Professional Documents

Culture Documents

Sem 3 Audit

Uploaded by

madhuriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sem 3 Audit

Uploaded by

madhuriCopyright:

Available Formats

A Study of Auditing And Audit of DNS Bank

CHAPTER NO. 1

INTRODUCTION OF AUDITING

1.1 : INTRODUCTION -AN OVERVIEW OF AUDITING

Economic decisions in every society must be based upon the information available at the time the

decision is made. For example, the decision of a bank to make a loan to a business is based upon

previous financial relationships with that business, the financial condition of the company as

reflected by its financial statements and other factors.

If decisions are to be consistent with the intention of the decision makers, the information used in

the decision process must be reliable. Unreliable information can cause inefficient use of resources

A Study of Auditing And Audit of DNS Bank

to the detriment of the society and to the decision makers themselves. In the lending decision

example, assume that the barfly makes the loan on the basis of misleading financial statements and

the borrower Company is ultimately unable to repay. As a result the bank has lost both the

principal and the interest. In addition, another company that could have used the funds effectively

was deprived of the money.

As society become more complex, there is an increased likelihood that unreliable information will

be provided to decision makers. There are several reasons for this: remoteness of information,

voluminous data and the existence of complex exchange transactions

As a means of overcoming the problem of unreliable information, the decision-maker must

develop a method of assuring him that the information is sufficiently reliable for these decisions.

In doing this he must weigh the cost of obtaining more reliable information against the expected

benefits.

A common way to obtain such reliable information is to have some type of verification (audit)

performed by independent persons. The audited information is then used in the decision making

process on the assumption that it is reasonably complete, accurate and unbiased.

1.2 : DEFINITION OF AUDITINGS

The term auditing has been defined by different authorities :

1.

Spicer and Pegler: "Auditing is such an examination of books of accounts and vouchers of

business, as will enable the auditors to satisfy himself that the balance sheet is properly drawn up, so

as to give a true and fair view of the state of affairs of the business and that the profit and loss

account gives true and fair view of the profit/loss for the financial period, according to the best of

information and explanation given to him and as shown by the books; and if not, in what respect he

is not satisfied."

2.

Prof. L.R.Dicksee. "auditing is an examination of accounting records undertaken

A Study of Auditing And Audit of DNS Bank

with a view to establish whether they correctly and completely reflect the transactions

to which they relate.

3.

The book "an introduction to Indian Government accounts and audit" "issued by

the Comptroller and Auditor General of India, defines audit an instrument of

financial control. It acts as a safeguard on behalf of the proprietor (whether an

individual or group of persons) against extravagance, carelessness or fraud on the part

of the proprietor's agents or servants in the realization and utilisation of the money or

other assets and it ensures on the proprietor's behalf that the accounts maintained truly

represent facts and that the expenditure has been incurred with due regularity and

propriety. The agency employed for this purpose is called an auditor."

1.3 : ORIGIN AND EVOLUTION

The term audit is derived from the Latin term audire, which means to hear. In early days an

auditor used to listen to the accounts read over by an accountant in order to check them.

Auditing is as old as accounting. It was in use in all ancient countries such as Mesopotamia,

Greece, Egypt. Rome, U.K. and India. The Vedas contain reference to accounts and auditing.

Arthasashthra by Kautilya detailed rules for accounting and auditing of public finances. The

original objective of auditing was to detect and prevent errors and frauds.

A Study of Auditing And Audit of DNS Bank

Auditing evolved and grew rapidly after the industrial revolution in the 18th century With

the growth of the joint stock companies the ownership and management became separate.

The shareholders who were the owners needed a report from an independent expert on the

accounts of the company managed by the board of directors who were the employees.

The objective of audit shifted and audit was expected to ascertain whether the accounts were

true and fair rather than detection of errors and frauds. In India the companies Act 1913

made audit of company accounts compulsory.

With the increase in the size of the companies and the volume of transactions the main

objective of audit shifted to ascertaining whether the accounts were true and fair rather than

true and correct. Hence the emphasis was not on arithmetical accuracy but on a fair

representation of the financial efforts.

The companies Act.1913 also prescribed for the first time the qualification of auditors. The

International Accounting Standards Committee and the Accounting Standard board of the

Institute of Chartered Accountants of India have developed standard accounting and auditing

practices to guide the. accountants and auditors in the day to day work.

1.4 : FEATURES OF AUDITING

1) Audit is a systematic and scientific examination of the books of accounts of a

business;

2) Audit is undertaken by an independent person or body of persons who are duly

qualified for the job.

3) Audit is a verification of the results shown by the profit and loss account and the state

A Study of Auditing And Audit of DNS Bank

of affairs as shown by the balance sheet.

4) Audit is a critical review of the system of accounting and internal control.

5) Audit is done with the help of vouchers, documents, information and explanations

received from the authorities.

6) The auditor has to satisfy himself with the authenticity of the financial statements and

report that they exhibit a true and fair view of the state of affairs of the concern.

7) The auditor has to inspect, compare, check, review, scrutinize the vouchers supporting

the transactions and examine correspondence, minute books of share holders,

directors, Memorandum of Association and Articles of association etc., in order to

establish correctness of the books of accounts.

1.5 : OBJECTIVE OF AUDTING

There are two main objectives of auditing. The primary objective and the secondary or

incidental objective.

A. Primary objective as per Section 227 of the Companies Act 1956, the primary duty

(objective) of the auditor is to report to the owners whether the balance sheet gives a

true and fair view of the Companys state of affairs and the profit and loss A/c gives a

correct figure of profit of loss for the financial year.

A Study of Auditing And Audit of DNS Bank

B. Secondary objective it is also called the incidental objective as it is incidental to the

satisfaction of the main objective. The incidental objective of auditing are:

i) Detection and prevention of Frauds, and ii) Detection and prevention of Errors.

Detection of material frauds and errors as an incidental objective of independent financial

auditing flows from the main objective of determining whether or not the financial

statements give a true and fair view. As the Statement on auditing Practices issued by the

Institute of Chartered Accountants of India states, an auditor should bear in mind the

possibility of the existence of frauds or errors in the accounts under audit since they may

cause the financial position to be mis-stated.

