Professional Documents

Culture Documents

Standalone Financial Results For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

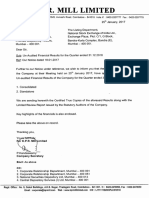

To

National Stock Exchange of India Limited

Exchange Plaza, 5th Floor

Plot No.C/1, G Block

Bandra Kurla Complex

Bandra (E)

Mumbai 400 051

The Bombay Stock Exchange Limited

Phiroze Jeejeebhoy Towers

Dalal Street

Mumbai 400 023

14th November, 2016

Dear Sirs,

Sub: Financial Results for the Quarter and Half-Year

ended 30th September, 2016

***

Pursuant to Regulation 33 of SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015, we are sending herewith the Unaudited Financial

Results of our Company for the Quarter and Half-Year ended 30th September, 2016

placed before the Audit Committee and approved by the Board of Directors in their

meeting held on 14th November, 2016.

The Board Meeting commenced at 2.30 p.m. and concluded at 8.00 p.m.

We are arranging for publication of the above financial results in the Newspapers.

The financial results will also be available on the website of the Company

www.easunreyrolle.com.

Please take the same on your record.

Yours faithfully

for Easun Reyrolle Limited

Sudhir Anand

Head Legal & Company Secretary

CIN NO.L31900TN1974PLC006695

EASUN REYROLLE LTD.

No.98, Sipcot Industrial Complex, Hosur 635 126, India

Tel: +91 4344 276995, 401 600-602 Fax: +91 4344 276397 Email: hosur@easunreyrolle.com

Regd. Office: Temple Tower, VI Floor, 672, Anna Salai, Nandanam, Chennai 600 035, India Website: www.easunreyrolle.com

Easun Reyrolle Limited

Registered Office : "Temple Tower", VI Floor, 672 Anna Salai,

Nandanam, Chennai - 600 035

CIN: L31900TN1974PLC006695

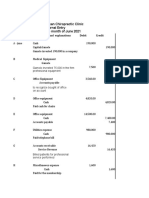

Statement of Standalone Financial Results for the Quarter and half year ended 30th September, 2016

Rs. In Lakhs

3 Months ended

Sl.

No.

Particulars

1 Income from Operations

a) Net Sales / Income from Operations (Net of Excise Duty)

b) Other Operating Income

c) Total income from Operations (Net)

2 Expenses

a) Cost of Materials Consumed

b) Purchase of Stock-in-trade

c) Changes in inventories of Finished Goods,

Work-in-progress and Stock-in-trade

d) Employee Benefit Expenses

e) Depreciation and Amortisation Expenses

f) Other Expenses

Total Expenses

Profit/(Loss) from Operations before Other Income, Finance

3

Costs and Exceptional Items (1-2)

4 Other Income

Profit/(Loss) from Ordinary Activities before Finance Cost &

5

Exceptional Items (34)

6 Finance Cost

7 Profit/(Loss) from Ordinary Activities after Finance Costs but

before Exceptional Items (5 6)

8 Exceptional items

9 Profit/(Loss) from ordinary activities before tax (7 8)

10 Tax Expense

11 Net Profit / (Loss) from Ordinary Activities after Tax (9 10)

12 Extraordinary Items (Net of Tax Expense)

13 Net Profit/(Loss) for the Period (11 12)

14 Paid-up Equity Share Capital (Face Value Rs.2)

15 Reserves excluding Revaluation Reserves

(as per Balance Sheet of Previous Accounting Year)

Earnings Per Share (before Extraordinary Items) of Rs.2 each)

16 i

(Not Annualised)

a) Basic

b) Diluted

16 ii Earnings Per Share (after Extraordinary Items) of Rs.2 each)

(Not Annualised)

a) Basic

b) Diluted

Half-Year Ended

30.09.2016 30.06.2016 30.09.2015 30.09.2016 30.09.2015

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

Year Ended

31.03.2016

(Audited)

970.59

1.87

972.46

619.18

87.92

707.10

906.34

54.78

961.12

1,589.77

89.79

1,679.56

2,041.75

158.22

2,199.97

462.09

421.92

-

519.38

-

884.01

1,192.33

-

2043.15

-

(18.41)

297.75

138.14

165.85

1,045.42

(96.51)

