Professional Documents

Culture Documents

Islamic Financing

Uploaded by

Micheal Worth0 ratings0% found this document useful (0 votes)

53 views1 pagea quit outline of the course

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta quit outline of the course

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views1 pageIslamic Financing

Uploaded by

Micheal Wortha quit outline of the course

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

INSTRUCTOR:

Madam Shumaila Zeb

COURSE:

Financial Management

SLAMIC FINANCING?

TOPIC:

Presented By:

ISLAMIC

FINANCING

Ammar Ikram

Abdul

Islamic financing refers to the means by which corporations in the Muslim world, including banks and other lending institutions,

raise capital in accordance with Sharia, or Islamic law. Sharia law prohibits- Riba and Investment in Haram businesses.

BASIC DIFFERENCE BETWEEN ISLAMIC FINANCING AND CONVENTIONAL BANKING

ISLAMIC FINANCING

The functions and operating modes of Islamic

banks are based on the principles of Islamic

Shariah.

In the modern Islamic banking system, it has

become one of the service oriented functions

of the Islamic banks to be a zakat collection

centre.

It provides risk sharing between provider of

MODES OF ISLAMIC FINANCING

CONVENTIONAL BANKING

The functions and operating modes of

conventional banks are based on fully

manmade principles.

It does not deal with zakat.

The investor /lender is guaranteed of a

predetermined rate of interest or returns.

A). PARTNERSHIP BASED MODES:

1.

Musharakah is a joint enterprise or partnership structure

with profit/loss sharing implications that is used in Islamic

finance instead of interest-bearing loans. It allows each party

involved in a business to share in the profits and risks

(losses)

Characteristics:

All parties share in capital.

All Parties share profit as well as losses

Profits are distributed as per agreed ratio

Loss is borne by parties as per capital ratio

2.

Mudarabah is a kind of partnership where one partner

(Rab al Mal) contributes capital and the other (Mudarib)

contributes his skills and services to the venture.

Characteristics:

Both share profit in pre-agreed ratio.

Loss is borne by Rab al Mal only, Mudarib loses

his services.

B). TRADE BASED MODES:

1.

Salam is a forward financing transaction, where the financial

institution pays in advance for buying specified assets, which the

seller will supply on a pre-agreed date.

Characteristics

Buyer pays 100 % amount in advance

Purchased product must be quantified, identified and measured

with quality.

Date of delivery, Time, place must be clearly mentioned in

advance.

This mode of financing can be used by the modern banks and

financial institutions, especially to finance the agricultural

sector.

2.

Istisna means asking someone to construct, build or

manufacture an asset. In Islamic finance, istisna' is

generally a long-term contract whereby a party

undertakes to manufacture, build or construct assets,

with an obligation from the manufacturer or producer to

deliver them to the customer upon completion

Characteristics

Not necessary for buyer to pay 100 % amount in

advance.

Price must be decided at the beginning of contract.

Qualities, features of product must be clearly

identified.

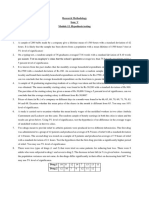

DIFFERENCE BETWEEN SALAM AND ISTISNA:

Salam is ideal for agricultural sector

Advance payment is necessary

Date and time of delivery is important

Salam can be cancelled by one party

Istisna deal with manufacturing items

Advance payment is not necessary

Date and time of delivery is not important

Istisna cannot be cancelled if the production has not started yet

You might also like

- ConclusionDocument57 pagesConclusionAbubakar BakulkaNo ratings yet

- Deposit Mobilization TechniquesDocument8 pagesDeposit Mobilization TechniquesFahad Bhuiyan100% (1)

- Islamic Finance: Issues in Sukuk and Proposals for ReformFrom EverandIslamic Finance: Issues in Sukuk and Proposals for ReformNo ratings yet

- Islamic FinanceDocument31 pagesIslamic FinanceSALEEMNo ratings yet

- Study On Islamic Finance and Products.: Mohammed Saleem .OADocument31 pagesStudy On Islamic Finance and Products.: Mohammed Saleem .OASaleem VettomNo ratings yet

