Professional Documents

Culture Documents

Senate Bill 85

Uploaded by

chrisfuhrmeisterCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Senate Bill 85

Uploaded by

chrisfuhrmeisterCopyright:

Available Formats

17

LC 36 3174

Senate Bill 85

By: Senators Jeffares of the 17th, Hill of the 6th, Martin of the 9th, Hufstetler of the 52nd,

Albers of the 56th and others

A BILL TO BE ENTITLED

AN ACT

To amend Chapter 5 of Title 3 of the Official Code of Georgia Annotated, relating to malt

beverages, so as to provide for the limited sale of malt beverages at retail by manufacturers

of malt beverages; to provide for a definition; to provide for the promulgation of rules and

regulations by the state revenue commissioner; to provide for certain powers of the state

revenue commissioner; to clarify that sales of malt beverages by brewpubs for consumption

off the premises are governed by the local jurisdiction; to provide for remittance of local

excise taxes by brewers; to provide for related matters; to repeal conflicting laws; and for

other purposes.

BE IT ENACTED BY THE GENERAL ASSEMBLY OF GEORGIA:

10

SECTION 1.

11

Chapter 5 of Title 3 of the Official Code of Georgia Annotated, relating to malt beverages,

12

is amended by revising Code Section 3-5-1, relating to definitions, as follows:

13

"3-5-1.

14

As used in this chapter, the term:

15

(1) 'Barrel' means 31 gallons.

16

(1)(2) 'Brewer' means a manufacturer of malt beverages.

17

(2)(3) 'Case' means a box or receptacle containing not more than 288 ounces of malt

18

beverages on the average."

19

20

SECTION 2.

Said chapter is further amended by adding a new Code section to read as follows:

21

"3-5-24.1.

22

(a) A limited exception to the provisions of Code Sections 3-5-29 through 3-5-32

23

providing a three-tier system for the distribution and sale of malt beverages shall exist to

24

the extent that the license to manufacture malt beverages in this state shall include the right

S. B. 85

-1-

17

LC 36 3174

25

to sell up to 3,000 barrels of malt beverages per year produced at the brewer's licensed

26

premises to individuals who are on such premises for:

27

(1) Consumption on the premises; and

28

(2) Consumption off the premises, provided that such sales for consumption off the

29

premises shall not exceed a maximum of 288 ounces of malt beverages per consumer per

30

day.

31

(b) A brewer may sell malt beverages pursuant to subsection (a) of this Code section on

32

all days and at all times that sales of malt beverages by retailers are lawful within the

33

county or municipality in which the licensed premises of the brewer is located, including,

34

but not limited to, Sundays.

35

(c) Any brewer engaging in retail sales of malt beverages pursuant to this Code section

36

shall remit all state and local sales, use, and excise taxes to the proper tax collecting

37

authority.

38

(d) The commissioner shall promulgate and enforce such rules and regulations as he or she

39

may deem reasonable and necessary to effectuate the provisions of this Code section.

40

(e) Upon a violation by a brewer of any provision of this Code Section or this title or any

41

rule or regulation promulgated thereunder, the commissioner shall have the power to place

42

conditions or limitations on such brewer's license and to modify or amend such conditions

43

or limitations."

44

SECTION 3.

45

Said chapter is further amended by revising paragraph (4) of Code Section 3-5-36, relating

46

to the brewpub exception to three-tier distribution system, as follows:

47

"(4) A brewpub license does not authorize the holder of such license to sell alcoholic

48

beverages shall not be prohibited from selling wine or malt beverages by the package for

49

consumption off the premises where so permitted by resolution or ordinance of the

50

county or municipality;"

51

SECTION 4.

52

Said chapter is further amended by revising Code Section 3-5-38, relating to permits for free

53

tasting of malt beverages during educational and promotional brewery tours, merchandising,

54

fees for tours, selling of beverages, and administration, as follows:

55

"3-5-38.

56

(a) As used in this Code section, the term:

57

(1) 'Brewery tour' means guided access to the manufacturing portion of the licensed

58

premises of a brewer.

