Professional Documents

Culture Documents

Table of Contant: Chapter One Introduction

Uploaded by

Eng Abdulkadir MahamedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table of Contant: Chapter One Introduction

Uploaded by

Eng Abdulkadir MahamedCopyright:

Available Formats

TABLE OF CONTANT

Title------------------------------------------------------------------Page number

Declaration -----------------------------------------------------------------------I

Declaration---------------------------------------------------------------------- II

Approval-------------------------------------------------------------------------III

Dedication-----------------------------------------------------------------------IV

Acknowledge---------------------------------------------------------------------V

Abstract------------------------------------------------------------------------- VI

Chapter one introduction

1.0

Instruction

...........................................................

1

1.1 Back Ground Of The Study

..........................................................1

1.2 Research Proble

m......................................................................3

1.3 Purpose Of The Study

.................................................................4

1.4

Research Objective .....................................................................

1.5

Research Question.....................................................................4

1.6

The Significant Of The Study......................................................

1.7

The Scope Of Study ....................................................................

.5

6

Chapter two Literature Review

.............................................

2.0 Introduction .......................................................... 7.

2.1 Performance Of Islamic Banks....................................................

.7

2.2 Profitablity Ofislamic Banking

.......................................................8

2.3

Theoretecal And Islamic Bankingsystem. .....................................

11

2.3.1

Islamic Banking Principles ....................................................

15

2.4

Basis Of Islamic Banking ...........................................................

16

2.4.1

Investment Of Islamic Banking Sytem ...................................

2.4.2

Concept Of Islamic Banking System On Money.......................

2.4.3

Concept Of Islamic Banking On Risk-Sharing ..........................

2.4.4

Income Distribution Of Islamic Banking System ......................

19

20

21

22

2.5

Islamic Financial System ...........................................................

2.6

Practical Framework Of Islamic Banking Model .............................

23

26

2.6.1

Functions Of Islamic Banking ................................................

2.6.2

Products Of Islamic Banks ....................................................

27

27

2.6.3

Specific Products .................................................................

28

2.7

Beginning Of Islamic Banking....................................................

29

Chapter three research methodology

3.0

Introduction

...................................................... 30

3.1

Research Design ......................................................................

3.2

Population And Samling ............................................................

30

31

3.2.1

Target Population ................................................................

3.2.2

Sample Design....................................................................

3.2.3

Sample Techniques .............................................................

31

31

31

3.3

Data Collection........................................................................

31

3.3.1

Research Instrument ...........................................................

34

3.4

Quality Control.........................................................................

34

3.4.1

Validity And Reliability Of Research Instrument .................... 35

3.4.2

Data Gathering ...................................................................

35

3.5

Data Analysis ...........................................................................

3.6

Assumptions And Limitations .....................................................

35

36

3.7

Ethical Considerations ...............................................................

37

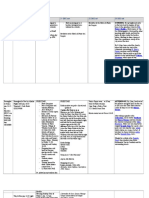

Chapter four Data Presentation, Analysis And Interpretation

4.0 Overview ................................................................................40

4.1 Profile Of The Respondents ........................................................

40

4.2

The Distribution Of Respondents Occupation ...............................

4.3

The Distribution Of Respondents Gender ....................................

4.4

The Distribution Of Respondents Age .........................................

4.5

The Marital Status Of The Respondents .......................................

4.6

The Educational Level Of The Respondents ..................................

4.7

The Residence Location Of The Respondents................................

4.8

The Experience Level Of The Respondents ...................................

4.9

Performance Of Islamic Banks In Puntland. .................................

41

42

43

45

46

47

49

50

4.10 Islamic Banks Uses Methods Of Islamic Finance. ..........................

51

4.11 Your Ability, Knowledge About Islamic Banking System. ................

52

4.12 The Profitability Of Islamic Banks Is Increasing ............................

54

4.13 The Bank Mostly Use Population In Puntland ................................

55

4.14 Islamic Banks System Is Different Another Banks.........................

56

4.15 Attitude Towards Islamic Banks System In Puntland .....................

57

4.16 Islamic Bank Does Not Influence The Financial Crises That Took Pl

ace

The World. ...................................................................................... 5

8

4.17 Islamic Banks Applying To The Islamic Finance. ...........................

59

4.18 Islamic Banks Believe God Is True Owner Of All Things. ...............

. 60

4.19 Shows Islamic Made Zakat Compulsory On The Wealth Of Rich

Muslim...........................................................................................61

4.20 People Trust Islamic Banks ........................................................

62

4.21 During War The Islamic Banks Increased And People Became Rich.

63

4.22 In Islam Hoarding Wealth Is Prohibited .......................................

65

4.23 In Islam Banking System Influence Exchange Rate .......................

66

Chapter five findings,conclutions and recommedations

5.0 Introduction

...........................................................68

5.1

Findings And Summary .............................................................

