Professional Documents

Culture Documents

20131161611471993IT 2TY 2013withformula

Uploaded by

zahids2kOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20131161611471993IT 2TY 2013withformula

Uploaded by

zahids2kCopyright:

Available Formats

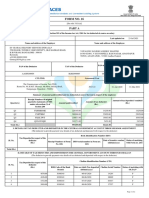

RETURN OF TOTAL INCOME/STATEMENT OF FINAL TAXATION

UNDER THE INCOME TAX ORDINANCE, 2001 (FOR INDIVIDUAL / AOP)

Taxpayer's Name

CNIC (for Individual)

Registration (*)

Business Name

Business Address

Res. Address

E-Mail Address

Phone

Principal Activity

Code

Employer

NTN

Name

Representative

NTN

Name

Authorized Rep.

NTN

Name

Employee/PA Number

FINAL TAXATION

IVIDUAL / AOP)

Control Centre

N

NTN

Gender

Male

Tax Year

Res. Status

Enter 1 for Male or 2 for Female

1

1

Enter 1 for IND or 2 for AOP

Enter 1 for Resident or 2 for Non-Reside

Enter 1 for YES 2 for NO

30.06.2013

Year Ending

Person

Female

IND

Non-Res.

2013

AOP

Resident

Birth Date

Filing Section

RTO/LTU

Is authorized Rep. applicable?

Yes/No

for Female

or 2 for Non-Resident

Version

1.0

Source

Turbo Tax Assistant

Wealth Statement Filled

IT-2 (Page 1 of 2)

RETURN OF TOTAL INCOME/STATEMENT OF FINAL TAXATION

Registration

UNDER THE INCOME TAX ORDINANCE, 2001 (FOR INDIVIDUAL / AOP)

Taxpayer's Name

NTN

CNIC (for Individual)

Gender

Business Name

Year Ending

Business Address

Tax Year

Res. Address

Person

0

0

E-Mail Address

Principal Activity

Employer's

NTN

Representative

Authorized Rep.'s

Manufacturing/ Trading, Profit & Loss

Account ( including Final/Fixed Tax)

Ownership

NTN

2

3

4

5

6

7

8

9

10

11

12

Adjustments

Res. Status

Code

Birth Date

0

0

NTN

Name

NTN

Name

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

Net Sales (excluding Sales Tax/ Federal Excise Duty)

Cost of Sales [3 + 4 + 5 - 6]

Opening Stock

Net Purchases (excluding Sales Tax/ Federal Excise Duty)

Other Manufacturing/ Trading Expenses

Closing Stock

Gross Profit/ (Loss) [1-2]

Transport Services U/S 153(1)(b) (Transferred from Row 1 Column 5 of Annex H)

Other Services U/S 153(1)(b) (Transferred from Row 1 Column 6 of Annex H)

Other Revenues/ Fee/ Charges for Professional and Other Services/ Commission

Profit & Loss Expenses

Net Profit/ (Loss) [(7 + 8 + 9 + 10) - 11]

Inadmissible Deductions

Admissible Deductions

Unadjusted Loss from business for previous year(s)

[to be reconciled with Annex-C]

Un-absorbed Tax Depreciation for previous/ current year(s)

Total Income (18+31)

Total Income u/s 10(a) [Sum of 19 to 24]

Salary Income

Business Income/ (Loss) [ (12 + 13) - 14 - 15 - 16 ]

Share from AOP [Income/(Loss)]

Capital Gains/(Loss) u/s 37

Other Sources Income/ (Loss)

Foreign Income/ (Loss)

Deductible Allowances [Sum of 26 to 29]

Zakat

Workers Welfare Fund (WWF)

Workers Profit Participation Fund (WPPF)

Charitable donations admissible as straight deduction

Taxable Income/ (Loss) [18 - 25]

Exempt Income/ (Loss) u/s 10(b) [Sum of 32 to 38]

Salary Income

Property Income

Business Income/ (Loss)

Capital Gains/(Loss)

Agriculture Income

Foreign Remittances (Attach Evidence)

Other Sources Income/ (Loss)

Tax Payable on Taxable Income

[Transfer from Sr. 31 of Annex-A]

Yes

Yes

No

[to be reconciled with Annex-C]

[ Transfer from Sr-7 of Annex-G]

[ to be reconciled with Annex-C ]

Transfer from Sr-25 of Annex-G]

[Transfer from Sr-22 of Annex-E]

[Transfer from Sr-5 of Annex-E]

[Transfer from Sr. 31 of Annex-A]

Average Rate of Tax (%):

If, Yes, Do you want to avail Norma

Female

AOP

Non-Res.