Fraud refers to intentional misrepresentation of financial information with the intention to

deceive. Frauds can take place in the form of manipulation of accounts, misappropriation of

cash and misappropriation of goods. It is of great importance for the auditor to detect any

frauds, and prevent their recurrence. Errors refer to unintentional mistake in the financial

information arising on account of ignorance of accounting principles i.e. principle errors, or

error arising out of negligence of accounting staff i.e. Clerical errors.

1.6 : ADVANTAGES AND LIMITATIONS OF AUDIT

ADVANTAGES OF AUDTING

A. Businessmens Point of View :

1) Detection of errors and frauds

2) Loan from Bank

A Study of Auditing And Audit of DNS Bank

3) Build Reputation

4) Proper Valuation of Assets

5) Government Acceptance

6) Suggestions for Improvement

7) Useful for Agency

B. Investor's Point of View :

1.

Protects Interest

2.

Moral Check

3.

Proper Valuation of Investments

4.

Good Security

C. Other Advantages :

1.

Evaluate financial status

2.

Usting of shares

3.

Settlements of Claims

4.

Evidence in Court

5.

Settlement of Accounts

A Study of Auditing And Audit of DNS Bank

6.

Facilitates Taxation

LIMITATIONS OF AUDITING

1. Non-detection of errors/frauds:- Auditor may not be able to detect certain frauds which

are committed with malafide intentions.

2. Dependence on explanation by others:- Auditor has to depend on the explanation and

information given by the responsible officers of the company. Audit report is affected

adversely if the explanation and information prove to be false.

3. Dependence on opinions of others:- Auditor has to rely on the views or opinions given

by different experts viz Lawyers, Solicitors, Engineers, Architects etc. he can not be an

expert in all the fields.

4. Conflict with others: - Auditor may have differences of opinion with the accountants,

management, engineers etc. In such a case personal judgement plays an important role. It

differs from person to person.

5. Effect of inflation : - Financial statements may not disclose true picture even after audit

due to inflationary trends.

6. Corrupt practices to influence the auditors :- The management may use corrupt

practices to influence the auditors and get a favourable report about the state of affairs of the

organisation.

8

A Study of Auditing And Audit of DNS Bank

7. No assurance :- Auditor cannot give any assurance about future profitability and

prospects of the company.

8. Inherent limitations of the financial statements :- Financial statements do not reflect

current values of the assets and liabilities. Many items are based on personal judgement of

the owners. Certain non-monetary facts can not be measured. Audited statements due to

these limitations can not exhibit true position.

9. Detailed checking not possible :- Auditor cannot check each and every transaction. He

may be required to do test checking.

1.7 : QUALITIES OF AN AUDITOR

So far we have discussed the question of formal qualifications of an auditor. But it is not

enough to realise what an auditor should be. He is concerned with the reporting on financial

matters of business and other institutions. Financial matters inherently are to be set with the

problems of human fallibility; errors and frauds are frequent. The qualities required,

according to Dicksee, are tact, caution, firmness, good temper, integrity, discretion, industry,

judgment, patience, clear headedness and reliability. In short, all those personal qualities that

goes to make a good businessman contribute to the making of a good auditor. In addition, he

must have the shine of culture for attaining a great height. He must have the highest degree

of integrity backed by adequate independence. In fact, AAS-1 mentions integrity, objectivity

A Study of Auditing And Audit of DNS Bank

and independence as one of the basic principles.

He must have a thorough knowledge of the general principles of law which govern matters

with which he is likely to be in intimate contact. The Companies Act, 1956 and the

Partnership Act, 1932 need special mention but mercantile law, specially the law relating to

contracts, is no less important.

Needless to say, where undertakings are governed by a special statute, its knowledge will be

imperative; in addition, a sound knowledge of the law and practice of taxation is

unavoidable.

He must pursue an intensive programme of theoretical education in subjects like financial

and management accounting, general management, business and corporate laws, computers

and information systems, taxation, economics, etc. Both practical training and theoretical

education are equally necessary for the development of professional competence of an

auditor for undertaking any kind of audit assignment.

The auditor should be equipped not only with a sufficient knowledge of the way in which

business generally is conducted but also with an understanding of the special features

peculiar to a particular business whose accounts are under audit. AAS-8 on Audit Planning

emphasises that an auditor should have adequate knowledge of the clients business. The

auditor, who holds a position of trust, must have the basic human qualities apart from the

technical requirement of professional training and education.

He is called upon constantly to critically review financial statements and it is obviously

useless for him to attempt that task unless his own knowledge is that of an expert. An

exhaustive knowledge of accounting in all its branches is the sine qua non of the practice of

auditing. He must know thoroughly all accounting principles and techniques.

Auditing is a profession calling for wide variety of knowledge to which no one has yet set a

limit; the most useful part of the knowledge is probably that which cannot be learnt from

10

A Study of Auditing And Audit of DNS Bank

books because its acquisition depends on the alertness of the mind in applying to ever

varying circumstances, the fruits of his own observation and reflection; only he who is

endowed with common sense in adequate measure can achieve it.

Lord Justice Lindley in the course of the judgment in the famous London & General Bank

case had succinctly summed up the overall view of what an auditor should be as regards the

personal qualities. He said, an auditor must be honest that is, he must not certify what he

does not believe to be true and must take reasonable care and skill before he believes that

what he certifies is true.

1.8 : IMPORNTANT CONCEPTS IN AUDTING

Auditing: Auditing is a systematic and scientific examination of the books of accounts and

records of business to enable the auditor to satisfy himself that the profit and loss account

and the balance sheet are properly drawn up so as to exhibit a true and fair view of the

financial state of affairs of the business and profit or loss for the financial period.

Continuous audit: An audit which involves a detailed and exhaustive examination of the

books of accounts at regular intervals throughout the year along with the accounting work.

11

A Study of Auditing And Audit of DNS Bank

Errors: Mistakes committed innocently and unknowingly while making entries in the books

of accounts.

Frauds: Fictitious entries made in the books of accounts with certain motives.

Interim audit: An audit which is conducted for a part of the accounting period for some

specific purpose.

Investigation: Examination of accounts for special purpose.

Qualified auditor: A person who is a Chartered Accountant within the meaning of the

Chartered Accountants Act,1949.

Statutory audit: An audit undertaken under any specific statute or Act.

True and fair view: A phrase which means that the financial statements must not contain

anything which is untrue, unfair, unlawful, immoral and unethical i.e. the financial

statements must not contain errors and fraud.