5.2

Conclusion ...............................................................................

68

69

5.3Recommendation ..................................................................... 72

You might also like

- MyCoID 2016 User Manual GuideDocument300 pagesMyCoID 2016 User Manual GuideGohBerry OenothequeNo ratings yet

- ResearchDocument63 pagesResearchSeid KassawNo ratings yet

- S08-001 - Roller Compacted Concrete - USDocument72 pagesS08-001 - Roller Compacted Concrete - USzhungjian586No ratings yet

- Purchasing Power Parities and the Real Size of World EconomiesFrom EverandPurchasing Power Parities and the Real Size of World EconomiesNo ratings yet

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandFrom EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNo ratings yet

- Hajveri SetingDocument64 pagesHajveri SetingHussain HadiNo ratings yet

- Complaint by Govt. of Guam Et Al. v. Countrywide Et Al.Document439 pagesComplaint by Govt. of Guam Et Al. v. Countrywide Et Al.francoisvilonNo ratings yet

- Forms Personalization - Training ManualDocument36 pagesForms Personalization - Training ManualEhsan Ali100% (1)

- Business Plan 1Document23 pagesBusiness Plan 1Wayd TubeNo ratings yet

- vip-system-base-i-tech-specs-volume-2Document352 pagesvip-system-base-i-tech-specs-volume-2kwe nhuNo ratings yet

- Medicine RCDocument67 pagesMedicine RCvinverma7No ratings yet

- SAP Mannual FinanceDocument212 pagesSAP Mannual FinanceHridya PrasadNo ratings yet

- UsedcarDocument145 pagesUsedcarTim LaneNo ratings yet

- Process of Banking in IndiaDocument356 pagesProcess of Banking in IndiaSunil PurwarNo ratings yet

- Description: Tags: 0405CODVol6TOCDLToolsDocument3 pagesDescription: Tags: 0405CODVol6TOCDLToolsanon-532570No ratings yet

- Visanet Authorization Only Online Messages Technical Specifications Volume 2Document350 pagesVisanet Authorization Only Online Messages Technical Specifications Volume 2Leonardo Garcia MejiaNo ratings yet

- PSRC - Regional Aviation Baseline Study Final ReportDocument92 pagesPSRC - Regional Aviation Baseline Study Final ReportThe UrbanistNo ratings yet

- IRS Processing Codes and InformationDocument613 pagesIRS Processing Codes and Informationsabiont100% (1)

- Undergraduate Application FormDocument7 pagesUndergraduate Application FormswarreslesauxNo ratings yet

- Motor Vehicle Title Manual Book 451Document368 pagesMotor Vehicle Title Manual Book 451Tere PerezNo ratings yet

- Managing Market Risk 2 EdDocument189 pagesManaging Market Risk 2 EdAnkita RoyNo ratings yet

- Role of Bajaj Finance in driving consumer durable salesDocument84 pagesRole of Bajaj Finance in driving consumer durable salesNiraj tiwariNo ratings yet

- Bizhub 180Document256 pagesBizhub 180Jefferson CcoicaNo ratings yet

- Motor Vehicle Title Manual Book 451Document368 pagesMotor Vehicle Title Manual Book 451PeteNo ratings yet

- Series 3 Manual (v42)Document158 pagesSeries 3 Manual (v42)xywqb4xdgrNo ratings yet

- Bihar Tariff 2012-13Document373 pagesBihar Tariff 2012-13Vikram SaharanNo ratings yet

- US Reference GuideDocument57 pagesUS Reference Guidestan nedNo ratings yet

- Ficustomisation FixedDocument134 pagesFicustomisation FixedSundarKrishnaNo ratings yet

- Organizer Manual STDDocument74 pagesOrganizer Manual STDsidNo ratings yet

- Auto1 PDFDocument211 pagesAuto1 PDFjamesbeaudoinNo ratings yet

- Confirmit v16 - Scripting - Rev1Document242 pagesConfirmit v16 - Scripting - Rev1Crazzy KiddNo ratings yet