Resident

Filing Section

0

0

RTO/LTU

#DIV/0!

Yes/No

Yes

No

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Eligible

Partially Eligible

Tax Computation

b) In order to Determine your eligibility for availing Normal Tax Regime, Click Annex-J

Not Eligible

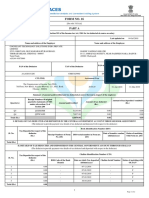

43 Minimum tax on electricity consumption ( where monthly bill amount is up to Rs. 30,000) u/s 235 (4)

44 Balance tax chargeable [ (39 minus 40 plus 41) or 43, whichever is higher

Minimum Tax Payable U/S 113 [if 45(iv) minus 44 > zero then Amount equals to 45(iv) minus 44, else zero]

(i)

(iii) Reduction @

Total Turnover

20.00%

(ii) Minimum tax @ 0.5%

(iv) Net Minimum tax

46 Full Time Teacher/Researcher's Rebate

47 Net tax payable [44 + 45 - 46 + 97]

48 Total Tax Payments (Transfer from Sr. 31 of Annex-B)

9304

9305

9306

9309

9307

9499

400

-400

0

-400

45

49

Tax Payable/ Refundable [47 - 48 + WWF Payable from Sr. 32 of Annex-B]

9999

50

Refund Available (Current plus prior years)

9991

51

Refund Adjustments (not exceeding current year's tax payable)

9998

52

Annual personal expenses for individual only (transfer from Sr. 12 of Annex-D)

6109

Refund

Net Tax Refundable, may be credited to my bank account as under:

A/C No.

Bank

Branch Name & Code

Total

9303

Yes

Capital Amount

100%

Code

3103

3116

3117

3106

3111

3118

3119

3121

3122

3131

3189

3190

3191

3192

3902

3988

9000

9099

1999

3999

312021

4999

5999

6399

9139

9121

9122

9123

9124

9199

6199

6101

6102

6103

6104

6106

6107

6105

9201

9249

Difference of minimum Tax Payable on business transactions Annex - H

42 a) Do you fall under PTR Regime

2013

IND

% in Capital

40 Tax Reductions/Credits/Averaging other than Teacher/Researcher Rebate (including rebate on Bahbood Certificates, etc.)

41

Male

Is authorized Rep. applicable?

Proprietor/Member/Partners' Name

Others

Total

Items

1

Phone

Name

Employee/PA Number

Total / Taxable Income Computation

Signature

IT-2 (Page 2 of 2)

RETURN OF TOTAL INCOME/STATEMENT OF FINAL TAXATION

UNDER THE INCOME TAX ORDINANCE, 2001 (FOR INDIVIDUAL / AOP)

Taxpayer's Name

NTN

CNIC

(for Individual)

Tax Year

2013

Business Name

RTO/LTU

Rate

(%)

Code

Tax Chargeable

Final Tax

Source

Code

Receipts/Value

53 Imports

64013

92013

54

64011

92011

55

64012

92012

56

64015

92015

57 Dividend

64032

10

92032

58

64033

7.5

92033

59 Profit on Debt

64041

10

92041

60 Royalties/Fees (Non-Resident)

640511

15

920511

61

640512

920512

62 Contracts (Non-Resident)

640521

920521

63 Insurance Premium (Non-Resident)

640524

920524

64 Advertisement Services (Non-Resident)

640525

10

920525

65 Supply of Goods

640611

3.5

920611

66

640612

1.5

920612

67

640613

920613

68 Payments to Ginners

640614

920614

69 Contracts (Resident)

640631

920631

70

640632

920632

71 Exports/related Commission/Service

640641

0.5

920641

72

64072

92072

73 Foreign Indenting Commission

64075

92075

74 Prizes/Winnings of cross word puzzles

64091

10

92091

75 Winnings - Others

64092

20

92092

76 Petroleum Commission

64101

10

92101

77 Brokerage/Commission

64121

10

92121

78 Advertising Commission

64122

92122

79 Services to Exporters u/s 153(2)

64123

92123

80 Goods Transport Vehicles

92141

81 Gas consumption by CNG Station

64142

92142

Distribution of cigarette and

82

pharmaceutical products

64143

92143

83 Retail Turnover upto 5 million

310102

920202

84 Retail Turnover above 5 million

310103

920203

85 Property Income

210101

920235

Capital gains on Securities held for < 6

months

Capital gains on Securities held for >= 6

87

months and < 12 months

86

88

Fixed Tax

Capital gains on Securities held for >=12

months

Capital gains arising on disposal of

89

immovable property held upto 1 year

Capital gains arising on disposal of

90 immovable property held for > 1 year and

upto 2 year

91 Purchase of locally produced edible oil

92 Flying/Submarine Allowance

Monetization of Transport Facility For

93

Civil Servants

Services rendered / contracts executed

94

outside Pakistan

Number of persons sent for Hajj & Tax payable

610401

10

961041

610402

8.00

961042

610403

961043

610404

10

961044

610405

961045

310431

920208

112001

2.5

920234

112002

920237

63311

1.00

920236

92144

95 under Clause (72A)