1.9 : BASIC PRINCIPLES OF AUDIT

AAS-1 describes the basic principles, which govern the auditor's professional

responsibilities and which should be complied with whenever an audit is carried out. These

are:-

1. Integrity, objectivity and independence: The auditor should be straightforward, honest

and sincere in his approach to his professional work. He must be fair and must not allow

prejudice or bias to override his objectivity. He should maintain an impartial attitude and

12

A Study of Auditing And Audit of DNS Bank

appear to be free of any interest which might be regarded. Whatever it's actual effect, as

being incompatible with integrity and objectivity.

2. Confidentiality: The auditor should respect the confidentiality of information acquired in

the course of his work and should not disclose any such information to a third party without

specific authority or unless there is legal or professional duty to disclose. It is remarked that

an auditor should keep his ears and eyes open but his mouth shut.

3. Skill and competence: The audit should be performed and the report prepared with due

professional care by persons who have adequate training, experience and competence. This

can be acquired through a combination of general education, technical knowledge obtained

through study and formal courses concluded by a qualifying examination recognized for this

purpose and practical experience under proper supervision.

4. Work performed by others: When the auditor delegates work to assistant* or uses work

performed by other auditors or experts, he will continue to be responsible for forming and

expressing his opinion on the financial information.

5. Documentation: The auditor should document matters, which are important in providing

evidence that the audit was carried out in accordance with the basic principles.

6. Planning: The auditor should plan his work to enable him to conduct an effective audit in

an efficient and timely manner. Plans should be based on knowledge of client's business.

They should be further developed and revised, if required, during the course of audit.

7. Audit evidence: The auditor should obtain sufficient appropriate audit evidence through

the performance of compliance and substantive test procedure. It will enable him to draw

reasonable conclusions there from on which he has to base his opinion on the financial

information.

13

A Study of Auditing And Audit of DNS Bank

8. Accounting system & internal control: The auditor should gain an understanding of the

accounting system and related internal controls. He should study and evaluate the operation

of those internal controls upon which he wishes to rely in determining the nature, timing and

extent of other audit procedures.

9. Audit conclusions and reporting: The auditor should review and assess the conclusions

drawn from the audit evidence obtained and from his knowledge of business of the entity as

the basis for the expression of his opinion on the financial information.

The audit report should contain a written expression of opinion of the financial information.

It should comply with the legal requirements. In case of a qualified opinion, adverse opinion

or disclaimer of opinion is given or reservation on any matter is to be made reasons thereof.

1.10 : AUDIT TYPES

MEANING: Audit is not legally obligatory for all types of business organizations or

institutions. On this basis audits may be of two broad categories i.e., audit required under

law and voluntary audits.

(i) Audit required under law : The organizations which require audit under law are the

following:

14

A Study of Auditing And Audit of DNS Bank

(a) companies governed by the Companies Act, 1956;

(b) banking companies governed by the Banking Regulation Act, 1949;

(c) electricity supply companies governed by the Electricity supply Act, 1948;

(d) co-operative societies registered under the co-operative Societies Act, 1912;

(e) public and charitable trusts registered under various Religious and Endowment Acts;

(f) corporations set up under an Act of parliament or State Legislature such as the Life

Insurance Corporation of India.

(g) Specified entities under various sections of the Income-tax Act, 1961.

(ii) In the voluntary category are the audits of the accounts of proprietary entities,

partnership firms, Hindu undivided families, etc. in respect of such accounts, there is no

basic legal requirement of audit. Many of such enterprises as a matter of internal rules

require audit. Some may be required to get their accounts audited on the directives of

Government for various purpose like sanction of grants, loans, etc. But the important motive

for getting accounts audited lies in the advantages that follow from an independent

professional audit. This is perhaps the reason why large numbers of proprietary and

partnership business get their accounts audited.

INTERIM AUDIT:

An audit that is taken up between two annual audits is called an Interim Audit. A specific

date, as per the clients requirement is taken into account, e.g. 30th September, 31st

December, etc. a trial balance is drawn and verified with a view to prepare financial

statement. Financial statement are prepared and authenticated for the interim audit period.

Assets and liabilities are verified for interim balance sheet purposes. Independence is

considered less independent than the statutory Auditor; generally an employee of the

15

A Study of Auditing And Audit of DNS Bank

enterprise will be the internal auditor. In the interim audit no format is prescribed. It depends

on the nature of work, coverage and audit observations.

CONTINUOUS AUDIT:

A continuous audit is one in which the auditors staff is engaged continuously in checking

the accounts of the client, during the whole year round or when for the purpose, the staff

attends at quite frequent intervals say weekly basis during the financial period.

A continuous audit is preferred for the following reasons:

i. It makes it possible for the management to exercise a stricter control over the accounts in

as much as one is able to check sooner the causes of any errors of frauds uncovered by such

an audit.

ii. The frequent attendance by the staff deters persons so inclined, from committing a fraud.

iii. The accounting staff of the client is motivated to keep the books of account up-to-day.

CHAPTER NO. 2

2.1 : LITERTURE REVIEW

This chapter reviews a range of literature and concepts relevant to the study. The literature

review is centered around the core aspects of bank auditing, these include the functions of

bank Audit, objectives of bank audit, the role of auditors while doing audit, Means of

achieving control over system, the control environment, Board of Directors or Audit

16

A Study of Auditing And Audit of DNS Bank

Committee, Authority and Responsibility, Audit Committee Financial Expert, Organisational

structure, and the challenges of auditing. The core components above, guide the

establishment and effective functioning of in auditing departments and the Audit department

of DNS BANK for that matter, and therefore to adequately treat the topic of auditing and the

case of the audit department of the bank, it is important that we understand these important

aspects and the extent of work that have been done on them.

2.2 : OBJECTIVES OF THE STUDY

The main objectives of the study are as follows:

1.

To critically evaluate the audit of bank and their compliance with critical elements of

external audit operations.

2.

Identify short-comings or weakness in the Auditing practices of the Auditing Departments

if any.

17

A Study of Auditing And Audit of DNS Bank

3.

Make recommendations to improve on weaknesses and short-comings of the bank auditing

departments.

4.

To stimulate further research into other areas of bank to improve their strength.

5.

To understand the audit procedure of bank.

2.3 : RESEARCH METHODOLOGY

This chapter discussed how data was gathered, analysed, and interpreted to explain the

relationships between the various variables in relation to the objectives of the research paper.