- pnady273Document64 pagespnady273Anderson YaendiNo ratings yet

- Flightsafety 208G1000 PTM 1 PDFDocument298 pagesFlightsafety 208G1000 PTM 1 PDFPhilMadez100% (7)

- 4_5789925934337362430Document36 pages4_5789925934337362430ybegduNo ratings yet

- Asset ManagementDocument426 pagesAsset ManagementHemanth KumarNo ratings yet

- IT Policies and ProceduresDocument35 pagesIT Policies and ProceduresAgaje O. KelvinNo ratings yet

- UGI RFM 2020 ConfigurationGuide S4HDocument92 pagesUGI RFM 2020 ConfigurationGuide S4Hmuhammad zohaibNo ratings yet

- Usa Refguide Oct2020-FinalDocument56 pagesUsa Refguide Oct2020-FinalATIF HASANNo ratings yet

- Global Absence FastFormula User Guide PDFDocument102 pagesGlobal Absence FastFormula User Guide PDFPavan Kumar ReddyNo ratings yet

- Hospital Last Second SemisterDocument88 pagesHospital Last Second SemisterbenjaCR TubeNo ratings yet

- Wollega University Shambu Campus: Advisor: Adugna (MSC)Document38 pagesWollega University Shambu Campus: Advisor: Adugna (MSC)Adugna MegenasaNo ratings yet

- C360 TCodeDocument193 pagesC360 TCodezaheerNo ratings yet

- IRS - MSSP Restaurant and Bar ATG FinalDocument113 pagesIRS - MSSP Restaurant and Bar ATG FinalJeronimo NgNo ratings yet

- TEXAS Salvage Nonrepairable Manual 7-2020Document80 pagesTEXAS Salvage Nonrepairable Manual 7-2020gearhead1No ratings yet

- CIP VN_ Configuration Document_MM Module_f1.0 (1)Document115 pagesCIP VN_ Configuration Document_MM Module_f1.0 (1)anh.ntq281002No ratings yet

- Registrants HandbookDocument149 pagesRegistrants Handbookakxenia70No ratings yet

- FB-Pier Users Guide and Manual SVDocument152 pagesFB-Pier Users Guide and Manual SVroddick13100% (3)

- WAC BI Analytics - Business RequirementsDocument80 pagesWAC BI Analytics - Business RequirementsRedNo ratings yet

- FB-Pier Users Guide and Manual: For The Analysis of Group Pile FoundationsDocument212 pagesFB-Pier Users Guide and Manual: For The Analysis of Group Pile Foundations얄루얄루No ratings yet

- Description: Tags: ComboTOCDocument2 pagesDescription: Tags: ComboTOCanon-777246No ratings yet

- Wakuma Reports in Ob2Document22 pagesWakuma Reports in Ob2wakugirtufaNo ratings yet

- PM HandbookDocument119 pagesPM HandbookWedaje AlemayehuNo ratings yet

- Tips Equity Financing CitibankDocument102 pagesTips Equity Financing CitibankMa LmNo ratings yet

- Excerpts La HandbookDocument33 pagesExcerpts La HandbookINNOBUNo7No ratings yet

- Financial Statements Q 42017 enDocument273 pagesFinancial Statements Q 42017 enSHERIEFNo ratings yet

- 2023-2024 Competition Rules Price Media Law Moot CourtDocument23 pages2023-2024 Competition Rules Price Media Law Moot CourtSamridhi BajoriaNo ratings yet

- Siteplanning Anddesign: Technical ManualDocument77 pagesSiteplanning Anddesign: Technical ManualPDHLibraryNo ratings yet

- Oracle ARDocument1,896 pagesOracle ARZubair KhanNo ratings yet

- Activity Template Project CharterDocument3 pagesActivity Template Project CharterEng Abdulkadir MahamedNo ratings yet

- Deegaanka Dhulbahante Miyuu Ka Mid Ahaa Dhulkii Gumaystihii Ingiriisku Ku Magacaabay British ProtectorateDocument25 pagesDeegaanka Dhulbahante Miyuu Ka Mid Ahaa Dhulkii Gumaystihii Ingiriisku Ku Magacaabay British ProtectorateEng Abdulkadir MahamedNo ratings yet

- Deegaanka Dhulbahante Miyuu Ka Mid Ahaa Dhulkii Gumaystihii Ingiriisku Ku Magacaabay British ProtectorateDocument25 pagesDeegaanka Dhulbahante Miyuu Ka Mid Ahaa Dhulkii Gumaystihii Ingiriisku Ku Magacaabay British ProtectorateEng Abdulkadir MahamedNo ratings yet