- Assignment No. 2Document6 pagesAssignment No. 2Rehan DhamiNo ratings yet

- IB Solved Assignment 3Document3 pagesIB Solved Assignment 3syed.12727No ratings yet

- Meezan Bank LTDDocument53 pagesMeezan Bank LTDim.abid1No ratings yet

- Study On Islamic Finance and ProductsDocument32 pagesStudy On Islamic Finance and ProductsRaza RizviNo ratings yet

- CH 8.islamic Financial System: DR - Phil.Ninik Sri RahayuDocument19 pagesCH 8.islamic Financial System: DR - Phil.Ninik Sri RahayuCelvin SaputraNo ratings yet

- Concept of Various Islamic Modes of Financing: 2.1.1 Mudarabah As A Mode of FinanceDocument3 pagesConcept of Various Islamic Modes of Financing: 2.1.1 Mudarabah As A Mode of FinancehudaNo ratings yet

- Presented To:: Islamic FinanceDocument31 pagesPresented To:: Islamic FinanceRizwan Bin RafiqNo ratings yet

- Xpress Cash Financing-IDocument15 pagesXpress Cash Financing-ISyirah Che AzizNo ratings yet

- Islamic Banking: A Brief Summary of The IndustryDocument6 pagesIslamic Banking: A Brief Summary of The IndustryAbimbola Adewale MonsurNo ratings yet

- Ch-5 Working Capital Financing of Islamic BankingDocument5 pagesCh-5 Working Capital Financing of Islamic BankingMd AzizNo ratings yet

- Islamic Banking: Deposit ProductsDocument27 pagesIslamic Banking: Deposit ProductsFaizan Ahmed KiyaniNo ratings yet

- Islamic Banking: By: Soukaina Ikbal & Chaimae BenyahyaDocument10 pagesIslamic Banking: By: Soukaina Ikbal & Chaimae BenyahyaKenza HazzazNo ratings yet

- Project Appraisal-Financing ProjectsDocument17 pagesProject Appraisal-Financing ProjectsShailendra ChauhanNo ratings yet

- Banking AssignmentDocument10 pagesBanking AssignmentYarka Buuqa Neceb MuuseNo ratings yet

- Islamic Finance NotesDocument6 pagesIslamic Finance NotesHosea KanyangaNo ratings yet

- Products of Islamic FinanceDocument18 pagesProducts of Islamic FinanceTanveer Shah, MBA Scholar, Institute of Management Studies, UoPNo ratings yet

- Executive Summary: Credit SanctioningDocument18 pagesExecutive Summary: Credit SanctioningMd. Tauhidur Rahman 07-18-45No ratings yet

- Project IBF Submitted To: DR. Sabeen Khurram KhanDocument7 pagesProject IBF Submitted To: DR. Sabeen Khurram KhanSheikh AbdullahNo ratings yet

- Sources and Uses of Funds Islamic BankDocument2 pagesSources and Uses of Funds Islamic BankAkma AseriNo ratings yet

- Rameen Khan 5B.Document18 pagesRameen Khan 5B.Umair FarooquiNo ratings yet

- MAFDocument3 pagesMAFannastasia luyahNo ratings yet

- Lecture-3-Mudaraba As A Mode of Islamic FinanceDocument38 pagesLecture-3-Mudaraba As A Mode of Islamic FinanceJaved AnwarNo ratings yet

- Assignment 2 - FIN 545Document7 pagesAssignment 2 - FIN 545tuna100% (3)

- MurabahaDocument44 pagesMurabahaAnumHashmiNo ratings yet

- FIN 2024 AnswersDocument6 pagesFIN 2024 AnswersBee LNo ratings yet

- IBF BY DaniDocument14 pagesIBF BY DaniDaniyal AwanNo ratings yet

- Islamic Banking Myths and FactsDocument12 pagesIslamic Banking Myths and Factsthexplorer008No ratings yet

- Products and Services Offered by Islamic Banks.Document6 pagesProducts and Services Offered by Islamic Banks.Jaffer J. KesowaniNo ratings yet

- Syahrini Back IssueDocument7 pagesSyahrini Back IssueAnnisa SophiaNo ratings yet

