Professional Documents

Culture Documents

Nrv-Faq For CB

Uploaded by

Rupali KhannaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nrv-Faq For CB

Uploaded by

Rupali KhannaCopyright:

Available Formats

Frequently Asked Questions (FAQs)

What is Net Relationship Value and how is it calculated?

Net Relationship Value (NRV) is an aggregate of the average value of certain relationships you hold with us,

calculated on a monthly basis. It not only considers the savings balance in your account but also includes your fixed

deposits (FDs), investments & insurance policies taken through Citibank, outstanding principal on Citibank Home

Loans and a part of the holdings in your Citibank Demat Account.

For example, if you have subscribed to investments worth Rs. 1.5 lakhs through your Citibank account and have

Rs. 50,000 in an FD, then your NRV is Rs. 2 lakhs, even if the balance in the savings account is nil.

Below is a working example of how the NRV is calculated:

Description

Holdings

a) Current/Saving Account

25000

b) Fixed Deposit

25000

c) Mutual Funds

d) Loans against securities

e) Demat average balance

40000

25000

100000

f ) Insurance Premium

10000

500000

g) Mortage/Home Loan

Average Monthly Relationship Value

650000

Average for the Month,calculated based on total of daily end of day

balance/total number of days

Daily end of day balances of principal amount/total number of days

Daily end of day balances/total number of days

Daily end of day balances/total number of days

Sum (non-pledged shares x Market rate); Only 25% of the balance will

be considered

Sum of total premium paid*

Outstanding principal amount

a + b + c + d + 25% x e + f + g

* Towards active individual life insurance policies with the account holder as proposer

Are there any charges currently levied on my account in case the NRV falls below this threshold?

Yes, currently non-maintenance charge of Rs. 500 (domestic) and Rs. 400 (non-resident) is levied, where NRV falls

below the threshold limit.

What is the change in the non-maintenance charge applied in case my accounts NRV falls below the threshold?

W.e.f. 1st April 2015, we have revised the NRV non-maintenance charges to only 1% of the NRV shortfall or Rs. 600

(domestic) and Rs. 400 (non-resident), whichever is lower, applicable only if you are not able to maintain the NRV

by the end of the next month. The shortfall will be calculated on the higher NRV maintained across the two

consecutive months.

Below is a table showing different scenarios on charge calculation:

Example: Account type = Domestic; Min. NRV requirement = Rs. 1 lac

Month 1

Month 2

Month 3

Month 4

Month 5

80,000

70,000

110,000

30,000

20,000

80,000

70,000

110,000

30,000

20,000

500

500

NA

500

500

NRV used for charge calculation

(Higher of the current and previous

month)

..

80,000

110,000

110,000

30,000

Charges - 1% of the NRV shortfall or Rs.

600, whichever is lower

..

200

Nil

Nil

600

NRV maintained

Current Process

NRV used for charge calculation

(same as the current month NRV)

Charges (Flat-fee)

Revised Process (w.e.f. 1st April, 2015)

Please note that the above examples are for explanation purposes only.

Page 1 of 2

Last modified on 1-4-15

How is this change beneficial for me?

This change is better as you now enjoy the following benefits:

Additional one month for building up your NRV

Pro-rata charges, calculated only on the shortfall instead of a flat fee

No charges if you maintain NRV within one month of notice

How will I get to know in case my accounts NRV has fallen short of threshold?

You will receive intimation via SMS and Email when your accounts NRV falls below the threshold and when the

charge is levied on your account.

When will the charge be deducted from my account?

If your NRV falls below the threshold, you will get a one month period to maintain it up to the threshold, failing

which, non-maintenance charges will be deducted at the end of second month.

For example, if your NRV in April falls below the threshold, charges will be deducted at the end of May. However,

if your NRV in May is above threshold, no charges will be deducted.

How can I check the minimum NRV requirement to be maintained in my account?

The minimum monthly NRV threshold varies basis the type of account you hold with us. To know this limit, please

see the Schedule of Charges applicable for your account.

How can I build up my NRV to meet the minimum requirement?

There are many convenient ways to build up your NRV, which Citibank provides:

Increasing the savings account balance

Booking a new fixed deposit

Bringing in funds for investing in mutual funds

Purchasing a fresh insurance policy

Taking a Citibank home loan or by transferring an existing home loan to Citibank

How will I get to know what is the NRV of my account?

You can check your average monthly NRV on the monthly account statement.

Page 2 of 2

Last modified on 1-4-15

You might also like

- Landline TraiDocument6 pagesLandline TraiRupali KhannaNo ratings yet

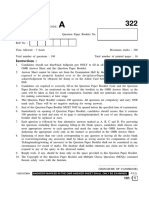

- 322 A PDFDocument16 pages322 A PDFRupali KhannaNo ratings yet

- Request Slip For ExchangeDocument1 pageRequest Slip For ExchangesouthliveNo ratings yet

- New Syllabus: Time Allowed: 3 Hours Maximum Marks: 100Document3 pagesNew Syllabus: Time Allowed: 3 Hours Maximum Marks: 100Steffanie228No ratings yet

- SBI PO Preliminary Exam 2015 Solved Question PaperDocument8 pagesSBI PO Preliminary Exam 2015 Solved Question PaperManu BhatiaNo ratings yet

- Minor ReportDocument30 pagesMinor ReportRupali KhannaNo ratings yet

- SBI PO Exam 7.03.2010 Answer KeyDocument4 pagesSBI PO Exam 7.03.2010 Answer KeyRamu BattaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Capital Budgeting Questions and ExercisesDocument4 pagesCapital Budgeting Questions and ExercisesLinh HoangNo ratings yet

- Bof IDocument1 pageBof IMd Abul Bashar SumonNo ratings yet

- Business Concepts and Definitions: 1. Enterprise: 2. EntrepreneurshipDocument22 pagesBusiness Concepts and Definitions: 1. Enterprise: 2. EntrepreneurshipNatalieNo ratings yet

- Engleski Jezik Za Ekonomiste 2 - Test Sa Resenjima 2016Document24 pagesEngleski Jezik Za Ekonomiste 2 - Test Sa Resenjima 2016MarkoNo ratings yet

- Equity FundsDocument3 pagesEquity FundsRosyDayNo ratings yet

- Basic Capital BudgetingDocument42 pagesBasic Capital BudgetingMay Abia100% (2)

- Motilal Oswal Zomato IPO NoteDocument10 pagesMotilal Oswal Zomato IPO NoteKrishna GoyalNo ratings yet

- Lista Societatilor Tip HoldingDocument5 pagesLista Societatilor Tip HoldingMihaela AnghelNo ratings yet

- Private Equity ReportDocument28 pagesPrivate Equity Reportyahoooo1234No ratings yet

- Bank of IndiaDocument15 pagesBank of Indiashreyaasharmaa100% (1)

- Numerical Reasoning Practice Test 1Document3 pagesNumerical Reasoning Practice Test 1venus191089No ratings yet

- E-Banking's Impact on Customer Value at Pragathi Krishna BankDocument100 pagesE-Banking's Impact on Customer Value at Pragathi Krishna BankCenu RomanNo ratings yet

- Please Pay by Total Due: Casimiro YulfoDocument2 pagesPlease Pay by Total Due: Casimiro YulfoJohn Bean100% (4)

- Fernado Ong vs Court of Appeals (1983) case analysisDocument23 pagesFernado Ong vs Court of Appeals (1983) case analysiskarenkierNo ratings yet

- Tally ERP 9 Notes EnglishDocument32 pagesTally ERP 9 Notes Englishravinder raviNo ratings yet

- International Economics II - CH 3Document35 pagesInternational Economics II - CH 3Ermias AtalayNo ratings yet

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Far 2 Vol1 by Sir Jawad - 2022-08-03 10-11-29Document298 pagesFar 2 Vol1 by Sir Jawad - 2022-08-03 10-11-29Ar Sal AnNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Notes Budget ManthanDocument3 pagesNotes Budget ManthanvishalNo ratings yet

- PressenTatIon of UBL (Loan)Document15 pagesPressenTatIon of UBL (Loan)Adeel ShahNo ratings yet

- Loan Products of SBIDocument46 pagesLoan Products of SBIvinodksrini007No ratings yet

- What Is Financial Management's Importance?: July 2021Document5 pagesWhat Is Financial Management's Importance?: July 2021Utkarsh DwivediNo ratings yet

- Session 5 - 7 Financial Statements of Bank PDFDocument15 pagesSession 5 - 7 Financial Statements of Bank PDFrizzzNo ratings yet

- HDFC Rtgs FormDocument9 pagesHDFC Rtgs Formsulthaninvst03No ratings yet

- Mock Exam For CFA Level 1Document70 pagesMock Exam For CFA Level 1christyNo ratings yet

- Forbes Asia December 2017Document100 pagesForbes Asia December 2017Mateus de OliveiraNo ratings yet

- HSBC - de - PGL - Bank Endorsed - DraftDocument10 pagesHSBC - de - PGL - Bank Endorsed - DraftzagogNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingJane Masigan50% (2)

- Loan AgreementDocument20 pagesLoan AgreementAnjani DeviNo ratings yet