63312

96 Employment Termination Benefits

118301

Number

3500

920211

97 Final/Fixed Tax Chargeable (53 to 96)

9202

Documents

Required

1. Wealth Statement (For Individuals and Members of AOP only)

Attached

2. Balance Sheet in case of income from business (in case declared/assessed turnover

for the tax year 2012 or any subsequent year is Rs. 5 million or more).

Attached

(Above documents are mandatory)

Note Under Income Support Levy Act, 2013, levy computed as per attached CP-34 form is to be deposited along with wealth statement

Verification

, in my capacity as

Self/ Partner or Member of Association of Persons/ Representative (as defined in section 172 of the Income

Tax Ordinance, 2001) of Taxpayer named above, do solemnly declare that to the best of my

knowledge and belief the information given in this Return/Statement u/s 115(4) and the attached Annex(es),

Statement(s), Document(s) or Detail(s) is/are correct and complete in accordance with the provisions of the

Income Tax Ordinance, 2001 and Income Tax Rules, 2002 (The alternative in the verification, which is not

applicable, should be scored out).

Date :

Signatures:

Acknowledgement

I,

holder of CNIC No.

Signatures & Stamp

of Receiving Officer with Date

NTN

Annex - A

2013

Depreciation, Initial Allowance and Amortization

CNIC for Individual

Depreciable Assets

Type

Additions

Sr.

#

Description

Code

WDV (BF)

Initial Allowance

Previously

used in

Pakistan

New

Rate (%)

Deletions

New

Old

Rate (%)

Allowance

Extent

(%)

Depreciation

WDV (CF)

Building (all types)

3202

25%

0%

10%

Machinery and plant (not otherwise specified)

320301

50%

0%

15%

Computer hardware (including allied items)

320302

50%

0%

30%

Furniture (including fittings)

320303

0%

0%

15%

Technical and professional books

320304

50%

0%

15%

Below ground installations of mineral oil concerns

320306

50%

0%

100%

Off shore installations of mineral oil concerns

320307

50%

0%

20%

Machinery and equipment used in manufacture of IT products

320308

50%

0%

30%

Motor vehicles (not plying for hire)

32041

0%

0%

15%

10 Motor vehicles (plying for hire)

32042

50%

0%

15%

11 Ships

32043

50%

0%

15%

12 Air crafts and aero engines

32044

50%

0%

30%

13 Machinery and equipment Qualifying for 1st year Allowance

320309

90%

0%

15%

320312

0%

0%

50%

15 Any plant or machinery that has been used previously in Pakistan

320310

0%

0%

15%

Any plant or machinery in relation to which a deduction has been

16 allowed under another section for the entire cost of the asset in the

tax year in which the asset is acquired.

320311

0%

0%

15%

17 Ramp for Disabled Persons

320313

100%

0%

100%

14

Computer hardware including printer, monitor and allied items, that

have been used previously in Pakistan

18 Total

19 Total Depreciation (Initial plus Normal)

20 Proportionate Depreciation in case of transitional tax year

Intangibles

Description

21 Intangibles

3205

22 Expenditure providing long term advantage/benefit

3207

Acquisition Date

Useful

Life(Years)

24 Pre commencement expenditure

Description

Original

Cost

Extent

(%)

Amortization

23 Total

Description

Brought Forward Adjustments

Code

Original

Expenditure

Code

Rate (%)

3206

Code

Amortization

20%

Amount

Tax Year

Description

Code

Amount

Tax Year

25

3902

2007

Unabsorbed Amortization of intangibles / expenditure providing long term

advantage/benefit for previous year(s) adjusted against Business Income for

current year

3987

upto 2012

26

3902

2008

Amortization of intangibles / expenditure providing long term advantage/benefit

for current year adjusted against Business Income for current year

3987

2013

3902

2009

Unabsorbed tax depreciation/initial allowance of fixed assets for previous

year(s) adjusted against Business Income for current year

3988

upto 2012

28

3902

2010

Depreciation/initial allowance of fixed assets for current year adjusted against

Business Income for current year

3988

2013

29

3902

2011

30

3902

2012

27

Unadjusted Business loss for previous year (s)

adjusted against Business income for current year

Total (Not exceeding the amount of Business Income available for

31

adjustment) (transfer to Sr. 15 of Main Return)