The researcher used a case study to explain the relationship between the variables: the case

of the bank audit. The researcher employed both primary and secondary data, qualitative and

quantitative research methods were also used to examine the bank audit. A number of data

collection methods were combined to verify the reliability and accuracy of the data as study

used a combination of data collection tools; a Survey, Questionnaire, Relevant Corporate

Documents and Observation.

18

A Study of Auditing And Audit of DNS Bank

Sources of Data :

The sources of data for the study were mainly primary and secondary. The primary sources

employed questionnaire, and observation to record data. The Secondary sources include,

company archives, auditing reports, bank website and bank auditing framework or regulation

of bank.

2.4 : LIMITATIONS OF THE STUDY

The research was limited to DNS BANK. The researcher was constrained by time and

financial resources and could not therefore apply other methods of research aside

Questionnaire, Relevant Corporate Documents and Observation.

As with all surveys, a further limitation is that the results rely on the self-reports of

respondents and are therefore open to misinterpretation of the questions as well as to

subjectivity in the responses. Questionnaires require careful design, for example, to ensure

that key issues are included, whilst avoiding ambiguous or confusing questions. Bias may

19

A Study of Auditing And Audit of DNS Bank

arise from poor sampling or if respondents feel that they should give a correct reply rather

than their real view. Poor response may also lead to problems of non-response bias or

inadequate numbers for valid statistical analysis.

CHAPTER NO. 3

3.1 : PROFILE DOMBIVLI SAHKARI BANK LID.

20

A Study of Auditing And Audit of DNS Bank

Way back in 60s Few enthusiastic persons gathered together with a common goal to make

available the banking facility to the commonest of the common man. They had an aim that

any person in genuine financial difficulty or in need of finance to fulfill his dreams whether

personal or professional should have an institutional support and he should not be a prey of

traditional moneylenders.

The dream of these persons came into existence by bearing a name i.e. Dombivli Nagari

Sahakari Bank Ltd. on 6th September, 1970. Since then the bank has grown by leaps and

bound. With a modest beginning in a small 500 sq.ft. of main branch cum central office,

having deposit base of 7.04 lacs and total advances of 5.75 lacs in June 1971, it has now

reached a business mix of Rs. 6414 crores contributed by deposit of Rs.3688 crores and Rs.

2726 crores of advances with 47 branches spread across 12 districts of Maharashtra.

Milestones Scheduled status in 1996. Rs. 100 crores deposit in financial year 1994 to 1995.

Rs. 500 crores deposit in financial year 2002 to 2003. Crossed Thane Dist. Border by

opening Fort and Pune Branches in 2002-03. Core Banking Services From Year 2006.

Merging of Shivneri Sahakari Bank With DNS Banks On 13 October 2007 and Suvarana

Mangal Mahila Sahakari Bank on 3rd January 2010. Crossed the milestones Rs. 4000 crores

Business Mix in March 2013. Crossed the milestones Rs. 5000 crores Business Mix in

March 2014. Crossed the milestones Rs. 6000 crores Business Mix in March 2015. Key

21

A Study of Auditing And Audit of DNS Bank

Financial Indicators Since inception Audit class A. Maximum permissible dividend paid

every year. Net NPA 1.39% CRAR at 13.08% USP Business philosophy

We aim at: Evolving ourselves into a strong and sound competitive financial system,

providing integrated services to customers from all segments, leverage on technology and

human resources, adopt best accounting and ethical practices and fulfill corporate and social

responsibilities towards all stakeholders, visualize aspiring benchmarks / goals and attain

them efficiently and effectively. Technology Consumer banking brings a welcome change in

a common person's life. It is not only the name for giving services to elite and privileged

class of the society but is also to facilitate the common people, which normally represent a

big proportion of the society. It is not possible for Banks to offer better services to this big

proportion of the society without the help of Technology. Mobile & SMS Banking DNS

Bank Ltd. in an attempt to fulfill the ever rising needs of banks customers has launched SMS

banking facility.

SMS Banking brings Banking to your fingertips. With SMS, you can perform a wide range

of query based transactions from your mobile phone. Also get alerts for transaction in

account, Deposit Maturity and EMI Due's. DNS is 1st Co-op. Bank to launch Mobile

Banking Services in India. The Bank's customers can send and receive funds on any day and

any time as per their convenience by using their mobile phones. Various bill payment,

Mobile and DTH Recharge facility is available in mobile banking. ATM Shared Network

DNS Bank is amongst the 1st five Co-op. Banks to join NFS ATM Shared Network. The

customers now have access to 1,80,000 + ATMs across most of the bank's operating in India

and bank owns 42 ATM centers. Debit Card Our DNS Bank offers RuPay Debit Card and the

Card would be accepted on over one lakh ATMs of NFS Members Banks in the Country and

would be accepted on Point of Sale (POS) and Internet. The Bank also able to provide

customers anytime, anywhere, payment systems services which are simple, easy to use, safe,

secure, fast and also cost effective version with introduction of Rupay Debit Card. RTGS &

NEFT Since 2004, when RBI introduced RTGS, DNS is providing this electronic funds

transfer facility. Using which customer can transfer funds to any other person's bank account

within few hours in India. The NEFT facility which is similar to RTGS is also provided by

22

A Study of Auditing And Audit of DNS Bank

the bank from the year 2007.

E-Lobby The bank has setup E-Lobby at 11 Branches. The Lobby has facilities for

customers to deposit cheques, cash, print passbook, withdraw cash, 24 hours and 365 days.

Any branch's customer can access the E-Lobby for their requirements. Social Commitment

While carrying out conventional banking bank has not lost sight of its Social responsibilities.

An amount of over Rs 28 Lacs has been granted as subsidy to 101 Social, and Educational

institutes working in rural areas. Bank also helps students in remote areas of Talasari,

Shahapur, Nashik, Karjat and Khopoli Blocks by providing collection of 'expected questions'

and 'ideal answer sheets' on all subjects.