354.77

158.14

247.17

1,085.49

(114.92)

652.52

296.28

413.02

2,130.91

83.49

769.89

346.60

569.11

2,961.42

60.36

1157.97

730.91

1134.85

5,127.24

(72.96)

(378.39)

-

(374.72)

-

(451.35)

(761.45)

-

(954.21)

-

(72.96)

822.79

(378.39)

715.84

(374.72)

693.22

(451.35)

1,538.63

(761.45)

1,271.85

(954.21)

2,731.72

(895.75)

(1,067.94)

(203.27)

(1,271.21)

(1,271.21)

(1,271.21)

615.88

-

(1,989.98)

78.85

(2,068.83)

(895.75)

615.88

-

(1,094.23)

78.85

(1,173.08)

(1,173.08)

(1,173.08)

615.88

-

(2,068.83)

615.88

-

(2,033.30)

(388.88)

(2,422.18)

(2,422.18)

(2,422.18)

615.88

-

(3,685.93)

801.45

(4,487.38)

(4,487.38)

(4,487.38)

615.88

15,526.93

(7.71)

(7.71)

(3.81)

(3.81)

(7.87)

(7.87)

(6.72)

(6.72)

(7.87)

(7.87)

(14.57)

(14.57)

(7.71)

(7.71)

(3.81)

(3.81)

(7.87)

(7.87)

(6.72)

(6.72)

(7.87)

(7.87)

(14.57)

(14.57)

(895.75)

(895.75)

24.37

396.05

173.65

222.39

1,335.84

(2,068.83)

3,503.61

669.42

4,173.03

STATEMENT OF ASSETS AND LIABILITIES

Rs. In lakhs

Particulars

EQUITY AND LIABILITIES

Shareholders' funds

(a) Share Capital

(b) Reserves & Surplus

(c) Money received against share warrants

Sub-total - Shareholders' funds

Share application money pending allotment

Minority Interest*

Foreign Currency Monetary transaction Reserve

Non-current liabilities

(a) Long-term borrowings

(b) Deferred tax liabilities (net)

(c) Other long term liabilities

(d) Long-term provisions

Sub-total - Non-current liabilities

Current liabilities

(a) Short-term borrowings

(b) Trade payables

(c) Other current liabilities

(d) Short-term provisions

Sub-total - Current liabilities

TOTAL - EQUITY AND LIABILITIES

ASSETS

Non-current assets

(a) Fixed assets

(b) Goodwill on consolidation*

(c) Non-current investments

(d) Long-term loans and advances

(e) Other non-current assets

Sub-total - Non-current assets

Current assets

(a) Current Investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

(f) Other current assets

2

3

4

B

1

Sub-total - Current assets

TOTAL ASSETS

Half-Year

Ended

30.09.2016

(Unaudited)

615.88

13,560.34

14,176.22

Year Ended

31.03.2016

(Audited)

615.88

15,526.93

16,142.81

-

4,176.23

60.68

4,236.91

4,176.23

49.68

4,225.91

20,682.83

8,224.06

9,447.04

163.09

38,517.02

56,930.15

17,724.47

12,692.02

8,468.78

163.09

39,048.36

59,417.08

7,649.49

15,502.10

3,651.94

469.12

27,272.65

7,937.87

15,502.10

3,666.36

181.79

27,288.12

3,614.85

17,506.42

137.10

8,368.78

30.35

3,712.55

20,405.73

423.57

7,551.17

35.94

29,657.50

56,930.15

32,128.96

59,417.08

Note:

1.The above Standalone Financial Results were reviewed and recommended by the Audit Committee and approved by the Board of Directors at its Meeting held

on 14th November, 2016

2. The Company is engaged in Power Transmission and Distribution segment and same is being reported.

3.The figures have been re-grouped wherever necessary to conform to current period's classification.

6. The Company had no pending investor complaints as on 30th June, 2016. During the quarter ended 30th September,2016 the Company received 2 compliants

from shareholders and the same has been resolved. There were no investor compliants pending as on 30th September, 2016.

