Professional Documents

Culture Documents

Stock Watson

Uploaded by

Alfredo MenesesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Watson

Uploaded by

Alfredo MenesesCopyright:

Available Formats

TestingforCommon Trends

JAMESH. STOCK and MARKW. WATSON*

Cointegrated

multipletimeseriesshareat leastone commontrend.Two testsare developedforthenumberof common

drift.Bothtestsinvolvethe

timeserieswithand without

in a multiple

stochastic

trends(i.e., fortheorderofcointegration)

lag. Criticalvaluesforthe

theseriesontoitsfirst

matrix

obtainedbyregressing

leastsquarescoefficient

rootsoftheordinary

in a MonteCarlostudy.Economictimeseriesareoftenmodeledas havinga

andtheirpoweris examined

testsaretabulated,

a stochastic

trend.Butbothcasualobservation

as containing

or (equivalently)

representation,

unitrootintheirautoregressive

If each

trendsso thattheyare cointegrated.

containthesamestochastic

suggestthatmanyseriesmight

and economictheory

thenthevectorrepresentation

trends,

byk < n stochastic

ofn seriesis integrated

oforder1 butcan be jointlycharacterized

linearcombinations.

Ourproposedtestscanbe viewedalternatively

stationary

oftheseserieshask unitrootsandn - k distinct

or autoregressive

unitrootsofthevector

vectors,

cointegrating

linearly

independent

as testsofthenumber

ofcommon

trends,

thatcertain

The first

test(qf) is developedundertheassumption

similar.

process.Bothoftheproposedtestsareasymptotically

are

and thenuisanceparameters

vectorautoregressive

(VAR) representation,

of theprocesshavea finite-order

components

of a corrected

theeigenvalues

handledby estimating

thisVAR. The secondtest(q,) entailscomputing

samplefirst-order

a sumof theautocovariance

matrices.

Previousresearchers

have

is essentially

wherethecorrection

autocorrelation

matrix,

oforder1. In addition,thetheory

of the

appearto be integrated

foundthatU.S. postwarinterest

rates,takenindividually,

maturities

willbe cointegrated.

Applying

theseteststo postwar

termstructure

impliesthatyieldson similarassetsofdifferent

billratesprovidessupportforthisprediction:

treasury

U.S. data on thefederalfundsrateand thethree-and twelve-month

ratesappearto be cointegrated.

The threeinterest

processes;Multipletimeseries;Unitroots;Yield curve.

Factormodels;Integrated

KEY WORDS: Cointegration;

thatit has m < k commontrends.

againstthealternative

of

ofX, is integrated

It is assumedthateach component

of

combinations

k

linear

but

that

there

are

n

1,

order

(1987)

and

0.

Engle

Granger

of

order

are

integrated

that

X,

oforder(1, 1).

definedsucha processto be cointegrated

are a'X,, thenthe

linearcombinations

If the stationary

vectorsofX,.

columnsof a are termedthecointegrating

then

if

is

cointegrated,

that

showed

and

Granger

Engle

X,

in termsof an error-correction

it has a representation

model,as developedbySargan(1964),Davidson,Hendry,

1. INTRODUCTION

There is considerableempiricalevidencethatmany

macroeconomic

timeseriesare welldescribedbyunivarimovingaverage(ARIMA)

integrated

ate autoregressive

the data producesa seriesthat

models,so differencing

It has beenlessclear

appearsto be covariancestationary.

whattransformation

shouldbe appliedto data used in

models,since(looselyspeaking)thenumber

multivariate

ofunitrootsin a multiple

timeseriesmaybe lessthanthe

univarisumofthenumberofunitrootsintheconstituent

Srba, and Yeo (1978), and others.

series

althougheach univariate

ate series.Equivalently,

an oldernotion

formalizes

The conceptofcointegration

containa stochastic

trend,in a vectorprocessthese thatsomelinearcombinations

might

oftimeseriesvariablesaptrendsmightbe commonto severalofthevaristochastic

whereasothersappearto be almost

pear nonstationary,

ofthese

thenumber

evidenceconcerning

ables.Empirical

to thoselinearcomwhitenoise. Frisch(1934) referred

forseveralreasons.First,an binations

commontrendsis ofinterest

of timeseriesdata withverysmallvariancesas

economicor physicaltheorymightpredictthatthevari- beinggenerated

one ofhisprimary

by"trueregressions";

anda testforthesecommon concernswas withthe "multiplecolinearity"

ablescontaincommontrends,

thatarose

of thetheory.

trendswouldbe a testof thisimplication

(cointewhentherewas morethanone trueregression

thenumber grating

Second,one mightwishto imposeexplicitly

vector)amongthevectorofvariates.Box andTiao

Third,itmight (1977)associatedtheleastpredictable

ofcommontrendswhenmakingforecasts.

linearcombinations

be desirableto specify

a timeseriesmodelin whichall of (i.e., thosewiththeweakestserialdependence)of with

X,

butinwhichthedataare not

thevariablesare stationary,

theydescribed

relationships;"

"stablecontemporaneous

would occur

Such overdifferencing

"overdifferenced."

as characterizing

dy- ma

the mostpredictablerelationships

in termsof thefirstdifferences namic

werethemodelspecified

series.

to

all

of

the

common

growth

of the variables,becausethiswouldignorethe reduced

in

modelscan be represented

formally

Cointegrated

ofthecommontrends.

dimensionality

stochastic

of

common

number

trends,

termsof a reduced

thatan n x 1

We developtestsof thenullhypothesis

Forunivariate

or stationary,

components.

plustransitory,

trends,

stochastic

timeseriesvariableX,hask c n common

models,Beveridgeand Nelson (1981) showedthatany

identified

ARIMA processhasan exactly

integrated

singly

in

which

the

trendis

representation,

trendplustransitory

* JamesH. Stock is AssistantProfessorof PublicPolicy,JohnF. Kenis

covariance

component

a randomwalkandthetransitory

HarvardUniversity,

Cambridge,MA 02138.

nedySchool of Government,

Fountisand Dickey(1986) extendedthisdeMark W. Watson is Associate Professor,Department of Economics, stationary.

NorthwesternUniversity,Evanston, IL 60208. This researchwas supported in part by National Science Foundation Grants SES-84-08797,

SES-85-10289, and SES-86-18984. The authors are gratefulto C. Cavanagh,R. F. Engle, J. Huizinga, J. Patel, C. Plosser, P. C. B. Phillips,

R. Tsay, the referees,and an associate editorforhelpfulsuggestions.

1097

? 1988AmericanStatistical

Association

oftheAmericanStatistical

Association

Journal

and Methods

December1988,Vol.83, No.404,Theory

Joumal ofthe American StatisticalAssociation,December 1988

1098

of (2.1) yields

composition

to vectorautoregressive

(VAR) modelswith stitution

k = 1. In Section2, we providea generalrepresentation

Xt = XO+ ,ut+ C(l)G'112t+ C*(L)Gl/2vt, (2.2)

between

thesemodels,

fork c n. Becauseoftheequivalence

ourproposedtestsfork versusm commontrendscan be where C*(L) = (1 - L)-1(C(L) - C(1)) so that Cj* =

ofn - k versusn ofas testsfortheexistence

thought

Ci. Because a'C(l) = 0 and a'u = 0, it follows

-E'=j,I

that

vectors.

m linearly

independent

cointegrating

Severalspecialcasesofthistesting

problemhavebeen

(2.3)

a'Xt = a'Xo + a'C*(L)GlI2vt.

Zt

considered

elsewhere.

The case thathasreceivedthemost

in (2.1) thatC(L) is 1attention

has been testingfor1 versus0 unitrootsin a Withthe additionalassumption

summable

(Brillinger

1981),C*(L) isabsolutely

univariate

timeseries(e.g., see Dickeyand Fuller1979; summable

Fuller1976;Phillips1987;Solo 1984). In a multivariateand Zt has boundedvariance.

represetting,

a testof k = 1 versusm = 0 was developedby

The cointegrated

processXt has an alternative

in termsof a reducednumberof commonranFountisand Dickey(1986)forprocesseswitha VAR rep- sentation

resentation

withiid normalerrors.Engle and Granger domwalksplus a stationary

This "common

component.

is readilyderivedfrom(2.2). Be(1987) proposedand compareda varietyof testswhenn trends"representation

= k = 2 and the hypothesisof interestis k = 2 versusm cause C(1) has rankk < n, thereis an n x r matrix

H1

= 1. Liketheothertestsinthisliterature,

ifH2 is

ourtestisbased withrankr suchthatC(1)H1 = 0. Furthermore,

to

on therootsoftheestimated

autoregressive

representationan n x k matrixwithrankk and columnsorthogonal

thecolumnsof H1, thenA C(1)H2 has rankk. The n

of thetimeseries.