The Bank has continued its efforts in micro financing through self help groups. In Shahapur

alone bank had disbursed a loan of over Rs 1.5 crores to such SHGs. The purpose includes

Poultry, Dairy, goat rearing, purchase of Fertilizers etc. I am happy to report that the

repayment has been satisfactory. Bank receives help in this behalf from Utkarsh

Navinyapurna Shakari Sanstha promoted by Sahakar Bharati. Sahakar Bharati : is working in

Co-operative sector on national level. Shri. Vasantrao Deodhar of this organization was

awarded 'SAHAKAR MITRA'. Mr. Sanjeev Vibhute actively working in field of child

education, eradication of superstition from society, helping people to overcome vices, was

awarded 'SAMAJ MITRA'. In addition to above bank also helps Sports and cultural

activities. Accordingly the eight sport persons who achieved medals in Commonwealth

Games were honored by the bank. Ms. Suma

Shirur (Panvel), Madhurika Patkar and Mamata Prabhu (Thane), Anisa Saiyad (Pune), Rachi

Sarnobat and Tejasvini Sawant (Kolhapur). Kavita Raut (Nasik) and Narsing Yadav

(Mumbai) were honored by the bank duly visiting their homes. The sport persons

appreciated the initiatives taken the bank. Green Project Our Bank is thinking positively to

participate in social aforestation project. This project will be implemented in the area of

Mamnoli, Murbad which is about 100 kms from Mumbai with the cooperation of Paryavaran

Dakshata Manch. Financial Inclusion The Bank has continued its efforts in micro financing

through self help groups. In Shahapur alone bank had disbursed a loan of over Rs 1.5 crores

to such SHGs. The purpose includes Poultry, Dairy, goat rearing, purchase of Fertilizers etc.

23

A Study of Auditing And Audit of DNS Bank

BOARD OF DIRECTORS

Chairman C.A. Mr. Uday Madhusudan Karve (C.A., L.L.B. (General))

Vice Chairperson Mrs. Nandini Shashikant Kulkarni (B.Com., L.L.B., C.A.I.I.B.)

Director C.A. Mr. Jayant Balkrishna Pitre (B.Com., F.C.A. (D.I.S.A.))

CHAPTER NO. 4

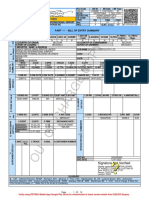

4.1 : APPROACH TO BANK AUDIT

24

A Study of Auditing And Audit of DNS Bank

1. KNOW THE BRANCH

2. UNDERSTAND BANKING SOFTWARE

3. COMPONENTS OF FINANCIAL STATEMENTS

4. AUDIT PROCEDURES

5. CONCLUSIONS

1. KNOW THE BRANCH

Obtain the following reports to assess the branch performance :

25

A Study of Auditing And Audit of DNS Bank

PreviousYearsAuditorsReport/LFAR;

Concurrent Audit Reports for the audit period;

Risk Based Internal Audit Report;

Zonal Inspection Reports, if any;

Exception Report;

Latest Revenue Audit Report;

IT System Audit Report;

RBI Inspection Report.

Understand the bank portfolio :

Types of deposits and advances

Whether branch is deposit or advance rich

Types of customers and borrowers

Must go through :

RBI Master Circulars

26

A Study of Auditing And Audit of DNS Bank

Banks Internal Circulars and Guidelines

Relevant Closing Circulars

Other relevant regulations under various statutes

Reporting Requirements :

List the Returns and Certificates to be signed

Items to be reported in LFAR

Audit Report Format

2. UNDERSTAND BANKING SOFTWARE

Understand the structure of accounting software whether following are in different

modules or same

27

A Study of Auditing And Audit of DNS Bank

Recording of day-to-day transactions

Financial Statements

Various closing returns and certificates at branch level

Level of Automation

Centralized or Decentralized accounting

Exception Reports

Level of access rights at branch leveleditable and uneditable fields

System of downgrading and upgrading of accounts

Interest Calculations

Generation of reports relating to advance classification and Capital Adequacy calculation

etc..

Illustrative structure of Banking Software

Banking

Software

28

A Study of Auditing And Audit of DNS Bank

CBS (Records

day to day

software)

Like Balance

Sheet and

Profit & Loss

Financial

Statements

generating

software

All other non

advances

related

returns

Assets

classification

&Provisioning

software

Other

Returns &

Certificates

All advances

related Basel and

Capital Adequacy

Returns

29

A Study of Auditing And Audit of DNS Bank

30

A Study of Auditing And Audit of DNS Bank

CHAPTER NO. 4

4.1 : STURCTURE OF STAR ASSURANCE AUDIT DEPARTMENT

BOARD AUDIT COMMITEE

HEAD OF AUDIT

DEPARTMENT

31

A Study of Auditing And Audit of DNS Bank

FINANCIAL

AUDIT

SYSTEMS

AUDIT

4.2 : FUNCTIONS OF INTERNAL AUDIT

Organizations have encountered rapid changes in economic complexity, expanded regulatory

requirements, and technological advancements in recent years. These changes have given the

internal audit function (IAF) a set of expanded opportunities to support management,

provide services to other organizational functions, and generate direct reporting links to the

audit committee.(Hass et al, 2006)

According to Cai Chun, (1997) the function of internal audit is a vital and controversial

problem in auditing theory and practice worldwide. There has been a widespread view in the

western auditing circles that internal audit is an independent appraisal function.

In June 1999, the Institute of Internal Auditors (IIA) officially adopted a new definition of

the internal auditing function. The new definition was developed by the Guidance Task

Force and defines the internal audit function as:

An independent, objective assurance and consulting activity designed to add value and

improve an organisations operations. It helps an organisation accomplish its objectives by

bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk

management, control, and governance processes (IIA, 2001)

4.3 : ROLE OF INTERNAL AUDITOR

To look at the current role of internal audit, it is worth looking at the definitions of internal

32

A Study of Auditing And Audit of DNS Bank

audit by the audit practice board and the institute of internal auditors.

According to the Audit Practice Board, internal audit is an independent appraisal function

established by management for the review of the internal control system as a service to the

organization. It objectively examines, evaluates and reports on the adequacy on internal

control as a contribution to the proper economic, efficient and effective use of resources.

The IIA came up with a new definition of internal auditing in 1999, changing the focus of

internal audit towards a more risk based, consultancy type activity and recognizing that

internal audit is not always within the organization, but can be an outsource activity. The

following are the element of the institute definitions.

- Independence, objectivity assurance, consulting activity.

- Designed to add value and improve organization operations.

- Helps an organization accomplish its objectives.

