Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

November 10,201 6

To,

+The Secretary,

BSE Limited,

P.J. Towers,

Dalal Street,

Murnbai- 400 001

Scrip Code: 539542

To,

'The Secretary,

National Stock Exchange of

India Ltd.,

Exchange Plaza, C-1, Block G,

Bandm Kurla Complex, Bandera

(E),

Mumbai - 400 05 1

Symbol: LUXIND

To,

To,

The Secretary,

The Secretary,

The Calcutta Stock The Ahmedabad Stock

Exchange Limited,

Exchange Limited,

7, Lyons Range,

1st Floor, Kamdhenu

Kolkata- 700 001

Complex, Opp. Sahajanand

Scrip Code: 0221 24

College, Panjara Pole,

Ahmedabad: 380 015

Scrip Code: 32985lLUX

HOSlN

Dear Sir,

Sub: Un-audited Financial Results along with Limited review Report of the Statutory Auditors for

the quarter and halfyear ended 3dhSeptember, 2016.

Pursuant to regulation 33 of the SEBI (Listing Obligation and Disclosure Requirements) Regulations,

2015 we wish to enclose herewith Un-audited Financial Results of the company for the quarter and

half year ended 30' September, 2016 as approved by the board of directors at its meeting held today.

The meeting of the Board of Directors of the Company commenced at 3:30 p.m. and concluded at

5.10 p.m.

We also enclose herewith Limited Review Report of the Statutory Auditor of the Company in respect

of the said results

We request you take the same on your record.

Thanking You

Yours faithfully,

for LUX INDUSTRIES LIMITED

V

Pankaj Kumar Kedia

(Vice President & Company Secretary)

LUX INDUSTRIES LTD

PS Srijan Tech - Park, 10th Floor, DN - 52, Sector - V, Saltlake, Kolkata - 700 091, lndia. P: 91-33-4040 2121, F: 91-33-4001 2001, E: info@luxinnerwear.com

Regd. Office: 39 Kali Krishna Tagore Street, Kolkata - 700 007, lndia, P: 91-33-2259 8155, Website: vwwluxinnemear.com a CIN : L17309WB1995PLC073053

SANJAY MOD1 & CO.

CHARTERED ACCOUNTANTS

LIMITED REVIEW REPORT

TO

The ~ o b r dof Directors

Lux lndustries Ltd

39, Kali Krishna Tagore Street

Kolkata-7000 07.

We have reviewed the accompanying Statement of Unaudited Standalone of Financial Results of Lux

lndustries Limited ("The Company") for the quarter and half year ended 3oth september, 2016 and

Unaudited Standalone Statement of Assets and Liabilities. This statement is the responsibility of the

Company's Management and has been approved by the Board of Directors. Our responsibility is to issue

a report on these Financial Statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410, 'Review

of Interim Financial Information performed by the Independent Auditor of the Entity' issued by the Institute

of Chartered Accountants of India. This standard requires that we plan and perform the review to

obtained moderate assurance as to whether the financial statements are free of material misstatements.

A review is limited primarily to inquiries of Company personnel and analytical procedures applied to

financial data and thus provided less assurance than an audit. We have not performed an audit and

accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe

that the accompanying Statement of Unaudited Financial Results prepared in accordance with applicable

Accounting Standards and other recognized practices and policies, has not disclosed the information

required to be disclosed in terms of Regulation 33 of the SEBl (Listing Obligations and Disclosure

Requirements) Regulations, 2015, read with Circular No. CIR/CFD/FAC/62/2016 dated 5thjuly 2016,

including the manner in which it is to be disclosed, or that it contains any material misstatement.

For Sanjay Modi & Co

Chartered Accountants

FRN: 322295E

&by--

CA Prodyat Chaudhuri

Partner

M.N0:065401

Place: Kolkata

Date: 10.11.2016

109, JOY COMPLEX, 46, BIPIN BEHARI GANGULY STREET, KOLKATA - 700 0 1 2

Phone : 2237-1037, 2221-7177, Fax : 91-33-2236-6455, E-mail : info@smco.co.in

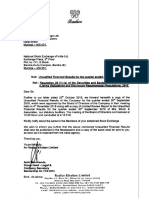

LUX INDUSTRIES LIMITED

Read. Offlu: 39. W KRISHNA TAGORE STREET. KOLKATA 700 007

STATEMENT OF FINANCIAL RESULTS FOR THE QUARTER ENDED MTH SEPTEMBER' 2016

Quarter Ended

Partlculan

1. NO

Income from operations

a) Net Sales IIncome from operations (Net of excise duty)

-,---.

