quantity Item Description

Unit List

Unit Net

Subtotal

Amount Due

(b) (1 pt) What is the last day of the discount period?

(c) (1 pt) What is the last day of the credit period?

(d) (2 pt) If you pay your bill on May 5, what is the amount due?

Math with Business Applications

Exam 3 (Written Portion)

20 points possible

Version 2

4. (3 pts) The Cadbury Crme Eggs you purchased in #3 always fly off the shelves; in

the past, you have always sold out of them by Easter. Assuming this is true, find

the selling price for the Cadbury Crme Eggs in your store. In the candy section,

you markup 80% on selling price. Remember to pass along the savings of the cash

discount to your customers.

5. retailer purchases flashlights for $8 apiece, after a 50% trade discount and a 5%

cash discount were applied. The retailer marks up everything in the hardware

section by 125% of cost for operating expenses and another 75% of cost for profit.

(a) (1 pts) What was the unit net price of the flashlight?

(b) (1 pts) What was the unit list price of the flashlight?

(c) (1 pts) What is the retailers target selling price?

(d) (1 pts) Assume that the flashlight is sold during a 25% off sale. What is the sale

price?

(e) (1 pts) Profit is the difference between sales, inventory costs and operating

expenses. Did the retailer make a profit or a loss on the flashlight? Calculate

the profit/loss on the sale price of the flashlight.

Math with Business Applications

Exam 3 (Written Portion)

20 points possible

Version 2

6. Create a sample promissory note: The Example is as follows:

Promissory Note

For value received, XYZ Corporation promises to pay $50,000 to ABC Bank on March 1,

2017 along with interest of 6% interest due at the time of payment. This agreement is

dated November 14, 2016.

Signed XYZ Corporation

On December 15, a payment of $10,000 will be made to ABC Bank.

Interest accrued to date: 50,000(.06)(31/360) = $258.33

Adjusted balance due on Dec 15: 50,000 + 258.33 = $50,258.33

Balance Due after Payment: 50258.33 - 10,000 = $40,258.33

On February 1, 2017, a payment of $15,000 will be made.

Interest accrued to date: 40258.33(.06)(48/360) = $322.07

Adjusted balance due on Feb 1: 40258.33 + 322.07 = $40,580.40

Balance Due after Payment: 40580.40 - 15000 = $25,580.40

On the promissory note's due date, March 1, the final payment is due.

Interest accrued to date: 25,580.40(.06)(28/360) = $119.38

Adjusted balance due on Mar 1: 25580.40 + 119.38 = $25,699.78

Balance due after final payment: 25,699.78 - 25,699.78 = $0

Balance paid in full!

Then, give a payment schedule involving a minimum of three payments: two partial

payments and a final payment. Apply the U.S. Rule.

For full credit, you must:

State the face value, interest rate and maturity date of the short-term (less than one

year) note, along with a proposed partial payment schedule.

Show all of your work for each of the two partial payments, including the calculation

of interest due and adjusted principal balance.

Calculate the note's final payment due on the maturity date.

You might also like

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- 2-200-97A Workbook With Solutions - Midterm - MAJ 20 Août 2017Document38 pages2-200-97A Workbook With Solutions - Midterm - MAJ 20 Août 2017Aya AzanarNo ratings yet

- CH 003 HWKDocument11 pagesCH 003 HWKdwm1855100% (1)

- 547f68fde4b029305d9c1f1c Twolsey5 1417636145991 ConsumermathafinalexamstudyguideDocument12 pages547f68fde4b029305d9c1f1c Twolsey5 1417636145991 Consumermathafinalexamstudyguidewoodlandsoup70% (1)

- QRB 501 Week 3 Learning Team Case StudiesDocument11 pagesQRB 501 Week 3 Learning Team Case StudiesDJNo ratings yet

- End Term Business Statistics Sec D E FDocument6 pagesEnd Term Business Statistics Sec D E Fdeliciousfood463No ratings yet

- Taxes, Tips, and DiscountsDocument11 pagesTaxes, Tips, and DiscountsMr. PetersonNo ratings yet

- FIN500 Excel Assignment 1Document18 pagesFIN500 Excel Assignment 1Magdalena SimicNo ratings yet

- Month Sales Comm Rate Tot Comm Compound Annual Growth Rate CalculationsDocument13 pagesMonth Sales Comm Rate Tot Comm Compound Annual Growth Rate CalculationsHimanshu KashyapNo ratings yet

- CM SampleExam 2Document10 pagesCM SampleExam 2sarahjohnsonNo ratings yet

- Assignment DSDocument1 pageAssignment DSbitupatel.aprNo ratings yet

- CODES Sections of The Bubble SheetDocument6 pagesCODES Sections of The Bubble SheetAliImranNo ratings yet