H = (H1 H2) is nonsingular

and C(1)H = (O

andcommon-trendsx n matrix

Section2 presents

thecointegrated

matrix[Okx(n-k)

ourtesting

representations

ofX,andsummarizes

strategy. A) = ASk,whereSkis thek x n selection

In Sections3 and 4, two testsof k versusm common Ik], whereOkx(n-k) is a k x (n - k) matrixof zeros.In

stochastic

trendsare proposedforthespecialcase thatXO addition,becausea'C(l) = 0 and a' = 0, ,ulies in the

= 0 andtheprocesshasno drift.

# = C(l),u,where

Thesetestsareextended columnspaceofC(1) andcanbe written

and drift

in ,uis an n x 1 vector.Thus(2.2) yieldsthecommon-trends

in Section5 to handlean estimated

intercept

forXt:

The asymptotic

valuesare representation

therelevant

regressions.

critical

tabulatedin Section6, and a smallMonteCarlo experiXt = XO+ C(l)[fit + G112Xt+ C*(L)Gl/2vt

mentinvestigating

the size and powerof thesetestsis

reportedin Section7. The testsare appliedto data on

= Xo + C(1)H[H-1it + H-IG12Xt] + at

ratesin Section8, and ourconclupostwarU.S. interest

= Xo + ATt + at,

Tt = 7r + Tt-1 + Vt,

(2.4)

sionsare summarized

in Section9.

whereat = C*(L)Gl/2vt,cTt= SkH lft + SkHG 1/2Xt,ir

= SkH-l'/,and vt = SkH-1G"12v,.[For a different

deriLet X, denotean n x 1 timeseriesvariablethatis vationofthecommon-trends

(2.4) andfurrepresentation

of order(1, 1). Thatis, each elementofX, therdiscussion,see King, Plosser,Stock,and Watson

cointegrated

ofX,that (1987).] The common-trends

is integrated,

buttherearerlinearcombinations

expressesXt

representation

of Engle and as a linearcombination

are stationary.

We workwithan extension

of k randomwalkswithdriftn,

thatallows plus sometransitory

of cointegration

Granger's(1987) definition

components,

at,,thatare integrated

forpossibledriftin X,. The changein X, is assumedto oforder0.

havethecointegrated

vectormovingaveragerepresenta- The common-trends

providesa converepresentation

tion

inwhichto motivate

ourproposedtests.

nientframework

thecomplications

thatarise

asideforthemoment

Putting

in

(2.2),

a natural

and

time

trend

intercept

from

a

nonzero

j + C(L)et,

AX=

(2.1)

E jjCj <00,

trends

k versusm commonstochastic

approachto testing

j=1

wouldbe to examinethefirst-order

serialcorrelation

mawhereC(z) = X,=oCiziwithC(0) = In(then x n identity trixofXt.BecauseXtis composedofbothintegrated

and

matrix),et is iid withmean 0 and covariancematrixG, L nonintegrated

however,its estimatedfirstcomponents,

is thelag operator,and A 1 - L. C(1) is assumedto orderserialcorrelation

matrix

limiting

has a nonstandard

haverankk < n, so X, is cointegrated;

thatis,thereis an distribution

thatgenerallydependson nuisanceparamn x r matrixa (where r = n - k) such thata'C(1) = 0 etersin complicated

thisdifficulty

we

ways.To mitigate

and a'p = 0. As Engle and Grangerpointedout, this examinefunctions

ofa lineartransofregression

statistics

ofAX,atfrequency formation

matrix

ofXt,denotedby Yt,chosenso thatunderthe

impliesthatthespectral

density

0, (2r)-1C(1)GC(1)', is singular.The columnsof a are nullhypothesis

the firstn - k elementsof Ytare not

thecointegrating

vectorsofX,.

whereasthefinalk elementsof Ytcan be exintegrated,

A representation

forthestationary

linearcombinations pressedin termsofthek separatetrends.Moreprecisely,

and let Y, = DX,, whereD = [a at]', whereat is an n x k

a'Xt is readilyobtainedfrom(2.1). Let vt= G-112et

chosenso thatat'a = 0 and at?at

adopttheconventional

assumption

(e.g., matrixof constants

Xf= zslVs

Dickeyand Fuller1979)thates = 0 (s < 0), andallowXt 'k. The firstn - k elementsof Y,are Z, in (2.3). Let W,

to havea nonrandom

initialvalueXO.Thenrecursive

sub- denotethe finalk integrated

elementsof Y,. It follows

2. THEMODELAND TESTING

STRATEGY

1099

Stock and Watson: Testing forCommon Trends

THE DATA

3. A TESTBASED ON FILTERING

from(2.1) that

inwhichthenuisance

a teststatistic

Thissectionpresents

by assuminga

of theprocessare eliminated

parameters

whereu, = C(L)vt, withC(L) = at'C(L)G112. Combining

Wt.

fortheprocessgenerating

representation

parametric

(2.3) and (2.5),

ofthistestparallelsDickeyandFuller's

The development

fora unitrootin a univariate

(2.6)

(1979) approachto testing

AkYt = ( + F(L)vt,

supposethatAW,has a finitetimeseries.Specifically,

where

so that(2.5) can be rewritten

orderVAR representation

as

(2.5)

AW, = att' + U,

Ak

[Ik

AIk]

FL=[aPC*(L)G

= [C C-o

F(L)

a-

H (L)AW, = Y + ?7,

(3.1)

of knownorderp

lag polynomial

whereH(L) is a matrix

withall rootsoutsidetheunitcircle,qais iidwithmean0,

1/21

of (2.6) showsthatYtcan be rep- and H(O) is normalizedso thatEq,q' = Ik. In thissection

Recursivesubstitution

it is assumed that WO= y = 0.

resentedas

First,supposethatD andH(L) are knownandlet t =

=

+[OC(n1)x]

=

a+

/32t+

LO( -k)x1

+[a

IH(L)Wt. Under (3.1), H(L)AWt = A[H(L)Wt] = t7,so

C*(L)G

latt+ /h(L)vt,

(2.7)

areranofHI(L)Wt

theelements

underthenullhypothesis

of m < k

underthe alternative

domwalks.In contrast,

of HI(L)Wtare rancommontrends,onlym components

areintegrated

elements

domwalks,whereastheremaining

fork versusm common

testing

of order0. Thissuggests

the rootsof the firstsampleautotrendsby examining

whereC*(L) = (1 - L) -1(C(L) - C(1)).

correlationmatrixformedusingSt,

In termsof Wt,a testof k versusm commontrends

becomesa testof whetherC(1) has rankk againstthe

theproposed

tha ithas rankm. To motivate

alternative,

(Pf,we have

tests,supposethatXO =,uh= 0, and considerthe result Rewriting

of regressing

Wtonto Wt1. Underthe nullhypothesis,

(3.2)

T[1f - Ik] = TkT(FkT),

sos,

ofk integrated

Wtis a linearcombination

processes,

wherePkT = T-1 I (t-ji7a and FkT = T2 E(t_1limitof

theprobability

behaviorofTkT and FkT has been treated

The limiting

= ][>3 Wac1Wonide-1,(2.8) intheunivariate

t

case by(forexample)White(1958),Solo

=[t

WW'

case

(1984), and Phillips(1987), and in themultivariate

Wtincludesm byPhillipsand Durlauf(1986)andChanandWei (1988).

has k realunitroots.Underthealternative

variablesand k - m nonintegrated

integrated

variables, Theserandommatrices

of

weaklyto functionals

converge

cointe- the k-dimensional

orequivalently

independent

Wthask - mlinearly

WienerprocessBk(t): FkT > =k

PDhas onlym

vectors.Thusunderthealternative

grating

foBk(t)Bk(t)'dtand tkT > Akk fo Bk(t)dBk(t)', where

variuniteigenvaluescorresponding

to them integrated

on thespaceofcontinuous

=> denotesweakconvergence

withmodulus(andtherefore functions

ables,andk - meigenvalues

(1968).Thus

on [0, 1]k inthesenseofBillingsley

withreal parts)less than1. Lettinglm,+1 denotethe ei- from

that

IkI

-1;

is,

T[.:f - 1k]