3

4

5

7

8

9

10

11

12

13

14

15

b) Other O~eratina

" income

Total Income from Operation (Net)

Expenditure

a) Cost of matelials consumed

b) Purchase of Stock in Trade

c) Change in inventories of Finished goods, work in

progress, and Stock in trade

d) Employee benefits Expense

e) Depreciation 8 amortisation Expenses

9 SubantradingNobbing Expense

g) Other Expenses

Total Expenaa

Profit from Operation before Other income, finance costs

and exceptional items (1-2)

Other lncome

p m n t from ordlnary activities before finance cost and

exceptional I t e m (3+4)

Finance Costs

Profit from ordinary activlties after finance cost b u t before

exceptional llemss (54)

Exeptional items

ProRU(Los8) from Ordinary Activities

before tax (74)

Tax Expenses

Net ProflV(Lo8s) from Ordinary

Activities after tax (9-10)

Extraordlnary ltems

Net Pmflt for the perlod (11-12)

Paid-Up Equity Share Capital

(Face Value of 7101- each)

(7 In Lacs)

Year to data

flguma for the

pmv.

Period ended

Year to data

flguma for

current

Period ended

Year Ended

3010912016'

3WW2016

3010912015~

3010912016

SOW2015

3110312016

(Unaudted)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudiied)

(Audited)

26,574.65

462.70

17,988.79

330.89

24,901.14

305.00

44,563.44

793.59

41,299.60

548.55

92.980.09

1,106.44

Reserves excluding Revaluation Reserves as per Balance Sheets

16 EPS for the Perlod (not Annuallsed)

I.Before extraordinary items

(a) Baslc

(b) Diluted

ii.After extraordinary items

(a) B a s k

(b) Diluted

I

1)

The unaudled financial results and statement of assets and liabilities have been reviewed by the Audit Committee and approved by the Bowd of Diredors in their meeting held on 10th

Novemhr, 2018.The Statutory Audiior have carried out a limi(ed review of h e above Financial Resuns as required under Regulation 33 of the SEBI (listing obligations and Disclosure

Requirements) Regulations,2015 (listing Regulations) and have issued an unqualified Dpinion thereon.

2)

The Company is engaged In the business of Manufacturing 8 Sales of Knihuear. Acwrdingly. the Company has single significant primary business segment. As such no separate segment

informalion is diwlosed.

3)

4)

The Company has sub divided I s Equity shares from face value of Rs.10 each to face value of Rs. 2 each w.e.f. 06.06.2016. Accordingly the Eaming per share has men restated as per

Per Share".

. para 24 of AS 20" Eaming

The Company has reviaed Its accounting policy of Inventory valuation from h e FlFO method to the Weighted moving average method wnalstent with the beat accounting practices . The

change in the above accounting pclicy has resulted decreasing in value of Inventories by Rs.106.B lacs.ConsequentlyUm net prof#for the wnent quarter is lower by the said amount.

Had h e wmpny followed the FlFO method for Inventory valuation, the surplus for the quarter ended would have been higher by Ra. 106.26 lacs.

5)

prior period) year figures have been rearrangedlregrouped. herever considered necessary to c o n f m to the current period clasmcatiorv disclosure.

By Order o f the Board

for L u x tNousTRlEs LIMITED

Place : Kolkata

l ~ a t e. 10th November. 2016.

*-',

Ashok Kumar Todi

Chairman

:,

I

I

PS Srijan Tech - Park, 10th Floor, DN - 52, Sector - V, Saltlake, Kolkata - 700 091, India. P: 91-33-4040 2121, F: 91-33-4001 2001, E: info@luxinnerwear.com

Regd. Office: 39 Kali Krishna Tagore Street, Kolkata - 700 007, India, P: 91-33-2259 8155, Website: www.luxinnerwear.com

ClN : L17309WB1995PLC073053

LUX INDUSTRIES LIMITED

Standalone Statement of Assets and Liabilities

S.N.

(7 In Lacs

Standalone

Audited

Particulars

As at

30.09.2016

A. Equity and Liabilities

1 Shareholders' funds .

(a) Share Capital

(b) Reserves & Surplus

Sub-total -Shareholders' funds

2

6,129.98

As at

31.03.2016

6,129.98

Non current liabilities

(a) Long-term borrowings

(b)

. . Deferred Tax Liabilities (Net)

(c) Long-term provisions

Sub-total Non-current liabilities

3 Current Liabilities

(a) Short-term borrowings

(b) Trade payables

(c) Other current liabilities

(d) Short-term provisions

Sub-total Current liabilities

91.18

(ii) Intangible assets

(iii) Capital work-in-progress

(b) Non-current investments

(c) Long-term loans and advances

Trade receivables

Cash and bank balances

(d) Short-term loans and advances

Sub-total Current assets

(b)

(c)

By Order of the Board

for LUX INDUSTRIES LIMITED

, k 2 m b aAshok Kumar Todl

Chairman

DIN-00053599

L U X INDUSTRIES LTD

PS Srijan Tech - Park, 10th Floor, DN - 52, ~ e c i o-rV, Saltlake. Kolkata - 700 091, India. P: 91-33-4011) 2121, F: 91-33-1

2001, L inf~@luxinne~we~r.corn

Regd. Office: 39 Kali Krishna Tagore Street, Kolkata - 700 007, India, P: 91-33-2259 8155, Website: ww.luxinnemar.com

