Professional Documents

Culture Documents

Internal Rate of Return IRR Calculation - Example - Decision Rule

Uploaded by

akram1978Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Rate of Return IRR Calculation - Example - Decision Rule

Uploaded by

akram1978Copyright:

Available Formats

11/5/2016

Internal Rate of Return IRR Calculation | Example | Decision Rule

AccountingExplained

Home > Managerial Accounting > Capital Budgeting > Internal Rate of Return

Internal Rate of Return (IRR)

Internal rate of return (IRR) is the discount rate at which the net present value of an investment becomes zero. In other words, IRR is the discount rate which

equates the present value of the future cash flows of an investment with the initial investment. It is one of the several measures used for investment appraisal.

Decision Rule

A project should only be accepted if its IRR is NOT less than the target internal rate of return. When comparing two or more mutually exclusive projects, the

project having highest value of IRR should be accepted.

IRR Calculation

The calculation of IRR is a bit complex than other capital budgeting techniques. We know that at IRR, Net Present Value (NPV) is zero, thus:

NPV = 0; or

PV of future cash flows Initial Investment = 0; or

CF1

1

(1+r)

CF2

2

(1+r)

CF3

( 1 + r )3

+ ... Initial Investment = 0

Where,

r is the internal rate of return;

CF1 is the period one net cash inflow;

CF2 is the period two net cash inflow,

CF3 is the period three net cash inflow, and so on ...

But the problem is, we cannot isolate the variable r (=internal rate of return) on one side of the above equation. However, there are alternative procedures

which can be followed to find IRR. The simplest of them is described below:

1. Guess the value of r and calculate the NPV of the project at that value.

2. If NPV is close to zero then IRR is equal to r.

3. If NPV is greater than 0 then increase r and jump to step 5.

4. If NPV is smaller than 0 then decrease r and jump to step 5.

5. Recalculate NPV using the new value of r and go back to step 2.

Example

http://accountingexplained.com/managerial/capital-budgeting/irr

1/2

11/5/2016

Internal Rate of Return IRR Calculation | Example | Decision Rule

Find the IRR of an investment having initial cash outflow of $213,000. The cash inflows during the first, second, third and fourth years are expected to be

$65,200, $96,000, $73,100 and $55,400 respectively.

Solution

Assume that r is 10%.

NPV at 10% discount rate = $18,372

Since NPV is greater than zero we have to increase discount rate, thus

NPV at 13% discount rate = $4,521

But it is still greater than zero we have to further increase the discount rate, thus

NPV at 14% discount rate = $204

NPV at 15% discount rate = ($3,975)

Since NPV is fairly close to zero at 14% value of r, therefore

IRR 14%

Written by Irfanullah Jan

Related Topics

Income Statement

Return on Investment

Residual Income

Multiple IRRs

Profitability Index

Managerial Accounting

Managerial Accounting Intro

Cost Classifications

Cost Accounting Systems

Cost Allocation

Cost Behavior Analysis

Cost-Volume-Profit Analysis

Relevant Costing

Capital Budgeting

Hurdle Rate

Mutually Exclusive Projects

Projects with Uequal Lives

Sunk vs Opportunity Costs

Incremental Cash Flows

Payback Period

Discounted Payback Period

Accounting Rate of Return

Net Present Value

NPV and Inflation

NPV and Taxes

Internal Rate of Return

Multiple IRRs

NPV vs IRR

Profitability Index

http://accountingexplained.com/managerial/capital-budgeting/irr

2/2

You might also like

- Harley-Davidson, Inc. Financial AnalysisDocument32 pagesHarley-Davidson, Inc. Financial AnalysisAlex Hudock100% (8)

- CH 12Document31 pagesCH 12Mochammad RidwanNo ratings yet

- Workbook 2 - Valuation of SecuritiesDocument3 pagesWorkbook 2 - Valuation of Securitieskrips16100% (1)

- Calculation of Septic Tank & Sock PitDocument11 pagesCalculation of Septic Tank & Sock Pitakram1978No ratings yet

- CH 08 RevisedDocument51 pagesCH 08 RevisedBhakti MehtaNo ratings yet

- Capital Budgeting Excel TemplateDocument2 pagesCapital Budgeting Excel TemplateRoderick Jackson JrNo ratings yet

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocument8 pagesAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedNo ratings yet

- Assignment 3Document7 pagesAssignment 3Abdullah ghauriNo ratings yet

- Financial Management 2: UCP-001BDocument3 pagesFinancial Management 2: UCP-001BRobert RamirezNo ratings yet