(3.2), T[1f

a> PkF

real part,our converges

genvalueof P withthe (m + 1)th-largest

weaklyto a randomvariablethathas thesame

null and alternativehypothesesare Ho: real(Am

+1) = 1

as Tkk-1. It followsthatT(Af - i) 4> A.,

distribution

versusH1: real(i{m+)< 1.

whereA. denotesthe vectorof orderedeigenvaluesof

of 'P when'P has Tk'kL , Afdenotesthe vectorof orderedeigenvaluesof

Muchis knownabouttheproperties

someunitroots.Whenn = 1 and utis seriallyuncorre- (Df,and i= (11

1)'.

studied

byWhite(1958),Fuller

lated,1 hasthedistribution

could be

If D and H(L) were knowna teststatistic

(1987) constructed

(1976),DickeyandFuller(1979),andothers.Phillips

D andH(L)

however,

usingif. In applications,

of T(Q - 1) underlessrestric- are typically

examinedthedistribution

can be remedied

unknown.This deficiency

on theerrors;thisanalysiswasgeneralized byusingestimators

tiveconditions

D and 1(L) of D and H(L), respeccase by Phillipsand Durlauf(1986). tively.Forthemoment,

to the multivariate

assumethatD andrI(L) existand

whenutis seriallycorrelatedthe distri- that (a) D -P> RD under both Ho and H1, where R =

Unfortunately,

i. dependson theautoco- diag(R1,R2), whereR1 and R2 are, respectively,

butionof'P and itseigenvalues

nonsinvariancesof ut.This dependencemakesit impossibleto gular(n - k) x (n - k) and k x k matrices

underthe

based null and (n - m) x (n - i) and

criticalvaluesof a statistic

tabulatetheasymptotic

k

kx

matricesunder

this thelalternativ,nd (b) H(L) and R2H(L)R ic

forcircumventing

on A in a practicalway.Strategies

underHo.

similartestsare Let Wt = SkDXtandSt = Hl(L)1. Thenone couldconproblemand developingasymptotically

in Sections3 and 4 forthecase (/h= 0, /12 =

presented

leastsquares(OLS) estimator

sidertheordinary

0, /12 = 0) and (/h

0) and are extendedto thecases(IA#&

# 0, /2 # 0) inSection

5.

1100

Journalof the American StatisticalAssociation,December 1988

covariancematrixensures

This modified

versionof (F, computedusingthefiltered an identity-contemporaneous

R2Hi(L)R-1.

series(t, has a limiting

in whichthenui- that1(L)

representation

in(3.1) do notappear.Letting

thatthere

sanceparameters

Thistestis consistent

againstthealternative

Afdenote

thevectoroforderedeigenvalues

of(Df,we haveTheorem arem ratherthank commontrendsusingeitherestimator

3.1.

oforder

ofrl(L), eveniftheprocessis notautoregressive

with

m

vectors.

n

p

but

satisfies

(2.1)

cointegrating

3.1. SupposethatD P RD, W,is generated

Theorem

the

DA

comUnder

alternative,

(constructed

using

principal

by (3.1) withW0 =y = 0, H(L) - * R2HI(L)R-1, and maxi

to

some

matrix

the

in

ponents)

converges

probability

Da,

- Ik) > R2*'TkF1R2j1,

E(i)

C /4 < oo. Then, (a) T((

vectors

which

contain

the

first

n

m

rows

of

cointegrating

(b) T(Af- i) a> A., and (c) T(IAfI- i) 4>real(A.).

to the

Proof. At the suggestion

of the editortheproofsof ofX, and thefinalm rowsofwhichare orthogonal

In

under

the

alternative

vectors.

cointegrating

addition,

alllemmasandtheorems

areomitted

butprovided

inStock

matrixlag polyJt(L) convergesto some (finite-order)

and Watson(1988).

nomial11a(L) evenifAW,does nothave a VAR(p) repTheorem3.1 suggeststestingfork versusm common resentation.

of A,At

From(2.1) and the definition

trends-orequivalently

fork versusm realunitrootsin

A

I(L)

Ha(L)

and

,

where

D5A

Da. Since

l(L)SkIC(L)eW

(D-usingthestatistic

has

finite

and

is

summable

order

rIa(L)

C(L) absolutely

underboththenulland thealternative,

HIa(L)SkDaC(L)

q f(k, m) = T[real(Af

m+1)- 11,

thealternaunder

is

absolutely

summable.

Furthermore,

where Af,m+1

is the (m + 1)th elementof Af.Under the

<

m'

rank(C(1)) = m < k.

nullhypothesis,

fromTheorem3.1(b) qf(k, m) asymp- tive,rank(HIa(1)SkDaC(1))

a

like

it

can

be shownthatas

Using construction (2.6),

totically

has thesamedistribution

as real(.*m+,).

St[and,by theconverThe construction

of qf requiresthe estimation

of RD thesamplesize tendsto infinity,

unit

of

rootsin itssample

and theautoregressive

matrixpolynomial

HI(L) in (3.1). gence H(L) and D, (t] has m'

- m' rootsless

k

and

matrix

autoregressive

The n x n matrixRD can be estimated

in a varietyof first-order

withrealpartsthatare

ways.The firstn - k rowsof D (and thusofRD) are a than1 in modulusand therefore

- 1 convergesin

1.

less

than

In

particular,

real(f,m+')

basisforthespace spannedby thecointegrating

vectors

so thetestis consistent.

to a negativenumber,

of X, underthe null. Because the cointegrating

vectors probability

obtains

whetherthe filteris

that

a

test

Note

consistent

formlinearcombinations

ofX,thathaveboundedvariance

thattheorder

or

assuming

estimated

either

using

AWt

uAt,

fromtheotherwise

integrated

elementsof Xt,they(like

of

the

fixed.

filter

is

the autoregressive

coefficient

in the univariate

unit-root

problemor itsmultivariate

analog,discussedin thepre4. A TESTBASED ON CORRECTINGTHEOLS

cedingsections)can be estimatedconsistently

without

AUTOREGRESSIVE

MATRIX

a particular

specifying

parametric

processforthe additestsfork versusk - 1

Our secondproposedstatistic

tionalstationary

As demonstrated

components.

in Stock

a

versionof P, thesample

common

trends

corrected

using

(1987,theorem

2), ifX, has therepresentation

(2.1) with

matrix

forWtin (2.8), under

autocorrelation

K

first-order

n - k cointegrating

vectorsand maxiE(84) < ??,

=

=

0

in (2.7). In thiscase,

that

the

assumption fl, fl2

thenthe cointegrating

of thecolumns

vectorsconsisting

(P

a

the

asymptotic

representation

giveninLemma4.1.

of can be estimated

by contemporaneous

OLS regres- has

sionsofone elementofXton theothers,afteran arbitrary Lemma 4.1. If maxiE(v4t) - /U4< ?oand = fl2 = 0

/l

normalization

to ensurethattheestimates

are linearly

in- in (2.7), then

dependent.

We adopta modification

ofthisapproach,inwhichthe T(&P - Ik) [C(1)PnTC(Q)1 + M'I[C(1)rnTC(Q)111

vectorsare constructed

cointegrating

to be orthonormal

A 0,

withthefirst

vectorforming

thelinearcomcointegrating

and M =

E

binationof Xt havingthe smallestvariance,the second where 'nT = T-1 I 't_lVt', Via =

1Eutjut'.

vectorhavingthenextsmallest

cointegrating

variance,and [,7o (C, - C,)q + (l)C(1)'] =

so on. Implementing

thisproceduresimplyentailsestiThis lemma indicatesthat T(Q - Ik) asymptotimatingtheprincipal

ofXt; a is estimated

components

by cally consistsof two parts.The first,[C(1)$nTC(1)']'

thoselinearcombinations

to thesmallest

n [C(1)FnTC(1)'iI1,is T timestheerrorin theestimateof

corresponding

- k principalcomponents,

and a' is estimatedby the (P obtainedbyregressing

therandomwalkC(l)4t ontoits

linearcombinations

to thelargestk prin- laggedvalue. The second,M'[C(1)rnTC(1)'I1,

corresponding

is analocipalcomponents.

