Professional Documents

Culture Documents

Technology and Services

Uploaded by

Quelmis De La Cruz Vilca AmesquitaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technology and Services

Uploaded by

Quelmis De La Cruz Vilca AmesquitaCopyright:

Available Formats

Global Business Reports

PERU MINING PRE-RELEASE

www.gbreports.com

Technology and services: the innovation push

Companies need to invest some time and money to think outside the box

Faced by challenging economic scenarios,

companies have a dilemma to solve: they

can do things the same way that they have

been done for years, lower some targets,

and try to decrease costs in the hope that

the storm will pass soon. Or, they reflect

and strategize about how to be efficient

and profitable even if the storm becomes

permanent.

The second option requires more time,

creativity and, initially, money in most instances, but it is the long-term results that

will prove the adequacy of this strategy. For

miners who look at a 20, 30 or 50-year horizon, constantly rethinking processes will

certainly pay off.

Miners need to ask themselves: what I

can do that will increase my bottom line,

without compromising the future of the

operation? Can some capital costs for infrastructure be deferred? Can we modify

the schedule to defer waste and bring high

grade forward? Can we decrease the dilu-

10

tion of the ore? Is the mine optimized for

the prevailing commodity prices?, explains

Paul Murphy, Lima Manager at Mining Plus,

an Australian engineering consultancy.

The research and development (R&D) support that providers can bring to the industry

is invaluable. Certimin, a large laboratory,

has created a new position exclusively dedicated to new technologies. After investing

in a mini flotation pilot plant last year, which

is already working on several projects for

an important base metals producer in the

country, the company is introducing aerophotogrammetry services with drones that

add to its previous offer in geochemical,

metallurgical and environmental analysis.

Aero-photogrammetry offers multiple applications: we obtain very valuable data

to measure the pit and the progress on

mineral extraction, to carry out volumetric control, to manage inventory and planning for stockpiles and waste rock dumps,

to detect acid concentrations in leaching

Global Business Reports // PERU MINING PRE-RELEASE

pads, to monitor tailings dams and handle geomechanical aspects, among others in the engineering, control and safety

areas, explains Luz Blancas, commercial

manager of Certimin.

lvaro Salazar, general manager of Certimin, assures that innovation is a fundamental value. In a time where the priority

is reducing costs, we are tackling this problem by boosting productivity through new

technologies. Analytical services have become a commodity, so we need to differentiate ourselves in other areas. We cannot

just start a price war, because that would

not be sustainable.

Exsa, a blasting solutions company, is also

reaping the fruits of its R&D activities by

introducing a new explosive technology to

the market this year, called Quantex. It uses

high-density ammonium nitrate, which is

easier to source if compared to the traditional, porous ammonium nitrate. Gustavo

Gmez Snchez, commercial manager of

Exsa, gives more details: The main use

of this technology is rock fragmentation in

surface mining. The product offers cost savings of 15% to 20% and further significant

savings on the operational aspects, as well

as up to an 18% reduction in greenhouse

emissions. In Peru, both Southern Copper,

in Toquepala and Cuajone, and Newmont, in

Yanacocha, are already using this product.

Exsa is expanding its scope, opening up

operations in Chile and increasing its service offering beyond the mere provision of

explosives, with activities such as secondary drilling or the design and construction

of explosives warehouses within projects

such as Minsurs Mina Justa and MMGs

Las Bambas. Product-wise, the companys

R&D department is working to improve its

underground explosives offering, with a focus on dynamite.

Also in underground operations, local equipment manufacturer Resemin has just introduced a new micro-jumbo, the Muki, which

is designed to work in extreme narrow-vein

operations and allows for mechanization in

tunnels where traditional methods were

the only option. This has important implications safety-wise (see following article), but

Global Business Reports

www.gbreports.com

James Valenzuela,

managing director,

Resemin

Luz Blancas,

commercial manager,

Certimin

it also increases productivity, as explained

by Resemins managing director James Valenzuela: The Muki can radically change

mining in extremely narrow veins worldwide. There was not a machine with these

features in the market. It is a micro-jumbo

with a width of 1.05 meters and can drill a

2.4-meter hole in 40 seconds, as opposed

to seven minutes with traditional methods.

The Muki is already operating in one of

Castrovirreynas mines in Peru, and Valenzuela expects to sell it worldwide. Resemin

exported 43% of the machines that it produced last year.

