Professional Documents

Culture Documents

Petro Chemical Industry

Uploaded by

himanshu sisodiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petro Chemical Industry

Uploaded by

himanshu sisodiaCopyright:

Available Formats

Petro Chemicals

PREFACE-

INTRODUCTION

GLOBAL SCENARIO

CHALLENGES AT WORD WIDE LEVEL

CHALLENGES AT INDUSTRY LEVEL

TRENDS

EXPECTATION AT MACRO LEVEL

COUNTRY SCENARIO- “India”

HISTORY

CURRENT SCENARIO

INVESTMENT OPPORTUNITIES

CHARACTERISTICS

GROWTH

KEY SEGMENTS

CHALLENGES

EXPECTATION

SWOT ANALYSIS

PROMOTING ENVIRONMENTAL, SOCIAL AND ECONOMIC GAIN

IN PETROCHEMICAL INDUSTRY

Submitted by: Himanshu Kumar

INTRODUCTION

The petrochemical industry, which produces chemicals using OIL AND NATURAL GAS as major raw

materials, occupies an important position in MANUFACTURING and consuming sectors. Oil and

natural gas are composed primarily of hydrocarbons. Most petrochemicals contain hydrogen or

carbon or both. Petrochemicals can be converted into thousands of industrial and consumer

products, including PLASTICS, paints, RUBBER, fertilizers, detergents, dyes, TEXTILES and solvents.

The industry consists of 2 major divisions. The primary petrochemical industry produces basic

chemicals, such as ethylene, from oil or gas. The secondary industries convert the basic

petrochemicals into materials that may be directly used by other industries. Standard of living is

dependent to a significant degree on domestic petrochemical production. The availability of

economic petrochemicals allows the domestic production of numerous items that could be more

costly if imported.

PETROCHEMICALS-

Petrochemicals, as the name suggests, are chemicals obtained from the cracking of petroleum

feedstock. Petrochemicals are used in many manufacturing fields. The industry is built on small

number of basic commodity chemicals, also known as building blocks such as ethylene, propylene,

butadiene, benzene, toluene and xylene. Ethylene, propylene and butadiene are commonly referred

to as olefins, while benzene, toluene and xylene are known as aromatics. Together, they form the

basis of all petrochemical products.

The broad product segments of the industry include:-

1. Basic petrochemicals: These are the basic building blocks, which are divided into olefins and

aromatics. These are used primarily for polymerization. These are mainly used to designate

the capacity of industry.

2. Polymers: These are made from basic petrochemicals by polymerization. Major products

include PVC, HDPE, LDPE and PP. These find use primarily in the packaging industry and

plastic industry.

3. Polyesters: These are synthetic fibre used in textiles industry. These include polyester

filament yarn (PFY) and polyester staple fibre (PSF).

4. Fibre Intermediates: These consist of PTA, DMT, MEG, paraxylene, caprolactum, and

acronitrile and are mainly used for manufacturing synthetic fibres like PFY and PSF.

5. Chemicals: These include Linear Alkyl Benzene (LAB), methanol, maleic anhydride, phenols,

ethylene oxide, orthoxylene and vinyl acetate monomer. They find use in chemical industry.

GLOBAL SCENARIO

On the global front the Petrochemical Industry is expected to see a structural shift during coming

years. Both the demand and the supply drivers of the industry namely North America and Western

Europe are expected to be replaced by China as a demand driver and Middle East as supply leader.

With increase in the crude oil prices, polymer commodity prices increased drastically while prices of

speciality are struggling to maintain a premium over prices of polymer prices.

Submitted by: Himanshu Kumar

CHALLENGES AT WORLD-WIDE LEVEL

Over the past year, the petrochemical industry worldwide has faced one of the most challenging

periods. The combined effects of the economic slowdown and a cyclical industry posed major

challenges. The supply-side continued to lengthen as new cracker and derivative capacity came on

stream.

Despite the fragile demand in the US markets, petrochemical markets were largely kept tight last

year with a shortage of olefins constraining production of derivatives.

With constrained demand, the long-term outlook for growth is still bright. The new growth outlook

sees major markets contracting; however, the GDP is expected to grow as industries rebuild

inventories and confidence returns. In fact, prospects for the petrochemical industry depend on

many factors beyond production control such as outlook for crude oil price, global economy outlook

and even currency fluctuations.

Energy majors such as Indian Oil have for long had a presence in the specialty chemical and

aromatics segment of petrochemicals with world-scale linear alkyl benzene (LAB) and an integrated

para-xylene/purified terephthalic acid (PX/PTA) capacity. It has recently commissioned the world's

largest operating naphtha-based cracker along with a downstream petrochemical complex at

Panipat.

With this, the company has entered the olefin segment and offers a full product slate covering all

segments of petrochemicals.

Today, its petrochemicals investments are primarily for enhancing operating performance and

downstream integration.

As per Nexant's (a global provider of clean energy solutions) forecasts, the price of crude oil and the

growth rate of the global economy potentially have the greatest influence on the performance of

the petrochemical industry; yet they are among the hardest measures to predict.

Impact of crude prices

The price of crude oil is of critical importance to petrochemical producers, as the prices of the

majority of petrochemical feedstocks directly track crude oil. Strengthening demand generally allows

producers to raise prices to support higher margins.

The overriding factor is, thus, the need to respond to the global energy challenge since it will have an

impact on the petrochemicals business that relies heavily on oil and gas for feedstock and energy.