Sincea consistently

estimates

thecoin- gousto theO(T-1) bias in contemporaneous

regressions

tegratingvectorsup to an arbitrarylinear transfor-of cointegrated

variables.This bias arisesfromthe cormation,D 4 RD = [aRl a'R']' forsomeR1and R2.

relationbetweentheregressor

Wt-1and utin (2.5). This

_4 Ik under the null [where (

=

Since (

termis relatedto the bias in OLS regression

estimates

&'1( Wt_1W)t-j-11,

z Wt

theparameters

ofR2lH(L)R1-l whentherearestationary

laggeddependent

variablesand

can be estimated

consistently

bya VAR(p) regression

us- seriallycorrelated

errors.In thepresentcontext,

sinceu,

ingeitherAIVWt

or it, whereui, are theresiduals

froma is notintegrated

(butis seriallycorrelated)

and W,is interegression

ofWtontoWt1. In eithercase,normalizing

the grated,thiscorrelation

producesnotinconsistency

buta

VAR coefficient

matrices

so thattheVAR residualshave component

of P thatis Op(T-1).

-

1101

Stockand Watson:TestingforCommon Trends

sinceitspresencemeans utut';. ThenM can be estimated

ThebiastermM isproblematic,

by

thatthedistribution

of (F (and its eigenvalues)depends

I

thelimiting

repon M and thuson C(L). Nevertheless,

M

(4.1)

K( )Vill

a solutionto thisprobresentation

inLemma4.1 suggests

j=1

(F usingan estimator

of

lem: ModifytheOLS estimator

whereK(j) is a (timedomain)kernel.For a proofofthe

distribution

of theeigenvalues

M so thatthe asymptotic

case forK(j) = 1 and

ofM in theunivariate

consistency

dependsonlyon r, and

of themodifiedOLS estimator

J = o(T1'4), see Phillips(1987).

tn.

This approach generalizesto the multivariate-setting

if M A

The testbased on q,(k, k - 1) is consistent

Phillips(1987,theorem5.1) testfora singleunitrootin

whereut = Wt- Wtu underthealternative,

Y271

Eu,1j

a univariate

wereW,observedand

process.Specifically,

write': = QAQ1 under

thisconsistency,

To demonstrate

M known,a corrected

by

estimator

(C couldbe computed

withtheroots

whereA is a diagonalmatrix

thealternative,

offthetroublesome

subtracting

term:

of 1 on the diagonalso thatthe firstk - 1 diagonal

, = [T-2 WtW>_2T-1M'][T-2

E Wt-W>]

1.

E

elementsare 1 and the finalelementis less than 1 in

ofeigenvectors

modulus,andwhereQ is thek x k matrix

Letting)c denotethevectorofthek orderedeigenvalues of(D. Underthealternative,

thelastelementofthetransof (Fc, we have Lemma 4.2.

process.

formedvariateQWt[say(QWt)kIis a stationary

and

autocorrelation

the

jth

(w)

denote

and

Let

pj

f(QwI)k

Lemma4.2. Let fl by a k x k matrixsuchthatflQQ'

A

respectively.

of

density

spectral

the

(scalar)

(QWt)k,

ofLemma4.1,

C(1)C(1)'. Then,undertheconditions

(1988)

Watson

and

Stock

in

techniques

the

using

calculation

I

(a) T(Q:c - Ik) 4 frr- lFj- and (b) T(ic - i) c A*

showsthatunderthefixedalternative,

Ack A 1 - (1 E

+

Because

= c(1 + 2 E

f(Qw,)k(O)

pP) Alck.

to Lemma4.2, thedistribution

of thestan- Plt)(l

According

c

positiveconis

a

(where

0

>

alternative

the

under

pj)

dardizedeigenvalues

of(Dcdo notdependon anynuisance

: - I, SO 2ck C 1 - 2(1 - pl)2 < 1 for Ipl(

El

stant),

pj

parametersand thuscan be tabulated.But (bc cannotitself

formthebasisfora testbecauseit involvesWt,whichis <1. Thus T(iCk - 1) tendsto -oX underthefixedalterthatthetestis consistent.

notdirectly

observed,andM, whichdependson unknown native,demonstrating

termM

of thecorrection

estimators

candidate

all

Not

As we discusslater,however,M can be esparameters.

that

suppose

In

particular,

test.

in

a

consistent

result

AWt

ofM, M, is suchthat

timated;supposethattheestimator

M

that

so

estimator

an

iS

to

construct

than

used

Ua

rather

M AP R2MR2. Let Y1= DXI, and use W, = SkYtand M

to formthe analog of (bc,

MAP-

I E[A Wt_jAW'W]

underboththe nulland thefixed

usingM and

alternative.

Underthenull,thetestsformed

D = [T2 >E W - T-'M'I[T2

I

equivalent.Underthe alternative,

M are asymptotically

usingM, DcA Ik, so in particular

however,ifcorrected

The consistency

of D and M ensurethattheeigenvalues

p 1 and a one-sidedtestbased on thisrootis

real(Ac{k)

of(DC,AC,are asymptotically

equivalent

to theeigenvalues notconsistent.

of$C.

AA

Theorem4.1. Suppose that D P RD and M p

ofLemma4.1, (a)

R2MR'. Then,undertheassumptions

T((Dc - Ik) 4 R2fIPrk-1f'-1R-1 and (b) T(Q, - I) 4

5. MODIFICATIONSFOR ESTIMATEDINTERCEPTS

AND DRIFTS

In practiceit is desirableto allowfornonzeroXO,and

modelmightbe

a moreappropriate

in manyapplications

as

a cointegrated

drift

as

well

nonzero

has

a

oneinwhichX,

Part(a) of thistheorempresentsa limiting

represen- stochastic

the

addresses

This

section

problemof

structure.

tationforthe orderedeigenvaluesof (Dc. We therefore testing

is

of

rank

that

the

k, against

null

C(1)

the

hypothesis

definetheteststatistic

and

the

when

<

k

it

is

m

intercept

that

the alternative

this

entails

of

In

terms

testing

(2.7),

drift

maybe nonzero.

qj(k, k - 1) = T[real(Ac,k)- 1],

thattherankof C(1) is k versusm wheneither(a) fi2 =

or (b) fi,

whereAc,kis the kthelementof Ac.Underthe nullhy- Obutfi,mightbe nonzero(butis nonrandom)

In case

be

nonzero.

both

but

pothesis,qj(k, k

1) convergesto the real partof the andfi2 arenonrandom might

that

are

combinations

k

linear

has

(b) underthenullXt

T'rL-1

smallesteigenvalueoftherandommatrix

under

the

alwhereas

The construction

of theqc statistic

requiresestimators randomwalkswithnonzerodrifts,

In

a

univaricombinations.

linear

of D was discussedin Section3. ternative

D and M. Construction

Xthas m such

dataareoftenmodeledas stamacroeconomic

forM in Lemma4.1 suggestsan ate setting

The secondexpression

nonzeromean;

a constant

around

differences

infirst

ofthek tionary

ofM basedon thesamplecovariances

estimator

this

x 1 vectorofresidualsut= Wt- (Wt 1 fromtheregres- as BeveridgeandNelson(1981)showed, impliesthat

as thesumof a randomwalk

ofM is clearlyrelated theprocesscan be written

sionofW,ontoW_1&.

The estimation

component.

a

and

mean-Ostationary

to theproblemof estimating

thespectraldensitymatrix withnonzerodrift

fit

thisunivariboth

generalizes

fi2

be

nonzero

of ut at frequency

0, (2ir)-1 ,__ Vj = (2rr)'(Vo + M Letting and

testpermits

case

and

multivariate

to

the

ate

specification

+ M') (whereVj = Eu,utt ), so techniques

developedfor

up

in

which

alternative,

an

against

trends

ingforcommon

its estimation

can be appliedhere.Let V. = T'1 StT=

A*.*

1102

Journalofthe American StatisticalAssociation,December 1988

to n - m components

are stationary

arounda lineartime and

trend.Fora discussion

ofthemacroeconomic

implications

-2 E Wt

dIr = [T-2 E WTWT'

ofstochastic

versusdeterministic

trendsineconomictime

series,see Nelsonand Plosser(1982); foran alternative The treatment

of

of 41P and bT parallelsthetreatment

approachinwhichthedrift

in thestochastic

trendis itself 1 in Section4. It is firstshownthatthe asymptotic

dismodeledas a randomwalk(so thattheseriesis stationary tributions

of P, ?P, and Vr dependon thesamenuisance

onlyaftertakingseconddifferences),

see Harvey(1985). parameters,althoughthe randomcomponentsin the

WefollowFuller's(1976)andDickeyandFuller's(1979) asymptotic

Thismakesit possible

differ.

representations

univariatetreatment

of intercepts

and timetrendsand toconstruct

matricesI)Pand )r,theeigenvalues

corrected

thepreviousteststatistics

modify

so thatan intercept

or of whichhave a distribution

of the

thatis independent

an intercept

and a driftare estimated.Accordingly,

let nuisanceparameters.

