Professional Documents

Culture Documents

Fa2prob1 7

Uploaded by

jay0 ratings0% found this document useful (0 votes)

19 views1 pagevalix

Original Title

fa2prob1-7

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentvalix

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pageFa2prob1 7

Uploaded by

jayvalix

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

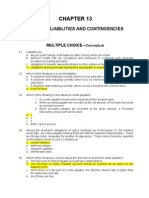

Problem 1-7 Multiple choice (IFRS)

1. Which of the following statements best describes the term "liability" ?

a. An excess of equity over current assets

b. Resources to meet financial commitments as they fall due

c. The residual interest in the assets of the entity after deducting all of the liabilities

d. A present obligation of the entity arising from past events

2. Conceptually, a short-term note payable with no stated rate of interest should be

a. Recorded at maturity value.

b. Recorded at the face amount.

c. Discounted to its present value.

d. Reported separately from other short-term notes payable.

3. In which section of the statement of financial position should employment taxes

that are due for settlement in 15 months' ime be presented?

a. Current liabilities

b. Current assets

c. Noncurrent liabilities

d. Noncurrent assets

4. Which of the following should be classified as noncurrent liability?

a. Unearned revenue

b. Mandatory redeemable preference share

c. The currently maturing portion of long-term debt

d. Accrued salaries payable to management

5. Which of the following is a noncurrent liability?

a. Income tax payable

b. One-year magazine subscription received in advance

c. Unearned interest income related to noninterest-bearing long-term note

receivable

d. Estimated warranty liability

You might also like

- Intermediate Accouting Testbank ch13Document23 pagesIntermediate Accouting Testbank ch13cthunder_192% (12)

- Chapter 13 Intermediate AccoutingDocument8 pagesChapter 13 Intermediate AccoutingMarlind3No ratings yet

- TOA - LiabilitiesDocument102 pagesTOA - LiabilitiesYenNo ratings yet

- Statement of Financial Position - TheoryDocument2 pagesStatement of Financial Position - Theoryricamae saladagaNo ratings yet

- ch13 PDFDocument43 pagesch13 PDFerylpaez100% (3)

- ch13 Testbank Intermediate AccountingDocument43 pagesch13 Testbank Intermediate Accountingalaa96% (53)

- Shareholders Equity PDF FreeDocument111 pagesShareholders Equity PDF FreeJoseph Asis100% (1)

- RemovalDocument6 pagesRemovalJessa Mae BanseNo ratings yet

- Current LiabDocument24 pagesCurrent LiabSamantha Marie ArevaloNo ratings yet

- Current Liabilities Provisions and Contingencies TheoriesDocument12 pagesCurrent Liabilities Provisions and Contingencies TheoriesKristine Trisha Anne SabornidoNo ratings yet

- Acctexam - Current Liabilities and ContingenciesDocument7 pagesAcctexam - Current Liabilities and ContingenciesAsheNo ratings yet

- Solution File: Choose The Correct Option Among The Choices Given BelowDocument7 pagesSolution File: Choose The Correct Option Among The Choices Given BelowPranav KolaganiNo ratings yet

- MT Assign 1Document2 pagesMT Assign 1Al-Ameen P. MacabaningNo ratings yet

- Answer KeyDocument18 pagesAnswer KeyChristian N MagsinoNo ratings yet

- Current Liabilities, Provisions, and Contingencies: Chapter Learning ObjectivesDocument43 pagesCurrent Liabilities, Provisions, and Contingencies: Chapter Learning Objectivesannedanyle acabadoNo ratings yet

- IA 3 ReviewerDocument23 pagesIA 3 ReviewerLarra NarcisoNo ratings yet

- The Assets That Can Be Converted Into Cash Within A Short Period (1 Year or Less) Are Known AsDocument17 pagesThe Assets That Can Be Converted Into Cash Within A Short Period (1 Year or Less) Are Known As4- Desiree FuaNo ratings yet