CHALLENGES AT INDUSTRY LEVEL

The challenges facing India petrochemical industry provides the industry with better tools which

would in turn help the growth of the economy.

India has stably established itself in the core of the international production of petrochemical and

petrochemical- related products in the present scenario. With the economic growth cycle slowing

down in the United States, the Asian developing nations, especially India, would ideally fortify its

Submitted by: Himanshu Kumar

stand in the global petrochemical market as a producer of these products. This is one of the major

challenges facing Indian petrochemical industries.

A recession has many attributes and can include declines in: (1) overall economic activity, (2)

employment, (3) cash flow, (4) investment, and of course, (5) the corporate profits. Recessions are

the result of falling demand and cash flow – and are called DEFLATION when associated with falling

prices, INFLATION when associated with raising prices and STAGFLATION when prices go up without

growth.

THE IMPACT OF A RECESSION ON PETROCHEMICALS AND STRATEGIES

Here are some of the potential events and strategies for reacting to the petrochemical recessions –

industry with high capital intensity – applicable to petrochemical industries.

THE SEQUENCE OF EVENTS

1. Markets (demand) weaken, the prices will fall

2. Falling prices will depress the short-term margins

3. The secondary impact – the utilization rates will fall

4. The variable costs will (ex- raw materials) will go up – putting additional pressure on margins

5. Overall impact – lower revenues

– Constant to increasing expenses

– Lower margins

TRENDS

Global Petrochemical Industry Future Trends-

Global Shifting Trade Flows - 2008-2020

The China and Middle East – a regional balance until China’s reaches self sufficiency

Middle East positioned to supply Europe and North America to replace the Chinese demand

U.S industry will stand still till the regional balances are complete

Overall, Middle East will supply the raw materials, China will be the processor; US, Europe

and Japan will be the primary consumers – followed by China India/Asia

Basic Scenario – 2012 Middle East Phase I on Stream

The phase I of Middle Eastern production comes on stream

Submitted by: Himanshu Kumar

China’s supply/demand moves toward a balance

Less direct impact on U.S, Japan and Asia

ASEAN economies continue to benefit from Chinese growth

Phase II of Middle Eastern expansion announcements – emphasis on level II and value added

products

The New Race for Global Value Added Products

Basic Scenario – 2015 Middle East Phase II on Stream

The phase II of Middle Eastern demand comes on stream

China’s supply/demand closer to a balance

The Middle Eastern Demand needs outlet Impact on ASEA , Japan

ASEAN economies continue to move to value addition and downstream

Phase II of Middle Eastern expansion on stream = level II and value added products

EXPECTATION AT MACRO LEVEL

As the world watches crude oil prices fluctuate at high levels, attention is inevitably drawn to the

Middle East for signals regarding the potential direction for this basic resource. Similarly, participants

in the global petrochemical industry must consider the changes brought about by the capacity growth

in the Middle East and the subsequent impact on global markets. This region is poised to become a

larger factor in the world of petrochemicals such that its petrochemicals market share could ultimately

rival its share of world oil and gas production. CMAI estimates that by the year 2010, the countries of

the Middle East will produce about 20% of the world’s basic petrochemicals and polymers, such as

ethylene and polyethylene. This is significant in itself, when one considers that there was little-to-no

petrochemical production in the region as recently as 20 years ago. To put these changes and their

implications in perspective, this article will briefly address important factors which have and will

continue to shape Middle East petrochemical development. These include:

Demographics, Employment and GDP-

Submitted by: Himanshu Kumar

Despite this record of continued improvement, unemployment rates of more than 10% exist

in many countries in the region. As a result, governments are actively promoting both

primary (basic) and secondary (intermediate and finished goods) petrochemical industries as

a means of economic development. It is well known that the petrochemical industry, like

refining, is a very capital intensive industry. Thus one key trend for the future, CMAI expects,

is that governments throughout the region will seek to develop secondary industries as well

as production of finished goods.

Oil Revenues-

In a very general sense, high oil prices imply that Gulf countries maintain a share of oil

markets at or near current levels. On the down side, higher oil prices also negatively impact

the world economy, which translates to lower world petrochemical demand growth and the

requirement for fewer new facilities. As the incremental low cost producing region, however,

Middle Eastern petrochemical investments are likely to continue in the face of reduced

demand at the expense of investment in other regions. Lower demand could also force

rationalization of existing old (1970s’ vintage) units in areas of sustained high cash costs.

Additionally, higher oil prices imply that advantaged ethane feedstock regimes may well be

built in preference to naphtha-based capacity.

Cost-Advantaged Gas and Gas Liquids-

Capacity growth has happened in most Middle Eastern petrochemical markets, but most dramatically

in gas-based petrochemicals, such as methanol and ethylene. The olefin market is a good example of

the petrochemical growth in the region. The chart shows global ethylene capacity in 1985 and

forecasts capacity for 2010.

Submitted by: Himanshu Kumar

Further Downstream Development Potential-

Other opportunities for continued and future petrochemical development include exploiting the energy

advantage to an even greater degree. This means not to stop with methanol and ethylene, but build

capacity in energy intensive chemicals, such as chlorine.

Existing Infrastructure-

In a number of countries (ie, Saudi Arabia, Kuwait, Qatar, UAE) there is already in place

healthy and growing base chemical production that utilizes methane, ethane, and gas liquid

feedstock in petrochemical units that are among the best in class producers on a global

basis.