The main role of internal audit according to Turnbull report published in 1999 is normally to

evaluate risk and monitor the effectiveness of the system of internal control. The Report

identifies the following criteria as the basis of an effective Internal Audit

Assurance that the management processes are adequate to identify and monitor

significant risks

Confirmation of the effective operation of the established internal control systems

33

A Study of Auditing And Audit of DNS Bank

Credible processes for feedback on risks management and assurance, and

Objective confirmation that the Board receives the right quality of assurance and

information from management and this information is reliable.

4.4 : ELEMENTS OF INTERNAL AUDIT

According to the IIA guidelines there are certain elements, which are critical to the setting up

and operation of internal audit departments. In chronological manner these elements could

be listed as follows:

Where to be placed ?

34

A Study of Auditing And Audit of DNS Bank

What to do ?

How much the department has to do ?

When the things have to be done ?

Who have to do things?

How to review ?

The where element :

A study conducted by Liu et al. (1997) show that where the department is to be placed in

the chain of command or the hierarchical system is a very significant element. This should

be the first major question that needs to be addressed in setting up an internal audit

department.(Liu et al. (1997). The Research shown that, the internal audit department

provides service to the organization and therefore the implication is that its effectiveness

will rest on the position it is given in the organization both in actual and perceived cases.

The research revealed that the traditional view of auditors as being part of the finance or

accounting function is now too narrow to be accepted as a definition. This is implied from

the fact that, the objectives of internal audits are being increased to cover social,

management, operational and ad hoc audits.

The department should, therefore, enjoy a high profile from the start. It should be placed

high in the organization so that the internal audit staff can audit virtually any functional

level for compliance with strategic objectives and liaise with the strategic planning

department in relation to possible changes in objectives. The department has to be linked

to the top management, directors and the chief executive.

The What Element :

35

A Study of Auditing And Audit of DNS Bank

It is essential that all levels of staff within the organization know about the functions of the

internal audit department and are aware of the terms of reference under which the

department has been authorized to operate.(Liu et al. (1997). It is thus important that the

audit committee on behalf of the board of directors should draw up an audit charter, detailing

the work of the department.

The practice advisories (PA) issued by the Institute of Internal Auditors (IIA) require internal

auditors to share observations and recommendations with those charged with oversight

responsibilities, typically, the board of directors. Also a charter, internal audit plans, and

activity reports are discussed in the advisories.

The PAs specify that every internal audit department should have a charter. The document

validates the units position in the entity, authorizes internal audit access to records, and

defines the scope of its work.

The charter should be approved by senior management and accepted by the board.

Periodically, the Chief Audit Executive (CAE) should assess whether the charter is still

adequate and communicate the assessment to senior management and the board. The CAE

should also submit to senior management and the board a summary of plans of work for the

upcoming year.

The summary should be approved by senior management and tendered to the board for

informational purposes. Such information helps the board ascertain if the work of internal

auditing supports the objectives and plans of the entity.

After completing the work, the internal audit department should present reports of its

activities to senior management and the board. Significant engagement observations and

recommendations are included in the report and this must be done at least annually. Below

are those items which the PAs suggest might constitute significant engagement observations

and therefore, should be communicated to the board.

36

A Study of Auditing And Audit of DNS Bank

Irregularities

Illegal acts

Errors

Waste

Inefficiencies

Ineffectiveness

Conflicts of interest

Control weaknesses

While it is the internal auditors responsibility to report significant engagement observations,

it is managements duty to resolve those issues. Management may decide to act by

implementing recommendations made by the internal auditors or by making other changes.

Alternatively, management may decide not to take action, thereby accepting whatever risk

the internal auditors have identified in the current situation. Regardless of which course

management chooses, the internal auditor is then responsible for informing the board as to

managements actions or decisions.

The charter should also contain:

A. An outline of the assurance which the board expects to receive. These may include

assurance that there is surveillance of internal controls throughout the organization. Also the

assets are safeguarded and the performance reporting can be accepted with confidence.

B. The authority given to internal audit to examine all activities throughout the organization

for the purpose of evaluating internal control. This should specify responsibilities to reassure

37

A Study of Auditing And Audit of DNS Bank

accountable managers of the adequacy and efficiency of their internal controls, identifying

any unsound commercial procedures to management and offering recommendations for

improving performance and preventing future shortcomings. The charter should make clear

to management at all levels that internal audit is independent from the operations they audit

and that, they are empowered to make changes to systems, methods or staffing.

C.The various types of reviews or audits to be undertaken for e.g. efficiency reviews,

environmental audits, and operational audits.

D. The procedures for issuing, and responding to reports from internal audit. The audit report

may be dealt with as confidential documents to be delivered to and responded to by the level

of management who can take effective action on any recommendations made.

The How Element- Audit Scope :

The internal audit function is responsible for evaluating and commenting on the

effectiveness of risk management, control and corporate governance processes. However,

management remains responsible for identifying and management risk, reporting of risk and

ensuring that the right policies, procedures and practices are in place.The amount of work

involved in giving assurances under the terms of the charter will need to be estimated. To

achieve this, it is necessary to undertake a review of all systems used within the

organization. It will require a prior knowledge of business organization and methodology. To

make the assessment worthwhile, it is necessary to carry out an overall review of the whole

organization. Each system has to be recorded and evaluated using common terminology

wherever possible so that the relevant audit priorities of one system against another can be

ascertained. Having drawn a map in this manner then, in order to provide some form of

ranking, it is recommended that risk analysis is used whereby various elements of each

system can be valued and each system can be compared by total value with all other systems.

This is one method by which priorities can be assessed and a full picture of the risk element

to which an organization is exposed can be drawn.

The Who Element

38

A Study of Auditing And Audit of DNS Bank

Having established the map, the risk analysis and the resource allocation, the audit

committee will need to decide on who will carry out the audit plan, the size of the internal

audit department and the professional expertise required. The responsibilities of the persons

to be appointed include:

a. They should foster constructive working relationships with accountable management

and their staff and with the external auditors.

b. They should consider the planning, controlling and recording of their work as important

elements of the job so that their work can be easily reviewed.

c. They must exercise due care in the collection and interpretation of their findings and

recommendations.

d. They must adopt a professional attitude and ethical standards at all times. The chief

internal auditor should be responsible for details of the duties of staff but all staff should

be made to apply a sound understanding of internal audit techniques to a through

understanding of the organization and its systems of internal control involving all

activities. To maximize the benefit to the organization, staff should agree with accountable

management the program and timing of audits and identify, assess and rank the risk

involved in all systems. Of paramount importance is the internal auditors ability to

evaluate the adequacy and effectiveness of the system of internal control, to carry out all

necessary tests and report their findings promptly and objectively.