CIN : L17309WBl995PLC073053

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document3 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Industries Limited: BSE Limited Stock ExchangeDocument12 pagesIndustries Limited: BSE Limited Stock ExchangeBishal GuptaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Exide: EIL/SEC/2020Document18 pagesExide: EIL/SEC/2020Aneesh ViswanathanNo ratings yet

- S Chand and Company LimitedDocument21 pagesS Chand and Company LimitedNishit GolchhaNo ratings yet

- A.L .Oo .9-U'-: Industries LimitedDocument21 pagesA.L .Oo .9-U'-: Industries LimitedvijaybhaskarthatitNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- BSE LTD.: Date: - 28 October, 2022Document14 pagesBSE LTD.: Date: - 28 October, 2022apoorvsharanNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results Q2 Report 2023 24Document15 pagesFinancial Results Q2 Report 2023 24Nilay KumarNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Material Accounting & Related DocumentsDocument21 pagesMaterial Accounting & Related DocumentsAnand Dubey100% (1)

- Internal Auditor Magazine - April 2009 - Whirlwind of DeceptionDocument3 pagesInternal Auditor Magazine - April 2009 - Whirlwind of DeceptionBrian WillinghamNo ratings yet

- Integrating Iso 10006-Pmbok Into PdcaDocument34 pagesIntegrating Iso 10006-Pmbok Into Pdcaalex1123No ratings yet

- Chapter 1 - Introduction To Financial AnalysisDocument42 pagesChapter 1 - Introduction To Financial AnalysisMinh Anh NgNo ratings yet

- CA Ipcc Audit m21 Book FVDocument405 pagesCA Ipcc Audit m21 Book FVKC XitizNo ratings yet

- Auditing - Principles and Practice PDFDocument171 pagesAuditing - Principles and Practice PDFKiran Ravi Srivastava80% (5)

- Auditing MCQ Unit 1 To Unit 4Document6 pagesAuditing MCQ Unit 1 To Unit 4amitNo ratings yet

- Environmental Management SystemsDocument33 pagesEnvironmental Management SystemsKrishan KantNo ratings yet

- Dheeraj Kumar: Total Working Experience: Professional QualificationDocument4 pagesDheeraj Kumar: Total Working Experience: Professional QualificationmrkunaljainNo ratings yet

- Final Criteria - Jps 2019-2024 Rate Review ProcessDocument137 pagesFinal Criteria - Jps 2019-2024 Rate Review Processcsf571No ratings yet

- Waste Auditing Guide Guiding PrinciplesDocument24 pagesWaste Auditing Guide Guiding PrinciplesChristineNo ratings yet

- At Aud001Document4 pagesAt Aud001KathleenNo ratings yet

- Safety in Airport OperationsDocument25 pagesSafety in Airport OperationsChoy Aming AtutuboNo ratings yet

- IIA Maturity Model PDFDocument13 pagesIIA Maturity Model PDFZsL6231No ratings yet

- AIS Week 5 QuizDocument2 pagesAIS Week 5 QuizMarvina Paula Vierneza LayuganNo ratings yet

- Engagement LetterDocument3 pagesEngagement LetterRathan Mat100% (1)

- Tax AsynchDocument8 pagesTax AsynchNeil FrangilimanNo ratings yet

- For HODDocument94 pagesFor HODVinu VaviNo ratings yet

- Accounting Standards - Will The World Be Talking The Same Language - Published in CA Journal Feb 2005Document6 pagesAccounting Standards - Will The World Be Talking The Same Language - Published in CA Journal Feb 2005shrikantsubsNo ratings yet

- Cta 2D CV 09396 D 2019apr08 Ass PDFDocument205 pagesCta 2D CV 09396 D 2019apr08 Ass PDFMosquite AquinoNo ratings yet

- GT Energy Audit Plan (2016!09!14)Document30 pagesGT Energy Audit Plan (2016!09!14)Amartya Ahmad AtmawijayaNo ratings yet

- COA IssuanceDocument10 pagesCOA IssuanceJenny RabanalNo ratings yet

- FreightDocument37 pagesFreightALLIA LOPEZNo ratings yet

- LESSONS LEARNED The Costs and Benefits of The Earned ValueDocument14 pagesLESSONS LEARNED The Costs and Benefits of The Earned Valuehh00216100% (1)

- Apple Conflict Free MineralsDocument15 pagesApple Conflict Free MineralsMikey CampbellNo ratings yet

- ACC306 Advanced Assurance and AttestationDocument2 pagesACC306 Advanced Assurance and Attestationbandlover12341No ratings yet

- Fabm From MamDocument4 pagesFabm From MamJasmine MendozaNo ratings yet

- Audit of Govt CompaniesDocument4 pagesAudit of Govt CompaniesNisha ChanchlaniNo ratings yet

- QP.39 External AuditsDocument2 pagesQP.39 External AuditsprytzNo ratings yet

- 1 s2.0 S1877042814059035 Main PDFDocument8 pages1 s2.0 S1877042814059035 Main PDFwulandariNo ratings yet

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessFrom EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsFrom EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsRating: 4 out of 5 stars4/5 (26)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet