Professional Documents

Culture Documents

Tax Compliance in Nigeria Uddin 2017

Uploaded by

GodwinUddinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Compliance in Nigeria Uddin 2017

Uploaded by

GodwinUddinCopyright:

Available Formats

Tax Compliance in Nigeria: The Case of Lagos State

As part of every economy, the government thus largely plays a role in ensuring the welfare of citizens and

sustainable development. in order to achieve this feat, the government thereby engage in numerous task

by spending public fund as government expenditure. Hence, as the government exists not as a profitmaking firm or group of individuals accumulating wealth for themselves, the government as a machinery

of the state thereby device certain means or measures promulgated by law as part of the constitution and

reflected as the constitutional duties of the government in order to generate fund. Amongst these measures

is the exercise of tax system.

The tax system thereby remains note worthily as a procedure promulgated and implemented by every

government of every country to raise funds for their public projects. This system notably empowers the

government to demand from citizens as well as foreigners in a country certain amount of money of their

earnings, of which is to be paid for enjoying the creation of public utilities. A tax thus is a compulsory

levy enforced by the government of a state, to be paid by citizens and foreign nationals situated in the

country over a period of time, usually monthly or annually. Tax payments by individuals thus serve as one

of the means by which the government raises funds for the accomplishment of most of their constitutional

task.

In Nigeria, tax payments thus are constitutionally upheld by state governors and the federal government.

Payments such as this gives the state and the federal governments the enablement to control land, landed

properties (buildings and firms) as well as public utilities for public interest. In terms of land, the

government thereby demand for Land Use Charge or Lease rent at specified intervals while for landed

properties (buildings and firms), the government demand tenement rate from owners of residential

buildings and from firms as they use their buildings for either industrial or commercial use, the remittal of

different forms of tax like capital gain tax, profit tax and sometimes probate tax. Alongside, there is the

demand for income tax from civil servants or public officers or federal/state/local government employees.

These compulsory levies as tax evidently assist and enable the government in their effort for the provision

of social amenities for peoples comfort or infrastructures to aid industrialization or promote economic

development. Most certainly, well directed and efficiently utilized public fund raised from tax payments

thus make visible the creation and upgrading of hospitals in terms of primary health care; the

establishment, rehabilitation and funding of institutions for learning particularly primary and secondary

schools; as well as the creation of other public utilities like efficient road networks and comfortable

means of transportation.

These dividends of the tax system as deliverables necessary for the upliftment of Lagos State to be a true

place of comfort, the nations pride as a result a mega city as it remains the countrys centre of excellence

evidently cannot be overemphasized, been that such can only be realized by the prompt payment,

consistent remittance and adherence of every taxable individual to payment of tax for the realization of

the Lagos State of our dream. This is a noble and worthy endeavour every citizen, employee and residents

in Lagos are encouraged to fulfill and or undertake.

Eko o ni baje o!

You might also like

- The Monetary Policy Transmission ChannelsDocument4 pagesThe Monetary Policy Transmission ChannelsGodwinUddinNo ratings yet

- The Tobin's Q Theory of InvestmentDocument3 pagesThe Tobin's Q Theory of InvestmentGodwinUddinNo ratings yet

- Inflation Targeting and Central Bank of NigeriaDocument3 pagesInflation Targeting and Central Bank of NigeriaGodwinUddinNo ratings yet

- Sustainability Reporting: An IntroductionDocument1 pageSustainability Reporting: An IntroductionGodwinUddinNo ratings yet

- Nigeria in Focus: Thoughts For Manufacturing and Agricultural BusinessesDocument7 pagesNigeria in Focus: Thoughts For Manufacturing and Agricultural BusinessesGodwinUddinNo ratings yet

- Relevance of The Monetary Transmission Mechanism Theories To The Nigerian Economy: A DiscourseDocument4 pagesRelevance of The Monetary Transmission Mechanism Theories To The Nigerian Economy: A DiscourseGodwinUddinNo ratings yet

- Financial Intermediation As Delegated Monitoring and Thoughts On Its Practice: A ReviewDocument2 pagesFinancial Intermediation As Delegated Monitoring and Thoughts On Its Practice: A ReviewGodwinUddinNo ratings yet

- Resource Breakdown StructureDocument4 pagesResource Breakdown StructureGodwinUddinNo ratings yet

- Developing Nigeria Uddin 2017Document1 pageDeveloping Nigeria Uddin 2017GodwinUddinNo ratings yet

- General Equilibrium Modelling The State of The ArtDocument7 pagesGeneral Equilibrium Modelling The State of The ArtGodwinUddinNo ratings yet