- Foundations of Finance - Final Prac Exam 1Document12 pagesFoundations of Finance - Final Prac Exam 1xuechengbo0502No ratings yet

- ACCT 7004 Exam F2022 TemplateDocument17 pagesACCT 7004 Exam F2022 TemplateJesse DanielsNo ratings yet

- Fundamentals of Business Mathematics in Canada CANADIAN EDITION Canadian 1st Edition Jerome Test Bank 1Document64 pagesFundamentals of Business Mathematics in Canada CANADIAN EDITION Canadian 1st Edition Jerome Test Bank 1elizabeth100% (46)

- Freshfiles - On Farm BakeryDocument14 pagesFreshfiles - On Farm BakerygjuddyNo ratings yet

- BUS MATH Q3 L6. SLeM - 2S - Q3 - W6 - MARKUP MARKDOWN MARKONDocument14 pagesBUS MATH Q3 L6. SLeM - 2S - Q3 - W6 - MARKUP MARKDOWN MARKONSophia MagdaraogNo ratings yet

- Lococos Katherina MidtermDocument22 pagesLococos Katherina Midtermapi-237105574No ratings yet

- Business Mathematics - Module 5 - Mark On Mark Up and MarkdownDocument15 pagesBusiness Mathematics - Module 5 - Mark On Mark Up and MarkdownRenmel Joseph PurisimaNo ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Carroll MableNo ratings yet

- Chapter 11Document5 pagesChapter 11Arr ZoneNo ratings yet

- Assignment B - Calculating Individual and Cumulative Markups 7Document4 pagesAssignment B - Calculating Individual and Cumulative Markups 7api-513411115No ratings yet

- Stocks Question and AnswersDocument6 pagesStocks Question and AnswersIrfan ShakeelNo ratings yet

- FIN 4610 HW 3Document19 pagesFIN 4610 HW 3Michelle Lam50% (2)

- FINA 2330 Assignment 5Document4 pagesFINA 2330 Assignment 5rebaNo ratings yet

- Chapter Review Problems: Unit 5.1 Trade DiscountsDocument4 pagesChapter Review Problems: Unit 5.1 Trade DiscountsJaccaNo ratings yet

- Name: Student ID: DOB: . (X Month) Tittle: No. Name - Student ID - (Ex: 02. Dang Quynh Anh - 11204255 - )Document2 pagesName: Student ID: DOB: . (X Month) Tittle: No. Name - Student ID - (Ex: 02. Dang Quynh Anh - 11204255 - )Hà NguyễnNo ratings yet

- The Uthred Company A Merchandising Firm Has P...Document3 pagesThe Uthred Company A Merchandising Firm Has P...Md Rifat Motaleb100% (1)

- Individual Case:Business Memo AssignmentDocument6 pagesIndividual Case:Business Memo AssignmentNathan MustafaNo ratings yet

- Practice Midterm 1Document3 pagesPractice Midterm 1stargearNo ratings yet

- (Solved) - Save Lot Retailers The Following Table Shows Financial Data (Year... - (1 Answer) - TransDocument7 pages(Solved) - Save Lot Retailers The Following Table Shows Financial Data (Year... - (1 Answer) - Transkumar n0% (1)

- Packet 9: Discounts and Sales Tax: Method 1 Method 2Document9 pagesPacket 9: Discounts and Sales Tax: Method 1 Method 2cairo861No ratings yet

- Chap 003Document12 pagesChap 003charlie simoNo ratings yet

- Lesson 7: Markup and Markdown Problems: Student OutcomesDocument4 pagesLesson 7: Markup and Markdown Problems: Student OutcomesJoan BalmesNo ratings yet

- Lesson 7: Markup and Markdown Problems: Student OutcomesDocument4 pagesLesson 7: Markup and Markdown Problems: Student OutcomesJoan BalmesNo ratings yet

- 2015 PDFDocument4 pages2015 PDFRishneel DeoNo ratings yet

- The Campus Bookstore at East Tennessee State University Must Decide How Many Economics TextbooksDocument12 pagesThe Campus Bookstore at East Tennessee State University Must Decide How Many Economics TextbooksSantanu DasmahapatraNo ratings yet

- Corporate Finance Assignment Questions PDFDocument5 pagesCorporate Finance Assignment Questions PDFPaul NdegNo ratings yet

- CE F3i 001 PDFDocument24 pagesCE F3i 001 PDFhayarpiNo ratings yet

- Jollibee Foods-WPS OfficeDocument2 pagesJollibee Foods-WPS OfficeAramina Cabigting BocNo ratings yet

- Finance OverviewDocument19 pagesFinance OverviewyomoNo ratings yet

- Finance ExamplesDocument15 pagesFinance ExamplescherifsambNo ratings yet

- FINA2303 2018-2019 Fall Quiz SolutionsDocument5 pagesFINA2303 2018-2019 Fall Quiz SolutionsSin TungNo ratings yet

- Premiums and WarrantyDocument8 pagesPremiums and WarrantyMarela Velasquez100% (2)

- Test Bank - Chapter 13Document10 pagesTest Bank - Chapter 13Jihad NakibNo ratings yet

- Question 1 (3 Points) :: Need To Show All Your Steps and Explain Your AnswerDocument2 pagesQuestion 1 (3 Points) :: Need To Show All Your Steps and Explain Your AnswerBE ACCOUNTANTNo ratings yet

- Chapter 4 Tutorial QuestionsDocument9 pagesChapter 4 Tutorial QuestionsThinagaran Mahendran100% (1)

- CVP Review QuestionsDocument6 pagesCVP Review QuestionsCharlie True FriendNo ratings yet

- Assignment Print View06Document6 pagesAssignment Print View06arnbookNo ratings yet

- From The Following Forecasts of Income and Expenditure, Prepare A Cash Budget For Three Months Commencing - Brainly - inDocument4 pagesFrom The Following Forecasts of Income and Expenditure, Prepare A Cash Budget For Three Months Commencing - Brainly - inkillarsubigarNo ratings yet

- Heep209 PDFDocument28 pagesHeep209 PDFAjiteshPaddaNo ratings yet

- Third Form ProjectDocument3 pagesThird Form ProjectMacheala HansonNo ratings yet

- The Box MethodDocument9 pagesThe Box MethodDiyonata KortezNo ratings yet

- Problem Set #2: ECO380 Markets, Competition, and StrategyDocument7 pagesProblem Set #2: ECO380 Markets, Competition, and StrategyChristina ZhangNo ratings yet

- QUIZ 8.docx EditDocument18 pagesQUIZ 8.docx EditSaeym Segovia100% (1)

- Selected LP Apps Handouts 3 PDFDocument88 pagesSelected LP Apps Handouts 3 PDFcarlette110% (1)

- SHL Numerical Test GuideDocument14 pagesSHL Numerical Test Guideobaid naser100% (1)

- Cashing in on Credit Cards: Scott A. Wheeler, Rt(R)(Mr)(Ct)From EverandCashing in on Credit Cards: Scott A. Wheeler, Rt(R)(Mr)(Ct)Rating: 4.5 out of 5 stars4.5/5 (4)

- Standard DistributionDocument1 pageStandard DistributionShrey MangalNo ratings yet

- AkiraDocument1 pageAkiraShrey MangalNo ratings yet

- 0.001 7.863 That There Is Significant Variance Between The ThreeDocument1 page0.001 7.863 That There Is Significant Variance Between The ThreeShrey MangalNo ratings yet

- GroupXX Assign4Document5 pagesGroupXX Assign4Shrey MangalNo ratings yet

- LIQUIDITYDocument1 pageLIQUIDITYShrey MangalNo ratings yet

- UuDocument1 pageUuShrey MangalNo ratings yet

- 14Document3 pages14Shrey MangalNo ratings yet

- HarkerDocument4 pagesHarkerShrey MangalNo ratings yet

- Office Building, or A Warehouse. The Future States of Nature That Will Determine The Profits Payoff Table For This Decision Problem Is Given BelowDocument1 pageOffice Building, or A Warehouse. The Future States of Nature That Will Determine The Profits Payoff Table For This Decision Problem Is Given BelowShrey MangalNo ratings yet

- 15 Multiple ChoicesDocument7 pages15 Multiple ChoicesShrey MangalNo ratings yet

- 5 45Document2 pages5 45Shrey MangalNo ratings yet

- Proble M Number Solution: Answer SheetDocument11 pagesProble M Number Solution: Answer SheetShrey MangalNo ratings yet

- EquationDocument1 pageEquationShrey MangalNo ratings yet

- Enterprise Zones 2Document2 pagesEnterprise Zones 2Shrey MangalNo ratings yet

- Sunset Boards Case StudyDocument3 pagesSunset Boards Case StudyMeredith Wilkinson Ramirez100% (2)

- 13 15Document4 pages13 15Shrey Mangal0% (1)

- 1Document2 pages1Shrey Mangal0% (1)

- Bsbsus501a As 1Document12 pagesBsbsus501a As 1Shrey Mangal29% (7)

- 1Document2 pages1Shrey MangalNo ratings yet

- 2 - Ch12 CrustalDeformation Lab Responses 1 PDFDocument9 pages2 - Ch12 CrustalDeformation Lab Responses 1 PDFShrey Mangal0% (10)

- Budget Variance WorksheetDocument4 pagesBudget Variance WorksheetShrey MangalNo ratings yet