Meanwhile, global manufacturer Atlas

Copco is introducing the Simba S7 C

long-hole drill, which incorporates a computerized system, and a new hand-held

hydraulic rock drill. Atlas Copcos general

manager in Peru, Brian Doffing, provides

more insights about the latter: Peru

is one of the two countries that we have

selected to do the trials for this product.

It can drive efficiencies up by at least 25%

over traditional pneumatic drills in hard

rock applications.

Global Business Reports // PERU MINING PRE-RELEASE

11

PERU MINING PRE-RELEASE

Global Business Reports

www.gbreports.com

Miners need to ask themselves: what I can do to increase my bottom line, without compromising the future of the operation? Can some capital costs be deferred? Can we modify the

schedule to defer waste and bring high grade forward? Can we decrease the dilution of the

ore? Is the mine optimized for the prevailing commodity prices?

- Paul Murphy, Lima manager, Mining Plus

The need for innovation is not just a result of lower market condi- compromised. Moving the necessary parts and equipment to the

tions in the mining sector. Peru offers other challenges in terms of mining operations in very remote areas requires a whole engineersocial relations, for instance, that push providers to source locally

ing job, says Carlos Roldn, general manager of Stiglich Transand provide business opportunities for the communiportes: Along the coast we have better roads, but they

ties; or serious infrastructure shortages, that affect

go through cities that have practically invaded the

the economic indicators of projects before and

road, so there is high risk of accidents and human

during the operation.

life loss. Also, there are so many intersections

Perus main challenge is its infrastructure

that the speed is very low. Taking oversized

deficit. As soon as you go out of Lima, the

cargo from Callao to the south, for inroads are in very bad condition. Without

stance, can take us five days. We need

the necessary infrastructure of roads, ento move by night, remove traffic lights

ergy and ports, all costs go up. There is

and pedestrian bridges, and put them

this belief that companies must do the

back on immediately after. Sometimes our

States work, and that way corporate sowork starts one year before.

cial responsibility becomes public charity.

The mining industry will never stop facCarlos Soldi, general manager,

SVS Ingenieros (SRK)

The State should provide the necessary services

ing challenges, from lower grades and higher

so companies can operate, affirms Carlos Soldi, genprocessing volumes to managing water and taileral manager of SVS Ingenieros, now part of SRK, an inings dams. In this environment, providers will play

ternational engineering consultancy.

a key role in supporting the miners with new ideas, as long as

Among others, bad infrastructure becomes a headache for trans- mining companies themselves also dedicate some people to listen

portation companies, which see their safety and timely deliveries and evaluate these new ideas as well.

12

Global Business Reports // PERU MINING PRE-RELEASE

Global Business Reports

www.gbreports.com

Mining safety

Zero is more than a simple number

Perus mining industry suffered 32 fatalities in 2014, a 32% reduction year-on-year.

The downward trend seems positive, but

surely the relatives of those who died on

mining duty will not care about this. Indeed, human safety is that particular parameter where numbers never add up,

unless there is a zero at the end of the

spreadsheet; hence, the need remains for

the industry to keep working on how to

reach that goal.

The safety challenge involves a multidisciplinary approach: from continuous

innovation in new, safer technologies, to

intensive education and training to ensure that all workers not only understand

how to follow the right procedures, but

also are dedicated, 100% of the time,

to their own safety and to the safety of

those around them.

Peru has been a mining country for centuries, yet the experience of such a long

history extracting metals does not take

out the need for intensive training in

this matter. In the words of Steve Dixon,

CEO of mining contractor Stracon GyM,

the mining industry in Peru has experienced very strong growth over the

last years, and it will grow again after the

current slowdown. This means that a lot

of inexperienced, young people will enter

the industry, and keeping these people

Lowering accident rates requires a combination of new technologies, safe procedures and

awareness among workers. Photo: Constancia mine, courtesy of Stracon GyM.

safe will be a huge challenge. The process

is never going to end because everyone

needs to return home safely every day.

Looking at the cold numbers from 2014,

rockfall accidents accounted for 28% of

deaths, followed by traffic crashes, which

were 25%. While accident rates have consistently declined in recent years, Perus

Institute of Mining Safety (ISEM) is implementing a program with associated companies that aims to have zero fatalities by

2021 (see interview on next page).

Innovation and awareness

Creativity is a key ingredient in the industrys drive for lower production costs.

The good news about this compulsory

bias towards innovations is that better

technology and processes have a positive

impact on safety. Bearing in mind that a

majority of deaths in Peru happen in underground mining environments, mechanization is a key aspect to take operators out

of the line of fire.