Ytl = Yt - T

Ytand Yr =Yt - fi1- fl2t, where/,h

and fl2 are the OLS estimatesof Il and fl2 obtainedby

Lemma5.1. SupposethatmaxiE(vit) c u4 < ??. (a) If

regressing

and t,and let Wt = SkYt and

Yton a constant

0

is an arbitrary

constant,

then

to thefiltering

testentails fl2 = in (2.7), andf?l

Wt= SkYT.The modification

estimating

the autoregressive

polynomial

H(L) usingWt

I)

[C(1)nTQC(1)Y + M'I[C(1)rfTC(1) I1 -4 0.

T(

or WtT

ratherthanWt(as inSec. 3). Let = R

H(L) Wtand

then

constants,

(b) If/,and/12 in (2.7) are arbitrary

t = H(L)WtT, and define

40,

i)

[C(1)Pt'TC(1)' + M'I[c(1)r,TC(T)QI1

(4)y

- [E

ct-1ct8 1]1

t Ct8-l

and

Or

Let TI

foBi(t)

(MItt

24tr

( l (T]-

dBi(t), rF

11

f0 Bk (t)B (t)' dt,

f1Br(t)Br(t)' dt,where

foBk(t) dBk (t), and T f

B8(t) = Bk(t) - fo Bk(s) ds and BT(t) = Bk(t) ds - t f a2(s)Bk(s) ds, where al(s) = 4 f a(s)B(s)

6s and a2(s) = -6 + 12s. Also, let Ay,Ai,A)*,and A*,

respectively,

denotethe orderedeigenvaluesof I l,4?,

tIP'(Fl)-t, and PT'(F)-T) We nowhaveTheorem5.1.

=

T1

T

2 'P- 15A , FnT

whereAPT

T-1 2 (T 5T

T =

T1/20OT and

T

=T32

St=1

- 6(tlT), and a2t

0iT

and F"T

T-2 2 ,p,8

T~T',where

T1/2E1T -

T-1/202Tt, where

(i = 0, 1, 2), withaot= 1, alt

- 6 + 12(tlT).