- 11 Investment AppraisalDocument37 pages11 Investment AppraisalMusthari KhanNo ratings yet

- Capital BudgetingDocument13 pagesCapital Budgetingaon aliNo ratings yet

- Capital Budgeting - SolutionsDocument16 pagesCapital Budgeting - SolutionsDoula IshamNo ratings yet

- Tutorial Questions - Solutions: Question OneDocument8 pagesTutorial Questions - Solutions: Question Onephillip quimenNo ratings yet

- Project Feasibilit Y StudyDocument60 pagesProject Feasibilit Y StudyWhella BacaycayNo ratings yet

- Budgets and Budgetary ControlDocument56 pagesBudgets and Budgetary ControlKartik JunejaNo ratings yet

- Cost of Capital Questions 2Document3 pagesCost of Capital Questions 2Andrya VioNo ratings yet

- Product Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingDocument23 pagesProduct Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingTapiwa Tbone MadamombeNo ratings yet

- Capital Budgeting: Year Cash FlowDocument5 pagesCapital Budgeting: Year Cash FlowNaeem Uddin100% (3)

- Module 3 - Capital BudgetingDocument1 pageModule 3 - Capital BudgetingPrincess Frean VillegasNo ratings yet

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocument24 pagesCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNo ratings yet

- Capital Budgeting Techniques Capital Budgeting TechniquesDocument58 pagesCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad ZeeshanNo ratings yet

- Financial Anaysis of ProjectDocument48 pagesFinancial Anaysis of ProjectalemayehuNo ratings yet

- 02 LasherIM Ch02Document25 pages02 LasherIM Ch02Rohit SinghaniaNo ratings yet

- Problem Review Set Capital Structure and LeverageDocument6 pagesProblem Review Set Capital Structure and LeverageTom FalcoNo ratings yet

- Chapter Three: Valuation of Financial Instruments & Cost of CapitalDocument68 pagesChapter Three: Valuation of Financial Instruments & Cost of CapitalAbrahamNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- Chapter 12Document34 pagesChapter 12LBL_Lowkee100% (1)

- Risk Adjusted Discount Rate Method: Presented By: Vineeth. KDocument13 pagesRisk Adjusted Discount Rate Method: Presented By: Vineeth. KathiranbelliNo ratings yet

- Feasibility Study TemplateDocument6 pagesFeasibility Study TemplateMUTHUVEL MNo ratings yet

- Chapter 6 Discounted Cash Flow ValuationDocument27 pagesChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Answers To Midterm 3040ADocument12 pagesAnswers To Midterm 3040ApeaNo ratings yet

- Module - 3 Feasibility Analysis and Crafting Business Plan Chetan T.RDocument56 pagesModule - 3 Feasibility Analysis and Crafting Business Plan Chetan T.RReyaansh 189No ratings yet

- Chapter 10Document42 pagesChapter 10LBL_LowkeeNo ratings yet

- Moyer FINANZAS CUESTIONARIODocument26 pagesMoyer FINANZAS CUESTIONARIOMariana Cordova100% (2)

- ThroughputDocument15 pagesThroughputVaibhav KocharNo ratings yet

- 07 Rate of Return AnalysisDocument34 pages07 Rate of Return AnalysisNadira Nanda Paringgusti WijNo ratings yet

- IrrDocument11 pagesIrrnitishNo ratings yet

- Capital StructureDocument41 pagesCapital StructurethejojoseNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- Chapter 6 Cost of CapitalDocument18 pagesChapter 6 Cost of CapitalmedrekNo ratings yet

- Introduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPADocument35 pagesIntroduction To Taxation: (Taxes, Tax Laws and Tax Administration) by Daryl T. Evardone, CPAKyla Marie HubieraNo ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- CH 12 Cash Flow Estimatision and Risk AnalysisDocument39 pagesCH 12 Cash Flow Estimatision and Risk AnalysisRidhoVerianNo ratings yet

- Capital Budgeting Problems PDFDocument23 pagesCapital Budgeting Problems PDFJitendra SharmaNo ratings yet

- Meyer Appliance Company Makes Cooling Fans The Firms Income Statement Is As Follows ComputeDocument2 pagesMeyer Appliance Company Makes Cooling Fans The Firms Income Statement Is As Follows ComputeDoreenNo ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Financial Statement Analysis Chapter 15Document13 pagesFinancial Statement Analysis Chapter 15April N. Alfonso100% (1)