- Importance of Sound Project AnalysisDocument1 pageImportance of Sound Project AnalysisGodwinUddin50% (2)

- Cost Baseline (Continued) : TH ST ND RD TH TH ST NDDocument1 pageCost Baseline (Continued) : TH ST ND RD TH TH ST NDGodwinUddinNo ratings yet

- Cost BaselineDocument2 pagesCost BaselineGodwinUddinNo ratings yet

- Project Plan For IfewaraDocument25 pagesProject Plan For IfewaraGodwinUddinNo ratings yet

- The Fallacy of Success (Uddin, 2014)Document3 pagesThe Fallacy of Success (Uddin, 2014)GodwinUddinNo ratings yet

- Child Abuse: Uddin, Godwin Enaholo 2014Document2 pagesChild Abuse: Uddin, Godwin Enaholo 2014GodwinUddinNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- 20852891627920AI21180Document1 page20852891627920AI21180Ahmed MahmoudNo ratings yet

- Op Transaction History 16!12!2023Document3 pagesOp Transaction History 16!12!2023Amar GikiNo ratings yet

- CarlosSuperDrug v. DSWD Case DigestDocument2 pagesCarlosSuperDrug v. DSWD Case DigestjohnNo ratings yet

- Profit Sharing Agreement SampleDocument4 pagesProfit Sharing Agreement SampleCatherine LopezNo ratings yet

- Form 2 Bond LodgementDocument3 pagesForm 2 Bond LodgementAjini SahejanaNo ratings yet

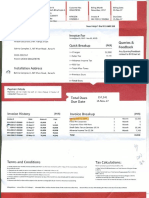

- Tax Invoice: Manual SwitchDocument1 pageTax Invoice: Manual SwitchSandeep SolankiNo ratings yet

- Airtel Broadband BillDocument4 pagesAirtel Broadband BillJaya SinghNo ratings yet

- Export/Import Procedures: Md. Sarwar Hossain Deputy General Manager Bangladesh BankDocument12 pagesExport/Import Procedures: Md. Sarwar Hossain Deputy General Manager Bangladesh BankAlam (MDO)No ratings yet

- Moneylion StatementDocument1 pageMoneylion StatementrolphcourtenayNo ratings yet

- InsureTech Connect Asia 2023Document1 pageInsureTech Connect Asia 2023Somansh BansalNo ratings yet

- Computed Using Classification and Globalization Rule: or Business Income Such As Passive IncomeDocument10 pagesComputed Using Classification and Globalization Rule: or Business Income Such As Passive IncomelcNo ratings yet

- Fringe Benefits: Laban Lang Noh!Document20 pagesFringe Benefits: Laban Lang Noh!Alyssa Joie PalerNo ratings yet

- National Technology: Institute ofDocument2 pagesNational Technology: Institute ofAlex ConnorNo ratings yet

- Finance Act 2022 Analysis by KPMGDocument17 pagesFinance Act 2022 Analysis by KPMGSaviusNo ratings yet

- Ib-Nhóm 12Document83 pagesIb-Nhóm 12ivylinhnguyen2708No ratings yet

- EOBI FormDocument3 pagesEOBI Formhaf472No ratings yet

- CTC Break Up - PGDM 1Document16 pagesCTC Break Up - PGDM 1piyush rawatNo ratings yet

- Receipt - LinkedIn FebDocument1 pageReceipt - LinkedIn FebJacob PruittNo ratings yet

- TAX ReviewerDocument77 pagesTAX ReviewerMark AloysiusNo ratings yet

- Jazz PDFDocument3 pagesJazz PDFSyed Yahya AhsanNo ratings yet

- 5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoDocument4 pages5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoConcerned CitizenNo ratings yet

- GA502263-Tax Invoice (Client Copy)Document1 pageGA502263-Tax Invoice (Client Copy)Nelly HNo ratings yet

- This Is A Computer Generated Statement NOT Requiring Any SignatureDocument1 pageThis Is A Computer Generated Statement NOT Requiring Any Signatureraj dNo ratings yet

- CDP NarrativeDocument1 pageCDP NarrativeJazz AdazaNo ratings yet

- Fabm2 - 8.2Document15 pagesFabm2 - 8.2Kervin GuevaraNo ratings yet

- PaymentMethodsRevised PDFDocument2 pagesPaymentMethodsRevised PDFMohd AzamNo ratings yet

- Tax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Document5 pagesTax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Shivani Jani0% (3)

- ARCC - Renewal of ARCCDocument85 pagesARCC - Renewal of ARCCasombrado.cscdNo ratings yet

- CustomInvoice 7670709745Document1 pageCustomInvoice 7670709745budi irawanNo ratings yet