'rnT

dependon M, givenin

representations

These limiting

by corLemma4.1. This dependencecan be eliminated

~~~~~~~~~~~~~A

ofM, M, as suggested

(b and4YTusingan estimator

recting

in Section4. In addition,sinceD and therefore

Wtare

-

unknown,replace WtwithWt= SkDXt. Accordingly,let

1

(DP= [TW8Wv

1- T-1M'][T-2 Ml_ Wr 1]

A

5.1. SupposethatD -P RD, Wtis generated

Theorem

and

< j4 < ??

by (3.1), I(L) 4 R21(L)R2r, and max E(1)

1

(a) If = 0 and W0is an arbitrary

constant,then(i)

E

(DC = [T-2 E WtVWvl- T-1_][T-2

T((Dj - Ik) a R2APk'(FO)-1R-1, (ii) T(Iy - i) a A;*,and

denotethevectorofordered

(iii) T(IAy- i) > real(/*)).(b) If yand W0are arbitrary andletAlandATrespectively,

of eIYand eIT.We nowhaveTheorem5.2.

eigenvalues

constants,then(i) T(4Dr - Ik) > R2'' (Frk)- 1Rr-1, (ii)

) > real(AT).

T(i) > Ar,and (iii) T(I)4-r

r

The counterparts

of qf(k, m) whentheremightbe a

nonzerointercept

or a nonzerointercept

and drift

are

qy(k,m) = T[real(Iym+i) - 11

and

Theorem5.2. Suppose that D P RD, M 4 R2MR2,

and the assumptionsof Lemma 5.1 hold. (a) If f2 = 0 in

then(i) T(PDY- I)

constant,

(2.7) and f1is an arbitrary

# R2

'(Fk)lfl

- R -1, (ii) T(A4

i)

a ll, and (iii)

real()A). (b) Iff,landfl2in(2.7) arearbitrary

constants,then (i) T(4T - I) a R2Q1k'(Fk)

2

- i) i real(AT).

(ii) T( AT- i) a Ar, and (iii) T(IACI

T(I)A1- i)

qT(k,m) = T[real()4m+A)- 11,

teststatistics

makesitpossibletoconstruct

have the same limiting

distribution Thistheorem

which(respectively)

an estito

k

for

either

1)

accounting

analogous

qc(k,

underthe null as real(i.A/m+t)

and real(iAm+t),

where

mated

or

an

estimated

and

The

drift.

intercept

intercept

eigenvalueof FDy,and so

AY,m+tis the (m + 1)th-largest

comare,

respectively,

modification

is

that

the

tests

only

on.

The modification

to theq, statistic

fora nonzerointer- putedusingdeviationsof Wtaroundits averageor the

of Wtontoa constantand a

cept or driftproceedssimilarly.

Suppose thatD were residualsfroma regression

linear

time

trend.

Therefore,

let

known,let YH = Yt - T-1 I Ytand Yr = Yt - fit- fl2t,

fit

where andfi2 arethecoefficients

fromregressing

Y onto

qP(k, k - 1) = T[real(A',k) - 11

Wa = SkYe

Wth

SkYc.

and

=

By analogyto

(1, t). Let

A,define

and

?#= [T-2 E W#tt]T2

8l8l

qc(k,k

1)

T[real(/Ick)

11]

1103

Stock and Watson: Testing forCommon Trends

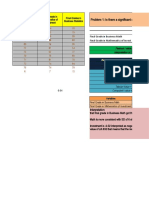

Table 1. Quantiles of real(1*)

Eigenvalue number

Significance

level

1%

2.5%

5%

10%

15%

50%

90%

95%

-13.8

-10.6

-8.0

-5.6

-4.36

-.87

.94

1.30

1%

2.5%

5%

10%

15%

50%

90%

95%

-6.7

-5.1

-3.78

-2.71

-2.10

-.21

1.15

1.50

-24.4

-20.4

-17.5

-14.3

-12.3

-5.8

-1.30

-.62

1%

2.5%

5%

10%

15%

50%

90%

95%

-4.24

-3.23

-2.53

-1.82

-1.4

.02

1.24

1.58

-15.0

-12.9

-11.1

-9.2

-8.1

-3.97

- .56

-.08

-34.6

-29.7

-26.0

-22.2

-19.9

-11.6

-4.97

-3.83

1%

2.5%

5%

10%

15%

50%

90%

95%

-3.19

-2.5

-1.95

-1.4

-1.07

.14

1.29

1.62

-11.5

-9.9

-8.5

-7.2

-6.4

-3.13

- .21

.20

-22.6

-20.1

-18.0

-15.6

-14.1

-8.4

-3.57

-2.74

-43.3

-38.3

-34.4

-30.0

-27.2

-17.5

-9.4

-7.8

1%

2.5%

5%

10%

15%

50%

90%

95%

-2.67

-2.04

-1.64

-1.17

-.88

.22

1.32

1.66

-9.6

-8.3

-7.2

-6.1

-5.5

-2.66

-.02

.36

-18.3

-16.1

-14.5

-12.6

-11.4

-6.9

-2.93

-2.25

-30.1

-27.1

-24.7

-22.0

-20.2

-13.4

-7.3

-6.1

-51.6

-46.2

-41.9

-37.4

-34.5

-23.6

-14.1

-12.3

1%

2.5%

5%

10%

15%

50%

90%

95%

-2.25

-1.75

-1.40

-1.00

-.74

.28

1.36

1.69

-8.3

-7.3

-6.4

-5.4

-4.84

-2.28

.13

.49

-15.5

-13.8

-12.4

-10.9

-9.9

-6.0

-2.5

-1.89

-24.5

-22.3

-20.4

-18.2

-16.8

-11.3

-6.2

-5.3

-38.1

-34.3

-31.5

-28.3

-26.3

-18.6

-11.4

-9.9

Dimension

of A.

-60.2

-54.6

-49.8

-44.8

-41.7

-29.7

-19.1

-16.8

where l,4k (or Ac,k) is thekth-largest

eigenvalueof IP (or of therealpartof thesmallestrootof kTFkkT1,whichin

the

as real(A*,J,

distribution

eF").Theorems5.1 and 5.2 implythatunderthenullhy- turnhasthesameasymptotic

pothesisqy(k,m) > real(Iu,m+),

q"(k, m) > real(iI*m+), realpartofthesmallestrootofT'VF-1.Theorems5.1 and

q1(k, k - 1) > real(A/*k), and qc(k, k - 1) > real(IAVk). 5.2 implythatsimilarremarksapplyfortheq/, q", q',

ofthe

thedistributions

Accordingly,

andq" teststatistics.

and

of

roots

ordered

the

of

1,

real

parts

Pk'TkT

Pkt(FTkT)

6. CRITICALVALUES

A

AyT(F

'IT)- were computedusing30,000Monte Carlo rep-

do licationswithT = 1,000.(As a checkof whetherT =

Althoughthepreceding

asymptotic

representations

large,thek = 3 entriesin thetables

notprovideexplicitdistributions

oftheproposedteststa- 1,000is sufficiently

withT = 2,000.

using10,000replications

forcomputing wererecomputed

tistics,

theydo suggesta simpleprocedure

werenegbetweenthetwodistributions

the asymptotic

distributions

using Monte Carlo tech- Thediscrepancies

niques.Forexample,fromTheorem3.1 (b) andTheorem ligible.)

of real(X*1)are

4.1 (b), theasymptotic

distributions

of qf(k,k - 1) and

Selectedquantilesof the distribution

=

and

j = 1,...,

6

.

.

.,

1,

k

1

for

in

Table

tabulated

distribution

qc(k,k - 1) are thesameas theasymptotic

Journalof the American StatisticalAssociation,December 1988

11104

Table2. Quantilesofreal(AlJ

Dimension

ofA;

Significance

level

number

Eigenvalue

1

1%

2.5%

5%

10%

15%

50%

90%

95%

-20.6

-16.8

-14.1

-11.2

-9.5

-4.36

-.82

-.1 1

1%

2.5%

5%

10%

15%

50%

90%

95%

-12.3

-10.3

-8.8

-7.2

-6.2

-3.03

-.29

.33

-30.9

-26.4

-23.0

-19.5

-17.2

-9.7

-4.05

-3.10

1%

2.5%

5%

10%

15%

50%

90%

95%

-9.1

-7.9

-6.8

-5.7

-4.99

-2.53

-.07

.53

-20.1

-17.7

-15.7

-13.5

-12.1

-7.1

-2.91

-2.19

-40.2

-35.4

-31.5

-27.3

-24.8

-15.6

-8.1

-6.8

1%

2.5%

5%

10%

15%

50%

90%

95%

-7.6

-6.6

-5.8

-4.91

-4.33

-2.33

.04

.64

-15.9

-14.1

-12.6

-10.9

-9.9

-5.8

-2.35

-1.73

-27.7

-24.8

-22.5

-19.8

-18.2

-11.9

-6.3

-5.3

-49.2

-43.6

-39.3

-35.0

-32.1

-21.6

-12.7

-11.0

1%

2.5%

5%

10%

15%

50%

90%

95%

-6.7

-5.8

-5.2

-4.45

-3.94

-2.05

.13

.75

-13.5

-12.1

-10.8

-9.5

-8.6

-5.1

-2.02

-1.43

-22.7

-20.3

-18.4

-16.5

-15.2

-10.0

-5.4

-4.59

-35.5

-32.0

-29.2

-26.4

-24.4

-17.0

-10.3

-8.9

-57.1

-51.5

-47.0

-42.1

-39.1

-27.8

-17.6

-15.5

1%

2.5%

5%

10%

15%

50%

90%

95%

-6.1

-5.4

-4.75

-4.09

-3.64

-1.9

.2

.79

-12.2

-10.9

-9.7

-8.6

-7.8

-4.62

-1.77

-1.26

-19.7

-17.8

-16.2

-14.4

-13.3

-8.9

-4.83

-4.06

-29.1

-26.5

-24.5

-22.1

-20.6

-14.5

-8.9

-7.8

-42.5

-39.1

-36.1

-32.8

-30.7

-22.3

-14.5

-12.8

-65.5

-59.7

-54.9

-49.7

-46.3

-34.0

-22.8

-20.3

If the qy or qHtestsare

k; thequantilesforreal()Nj)andreal(Aj) aregiveninTa- -8.5 and -11.5, respectively.

bles2 and3, respectively.

Referring

toTable 1,theblocks used,thecriticalvaluescomefromTable 2. If theq or

of rowsrepresent

thedimension

of A,or equivalently

k, qctestsare used,thecriticalvaluescomefromTable 3.

oftheqj(k, k - 1) and

nulldistribution

The asymptotic

thedimension

of W,used to construct

theqf or q, tests.

of the real

the

distribution

Thecolumns

ofthetabledenotethejth-largest

eigenvalue, ql(k, k - 1) statistics

[i.e:,

to theeigenvalue

corresponding

on whichthetestis based partofthesmallesteigenvalueofPS'(FM)1] is plottedin

whentherearem = j - 1 unitrootsunderthealternative. Figure 1 fork = 1, . . , 6. The figureemphasizeshow

For example,in a testofk = 4 versusm = 3 unitroots, severelythecdf'sof thesmallesteigenvaluesare shifted

theqf(4,3) orq,(4, 3) testswouldbe basedon thefourth- below0, evenwhenk = 1 or 2.

largesteigenvalue,so the 5% criticalvalue forthe test

7. SIZEAND POWERCOMPUTATIONS

(takenfromTable 1) is -34.4 and the1% criticalvalue

is -43.3. For a testof k = 4 versusm = 1 unitroots,