- Special Topics in Banking & Finance CH 8Document15 pagesSpecial Topics in Banking & Finance CH 8karim kobeissiNo ratings yet

- Philosophy of Islamic Banking and FinanceDocument9 pagesPhilosophy of Islamic Banking and FinanceNabeela ShahNo ratings yet

- Modes of Deployment of Fund by Islamic BanksDocument30 pagesModes of Deployment of Fund by Islamic Banksvivekananda Roy100% (1)

- Presentation of Islamic Banking of FinanceDocument18 pagesPresentation of Islamic Banking of FinanceZarlish Naseem RanaNo ratings yet

- Islamic Banking - An Introduction - Split - 1Document3 pagesIslamic Banking - An Introduction - Split - 1ytz007163.comNo ratings yet

- Rehan Dhami Fa16 Bba 151Document5 pagesRehan Dhami Fa16 Bba 151Rehan DhamiNo ratings yet

- Differences Between Islamic Banks & ConventionalDocument3 pagesDifferences Between Islamic Banks & ConventionalBushra KhanNo ratings yet

- Islamic BankingDocument3 pagesIslamic BankingmuneebalamNo ratings yet

- Salient Features of Islamic BankingDocument2 pagesSalient Features of Islamic BankingNoor Hafizah0% (2)

- Islamic Banking Papers and Its Products FullDocument6 pagesIslamic Banking Papers and Its Products FullNur Arif Trisandi SapariNo ratings yet

- Operational Techniques of Islamic BankDocument44 pagesOperational Techniques of Islamic BankShahin RahmanNo ratings yet

- Islamic Banking: Presented by Lakshmi and ShameemDocument21 pagesIslamic Banking: Presented by Lakshmi and ShameemvidyaposhakNo ratings yet

- Chapter # 7 Islamic Banking System: Prof. Dr. Md. Abu SinaDocument38 pagesChapter # 7 Islamic Banking System: Prof. Dr. Md. Abu Sinaabu hussainNo ratings yet

- SukukDocument15 pagesSukuk2345008100% (1)

- Meezan Bank Internship ReportDocument32 pagesMeezan Bank Internship ReportRanaAakashAhmadNo ratings yet

- Islamic Banking System - EditedDocument5 pagesIslamic Banking System - EditedLubaba RazaNo ratings yet

- Islamic BankingpdfDocument6 pagesIslamic BankingpdfMD. IBRAHIM KHOLILULLAHNo ratings yet

- Conventional Bank: This Ideal of Economic Bank May Be A Establishment That Accepts DepositsDocument11 pagesConventional Bank: This Ideal of Economic Bank May Be A Establishment That Accepts DepositsRasheed M IsholaNo ratings yet

- TO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi MamDocument12 pagesTO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi Mamnaina_jageshaNo ratings yet

- Finance New SiDocument5 pagesFinance New SiTheFamous SalmanNo ratings yet

- Islami Bank Fin 464Document8 pagesIslami Bank Fin 464Abid Hasan RomanNo ratings yet

- Diffrence Between Conventional Bank and Islamic BankDocument1 pageDiffrence Between Conventional Bank and Islamic BankChowdhury Mahin Ahmed100% (1)

- Conventional Bank Vs Islamic BankDocument2 pagesConventional Bank Vs Islamic BankSyaii Mohamed100% (2)

- Deductive Vs Inductive LogicsDocument32 pagesDeductive Vs Inductive LogicsMicheal WorthNo ratings yet

- Candia Milk FailedDocument38 pagesCandia Milk FailedMicheal Worth100% (1)

- Report On McdonaldsDocument21 pagesReport On McdonaldsMicheal WorthNo ratings yet

- Services Brandfailuresedited 150519033227 Lva1 App6892Document12 pagesServices Brandfailuresedited 150519033227 Lva1 App6892Micheal WorthNo ratings yet

- Capital Budgeting Techniques - pp13Document53 pagesCapital Budgeting Techniques - pp13Micheal WorthNo ratings yet

- Positive Psychological CapitalDocument5 pagesPositive Psychological CapitalMicheal WorthNo ratings yet