S. B. 85

-2-

17

LC 36 3174

59

(2) 'Free souvenir' means a complimentary sealed container or containers of malt

60

beverages with a total liquid capacity that does not exceed 72 ounces.

61

(3) 'Free tastings' means the provision of complimentary samples of malt beverages to

62

the public for consumption on the premises of a brewer.

63

(4) 'Sample' means a quantity of malt beverages manufactured by the brewer.

64

(b)(1) A brewer licensed in this state may apply to the commissioner for an annual

65

permit authorizing such brewer to conduct educational and promotional brewery tours on

66

the licensed premises of the brewer, free of charge or for a fee, which may include:

67

(A) Free souvenirs;

68

(B) Free food; and

69

(C)

70

manufactured by such brewer.

Free tastings on the licensed premises of the brewery of malt beverages

71

(2) No brewer providing free souvenirs pursuant to this subsection shall provide, directly

72

or indirectly, more than one free souvenir to the same individual in one calendar day.

73

Each free souvenir shall consist of malt beverages manufactured by the brewer on the

74

licensed premises.

75

(3) No brewer conducting free tastings pursuant to this subsection shall provide, directly

76

or indirectly, to the same individual in one calendar day more than 36 ounces of malt

77

beverages for consumption on the premises. Free tastings shall be held in a designated

78

tasting area on the licensed premises of the brewer and all open bottles containing malt

79

beverages shall be visible at all times.

80

(4) Free souvenirs shall only be provided after the brewery tour and only to individuals

81

who have attended a brewery tour on the same calendar day. Free tastings and free food

82

may be provided before, during, and after a brewery tour. An individual shall be 21 years

83

of age or older to receive a free souvenir or free tasting.

84

(5) The brewer shall pay all excise and use taxes on any samples and all use taxes on any

85

free souvenirs provided pursuant to this subsection.

86

(c) A brewer may provide to the public free of charge or for a fee merchandise such as

87

shirts, glasses, and other promotional items which do not contain alcoholic beverages.

88

(d) If a brewer chooses to charge a fee for a brewery tour pursuant to subsection (b) of this

89

Code section, such brewer may charge varying fees for the brewery tours, provided that

90

such fees are charged prior to the beginning of such tour. The provision of malt beverages

91

by a brewer as part of a brewery tour pursuant to this Code section shall not be deemed a

92

retail sale of alcoholic beverages.

93

(e) No alcoholic beverages shall be sold on any licensed premises for which a permit has

94

been issued pursuant to this Code section.

S. B. 85

-3-

17

LC 36 3174

95

(f) The department shall promulgate and enforce such rules and regulations as it may deem

96

necessary to effectuate the provisions of this Code section. Reserved."

97

SECTION 5.

98

Said chapter is further amended by revising Code Section 3-5-81, relating to payment of tax

99

by wholesale dealers generally, time of payment, reports by dealers as to quantities of

100

beverages sold, as follows:

101

"3-5-81.

102

(a) The excise taxes provided for in this part shall be imposed upon and shall be paid by

103

the licensed wholesale dealer in malt beverages; provided, however, that such taxes shall

104

be imposed upon and shall be paid by the licensed brewer for malt beverages served or sold

105

by the brewer directly to the public pursuant to Code Section 3-5-24.1.

106

(b) The taxes shall be paid on or before the tenth day of the month following the calendar

107

month in which the beverages are sold or disposed of within the particular municipality or

108

county by the wholesale dealer.

109

(c) Each licensee responsible for the payment of the excise tax shall file a report itemizing

110

for the preceding calendar month the exact quantities of malt beverages, by size and type

111

of container, sold during the month within each municipality or county. The licensee shall

112

file the report with each municipality or county wherein the beverages are sold by the

113

licensee.

114

(d) The wholesaler licensee shall remit to the municipality or county on the tenth day of

115

the month following the calendar month in which the sales were made the tax imposed by

116

the municipality or county."

117

118

SECTION 6.

All laws and parts of laws in conflict with this Act are repealed.

S. B. 85

-4-

You might also like

- Senate Bill 85Document8 pagesSenate Bill 85chrisfuhrmeisterNo ratings yet

- Senate Bill 85Document8 pagesSenate Bill 85maggieNo ratings yet

- I1183 PDFDocument60 pagesI1183 PDFTiclomarol JohnNo ratings yet

- Senate Bill 108 - Nevada BrewpubsDocument8 pagesSenate Bill 108 - Nevada BrewpubsKSNV News3LVNo ratings yet

- Liquor Store Permit LegislationDocument25 pagesLiquor Store Permit LegislationAnthony WarrenNo ratings yet

- Chapter05-Alcoholic Beverages 2011Document37 pagesChapter05-Alcoholic Beverages 2011mypoll1001No ratings yet

- Hb114 IntrDocument30 pagesHb114 IntrWSYX/WTTENo ratings yet

- As Passed by The House 131st General Assembly Regular Session Am. H. B. No. 351 2015-2016Document5 pagesAs Passed by The House 131st General Assembly Regular Session Am. H. B. No. 351 2015-2016Chris BurnsNo ratings yet

- HB264-Gourmet Bottle BillDocument8 pagesHB264-Gourmet Bottle BillMadison UnderwoodNo ratings yet

- Direct Shipment of WineDocument70 pagesDirect Shipment of WineAnthony WarrenNo ratings yet

- Brew Pubs and Craft Brewers - 2013 SSL Draft, The Council of State GovernmentsDocument2 pagesBrew Pubs and Craft Brewers - 2013 SSL Draft, The Council of State Governmentsbvoit1895No ratings yet

- Senate Bill 1564Document4 pagesSenate Bill 1564Sinclair Broadcast Group - EugeneNo ratings yet

- Pooler Chapter 6 - Alcohol Ordinance - 2021-11-15 - DraftDocument43 pagesPooler Chapter 6 - Alcohol Ordinance - 2021-11-15 - Draftsavannahnow.comNo ratings yet

- Maine 130 - SP 94 Item 1Document4 pagesMaine 130 - SP 94 Item 1NEWS CENTER MaineNo ratings yet

- A Bill To Amend 1998 PA 58, Entitled "Michigan Liquor Control Code of 1998," (MCL 436.1101 To 436.2303) by Adding Section 203aDocument4 pagesA Bill To Amend 1998 PA 58, Entitled "Michigan Liquor Control Code of 1998," (MCL 436.1101 To 436.2303) by Adding Section 203aAfzal ImamNo ratings yet

- In General Assembly January Session, A.D. 2020Document5 pagesIn General Assembly January Session, A.D. 2020NBC 10 WJARNo ratings yet

- Montgomery County - Alcoholic Beverages - Class A Beer, Wine, and Liquor Licenses and Purchases From Licensed Wholesalers MC 3-16Document7 pagesMontgomery County - Alcoholic Beverages - Class A Beer, Wine, and Liquor Licenses and Purchases From Licensed Wholesalers MC 3-16Aaron KrautNo ratings yet

- Alcohol-to-Go BillDocument13 pagesAlcohol-to-Go BillGary DetmanNo ratings yet

- Laws of New York, 2009 Chapter 59, Part Ss The "Bigger Better Bottle Law"Document14 pagesLaws of New York, 2009 Chapter 59, Part Ss The "Bigger Better Bottle Law"Daily FreemanNo ratings yet

- SB 1801 A EngrossedDocument3 pagesSB 1801 A EngrossedSinclair Broadcast Group - EugeneNo ratings yet

- 2020 Sib 0938Document3 pages2020 Sib 0938Dr. Murad AbelNo ratings yet

- State of Colorado: First Regular Session Sixty-Eighth General AssemblyDocument7 pagesState of Colorado: First Regular Session Sixty-Eighth General AssemblyEthan AxelrodNo ratings yet

- S2823 (An Act Relative To Equity in The Cannabis Industry) As Amended by House Ways and MeansDocument13 pagesS2823 (An Act Relative To Equity in The Cannabis Industry) As Amended by House Ways and MeansGrant EllisNo ratings yet

- Indiana 2024 SB0205 Comm SubDocument9 pagesIndiana 2024 SB0205 Comm SubAnthony WrightNo ratings yet