Financing-

Well established economic and industrial centers are forming around petrochemical industrial sites in

the region, further propagating investment. Jubail and Yanbu΄ in Saudi Arabia are examples. Just as

highly skilled technical and craft personnel migrate toward areas of opportunity, so do the industries

necessary for further development. In the past decade, strong growth has occurred in the Middle East

banking sector, and equity markets have emerged in many Arab countries. No fewer than 15 of the

top 20 banks in the Arab world, including Egypt, are based in the GCC., In addition to a relatively

large banking sector, the regional markets for equity are also beginning to grow.

Technology and Know-how-

Governments and companies in the region are actively pursuing and forming collaborative

relationships with petrochemical industry participants to gain access to characteristics critical to

market success. Governments and petrochemical producing entities are taking the necessary steps to

form alliances and ventures to promote further development. With the exception of Saudi Basic

Industries Corporation (SABIC), most Middle East petrochemical companies require the participation

of international petrochemical companies to provide access to technology and markets. This will

change over the next five-to-ten years as more companies, such as NPC of Iran, reach critical mass

in the competitive global marketplace.

Submitted by: Himanshu Kumar

COUNTARY SCENARIO- “India”

HISTORY-

Chemical industry is one of the oldest industries in India. The industry, including petrochemicals,

and alcohol-based chemicals, has grown at a pace outperforming the overall growth of the industry.

Petrochemical industry is a cyclical industry. Globally the petrochemical industry is characterized by

sluggish demand and volatile feedstock prices. In India, consumption of petrochemical products is

still one of the lowest in the world. For example in case of polyester, India's per capita consumption

is 1.4 kg compared to 6.6 kg for China and 3.3 kg for the world. In case of polymers, per capita

consumption of India is 4 kg and is about a fifth of the world. Demand for the petrochemicals

products has grown in double digits for a long period.

CURRENT SCENARIO-

The Indian Chemical Industry ranks 12th by volume in the world production of chemicals. The

industry’s current turnover is about USD 30.8 billion which is 14 per cent of the total manufacturing

output of the country. In terms of consumption, the chemical industry is its own largest customer

and accounts for approximately 33 per cent of the consumption. In most cases, basic chemicals

undergo several processing stages to be converted into downstream chemicals. These in turn are used

for industrial applications, agriculture, or directly for consumer markets. Industrial and agricultural

uses of chemicals include auxiliary materials such as adhesives, unprocessed plastics, dyes and

fertilizers, while uses within the consumer sector include pharmaceuticals, cosmetics, household

products, paints, etc.

India also produces a large number of fine and speciality chemicals, which have very specific uses

and are essential for increasing industrial production. These find wide usage as food additives,

pigments, polymer additives, anti-oxidants in the rubber industry, etc. Some of the important

manufacturers of speciality chemicals include NOCIL, Bayer

India), ICI (India), Hico Products and Colourchem.

INVESTMENT OPPORTUNITIES-

FDI-

The procedure has been simplified for facilitating foreign direct investment. Most of the chemical

items fall under the RBI automatic approval route for FDI/NRI/OCB investment up to 100%

except the following

• Activities / items that require an industrial license

• Proposals in which the foreign collaborator has previous / existing venture/tie up in India in the

same or allied field

• All proposals relating to acquisition of shares in an existing Indian company by a foreign/NRI

investor

• All proposals falling outside notified sectoral policy/caps or under sectors in which FDI is not

permitted

Due to its low cost infrastructure, India has potential of growth in exports. According to

a report by McKinsey, India’s manufactured exports have the potential to rise from $40 bn last year

to $300 bn by 2015. This defines an investment of $50 bn in chemical industry alone. India has the

capacity for major value addition being close to Middle East. This is a cheap and abundant source for

petrochemical feedstock.

In certain categories of chemicals India does have advantage for exports (dyes, Pharmaceuticals and

agrochemicals) by creating strategic alliances with countries like Russia and CIS countries. With the

Submitted by: Himanshu Kumar

know-how available in the country there is a tremendous potential to grow and increase exports in

dyestuff and agrochemical market. Availability and abundance of raw materials for titanium dioxide

and agro-based products like castor oil offer an opportunity to generate significant value addition.

This, however, would require substituting their exports in raw form by manufacturing higher value

derivatives. The major challenges are quest for feedstock and knowledge management. Traditionally

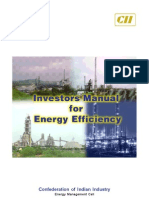

naphtha-based crackers have been providing feedstock to the industry. Today, they are being

replaced by new gas-based crackers. India and China will pose a stiff competition to the Middle East

due to the vibrant exports and large unexplored reserves of oil and gas.

CHARACTERISTICS of INDIAN PETROCHEMICAL INDUSTRY-

The petrochemical industry in India has been one of the fastest growing industries in the country.

Since the beginning, the Indian petrochemical industry has shown an enviable rate of growth. This

industry also has immense importance in the growth of economy of the country and the growth and

development of manufacturing industry as well. It provides the foundation for manufacturing

industries like construction, packaging, pharmaceuticals, agriculture, textiles etc.