As portrayed in the previous article, local

equipment manufacturer Resemin has

come up with a small jumbo, the Muki,

for very narrow vein operations. According to James Valenzuela, managing director of Resemin, old mining was built on

rails and wooden frames; many mines are

going back to that standard, which poses

high risks for operators. It is inconsistent

with modernity, but the problem is that

until now there was no equipment in the

market for these types of veins.

As underground operations go deeper,

Peru can learn from the experience of other mining countries, namely South Africa.

International engineering firm WorleyParsons, for instance, acquired TWP of South

Africa in 2012, and incorporated important

expertise designing shafts and introducing

mechanized mining models. The company

is currently developing two shafts for Peruvian clients. In Peru there are not many

underground miners that have mechanized

and modernized their operations. Tradi-

Global Business Reports // PERU MINING PRE-RELEASE

13

You might also like

- The Future of Mining Is Safer Smarter and SustainableDocument14 pagesThe Future of Mining Is Safer Smarter and SustainableAlbertus DickyNo ratings yet

- Shaft sinking methods and trendsDocument4 pagesShaft sinking methods and trendstamanimoNo ratings yet

- Case Study Reviews Safety Procedures for Indian MiningDocument15 pagesCase Study Reviews Safety Procedures for Indian MiningLTE002No ratings yet

- Paper Jeffrey Dawes Digital MiningDocument9 pagesPaper Jeffrey Dawes Digital MiningelderNo ratings yet

- Disruptive Innovation in Digital Mining PDFDocument8 pagesDisruptive Innovation in Digital Mining PDFJosé Tapia MarchantNo ratings yet

- David Brown in International MiningDocument9 pagesDavid Brown in International MiningKroya HunNo ratings yet

- How Reduce Costs WP 310310Document9 pagesHow Reduce Costs WP 310310Ryodi HanandaNo ratings yet

- Strategic Mine Planning: Is Essential To Ensure Long-Term Viability in Changing TimesDocument3 pagesStrategic Mine Planning: Is Essential To Ensure Long-Term Viability in Changing TimesemmanuelNo ratings yet

- Financing Mining Projects PDFDocument7 pagesFinancing Mining Projects PDFEmil AzhibayevNo ratings yet

- Minimizing Operational Risk in Oil Gas IndustryDocument12 pagesMinimizing Operational Risk in Oil Gas IndustryLogan JulienNo ratings yet

- Mgu Project ThesisDocument7 pagesMgu Project ThesisJennifer Strong100% (2)

- How Digital Innovation Can Improve Mining ProductivityDocument14 pagesHow Digital Innovation Can Improve Mining ProductivityAylin Polat100% (1)

- # Limestone Mining Construction: Challenges and OpportunitiesDocument6 pages# Limestone Mining Construction: Challenges and OpportunitiesIndra RahmatNo ratings yet

- Mining Software:: Overland Conveyors Gearless Drives IPCC SystemsDocument5 pagesMining Software:: Overland Conveyors Gearless Drives IPCC SystemsllllcesarllllNo ratings yet

- The Contractors Perspective: A.A.B DouglasDocument9 pagesThe Contractors Perspective: A.A.B DouglasJesus SalamancaNo ratings yet

- Off Shore Drilling NotesDocument15 pagesOff Shore Drilling NotesAamir LokhandwalaNo ratings yet

- Pm3e PDFDocument8 pagesPm3e PDFEdwar ForeroNo ratings yet

- Minings Next Performance HorizonDocument14 pagesMinings Next Performance HorizonRegina RosarioNo ratings yet

- NTM Res Sim PDFDocument6 pagesNTM Res Sim PDFAle AiNo ratings yet

- Anti Collision PDFDocument12 pagesAnti Collision PDFMokshda JhaNo ratings yet

- Autonomy Lessons From Early Adopters - Canadian Mining JournalCanadian Mining JournalDocument5 pagesAutonomy Lessons From Early Adopters - Canadian Mining JournalCanadian Mining JournalJunior MendozaNo ratings yet

- Optimal Approaches To Drilling Technology DevelopmentDocument5 pagesOptimal Approaches To Drilling Technology DevelopmentAli HosseiniNo ratings yet

- Tailings Report 2022Document18 pagesTailings Report 2022Leandro OliveiraNo ratings yet

- A Transnational Approach of Research Developments in Maritime TransportDocument9 pagesA Transnational Approach of Research Developments in Maritime Transportcristina.cristinaNo ratings yet