- TheoriesDocument28 pagesTheoriesYou Knock On My DoorNo ratings yet

- Sanicomodule 2Document11 pagesSanicomodule 2Luigi Enderez BalucanNo ratings yet

- IA Reviewer 2Document25 pagesIA Reviewer 2Krishele G. GotejerNo ratings yet

- Finance QuestionsDocument2 pagesFinance QuestionsSandeep SinghNo ratings yet

- Fundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 1 Statement of Financial PositionDocument9 pagesFundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 1 Statement of Financial PositionJhon Michael GambongNo ratings yet

- Intermediate Accounting 2 Theory ReviewerDocument62 pagesIntermediate Accounting 2 Theory ReviewerDip Per100% (1)

- Intermediate Accounting 2 THEORIESDocument68 pagesIntermediate Accounting 2 THEORIESLedelyn MaullonNo ratings yet

- Statement of Changes in Equity MCQDocument4 pagesStatement of Changes in Equity MCQMia CatanNo ratings yet

- FAR Theory Quiz 1Document7 pagesFAR Theory Quiz 1Ednalyn CruzNo ratings yet

- Test Bank Reviewer Part 2Document4 pagesTest Bank Reviewer Part 2tres gian de guzmanNo ratings yet

- Chap 8, UnfinishedDocument11 pagesChap 8, UnfinishedGuiana WacasNo ratings yet

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- Finacc5 LQ1Document6 pagesFinacc5 LQ1Kawaii SevennNo ratings yet

- Liability FinalDocument26 pagesLiability FinalJomarie UyNo ratings yet

- Employee Benefits ExamDocument11 pagesEmployee Benefits ExamLouiseNo ratings yet

- Cash and Cash Equivalents, Accounts Receivable, Bad DebtsDocument5 pagesCash and Cash Equivalents, Accounts Receivable, Bad DebtsDennis VelasquezNo ratings yet

- Kumpulan SoalDocument22 pagesKumpulan Soalmariko1234No ratings yet

- GEN 010 P1 ExamDocument20 pagesGEN 010 P1 ExamJulian Adam PagalNo ratings yet

- AFS QuestionsDocument47 pagesAFS QuestionsashutoshtherebelNo ratings yet

- Exam ReviewerDocument10 pagesExam Reviewerjoseph christopher vicenteNo ratings yet

- SLM Module in Fabm2 Q1Document53 pagesSLM Module in Fabm2 Q1Fredgy R BanicoNo ratings yet

- Current AssetsDocument53 pagesCurrent AssetsIris Mnemosyne100% (1)

- Ufrs Quiz 1-3Document7 pagesUfrs Quiz 1-3Adria MeNo ratings yet

- Ldersgate Ollege Ourse Udit Chool OF Usiness AND Ccountancy Odule IabilitiesDocument4 pagesLdersgate Ollege Ourse Udit Chool OF Usiness AND Ccountancy Odule Iabilitiescha11No ratings yet

- Corporate Finance Core Principles and Applications 3rd Edition Ross Test BankDocument65 pagesCorporate Finance Core Principles and Applications 3rd Edition Ross Test BankChristopherDyerkczqw100% (20)

- TOA QuizletDocument13 pagesTOA QuizletJehugem BayawaNo ratings yet

- Problem 1-8 Multiple Choice (IAA)Document2 pagesProblem 1-8 Multiple Choice (IAA)jayNo ratings yet

- ACYFAR1 CE On PAS1 (IAS1) Presentation of FSDocument4 pagesACYFAR1 CE On PAS1 (IAS1) Presentation of FSElle KongNo ratings yet

- DBC FinquizDocument6 pagesDBC FinquizAshutosh SatapathyNo ratings yet

- Ia2 Examination 1 Theories Liabilities and Provisions - CompressDocument3 pagesIa2 Examination 1 Theories Liabilities and Provisions - CompressTRECIA AMOR PAMILARNo ratings yet

- Financial Accounting 2 ExercisesDocument6 pagesFinancial Accounting 2 ExercisesezraelydanNo ratings yet