- @somalilibarary-Hagaha Akhristaha NewDocument30 pages@somalilibarary-Hagaha Akhristaha NewXul XaragoNo ratings yet

- Sophie K. Shawmut: Core CompetenciesDocument2 pagesSophie K. Shawmut: Core CompetenciesEng Abdulkadir MahamedNo ratings yet

- Clean Up Project How-To (PDF) - 201403281202019510Document6 pagesClean Up Project How-To (PDF) - 201403281202019510jal1978No ratings yet

- Magnetic Water Softener: Hard Water in Agricultural FieldDocument3 pagesMagnetic Water Softener: Hard Water in Agricultural FieldEng Abdulkadir MahamedNo ratings yet

- Activity Template Project CharterDocument3 pagesActivity Template Project CharterEng Abdulkadir MahamedNo ratings yet

- Murti Iyo SheekooyinDocument103 pagesMurti Iyo SheekooyinEng Abdulkadir Mahamed100% (1)

- EKrCLBxRPaCqwiwcST2Vg Template Personal OKRsDocument1 pageEKrCLBxRPaCqwiwcST2Vg Template Personal OKRsEng Abdulkadir MahamedNo ratings yet

- How To Write A ReportDocument21 pagesHow To Write A ReportEng Abdulkadir MahamedNo ratings yet

- Setting SMART Goals and Objectives (39Document4 pagesSetting SMART Goals and Objectives (39DFLQMSNo ratings yet

- Xz9ZZAXhRIu WWQF4eSLrw Activity-Exemplar - WBS-Brainstorm-DiagramDocument1 pageXz9ZZAXhRIu WWQF4eSLrw Activity-Exemplar - WBS-Brainstorm-DiagramGideon chrisNo ratings yet

- How To Organize A Neighborhood CleanupDocument4 pagesHow To Organize A Neighborhood CleanupEng Abdulkadir MahamedNo ratings yet

- 35fol5t5TAGX6JebeSwBTA - Activity Template - WBS Brainstorm DiagramDocument1 page35fol5t5TAGX6JebeSwBTA - Activity Template - WBS Brainstorm DiagramEng Abdulkadir MahamedNo ratings yet

- Plant Pals WBS Spreadsheet Project MilestonesDocument1 pagePlant Pals WBS Spreadsheet Project MilestonesMaurice PatelNo ratings yet

- PP1 AssignmentsDocument1 pagePP1 AssignmentsEng Abdulkadir MahamedNo ratings yet

- l7iziTi7QTi4s4k4u1E4Xg Activity Template WBS SpreadsheetDocument2 pagesl7iziTi7QTi4s4k4u1E4Xg Activity Template WBS SpreadsheetEng Abdulkadir MahamedNo ratings yet

- Working With Cross Functional TeamsDocument3 pagesWorking With Cross Functional TeamsemiloNo ratings yet

- SubtitleDocument2 pagesSubtitleEng Abdulkadir MahamedNo ratings yet

- The Core Skills of A Project ManagerDocument2 pagesThe Core Skills of A Project ManagerEng Abdulkadir MahamedNo ratings yet

- Arabic Language Lessons Book 1Document127 pagesArabic Language Lessons Book 1Dias JameelaNo ratings yet

- Quality and Service Monthly Report: Date: June & July 2021Document4 pagesQuality and Service Monthly Report: Date: June & July 2021Eng Abdulkadir MahamedNo ratings yet

- CarrotsDocument10 pagesCarrotsDanOliverMaseseNo ratings yet

- Working With Cross Functional TeamsDocument3 pagesWorking With Cross Functional TeamsemiloNo ratings yet

- QuotationDocument5 pagesQuotationEng Abdulkadir MahamedNo ratings yet

- TEMS DiscoveryDocument161 pagesTEMS DiscoveryEduardo SuarezNo ratings yet

- Date BTS Name 8-Jul-13 1 Hrs 8-Jul-13 23:00 2:30 HRSDocument2 pagesDate BTS Name 8-Jul-13 1 Hrs 8-Jul-13 23:00 2:30 HRSEng Abdulkadir MahamedNo ratings yet

- GGGDocument8 pagesGGGEng Abdulkadir MahamedNo ratings yet

- BTS Switch OFF Time BTS Switch On Time BTS State Advanced Time Bts Switch OFF Delay Timebts Switch OFF Advance D Time BTS Switch ONDocument2 pagesBTS Switch OFF Time BTS Switch On Time BTS State Advanced Time Bts Switch OFF Delay Timebts Switch OFF Advance D Time BTS Switch ONEng Abdulkadir MahamedNo ratings yet