- House Bill 1524Document13 pagesHouse Bill 1524augustapressNo ratings yet

- House File 364 - IntroducedDocument5 pagesHouse File 364 - IntroducedBarrySteinNo ratings yet

- Legp604 PDFDocument15 pagesLegp604 PDFLaura Peters ShapiroNo ratings yet

- Oklahoma 2023 HB1392 EngrossedDocument9 pagesOklahoma 2023 HB1392 EngrossedKTUL - Tulsa's Channel 8No ratings yet

- Karnataka Excise (Brewery) Rules, 1967Document11 pagesKarnataka Excise (Brewery) Rules, 1967anshuman1802No ratings yet

- Senate Gov.Document23 pagesSenate Gov.Lili NiniNo ratings yet

- HB 645 BillDocument5 pagesHB 645 Billapi-404247469No ratings yet

- Sports Plaza Ordinance DRAFT 1.13.16 V2 1Document4 pagesSports Plaza Ordinance DRAFT 1.13.16 V2 1dannyecker_crainNo ratings yet

- Ra 9334Document27 pagesRa 9334Greg AustralNo ratings yet

- Bill 68: An Act To Amend The Act Respecting Liquor Permits and Other Legislative ProvisionsDocument32 pagesBill 68: An Act To Amend The Act Respecting Liquor Permits and Other Legislative ProvisionsOpenFileMTLNo ratings yet

- Rule Liquor Supply by Wholesale Rule 1983Document37 pagesRule Liquor Supply by Wholesale Rule 1983VigneshVickeyNo ratings yet

- NC HB 971 AbcDocument6 pagesNC HB 971 AbcAnonymous jeL70dsNo ratings yet

- Karnataka Excise RulesDocument18 pagesKarnataka Excise RulesShah RukhNo ratings yet

- NIRC Sec 141-151Document9 pagesNIRC Sec 141-151Euxine AlbisNo ratings yet

- House Bill 1644Document4 pagesHouse Bill 1644DigitalNo ratings yet

- Ra 10351Document30 pagesRa 10351Erika ValmonteNo ratings yet

- Michigan House Bill No. 4328Document13 pagesMichigan House Bill No. 4328Elizabeth WashingtonNo ratings yet

- Excise Tarriff Act Chapter - 338Document6 pagesExcise Tarriff Act Chapter - 338IdealNo ratings yet

- An Act To Extend The Ability of Restaurants and Bars To Serve Alcohol To GoDocument3 pagesAn Act To Extend The Ability of Restaurants and Bars To Serve Alcohol To GoNEWS CENTER MaineNo ratings yet

- Marks and Labels On Containers of BeerDocument68 pagesMarks and Labels On Containers of BeerderbewalebelNo ratings yet

- Rutherford Drinking Age Pre-Filed House Bill 4512Document9 pagesRutherford Drinking Age Pre-Filed House Bill 4512MarcusNo ratings yet

- Revenue Regulations on Excise Tax for Cigars and CigarettesDocument13 pagesRevenue Regulations on Excise Tax for Cigars and CigarettesCarla CucuecoNo ratings yet

- HB213Document10 pagesHB213Wanda PeedeeNo ratings yet

- Bill 26 (Alberta)Document56 pagesBill 26 (Alberta)CPAC TVNo ratings yet

- Ohio House Bill 19Document30 pagesOhio House Bill 19WKYC.comNo ratings yet

- SB 19Document4 pagesSB 19Lindsey BasyeNo ratings yet

- Chicago Wrigley Field Sports Plaza OrdinanceDocument8 pagesChicago Wrigley Field Sports Plaza OrdinanceDNAinfo ChicagoNo ratings yet

- HB 1146Document6 pagesHB 1146Rob PortNo ratings yet

- Assignment Dated 02.07.22Document7 pagesAssignment Dated 02.07.22ami thakkerNo ratings yet

- H.B. 1168Document12 pagesH.B. 1168Anthony WarrenNo ratings yet

- S 8084-A HINCHEY Same As A9283 Peoples-Stokes Same AsDocument10 pagesS 8084-A HINCHEY Same As A9283 Peoples-Stokes Same AsWGRZ-TVNo ratings yet

