Professional Documents

Culture Documents

Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017

Uploaded by

Dilip KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017

Uploaded by

Dilip KumarCopyright:

Available Formats

FORM NO.

12B

[See rule 26A]

Form for furnishing details of income under section 192(2) for the year ending 31st March, 2017

Name and address of the employee

Permanent Account No.

Residential status :

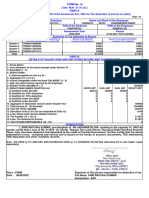

TAN of the Permanen Period Particulars of salary as defined section 17,

Serial Name and employer t Account of paid or due to be paid to the employee Total Amount Total Remarks

Number address of (s) as Number of employ during the year of deducted in amount of

employer(s allotted of the ment colum respect of life tax

) the ITO employer( ns 6,7 insurance deducted

s) and 8 premium, during the

provident fund year

contribution, (enclose

etc., to which certificate

section 80C! issued

applies (give under

details) section

203)

Total Total amount Value of

amount of of house rent perquisites

salary allowance, and

excluding conveyance amount of

amounts allowance and accretion

required to other to

be shown in allowances to employees

columns 7 the extent provident

and 8 chargeable to fund

tax [See account

section (give

10(13A) read details in

with rule 2A the

and section Annexure)

10(14)]

1 2 3 4 5 6 7 8 9 10 11 12

Signature of the employee

Verification

I, _____________________ do hereby declare that what is stated above is true to the best of my knowledge and belief. Verified today, the _______ day of ______________

2008.

.

Signature of the employee

ANNEXURE

[See column 8 of Form No. 12B]

Particulars of value of perquisites and amount of accretions to employees fund account

Name and address of the employee.......................................................................................NOT APPLICABLE

Permanent Account No. ...................................................

Period: Year ending 31st March, 19 .............

Name of the TAN/PAN of Value of rent-free accommodation or value of any concession in rent for the accommodation provided by the employer (give

employee the employer basis of computation) [See rules 3(a) and 3(b)]

Where accommodation is furnished

Where Rent, if any, Value of

accommodatio paid by the perquisite(colu

n is employee mn 3 minus

unfurnished column 8 or

column 7

minus column

8 as may be

applicable

Value as if Cost of Perquisite Total of

accommodatio furniture value of columns 4 and

n is (including furniture (10% 6

unfurnished television sets, of column 5)

radio sets, OR actual hire

refrigerators, charges

other payable

household

appliances and

air-

conditioning

plant or

equipment OR

hire charges, if

hired from a

third party

1 2 3 4 5 6 7 8 9

ANNEXURE

(Contd.)

Whether any Remuneration paid Value of free or Estimated value of Employers Interest credited to Total of columns 9

conveyance has by employer for concessional any other benefit or contribution to the assessees to 15 carried to

been provided by domestic and/or passages on home amenity provided by recognised account in column 8 of From

the employer free or personal services leave and other the employer, free of provident fund in recognised No. 12B

at a concessional provided to the travelling to the cost or at excess of 10% of the provident fund in

rate or where the employee (give extent chargeable to concessional rate employees salary excess of the rate

employee is allowed details) [See rule tax (give details) not including in the [See Schedule IV fixed by the Central

the use of one or 3(g)] [See rule 2B read preceding columns Part A] Government [See

more motor cars with section 10(5) (give details), e.g. Schedule IV Part

owned or hired by (ii)] supply of gas, A]

the employer, electronic or water

estimated value of for household

perquisite (give consumption, free

details) [See rule educational

3(C)] facilities transport

for family, etc., [See

rules 3(d), 3(e) and

3(f)]

10 11 12 13 14 15 16

Signature of the employee

You might also like

- How To Get Employer Identification NumberDocument3 pagesHow To Get Employer Identification NumberChristian Jerrel SantosNo ratings yet

- FTF 2023-01-11 1673425648918Document12 pagesFTF 2023-01-11 1673425648918Charles Goodwin100% (1)

- Corporate Dissolution or Liquidation: InstructionsDocument2 pagesCorporate Dissolution or Liquidation: InstructionsFab Management100% (1)

- Kumar - Letter of AppreciationDocument1 pageKumar - Letter of AppreciationDilip KumarNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Notice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Document4 pagesNotice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Therese FadelNo ratings yet

- PDF ContentDocument9 pagesPDF Contentsuresh sivadasanNo ratings yet

- Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediDocument5 pagesCertificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediprabhatNo ratings yet

- CARIÑO - Republic V ParañaqueDocument1 pageCARIÑO - Republic V ParañaqueGail CariñoNo ratings yet

- BIR Ruling 19-01 May 10, 2001Document3 pagesBIR Ruling 19-01 May 10, 2001Raiya AngelaNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- CIR vs BOAC Philippine Income TaxDocument2 pagesCIR vs BOAC Philippine Income TaxKim Lorenzo CalatravaNo ratings yet

- Centrel PDFDocument658 pagesCentrel PDFசுப்பிரமணிய தமிழ்100% (1)

- ISGEC Form 12B DetailsDocument3 pagesISGEC Form 12B DetailsSantosh Kumar JaiswalNo ratings yet

- Form No. 12B: (See Rule 26A)Document3 pagesForm No. 12B: (See Rule 26A)sumit vermaNo ratings yet

- Annex 6 - Form 12B PDFDocument3 pagesAnnex 6 - Form 12B PDFAnonymous Q1Y71rNo ratings yet

- FORM 12B DETAILSDocument4 pagesFORM 12B DETAILSRanga.SathyaNo ratings yet

- Income Tax Form 12BDocument3 pagesIncome Tax Form 12BlktyagiNo ratings yet

- Furnishing Income Details - FORM 12BDocument4 pagesFurnishing Income Details - FORM 12BMahi MahajanNo ratings yet

- Form 12B detailsDocument3 pagesForm 12B detailskawoNo ratings yet

- Form No. 12B: Prabhakarappa ShashidharDocument1 pageForm No. 12B: Prabhakarappa ShashidharAmbika BpNo ratings yet

- FORM 12B - Previous Employment Income DeclarationDocument3 pagesFORM 12B - Previous Employment Income DeclarationsudhakarNo ratings yet

- Form 12-B Updt23Document4 pagesForm 12-B Updt23Durga prasad DashNo ratings yet

- Sample Filled Form 12BDocument3 pagesSample Filled Form 12BSanjay sharma50% (2)

- 10 Previous Employer 12BDocument3 pages10 Previous Employer 12BvenkyNo ratings yet

- Annexure VI - Form 12B - Prior EmploymentDocument1 pageAnnexure VI - Form 12B - Prior EmploymentPruthvi PrakashaNo ratings yet

- EMP ID FORM 12B DETAILSDocument2 pagesEMP ID FORM 12B DETAILSsrinivasNo ratings yet

- Form No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchDocument3 pagesForm No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchRakesh PawarNo ratings yet

- Form 64C Statement Income Distribution Investment FundDocument1 pageForm 64C Statement Income Distribution Investment Funddizzi dagerNo ratings yet

- Form 12B - Previous Employment Income DetailsDocument2 pagesForm 12B - Previous Employment Income DetailsSachin5586No ratings yet

- PF Return Monthly, Yearly & ChallanDocument9 pagesPF Return Monthly, Yearly & ChallanSatyam mishra100% (1)

- Payment of Bonus Act FormsDocument5 pagesPayment of Bonus Act Formspratik06No ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Form No 10eDocument3 pagesForm No 10eIncome Tax Department JindNo ratings yet

- Form 12A FormatDocument1 pageForm 12A FormatjaipalmeNo ratings yet

- Form No. 64C: (In RS.)Document1 pageForm No. 64C: (In RS.)busuuuNo ratings yet

- ESIC From 5A Return of ContributionDocument4 pagesESIC From 5A Return of ContributionCA.Nahush SahasrabuddheNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form16 16 2015-16Document4 pagesForm16 16 2015-16BDO KhandalaNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- US Internal Revenue Service: f8390 - 1993Document4 pagesUS Internal Revenue Service: f8390 - 1993IRSNo ratings yet

- Dry de Fashion Pvt. Ltd. CALCUTTA - 711 102Document5 pagesDry de Fashion Pvt. Ltd. CALCUTTA - 711 102api-3706890No ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Payment of Bonus Rules (Pt.-4)Document9 pagesPayment of Bonus Rules (Pt.-4)Anonymous QyYvWj1No ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- PF MonthlyDocument1 pagePF Monthlyaravind nagaramNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Adobe Scan 01 Aug 2023Document6 pagesAdobe Scan 01 Aug 2023Soffiya SoffiyaNo ratings yet

- PFF12Document2 pagesPFF12humanresources.qualimarkNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeDocument3 pagesForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- US Internal Revenue Service: f8390 - 1991Document4 pagesUS Internal Revenue Service: f8390 - 1991IRSNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- 7 Form 7 (Claim Bill) 23Document2 pages7 Form 7 (Claim Bill) 23BEST IN THE UNIVERSE CHECK IT OUTNo ratings yet

- Monthly Return For Unexempted Establishment Form 12ADocument1 pageMonthly Return For Unexempted Establishment Form 12AAnonymous wG3iH084No ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- FORM 5 RETURN OF CONTRIBUTIONSDocument4 pagesFORM 5 RETURN OF CONTRIBUTIONSsavita17julyNo ratings yet

- FORM No. 16: Pune Municipal CorporationDocument2 pagesFORM No. 16: Pune Municipal CorporationAtharv MarneNo ratings yet

- Arrears Relief Calculator For W.B.govt Employees 2Document4 pagesArrears Relief Calculator For W.B.govt Employees 2Rana BiswasNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Otsi HR BP Job ResponsesDocument2 pagesOtsi HR BP Job ResponsesDilip KumarNo ratings yet

- My Responses To Job DescriptionDocument2 pagesMy Responses To Job DescriptionDilip KumarNo ratings yet

- ResumeDocument3 pagesResumeDilip KumarNo ratings yet

- Achieving logistics excellenceDocument8 pagesAchieving logistics excellenceDilip KumarNo ratings yet

- Dilip Kumar MN HR Generalist Manager V2Document4 pagesDilip Kumar MN HR Generalist Manager V2Dilip KumarNo ratings yet

- GaneshGedela (1 0)Document3 pagesGaneshGedela (1 0)Dilip KumarNo ratings yet

- GreetingsDocument1 pageGreetingsDilip KumarNo ratings yet

- Negative Covenant in Contract of EmploymentDocument5 pagesNegative Covenant in Contract of EmploymentSidharthChopra124No ratings yet

- Industrial, Labour and General Laws (Module II Paper 7)Document0 pagesIndustrial, Labour and General Laws (Module II Paper 7)Jhha KKhushbuNo ratings yet

- Dilipupdated 10310 MarketingDocument4 pagesDilipupdated 10310 MarketingDilip KumarNo ratings yet

- SSC - Candidate's Application Details (Registration-Id - 51119489654) PDFDocument5 pagesSSC - Candidate's Application Details (Registration-Id - 51119489654) PDFDilip KumarNo ratings yet

- Forest Range OfficerDocument47 pagesForest Range OfficersultanprinceNo ratings yet

- Why Brand Name Kept More6-14Document8 pagesWhy Brand Name Kept More6-14Dilip KumarNo ratings yet

- Innovative Recruitment Nov 03Document94 pagesInnovative Recruitment Nov 03Itika SinghNo ratings yet

- Final SM TM PPRDocument27 pagesFinal SM TM PPRDilip KumarNo ratings yet

- Dilip Kumar MN-10310 HR&ITDocument3 pagesDilip Kumar MN-10310 HR&ITDilip KumarNo ratings yet

- Summary SoundCloud Premier G210110174 U865097 2021 06Document2 pagesSummary SoundCloud Premier G210110174 U865097 2021 06danNo ratings yet

- Payslip TemplateDocument1 pagePayslip TemplateLeonardo GonzalezNo ratings yet

- Individual Income Tax Return: Confidential Year of AssessmentDocument3 pagesIndividual Income Tax Return: Confidential Year of AssessmentLightning ThunderNo ratings yet

- Special Tax Regime For TradersDocument5 pagesSpecial Tax Regime For TradersArsalan LobaniyaNo ratings yet

- Alternative Minimum TaxDocument2 pagesAlternative Minimum TaxJeremy A. MillerNo ratings yet

- BIR business registration practice problemsDocument1 pageBIR business registration practice problemsElai grace FernandezNo ratings yet

- Christopher Driskell - MATH 12 (10.1) the US Tax SystemDocument3 pagesChristopher Driskell - MATH 12 (10.1) the US Tax SystemdriskelltopherNo ratings yet

- Deduction From Gross EstateDocument41 pagesDeduction From Gross EstateDianne Pearl DelfinNo ratings yet

- The Step by Step Process Extra JudicialDocument1 pageThe Step by Step Process Extra JudicialErmie SoleroNo ratings yet

- Nomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Document2 pagesNomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Dinesh SahuNo ratings yet

- STFCS 2022-11-05 1667702284229Document7 pagesSTFCS 2022-11-05 1667702284229Charles GoodwinNo ratings yet

- Earnings: Manoj Kumar Field ExecutiveDocument1 pageEarnings: Manoj Kumar Field ExecutiveSubhash SharmaNo ratings yet

- Quotation - ABS 2020-21 - E203 - Mr. K Ramesh ReddyDocument1 pageQuotation - ABS 2020-21 - E203 - Mr. K Ramesh ReddyairblisssolutionsNo ratings yet

- Salary Slip (30423846 April, 2018)Document1 pageSalary Slip (30423846 April, 2018)Muhammad Ahmad JavedNo ratings yet

- Estate Tax Calculations for Different Marital and Property ScenariosDocument6 pagesEstate Tax Calculations for Different Marital and Property Scenariosmusic lyricsNo ratings yet

- Dealings in Properties: Ordinary Gains and Losses Capital Gain and LossesDocument12 pagesDealings in Properties: Ordinary Gains and Losses Capital Gain and LossesJieve Licca FanoNo ratings yet

- Management ScienceDocument2 pagesManagement ScienceManuela MagnoNo ratings yet

- 2020 P T D 1908Document2 pages2020 P T D 1908haseeb AhsanNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- VVQjb9XZmUm94q2eLRR0Fg PDFDocument4 pagesVVQjb9XZmUm94q2eLRR0Fg PDFObnoNo ratings yet

- L AkshayDocument1 pageL AkshaymksioclNo ratings yet