- Chapter 1 - LiabilitiesDocument2 pagesChapter 1 - LiabilitiesXienaNo ratings yet

- QuestionDocument1 pageQuestionRenoNo ratings yet

- C. Both Statements Are FalseDocument12 pagesC. Both Statements Are FalseShaira Bagunas ObiasNo ratings yet

- Audit Prob Part 2Document6 pagesAudit Prob Part 2Koko LaineNo ratings yet

- Toa Drill 2 (She, SFP, Sme, Lease, Govt GrantsDocument15 pagesToa Drill 2 (She, SFP, Sme, Lease, Govt GrantsROMAR A. PIGANo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Fa2prob4 9Document3 pagesFa2prob4 9jayNo ratings yet

- Problem 5-4 Multiple Choice (IAA)Document2 pagesProblem 5-4 Multiple Choice (IAA)jayNo ratings yet

- Problems 5-1 Multiple Choice (PFRS 9)Document2 pagesProblems 5-1 Multiple Choice (PFRS 9)jayNo ratings yet

- Fa2prob5 3Document3 pagesFa2prob5 3jayNo ratings yet

- Problem 4-10 Multiple Choice (IAA)Document2 pagesProblem 4-10 Multiple Choice (IAA)jayNo ratings yet

- Fa2prob5 2Document3 pagesFa2prob5 2jayNo ratings yet

- Fa2prob4 3Document2 pagesFa2prob4 3jayNo ratings yet

- Fa2prob4 6Document3 pagesFa2prob4 6jayNo ratings yet

- Fa2prob4 8Document3 pagesFa2prob4 8jayNo ratings yet

- Fa2prob4 4Document2 pagesFa2prob4 4jayNo ratings yet

- Problem 4-5 Multiple Choice (IFRS)Document2 pagesProblem 4-5 Multiple Choice (IFRS)jayNo ratings yet

- Problem 1-2 Multiple Choice (PAS 1)Document2 pagesProblem 1-2 Multiple Choice (PAS 1)jayNo ratings yet

- Fa2prob4 7Document2 pagesFa2prob4 7jayNo ratings yet

- Fa2prob4 4Document2 pagesFa2prob4 4jayNo ratings yet

- Problem 1-5 Multiple Choice (IAA)Document2 pagesProblem 1-5 Multiple Choice (IAA)jayNo ratings yet

- Problem 4-1 Multiple Choice (PAS 37)Document3 pagesProblem 4-1 Multiple Choice (PAS 37)jayNo ratings yet

- Problem 4-3 Multiple Choice (PAS 37)Document2 pagesProblem 4-3 Multiple Choice (PAS 37)jayNo ratings yet

- Problem 1-8 Multiple Choice (IAA)Document2 pagesProblem 1-8 Multiple Choice (IAA)jayNo ratings yet

- Fa2prob1 9Document2 pagesFa2prob1 9jayNo ratings yet

- Fa2prob2 2Document2 pagesFa2prob2 2jayNo ratings yet

- Problem 1-4 Multiple Choice (IAA)Document2 pagesProblem 1-4 Multiple Choice (IAA)jayNo ratings yet

- Problem 1-3 Multiple Choice (PAS 1)Document2 pagesProblem 1-3 Multiple Choice (PAS 1)jayNo ratings yet

- Fa2prob1 6Document2 pagesFa2prob1 6jayNo ratings yet

- Fa2prob3 1Document3 pagesFa2prob3 1jayNo ratings yet

- Fa2 Chapter 1 Problem 1Document2 pagesFa2 Chapter 1 Problem 1jayNo ratings yet

- Document 1Document1 pageDocument 1jayNo ratings yet

- HihiDocument1 pageHihijayNo ratings yet

- Example of A Management Representation LetterDocument2 pagesExample of A Management Representation LettersonicefuNo ratings yet

- Example Representation Letter ESTGAAPDocument3 pagesExample Representation Letter ESTGAAPjanicasiaNo ratings yet