Professional Documents

Culture Documents

Glaukos Investor Presentation For Web 01112017

Uploaded by

medtechyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Glaukos Investor Presentation For Web 01112017

Uploaded by

medtechyCopyright:

Available Formats

January 2017

2017 Glaukos Corporation.

DISCLAIMER

All statements other than statements of historical facts included in this presentation that address activities, events or developments that we expect, believe or

anticipate will or may occur in the future are forward-looking statements. Although we believe that we have a reasonable basis for forward-looking statements

contained herein, we caution you that they are based on current expectations about future events affecting us and are subject to risks, uncertainties and factors

relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that may cause our actual results to

differ materially from those expressed or implied by forward-looking statements in this presentation. These potential risks and uncertainties include, without limitation,

uncertainties about our ability to maintain profitability; our dependence on the success and market acceptance of the iStent; our ability to leverage our sales and

marketing infrastructure to increase market penetration and acceptance of our products; our dependence on a limited number of third-party suppliers for components

of our products; the occurrence of a crippling accident or other disruption at our primary facility, which may materially affect our manufacturing capacity and

operations; maintaining adequate coverage or reimbursement by third-party payors for procedures using the iStent or other products in development; our ability to

properly train, and gain acceptance and trust from, ophthalmic surgeons in the use of our products; our ability to successfully develop and commercialize additional

products; our ability to compete effectively in the highly competitive and rapidly changing medical device industry and against current and future competitors

(including MIGS competitors) that are large public companies or divisions of publicly traded companies that have competitive advantages; the timing, effect and

expense of navigating different regulatory approval processes as we develop additional products and penetrate foreign markets; the impact of any product liability

claims against us and any related litigation; the effect of the extensive and increasing federal and state regulation in the healthcare industry on us and our suppliers;

the lengthy and expensive clinical trial process and the uncertainty of outcomes from any particular clinical trial; our ability to protect, and the expense and time-

consuming nature of protecting, our intellectual property against third parties and competitors that could develop and commercialize similar or identical products; the

impact of any claims against us of infringement or misappropriation of third party intellectual property rights and any related litigation; and the markets perception of

our limited operating history as a public company. These and other known risks, uncertainties and factors are described in detail under the caption Risk Factors and

elsewhere in our filings with the Securities and Exchange Commission, including our Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 filed

with the Securities and Exchange Commission on November 14, 2016. Our filings with the Securities and Exchange Commission are available in the Investor Section

of our website at www.glaukos.com or at www.sec.gov. In addition, information about the risks and benefits of our products is available on our website at

www.glaukos.com. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You

are cautioned not to place undue reliance on the forward-looking statements in this press release, which speak only as of the date hereof. We do not undertake any

obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except as may be required

under applicable securities law.

2017 Glaukos Corporation.

2

is transforming

glaucoma therapy

LARGE MARKET UNMET NEED DEMONSTRATED EXECUTION JUST THE BEGINNING

Growing $5bn Significant drawbacks Broad reimbursement Advanced portfolio

global opportunity1 of current treatments and highly successful launch of micro-scale

injectable therapies

1 Market Scope estimate for 2016 total global glaucoma market, Sept. 2016

2017 Glaukos Corporation.

3

2016 Major Accomplishments

1. Reported 58% YoY global net sales growth through 9/30/16; exceeded U.S. surgeon training

targets

2. Delivered 13 consecutive quarters of > 40% YoY growth since U.S. commercialization

3. Achieved gross margin in mid-80% range through 9/30/16

4. Added Anthem and Tricare to reach 95+% U.S. reimbursement coverage

5. Secured new 2017 iStent device intensive offset Medicare payment for ASCs

6. Published 14 peer-reviewed clinical studies, bringing the company total to 55

7. Completed enrollment of iStent inject Phase I standalone clinical trial

8. Initiated iDose Phase 2b clinical trial

9. Established direct sales operations in 8 new intl markets1, reaching 55 intl commercial personnel

and bringing total number of global direct markets to 13

10. Secured Japanese iStent regulatory approval (Mar) and formal reimbursement (Dec)

1 Brazil, UK, Ireland, Sweden, Netherlands, France, Spain, Switzerland

2017 Glaukos Corporation.

4

Aging Population Drives Glaucoma Prevalence

US GLAUCOMA POPULATION1

(in millions)

Reducing IOP is the only proven 5

treatment for glaucoma 4

4.5

4.0

5.0

Typically associated with elevated 3.6

3

intraocular pressure (IOP)

Open-angle glaucoma (OAG) is 2

most common type and majority of

patients have mild-to-moderate

1

OAG

Global glaucoma population to 0

increase from 83mm in 2016 to 2016 2021 2016 2021

94mm in 20211 $5 billion market2 $7 billion market2 Open-Angle Glaucoma All Glaucoma

1 Market Scope estimates for glaucoma prevalence; excludes ocular hypertension, Sept. 2016

2 Market Scope estimates for total global glaucoma market, Sept. 2016

2017 Glaukos Corporation.

5

How The Eyes Drainage System Works

Elevated IOP occurs when Secondary outflow pathway is

aqueous humor outflow through the suprachoroidal space

the trabecular meshwork and into

Schlemms canal is reduced due

to degeneration and obstruction

2017 Glaukos Corporation.

6

iStent vs. Conventional Surgery

Conventional

Surgery

2017 Glaukos Corporation.

7

Our Solution Portfolio:

Transformational Shift to Micro-Scale Injectable Therapy

Precision solutions for complete range of

glaucoma disease states & progression

Injectable Flow Platform Injectable Drug Delivery

iStent iStent Inject iStent Supra iDoseTM

Used in combination Injectable 2-stent therapy Designed to access Targeted injectable drug-

with cataract surgery for combo-cataract and secondary outflow delivery implant; sustained

standalone procedures pathway drug therapy

RESTORE FLOW FURTHER ENHANCE FLOW COMBINATION DRUG & FLOW

iStent Inject, iStent Supra and iDose are not approved by the FDA. iStent Inject and iStent Supra are currently being evaluated in IDE clinical trials; iDose is currently being evaluated in Phase II IND clinical trial.

The iStent is approved in the European Union and certain other international markets for use either in combination with cataract surgery or as a standalone procedure in phakic and pseudophakic eyes. In the United States, the iStent is indicated for use in

conjunction with cataract surgery for the reduction of IOP in adult patients with mild-to-moderate open-angle glaucoma currently treated with ocular hypotensive medication.

2017 Glaukos Corporation.

8

Compelling Clinical Results:

Single iStent + Cataract Surgery Achieves < 15 mm Hg Through 3 Years

MEAN IOP

CONSISTENT COHORT THROUGH 3 YEARS (n=39) AT 36 MONTHS

Reduction in Mean IOP Reduction in Mean # of Meds

23.4

24

Mean IOP (mm Hg)

20

16 14.3 14.9

13.9

12

Preop Month 12 Month 24 Month 36 36%

Consecutive series of 62 eyes; In consistent cohort of 39 Over same period,

decision to implant based on

patient desire to reduce topical

eyes followed through 36

months, mean IOP was

mean number of

topical meds declined 86%

meds and intent to offer 14.9 mm Hg, a 36% from 1.9 to 0.3, or

surgical treatment with reduction 86%

favorable safety profile

Neuhann T, J Cataract Refract Surg 2015

2017 Glaukos Corporation.

9

Compelling Clinical Results:

US Retrospective Studies of Single iStent + Cataract Surgery

MEAN IOP MEAN IOP

THROUGH 2 YEARS THROUGH 1 YEAR (n=134)

22 Preop

19.33 20 19.1 19.3 Year 1

20

Mean IOP (mm Hg)

18

16.37

Mean IOP (mm Hg)

15.67 16.44 16.29 16

16 15.17 13.6 13.6

14

12.7 12.6

12

12

10

Preop 1M 6M 12M 18M 24M Group 1: IOP controlled Group 2: IOP not controlled Group 3: IOP not controlled

(n=107) (n=102) (n=82) (n=98) (n=77) (n=107) on 1 med (n=65) on 2 meds (n=31) on 3 meds (n=38)

A consistent cohort of 107 open- Study represents the largest Study of 3 patient groups showed Majority of subjects were Hispanic,

angle glaucoma eyes followed sample size published to date 7-34% decrease in mean a population segment with higher-

through 2 years achieved mean IOP regarding iStent in medicated IOP; groups 1, 2, and 3 than-average incidence and

reduction of 22%, and 56% combination with cataract reduced mean meds by 75%, 64% prevalence of open-angle

reduction in mean medications to surgery and 44%, respectively; favorable glaucoma

0.6 meds safety profile across all groups

Ferguson J Berdahl J, Clinical Ophthalmology 2016 Gallardo M, Clinical Ophthalmology 2016

2017 Glaukos Corporation.

10

Compelling Clinical Results:

International Study Shows IOP-Lowering Capability of 1, 2 and 3 iStents

Mean IOP at 18 Months without Glaucoma

Demonstrates potential Medications

to titrate treatment based 26

on patients specific 22

disease state severity &

mm Hg

18

progression 14

15.9

14.1

Prospective, randomized Patients randomized to Safety data similar 12.2

study of 119 OAG patients receive 1, 2 or 3 iStents across all stent 10

with preoperative in standalone groups Mean preop medicated Mean preop IOP after Month 18 mean IOP

unmedicated IOP of 22-38 procedure; follow-up to IOP washout without medication

mm Hg continue for 5 years 1 Stent 2 Stent 3 Stent

Katz LJ et al Clinical Ophthalmology 2015

The iStent is approved in the European Union and certain other international markets for use either in combination with cataract surgery or as a standalone procedure in phakic and pseudophakic eyes. In the United States, the iStent is indicated for use in

conjunction with cataract surgery for the reduction of IOP in adult patients with mild-to-moderate open-angle glaucoma currently treated with ocular hypotensive medication.

2017 Glaukos Corporation.

11

Clinical Research Program Statistics

18 Prospective

clinical trials

currently

underway 55 Articles

published in

peer-reviewed

journals

2017 Glaukos Corporation.

12

Q3 2016 Financial & Operational Performance:

Growth Reflects iStent Adoption Trends

TOTAL NET SALES

(in millions)

13th consecutive quarter of at

$35

least 40% year-over-year growth

$30

$29.6 in net sales

$25

Includes 189% growth in

$20 $19.0 international sales, compared to

+56% Q3 2015

$15 YoY

Reflects increased unit volume

$10

worldwide, driven by increase in

$5 number of trained surgeons and

higher overall iStent utilization

$0

Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015Q4 2015 Q1 2016 Q2 2016Q3 2016

2017 Glaukos Corporation.

13

Current & Future Potential MIGS Market Participants

ALCON CYPASS

6.35mm suprachoroidal device for implantation into

supraciliary space using guidewire delivery (actual)

IVANTIS HYDRUS

8mm nitinol scaffolding device implanted into Schlemms

canal (image)

ALLERGAN XEN (FOR REFRACTORY GLAUCOMA)

5mm soft collagen shunt for implantation into

subconjunctival space (actual)

iStent iStent iStent XEN CyPass Hydrus

Inject Supra

2017 Glaukos Corporation.

14

Financial Summary

NET SALES GROSS MARGIN

(IN MILLIONS)

$71.7 86%*

82% Strong net sales growth, driven

$81.2

$51.4

(9 mos) by increases in trained doctors

(9 mos) and same-store sales

+58% Ability to leverage efficient

$45.6 YoY manufacturing and cost structure

Continued investments in pipeline

$20.9 development, iStent adoption and

global expansion

YTD Nine months ended Sept 30

2013 2014 2015 2016 2015 2016

* 2016 gross margin reflects suspension of medical device excise tax for 2016-2017, as well as Q1 2016 iStent inject sales in Australia and Canada for which manufacturing costs had been charged to R&D expense in 2015

2017 Glaukos Corporation.

15

Growth Strategies:

Establishing MIGS as OAG Standard of Care

01 02 03 04

Increase US iStent Secure FDA approvals Develop, secure Extend global reach of

adoption with seasoned with expanded regulatory approval for MIGS-based platform

sales force, broad indications for iStent and commercialize through targeted

reimbursement coverage pipeline products iDose drug-delivery international expansion

and compelling clinical pipeline

results

2017 Glaukos Corporation.

16

2017 Glaukos Corporation.

17

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Cherokee Herbal RemediesDocument292 pagesCherokee Herbal RemediesAlek Phabiovsky100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Corporate Presentation January 2019 1 PDFDocument23 pagesCorporate Presentation January 2019 1 PDFmedtechyNo ratings yet

- Alabama Board of Medical Examiners Statement On Federal Pill Mill TakedownDocument103 pagesAlabama Board of Medical Examiners Statement On Federal Pill Mill TakedownAshley RemkusNo ratings yet

- ENTEROBACTERIACEAEDocument13 pagesENTEROBACTERIACEAEStephen Jao Ayala Ujano100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Vol 19.1 - Sleep Disorders.2013Document252 pagesVol 19.1 - Sleep Disorders.2013Martoiu MariaNo ratings yet

- Head and Neck PDFDocument274 pagesHead and Neck PDFRakesh Jadhav100% (1)

- IntroductiontoEpidemiologyandPublicHealth AnswersDocument17 pagesIntroductiontoEpidemiologyandPublicHealth AnswersDiamond_136100% (2)

- Amgen 2019 JP Morgan PresentationDocument32 pagesAmgen 2019 JP Morgan PresentationmedtechyNo ratings yet

- Amgen 2019 JP Morgan PresentationDocument32 pagesAmgen 2019 JP Morgan PresentationmedtechyNo ratings yet

- Kriya For Balancing The ChakrasDocument5 pagesKriya For Balancing The ChakrasFedra Fox Cubeddu100% (2)

- Medtechy - The Place For Biotechnology & Medical Device NewsDocument4 pagesMedtechy - The Place For Biotechnology & Medical Device NewsmedtechyNo ratings yet

- Amarin ICER CVD Final Evidence Report 101719Document161 pagesAmarin ICER CVD Final Evidence Report 101719medtechyNo ratings yet

- Medtechy - The Place For Biotechnology & Medical Device NewsDocument4 pagesMedtechy - The Place For Biotechnology & Medical Device NewsmedtechyNo ratings yet

- MiMedx Shareholder Presentation 6-5-19 01095172 6xA26CADocument43 pagesMiMedx Shareholder Presentation 6-5-19 01095172 6xA26CAmedtechyNo ratings yet

- Medtechy - The Place For Biotechnology & Medical Device NewsDocument1 pageMedtechy - The Place For Biotechnology & Medical Device NewsmedtechyNo ratings yet

- CRISPR Corporate Overview July 2019Document25 pagesCRISPR Corporate Overview July 2019medtechyNo ratings yet

- Conmed and Buffalo Filter Acquisition PresentationDocument6 pagesConmed and Buffalo Filter Acquisition PresentationmedtechyNo ratings yet

- Celgene January 2019 Investor-PresentationDocument26 pagesCelgene January 2019 Investor-PresentationmedtechyNo ratings yet

- Transform Olympus 2019Document12 pagesTransform Olympus 2019medtechyNo ratings yet

- Titan Medical Investor Presentation November 2018Document18 pagesTitan Medical Investor Presentation November 2018medtechyNo ratings yet

- InspireMD Investor Deck October 2018Document29 pagesInspireMD Investor Deck October 2018medtechyNo ratings yet

- Intersect ENT Presentation November 2018Document23 pagesIntersect ENT Presentation November 2018medtechyNo ratings yet

- Abiomed - AHA DTU STEMI Safety and Feasibility Pilot Trial - 11.12.2018Document12 pagesAbiomed - AHA DTU STEMI Safety and Feasibility Pilot Trial - 11.12.2018medtechyNo ratings yet

- Titan Medical Investor Presentation November 28 2018 Piper JaffrayDocument23 pagesTitan Medical Investor Presentation November 28 2018 Piper JaffraymedtechyNo ratings yet

- Boston Scientific / BTG Acquisition PresentationDocument18 pagesBoston Scientific / BTG Acquisition PresentationmedtechyNo ratings yet

- Allergan Earnings FINAL-DECK-Q3-2018Document49 pagesAllergan Earnings FINAL-DECK-Q3-2018medtechyNo ratings yet

- Boston Scientific / BTG Acquisition PresentationDocument18 pagesBoston Scientific / BTG Acquisition PresentationmedtechyNo ratings yet

- Medtronic Earnings Presentation FY19Q2 FINALDocument16 pagesMedtronic Earnings Presentation FY19Q2 FINALmedtechyNo ratings yet

- Endologix Investor Meeting 10-02-18Document45 pagesEndologix Investor Meeting 10-02-18medtechyNo ratings yet

- InspireMD Investor Deck October 2018Document29 pagesInspireMD Investor Deck October 2018medtechyNo ratings yet

- Stereotaxis Investor Presentation 4Q2018Document17 pagesStereotaxis Investor Presentation 4Q2018medtechy100% (1)

- VRAY - Investor Presentation - October 2018Document24 pagesVRAY - Investor Presentation - October 2018medtechyNo ratings yet

- RTI Surgical Acquires Paradigm SpineDocument13 pagesRTI Surgical Acquires Paradigm SpinemedtechyNo ratings yet

- Otonomy OTO-413 Presentation (November 5, 2018)Document10 pagesOtonomy OTO-413 Presentation (November 5, 2018)medtechyNo ratings yet

- MannKind Investor Deck Cantor 2018 NYC FINALDocument25 pagesMannKind Investor Deck Cantor 2018 NYC FINALmedtechyNo ratings yet

- Varian Medical 2018 Q4 Earnings PresentationDocument36 pagesVarian Medical 2018 Q4 Earnings PresentationmedtechyNo ratings yet

- TRXC Acquisition of MST Medical Surgery Technologies 9.24.18Document19 pagesTRXC Acquisition of MST Medical Surgery Technologies 9.24.18medtechyNo ratings yet

- Klucel - Varnostni List PDFDocument4 pagesKlucel - Varnostni List PDFIljuha9No ratings yet

- Konsep Latihan Plyometric PDFDocument27 pagesKonsep Latihan Plyometric PDFDwinda Abi PermanaNo ratings yet

- Depression in Today - BioDocument5 pagesDepression in Today - Bioapi-272648963No ratings yet

- Evaluation of scales in immune-mediated polyneuropathiesDocument222 pagesEvaluation of scales in immune-mediated polyneuropathiesAngelo MalerbaNo ratings yet

- Staph and Strep Lab Report BMS 501Document2 pagesStaph and Strep Lab Report BMS 501aruiz93No ratings yet

- Legumes - AnOverview PDFDocument6 pagesLegumes - AnOverview PDFMayuri JagtapNo ratings yet

- Diagnostic Report SummaryDocument5 pagesDiagnostic Report SummaryShalini Rakesh JunejaNo ratings yet

- Basic Load (Individual) Veterinarian Field PackDocument3 pagesBasic Load (Individual) Veterinarian Field PackJohn MillerNo ratings yet

- Book Club Guide: INVINCIBLEDocument1 pageBook Club Guide: INVINCIBLEEpicReadsNo ratings yet

- Joint InfectionsDocument10 pagesJoint InfectionsJPNo ratings yet

- Resume 2019Document1 pageResume 2019api-316723361No ratings yet

- Gardens For Patients With Alzheimer's DiseaseDocument3 pagesGardens For Patients With Alzheimer's DiseaseKritikou1547No ratings yet

- Strategic PlanDocument84 pagesStrategic PlanAurutchat VichaiditNo ratings yet

- Wallen Et Al-2006-Australian Occupational Therapy JournalDocument1 pageWallen Et Al-2006-Australian Occupational Therapy Journal胡知行No ratings yet

- Bonifacio V. Romero High School Tle Beauty Care 9 1st Quarter Examination S.Y. 2018-2019Document6 pagesBonifacio V. Romero High School Tle Beauty Care 9 1st Quarter Examination S.Y. 2018-2019Virginia Saavedra100% (1)

- Fa14 Concept Map 10-26-14 2Document2 pagesFa14 Concept Map 10-26-14 2api-270415831No ratings yet

- Lawsuit Against Small Smiles Dental Center Aka Alabany Access Dental Center Et. Al.Document52 pagesLawsuit Against Small Smiles Dental Center Aka Alabany Access Dental Center Et. Al.DebHgnNo ratings yet

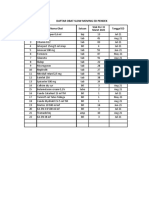

- Daftar Obat Slow Moving Dan Ed Rawat Inap Maret 2021Document8 pagesDaftar Obat Slow Moving Dan Ed Rawat Inap Maret 2021Vima LadipaNo ratings yet

- Europe PMC study finds computerized ADHD test improves diagnostic accuracyDocument22 pagesEurope PMC study finds computerized ADHD test improves diagnostic accuracyBudi RahardjoNo ratings yet

- Aa 1 MasterRQsDocument93 pagesAa 1 MasterRQsSadhana SabhandasaniNo ratings yet

- Science 5Document81 pagesScience 5Michael Joseph Santos100% (2)

- Relaxation TechniquesDocument13 pagesRelaxation TechniquesBhakti Joshi KhandekarNo ratings yet

- Elphos Erald: Second Shot: Hillary Clinton Running Again For PresidentDocument10 pagesElphos Erald: Second Shot: Hillary Clinton Running Again For PresidentThe Delphos HeraldNo ratings yet