- Term Paper Mec 208Document20 pagesTerm Paper Mec 208lksingh1987No ratings yet

- Table of Forces For TrussDocument7 pagesTable of Forces For TrussSohail KakarNo ratings yet

- M88A2 Recovery VehicleDocument2 pagesM88A2 Recovery VehicleJuan CNo ratings yet

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Document1 pageSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagNo ratings yet

- COKE MidtermDocument46 pagesCOKE MidtermKomal SharmaNo ratings yet

- 22 Caltex Philippines, Inc. vs. Commission On Audit, 208 SCRA 726, May 08, 1992Document36 pages22 Caltex Philippines, Inc. vs. Commission On Audit, 208 SCRA 726, May 08, 1992milkteaNo ratings yet

- NSTP 1: Pre-AssessmentDocument3 pagesNSTP 1: Pre-AssessmentMaureen FloresNo ratings yet

- Balance NettingDocument20 pagesBalance Nettingbaluanne100% (1)

- Private Copy of Vishwajit Mishra (Vishwajit - Mishra@hec - Edu) Copy and Sharing ProhibitedDocument8 pagesPrivate Copy of Vishwajit Mishra (Vishwajit - Mishra@hec - Edu) Copy and Sharing ProhibitedVISHWAJIT MISHRANo ratings yet

- Application Tracking System: Mentor - Yamini Ma'AmDocument10 pagesApplication Tracking System: Mentor - Yamini Ma'AmBHuwanNo ratings yet

- 341 BDocument4 pages341 BHomero Ruiz Hernandez0% (3)

- Earth Planet - Google SearchDocument1 pageEarth Planet - Google SearchDaivik Lakkol Eswara PrasadNo ratings yet

- SQL DBA Mod 1 IntroDocument27 pagesSQL DBA Mod 1 IntroDivyaNo ratings yet

- Capital Asset Pricing ModelDocument11 pagesCapital Asset Pricing ModelrichaNo ratings yet

- Which Delivery Method Is Best Suitable For Your Construction Project?Document13 pagesWhich Delivery Method Is Best Suitable For Your Construction Project?H-Tex EnterprisesNo ratings yet

- Encore HR PresentationDocument8 pagesEncore HR PresentationLatika MalhotraNo ratings yet

- Chapter FiveDocument12 pagesChapter FiveBetel WondifrawNo ratings yet

- Detect Single-Phase Issues with Negative Sequence RelayDocument7 pagesDetect Single-Phase Issues with Negative Sequence RelayluhusapaNo ratings yet

- Right To Resist Unlawful ArrestDocument1 pageRight To Resist Unlawful ArrestThoth AtlanteanNo ratings yet

- Power Steering Rack Components and Auto Suppliers Reference GuideDocument12 pagesPower Steering Rack Components and Auto Suppliers Reference GuideJonathan JoelNo ratings yet

- Payment Solutions For Travel Platform: SabreDocument2 pagesPayment Solutions For Travel Platform: Sabrehell nahNo ratings yet

- Depressurization LED Solar Charge Controller with Constant Current Source SR-DL100/SR-DL50Document4 pagesDepressurization LED Solar Charge Controller with Constant Current Source SR-DL100/SR-DL50Ria IndahNo ratings yet

- Mosfet PDFDocument13 pagesMosfet PDFTad-electronics TadelectronicsNo ratings yet

- VectorsDocument9 pagesVectorsdam_allen85No ratings yet

- Mecafix 120: Description Technical DataDocument1 pageMecafix 120: Description Technical DataJuan Carlos EspinozaNo ratings yet

- Habawel V Court of Tax AppealsDocument1 pageHabawel V Court of Tax AppealsPerry RubioNo ratings yet

- Rodriguez, Joseph Lorenz Ceit-08-402ADocument7 pagesRodriguez, Joseph Lorenz Ceit-08-402AJOSEPH LORENZ RODRIGUEZNo ratings yet

- Part 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Document127 pagesPart 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Duyen Pham75% (4)

- Power Efficiency Diagnostics ReportDocument16 pagesPower Efficiency Diagnostics Reportranscrib300No ratings yet

- Example Italy ItenararyDocument35 pagesExample Italy ItenararyHafshary D. ThanialNo ratings yet