- NTM Res SimDocument0 pagesNTM Res SimidscribdgmailNo ratings yet

- Industrial Coatings Market Shows Optimism After DownturnDocument5 pagesIndustrial Coatings Market Shows Optimism After DownturnjagrititanuNo ratings yet

- Impact of Data Analytics on Downstream Oil IndustryDocument6 pagesImpact of Data Analytics on Downstream Oil Industryshubham tiwariNo ratings yet

- OTC 18381 Flow-Assurance Field Solutions (Keynote) : Are We There Yet?Document3 pagesOTC 18381 Flow-Assurance Field Solutions (Keynote) : Are We There Yet?lulalala8888No ratings yet

- Petro ViewDocument34 pagesPetro ViewDayanand SinghNo ratings yet

- 329-338 Whittle PDFDocument10 pages329-338 Whittle PDF11804No ratings yet

- Asia-Pacific Needs To Address Offshore Oil and Gas Facility Decommissioning Costs, Analyst WarnsDocument3 pagesAsia-Pacific Needs To Address Offshore Oil and Gas Facility Decommissioning Costs, Analyst WarnsJun Hao HengNo ratings yet

- Primavera Oil Gas Solutions Brief 2203049Document6 pagesPrimavera Oil Gas Solutions Brief 2203049sujitmenonNo ratings yet

- Mine Managers ManualDocument177 pagesMine Managers ManualArnab Ghosh100% (6)

- Oil and Gas Project Management Essentials for Quantity SurveyorsDocument25 pagesOil and Gas Project Management Essentials for Quantity SurveyorsMendez Forbes JinNo ratings yet

- TIPM FinalDocument19 pagesTIPM FinalRajesh KhannaNo ratings yet

- Mine Backfill - Optimisation OpportunityDocument2 pagesMine Backfill - Optimisation OpportunityCarlos A. Espinoza MNo ratings yet

- Multifunctional Mobile Technology For Near-Surface Well InterventionDocument3 pagesMultifunctional Mobile Technology For Near-Surface Well InterventionRaam WilliamsNo ratings yet

- Oil Rig Literature ReviewDocument4 pagesOil Rig Literature Reviewc5p8vze7100% (1)

- Economics Articles 2Document1 pageEconomics Articles 2suewhfNo ratings yet

- Exp031 T DNVDocument4 pagesExp031 T DNVAli HosseiniNo ratings yet

- Spe 169914 MsDocument8 pagesSpe 169914 MsMaria Fernanda Landa ElizaldeNo ratings yet

- Improving Mining Operations with TechnologyDocument8 pagesImproving Mining Operations with TechnologyGerald EnriqueNo ratings yet

- Buckets of Innovation How Digital Has Transformed A Mining Company in Indonesia VFDocument7 pagesBuckets of Innovation How Digital Has Transformed A Mining Company in Indonesia VFdmamani31No ratings yet

- Chem Eng October 2014Document80 pagesChem Eng October 2014nurshafiqah150892No ratings yet

- The Race For More OilDocument10 pagesThe Race For More Oilk1m1mak1No ratings yet

- GX Er Sliding Productivity and Spiraling CostsDocument6 pagesGX Er Sliding Productivity and Spiraling Costssathishsutharsan87No ratings yet

- IPCC Momentum Grows as New Orders and Developments Drive InnovationDocument7 pagesIPCC Momentum Grows as New Orders and Developments Drive InnovationPatricia ReyesNo ratings yet

- Real Time Drilling OptimizationDocument3 pagesReal Time Drilling OptimizationSergio RamirezNo ratings yet

- Winter Industries DissertationDocument4 pagesWinter Industries DissertationPaperWritingServicePortland100% (1)

- Process Control in Metallurgical Plants: Towards OperationalDocument48 pagesProcess Control in Metallurgical Plants: Towards Operationalquinteroudina50% (2)

- Effective Mining Project Management SystemsDocument10 pagesEffective Mining Project Management Systemsjennifer_abols5419100% (1)

- Oil and Gas Production and Processing Project ReferencesDocument110 pagesOil and Gas Production and Processing Project Referenceszdq0267% (3)

- Gemcom Software Updates Optimise Mining PerformanceDocument0 pagesGemcom Software Updates Optimise Mining PerformanceKenny CasillaNo ratings yet