Total (Not exceeding the amount of Business Income available for adjustment) (transfer to

Sr. 16 of Main Return)

Signature

____________________

2013

Annex-B

Tax Already Paid

NTN

CNIC (for individual)

Particulars

1 On import of goods (other than tax deduction treated as final tax)

94019

2 On Realization of Export proceeds (other than tax deduction treated as final tax)

3 From salary

94020

4 On dividend Income (other than tax deduction treated as final tax)

5 On Government securities

94039

8 On disposal of listed securities u/s 100B (Collected by NCCPL)

9 On profit on debt (other than tax deduction treated as final tax)

94042

Branch

Share%

940539

14 On property income

15 On withdrawal from pension fund

16 On cash withdrawal from bank

940640

940619

94028

Bank

Engine / Seating Capacity

Branch

Share%

Consumer No.

Owner's Name

Manufacturer Particulars

Engine / Seating Capacity

Subscriber's CNIC

Subscriber's CNIC

Owner's Name

Share%

Subscriber's Name

Share%

Subscriber's Name

Share%

28 Advance Tax U/S 147(1) [ a + b + c + d]

CPR No.

b. Second installment

c. Third installment

d. Fourth installment

CPR No.

CPR No.

CPR No.

29 Advance Tax U/S 147(5B) [ a + b + c + d]

a. First installment

CPR No.

30

b. Second installment

c. Third installment

CPR No.

CPR No.

d. Fourth installment

CPR No.

94179

Admitted Tax Paid U/S 137(1) CPR No.

94149

94159

94169

94180

94121

94599

WWF Payable with Return (WWF payable will be adjusted against the excess payments made during the current year)

94591

9461

9461

9471

31 Total Tax Payments [26 + 27 + 28 + 29+30] (Transfer to Sr. 48 of Main Return)

32

94139

24 On Sale by Auction

25 On purchase of domestic air travel ticket

26 Total Tax Deductions at source (Adjustable Tax) [Sum of 1 to 25]

27 Total Tax Deductions at source (Final Tax)

a. First installment

94131

23 With telephone bills, mobile phone and pre-paid cards

Number

94119

94120

19 On sale/purchase/trading of shares through a Member of Stock Exchange

20 On financing of carry over trade

21 With motor vehicle token tax (Other than goods transport vehicles)

Registration No.

940639

17 On certain transactions in bank

18 With Motor Vehicle Registration Fee

Registration No.

940629

22 With bill for electricity consumption

Tax Payments

94049

10 On payments received by non-resident (other than tax deduction treated as final tax)

11 On payments for goods (other than tax deduction treated as final tax)

12 On payments for services (other than tax deduction treated as final tax)

13 On payments for execution of contracts (other than tax deduction treated as final tax)

Certificate/Account No. etc.

94043

94040

94041

Bank

Amount of Tax

deducted (Rs.)

94029

6 On sale or Transfer of Immovable Property @ 0.5% u/s 236C

7 On Sale to traders and distributors u/s 153A @ 0.5%

Certificate/Account No. etc.

Tax Collected/Deducted at Source (Adjustable Tax only)

Code

9308

Annex C

2013

Breakup of Sales in case of Multiple Businesses

C

0

Taxpayer Name

NTN

CNIC/Reg.No.

Tax Year

2013

Business Name

RTO/LTU

Business Name & Business Activity

Sales

Cost of Sales

Gross Profit/Loss

(1)

(2)

(3)

(4) = (2) - (3)

Sr.

Business Name

BUSINESS WISE BREAKUP OF SALES

1

Business Activity

Business Name

2

Business Activity

Business Name

3

Business Activity

Business Name

4

Business Activity

Business Name

5

Business Activity

Total (to be reconciled with Sr. 1, 2 & 7 of Main Return)

Signature:

Note : Grey blank fields are for official use

Annex - D

2013

Details of Personal Expenses (for individual)

Taxpayer Name

PERSONAL EXPENSES

NTN

0

0

CNIC (for individual)

Expenses

Sr

Description

Residence electricity bills

Residence telephone/mobile/internet bills

Residence gas bills

Residence rent/ground rent/property tax/fire insurance/security services/water bills