If an organization is able to adjust its audit plan, thereby reducing the levels of audit work, a

smaller staff may be a reasonable strategy. However, with the trend being towards increased

fraud prevention and detection, increased audit activities and increased reliance on internal

auditors, a reduced, workload may not be realistic. In addition, if staff are not competent no

matter how reduced the audit work is, more staff or time will be required.

The internal auditor should cultivate a close working relationship with top management.

39

A Study of Auditing And Audit of DNS Bank

This will call for developing a management perspective, understanding how management

has developed its long-term strategies and how it hopes to implement them. Staff training

should alert the audit staff to improvements that could be made in specific areas such as sales

and customer communication process. Finding new and improved motivational strategies

that encourage increase productivity from the staff should be a high priority. One of the keys

to improving the performance of the internal audit is to identify items that have the greatest

potential to operate as positive. These re-enforcers include: feedback, self-fulfillment, selfesteem and creativity and participation in goal setting.It will be a good idea to make the

management and staff aware of the potential benefits that a successful internal audit

department could bring.

4.5 : Board of Directors or Audit Committee

The control environment of an organization is significantly influenced by the effectiveness

of its board of directors or the audit committee. It was more than a decade ago when an

increasing number of stakeholders began to suggest that instances of fraudulent financial

reporting could be decreased by improving the effectiveness of audit committees. A common

thread that runs through suggestions from these different sources is that audit committees

need to assume greater responsibility with respect to corporate governance by overseeing

financial reporting and internal control matters. Factors that bear on the effectiveness of the

board or audit committee include the extent of its independence from management, the

40

A Study of Auditing And Audit of DNS Bank

experience and stature of its members, the extent to which it raises and pursues difficult

questions with management, and its interaction with the internal and external auditors.

Beginning with the 1999 Blue Ribbon Committee on Improving the Effectiveness of

Corporate Audit Committees (BRC), more formalized approaches were taken to develop and

publish explicit recommendations that audit committees could address to improve their

effectiveness. The audit committee of the board of directors should be composed of

independent directors who are not officers or employees of the organization and do not have

other relationships that impair independence. Corporate governance codes in most countries

typically require that internal auditors report functionally to the audit committee of their

companys board of directors. This enables the audit committee to be effective at overseeing

the quality of the organizations financial reports, and at acting as a deterrent to management

override of controls and to management fraud. The audit committee must establish

procedures for receiving, retaining and treating complaints about accounting, internal

control, or auditing matters and for the confidential, anonymous submission by employees of

their concerns about questionable accounting or auditing matters. The audit committee must

have authority to engage independent counsel and other advisors as the committee

determines necessary to carry out its duties.

The company must provide appropriate funding, as determined by the audit committee, for

the compensation of

(i) the audit work and any related work of the companys independent auditor

(ii) any other audit, review or attest services provided to the company by a public accounting

firm and

41

A Study of Auditing And Audit of DNS Bank

(iii) any advisors engaged by the audit committee. The Act requires of every reporting

company that the audit committee approve all audit services. Additionally, the audit

committee must approve all permitted non-audit services to be provided by the auditor or its

associated person before the services are provided.

CHAPTER NO. 5

5.1 : CONCLUSION

This chapter discusses the conclusions and recommendations of the study which was

conducted on the compliance or non-compliance of organisations with the requirements of

the Institute of Internal Auditors. A case study of Star Assurance Company Ltd.

42

A Study of Auditing And Audit of DNS Bank

My research revealed that Star Assurance Company Limited has an internal audit

department, which could be said to be auditing its activities in accordance with the definition

as specified by the I.I.A. It was observed that the Internal Audit department assisted

management in the discharge of their responsibilities by furnishing them with analysis,

recommendations and pertinent comments concerning activities of the company, e.g. the

Internal Audit department was involved in assessment and review of the activities of all

branches and departments.

The study can conclude on the following issues discussed as follows:

A. Identify the functions and role of the Internal Audit Department.

It was observed that the company was to a large extent complying with the functions and

role as outlined by the IIA.They assisted management in the effective discharge of their

responsibilities by furnishing them analyses, appraisals, recommendations.

B. Identify the ethical guidelines of the internal audit department.

It can be concluded that the organisation satisfies the ethical guidelines of organizational

status, objectivity and independence

C. Identify the control environment at Star Assurance Company Ltd

It was observed that the control environment was adequate for the operations of the

company. There were clear guidelines on integrity and ethical issues. There were also

human resource policies in place.

D. Identify the challenges faced by the internal audit department.

43

A Study of Auditing And Audit of DNS Bank

It was observed that the major challenge of the department was the small number of staff.

5.2 : RECOMMENDATION

It is also recommended that, the internal auditor should submit to senior management and

the board a summary of the plan of work for the upcoming year. The summary should be

approved by senior management and tendered to the board for nformational purposes.

Such information helps the board ascertain if the work of internal auditors supports the

objectives and plans of the entity

It was observed that, the internal auditor presents reports of its activities to senior

management which should be continued. Management has a duty to resolve issues raised.

Even though the company is not listed but, the company has puts in place an audit

committee. This ensured that corporate governance principles were adhered to.

5.3 : BIBLIOGRAPHY

Reference Books : 1. MCOM PART II - AUDITING.