- InsideGemcom Issue2 2012 FINALDocument0 pagesInsideGemcom Issue2 2012 FINALKenny CasillaNo ratings yet

- Irfan - OK - s42461-020-00262-1 PDFDocument15 pagesIrfan - OK - s42461-020-00262-1 PDFIrvan NoviantoNo ratings yet

- Shell Retail Network Development Programme: Case Studies Sinclair Knight Merz 2010 Annual ReviewDocument26 pagesShell Retail Network Development Programme: Case Studies Sinclair Knight Merz 2010 Annual Reviewsushilk28No ratings yet

- Mining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsFrom EverandMining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsNo ratings yet

- Carbon, Capital, and the Cloud: A Playbook for Digital Oil and GasFrom EverandCarbon, Capital, and the Cloud: A Playbook for Digital Oil and GasNo ratings yet

- European Port Cities in Transition: Moving Towards More Sustainable Sea Transport HubsFrom EverandEuropean Port Cities in Transition: Moving Towards More Sustainable Sea Transport HubsAngela CarpenterNo ratings yet

- Petroleum Refinery Relocation Projects: 5-Phases of Project ManagementFrom EverandPetroleum Refinery Relocation Projects: 5-Phases of Project ManagementNo ratings yet

- Zhjqag 232 PDFDocument1 pageZhjqag 232 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Zhjqag 232 PDFDocument1 pageZhjqag 232 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- ynjr-IM 2016 July 2016 PDFDocument3 pagesynjr-IM 2016 July 2016 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- What You're Not Measuring Could Be Affecting Your ProductivityDocument5 pagesWhat You're Not Measuring Could Be Affecting Your ProductivityQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Schaeff ITC 312Document1 pageSchaeff ITC 312Quelmis De La Cruz Vilca AmesquitaNo ratings yet

- ynjr-IM 2016 July 2016 PDFDocument3 pagesynjr-IM 2016 July 2016 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- VISTA Tire Care BrochureDocument2 pagesVISTA Tire Care BrochureQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Troidon 66 PDFDocument4 pagesTroidon 66 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Vista Trucklogic BrochureDocument4 pagesVista Trucklogic BrochureQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- VISTA Skill-Based Pay Plan SummaryDocument8 pagesVISTA Skill-Based Pay Plan SummaryQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- MUKI Front Face Upper DrillDocument7 pagesMUKI Front Face Upper DrillQuelmis De La Cruz Vilca Amesquita100% (1)

- Suncor VISTA TruckLogic Paper PDFDocument10 pagesSuncor VISTA TruckLogic Paper PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- DipticoPumaqSC2 PDFDocument2 pagesDipticoPumaqSC2 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- MaqDrill 28 PDFDocument2 pagesMaqDrill 28 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

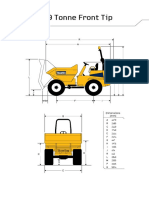

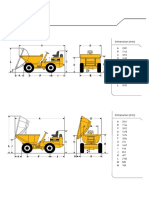

- Micro Dumper 300-0-3 Tonne UKDocument1 pageMicro Dumper 300-0-3 Tonne UKQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Alldrive 9 Tonne Front Tip SpecsDocument2 pagesAlldrive 9 Tonne Front Tip SpecsQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- MaqDrill 28 PDFDocument2 pagesMaqDrill 28 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- HES FORTA FI Fact Data Sheet 2015 PDFDocument2 pagesHES FORTA FI Fact Data Sheet 2015 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Alldrive 9 Tonne Front Tip SpecsDocument2 pagesAlldrive 9 Tonne Front Tip SpecsQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- DipticoPumaqSC2 PDFDocument2 pagesDipticoPumaqSC2 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- FORTA FI OSHA MDS Sheet S PDFDocument2 pagesFORTA FI OSHA MDS Sheet S PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Awxuzw Scalemin English - Rev. 160803 PDFDocument2 pagesAwxuzw Scalemin English - Rev. 160803 PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- Alldrive 9 Tonne Power Swivel: SpecificationsDocument2 pagesAlldrive 9 Tonne Power Swivel: SpecificationsQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- 10tonne Front Tip UK PDFDocument2 pages10tonne Front Tip UK PDFQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- 9 Tonne Front Tip Specs: MACH2090 Dimensions & CapacitiesDocument2 pages9 Tonne Front Tip Specs: MACH2090 Dimensions & CapacitiesQuelmis De La Cruz Vilca AmesquitaNo ratings yet