- The Potable Spirits ActDocument4 pagesThe Potable Spirits ActmuhumuzaNo ratings yet

- Michigan House Bill 4842Document3 pagesMichigan House Bill 4842Clickon DetroitNo ratings yet

- Memo Text: Bill No.: Actions VotesDocument5 pagesMemo Text: Bill No.: Actions VotesRick KarlinNo ratings yet

- Ba Bellies Lunch MenuDocument1 pageBa Bellies Lunch MenuchrisfuhrmeisterNo ratings yet

- Bikini Barista LawsuitDocument23 pagesBikini Barista LawsuitNeal McNamaraNo ratings yet

- Lingenfelter Dominguez FLSA Complaint (00326377xAB14F)Document13 pagesLingenfelter Dominguez FLSA Complaint (00326377xAB14F)chrisfuhrmeisterNo ratings yet

- The Cowfish Atlanta MenuDocument9 pagesThe Cowfish Atlanta MenuchrisfuhrmeisterNo ratings yet

- Gina Cirrincione ComplaintDocument9 pagesGina Cirrincione ComplaintLaw&CrimeNo ratings yet

- Chick-fil-A LawsuitDocument5 pagesChick-fil-A Lawsuitchrisfuhrmeister100% (1)

- Papa John's LawsuitDocument6 pagesPapa John's Lawsuitchrisfuhrmeister100% (1)

- Atlanta Falcons Executive OrderDocument2 pagesAtlanta Falcons Executive Orderchrisfuhrmeister100% (1)

- Scales 925 LawsuitDocument36 pagesScales 925 LawsuitchrisfuhrmeisterNo ratings yet

- Char Korean Bar & Grill MenuDocument6 pagesChar Korean Bar & Grill MenuchrisfuhrmeisterNo ratings yet

- LawsuitDocument12 pagesLawsuitchrisfuhrmeisterNo ratings yet

- Char Korean Bar & Grill Bar MenuDocument6 pagesChar Korean Bar & Grill Bar MenuchrisfuhrmeisterNo ratings yet

- Char Korean Bar & Grill MenuDocument6 pagesChar Korean Bar & Grill MenuchrisfuhrmeisterNo ratings yet

- Ba Bellies Beverage MenuDocument1 pageBa Bellies Beverage MenuchrisfuhrmeisterNo ratings yet

- Ba Bellies Brunch MenuDocument1 pageBa Bellies Brunch MenuchrisfuhrmeisterNo ratings yet

- Diner Weekend Breakfast MenuDocument3 pagesDiner Weekend Breakfast MenuchrisfuhrmeisterNo ratings yet

- Chipotle LawsuitDocument42 pagesChipotle Lawsuitchrisfuhrmeister100% (1)

- Pat Roberts BillDocument7 pagesPat Roberts BillchrisfuhrmeisterNo ratings yet

- Diner Daily MenuDocument6 pagesDiner Daily MenuchrisfuhrmeisterNo ratings yet

- Ba Bellies Dinner MenuDocument2 pagesBa Bellies Dinner MenuchrisfuhrmeisterNo ratings yet

- Pizza Ranch LawsuitDocument8 pagesPizza Ranch LawsuitdmronlineNo ratings yet

- Grumpy Cat LawsuitDocument26 pagesGrumpy Cat LawsuitchrisfuhrmeisterNo ratings yet

- Gipson vs. McDonald'sDocument11 pagesGipson vs. McDonald'schrisfuhrmeister100% (1)

- Superica Beverage MenuDocument2 pagesSuperica Beverage MenuchrisfuhrmeisterNo ratings yet

- Superica MenuDocument6 pagesSuperica MenuchrisfuhrmeisterNo ratings yet

- Smokebelly MenuDocument2 pagesSmokebelly MenuchrisfuhrmeisterNo ratings yet

- The Freakin' Incan MenuDocument2 pagesThe Freakin' Incan MenuchrisfuhrmeisterNo ratings yet

- Illegal Food MenuDocument3 pagesIllegal Food MenuchrisfuhrmeisterNo ratings yet