- NPV, Irr, ArrDocument9 pagesNPV, Irr, ArrAhsan MubeenNo ratings yet

- Chicago Valve TemplateDocument5 pagesChicago Valve TemplatelittlemissjaceyNo ratings yet

- Throughput Accounting: Prepared by Gwizu KDocument26 pagesThroughput Accounting: Prepared by Gwizu KTapiwa Tbone Madamombe100% (1)

- Leverage: Presented by Sandesh YadavDocument14 pagesLeverage: Presented by Sandesh YadavSandesh011No ratings yet

- Financial Planning & ForecastingDocument35 pagesFinancial Planning & ForecastingSaidarshan RevandkarNo ratings yet

- Time Value of MoneyDocument64 pagesTime Value of MoneyYasir HussainNo ratings yet

- Chapter 7 Introduction To Portfolio ManagementDocument6 pagesChapter 7 Introduction To Portfolio Managementmoonaafreen0% (1)

- Chapter 7 (An Introduction To Portfolio Management)Document28 pagesChapter 7 (An Introduction To Portfolio Management)Abuzafar AbdullahNo ratings yet

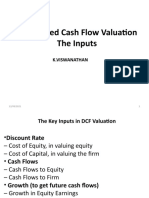

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- MGT705 - Advanced Cost and Management Accounting Midterm 2013Document1 pageMGT705 - Advanced Cost and Management Accounting Midterm 2013sweet haniaNo ratings yet

- Liquidity Ratios AssignmentDocument6 pagesLiquidity Ratios AssignmentNoor Hidayah Binti Taslim0% (1)

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Internal Rate of Return (IRR) : Decision RuleDocument2 pagesInternal Rate of Return (IRR) : Decision RuleDeep DebnathNo ratings yet

- Profitability IndexDocument3 pagesProfitability IndexSaira Ishfaq 84-FMS/PHDFIN/F16No ratings yet

- Auxillary TransformerDocument4 pagesAuxillary Transformerakram1978No ratings yet

- Work PakageDocument6 pagesWork Pakageakram1978No ratings yet

- Performance Based 2016Document1 pagePerformance Based 2016akram1978No ratings yet

- PBCDocument2 pagesPBCakram1978No ratings yet

- Environmental PBCDocument1 pageEnvironmental PBCakram1978No ratings yet

- WBSDocument4 pagesWBSakram1978No ratings yet

- Bluetooth Peripheral Device Doesn't Have A Driver: Name: IDDocument2 pagesBluetooth Peripheral Device Doesn't Have A Driver: Name: IDakram1978No ratings yet

- PerformancebasedDocument1 pagePerformancebasedakram1978No ratings yet

- Costs in Project ManagementDocument4 pagesCosts in Project Managementakram1978No ratings yet

- Emt1396 97Document301 pagesEmt1396 97akram1978No ratings yet

- Traffic Simulation Toolbox: User's ManualDocument24 pagesTraffic Simulation Toolbox: User's Manualakram1978No ratings yet

- Differences Between Management and AdministrationDocument2 pagesDifferences Between Management and Administrationakram1978100% (1)

- Costs in Project ManagementDocument4 pagesCosts in Project Managementakram1978No ratings yet

- MR Excel Excel Is Fun Trick 138Document12 pagesMR Excel Excel Is Fun Trick 138akram1978No ratings yet

- Beam AnalysisDocument230 pagesBeam Analysisakram1978No ratings yet

- Emt 1382 StartDocument1,942 pagesEmt 1382 Startakram1978No ratings yet

- Calculation: Design of Rectangular ColDocument84 pagesCalculation: Design of Rectangular Colakram1978No ratings yet

- Student Record PetroleumDocument13 pagesStudent Record Petroleumakram1978No ratings yet

- Design Circular Col For M&N Sheren FinalDocument30 pagesDesign Circular Col For M&N Sheren Finalakram1978No ratings yet

- Beam DesignDocument22 pagesBeam Designakram1978No ratings yet

- 30m Foundation (Soil) ENGDocument1 page30m Foundation (Soil) ENGakram1978No ratings yet

- Steel Beam DesignDocument9 pagesSteel Beam DesignSuresh DevarajanNo ratings yet

- Decision Making LectureDocument24 pagesDecision Making Lectureakram1978No ratings yet

- Pivot Table For Abet AnalysisDocument11 pagesPivot Table For Abet Analysisakram1978No ratings yet