Thissectionreportstheresultsofa smallMonteCarlo

on

test

would

be

based

the

thesizeandpowerofthetests

the qf(4, 1)

second-largestexperiment

thatinvestigates

in appliedwork.

for

sizes

encountered

typically

eigenvalue, whichthe5% and 1% criticalvaluesare insamplesof

.

1105

Stock and Watson: Testing forCommon Trends

Table 3. Quantiles of real(*)

Dimension

of AT

Significance

level

Eigenvalue number

1

1%

2.5%

5%

10%

15%

50%

90%

95%

-29.2

-24.8

-21.7

-18.2

-16.1

-9.0

-3.8

-2.7

1%

2.5%

5%

10%

15%

50%

90%

95%

-19.1

-16.8

-14.9

-12.9

-11.6

-7.0

-2.94

-1.97

-39.2

-34.6

-30.8

-26.7

-24.2

-15.1

-7.6

-6.3

1%

2.5%

5%

10%

15%

50%

90%

95%

-15.2

-13.4

-12.1

-10.7

-9.7

-6.2

-2.52

-1.55

-27.1

-24.3

-22.1

-19.5

-17.8

-11.3

-5.9

-4.91

-48.7

-43.5

-39.0

-34.6

-31.8

-21.4

-12.5

-10.7

1%

2.5%

5%

10%

15%

50%

90%

95%

-13.2

-11.8

-10.7

-9.5

-8.7

-5.7

-2.23

-1.32

-22.0

-19.8

-18.0

-16.0

-14.7

-9.5

-5.1

-4.19

-35.3

-31.6

-28.9

-25.9

-24.0

-16.7

-10.0

-8.7

-57.2

-51.7

-47.0

-42.0

-38.9

-27.6

-17.4

-15.3

1%

2.5%

5%

10%

15%

50%

90%

95%

-12.2

-10.9

-9.8

-8.7

-8.0

-5.3

-2.12

-1.20

-19.0

-17.2

-15.7

-14.0

-12.8

-8.4

-4.50

-3.72

-28.7

-26.3

-24.2

-21.9

-20.4

-14.3

-8.8

-7.7

-42.4

-38.8

-35.9

-32.6

-30.4

-22.1

-14.2

-12.6

-64.6

-59.2

-54.5

-49.2

-46.0

-33.7

-22.5

-20.1

1%

2.5%

5%

10%

15%

50%

90%

95%

-11.2

-10.1

-9.1

-8.1

-7.5

-4.99

-2.00

-1.06

-17.0

-15.4

-14.1

-12.6

-11.6

-7.5

-4.05

-3.36

-25.1

-23.1

-21.3

-19.3

-18.0

-12.9

-8.0

-7.0

-35.3

-32.7

-30.2

-27.7

-26.0

-19.1

-12.5

-11.0

-49.7

-45.7

-42.5

-38.9

-36.7

-27.6

-18.8

-16.9

-73.2

-67.1

-62.4

-56.8

-53.2

-39.9

-27.8

-25.2

p = 1, so therearetwo

The qj(2, 1) and q"(2, 1) testswerestudiedusingtwo value.Underthenullhypothesis,

II < 1, andthere

by commontrends;underthealternative,

modelsforY,. In thefirst,Y, was generated

different

is onlyone commontrend.The testswerecomputedas

theVAR(2)

describedin the previoussections,usingprincipalcom(7.1) ponentsto construct

L) (1 - <>L)Yt = c"

(1

D fromthegeneratedY,. Although

(since

by(7.1) or (7.2) is notcointegrated

(autoregressiveY,as generated

and in the secondby the mixed-vector

movingaverage)ARMA (1, 1) process

Y3,is not integrated),because D is computedby principal

wouldbe

teststatistics

equivalent

numerically

components

(7.2) obtainedusingX, = PYt, whereP is any nonsingular

(1 - .FL) Yt = (1 + OL)et,

P couldbe chosenso thatX,is coinIn particular,

matrix.

wherein (7.1) and (7.2) Ecte' = G, and where

tegrated.

1 .5 - .25

1 0 O

using2,000replicawereperformed

The experiments

.5a

.5

1

are

s

G

Bt = a

p

tionswitha samplesizeof T = 200.Thissampleis typical

1

- .25 .5

O O .5

research;forexample,

of thatfoundin macroeconomic

NationalIncomeand ProductAcBoth and 0 are scalarsthatare less than1 in absolute thepostwarquarterly

A

Journalof the American StatisticalAssociation,December 1988

1106

containresultsforthevectorARMA model(7.2) with0

= .4. The nominal

sizesoftheql test(columnsA andC)

abovetheiractuallevel,whereasthenomare somewhat

inalsize oftheqI testis aboveitslevelwhenthedataare

belowits

bya VAR (columnB) andsomewhat

generated

bya vectorMA (column

levelwhenthedataaregenerated

greaternominal

D). In addition,theqy(2,1) testexhibits

q#(2,1) testwiththeVAR

powerthantheapproximate

process,whereasthereverseis truewhen

data-generation

thedata are generatedbythevectorARMA process.

k=6

.8

>.6

-0

.2

-80

-70

-60

-50

-40

-30

-20

-10

10

U.S.

8. COMMON TRENDSIN POSTWAR

RATES

INTEREST

Re (kg)

ofcommontrends

In thissectionwe testforthenumber

maturities.

rateswithdifferent

amongthreeU.S. interest

1960

fromJanuary

observations

The dataare236monthly

countsdatasetfrom1947:1to 1986:4contains160obser- toAugust1979onthefederal

fundsrate(FF) (an overnight

financial

data set e ;aminedin interbank

vations,and the monthly

billrate(TB3),

loan rate),the90-daytreasury

Section8 has 236 observations.

Initialvaluesof Y0 = co and theone-yeartreasury

billrate(TB12). The treasury

= 0 wereused, and the testswerecomputedusingthe billratesare secondary

marketrates,and all ratesare on

generateddata Y1, . . . , Y200.Fewer observationswere an annualizedbasis. All threerateswereobtainedfrom

en- theCitibasefinancial

used to computetheVAR's and covariancematrices

data base.

teringthecorrection

termsas necessary.

The q1(2, 1) test

of interest

ratessugThe theoryof thetermstructure

windowof geststhatthereis at mostone commonstochastic

statistics

werecomputedusinga rectangular

trend

orderJ, so K(j) = 1 for11is J and 0 otherwise.

When underlying

thesethreerates:Becausetheexpectedreturn

thedataweregenerated

by(7.1), theq (2, 1) statistic

was on a multiperiod

intheory

instrument

equalstheexpected

oftheintegrated return

computed

byfiltering

thefirst

differences

overa sequenceofone-period

obtainedfromrolling

(underthenull)components

usingan estimated

VAR(1); instruments,

rateis

a stochastic

trendin the short-term

thecorrection

termM intheq1(2,1) statistic

wasestimated inherited

rate.

bythelonger-term

usinga windowof orderJ = 3. Whenthe data were

Table 5 presentsvarioustestsforunitrootsin these

wasestimated

generated

by(7.2), theqJ(2,1) filter

using interest

rates.Althoughall threeratesappearto contain

a VAR(3); theq1(2, 1) correction

was estimated

usingJ a unitroot,thedifferences

amongthem(thespreads)seem

= 1. Thustheorderof thefilter

in theqJ(2,1) statistic to be stationary.

of theDickey-Fuller

T (4)

[Application

was correctunderthenullwhenthedataweregenerated testto thefirstdifference

raterejectsthe

ofeachinterest

by (7.1), and the orderof the windowin the q1(2, 1) nullof a secondunitrootat the1% level.]Thissuggests

statistic

was correctunderthe nullwhenthe data were thatthereis a singlecommontrend.The multivariate

regeneratedby(7.2). In theothercases,a longerVAR (or sultsconfirm

for3 versus1 common

Testing

thissuspicion.

to approxadditionalcovarianceterms)was incorporated

the

MA

vector

imatethecovariancestructure

impliedby

Monthly

Testson Three

andCointegration

Table5. Integration

Interest

Rates,1960:1-1979:8

in

under

the

null.

first

differences

(or AR)

ColumnsA and B of Table 4 containresultsforthe

Univariate

results

VAR model (7.1) withq = 4, and columnsC and D

ofreal(A,k).

Distribution

Function

Figure1. Cumulative

Table4. MonteCarloExperiment

Results:RejectionProbabilities

Data-generating

process

(7.1), with0

A,

.4

B,

(7.2), with0 = .4

C,

D,

Level

qv(2, 1)

1)

q,0'(2,

q (2, 1)

q,(2, 1)

1.00

5%

10%

5%

10%

5%

.03

.07

.03

.06

.03

.06

.11

.21

.40

.10

.18

.34

.08

.19

.30

.07

.13

.22

.35

.60

5%

10%

.92

.97

.82

.90

.86

.95

.99

.99

.95

.90

.80

10%

.59

.50

.51

.74

NOTE: The results

werecomputed

using2,000MonteCarlodrawswitha samplesize ofT

= 200.

Sampleautocorrelations

Series

Lag 1

Lag2

FF

.941

.975

.936

TB3

.971

.935

TB12

.972

.825

FF-TB3

.902

.863

FF-TB12

.932

.727

TB3-TB12

.851

Common

trend

tests

qy(3,1);p = 2, -22.6a;p = 4, -21.6a

qy(2,1);p = 2, - 23.2b;p = 4, -23.5b

1);J = 2, -24.7b;J = 4, -296b

q#(2,

Lag3

.899

.899

.898

.741

.801

.614

T(4)

-1.79

-1.44

-1.34

- 3.17b

- 2.82c

- 4.09a

NOTE: i(4) denotesthe Dickey-Fuller

series

(1979) t testfora unitrootin a univariate

using

werecomputed

an estimated

Theq#statistics

constant

with

anAR(4)correction.

including

FF denotesthefederal

autocovariances.

theJestimated

a flatkemelforK(j) in(4.1) toweight

treasury

billrate,andTB12denotestheone-year

fundsrate,TB3denotesthe90-daytreasury

billrate.

a Significant

at the1% level.

b Significant

at the5% level.

Significant

level.

atthe10%h