- 415 416 4000D Uk PDFDocument2 pages415 416 4000D Uk PDFCristian Quelmis Vilca HuarachiNo ratings yet

- Red Mud Neutralization Using Inorganic AcidsDocument8 pagesRed Mud Neutralization Using Inorganic AcidsWinarto100% (2)

- Corrosion and DegredationDocument2 pagesCorrosion and DegredationDanielle HendricksNo ratings yet

- Carbon and Alloy Steel Properties GuideDocument51 pagesCarbon and Alloy Steel Properties Guidebs2002No ratings yet

- Coating Thickness GaugeDocument5 pagesCoating Thickness GaugecarlosNo ratings yet

- The Science of Innovation: Catalog 12Document200 pagesThe Science of Innovation: Catalog 12Dorian RiosNo ratings yet

- Intec Gold ProcessDocument19 pagesIntec Gold ProcessSteven Tremol100% (1)

- EarthScience12 Q1 Mod3 MineralsandItsImportance v3Document50 pagesEarthScience12 Q1 Mod3 MineralsandItsImportance v3Berlyn AmanoNo ratings yet

- SCC of Ss in NAOHDocument9 pagesSCC of Ss in NAOHKarna2504No ratings yet

- Fast-fading pigments and vat dyes for industrial applicationsDocument5 pagesFast-fading pigments and vat dyes for industrial applicationsXuân BaNo ratings yet

- 03 Articol Babut S FinalDocument6 pages03 Articol Babut S FinalduncaemiliaNo ratings yet

- Chemical Resistance Ohji Rubber Lining: 1. Inorganic AcidsDocument5 pagesChemical Resistance Ohji Rubber Lining: 1. Inorganic AcidsJavier Alejandro Rodriguez MelgozaNo ratings yet

- ASTM C139 Concrete Masonry Units For Construction of Catch Basins and ManholesDocument2 pagesASTM C139 Concrete Masonry Units For Construction of Catch Basins and ManholesAmanda Ariesta ApriliaNo ratings yet

- Mole Quantities LabDocument2 pagesMole Quantities Labapi-239386573No ratings yet

- Faraday's Laws 1. M: Q The Mass of The Metal Produced at TheDocument5 pagesFaraday's Laws 1. M: Q The Mass of The Metal Produced at Thelinm@kilvington.vic.edu.auNo ratings yet

- Lecture 11 & 12 - Metals in Dentistry (Slides)Document48 pagesLecture 11 & 12 - Metals in Dentistry (Slides)JustDen09100% (3)

- Formula Writing and NamingDocument5 pagesFormula Writing and NamingKwien AustriaNo ratings yet

- Astm B 138 - B 138M - 06Document4 pagesAstm B 138 - B 138M - 06Ramsi AnkziNo ratings yet

- Fire Stopping GuideDocument6 pagesFire Stopping GuidestephlyonNo ratings yet

- Specific Gravity Index For MineratDocument15 pagesSpecific Gravity Index For Mineratrandhir.sinha1592No ratings yet

- IIT JEE Main Advnaced Inorganic Chemistry 12th MetallurgyDocument34 pagesIIT JEE Main Advnaced Inorganic Chemistry 12th MetallurgySesha Sai Kumar0% (1)

- Diagonal Relationship - WikipediaDocument10 pagesDiagonal Relationship - WikipediaTahir A TahirNo ratings yet

- mnpl13 c3.pdf 6783292102Document130 pagesmnpl13 c3.pdf 6783292102DIEGO ABDON GUZMANNo ratings yet

- August Test Paper 1 Chemistry Form 6Document16 pagesAugust Test Paper 1 Chemistry Form 6sharifahNo ratings yet

- 03 MineralsDocument27 pages03 MineralsjcasafrancaNo ratings yet

- Chemistry Paper Form 2 Term 1 Exam 2017Document8 pagesChemistry Paper Form 2 Term 1 Exam 2017Godfrey MuchaiNo ratings yet

- Rivets Multi Grip CountersunkDocument1 pageRivets Multi Grip CountersunkIsrael OluwagbemiNo ratings yet

- Arsenic PapeDocument25 pagesArsenic PapeМладен БугарчићNo ratings yet

- General Requirements For Copper Alloy CastingsDocument6 pagesGeneral Requirements For Copper Alloy CastingsLC ChongNo ratings yet

- CH 06 - Corrosion & ErosionDocument22 pagesCH 06 - Corrosion & ErosionvegaronNo ratings yet