44

A Study of Auditing And Audit of DNS Bank

5.4 : WEBLIOGRAPHY

Websites :

1. www.starassurance.com

2. www.investopedia.com

3. www.shodganga.com

45

You might also like

- Madhu FM Print 1Document50 pagesMadhu FM Print 1madhuriNo ratings yet

- Preface: of Public Sector and Private Sector Banks"Document47 pagesPreface: of Public Sector and Private Sector Banks"madhuri100% (1)

- TaxxxDocument3 pagesTaxxxmadhuriNo ratings yet

- Audit ProjectDocument47 pagesAudit ProjectmadhuriNo ratings yet

- Audit ProjectDocument47 pagesAudit ProjectmadhuriNo ratings yet

- Auditing Project Sem2Document32 pagesAuditing Project Sem2madhuriNo ratings yet

- Chapter No:-1 1.1: Introduction of Audit: Stakeholders Material Legal PersonDocument31 pagesChapter No:-1 1.1: Introduction of Audit: Stakeholders Material Legal PersonmadhuriNo ratings yet

- Komal RM 2Document49 pagesKomal RM 2madhuriNo ratings yet

- FMM IcicDocument44 pagesFMM IcicmadhuriNo ratings yet

- KK KKKKKDocument61 pagesKK KKKKKmadhuriNo ratings yet

- AaaaaaDocument95 pagesAaaaaamadhuriNo ratings yet

- Project Completion Certificate: Future Value Retail LimitedDocument86 pagesProject Completion Certificate: Future Value Retail LimitedmadhuriNo ratings yet

- FM RichDocument34 pagesFM RichmadhuriNo ratings yet

- Fa 20Document33 pagesFa 20madhuriNo ratings yet

- Introduction Finacila ManagementDocument48 pagesIntroduction Finacila ManagementSagar ZineNo ratings yet

- Mcom Sem HDocument37 pagesMcom Sem HmadhuriNo ratings yet

- Ratio BirlaDocument47 pagesRatio BirlamadhuriNo ratings yet

- FM RichDocument34 pagesFM RichmadhuriNo ratings yet

- Ratio BirlaDocument47 pagesRatio BirlamadhuriNo ratings yet

- Mcom GDocument37 pagesMcom GmadhuriNo ratings yet

- Cost MadhuDocument38 pagesCost MadhumadhuriNo ratings yet

- Mcom Sem VDocument35 pagesMcom Sem VmadhuriNo ratings yet

- Project SMMDocument35 pagesProject SMMmadhuriNo ratings yet

- Unit 1 - Introduction To Environmental Auditing and ManagementDocument47 pagesUnit 1 - Introduction To Environmental Auditing and Managementmadhuri100% (1)

- Anu 25 FaDocument32 pagesAnu 25 FamadhuriNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of MoneymadhuriNo ratings yet

- Project SMMDocument35 pagesProject SMMmadhuriNo ratings yet

- Amar 38 FinalDocument36 pagesAmar 38 FinalmadhuriNo ratings yet

- Economics Project Sem2Document41 pagesEconomics Project Sem2madhuri50% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Budget and Budgetary ControlDocument17 pagesBudget and Budgetary ControlAshis karmakarNo ratings yet

- PI ShippingDocument3 pagesPI ShippingDylan PereraNo ratings yet

- DIGEST - BPI Vs CIR 2005Document2 pagesDIGEST - BPI Vs CIR 2005Mocha BearNo ratings yet

- FUNDLOANS Pre-QualificationDocument1 pageFUNDLOANS Pre-QualificationChristopher LeoneNo ratings yet

- GD-WAT BibleDocument84 pagesGD-WAT BibleKesava Krsna Das100% (1)

- Introduction To Accounting: Financial Statements AnalysisDocument15 pagesIntroduction To Accounting: Financial Statements AnalysisFaizal AbdullahNo ratings yet

- 679089110072023INBLR4BE1120720231426Document12 pages679089110072023INBLR4BE1120720231426Abishek AbiNo ratings yet

- Personal Financial Literacy: Madura Casey RobertsDocument337 pagesPersonal Financial Literacy: Madura Casey RobertsGrantt ChristianNo ratings yet

- Key Finding IFRS For Banking in Laos at BoLDocument56 pagesKey Finding IFRS For Banking in Laos at BoLMiladNo ratings yet

- Risk and Return EquationsDocument7 pagesRisk and Return EquationssitswaroopNo ratings yet

- Partnership CE W Control Ans PDFDocument10 pagesPartnership CE W Control Ans PDFRedNo ratings yet

- Mergers and AcquisationsDocument33 pagesMergers and AcquisationsAnku SharmaNo ratings yet

- What..? How..? and What Nextǥ?Document19 pagesWhat..? How..? and What Nextǥ?Amit BhardwajNo ratings yet

- Normanhurst Boys 2017 Year 9 Maths Yearly & SolutionsDocument29 pagesNormanhurst Boys 2017 Year 9 Maths Yearly & SolutionsPriscaNo ratings yet

- Palantir - Stock-Based Compensation Update (NYSE - PLTR) - Seeking AlphaDocument18 pagesPalantir - Stock-Based Compensation Update (NYSE - PLTR) - Seeking AlphaRyan LamNo ratings yet

- Guiding Principles of Asset ManagementDocument16 pagesGuiding Principles of Asset ManagementRm1262100% (2)

- 17 Big Advantages and Disadvantages of Foreign Direct InvestmentDocument5 pages17 Big Advantages and Disadvantages of Foreign Direct Investmentpatil mamataNo ratings yet

- 1651 20eDocument51 pages1651 20esafrazahamedNo ratings yet

- Legal OpinionDocument4 pagesLegal OpinionBaten KhanNo ratings yet

- Risk and Returns Questions With AnswersDocument19 pagesRisk and Returns Questions With AnswersyoussefNo ratings yet

- Code of Business Ethics PolicyDocument5 pagesCode of Business Ethics PolicyVIJAY SINGH RAGHAVNo ratings yet

- Quellaveco Site Visit Presentation PDFDocument38 pagesQuellaveco Site Visit Presentation PDFChristian Chávez BazánNo ratings yet

- Indian Automobile Industry AnalysisDocument41 pagesIndian Automobile Industry Analysismr.avdheshsharma85% (26)

- Property and Liability InsuranceDocument528 pagesProperty and Liability Insurancegiyer06111986No ratings yet

- PRMB PDFDocument13 pagesPRMB PDFkshitijsaxenaNo ratings yet

- Bond Markets in The MENA RegionDocument59 pagesBond Markets in The MENA RegionstephaniNo ratings yet

- Different Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4Document17 pagesDifferent Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4anon_855990044No ratings yet

- Kalac Becirovic Plojovic The Role of Financial Intermediaries-LibreDocument8 pagesKalac Becirovic Plojovic The Role of Financial Intermediaries-LibreSampatVHallikeriNo ratings yet

- Project Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oDocument79 pagesProject Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oanreshaNo ratings yet

- Invoice - INNOPARKDocument1 pageInvoice - INNOPARKAnkit SinghNo ratings yet