Stock and Watson: Testing forCommon Trends

trendusingthe qy(3, 1) statistic,

fromTable 2 the 5%

valueis -20.1.

critical

valueis - 15.7andthe1% critical

are morenegativethanboth

The reportedteststatistics

atthe1% level.

ofthesecritical

values,indicating

rejection

Testsof the morerefinedhypothesis

of 2 versus1 also

rejectthenullin favorof a modelin whichthesethree

ratescontaina singlecommontrend.

1107

Box, G. E. P., and Tiao, G. C. (1977), "A Canonical AnalysisofMultiple

Time Series," Biometrika,64, 355-365.

Brillinger,D. P. (1981), TimeSeriesAnalysisand Theory,San Francisco:

Holden-Day.

Chan, N. H., and Wei, C. Z. (1988), "LimitingDistributionsof Least

Squares Estimatesof UnstableAutoregressiveProcesses," TheAnnals

of Statistics,16, 367.

Davidson, J. E. H., Hendry,D. F., Srba, F., and Yeo, S. (1978), "EconometricModellingof the AggregateTime-SeriesRelationshipBetween

Consumer'sExpenditureand Income in the United Kingdom," EconomicJournal,88, 661-692.

Dickey, D. A., and Fuller,W. A. (1979), "DistributionoftheEstimators

9. CONCLUSIONS

for AutoregressiveTime Series With a Unit Root," Journalof the

AmericanStatisticalAssociation,74, 427-431.

The procedures

proposedin thisarticleprovidea way

to testfora reducednumberofcommontrendsin a mul- Engle, R. F., and Granger,C. W. J. (1987), "Cointegrationand Error

Correction:Representation,Estimation,and Testing,"Econometrica,

tivariate

timeseriesmodel.Although

thetestsdeveloped 55, 251-276.

applyto real unitroots,theycan be appliedto certain Fountis, N. G., and Dickey, D. A. (1986), "TestingFor a Unit Root

in MultivariateAutoregressiveTime Series," mimeo,

Nonstationarity

cointegrated

seasonalmodels.In particular,

supposethat

NorthCarolina State University,Dept. of Statistics.

(1 - L) in (2.1) is replacedbya seasonaldifference

(1 Frisch,R. (1934), StatisticalConfluenceAnalysisby Means of Complete

RegressionSystems,Oslo: Universitets0konomiske Institutt.

Ld), whered is someinteger.

Since(1 - Ld) = (1 - L)(1

W. A. (1976), Introductionto StatisticalTime Series,New York:

Fuller,

+ L + * + Ld -1), thetestsandasymptotic

theory

apply

JohnWiley.

directly

tothetransformed

series(1 + L + ... + Ld- )Xt. Harvey, A. C. (1985), "Trends and Cycles in Macroeconomic Time

Series," Journalof Business & Economic Statistics,3, 216-227.

Thisapproachonlytestsforcointegration

at frequency

0;

M. W. (1987), "Stohowever,it is possiblethatalternative

testscouldbe de- King, R., Plosser,C. I., Stock, J. H., and Watson,

chasticTrendsand Economic Fluctuations,"WorkingPaper 2229, Navelopedforcointegration

at seasonalfrequencies.

tional Bureau of Economic Research, Cambridge,MA.

The derivation

ofthetestsandtheMonteCarloresults Nelson, C. R., and Plosser, C. I. (1982), "Trends and Random Walks

in MacroeconomicTime Series," Journalof MonetaryEconomics, 10,

suggestthattheqf testmightperform

betterthantheqc

139-162.

testifunderthenullthedata are generatedby a VAR, Phillips,P. C. B. (1987), "Time Series RegressionWith Unit Roots,"

Econometrica,55, 277-302.

whereasthereverseis trueifthedata are generated

bya

P. C. B., and Durlauf, S. N. (1986), "Multiple Time Series

vectormoving

averageprocess.Further

simulation

studies Phillips,

RegressionWithIntegratedProcesses," Reviewof Economic Studies,

are neededto characterize

morefullythecircumstances 53, 473-496.

Sargan, J. D. (1964), "Wages and Prices in the United Kingdom: A

in whichthetestsare likelyto perform

well.

Studyin EconometricMethodology,"in EconometricAnalysisforNationalEconomic Planning,eds. P. E. Hart, G. Mills, and J. N. Whit[Received

June1986.RevisedMay1988.]

pp. 25-63.

taker,London: Butterworth,

in ARIMA Models," JourSolo, V. (1984), "The Order of Differencing

nal of theAmericanStatisticalAssociation,79, 916-921.

REFERENCES

Stock,J. H. (1987), "AsymptoticPropertiesof Least Squares Estimators

of CointegratingVectors," Econometrica,55, 1035-1056.

Beveridge,S., and Nelson, C. R. (1981), "A New Approach to DecomStock, J. H., and Watson,M. W. (1988), "TestingforCommonTrends:

position of Economic Time Series Into Permanentand Transitory

Technical Appendix," Discussion Paper 167D, Harvard University,

ComponentsWith ParticularAttentionto Measurementof the BusiKennedySchool of Government.

ness Cycle," Journalof MonetaryEconomics, 7, 151-174.

White,J. S. (1958), "The LimitingDistributionof theSerial Correlation

Billingsley,P. (1968), Convergenceof ProbabilityMeasures,New York:

Coefficientin the Explosive Case," Annals of MathematicalStatistics,

JohnWiley.

29, 1188-1197.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CE Data Analysys Chap1.Document60 pagesCE Data Analysys Chap1.Angel AntonioNo ratings yet

- Module Handbook MSC Political EconomyDocument29 pagesModule Handbook MSC Political EconomyFelipe ZegersNo ratings yet

- Jurnal Keperawatan Soedirman (The Soedirman Journal of Nursing), Volume 12, No.3 November 2017Document8 pagesJurnal Keperawatan Soedirman (The Soedirman Journal of Nursing), Volume 12, No.3 November 2017DyahEka PutriNo ratings yet

- Lesson 7Document74 pagesLesson 7Xivaughn SebastianNo ratings yet

- Gouni HW#6Document9 pagesGouni HW#6haritha vithanalaNo ratings yet

- How To Conduct A Multiple Regression in SPSS 1Document5 pagesHow To Conduct A Multiple Regression in SPSS 1Jess EjioforNo ratings yet

- Housing Prices SolutionDocument9 pagesHousing Prices SolutionAseem SwainNo ratings yet

- Asia Paci Fic Management Review: M. Adnan Kabir, Sultana Sabina ChowdhuryDocument12 pagesAsia Paci Fic Management Review: M. Adnan Kabir, Sultana Sabina ChowdhuryIonela EneNo ratings yet

- Quantitative Analysis AssignmentDocument6 pagesQuantitative Analysis AssignmentsarangpetheNo ratings yet

- Chapter6 Handbook On SEM Zainudin Awang - Univer PDFDocument33 pagesChapter6 Handbook On SEM Zainudin Awang - Univer PDFIslam Hamadeh100% (2)

- Sample Inferential Statistics Exercise #3Document6 pagesSample Inferential Statistics Exercise #3Veluz MarquezNo ratings yet

- Multiple Regression: X X, Then The Form of The Model Is Given byDocument12 pagesMultiple Regression: X X, Then The Form of The Model Is Given byezat syafiqNo ratings yet

- Jurnal ParlitDocument19 pagesJurnal ParlitSiti HamidNo ratings yet

- Purpose of Curve FittingDocument6 pagesPurpose of Curve Fittingابریزہ احمدNo ratings yet

- HW 8Document2 pagesHW 8Paranjay SinghNo ratings yet

- Nama: Rosalinda NIM: B11.2018.04883: Reliability StatisticsDocument7 pagesNama: Rosalinda NIM: B11.2018.04883: Reliability StatisticsMuhammad DaavaNo ratings yet

- Arch and GarchDocument39 pagesArch and GarchJovan NjegićNo ratings yet

- Statlearn PDFDocument123 pagesStatlearn PDFdeepak joshiNo ratings yet

- CP 3Document2 pagesCP 3Ankita MishraNo ratings yet

- SMMDDocument10 pagesSMMDAnuj AgarwalNo ratings yet

- Regression: Variables Entered/RemovedDocument4 pagesRegression: Variables Entered/RemovedMawar MerahNo ratings yet

- Linear RegressionDocument15 pagesLinear RegressionAnil Bera67% (3)

- Basic Business Statistics Berenson 13th Edition Solutions ManualDocument44 pagesBasic Business Statistics Berenson 13th Edition Solutions ManualKristinGreenewgdmNo ratings yet

- Assumptions of Simple and Multiple Linear Regression ModelDocument25 pagesAssumptions of Simple and Multiple Linear Regression ModelDivina GonzalesNo ratings yet

- AbisolaDocument12 pagesAbisolaAbiodun KomolafeNo ratings yet

- Sample Final SolutionsDocument23 pagesSample Final SolutionsĐức Hải NguyễnNo ratings yet

- Var SlidesDocument28 pagesVar SlidespinakimahataNo ratings yet

- Pengaruh Kualitas Produk, Harga dan Citra Merek terhadap Keputusan Pembelian Nissin BiscuitDocument8 pagesPengaruh Kualitas Produk, Harga dan Citra Merek terhadap Keputusan Pembelian Nissin BiscuitMuhammad Naufal IhsanNo ratings yet

- MaxabsDocument7 pagesMaxabskaushal patelNo ratings yet

- Quiz-1 - Soln AnnovaDocument2 pagesQuiz-1 - Soln AnnovaUJJWAL100% (1)