Education of children/ spouse/ self (Optional, it can be included in Sr-9)

Travelling (foreign and local) (Optional, it can be included in Sr-9)

Running and maintenance expenses of Motor vehicle(s)

Club membership fees/bills

Other personal and household expenses

10

Total personal expenses (Sum of 1 to 9)

11

(Less) Contribution by family members

12

Net Personal Expenses (10 - 11) transfer to Sr-52 of Main Return

0

Adults

Minor

13 Number of family members/dependents

Signature: _____________________

Annex - E

2013

E

Deductions (Admissible & Inadmissible)

Taxpayer Name

Deductions not allowed / inadmissible

Admissible Deductions

NTN

0

0

Sr.

CNIC (for individual)

Particulars

Code

Tax Amortization

319287

Tax Depreciation (If Sr. 20 of Annex-A > 0, then Sr. 20 else Sr. 19)

319288

Income/(Loss) relating to Final and Fixed tax

319289

Other Admissible Deductions

319298

Total [Add 1 to 4] to be transferred to Sr-14 of main return

Cess, rate or tax that is levied on the profits or gains or assessed as a percentage or otherwise on the basis of profits or gains

319101

Salary, rent, brokerage or commission, profit on debt, payment to non-resident, payment for services or fee from which the

company was liable to deduct tax at source unless the company has deducted and paid the tax as required by the Income Tax

Ordinance, 2001

319102

Entertainment expenditure in excess of prescribed limits

319104

Contribution to an un-recognized provident fund, pension fund, superannuation fund or gratuity fund

319105

Contribution to a provident fund or other fund established for the benefit of the employees, unless effective arrangements have

been made to deduct tax at source in respect of which the recipient is chargeable to tax under the head "salary"

319106

Fine or penalty for the violation of any law, rule or regulation

319107

Personal expenditure

319108

Provisions or amounts carried to reserves or funds etc. or capitalised in any way

319109

Profit on debt, brokerage, commission, salary or other remuneration paid by an AOP to its members

319110

10

Any salary, rent, brokerage or commission, profit ondebt, payment to non-resident or payment for services or fee on which tax

was required to be deducted and paid but was not deducted and paid

319111

11

Expenditure under a single account head which, in aggregate, exceeds Rs. 50,000 paid otherwise than by a crossed bank

cheque or crossed bank draft (excluding expenditures not exceeding Rs. 10,000 or on account of freight charges, travel fare,

postage, utilities or payment of taxes, duties, fees, fines or any other statutory obligation)

319112

12

Salary exceeding Rs. 15,000 per month paid otherwise than by a crossed cheque or direct transfer of the funds to the employee's

bank account

319113

13

Capital expenditure

319114

14

Provisions for bad debts, obsolete stocks, etc.

319115

15

Apportionment of expenditure including profit on debt, financial cost and lease payments relatable or attributable to non-business

activities

319116

16

Mark-up on lease financing

319118

17

Accounting pre-commencement expenditure written off

319120

18

Accounting loss on disposal of depreciable assets / intangibles

319121

19

Accounting amortization

319123

20

Accounting depreciation

319124

3192

21 Any other (please specify)

319125

22 Total [Add 1 to 21] to be transferred to Sr-13 of main return

3191

Amount (Rs.)

Signature _______________________

Annex - F

2013

Bifurcation of Income/(Loss) from business attributable to

Sales/Receipts etc. subject to Final Taxation

Taxpayer Name

NTN

0

Particulars

1. Sales (net of brokerage, commission and discount)

CNIC (for individual)

Code

Total

Amount (Rs.)

Subject to Final

Taxation

Amount (Rs.)

Code

Subject to Normal

Taxation

Amount (Rs.)

3010

3010F

(a)

Local sales/supplies - Out of imports (Trading)

30101

30101F

(b)

Local sales/supplies - Others

30102

30102F

(c)

Execution of contracts

30103

30103F

(d)

Export sales

30104

30104F

(e)

Others

30105

30105F

(f)

Sub-total [ Add 1(a) to 1(e)]

30106

30106F

(g)

Selling expenses (Freight outward, etc.)