Petrochemical Industry in India is a cyclical industry. This industry, not only in India but also across

the world, is dominated by volatile feedstock prices and sulky demand. India has one of the lowest

per capita consumptions of petrochemical products in the world. For example, the per capita

consumption of polyester in India lies at 1.4 kg only comparing to 6.6 kg for China and 3.3 kg for the

whole world. Similarly, the per capita consumption of polymers is 4 kg in India, whereas the per

capita consumption is around 20 kg for the whole world.

The Growth

Growth ofIndia petrochemical industry is playing a major part in the growth of the economy and

the development of the manufacturing sector. The petrochemicals industry provides more value

addition to theIndian economy than most of the other companies.

Petrochemicals are obtained from different chemical compounds which are by-products of crude oil

refining. Most of them fall may be categorized into hydrocarbons. With the fractional distillation of

the crude oil, chemicals like naphtha, kerosene, petroleum gases, ethane, methane, propane, and

butane are the primary stocks used in the petrochemical industry for the production of various other

chemical compounds.

Presently, the extent of penetration of the petrochemical products in day-to-day use is vast. It

actually covers most of the domain of existence such as apparels, accessories, household items,

furniture, electronics, construction, housing, automobiles, medical appliances, packaging,

horticulture, and agriculture.

TheIndia petrochemical industry originated in the 1970s and entered the arena of the industries

ofIndia. This sector was subjected to rapid growth in the period between the 1980s and 1990s. Even

today, expectations from this sector are sky-high. TheIndian petrochemical industry for it part is

doing very well and has been contributing significantly to the country's GDP fro several years now.

TheIndia petrochemical industry primarily consists of synthetic rubber i.e. elastomer, yarn of

synthetic fiber, synthetic detergent intermediates, performance plastics, plastic processing industry,

and polymers.

Submitted by: Himanshu Kumar

The Bongaigaon refinery was set up as an experimental one with the capacity of a refinery and a

petrochemical unit. The success of this integrated petroleum refinery-cum-petrochemicals unit led

to a spree of activities in this sector. Many such units were established to boost production

capabilities. With the growth of India petrochemical industry, it holds the share of around 20% of

the total global producer of petrochemical related products.

In the present scenario, 5 naphtha and 3 gas cracker coordination compounds are in operation with

ethane production capability of around 2.6 million tons every year, jointly. Along with this, another 4

aromatic coordination compounds are in operation with a xylene production capability of around 2.1

million tons.

The petrochemical industry in India came into existence during 1970s. The 1980s and 1990s saw

some rapid growths for Indian petrochemical industry. The biggest reason for this growth was the

high demand for petrochemicals in India, which grew at an annual rate of 13 to 14% since late 90s. It

also called for rapid expansion of capacity. The BMI forecast of average annual growth in India over

2007-2011 is 14 to 16%. However, the industry suffered setbacks during 2008 due to surge in the

price of crude oil. It will be tough for Indian petrochemical industry to plug the deficit of 5mn TPA of

ethylene and 4mn TPA of polymer by 2012 (according to the predictions of the government).

The Present Scenario Presently India has three gas-based and three naphtha-based cracker

complexes with a combined annual capacity of 2.9 MMT of ethylene. Besides this, there are also 4

aromatic complexes with a capacity of 2.9 MMT of Xylenes.

The production of 5.06 MMT polymers during FY09 accounted for around 62% of the total

production of key petrochemicals. It also achieved 88.5% capacity utilization. The industry also

produced 2.52 MMT of synthetic fibres during FY09 with a 73% of capacity utilization.

Key Segments

Petrochemical industry is constituted of the following key segments:

Polymers:

The demand for polymers saw a growth of 13.4% during 2007, comparing to a demand growth

of 5.6% in 2006. According to the prediction of Chemicals and Petrochemicals Manufacturers'

Association (CPMA), the demand growth for polymer would further be augmented to over 15%

in the coming year.

Polyester Intermediates: The combined production of 5 fibre intermediates (CAN, DMT,

Caprolactum, MEG and PTA was 3,417 KT during 2007. Among those, PTA and MEG accounted

for 69% and 27% respectively, while the rest were DMT, Caprolactum and CAN.

Aromatics (Paraxylene): The demand for Paraxylene (PX) saw a growth of 18% during

2007. According to the prediction of CPMA, it is expected to grow at the same rate in the

coming year as well.

Submitted by: Himanshu Kumar

Benzene, Toluene, MX and OX: The demands for Toluene and OX saw a contraction rate

of 4% and 10% respectively during 2007. However, Benzene and MX saw a positive growth

though.

Top Petrochemical Companies in India

Though the Indian petrochemical industry is highly dominated by only a few players, however, there

are a number of petrochemical companies in India, doing their share of business. Some of the top

companies can be listed as below:

Reliance Industries Ltd.

Haldia Petrochemicals Ltd.

Indian Oil Corporation

Gas Authority of India Limited

National Organic Chemical Industry Ltd.

Bongaigaon Refinery and Petrochemicals Ltd.

Manali Petrochemical Limited

I G Petrochemicals Limited

The Andhra Petrochemicals Limited

Tamilnadu Petroproducts Limited

CHALLENGES-

The availability of new hydrocarbon resources in India has spurred the demand for petrochemicals in

the country and spawned an industry that is based largely on captive and low-cost feedstock. There

is no denying that opportunities in the petrochemicals business must be capitalised upon for growth.

Today, the petrochemical industry is driven by size and cutting-edge technology. In the current

competitive environment, small-sized plants make no sense.

