Professional Documents

Culture Documents

HSL Weekly Insight: Retail Research

Uploaded by

umaganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSL Weekly Insight: Retail Research

Uploaded by

umaganCopyright:

Available Formats

RETAIL RESEARCH 27 Jan 2017

HSL Weekly Insight

Week ahead for Nifty with technicals

Nagaraj Shetti

nagarajs.shetti@hdfcsec.com

Tel-022-30750021

RETAIL RESEARCH P age |1

RETAIL RESEARCH

Nifty Daily Timeframe

Observation:

Daily Timeframe: The upside momentum continued in the market for the fourth consecutive session today and Nifty closed

the day higher by around 38 points.

After opening with slight positive note, Nifty shifted into gradual upmove for better part of session and later moved into

intraday consolidation towards the end.

We observe yet another positive candle formation today with minor long upper shadow, which is signaling minor profit

booking towards the end ahead of Union Budget of next week.

The key upside resistances have been broken one after another in the last few sessions and we observe a display of sharp

upside momentum.

After breaking above the crucial resistance of 8520 levels (as per the concept of change in polarity-green dashed line) on

Wednesday, Nifty moved above another hurdle of previous opening down gap of 2nd Nov (blue dashed horizontal line)

today and filled that gap completely. Both of these indications are positive for the market ahead.

The positive sequence of higher tops and bottoms is visible as per daily timeframe in the last one month and presently Nifty

is making attempt to form a new higher top of the sequence. But, the formation of higher top has not yet

formed/confirmed.

Daily 14 period RSI has turned up sharply and made a new swing high of around 73 levels. This area has been a significant

overbought zone (upside resistance) for this indicator in the last one year and led to reversal from the highs for few

occasions. Hence, this could be an early indication of overbought nature of the market, but still there is no signal of any

resumption of correction from the overbought region.

RETAIL RESEARCH P age |2

RETAIL RESEARCH

Nifty Weekly Timeframe

Weekly Timeframe: After showing minor consolidation type pattern during last week (type of an inside day-small bear

candle), Nifty witnessed an excellent upside momentum during this week and closed the week with hefty gains of around

292 points, as per week on week basis.

The key overhead resistance of around 8550 levels (green dashed horizontal line-as per the concept of change in polarity)

has been broken decisively on the upside and Nifty closed above it. This is positive indication for the market.

A long range bull candle has been formed this week (high low range of around 8327-8672 levels), which is suggesting a

strong buying enthusiasm during last week.

But, such formation of long bull candles after a reasonable upmoves are sometime acts as a downward reversal pattern

after the confirmation (this is contra view and needs confirmation of weakness to call this as a reversal).

Colored vertical lines on the weekly chart are indicative of periods of previous Union Budgets since 2012. Three out of the

last five Union Budgets have witnessed an excellent trend reversals (brown-2016, blue-2015 and green-2014) and

remaining two budgets (pink-2013 and orange-2012) have turned out to be a non-event for the market.

This means in the last three years, two intermediate down trends have reversed sharply on the up (formation of sharp

bottom reversal pattern) and one intermediate down trend has reversed excellently on the downside (formation of sharp

top reversal pattern), immediately after the budgets.

Hence this Union Budget (1st Feb 2017), which is scheduled next week, have already seen a sharp pre budget rally in the last

one month. This key economic event is going to be crucial and could be a trend decider by the next 1-2 weeks.

RETAIL RESEARCH P age |3

RETAIL RESEARCH

Summing Up:

The underlying trend of Nifty is strongly up and the market is witnessing a sharp upside momentum ahead of Union Budget

2017. As per the indications of previous budgets and overall chart pattern, we believe either of two crucial things could

happen in Nifty in coming weeks. They are as follows;

First case scenario The possibility of important top reversal; for this pattern to unfold, the market needs to witness sharp

declines in the next 1-2 weeks by forming a top reversal around 8700-8750 levels. Confirmation: Nifty should move/sustain

below 8500 levels and in such case a potential down side target could be watched around 8250 and next 7900 levels in the

next 2-3 months.

Second case scenario The possibility of trend continuation; for this pattern to happen, the Nifty needs to continue with

upside momentum after showing consolidations/minor corrections in the next two weeks. Confirmation: Nifty should find

support around 8500 levels during its minor intra week corrections and bounce back from the lows. The potential upside

target could be around 9000-9100 levels in the next 1-2 months.

RETAIL RESEARCH P age |4

RETAIL RESEARCH

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

HDFC Securities Ltd is a SEBI Registered Research Analyst having registration no. INH000002475.

Disclosure:

I, Nagaraj S. Shetti, Graduate, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views

about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities

Ltd. or its Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the

Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest. Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have

been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no

guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be

complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or

located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what

would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This

document may not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the

income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or

other services for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the

company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the

financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests

with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments

made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the

NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in

the report, or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this

report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject

company for any other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date

of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other

advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of

the research report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of

our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that

are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the

subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the

Subject Company or third party in connection with the Research Report.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters

mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.

RETAIL RESEARCH P age |5

You might also like

- Report PDFDocument4 pagesReport PDFshobhaNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchjaimaaganNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchshobhaNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail Researcharun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL Crystal Ball: Retail ResearchDocument6 pagesHSL Crystal Ball: Retail ResearchumaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchjaimaaganNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchshobhaNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Sector Technical Watch: Retail ResearchDocument6 pagesSector Technical Watch: Retail ResearchGauriGanNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument4 pagesHSL Techno-Sector Buzzer: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchshobhaNo ratings yet

- Monthly Technical Outlook of Nifty-July 2015Document5 pagesMonthly Technical Outlook of Nifty-July 2015GauriGanNo ratings yet

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Sector Technical Watch: Retail ResearchDocument4 pagesSector Technical Watch: Retail ResearchAnonymous y3hYf50mTNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail Researcharun_algoNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchjaimaaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument6 pagesHSL Techno-Sector Buzzer: Retail ResearchumaganNo ratings yet

- HSL Crystal Ball: Retail ResearchDocument7 pagesHSL Crystal Ball: Retail Researcharun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- Monthly Technical Outlook of Nifty-August-15: Technical Prediction of The Market For Near TermDocument6 pagesMonthly Technical Outlook of Nifty-August-15: Technical Prediction of The Market For Near TermGauriGanNo ratings yet

- Mentum Stocks: Sector Technical WatchDocument5 pagesMentum Stocks: Sector Technical WatchGauriGanNo ratings yet

- ReportDocument5 pagesReportDinesh ChoudharyNo ratings yet

- Closing Bell: Indices Close Change Change%Document5 pagesClosing Bell: Indices Close Change Change%BharatNo ratings yet

- Sector Technical Watch: A Periodical Technical Report On Banking & IT SectorsDocument6 pagesSector Technical Watch: A Periodical Technical Report On Banking & IT SectorsGauriGanNo ratings yet

- Daily Technical Snapshot: August 11, 2015Document2 pagesDaily Technical Snapshot: August 11, 2015GauriGanNo ratings yet

- Baby Bulls Mega Sectoral AnalysisDocument10 pagesBaby Bulls Mega Sectoral Analysisdaddyyankee995No ratings yet

- Weekly Snippets - Karvy 12 Mar 2016Document7 pagesWeekly Snippets - Karvy 12 Mar 2016AdityaKumarNo ratings yet

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- Nifty: Technical OutlookDocument2 pagesNifty: Technical OutlookAmit kumarNo ratings yet

- ReportDocument5 pagesReportDinesh ChoudharyNo ratings yet

- Weekly Technical Report - 300718-201807300920227372611Document5 pagesWeekly Technical Report - 300718-201807300920227372611AM PMNo ratings yet

- Daily Technical Snapshot: Nifty PerspectiveDocument2 pagesDaily Technical Snapshot: Nifty PerspectiveGauriGanNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument4 pagesHSL Techno-Sector Buzzer: Retail Researcharun_algoNo ratings yet

- Sectoral Index Report Banking 07042020 202004070809432449396 PDFDocument4 pagesSectoral Index Report Banking 07042020 202004070809432449396 PDFflying400No ratings yet

- DailyTechnical-Report - 27 July 2023 - 26-07-2023 - 21Document5 pagesDailyTechnical-Report - 27 July 2023 - 26-07-2023 - 21lachhireddy20No ratings yet

- WeeklyTechnicalPicks 05august2022Document9 pagesWeeklyTechnicalPicks 05august2022AJayNo ratings yet

- S&P CNX NIFTY Monthly & Sectoral: November 02, 2012: Retail ResearchDocument6 pagesS&P CNX NIFTY Monthly & Sectoral: November 02, 2012: Retail ResearchGauriGanNo ratings yet

- Weekly Technical Report: Retail ResearchDocument7 pagesWeekly Technical Report: Retail ResearchGauriGanNo ratings yet

- Daily Technical Report - 02 May 2022 - 02-05-2022 - 08Document5 pagesDaily Technical Report - 02 May 2022 - 02-05-2022 - 08vikalp123123No ratings yet

- ReportDocument6 pagesReportumaganNo ratings yet

- HSL Commodity & Currency Focus: Retail ResearchDocument6 pagesHSL Commodity & Currency Focus: Retail ResearchumaganNo ratings yet

- WeeklyTechnicalPicks 01092023Document9 pagesWeeklyTechnicalPicks 01092023Debabrata DasNo ratings yet

- Weekly View:: Nifty Likely To Trade in Range of 6600-6800Document14 pagesWeekly View:: Nifty Likely To Trade in Range of 6600-6800Raya DuraiNo ratings yet

- Technical Weekly Picks - 23 June 2023 - 25-06-2023 - 15Document8 pagesTechnical Weekly Picks - 23 June 2023 - 25-06-2023 - 15Porus Saranjit SinghNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Daily Derivatives: December 1, 2016Document3 pagesDaily Derivatives: December 1, 2016Rajasekhar Reddy AnekalluNo ratings yet

- DailyTechnical-Report - 25 Oct 2023 - 24-10-2023 - 23Document5 pagesDailyTechnical-Report - 25 Oct 2023 - 24-10-2023 - 23Masood AlamNo ratings yet

- Weekly Technical ReportDocument5 pagesWeekly Technical ReportumaganNo ratings yet

- MOStQuantitativeOutlookMonthly November2022Document9 pagesMOStQuantitativeOutlookMonthly November2022M DanishNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Index 29062013Document8 pagesIndex 29062013Bhasker NiftyNo ratings yet

- Hindustan Petroleum Corporation: Strong FootholdDocument9 pagesHindustan Petroleum Corporation: Strong FootholdumaganNo ratings yet

- ReportDocument6 pagesReportumaganNo ratings yet

- ReportDocument5 pagesReportumaganNo ratings yet

- ReportDocument6 pagesReportumaganNo ratings yet

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- HSL Crystal Ball: Retail ResearchDocument6 pagesHSL Crystal Ball: Retail ResearchumaganNo ratings yet

- An Exciting Ride Set To Take Off: Wonderla Holidays LTDDocument14 pagesAn Exciting Ride Set To Take Off: Wonderla Holidays LTDumaganNo ratings yet

- Trident LTD: Retail ResearchDocument18 pagesTrident LTD: Retail ResearchumaganNo ratings yet

- SML Isuzu: PCG ResearchDocument9 pagesSML Isuzu: PCG ResearchumaganNo ratings yet

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 02, 2017 To February 15, 2017Document2 pagesCorporate Event Tracker: Tracker of Forthcoming Corporate Action From February 02, 2017 To February 15, 2017umaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: February 23, 2017Document2 pagesPossible Nifty Scenario Over 2 - 3 Days: February 23, 2017jaimaaganNo ratings yet

- Special Technical Report - Crude Oil: Retail ResearchDocument3 pagesSpecial Technical Report - Crude Oil: Retail ResearchumaganNo ratings yet

- Technical Stock PickDocument2 pagesTechnical Stock PickumaganNo ratings yet

- ReportDocument5 pagesReportjaimaaganNo ratings yet

- ReportDocument5 pagesReportjaimaaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: February 23, 2017Document2 pagesPossible Nifty Scenario Over 2 - 3 Days: February 23, 2017jaimaaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverDinesh ChoudharyNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Weekly Technical ReportDocument5 pagesWeekly Technical ReportumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverDinesh ChoudharyNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- The Indian Cements LTD: Retail ResearchDocument22 pagesThe Indian Cements LTD: Retail ResearchumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverDinesh ChoudharyNo ratings yet

- Projectbyviveksaha 130303153621 Phpapp02Document66 pagesProjectbyviveksaha 130303153621 Phpapp02Aditya KudtarkarNo ratings yet

- Eefc Queries - FedaiDocument4 pagesEefc Queries - FedaicallvkNo ratings yet

- Project TopicDocument7 pagesProject TopicmehmudNo ratings yet

- Carrefour S.ADocument1 pageCarrefour S.ATeja_Siva_89090% (1)

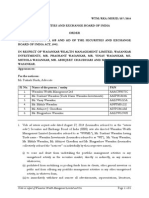

- Order in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarDocument6 pagesOrder in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarShyam SunderNo ratings yet

- Products and Services of Sharekhan Limited 8th JulyDocument13 pagesProducts and Services of Sharekhan Limited 8th JulySathishRaghupathyNo ratings yet

- ACCTG 136 Module 2 Audit PlanningDocument21 pagesACCTG 136 Module 2 Audit PlanningKaren PortiaNo ratings yet

- Sheikh Shakil (Repaired)Document75 pagesSheikh Shakil (Repaired)SaifulKhalidNo ratings yet

- How Did George Soros Get RichDocument2 pagesHow Did George Soros Get RichAnanda rizky syifa nabilahNo ratings yet

- The Securitzation of Commodities - RitterDocument6 pagesThe Securitzation of Commodities - RitterCervino InstituteNo ratings yet

- CRISIL Mutual Fund Ranking MethodologyDocument7 pagesCRISIL Mutual Fund Ranking MethodologyJoydeepSuklabaidyaNo ratings yet

- Broken by Broker While Trading? Don'T Worry, Zerodha Is Here !!!Document2 pagesBroken by Broker While Trading? Don'T Worry, Zerodha Is Here !!!faradayNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartbidyuttezuNo ratings yet

- PinoyInvestor Academy - Technical Analysis Part 3Document18 pagesPinoyInvestor Academy - Technical Analysis Part 3Art JamesNo ratings yet

- Formula Sheet FIMDocument4 pagesFormula Sheet FIMYNo ratings yet

- F11340000120144004Insurance ContractDocument71 pagesF11340000120144004Insurance ContractmuglersaurusNo ratings yet

- Topic 2 - Revised Shariah Screening Methodology - CLASS - NOV2018)Document40 pagesTopic 2 - Revised Shariah Screening Methodology - CLASS - NOV2018)KiMi MooeNa100% (1)

- Chapter 2 (Investment)Document20 pagesChapter 2 (Investment)Elen LimNo ratings yet

- J B Gupta Classes: General TopicsDocument29 pagesJ B Gupta Classes: General TopicsceojiNo ratings yet

- Olivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)Document473 pagesOlivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)João Henrique Reis MenegottoNo ratings yet

- American and Euro Option DifferenceDocument4 pagesAmerican and Euro Option DifferenceShabana KhanNo ratings yet

- PPT-McGuigan-14e-Chapter01 - REV COMPAREDocument21 pagesPPT-McGuigan-14e-Chapter01 - REV COMPAREcatherine sevidalNo ratings yet

- Activity Report PDFDocument124 pagesActivity Report PDF8001800No ratings yet

- Amaranth Advisors: Burning Six Billion in Thirty DaysDocument24 pagesAmaranth Advisors: Burning Six Billion in Thirty DaysRosalina MaharanaNo ratings yet

- Sources of FinanceDocument59 pagesSources of Financeprayas sarkarNo ratings yet

- Al-Baraka Islamic Bank Internship ReportDocument69 pagesAl-Baraka Islamic Bank Internship Reportbbaahmad89100% (8)

- Malaysia Securities Commission Licensing HandbookDocument83 pagesMalaysia Securities Commission Licensing HandbooksuhirseliaNo ratings yet

- A Study On Performance Evaluation Mutual Fund Schemes in IndiaDocument4 pagesA Study On Performance Evaluation Mutual Fund Schemes in IndiaprakhardwivediNo ratings yet

- Order in The Respect of Shamken Multifab Limited and OrsDocument15 pagesOrder in The Respect of Shamken Multifab Limited and OrsShyam SunderNo ratings yet

- Formative Assessment 2 FinMarDocument9 pagesFormative Assessment 2 FinMarFlorence Roselle Rejuso UdasNo ratings yet