30107

Net ex-factory or F.O.B. sales [ 1(f) minus 1(h)]

30108

(h)

2. Cost of sales

(a)

(b)

(c)

As per income statement

(e)

(b)

(i)

Actual / identifiable

(ii)

Average / proportionate to sales

30111

30111F

30112

30112F

301121F

(ii)

Accounting amortization

301122

301122F

(iii)

Others

301123

301123F

301124

301124F

30113F

30114F

Sub-total [Add c(i) to c(iv)]

30113

Revised cost of sales [2(b) minus 2(d)]

30114

Gross profit [ 1(h) minus 2(e)]

Other business revenues/receipts

3012F

3012

-

30121

30121F

30122

30122F

(i)

Brokerage and commission

301221

301221F

(ii)

Transport services

301222

301222F

(iii)

Royalty & fee for technical services (non-residents) 301223

301223F

(iv)

301224

301224F

301225

301225F

30123

30123F

Others

Other inclusions/exclusions in income

Total gross income [ Add 3(a) to 3(b)(v)]

3013

Apportioned on the basis of:

3013F

(i)

Actual / identifiable

(ii)

Average / proportionate to gross income

As per income statement

30131

30131F

(c)

Adjustment of inadmissible expenditures etc.

30132

30132F

(i)

Accounting depreciation

301321

301321F

(ii)

Accounting amortization

301322

301322F

Markup lease financing

301323

301323F

(iv)

Selling expenses (Freight outward, etc.)

301324

301324F

(v)

Other inadmissible deductions

301325

301325F

Others

301326

301326F

30133F

(iii)

(vi)

(e)

3011F

(b)

(d)

301121

4. Administrative, selling, financial expenses etc.

(a)

30108F

Accounting depreciation

Adjustment of inadmissible costs etc.

(v)

(c)

(i)

3. Gross profit/(loss) / other business revenues/receip

(a)

30107F

3011

Apportioned on the basis of:

(iv)

(d)

Sub-total [Add c(i) to c(vi)]

30133

Adjustment of admissible expenditures etc.

30134

30134F

(i)

Tax depreciation (Total)

301341

301341F

(ii)

Tax amortization (Total)

301342

301342F

(iii)

Lease rentals

301343

301343F

(iv)

Other admissible deductions

301344

301344F

(v)

Others

301345

301345F

30135F

30136F

3014F

(f)

Sub-total [Add e(i) to e(v)]

30135

(g)

Net expenditure [ 4(b) minus to 4(d) plus 4(f)]

30136

5. Net profit/loss from business [3(c) minus 4(g)]

3014

Signature

___________________

2013

ANNEX-G

Breakup of Expenses

Registry

(Separate form should be filled for each business)

0

NTN

CNIC

Tax Year

Business Name

RTO/LTU

Business Address

Business City

Manufacturing &

Trading Expenses

Sr. Description

Profit & Loss Account Expenses

Taxpayer Name

2013

Code

Salaries,Wages

311101

Electricity

311102

Gas

311103

Stores/Spares

311106

Repair & Maintenance

311108

Other Expenses

311118

Total

Rent/ Rates/ Taxes

3141

Salaries & Wages

3144

10

Travelling/ Conveyance

3145

11

Electricity/ Water/ Gas

3148

12

Communication Charges

3154

13

Repairs & Maintenance

3153

14

Stationery/ Office Supplies

3155

15

Advertisement/ Publicity/ Promotion

3157

16

Insurance

3159

17

Professional Charges

3160

18

Profit on Debt (Markup/Interest)

3161

19

Donations

3163

20

Bad Debts Written Off

31821

21

Obsolete Stocks/Stores/Spares Written Off

31822

22

Selling expenses(Freight outwards)

31080

23

Commission/Brokerage on sales

31081

24

Others

31090

25

Total [ Add 8 to 24]

[ Add 1 to 6]

[Transfer to Sr. 5 of main Return]

31100

[Transfer to Sr. 11 of main Return]

3170

Amount

Signature _______________________

Total Tax Payments (Transfer from Sr. 28 of Annex-B)

Annex H

2013

H

Determination of minimum Tax Payable on certain transactions

Taxpayer Name

NTN

CNIC/Reg.No.

Tax Year

Business Name

Sr.

RTO/LTU

Description

(2)

(1)

2013

Import Value/Services receipts subject to collection or deduction

of tax at source

Taxable Income [Transferred from Sr-30 ]

Income relateable to the transcations subject to payment of

minimum tax

Import of

Edible Oil U/S

148(8)

Import of

Packing

Material U/S

148(8)

Transport

Services U/S

153(1)(b)

Other Services

U/S 153(1)(b)

Total

(3)

(4)

(5)

(6)

(7) = (3 + 4 + 5 + 6)

0

0

a. Calculated on actual basis

b. Calculated on proportionate basis

Proportionate tax

Minimum Tax

a) Rate of Minimum Tax

b) Minimum Tax [ 5(a) * (1) ]

3%

5%

2%

6%

Higher of (4) and 5(b)

Difference of minimum Tax Payable on business transactions (Transfer to Sr. 41 of Main Return)

Signature ______________________

400

Annex J

2013

J

Request of Taxpayers falling under PTR Regime for availing Normal Tax Regime (NTR)

Taxpayer Name

NTN

CNIC/Reg.No.