Following are the challenges facing India petrochemical industry:

High cost of energy and feedstock and the impact on demand

The transformation in the kinetics of competition in manufacturing

Increase in the cost of project

Problems faced by the India petrochemical industry:

The manufacturing units mostly use obsolete format of technology and are not able

produce optimally

There is a necessity for the modernization of equipments

Excise duty on synthetic fiber should be rationalized

Prevention of reservation on Small Scale Units

Plastic waste to be recycled and the littering habits to be discouraged

India requires advantage on feedstock, so the import cost has to be brought down

The industry should have access to the primary amenities of infrastructure

Submitted by: Himanshu Kumar

EXPECTATION-

The key segments of Indian Petrochemical Industry are Polymers, Olefins, Surfactants, Polyester

Intermediates, Aromatics, and major petrochemicals like MX, Benzene, OX and Toluene. The major

growth drivers of Indian petrochemical industry are specialty chemicals, fertilizers, plastic, dyes and

intermediates with an aggregate demand of 23503kilotons in 2009. The increasing demand of these

products has played a vital role in the expansion of the sector and has triggered the restoration of

fertilizer and other chemical plants in India.

For the forthcoming Union Budget 2010-11, the Confederation of Indian Industry (CII) has proposed

the realization of direct tariffs in the Indian Petrochemical/ Chemical industry which can indirectly

assist the sector in expanding by leaps and bounds. This year also the emphasis will be on allocating

monetary incentives for setting and managing cross-nation oil and petroleum pipeline system for

circulation of the resource to common delivery centres.

Benefits of Petrochemical Products-

The Benefits of Petrochemical Products are profound in our daily life and without it this world

would come to a standstill. In India the Department of Chemicals & Petrochemicals, GOI are the

concerned highest authority of the Indian Petrochemical Industry and Environment related issues.

The Indian Petrochemical Industry and Environment related issues are well addressed to suit the

needs of the country. The Indian Petrochemical Industry is at par with world standard. Thus, India

share a good portion of Petrochemical business in world market. Asian countries, African countries

and even Arab world buys Indian Petrochemical products. The demand for Indian Petrochemical

products is high mainly because of its quality and competitive pricing. India’s low cost and high end

Petrochemical products manufacturing expertise coupled with developing world class infrastructure

is the main leveraging factor for the rise of this industry. India offers Petrochemicals at a substantial

discount than its western counterparts while delivering the same grade of output.

The Indian Petrochemical products are -

Fiber

Cotton

Cellulosics

Synthetics

Acrylics

Polyamides

Polyester

Wool

Elastomers

Polymers

Surfactants

Uses and final products of Petrochemicals are -

Paints

Alkyd Resins

Industrial De-greasers

Odorless Thinners

Inks

Submitted by: Himanshu Kumar

Construction Chemicals

Dry Cleaning

Cleaning chemicals

Maintenance Chemicals

Insecticides

Insecticides Aerosols

Agricultural pesticides

Paints

Thinners

Charcoal Lighters

Oil drilling

The advantages of manufacturing high class Petrochemical Products inIndia are -

Friendly Government ofIndia policies

Low cost labor

Low and world class infrastructure

Strong technical education

Large number of science and engineering graduates

Quality output

Highly skilled workforce

Usage of innovative process

Good client relationships

Huge scope for innovation

Expansion of existing relationships

Huge demand in overseas markets

Availability of more technical work force

Increased number and quality of training facilities

SWOT Analysis-

The Indian petrochemicals industry is finally discarding its nascent stage tag and the companies are

now vying for a major chunk of the global pie of the petrochemicals market. Indian major Reliance

has recently acquired a German polyester major Trevira GmbH and this marks the private sector

giant's entry into the European markets in a big way. At the same time, ONGC and IOC are planning

entry into the business in a major way as this is in line with their forward integration plans.

The petrochemicals cycle is currently on a global uptrend thanks to growing demand from China and

other developing nations. In the domestic markets, growing activity in infrastructure and

construction segments coupled with strong growth in the auto sector on the back of lower interest

rates have actually boosted the performance of the petrochemicals sector. Major beneficiaries of

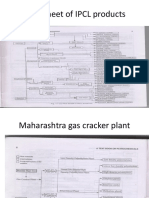

this uptrend are the integrated players such as Reliance Industries, GAIL and IPCL (to some extent).

A low per capita consumption of 4 Kgs of plastic as compared to a global average of 20 Kgs leaves

enough scope for capacity expansion resulting in ONGC and IOC venturing into the business. The

following are the major uses of the products:

Strengths of Indian Petrochemical industry -

Submitted by: Himanshu Kumar

Large and very fast growing Indian petrochemical market

Huge trained talent pool

Competitive labour cost

Weaknesses of Indian Petrochemical industry -

Insufficient basic infrastructure for the petrochemical industry

High feedstock cost in comparison to Middle East countries

Prevalence and use of old technology

Synthetic fibre industry is unorganized and operates in small clusters

Opportunities in Indian Petrochemical industry -

Huge demand for polymer and synthetic fibre

Great opportunity for product development exists

Low consumption of polymer in comparison to global consumption rate

Threats to Indian Petrochemical industry -

Stiff competition from other regional players like, china and the Middle East countries

Stiff rational pricing pressures

Environmental hazards concerns

Low market recognition

Relocation of manufacturing sites to region with abundance of feedstock

Notable points of the Indian Petrochemical industry -

Represents 2% of world market

Does business worth USD 30 billion

Rate of growth of the Indian petrochemical industry is 10%

Profit incurred is around 14%

Wide variety of products

Basic components are petrochemicals, inorganic chemicals and fertilizers

The Indian states of Gujarat, Maharashtra, West Bengal and Andhra Pradesh have the

largest concentration of chemical and petrochemical units

PROMOTING ENVIRONMENTAL, SOCIAL AND ECONOMIC GAIN IN

PETROCHEMICAL INDUSTRY

Create new economic opportunities through an efficient polymer cracking process for more

cost-effective plastics and petrochemicals manufacturing.

Reduce the carbon footprint of plastics manufacture, limit the use of landfill and conserve

valuable fossil resources

Challenge a substantial competitive advantage currently enjoyed by Middle-Eastern polymer

manufacturers over their Western counterparts

Submitted by: Himanshu Kumar

Isolating and purifying valuable monomer molecules from waste plastics cracking processes

is currently energy-intensive and uneconomic at small scale. There are also significant supply

chain difficulties in recycling waste plastics that are slowing down the adoption of new

technologies.

Aims to define and communicate industry's views, mainly on issues related to:

Health, safety and environment, including REACH, management,

Responsible and Product Stewardship

Regulatory issues

Trade and competitiveness, e.g. the European feedstock’s situation

Energy and climate change issues

Logistics, e.g. the European pipeline network

Market intelligence

Integration of Western and Eastern European petrochemical activities.

Thank you..

Submitted by: Himanshu Kumar

You might also like

- Charater Letter To JudgeDocument9 pagesCharater Letter To Judgechong seng fooNo ratings yet

- Verification Handbook For Investigative ReportingDocument79 pagesVerification Handbook For Investigative ReportingRBeaudryCCLE100% (2)

- List of Oil RefineriesDocument29 pagesList of Oil RefineriesSafyan ManzoorNo ratings yet

- Management Lessons From Bhagavad GitaDocument15 pagesManagement Lessons From Bhagavad Gitahimanshu sisodia100% (9)

- World Plastics Market Outlook 2015 2030Document3 pagesWorld Plastics Market Outlook 2015 2030akashdalwadi100% (1)

- Coal's potential as an oil source rockDocument46 pagesCoal's potential as an oil source rockArpita KunduNo ratings yet

- FCC Special Valves Best Practices To Increase Performance Reliability Service Life Natalini Remosa FCCU Galveston 2014Document30 pagesFCC Special Valves Best Practices To Increase Performance Reliability Service Life Natalini Remosa FCCU Galveston 2014siva prasadNo ratings yet

- Ebook Service Desk vs. Help Desk. What Is The Difference 1Document18 pagesEbook Service Desk vs. Help Desk. What Is The Difference 1victor molinaNo ratings yet

- Order To Cash ProjectDocument14 pagesOrder To Cash Projecthimanshu sisodia60% (5)

- Petrochemical Projects in the Gulf RegionDocument2 pagesPetrochemical Projects in the Gulf RegionGuillermoAlvarez84100% (1)

- CPI201T 12 PetroChemical IndustryDocument64 pagesCPI201T 12 PetroChemical IndustryPortia ShilengeNo ratings yet

- Juvenile Deliquency and Juvenile Justice SystemDocument32 pagesJuvenile Deliquency and Juvenile Justice SystemDrew FigueroaNo ratings yet

- International Strategic ManagementDocument82 pagesInternational Strategic Managementhimanshu sisodia50% (2)

- 978191228177Document18 pages978191228177Juan Mario JaramilloNo ratings yet

- Lurgi Technology For GTL CTL Project Amitava BanerjeeDocument80 pagesLurgi Technology For GTL CTL Project Amitava BanerjeePhoon Hee YauNo ratings yet

- Petrochemicals: Samata Deep Raj Deeksha.N.S Krishna Gowri DasariDocument14 pagesPetrochemicals: Samata Deep Raj Deeksha.N.S Krishna Gowri DasariKrishna Gowri Dasari100% (1)

- Aromatics and Derivatives (S&D Outlooks) Jan 2019Document21 pagesAromatics and Derivatives (S&D Outlooks) Jan 2019willbeacham100% (4)

- Anhydrous Ammonia Code of Practice December 06Document76 pagesAnhydrous Ammonia Code of Practice December 06M SharadNo ratings yet

- PetrochemicalsDocument25 pagesPetrochemicalsNilton Rosenbach Jr100% (1)

- Chemical IndustryDocument33 pagesChemical IndustryLarianNo ratings yet

- W4V22 - Petrochemical Industry - HandoutDocument6 pagesW4V22 - Petrochemical Industry - HandoutJessica King100% (1)

- Plant Nutrient Price Dashboard Weekly UpdateDocument2 pagesPlant Nutrient Price Dashboard Weekly UpdateAhmed SalehNo ratings yet

- Acetic Acid: US Chemical ProfileDocument1 pageAcetic Acid: US Chemical ProfileJESSICA PAOLA TORO VASCONo ratings yet

- Alternative Uses of Sugarcane and Its Byproducts in AgroindustriesDocument55 pagesAlternative Uses of Sugarcane and Its Byproducts in AgroindustriesKasaimNo ratings yet

- Korea's 2018 Petrochemical Industry Capacities by CompanyDocument34 pagesKorea's 2018 Petrochemical Industry Capacities by CompanyAnas Raza MohiuddinNo ratings yet

- Hydrogen ProductionDocument31 pagesHydrogen ProductionSajid AliNo ratings yet

- Pinch Technology AnalysisDocument20 pagesPinch Technology AnalysisPiyush JainNo ratings yet

- Overview of The Cost of Desalinated Wate PDFDocument14 pagesOverview of The Cost of Desalinated Wate PDFAhmed AnsariNo ratings yet

- EN EN: European CommissionDocument24 pagesEN EN: European Commissionandrea bottazziNo ratings yet

- SURFACE COAL GASIFICATION EXPERIENCE FROM TALCHER FERTILIZER PROJECTDocument37 pagesSURFACE COAL GASIFICATION EXPERIENCE FROM TALCHER FERTILIZER PROJECTAlfin A. N.No ratings yet

- HydrocrackingDocument1 pageHydrocrackingLeonardo MartinettoNo ratings yet

- Second Assessment - Unknown - LakesDocument448 pagesSecond Assessment - Unknown - LakesCarlos Sánchez LópezNo ratings yet

- CoA Judgment - Kwan Ngen Wah V Julita Binti TinggalDocument25 pagesCoA Judgment - Kwan Ngen Wah V Julita Binti TinggalSerzan HassnarNo ratings yet

- PetrochemicalDocument3 pagesPetrochemicalVidhi DaveNo ratings yet

- Company InformationDocument36 pagesCompany InformationAnaruzzaman SheikhNo ratings yet

- Natural Gas Pricing in IndiaDocument16 pagesNatural Gas Pricing in IndiaSurbhiAroraNo ratings yet

- 8 SMST-Tubes Urea Plants Brochure 2009Document12 pages8 SMST-Tubes Urea Plants Brochure 2009Lee Hui YiNo ratings yet

- Brochure Petrochemical IndustryDocument8 pagesBrochure Petrochemical IndustryrogarditoNo ratings yet

- Iran Now 1Document27 pagesIran Now 1schifanoNo ratings yet

- Pipes and Tubes SectorDocument19 pagesPipes and Tubes Sectornidhim2010No ratings yet

- Waste Minimization in Fertilizer IndustryDocument23 pagesWaste Minimization in Fertilizer IndustryRavi Bhaisare100% (5)

- GCC Power Market Outlook and Renewable Energy SnapshotDocument23 pagesGCC Power Market Outlook and Renewable Energy Snapshotjinalshah1012713No ratings yet

- China's Petrochemical Industry Growth and Major PlayersDocument4 pagesChina's Petrochemical Industry Growth and Major Playersstavros7No ratings yet

- Ethanol Production from Sugar CaneDocument4 pagesEthanol Production from Sugar CanequixoticepiphanyNo ratings yet

- MKG Group 17-08-16Document30 pagesMKG Group 17-08-16Rajnath Rajbhar PanchamNo ratings yet

- Proespektif of PlantDocument8 pagesProespektif of Plantrudy_423522658No ratings yet

- Final Executive Summary - Rice Straw ProjectDocument12 pagesFinal Executive Summary - Rice Straw ProjectAngeli Grace Muñoz Castalone100% (1)

- ROSE® Process Offers Energy Savings For Solvent ExtractionDocument14 pagesROSE® Process Offers Energy Savings For Solvent Extractiona_abbaspourNo ratings yet

- Used Cooking Oil To Make BiodieselDocument14 pagesUsed Cooking Oil To Make BiodieselNada ElSolhNo ratings yet

- Economics of Bioethanol From Rice StrawDocument8 pagesEconomics of Bioethanol From Rice StrawJosé Alberto CastilloNo ratings yet

- Control of Emissions From Power PlantsLarge Scale IndustriesDocument48 pagesControl of Emissions From Power PlantsLarge Scale IndustriesSonu Kumar100% (1)

- Refinery Report FINAL 1Document37 pagesRefinery Report FINAL 1pappuNo ratings yet

- IPCL chemicals flow sheetDocument51 pagesIPCL chemicals flow sheetDeekshith KodumuruNo ratings yet

- 2 Maaden PDFDocument29 pages2 Maaden PDFAnonymous q9eCZHMuSNo ratings yet

- 08-136univ - Metallocene Final PDFDocument8 pages08-136univ - Metallocene Final PDFAlex Jhon100% (1)

- Natural Gas Scenario in IndiaDocument28 pagesNatural Gas Scenario in IndiaShweta Suresh100% (1)

- Topik 6 Impact of Human Activities On Environmental QualityDocument35 pagesTopik 6 Impact of Human Activities On Environmental Qualitysushant980No ratings yet

- Presentation Michael HackingDocument29 pagesPresentation Michael HackingpoupoularyNo ratings yet

- IREDA InvestorManualDocument704 pagesIREDA InvestorManualAshish SharmaNo ratings yet

- Oil and Gas Journal - February, 02 2009 PDFDocument84 pagesOil and Gas Journal - February, 02 2009 PDFAnonymous KWScd5Es7No ratings yet

- 7 - Biogas Paper For Journal IISTEDocument10 pages7 - Biogas Paper For Journal IISTEiisteNo ratings yet

- Energy CrisesDocument258 pagesEnergy CrisesSyed ZulqarnainNo ratings yet

- LNG - Innovation in The LNG Industry - Shell's ApproachDocument12 pagesLNG - Innovation in The LNG Industry - Shell's ApproachNikesh PanchalNo ratings yet

- 1.1 Introduction To Biogas: Electrical DepartmentDocument38 pages1.1 Introduction To Biogas: Electrical DepartmentYogesh KhairnarNo ratings yet

- 2B Green BioEnergy Final Project AugDocument100 pages2B Green BioEnergy Final Project AugAnthony MNo ratings yet

- Indian Jewelry Industry InsightsDocument33 pagesIndian Jewelry Industry InsightsKingsten JonesNo ratings yet

- Icis Chemical Business 2013Document77 pagesIcis Chemical Business 2013mich0pNo ratings yet

- Assignment 4Document7 pagesAssignment 4Yash DNo ratings yet

- Petrochemicals-A CSR PerspectiveDocument22 pagesPetrochemicals-A CSR Perspectivehimanshu sisodiaNo ratings yet

- Assignment: PrefaceDocument29 pagesAssignment: Prefacehimanshu sisodiaNo ratings yet

- Individual Differences in PersonalityDocument15 pagesIndividual Differences in Personalityhimanshu sisodiaNo ratings yet

- Qualities of GirlsDocument2 pagesQualities of Girlshimanshu sisodiaNo ratings yet

- Political Risk AnalysisDocument8 pagesPolitical Risk Analysishimanshu sisodiaNo ratings yet

- Business Definition ProductDocument8 pagesBusiness Definition Producthimanshu sisodiaNo ratings yet

- Improving Employee Relations Through HRDDocument15 pagesImproving Employee Relations Through HRDhimanshu sisodiaNo ratings yet

- KinesicsDocument14 pagesKinesicshimanshu sisodia100% (1)

- Political Risks & IndexesDocument15 pagesPolitical Risks & Indexeshimanshu sisodiaNo ratings yet

- Bank Po Exam SyllabusDocument4 pagesBank Po Exam Syllabushimanshu sisodiaNo ratings yet

- Growth & Potential of Service Industry in India - 2010Document16 pagesGrowth & Potential of Service Industry in India - 2010himanshu sisodiaNo ratings yet

- SOP HimanshuDocument13 pagesSOP Himanshuhimanshu sisodiaNo ratings yet

- List of Solar Energy Operating Applications 2020-03-31Document1 pageList of Solar Energy Operating Applications 2020-03-31Romen RealNo ratings yet

- G. Rappaport: Grammatical Role of Animacy in A Formal Model of Slavic MorphologyDocument28 pagesG. Rappaport: Grammatical Role of Animacy in A Formal Model of Slavic Morphologyanon_315959073No ratings yet

- Rbi Balance SheetDocument26 pagesRbi Balance SheetjameyroderNo ratings yet

- Sunat PerempuanDocument8 pagesSunat PerempuanJamaluddin MohammadNo ratings yet

- Criminal Investigation 11th Edition Swanson Test BankDocument11 pagesCriminal Investigation 11th Edition Swanson Test BankChristopherWaltonnbqyf100% (14)

- Bio New KMJDocument11 pagesBio New KMJapi-19758547No ratings yet

- CW Module 4Document10 pagesCW Module 4Rodney Warren MaldanNo ratings yet

- Lesson Plan 2021Document68 pagesLesson Plan 2021ULYSIS B. RELLOSNo ratings yet

- Intercultural Presentation FinalDocument15 pagesIntercultural Presentation Finalapi-302652884No ratings yet

- Tritium - Radioactive isotope of hydrogenDocument13 pagesTritium - Radioactive isotope of hydrogenParva KhareNo ratings yet

- FREE MEMORY MAPS FOR ECONOMICS CHAPTERSDocument37 pagesFREE MEMORY MAPS FOR ECONOMICS CHAPTERSRonit GuravNo ratings yet

- Shot List Farm To FridgeDocument3 pagesShot List Farm To Fridgeapi-704594167No ratings yet

- In - Gov.uidai ADHARDocument1 pageIn - Gov.uidai ADHARvamsiNo ratings yet

- Romanian Society For Lifelong Learning Would Like To Inform You AboutDocument2 pagesRomanian Society For Lifelong Learning Would Like To Inform You AboutCatalin MihailescuNo ratings yet

- Questions of ValueDocument2 pagesQuestions of ValueRockyNo ratings yet

- CHAPTER 7 MemoDocument4 pagesCHAPTER 7 MemomunaNo ratings yet

- Types of Majority 1. Simple MajorityDocument1 pageTypes of Majority 1. Simple MajorityAbhishekNo ratings yet

- RGPV Enrollment FormDocument2 pagesRGPV Enrollment Formg mokalpurNo ratings yet

- Group 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDocument5 pagesGroup 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDominador RomuloNo ratings yet

- Tso C139Document5 pagesTso C139Russell GouldenNo ratings yet

- XCVBNMK, 54134Document49 pagesXCVBNMK, 54134fakersamNo ratings yet

- Rizal Back in MadridDocument3 pagesRizal Back in MadridElle Dela CruzNo ratings yet

- 8 deadly sins of investing: Overlooking fundamentals, myopic vision, ignoring portfolioDocument4 pages8 deadly sins of investing: Overlooking fundamentals, myopic vision, ignoring portfolionvin4yNo ratings yet