- 04 - 03 - Annex C - Maintenance Plan - Ver03Document2 pages04 - 03 - Annex C - Maintenance Plan - Ver03ELILTANo ratings yet

- DBBL (Rasel Vai)Document1 pageDBBL (Rasel Vai)anik1116jNo ratings yet

- SHFL Posting With AddressDocument8 pagesSHFL Posting With AddressPrachi diwateNo ratings yet

- MCQs On Transfer of Property ActDocument46 pagesMCQs On Transfer of Property ActRam Iyer75% (4)

- CareEdge Ratings Update On Tyre IndustryDocument5 pagesCareEdge Ratings Update On Tyre IndustryIshan GuptaNo ratings yet

- Reimbursement Receipt FormDocument2 pagesReimbursement Receipt Formsplef lguNo ratings yet

- Quiz 523Document17 pagesQuiz 523Haris NoonNo ratings yet

- Advt Tech 09Document316 pagesAdvt Tech 09SHUVO MONDALNo ratings yet

- School of Agribusiness Management: (Acharya N G Ranga Agricultural University) Rajendranagar, Hyderabad-500030Document25 pagesSchool of Agribusiness Management: (Acharya N G Ranga Agricultural University) Rajendranagar, Hyderabad-500030Donbor Shisha Pohsngap100% (1)

- UEH Mid-Term Micro Fall 2020 - B46Document4 pagesUEH Mid-Term Micro Fall 2020 - B46SƠN LƯƠNG THÁINo ratings yet

- Asset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White PaperDocument7 pagesAsset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White Papervarachartered283No ratings yet

- Jason HickelDocument1 pageJason HickelAlaiza Bea RuideraNo ratings yet

- Final EA SusWatch Ebulletin February 2019Document3 pagesFinal EA SusWatch Ebulletin February 2019Kimbowa RichardNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- Arcelor Mittal MergerDocument26 pagesArcelor Mittal MergerPuja AgarwalNo ratings yet

- Yr1 Yr2 Yr3 Sales/year: (Expected To Continue)Document7 pagesYr1 Yr2 Yr3 Sales/year: (Expected To Continue)Samiksha MittalNo ratings yet

- Globalization's Importance for EconomyDocument3 pagesGlobalization's Importance for EconomyOLIVER JACS SAENZ SERPANo ratings yet

- CH North&south PDFDocument24 pagesCH North&south PDFNelson Vinod KumarNo ratings yet

- Politics 17 July 2019 Reading ListDocument2 pagesPolitics 17 July 2019 Reading ListMan LoNo ratings yet

- BY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Document31 pagesBY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Ili SyazwaniNo ratings yet

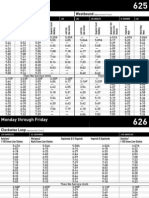

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet

- Chapter 15 Investment, Time, and Capital Markets: Teaching NotesDocument65 pagesChapter 15 Investment, Time, and Capital Markets: Teaching NotesMohit ChetwaniNo ratings yet

- REKENING KORAN ONLINE ClaudioDocument1 pageREKENING KORAN ONLINE Claudiorengga adityaNo ratings yet

- Receipt Voucher: Tvs Electronics LimitedDocument1 pageReceipt Voucher: Tvs Electronics LimitedKrishna SrivathsaNo ratings yet

- Assumptions in EconomicsDocument9 pagesAssumptions in EconomicsAnthony JacobeNo ratings yet

- Spence's (1973) Job Market Signalling GameDocument3 pagesSpence's (1973) Job Market Signalling GameKhanh LuuNo ratings yet

- CIR vs. First Express PawnshopDocument1 pageCIR vs. First Express PawnshopTogz Mape100% (1)

- Challenge of Educating Social EntrepreneursDocument9 pagesChallenge of Educating Social EntrepreneursRapper GrandyNo ratings yet

- TransportPlanning&Engineering PDFDocument121 pagesTransportPlanning&Engineering PDFItishree RanaNo ratings yet

- Monitoring Local Plans of SK Form PNR SiteDocument2 pagesMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosNo ratings yet