- Management Theory and Practice - Chapter 1 - Session 1 PPT Dwtv9Ymol5Document35 pagesManagement Theory and Practice - Chapter 1 - Session 1 PPT Dwtv9Ymol5DHAVAL ABDAGIRI83% (6)

- BSC Charting Proposal For Banglar JoyjatraDocument12 pagesBSC Charting Proposal For Banglar Joyjatrarabi4457No ratings yet

- AspenTech's Solutions For Engineering Design and ConstructionDocument13 pagesAspenTech's Solutions For Engineering Design and Constructionluthfi.kNo ratings yet

- BRAC Bank Limited - Cards P@y Flex ProgramDocument3 pagesBRAC Bank Limited - Cards P@y Flex Programaliva78100% (2)

- Industrial Relation of LawDocument3 pagesIndustrial Relation of LawArunNo ratings yet

- Tank+Calibration OP 0113 WebsiteDocument2 pagesTank+Calibration OP 0113 WebsiteMohamed FouadNo ratings yet

- Annotated Glossary of Terms Used in The Economic Analysis of Agricultural ProjectsDocument140 pagesAnnotated Glossary of Terms Used in The Economic Analysis of Agricultural ProjectsMaria Ines Castelluccio100% (1)

- A Case Study QuestionsDocument2 pagesA Case Study QuestionsMarrion MostarNo ratings yet

- BBP TrackerDocument44 pagesBBP TrackerHussain MulthazimNo ratings yet

- Payback PeriodDocument32 pagesPayback Periodarif SazaliNo ratings yet

- Practicum ReportDocument30 pagesPracticum ReportCharlie Jhake Gray0% (2)

- What Marketing Strategies Used by Patanjali?: 5 AnswersDocument4 pagesWhat Marketing Strategies Used by Patanjali?: 5 Answerskarthikk09101990No ratings yet

- Xxxxacca Kısa ÖzzetttDocument193 pagesXxxxacca Kısa ÖzzetttkazimkorogluNo ratings yet

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocument21 pagesAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriNo ratings yet

- New ISO 29990 2010 As Value Added To Non-Formal Education Organization in The FutureDocument13 pagesNew ISO 29990 2010 As Value Added To Non-Formal Education Organization in The Futuremohamed lashinNo ratings yet

- Bahan Presentasi - Kelompok 3 - Supply ChainDocument46 pagesBahan Presentasi - Kelompok 3 - Supply ChainpuutNo ratings yet

- Combination Resume SampleDocument2 pagesCombination Resume SampleDavid SavelaNo ratings yet

- Chapter 4 The Market Forces of Supply and DemandDocument76 pagesChapter 4 The Market Forces of Supply and DemandGiang NguyễnNo ratings yet

- Credit Card ConfigurationDocument5 pagesCredit Card ConfigurationdaeyongNo ratings yet

- ASB-Company ProfileDocument10 pagesASB-Company ProfileJie LionsNo ratings yet

- "Now 6000 Real-Time Screen Shots With Ten Country Payrolls With Real-Time SAP Blueprint" For Demo Click HereDocument98 pages"Now 6000 Real-Time Screen Shots With Ten Country Payrolls With Real-Time SAP Blueprint" For Demo Click Herevj_aeroNo ratings yet

- USP Cat Jan-FEB 2013 SandipDocument294 pagesUSP Cat Jan-FEB 2013 SandipNarendra SaiNo ratings yet

- Ccs (Conduct) RulesDocument3 pagesCcs (Conduct) RulesKawaljeetNo ratings yet

- Virata V Wee To DigestDocument29 pagesVirata V Wee To Digestanime loveNo ratings yet

- SCADocument14 pagesSCANITIN rajputNo ratings yet

- A KariozenDocument4 pagesA Kariozenjoseyamil77No ratings yet

- Real Options and Other Topics in Capital BudgetingDocument24 pagesReal Options and Other Topics in Capital BudgetingAJ100% (1)

- Module 12. Worksheet - Hypothesis TestingDocument3 pagesModule 12. Worksheet - Hypothesis TestingShauryaNo ratings yet

- Corrección Miro - Zrepmir7Document19 pagesCorrección Miro - Zrepmir7miguelruzNo ratings yet

- CH3Document4 pagesCH3Chang Chun-MinNo ratings yet