Place : Chennai

Date : 14th November, 2016

Sd/Raj H Eswaran

Managing Director

You might also like

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document1 pageStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333No ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document5 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form B For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Ref: Code No. 530427: Encl: As AboveDocument3 pagesRef: Code No. 530427: Encl: As AboveShyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document2 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Document6 pagesStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Particulars: Form II Operating StatementDocument26 pagesParticulars: Form II Operating StatementvineshjainNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Document8 pagesPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoNo ratings yet

- Investment Checklist PDFDocument4 pagesInvestment Checklist PDFDeepakNo ratings yet

- SBR Pocket NotesDocument32 pagesSBR Pocket Notesfab home100% (1)

- Assignment of Managerial AccountingDocument36 pagesAssignment of Managerial AccountingAlamgir Mohammad TuhinNo ratings yet

- Lecture 1-Introduction To Applied Office AccountingDocument15 pagesLecture 1-Introduction To Applied Office AccountingMary De JesusNo ratings yet

- ACCOUNTANCY+2 B0ardDocument12 pagesACCOUNTANCY+2 B0ardlakshmanan2838No ratings yet

- Boac Edralyn QuizDocument7 pagesBoac Edralyn QuizEdralyn BoacNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfDocument85 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonNo ratings yet

- 1.03 Why Money MattersDocument5 pages1.03 Why Money MattersJosue Lopez ChavarriaNo ratings yet

- Impact of Dividend Policy On Firm Performance: An Empirical Evidence From Pakistan Stock ExchangeDocument7 pagesImpact of Dividend Policy On Firm Performance: An Empirical Evidence From Pakistan Stock ExchangeZeeni KhanNo ratings yet

- AFA 403 Financial ManagementDocument5 pagesAFA 403 Financial ManagementKuljinder SinghNo ratings yet

- Accounting For Business CombinationsDocument52 pagesAccounting For Business CombinationsEliza BethNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial PositionRachelle Jose100% (2)

- Boston Chicken, Inc.Document7 pagesBoston Chicken, Inc.Tamar PkhakadzeNo ratings yet

- Solution Manual - Partnership & Corporation, 2014-2015 PDFDocument77 pagesSolution Manual - Partnership & Corporation, 2014-2015 PDFRomerJoieUgmadCultura78% (88)

- TOS-MT-SBCA-ACEFIAR-Fundamentals of Accounting and ReportingDocument3 pagesTOS-MT-SBCA-ACEFIAR-Fundamentals of Accounting and ReportingalexandreabautistaNo ratings yet

- Variable Costing Performance ReportingDocument66 pagesVariable Costing Performance ReportingAaminah BeathNo ratings yet

- Antamina ExcelDocument41 pagesAntamina ExcelRajesh GoelNo ratings yet

- J Sainsbury PLCDocument19 pagesJ Sainsbury PLCOsman IqbalNo ratings yet

- 8 Profit Maximisation TR TC AVG COSTSDocument28 pages8 Profit Maximisation TR TC AVG COSTSEsha ChaudharyNo ratings yet

- Estimation of Doubtful AccountsDocument3 pagesEstimation of Doubtful AccountsClar AgramonNo ratings yet

- Accounting CH 5Document32 pagesAccounting CH 5Nguyen Dac ThichNo ratings yet

- Advanced Corporate Finance I Valuation: Class 3 Capital Budgeting & Project FCF Examples Professor Janis SkrastinsDocument23 pagesAdvanced Corporate Finance I Valuation: Class 3 Capital Budgeting & Project FCF Examples Professor Janis SkrastinsAdam StylesNo ratings yet

- Final Examination in Accounting For Business CombinationDocument9 pagesFinal Examination in Accounting For Business CombinationJasmin Dela CruzNo ratings yet

- LK Aldo 2018 FixDocument87 pagesLK Aldo 2018 FixDedy Supriatna Haroena100% (1)

- M12 Gitman547280 07 MFBrief C12Document91 pagesM12 Gitman547280 07 MFBrief C12JoseeTorresNo ratings yet

- Manufacturing Accounts PowerpointDocument12 pagesManufacturing Accounts PowerpointRaynardo KnightNo ratings yet

- Income TaxationDocument15 pagesIncome TaxationTrixie mae MagdayongNo ratings yet

- Financial Statement: Unit-IiiDocument18 pagesFinancial Statement: Unit-IiiRamesh RengarajanNo ratings yet

- Case Study 1Document3 pagesCase Study 1நானும்நீயும்No ratings yet