Tax Year

Business Name

RTO/LTU

Sr.

Description

Imports u/s 148(7) Exports u/s 154(4)

(2)

(1)

1

Net Sales (Transferred from Sr-1 of Main Return)

Total Tax Payable (Sr. 44 plus Sr. 45 minus Sr.- 46) of Main Return)

(3)

(4)

2013

0

Sales/ Payments u/s

153(1) & u/s 169(1)b

TOTAL

(5)

(6) = (3 + 4 + 5)

0

-400

Value of Import/Export & Indent Comm/Sale of Goods subject to

collection/deduction of tax at source

Actual value of Sales/Exports

Tax Collected/Collectable/Deducted /Deductible at Source

Proportionate Tax Payable [ (4 / 1) * 2 ]

%age of Tax Deducted at Source for Qulaifying for NTR

60%

50%

70%

Minimum Tax required for eligiblity for NTR (8 = 5 * 7)

Yes

Yes

Yes

If (8) Less than or equlas to (6) then Qualified for NTR (Yes);

(Transfer to Sr. 42 of Main Return)

Note :

0

0

Yes

Based on the Qulaification under Normal Tax Regime (NTR), the respective Columns of PTR Portion will be disbaled in the e-Filing System. However, the persons

filing paper returns, should strike out the relevant columns of PTR Portion (Imports, Exports, Sales/ Purchases) of the IT-2 Return Form on the basis of their eligibility

for NTR.

Signature _______________________

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 220V AC 50Hz Auto Infrared Sensor Switc..Document6 pages220V AC 50Hz Auto Infrared Sensor Switc..zahids2kNo ratings yet

- In The Supreme Court of Pakistan: Tariq MehmoodDocument12 pagesIn The Supreme Court of Pakistan: Tariq Mehmoodzahids2kNo ratings yet

- 6864 7849 8660 Total Result 3904 4526 5749 5053 4141 23373Document4 pages6864 7849 8660 Total Result 3904 4526 5749 5053 4141 23373zahids2kNo ratings yet

- Concept Note For FAO Project On Preparation of Provincial Agriculture Disaster Risk Management Operational Plan and Implementation GuidelinesDocument3 pagesConcept Note For FAO Project On Preparation of Provincial Agriculture Disaster Risk Management Operational Plan and Implementation Guidelineszahids2kNo ratings yet

- HKPJ Author ChecklistDocument2 pagesHKPJ Author Checklistzahids2kNo ratings yet

- Jurisdiction - Terms and Conditions of Civil ServantsDocument8 pagesJurisdiction - Terms and Conditions of Civil Servantszahids2kNo ratings yet

- Water TestingDocument1 pageWater Testingzahids2kNo ratings yet

- Fish Seed ProductionDocument1 pageFish Seed Productionzahids2kNo ratings yet

- Pension CalculatorDocument4 pagesPension Calculatorzahids2kNo ratings yet

- Fish Seed ProductionDocument1 pageFish Seed Productionzahids2kNo ratings yet

- Python 3 Hands OnDocument139 pagesPython 3 Hands OnusersupreethNo ratings yet

- Fish Seed ProductionDocument1 pageFish Seed Productionzahids2kNo ratings yet

- Waterter MoreDocument1 pageWaterter Morezahids2kNo ratings yet

- Subject Marks English 28 Urdu 31 Studies 197 Social 67 Biology 160 Maths 167 G. Science 196 Chemistry 122 Physics 91Document1 pageSubject Marks English 28 Urdu 31 Studies 197 Social 67 Biology 160 Maths 167 G. Science 196 Chemistry 122 Physics 91zahids2kNo ratings yet

- Additional Fish LengthsDocument1 pageAdditional Fish Lengthszahids2kNo ratings yet

- Modified CobDouglas FunctionDocument1 pageModified CobDouglas Functionzahids2kNo ratings yet

- Manuscript Template For TJZDocument8 pagesManuscript Template For TJZzahids2kNo ratings yet

- A New Procedure To Clean Up Fish Collection DatabasesDocument9 pagesA New Procedure To Clean Up Fish Collection Databaseszahids2kNo ratings yet