- CHP 9 Case F16Document6 pagesCHP 9 Case F16Shrey MangalNo ratings yet

- コピーC14 01Document3 pagesコピーC14 01Shrey MangalNo ratings yet

- CH 13 ProbsDocument8 pagesCH 13 ProbsShrey MangalNo ratings yet

- M1Document2 pagesM1Shrey MangalNo ratings yet

- Statistics QuestionDocument1 pageStatistics QuestionShrey MangalNo ratings yet

- Quiz 6Document3 pagesQuiz 6Shrey MangalNo ratings yet

- HomeworkDocument6 pagesHomeworkShrey MangalNo ratings yet

- 1Document5 pages1Shrey MangalNo ratings yet

- Ghani Glass 2007Document39 pagesGhani Glass 2007Muhammad BilalNo ratings yet

- Chapter 6-Asset ManagementDocument22 pagesChapter 6-Asset Managementchoijin987No ratings yet

- ASIC Supervision of Markets and Participants: January To June 2013Document25 pagesASIC Supervision of Markets and Participants: January To June 2013AndrewSaksNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Leadership:: You're Doing It WrongDocument9 pagesLeadership:: You're Doing It WrongOaNa MironNo ratings yet

- ForecastingDocument4 pagesForecastingAde FauziNo ratings yet

- Kobetsu Kaizen: Maintenance ManagementDocument34 pagesKobetsu Kaizen: Maintenance ManagementMohammed Rushnaiwala100% (1)

- Unilever: AssignmentDocument8 pagesUnilever: AssignmentVishal RajNo ratings yet

- Henkel: Building A Winning Culture: Group 09Document11 pagesHenkel: Building A Winning Culture: Group 09sheersha kkNo ratings yet

- Business PlanDocument18 pagesBusiness Plandua maqsoodNo ratings yet

- CV-JM Van StraatenDocument5 pagesCV-JM Van StraatenJovan Van StraatenNo ratings yet

- SAL ReportDocument130 pagesSAL ReportjlolhnpNo ratings yet

- A Buyers Guide To Treasury Management SystemsDocument28 pagesA Buyers Guide To Treasury Management Systemspasintfi100% (1)

- SiaHuatCatalogue2017 2018Document350 pagesSiaHuatCatalogue2017 2018Chin TecsonNo ratings yet

- 2670 La Tierra Street, Pasadena - SOLDDocument8 pages2670 La Tierra Street, Pasadena - SOLDJohn AlleNo ratings yet

- Project Finance and Equator PrinciplesDocument8 pagesProject Finance and Equator PrinciplesSushma Jeswani TalrejaNo ratings yet

- Starvation Peak - Practice PaperDocument1 pageStarvation Peak - Practice Paperkashvisharma4488No ratings yet

- HR Presentation On RecruitmentDocument10 pagesHR Presentation On RecruitmentSaurav MukherjeeNo ratings yet

- Harden V. Benguet Consolidated Mining Company (G.R. No. L-37331, March 18, 1933)Document7 pagesHarden V. Benguet Consolidated Mining Company (G.R. No. L-37331, March 18, 1933)Rizza TagleNo ratings yet

- Vodafone Idea EFE, IFE, CPM Analysis: Strategic Management Quiz-1Document5 pagesVodafone Idea EFE, IFE, CPM Analysis: Strategic Management Quiz-1Faraaz Saeed100% (1)

- Director of Forestry Vs MunozDocument1 pageDirector of Forestry Vs MunozLiliaAzcarragaNo ratings yet

- Promotional Campaign On JOLLYBEE in BangladeshDocument38 pagesPromotional Campaign On JOLLYBEE in BangladeshTasnia Ahsan AnikaNo ratings yet

- Chapter 22 - Retained EarningsDocument8 pagesChapter 22 - Retained EarningsOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Key Odds WizardDocument1 pageKey Odds Wizardapi-3871338100% (1)

- David PortfolioDocument39 pagesDavid PortfolioKaziKwanguNo ratings yet

- Department of Labor: 2005 05 27 17 FLSA ShiftsDocument2 pagesDepartment of Labor: 2005 05 27 17 FLSA ShiftsUSA_DepartmentOfLaborNo ratings yet

- Bidder's Checklist of Requirements For Its Bid, Technical ProposalsDocument2 pagesBidder's Checklist of Requirements For Its Bid, Technical ProposalsJoseph Santos GacayanNo ratings yet

- Employment Application Form - Ver2 (1) .0Document7 pagesEmployment Application Form - Ver2 (1) .0ranjithsutariNo ratings yet

- Official Receipt PDFDocument1 pageOfficial Receipt PDFJohn Rey CastillanoNo ratings yet

- Sp12 General Probability ProblemsDocument5 pagesSp12 General Probability ProblemsRID3THELIGHTNINGNo ratings yet