- WordDocument1 pageWordakram1978No ratings yet

- Charette ProcedureDocument3 pagesCharette Procedureakram1978No ratings yet

- Charette ProcedureDocument12 pagesCharette Procedureakram1978No ratings yet

- H.W #3 em 661Document2 pagesH.W #3 em 661akram1978No ratings yet

- Mini Dashboard Case Study FinalDocument23 pagesMini Dashboard Case Study Finalakram1978No ratings yet

- Practice Set 3Document7 pagesPractice Set 3argie pelanteNo ratings yet

- AR Ali 80Document1 pageAR Ali 80Lieder CLNo ratings yet

- Efu Gen Year08 FinalDocument67 pagesEfu Gen Year08 FinalrjunejoNo ratings yet

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNo ratings yet

- The Truth About The Stock MarketDocument4 pagesThe Truth About The Stock MarketGoliardo100% (1)

- Fixed Asset Flexfields in Oracle Assets EBS R12Document2 pagesFixed Asset Flexfields in Oracle Assets EBS R12naveenravellaNo ratings yet

- Financial Markets BomdDocument7 pagesFinancial Markets BomdMadan VNo ratings yet

- CHAPTER-14: C I R P U I & B C, 2016: Orporate Nsolvency Esolution Rocess Nder Nsolvency Ankruptcy ODEDocument27 pagesCHAPTER-14: C I R P U I & B C, 2016: Orporate Nsolvency Esolution Rocess Nder Nsolvency Ankruptcy ODESrishti NigamNo ratings yet

- CSX - Conrail - Group 13Document10 pagesCSX - Conrail - Group 13Saquib HasnainNo ratings yet

- Lecture Guide No. 2 AE19.ChuaDocument5 pagesLecture Guide No. 2 AE19.ChuaJonellNo ratings yet

- Altman Z-Score: Presented By: Rutuja Brahmankar - 19368 Sayee Nikam - 19372 Shyamal Marathe - 19313Document12 pagesAltman Z-Score: Presented By: Rutuja Brahmankar - 19368 Sayee Nikam - 19372 Shyamal Marathe - 19313Shreyas BhadaneNo ratings yet

- Aa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerDocument6 pagesAa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerGarp BarrocaNo ratings yet

- Coteccons Construction JSC: Back To The RaceDocument5 pagesCoteccons Construction JSC: Back To The RaceDinh Minh TriNo ratings yet

- AFARDocument16 pagesAFARCheska MangahasNo ratings yet

- 2019 ResultsDocument98 pages2019 ResultsJulieAnnPaguicanNo ratings yet

- T2 Ans 1,3 - 4 (PS - ITA)Document5 pagesT2 Ans 1,3 - 4 (PS - ITA)MinWei1107No ratings yet

- BO Maintenance HandbookDocument250 pagesBO Maintenance HandbookyousufNo ratings yet

- Civil Code of The PhilippinesDocument8 pagesCivil Code of The PhilippinesCamille FaithNo ratings yet

- Principal of Accounting-1Document34 pagesPrincipal of Accounting-1thefleetstrikerNo ratings yet

- Cost of Goods Sold: R Manufacturing Company, LahoreDocument38 pagesCost of Goods Sold: R Manufacturing Company, LahoreMirza BabarNo ratings yet

- Weighted Average CostDocument5 pagesWeighted Average CostsureshdassNo ratings yet

- ITI Multi Cap Fund SIDDocument48 pagesITI Multi Cap Fund SIDRAHULNo ratings yet

- Edu Army Investment Basic Knowledge - Ririh A.P.Document7 pagesEdu Army Investment Basic Knowledge - Ririh A.P.refinaNo ratings yet

- Don Peebles The Peebles CorporationDocument4 pagesDon Peebles The Peebles CorporationDon Peebles Financial DocumentsNo ratings yet

- 3Q23 Earnings Release Final 8 1 23Document18 pages3Q23 Earnings Release Final 8 1 23Albenis ReyesNo ratings yet

- 3 CFSDocument65 pages3 CFSRocky Bassig100% (1)

- Solved Problems Depreciation, Impairment and DepletionDocument22 pagesSolved Problems Depreciation, Impairment and DepletionCassandra Dianne Ferolino MacadoNo ratings yet

- Account Classification and PresentationDocument8 pagesAccount Classification and Presentationariane100% (1)

- Annual Report 2020 V3Document179 pagesAnnual Report 2020 V3Uswa KhurramNo ratings yet