- Fish LengthsDocument1 pageFish Lengthszahids2kNo ratings yet

- Pak StudiesDocument2 pagesPak Studieszahids2kNo ratings yet

- Ehs Research UiowaDocument42 pagesEhs Research Uiowazahids2kNo ratings yet

- Workflow Slides JSLong 110410 PDFDocument14 pagesWorkflow Slides JSLong 110410 PDFzahids2kNo ratings yet

- Fish LengthsDocument1 pageFish Lengthszahids2kNo ratings yet

- WOR46Document21 pagesWOR46zahids2kNo ratings yet

- WOR46Document21 pagesWOR46zahids2kNo ratings yet

- Peshawar Karachi DistanceDocument1 pagePeshawar Karachi Distancezahids2kNo ratings yet

- Lahore DistanceDocument1 pageLahore Distancezahids2kNo ratings yet

- Karachi DistanceDocument1 pageKarachi Distancezahids2kNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Revenue Regulation 19 of 1986 PDFDocument7 pagesRevenue Regulation 19 of 1986 PDFRaymart SalamidaNo ratings yet

- Mires v. United States, 10th Cir. (2006)Document10 pagesMires v. United States, 10th Cir. (2006)Scribd Government DocsNo ratings yet

- Module in Basic Taxation - zp163922Document2 pagesModule in Basic Taxation - zp163922zandilendlovu199fNo ratings yet

- Direct Tax Summary For Ay 2023-24Document39 pagesDirect Tax Summary For Ay 2023-24CA PASSNo ratings yet

- 8938 InstructionsDocument13 pages8938 Instructionssrinivas NNo ratings yet

- Tax Digest 1Document2 pagesTax Digest 1Nikko Sterling100% (2)

- CCP Connecticut Giving Report 2018 0Document24 pagesCCP Connecticut Giving Report 2018 0Helen Bennett0% (1)

- Income Tax Quiz 3 and Quiz 4 Answers PDFDocument32 pagesIncome Tax Quiz 3 and Quiz 4 Answers PDFJeda UsonNo ratings yet

- Chapter 12 Lower Cost and Net Realizable ValueDocument13 pagesChapter 12 Lower Cost and Net Realizable ValueRNo ratings yet

- Paper 16 PDFDocument433 pagesPaper 16 PDFPravin ThoratNo ratings yet

- Q2 - Business Math LAS3 FOR PRINTING - 230517 - 092725Document5 pagesQ2 - Business Math LAS3 FOR PRINTING - 230517 - 092725yenny lynNo ratings yet

- Cir v. Pal DigestDocument4 pagesCir v. Pal DigestkathrynmaydevezaNo ratings yet

- Public Finance in IndiaDocument22 pagesPublic Finance in IndiaGauravSahaniNo ratings yet

- Sea Tax Guide To Taxation in Sea 2022Document219 pagesSea Tax Guide To Taxation in Sea 2022JosephNo ratings yet

- Fundamental Principles of TaxationDocument53 pagesFundamental Principles of TaxationENIDNo ratings yet

- Business TaxationDocument5 pagesBusiness TaxationMajoy BantocNo ratings yet

- Tax True or False Not FinalDocument3 pagesTax True or False Not FinalAdah Micah PlarisanNo ratings yet

- TaxationDocument8 pagesTaxationArlyn VicenteNo ratings yet

- Bba 6th GenDocument6 pagesBba 6th GenvinaybabaNo ratings yet

- US Internal Revenue Service: I1040se - 1997Document5 pagesUS Internal Revenue Service: I1040se - 1997IRSNo ratings yet

- Taxation Review LectureDocument642 pagesTaxation Review LectureJudelyn Hesita100% (2)

- 2019 07 23 09 00 40 881 - 452619484 - PDFDocument6 pages2019 07 23 09 00 40 881 - 452619484 - PDFSadhana TiwariNo ratings yet

- Loopholes of The RichDocument17 pagesLoopholes of The RichcarolinegodwinNo ratings yet

- Cfa Fra R23-24Document132 pagesCfa Fra R23-24Trang NgôNo ratings yet

- VAT Act 1997Document105 pagesVAT Act 1997JesseNderingoNo ratings yet

- SDCs Instructions - Measurement of Log Volume PDFDocument21 pagesSDCs Instructions - Measurement of Log Volume PDFLAILA PUTRI YANTI BATUBARANo ratings yet

- Chapter 7Document24 pagesChapter 7ClaraNo ratings yet

- Income Statement ABC TRADING CORPORATION.Document5 pagesIncome Statement ABC TRADING CORPORATION.Mell Armonnd MonrealNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet